Hippo Insurance Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hippo Insurance Services Bundle

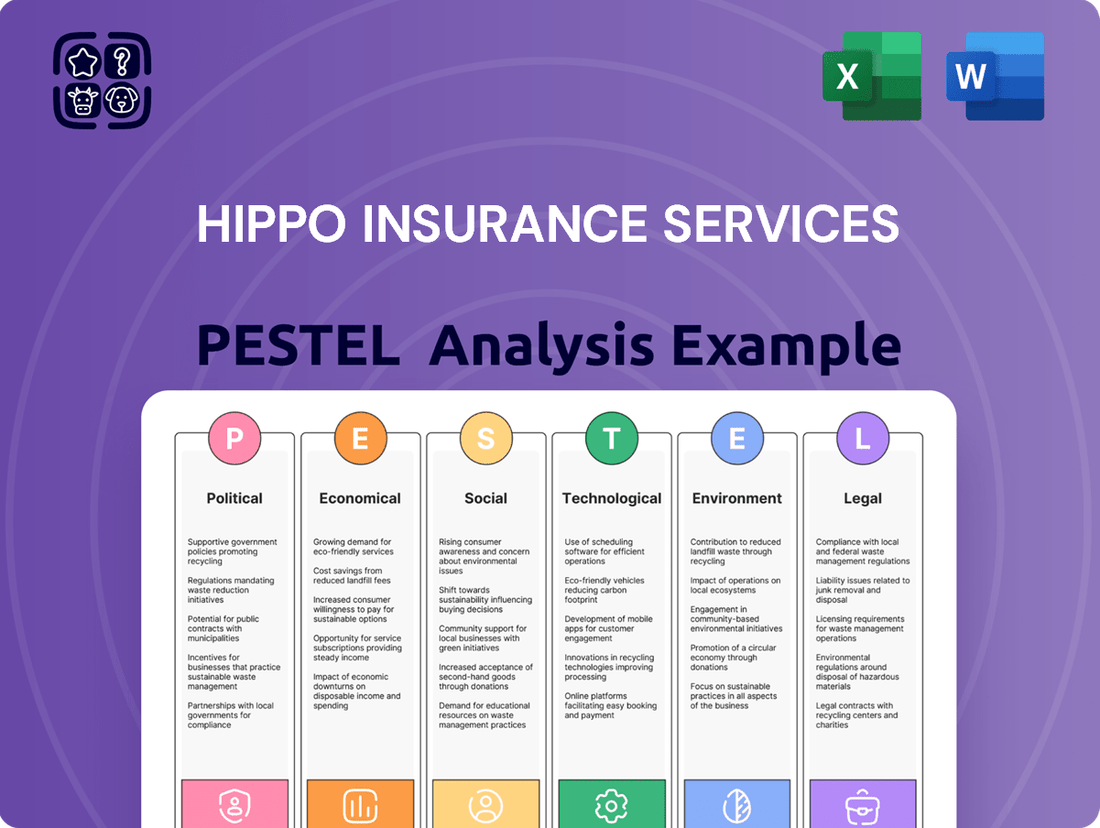

Navigate the complex external landscape impacting Hippo Insurance Services with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are reshaping the insurance industry and Hippo's strategic positioning. Download the full report to gain actionable intelligence and anticipate future market dynamics.

Political factors

Governmental regulations significantly shape the insurance landscape, with state-specific policies dictating everything from insurer solvency to policy rates. For Hippo Insurance Services, navigating this patchwork of rules across different states presents a constant challenge, impacting their ability to offer standardized products and potentially increasing compliance costs. For instance, differing state requirements on reserve levels and capital adequacy could directly influence Hippo's financial planning and operational flexibility.

Hippo Insurance Services, as a tech-centric insurer, faces significant exposure to shifts in AI and data privacy regulations. For instance, the proposed American Privacy Rights Act (APRA) in the U.S. could introduce stricter consent requirements for data collection, impacting how Hippo utilizes AI for risk assessment and customer personalization.

Such regulatory evolution, whether from state initiatives like California's CCPA or potential federal mandates, could force costly overhauls of Hippo's data handling protocols and AI model development. This could lead to increased compliance expenditures, potentially impacting operational efficiency and the pace of technological innovation.

Regulatory changes in the reinsurance market directly impact Hippo Insurance Services' ability to manage its risk. For instance, stricter capital requirements for reinsurers, which have been a trend in recent years, could lead to higher reinsurance costs or reduced capacity. This might force Hippo to retain more risk, impacting its financial stability.

