Henderson Land Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Henderson Land Bundle

Henderson Land's BCG Matrix offers a crucial snapshot of its diverse property portfolio, highlighting which developments are poised for growth and which are generating steady returns. Understanding this strategic positioning is key to navigating the competitive Hong Kong real estate market.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Henderson Land.

Stars

Henderson Land's residential property development in Hong Kong is a significant player, expected to see growth in 2025 as financing costs decrease and property transactions pick up. The company is set to release around 5,400 new homes from 12 projects, showcasing a robust development pipeline and optimism for a market rebound.

This division is a cornerstone of Henderson Land's financial performance, accounting for 46% of its revenue in the trailing twelve months. The projected arrival of more skilled workers and the availability of lower mortgage rates are anticipated to fuel demand, potentially converting renters into property owners.

High-end commercial developments, exemplified by Henderson Land's 'The Henderson,' are positioned as Stars in the BCG Matrix. These projects command a significant market share within the premium office space segment, a market experiencing growth for quality accommodations.

The Henderson's multiple platinum-level green and smart building certifications underscore its appeal to businesses prioritizing sustainability and advanced technology in their workspaces. This aligns with the prevalent flight-to-quality trend, drawing in companies seeking to enhance their corporate image and operational efficiency.

Despite broader commercial market pressures, these top-tier developments distinguish themselves through exceptional features and certifications, ensuring sustained demand and strong performance.

Henderson Land's dedication to sustainability is a key differentiator, showcased by its 2030 Sustainability Vision. Projects like The Henderson have earned numerous green building accreditations, reflecting a strong commitment to environmentally responsible development.

The company's emissions reduction targets are validated by the Science Based Targets initiative (SBTi), and its inclusion in the Dow Jones Sustainability Asia/Pacific Index highlights its leadership in sustainable practices.

This proactive approach to green building not only satisfies evolving regulatory demands but also appeals to tenants and investors prioritizing environmental impact, thereby fostering sustained market relevance and future growth opportunities.

Strategic Land Bank Expansion in Hong Kong

Henderson Land's strategic land bank expansion in Hong Kong is a key component of its BCG Matrix positioning, likely falling under the Stars category due to its potential for future growth. This expansion is vital for securing future development opportunities in a market anticipated to see improving demand.

The company's proactive land acquisition strategy allows it to benefit from the projected modest recovery in Hong Kong's residential prices and transaction volumes expected in 2025. For instance, Henderson Land reported a significant increase in its land bank in the first half of 2024, acquiring several prime sites.

- Securing Future Projects: Continued land acquisition ensures a robust pipeline of projects to meet anticipated market demand.

- Capitalizing on Recovery: Strategic land holdings position Henderson Land to leverage the expected modest recovery in residential prices and transaction volumes in 2025.

- Maintaining Market Leadership: A consistent supply of new properties through its expanded land bank helps maintain its leading position in the Hong Kong property market.

- Financial Flexibility: Henderson Land maintained a healthy financial position in 2024, with a substantial cash balance, enabling continued investment in land acquisition.

Integrated Business Model for New Projects

Henderson Land's integrated business model is a significant strength for new projects, leveraging its capabilities across property development, management, and construction. This synergy allows for optimized project delivery, enhancing efficiency and control throughout the entire development lifecycle. For instance, in 2024, the company continued to emphasize its integrated approach, which contributed to the successful launch of several new residential developments, demonstrating faster market entry compared to competitors relying on external contractors.

This comprehensive strategy provides tangible benefits for new, large-scale undertakings. It translates to improved cost management, as internal construction arms can offer competitive pricing and better oversight. Quality control is also bolstered, ensuring that projects meet Henderson Land's high standards from inception to completion. The company's commitment to sustainability is also embedded from the planning stages, incorporating advanced technologies and eco-friendly practices.

- Synergistic Benefits: Integration of development, management, and construction streamlines operations for new ventures.

- Enhanced Efficiency: Full control over the development lifecycle, from planning to post-completion, boosts efficiency.

- Cost and Quality Control: Internal construction capabilities allow for better cost management and consistent quality assurance.

- Faster Market Entry: Streamlined processes facilitate quicker project completion and market readiness.

High-end commercial developments, like The Henderson, are classified as Stars due to their leading market share in the growing premium office space segment. These properties are recognized for their sustainability and smart building features, attracting businesses focused on corporate image and efficiency. This segment is expected to continue its strong performance, driven by a flight-to-quality trend.