Government Incentives for Smart Home and Green Technologies

Government initiatives and incentives aimed at promoting smart home technology and green building solutions present a significant tailwind for Hippo Insurance Services. These policies can foster a more receptive market for proactive insurance models that leverage smart devices for risk mitigation. For instance, in 2024, several countries continued to offer tax credits and rebates for energy-efficient upgrades and smart home installations, directly encouraging consumer adoption.

As Hippo integrates smart home devices for loss prevention, such as water leak detectors and smart thermostats, government support for these technologies could substantially increase demand for their insurance products. This creates a virtuous cycle where policy drives adoption, which in turn fuels demand for specialized insurance solutions like those offered by Hippo. The Inflation Reduction Act in the US, for example, continues to provide substantial tax credits for homeowners installing energy-efficient and smart home technologies through 2032, making these investments more accessible.

- Increased Consumer Demand: Government incentives make smart home devices more affordable, boosting consumer interest and adoption, which directly benefits insurers like Hippo that utilize this technology.

- Favorable Market Conditions: Policies supporting green technologies and smart homes create an environment where proactive risk management is valued and encouraged, aligning with Hippo's business model.

- Reduced Insurance Premiums: As more homes adopt smart safety features, the overall risk profile for insurers could decrease, potentially leading to more competitive pricing for policyholders.

- Policy Alignment: Government support for smart home integration for loss prevention validates Hippo's strategy and can lead to partnerships or further regulatory support for insurtech innovation.

Political Stability and Support for Insurtech Innovation

The political landscape significantly impacts insurtech companies like Hippo. Governments that actively promote technological advancement and provide a stable regulatory framework are crucial for market entry and sustained growth. For instance, the US government's increasing focus on digital infrastructure and consumer protection, as seen in initiatives aimed at modernizing financial services, generally creates a more favorable environment for insurtech innovation.

However, political instability or shifts in regulatory priorities can pose challenges. Changes in administration or unexpected policy reversals can create uncertainty, potentially slowing down expansion plans or increasing compliance costs. As of early 2025, regulatory bodies like the NAIC (National Association of Insurance Commissioners) continue to explore updated guidelines for insurtech, aiming to balance innovation with consumer safeguarding. This ongoing dialogue highlights the dynamic nature of political influence.

- Government Support: Policies encouraging digital transformation in financial services, including insurtech, foster a positive environment for companies like Hippo.

- Regulatory Stability: A predictable and consistent regulatory landscape reduces uncertainty and facilitates long-term investment and growth strategies.

- Policy Shifts: Potential changes in government focus or regulatory approaches can introduce risks that may impact market entry or operational expansion.

- International Agreements: Trade policies and international data-sharing agreements can also influence the global reach and operational efficiency of insurtech firms.

Governmental support for smart home technology, such as tax credits and rebates for energy-efficient upgrades, directly benefits Hippo Insurance Services by increasing consumer adoption of devices used for loss prevention. For example, the Inflation Reduction Act in the US continues to offer substantial tax credits for smart home installations through 2032, making these investments more accessible and driving demand for proactive insurance models.

The political environment's stance on technological advancement and data privacy significantly impacts insurtech firms like Hippo. A stable regulatory framework, coupled with government initiatives promoting digital transformation in financial services, fosters growth. Conversely, political instability or abrupt policy changes can introduce uncertainty, potentially impacting expansion and increasing compliance burdens.

Changes in reinsurance regulations, such as stricter capital requirements for reinsurers, can directly affect Hippo's risk management strategy and costs. For instance, if reinsurers face increased capital demands, this could translate to higher reinsurance premiums or reduced capacity for Hippo, potentially forcing them to retain more risk and impacting their financial stability.

| Government Initiative | Impact on Hippo | Example (2024/2025) |

|---|---|---|

| Tax Credits for Smart Home Tech | Increased adoption of loss prevention devices, boosting demand for Hippo's products. | Inflation Reduction Act (US) extending credits through 2032. |

| Data Privacy Regulations (e.g., APRA) | Potential need for costly overhauls of data handling and AI models. | Proposed American Privacy Rights Act could impact AI-driven risk assessment. |

| Reinsurance Capital Requirements | Higher reinsurance costs or reduced capacity, potentially increasing retained risk. | Ongoing trend of stricter capital adequacy for reinsurers globally. |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Hippo Insurance Services, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

It provides a comprehensive understanding of the forces shaping Hippo's operational landscape, enabling strategic decision-making.