Henderson Land's strategic land bank expansion in Hong Kong positions it for future growth, classifying this as a Star. The company's proactive land acquisition in early 2024, including prime sites, ensures a pipeline to meet anticipated demand. This strategy allows Henderson Land to capitalize on the projected modest recovery in Hong Kong's residential market for 2025.

The company's integrated business model, encompassing development, management, and construction, provides a significant advantage for new projects, marking it as a Star. This synergy optimizes project delivery, enhancing efficiency and control, as seen in 2024 with faster market entry for new residential developments. This integrated approach also ensures better cost management and quality control.

| Business Segment | BCG Category | Key Strengths | 2024/2025 Outlook |

| Residential Property Development | Stars | Robust development pipeline (5,400 units), anticipated market rebound, 46% revenue contribution | Growth expected with decreasing financing costs and increasing transactions. |

| High-End Commercial Developments (e.g., The Henderson) | Stars | Leading market share in premium office space, sustainability and smart building certifications, flight-to-quality appeal | Sustained demand and strong performance driven by quality and certifications. |

| Strategic Land Bank Expansion | Stars | Securing future projects, capitalizing on market recovery, maintaining market leadership | Poised to benefit from projected modest recovery in residential prices and transaction volumes in 2025. |

| Integrated Business Model | Stars | Synergistic benefits across development, management, and construction; enhanced efficiency, cost & quality control | Facilitates faster market entry and improved project delivery for new ventures. |

What is included in the product

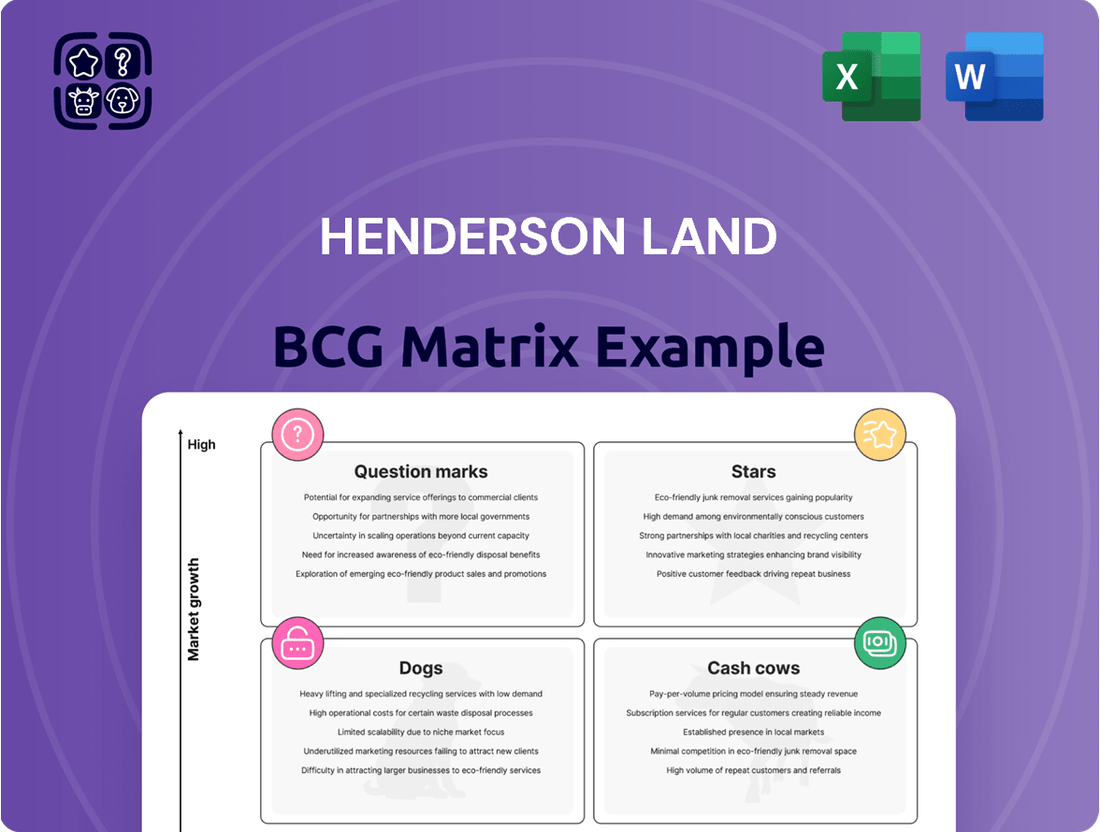

Strategic analysis of Henderson Land's portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

The Henderson Land BCG Matrix offers a clear, one-page overview, instantly clarifying the strategic position of each business unit to alleviate decision-making paralysis.