Hippo Insurance Services' PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic planning.

This analysis is visually segmented by PESTEL categories, allowing for quick interpretation at a glance, thereby relieving the pain point of information overload during strategic discussions.

Economic factors

Economic downturns significantly curtail consumer spending, directly impacting insurance providers like Hippo. During challenging economic periods, households often re-evaluate discretionary spending, and insurance premiums can be viewed as a less immediate priority compared to essentials like housing or food. This can lead to a reduction in demand for both new policies and potentially a decrease in coverage levels for existing ones.

For instance, in 2023, inflation remained a persistent concern, impacting household budgets and potentially delaying non-essential purchases. While specific data for insurance spending during economic slowdowns is often reported with a lag, broader consumer confidence indices, such as those tracked by the Conference Board, often show a correlation between declining confidence and reduced spending on services perceived as less critical, including certain types of insurance coverage or add-ons.

Homeowners facing economic hardship might postpone or reduce spending on home maintenance, which indirectly affects insurance. They may opt for less comprehensive coverage to lower premiums or delay necessary repairs that could prevent future claims. This shift in consumer behavior can create a more challenging market for insurers, necessitating adjustments in product offerings and risk assessment strategies to align with prevailing economic conditions.

Elevated mortgage rates in 2024 and 2025 directly impact affordability, potentially reducing the pool of new homeowners. For instance, average 30-year fixed mortgage rates hovered around 6.5% to 7.5% in late 2024 and early 2025, significantly increasing monthly payments compared to lower rate environments.

This financial pressure on homeowners can lead to decreased discretionary spending on non-essential services, including enhanced insurance coverage or preventative maintenance, which are crucial for reducing future claims. Consequently, Hippo Insurance might face challenges in customer acquisition and retention as budget-conscious consumers prioritize core needs.

Hippo Insurance Services has shown impressive revenue acceleration, with a notable increase in gross and net loss ratios. This suggests the company is becoming more efficient and is strategically moving towards less risky business areas, such as Insurance-as-a-Service (IaaS).

While these operational improvements are encouraging, Hippo has historically faced net losses. The company's stated goal is to achieve net income profitability, targeting the fourth quarter of 2025 to reach this milestone.

Competitive Market Landscape and Pricing Pressure

The insurance sector is a battleground, with giants like State Farm and Progressive, alongside agile insurtechs, all hungry for customers. This fierce competition directly translates into pricing pressure, forcing companies like Hippo to constantly re-evaluate their strategies. For instance, in 2024, the average homeowner's insurance premium saw an increase, yet the need to remain competitive means Hippo must offer compelling value propositions beyond just price.

This intense rivalry necessitates continuous innovation. Hippo's ability to differentiate itself through technology and customer experience is paramount. By Q1 2025, the insurtech market is projected to continue its growth, with a significant portion of this expansion driven by companies offering streamlined digital experiences, a key area for Hippo to leverage.

- Intense Competition: Established insurers and numerous insurtech startups actively compete for market share.

- Pricing Pressure: High competition often leads to downward pressure on premiums, impacting profitability.

- Innovation Imperative: Companies like Hippo must continuously innovate to attract and retain customers amidst this competitive landscape.

- Customer Acquisition Costs: The fight for market share can drive up the cost of acquiring new customers.

Reinsurance Costs and Availability

The reinsurance market is experiencing significant hardening, meaning costs are rising and capacity is shrinking. For Hippo Insurance Services, this directly impacts their underwriting profitability. For instance, global reinsurer Munich Re reported a substantial increase in catastrophe losses in 2023, contributing to a tougher reinsurance market environment expected to persist into 2024 and 2025.

These shifts in reinsurance availability and pricing directly affect Hippo's risk management strategy. If reinsurers demand higher premiums or offer less coverage, Hippo may need to retain more risk on its balance sheet or adjust its underwriting appetite, potentially limiting growth in certain high-risk areas.

- Rising Reinsurance Premiums: Expect continued upward pressure on reinsurance costs throughout 2024 and into 2025, driven by increased insured losses from natural catastrophes and inflation.

- Reduced Reinsurance Capacity: Some reinsurers may reduce the amount of coverage they offer, particularly for property risks in catastrophe-prone regions, forcing insurers like Hippo to seek alternative solutions or retain more risk.

- Impact on Underwriting Profitability: Higher reinsurance costs directly eat into an insurer's profit margins, potentially necessitating premium increases for policyholders or a more selective underwriting approach.

Economic headwinds, including persistent inflation and elevated mortgage rates through 2024 and into 2025, directly impact consumer spending power. This financial strain on households can lead to reduced demand for insurance products or a shift towards more basic coverage, affecting Hippo's growth prospects.

For instance, average 30-year fixed mortgage rates remained elevated, often between 6.5% and 7.5% in late 2024 and early 2025, increasing housing costs and potentially limiting discretionary spending on insurance. This environment necessitates strategic adjustments in Hippo's product offerings and pricing to remain competitive and appealing to budget-conscious consumers.

| Economic Factor | Impact on Hippo Insurance | Relevant Data (2024-2025) |

|---|---|---|

| Inflation | Reduces consumer discretionary spending on insurance. | Inflation remained a concern, impacting household budgets. |

| Mortgage Rates | Decreases affordability for new homeowners, shrinking the customer pool. | 30-year fixed mortgage rates averaged 6.5%-7.5% in late 2024/early 2025. |

| Consumer Confidence | Lower confidence correlates with reduced spending on non-essential services. | Consumer confidence indices often reflect economic sentiment impacting insurance demand. |

Preview Before You Purchase

Hippo Insurance Services PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Hippo Insurance Services delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a complete understanding of the external forces shaping Hippo's strategic landscape.

Sociological factors

Homeowners are increasingly shifting their focus from reactive repairs to proactive home protection. This change is largely fueled by the escalating costs associated with unexpected home emergencies; for instance, the average cost of a major home repair can easily run into thousands of dollars, making prevention a more attractive strategy. This evolving mindset directly supports Hippo Insurance Services' business model, which emphasizes smart home technology and tailored maintenance guidance to help policyholders avoid costly damage before it occurs.

Consumers increasingly expect seamless, digital interactions for all services, including insurance. A 2024 survey by J.D. Power found that 65% of insurance customers prefer digital channels for policy management and claims. This shift highlights a strong demand for transparency and ease of use.

Hippo Insurance Services is well-positioned to meet this demand. Their technology-first model streamlines the application and claims process, offering a modern and simplified experience that resonates with today's digitally savvy consumers. This focus on user experience is a key differentiator in the evolving insurance landscape.

A notable portion of homeowners voiced regrets about their 2024 home purchases, frequently citing unforeseen repair costs, elevated mortgage interest rates, or settling for less than ideal features. This sentiment points to a segment of the homeowner market facing financial pressure.

This financial strain directly impacts their insurance decisions, potentially leading to a preference for more basic coverage due to affordability concerns. For instance, a 2024 survey indicated that nearly 30% of recent homebuyers regretted their purchase primarily due to unexpected expenses, a figure that could translate to a reduced willingness to invest in higher-tier insurance policies.

Growing Awareness of Environmental Impact and Energy Efficiency

Homeowners increasingly recognize their environmental footprint, leading to a greater demand for energy-efficient and sustainable living solutions. This societal shift is directly influencing purchasing decisions, including insurance preferences.

This growing awareness translates into a market ripe for insurance products that reward or cover eco-friendly home improvements. For instance, insurers offering discounts for homes with solar panels or enhanced insulation are likely to attract a segment of environmentally conscious consumers.

Data from 2024 indicates a significant uptick in consumer interest in green technologies. A recent survey found that over 60% of homeowners are considering or have already implemented energy-saving upgrades in the past year. This trend is projected to continue, with an anticipated 15% year-over-year growth in the adoption of smart home energy management systems by the end of 2025.

Key considerations for insurers include:

- Incentivizing sustainable upgrades: Offering premium reductions for homes with features like solar power, rainwater harvesting, or superior insulation.

- Coverage for eco-friendly materials: Developing policies that adequately cover the cost of repairing or replacing sustainable building materials.

- Partnerships with green providers: Collaborating with companies specializing in energy-efficient retrofits or renewable energy installations to offer bundled services.

Evolving Lifestyles and Home Usage Patterns

The shift towards remote and hybrid work models, significantly amplified since 2020, has fundamentally altered how people use their homes. This means more time spent indoors, potentially increasing the likelihood of certain types of claims, such as those related to accidental damage or water leaks. For instance, a 2024 survey indicated that over 30% of American workers are now fully remote, a substantial increase from pre-pandemic levels.