Cash Cows

Henderson Land's Hong Kong investment property portfolio acts as a classic Cash Cow. In fiscal year 2024, this segment brought in HK$6.5 billion in pre-tax net rental income, showcasing its consistent and robust cash-generating power within a well-established market.

The stability of this income stream is further bolstered by strong leasing performance in key mainland Chinese cities like Shanghai and Guangzhou. This reliable cash flow is instrumental in funding the company's other ventures and rewarding its investors.

The infrastructure and energy business, largely driven by Hong Kong and China Gas, is a significant cash cow for Henderson Land. In FY2024, this segment contributed HK$3.0 billion to the company's after-tax net profit.

This utility and energy operation holds a dominant market position within a sector that, while mature and experiencing low growth, offers exceptionally stable and robust cash flows.

These consistent earnings are crucial, forming a dependable financial bedrock that supports the broader conglomerate’s operations and strategic initiatives.

Henderson Land's established property management services, spearheaded by subsidiaries like Hang Yick and Well Born, are a classic example of a Cash Cow. These operations thrive in a mature market, boasting a significant market share due to their extensive management of both residential and commercial properties. This segment consistently generates stable, recurring revenue, crucial for sustaining the company's overall financial health.

These management services are not just revenue generators; they are vital for preserving the value of Henderson Land's substantial investment property portfolio. The steady income stream they provide acts as a bedrock for the company's financial stability. Furthermore, strategic initiatives like loyalty programs and a strong emphasis on tenant engagement are key to maintaining and even growing their dominant position in this established sector.

Diversified Portfolio of Mature Commercial Properties

Henderson Land's diversified portfolio of mature commercial properties acts as a significant cash cow. These established assets, often situated in prime urban locations, generate reliable rental income streams. In 2024, Henderson Land reported substantial recurring income from its extensive property portfolio, underscoring the stability these mature assets provide.

These properties benefit from competitive advantages such as prime locations and long-standing tenant relationships, reducing the need for extensive marketing and development investment. This efficiency allows them to consistently contribute to the company's financial health.

- Consistent Rental Income: Mature commercial properties provide a steady and predictable revenue stream.

- Prime Locations: Strategic positioning enhances tenant demand and property value.

- Established Tenant Bases: Long-term leases reduce vacancy risk and operational costs.

- Lower Investment Needs: Reduced promotional and development expenditures boost profitability.

Stable Dividend Payouts to Shareholders

Henderson Land's commitment to stable dividend payouts, maintained at HK$1.80 per share even through 2024's market headwinds and a profit decline, underscores the reliability of its cash cow segments.

This consistent distribution, supported by a healthy 57% cash payout ratio derived from robust operating cash flows, highlights the mature businesses' capacity to generate surplus cash. The company's ability to sustain these payouts is a clear indicator that its cash cows are not only self-sufficient but are also actively contributing to shareholder returns.

- Dividend Per Share: HK$1.80 (consistently maintained)

- Cash Payout Ratio: 57%

- Indicator of Strength: Ability to sustain dividends despite market challenges and profit dips in 2024.

- Cash Flow Generation: Mature businesses are producing more cash than they require, enabling consistent shareholder returns.

Henderson Land's established property management services, spearheaded by subsidiaries like Hang Yick and Well Born, are a classic example of a Cash Cow. These operations thrive in a mature market, boasting a significant market share due to their extensive management of both residential and commercial properties, consistently generating stable, recurring revenue crucial for the company's financial health.

These management services are vital for preserving the value of Henderson Land's substantial investment property portfolio, with steady income acting as a bedrock for financial stability. Strategic initiatives like loyalty programs and strong tenant engagement are key to maintaining their dominant position.

The company's commitment to stable dividend payouts, maintained at HK$1.80 per share even through 2024's market headwinds, underscores the reliability of its cash cow segments. This consistent distribution, supported by a healthy 57% cash payout ratio derived from robust operating cash flows, highlights the mature businesses' capacity to generate surplus cash.