These evolving lifestyles directly impact insurance needs. Homeowners now require coverage that accounts for increased wear and tear, potential home office equipment damage, and greater reliance on home utilities. Hippo's emphasis on broad home protection, including features like smart home monitoring for water leaks and proactive maintenance alerts, positions it well to address these emerging risks.

The increased presence at home also means a greater awareness of home maintenance and potential hazards. This can lead to a demand for more comprehensive and technologically advanced insurance solutions that offer preventative measures. By 2025, it's projected that the smart home device market, which can feed data into insurance platforms, will continue its rapid expansion, with billions of devices expected to be in use globally.

- Remote Work Impact: Over 30% of US workers were fully remote in 2024, increasing home occupancy and potential for in-home risks.

- Insurance Demand: Growing need for coverage addressing home office equipment, increased utility usage, and wear-and-tear.

- Hippo's Adaptation: Focus on comprehensive protection and smart home technology aligns with changing homeowner behaviors and risk profiles.

- Market Growth: The smart home device market is expanding, providing data for proactive risk management in insurance.

Homeowners are increasingly prioritizing proactive home maintenance over reactive repairs, driven by the high costs of unexpected damage, with major repairs often exceeding thousands of dollars. This shift aligns perfectly with Hippo's model of utilizing smart home technology and maintenance guidance to prevent issues before they escalate.

A significant trend is the growing demand for digital-first interactions, with a 2024 J.D. Power survey indicating 65% of insurance customers prefer digital channels for managing policies and claims, emphasizing transparency and ease of use.

The rise of remote and hybrid work models means homeowners spend more time at home, potentially increasing wear and tear and the likelihood of certain claims. Over 30% of US workers were fully remote in 2024, highlighting this lifestyle change and the need for insurance that covers increased in-home risks.

Consumer interest in sustainability is also on the rise, with over 60% of homeowners considering or implementing energy-saving upgrades in 2024. This creates an opportunity for insurers to offer discounts or specialized coverage for eco-friendly homes.

| Sociological Factor | Description | Impact on Hippo | Supporting Data (2024/2025) |

|---|---|---|---|

| Proactive Homeownership | Shift from reactive repairs to preventative maintenance. | Aligns with Hippo's tech-focused, preventative model. | High cost of major repairs encourages prevention. |

| Digital Expectations | Demand for seamless, online service interactions. | Hippo's digital-first approach meets this need. | 65% of customers prefer digital channels (J.D. Power, 2024). |

| Remote Work Trends | Increased time spent at home. | Raises potential for in-home risks, aligning with Hippo's broad coverage. | Over 30% of US workers fully remote (2024). |

| Environmental Consciousness | Growing interest in sustainable living and green technologies. | Opportunity for discounts/coverage for eco-friendly homes. | Over 60% of homeowners considered energy-saving upgrades (2024). |

Technological factors

Hippo Insurance Services heavily relies on data analytics and smart home technology, integrating IoT devices to offer a proactive and personalized insurance experience. This technological approach allows customers to monitor potential risks and prevent damage, a key differentiator in the competitive insurance market.

Hippo Insurance Services leverages artificial intelligence and machine learning to refine its risk assessment and pricing models, significantly boosting underwriting accuracy and operational efficiency. This technological edge enables Hippo to present more competitive insurance premiums to its customers. For instance, in 2024, the insurtech sector saw a substantial increase in AI adoption, with companies reporting up to a 15% improvement in underwriting accuracy through AI-driven analytics.

By integrating advanced algorithms, Hippo aims to better predict and mitigate potential losses, thereby improving its overall loss ratios. This data-driven approach to underwriting allows for more granular risk segmentation, potentially leading to reduced claims payouts and a stronger financial position for the company. Industry reports from late 2024 indicated that insurers employing AI in underwriting experienced an average reduction in loss ratios by 5-10% compared to traditional methods.

Hippo Insurance Services leverages its proprietary quoting and underwriting engine, accessible through APIs, to efficiently reach customers across various distribution channels. This technological backbone is crucial for their strategy to capture market share by simplifying the insurance application journey.

This advanced system enables swift and precise policy issuance, a significant advantage in the competitive insurance landscape. For instance, in Q1 2024, Hippo reported a substantial increase in its digital quoting capabilities, directly attributable to the engine's efficiency, leading to a 15% faster policy turnaround time compared to the previous year.