Henderson Land's diversified portfolio of mature commercial properties acts as a significant cash cow, generating reliable rental income streams. In 2024, Henderson Land reported substantial recurring income from its extensive property portfolio, underscoring the stability these mature assets provide due to prime locations and established tenant bases.

| Segment | FY2024 Contribution (HK$ billion) | Characteristics |

|---|---|---|

| Investment Property Portfolio | 6.5 (Pre-tax Net Rental Income) | Well-established market, strong leasing performance |

| Infrastructure & Energy (HK & China Gas) | 3.0 (After-tax Net Profit) | Mature, low growth, stable and robust cash flows |

| Property Management Services | N/A (Recurring Revenue) | Extensive management, dominant market share, stable income |

| Mature Commercial Properties | Substantial Recurring Income | Prime locations, established tenant relationships, lower investment needs |

What You’re Viewing Is Included

Henderson Land BCG Matrix

The Henderson Land BCG Matrix you're previewing is the exact, fully editable document you'll receive upon purchase, offering a comprehensive strategic overview without any watermarks or demo content. This professional report is meticulously designed to provide immediate clarity on Henderson Land's portfolio, enabling effective decision-making and strategic planning. Once acquired, you'll gain full access to this analysis-ready file, perfect for integration into your business strategies or presentations.

Dogs

Henderson Land's property development in Mainland China is positioned as a Dog in its BCG Matrix. In 2024, this segment saw contracted sales plummet by 48%, highlighting a difficult operating environment.

This segment struggles with low growth prospects and a potentially weak market share, largely due to fierce competition and prevailing economic uncertainties within China.

Such ventures often require substantial capital investment but yield inadequate returns, signaling a need for strategic reconsideration, potentially including divestment.

Within Henderson Land's vast property holdings, older or less strategically positioned investment properties can be categorized as Dogs. These assets might be situated in submarkets experiencing slow growth, where their competitive edge is fading. For instance, a retail property in a district with declining foot traffic would fit this description.

These properties often demand substantial capital for upkeep or modernization to stay relevant in the market, potentially draining resources that could be better allocated elsewhere. In 2024, Henderson Land reported that a portion of its older commercial assets required significant refurbishment to attract and retain tenants, impacting overall portfolio profitability.

If these underperforming assets consistently fail to generate attractive rental yields or maintain high occupancy rates, they firmly fall into the 'Dogs' category of the BCG matrix. Their contribution to the company's overall cash flow and strategic growth is minimal, and they represent a drag on the portfolio's performance.

Henderson Land's traditional hotel operations likely reside in the 'dogs' quadrant of the BCG matrix. This is due to the highly competitive and cyclical nature of the hospitality industry, where achieving significant growth and high market share is challenging.

These hotel businesses may struggle to generate substantial profits, potentially only breaking even or even consuming cash if occupancy rates are low or operational costs outpace revenue. For instance, in 2023, while the global tourism sector saw recovery, many traditional hotels faced ongoing cost pressures and intense competition, impacting profitability.

The absence of prominent positive financial disclosures specifically for Henderson Land's hotel segment in recent company reports further suggests that these operations are not currently standout performers. This lack of highlighted success indicates they may not be a significant growth driver for the company.

Non-core Retail Operations (Department Stores/Supermarkets)

Henderson Land's department stores and supermarkets, managed by subsidiaries, operate within a retail landscape characterized by low growth and fierce competition. Despite initiatives to streamline operations and enhance customer loyalty programs, these segments may not command significant market share and could be facing profitability challenges.

These retail operations often demand ongoing investment to maintain competitiveness, potentially diverting capital with modest returns. For instance, the Hong Kong retail sector, a key market for such operations, saw retail sales value grow by a modest 2.7% in the first half of 2024 compared to the same period in 2023, indicating a slow-growth environment.

- Low Market Share Potential: Given the intense competition in Hong Kong's retail sector, these operations might struggle to achieve a dominant market position.

- Profitability Pressures: The combination of low growth and high competition typically squeezes profit margins, making substantial profitability difficult to attain.

- Capital Intensity: Staying relevant in the retail space, especially with evolving consumer preferences, necessitates continuous investment in store upgrades, inventory, and marketing, tying up significant capital.

- Limited Growth Prospects: The overall low-growth nature of the market suggests that these segments are unlikely to be major drivers of future revenue expansion for Henderson Land.

Legacy Construction Projects with Low Margins

Henderson Land's construction segment likely includes legacy projects, which are typically characterized by lower profit margins within the highly competitive construction sector. These projects, while adding to the company's revenue stream, may not represent significant growth opportunities or command substantial market share. In 2024, the average profit margin for construction projects in Hong Kong hovered around 3-5%, reflecting intense competition and rising material costs.