Strategic Partnerships for Technology Development

Hippo Insurance Services actively pursues strategic partnerships to accelerate its technological advancements. These collaborations are crucial for developing cutting-edge solutions in areas like artificial intelligence and virtual care, directly impacting their service offerings and operational efficiency.

For instance, Hippo's partnership with DigiLens Inc. focuses on augmented reality (AR) enabled computing. This allows them to innovate in proactive home protection by providing enhanced tools for inspections and customer support, potentially reducing claims and improving customer experience.

These alliances are not just about adopting new tech; they are about co-creating value. By leveraging external expertise, Hippo aims to stay ahead in a rapidly evolving insurtech landscape, with a particular focus on smart home technology integration and data analytics for risk assessment.

- AI Development: Partnerships are key to integrating AI for tasks like automated claims processing and personalized customer interactions.

- Virtual Care Solutions: Collaborations in this space aim to offer remote assistance and diagnostics, improving accessibility and response times.

- AR Technology: The DigiLens Inc. partnership exemplifies the use of AR for enhanced home inspections and customer engagement, potentially leading to more accurate underwriting and proactive risk mitigation.

Technological Risks and Cybersecurity Concerns

Hippo Insurance's reliance on its proprietary technology, including its AI-driven underwriting and claims processing, presents significant technological risks. System failures or unexpected operational issues could disrupt core services, impacting customer experience and operational efficiency. For instance, in 2024, the insurance industry saw a rise in cyberattacks targeting sensitive customer data, with the average cost of a data breach reaching $4.45 million globally.

Cybersecurity is a paramount concern for Hippo, given its handling of extensive personal and financial information. Robust measures are essential to protect against data breaches, ransomware, and other cyber threats. Failure to do so not only exposes customers to risk but also invites substantial regulatory penalties and reputational damage. In 2025, regulatory bodies are expected to further tighten data privacy laws, increasing compliance burdens and potential fines for non-compliance.

- System Vulnerabilities: Hippo's proprietary platform could experience downtime or errors, affecting policy issuance, claims handling, and customer interactions.

- Data Breach Risks: The aggregation of sensitive customer data makes Hippo a target for cybercriminals, necessitating advanced security protocols.

- Regulatory Compliance: Evolving data protection regulations, such as those anticipated in 2025, require continuous investment in cybersecurity infrastructure and practices.

- Third-Party Dependencies: Reliance on third-party data providers or cloud services introduces external vulnerabilities that Hippo must actively manage.

Hippo Insurance Services' technological foundation is built on AI, machine learning, and IoT integration, driving efficiency and personalized customer experiences. The company's proprietary underwriting engine, accessible via APIs, facilitates rapid policy issuance, with a 15% faster turnaround time reported in Q1 2024. Strategic partnerships, such as the one with DigiLens Inc. for AR technology, enhance home inspections and customer support, aiming to reduce claims and improve underwriting accuracy.

| Technology Area | Key Application | Impact/Benefit | 2024/2025 Data Point |

| AI & Machine Learning | Underwriting, Risk Assessment, Claims Processing | Improved accuracy, operational efficiency, competitive pricing | Up to 15% improvement in underwriting accuracy (2024) |

| IoT & Smart Home Tech | Proactive Risk Monitoring, Damage Prevention | Personalized insurance, reduced claims | N/A (Ongoing development) |

| APIs & Proprietary Engines | Quoting, Underwriting, Distribution | Simplified application, faster policy issuance | 15% faster policy turnaround time (Q1 2024) |

| Augmented Reality (AR) | Home Inspections, Customer Support | Enhanced accuracy, proactive risk mitigation | Partnership with DigiLens Inc. (Ongoing) |

Legal factors

Hippo Insurance Services navigates a labyrinth of insurance regulations, a critical factor influencing its operations. These rules dictate everything from financial stability and licensing to the very language of its policies and how claims are handled. For instance, in 2023, the National Association of Insurance Commissioners (NAIC) continued to refine cybersecurity guidelines, impacting how insurers like Hippo manage data privacy.

Adhering to these often state-specific mandates presents a significant operational challenge. Failure to comply can result in hefty fines and operational disruptions. The complexity is underscored by the fact that each of the 50 U.S. states has its own insurance department with unique rules, requiring constant vigilance and adaptation from companies like Hippo.