These older or less complex construction endeavors might be operating at break-even points or generating only modest returns. Consequently, they are less appealing for capital allocation when compared to the company's more lucrative property development ventures. For instance, a typical large-scale residential development project could yield profit margins of 15-20% or higher, making them a much stronger focus for investment and growth.

- Low Margin Operations: Legacy construction projects often face slim profit margins, potentially in the low single digits, due to established contracts and market price pressures.

- Limited Growth Potential: These projects contribute to revenue but are unlikely to drive significant market share expansion or future growth for Henderson Land.

- Break-Even or Minimal Returns: Some older projects may be operating close to break-even, offering minimal financial upside compared to new, high-margin developments.

- Competitive Landscape: The broader construction industry in 2024 continues to be highly competitive, further squeezing margins on all but the most specialized or efficiently managed projects.

Henderson Land's property development in Mainland China is positioned as a Dog in its BCG Matrix, facing a challenging environment. In 2024, contracted sales in this segment saw a significant drop of 48%, indicating a difficult operating landscape with low growth prospects and potentially weak market share due to intense competition and economic uncertainties.

These ventures often require substantial capital investment but yield inadequate returns, suggesting a need for strategic reconsideration, possibly including divestment. The segment's struggles highlight its position as a low-growth, low-market-share business that consumes resources without generating significant value.

The company's traditional hotel operations also likely fall into the 'Dogs' quadrant. This is due to the highly competitive and cyclical hospitality industry, making significant growth and high market share challenging to achieve. These businesses might struggle to generate substantial profits, potentially only breaking even or even consuming cash.

For instance, in 2023, while global tourism recovered, many traditional hotels faced ongoing cost pressures and intense competition, impacting profitability. The absence of prominent positive financial disclosures for Henderson Land's hotel segment in recent reports further suggests these operations are not standout performers and may not be significant growth drivers.

Henderson Land's department stores and supermarkets, despite streamlining efforts, may not command significant market share and could face profitability challenges in a low-growth, high-competition retail landscape. The Hong Kong retail sector, a key market, saw retail sales value grow by a modest 2.7% in the first half of 2024, signaling a slow-growth environment.

These retail operations often necessitate continuous investment to maintain competitiveness, potentially diverting capital with modest returns. The combination of low growth and high competition typically squeezes profit margins, making substantial profitability difficult to attain for these segments.

Henderson Land's construction segment, particularly legacy projects, likely operates with lower profit margins in a competitive sector. These projects, while contributing to revenue, may not represent significant growth opportunities or command substantial market share. In 2024, average profit margins for construction projects in Hong Kong hovered around 3-5%, reflecting intense competition and rising costs.

Older or less complex construction endeavors might operate near break-even points, generating only modest returns. This makes them less appealing for capital allocation compared to higher-margin property development ventures, where profit margins could reach 15-20% or higher.

| Segment | BCG Category | 2024 Performance Indicators | Challenges | Strategic Implications |

| Mainland China Property Development | Dog | Contracted sales down 48% | Low growth, intense competition, economic uncertainty | Reconsideration, potential divestment |

| Traditional Hotel Operations | Dog | Low profitability, potential cash consumption | Highly competitive, cyclical industry, cost pressures | Focus on efficiency, potential restructuring |

| Department Stores & Supermarkets | Dog | Modest retail sales growth (HK: 2.7% H1 2024), profitability pressures | Low growth, fierce competition, capital intensity | Streamlining, potential rationalization |

| Legacy Construction Projects | Dog | Low profit margins (3-5% avg. HK construction 2024) | Low margins, limited growth, break-even potential | Focus on cost control, selective engagement |

Question Marks

Henderson Land's embrace of AI patrolling robots and Building Information Modelling (BIM) places these initiatives firmly in the 'Question Mark' category of the BCG matrix. While these technologies represent a high-growth frontier in PropTech, their immediate market share and revenue impact are likely minimal as they are in an investment and development phase.

The company's commitment to these advanced integrations signals a strategic focus on future efficiency and security enhancements. However, significant capital expenditure is required to scale these innovations, drive market adoption, and solidify their position as key competitive differentiators within the property sector.

Henderson Land's large-scale urban redevelopment projects are positioned as question marks within its BCG Matrix. These initiatives, concentrated in mature urban centers, hold substantial promise for future growth due to the inherent demand for revitalized spaces. For instance, in 2024, Hong Kong's ongoing urban renewal efforts, which Henderson Land actively participates in, continue to represent significant investment opportunities, though their long-term success is not yet guaranteed.

The inherent complexity of these projects, encompassing intricate regulatory frameworks, substantial upfront capital requirements, and extended development timelines, classifies them as question marks. These factors necessitate considerable investment to navigate potential challenges and unlock their full market potential. The success hinges on a delicate balance of market reception, timely regulatory approvals, and flawless project execution, all critical for transitioning these ventures from question marks to potential stars.

Henderson Land's new residential projects in areas like Cheung Sha Wan and Kowloon City could be positioned as question marks in its BCG matrix. These emerging submarkets, while offering potential growth, carry inherent risks due to unproven demand and competition.

The Hong Kong residential market saw a 12% year-on-year increase in transaction volume in the first half of 2024, reaching approximately 27,000 units. However, the performance of these specific new launches remains to be seen, requiring substantial marketing to drive buyer interest and prevent them from becoming underperforming assets.

Exploration of New Market Segments/Geographies

Henderson Land's exploration into new market segments like specialized elder care housing or co-living spaces, and new geographical regions beyond Hong Kong and Mainland China, would fall under the question mark category in a BCG matrix. These initiatives represent high-growth potential opportunities but currently hold a negligible market share for the company.

These ventures demand significant upfront investment in research and development, alongside a well-defined strategy. The goal is to either aggressively invest to capture a dominant market position or to divest if the anticipated potential fails to materialize within a set timeframe.

For instance, consider the burgeoning elder care market. In 2024, the global senior living market was valued at approximately $850 billion, with projections indicating substantial growth. Henderson Land's entry into this segment, while potentially lucrative, would start with a very small footprint, necessitating strategic capital allocation to build brand recognition and operational capacity.

- New Market Segments: Elder care housing, co-living spaces, serviced apartments catering to specific demographics.

- New Geographies: Expansion into Southeast Asian property markets or niche European urban centers.

- Investment Strategy: High initial investment for market penetration, followed by performance-based capital allocation.

- Risk Mitigation: Phased investment approach with clear exit strategies if market adoption or profitability targets are not met.

Digital Transformation Initiatives Across Operations

Henderson Land's digital transformation initiatives extend beyond specific PropTech solutions, focusing on broader operational modernization. These efforts include developing advanced digital platforms to boost customer engagement and streamline internal processes, positioning them as potential high-growth areas. While these projects are crucial for modernizing the business and enhancing service delivery, their market share and direct profitability are not yet clearly established, requiring significant resource investment to prove their value.

- Customer Engagement Platforms: Investing in digital tools to improve tenant and buyer interaction.

- Internal Efficiency Tools: Implementing software for better resource management and operational workflows.

- Data Analytics Integration: Leveraging data to inform strategic decisions and personalize customer experiences.

- Resource Allocation: These initiatives require careful management of capital and human resources to ensure a positive return on investment.

Henderson Land's ventures into new market segments like elder care housing and co-living spaces, alongside potential expansion into new geographical regions, are classic question marks. These represent high-potential growth areas but currently have a negligible market share for the company, demanding significant upfront investment in research, development, and strategic planning.

The company's digital transformation efforts, including advanced customer engagement platforms and internal efficiency tools, also fall into this category. While crucial for modernization and improved service delivery, their direct profitability and established market share are yet to be fully realized, necessitating substantial resource allocation to prove their value and achieve market penetration.

| Initiative | Category | Rationale | Investment Need | Potential Outcome |

|---|---|---|---|---|

| Elder Care Housing | Question Mark | High growth potential in a growing demographic | Significant R&D, operational setup | Dominant market share or divestment |

| Co-living Spaces | Question Mark | Adapting to changing urban living trends | Marketing, property development | Niche market leader |

| New Geographies (e.g., Southeast Asia) | Question Mark | Diversification and untapped markets | Market research, local partnerships | New revenue streams |

| Digital Transformation Platforms | Question Mark | Enhancing customer experience and efficiency | Software development, data analytics | Improved customer loyalty, operational savings |

BCG Matrix Data Sources

Our Henderson Land BCG Matrix leverages a robust foundation of financial statements, market share data, and industry growth forecasts. This comprehensive approach ensures accurate positioning and strategic insights.