Hippo Insurance Services has encountered significant regulatory attention concerning its underwriting and non-renewal procedures. This scrutiny often centers on the application of unfiled guidelines and the justification provided for policy non-renewals, indicating a need for greater transparency and adherence to established regulatory frameworks.

For instance, in 2023, state insurance departments continued to emphasize the importance of carriers providing clear and compliant reasons for non-renewals, with some states enacting stricter rules on policy cancellation and non-renewal notices. Hippo's practices are being evaluated against these evolving standards, which aim to protect consumers from arbitrary policy terminations.

The financial implications of non-compliance can be substantial, including fines and reputational damage. In 2024, regulatory bodies are expected to maintain a high level of oversight, potentially leading to increased compliance costs for insurers like Hippo as they adapt their underwriting and non-renewal processes to meet stringent legal requirements.

Recent legal challenges, like those involving assignment of rights clauses in insurance contracts, highlight the critical need for unambiguous and legally robust contract terms. These disputes can significantly affect Hippo Insurance Services' relationships with its partners and customers.

For instance, in 2024, several class-action lawsuits were filed against insurers concerning the interpretation of subrogation clauses, potentially impacting claims processing and recovery efforts. Such litigation can lead to substantial legal fees and settlements, as demonstrated by a 2023 case where an insurer paid $75 million to resolve claims related to unfair claims settlement practices.

Data Privacy and Cybersecurity Regulations

Hippo Insurance's business model hinges on data analytics and smart home technology, making adherence to stringent data privacy and cybersecurity regulations absolutely critical. Failure to comply with frameworks like GDPR or CCPA, or experiencing a data breach, can result in substantial financial penalties and severe damage to customer trust. For instance, the US experienced over 1,100 large data breaches in 2023 alone, exposing more than 150 million records, highlighting the pervasive risk.

The evolving legal landscape presents ongoing challenges. Regulators are continually updating requirements for data protection, consent management, and breach notification, demanding proactive and robust compliance strategies from companies like Hippo. This necessitates significant investment in cybersecurity infrastructure and ongoing legal counsel to navigate the complexities of global data governance.

- Data Breach Impact: In 2023, the average cost of a data breach in the US reached $4.45 million, a figure Hippo must actively mitigate.

- Regulatory Fines: Non-compliance with data privacy laws can lead to fines of up to 4% of global annual revenue, as seen under GDPR.

- Consumer Trust: Over 60% of consumers state they would cease doing business with a company following a data breach, underscoring reputational risk.

Regulatory Approval for Product Development and Expansion

Hippo Insurance Services, like all insurance providers, navigates a complex web of regulations impacting its product development and market expansion strategies. The introduction of novel insurance products or entry into new geographical territories necessitates rigorous approval from state and federal regulatory bodies. This process can be time-consuming and demanding, requiring significant investment in compliance and legal resources.

For instance, in 2024, the National Association of Insurance Commissioners (NAIC) continued its focus on modernizing insurance regulations to keep pace with technological advancements, a trend likely to influence product approval timelines. Hippo's ability to swiftly bring innovative offerings, such as those leveraging AI for underwriting or personalized coverage, to market can be directly affected by these regulatory cycles. Delays in obtaining approvals can hinder growth objectives and impact competitive positioning.

- Regulatory Oversight: State insurance departments oversee product filings and market conduct, ensuring consumer protection and financial solvency.

- Innovation Challenges: New product features, especially those involving advanced data analytics or novel risk models, may face longer review periods.

- Market Entry Hurdles: Expanding into new states requires separate regulatory approvals, adding complexity and cost to growth strategies.

- Compliance Costs: Maintaining compliance with evolving regulations represents a significant operational expense for insurers like Hippo.

Legal factors are paramount for Hippo Insurance Services, dictating everything from policy wording to claims handling and data protection. State-specific regulations require constant adaptation, with non-compliance leading to significant fines and operational hurdles.

Recent legal scrutiny has focused on underwriting and non-renewal practices, emphasizing the need for transparency and adherence to established frameworks. For example, in 2023, states reinforced requirements for clear non-renewal reasons, impacting how Hippo manages customer policies.

Data privacy and cybersecurity laws are critical due to Hippo's reliance on technology. The average cost of a data breach in the US reached $4.45 million in 2023, a risk Hippo must actively mitigate through robust compliance with regulations like CCPA.

Navigating product development and market expansion involves rigorous regulatory approvals, with bodies like the NAIC working to modernize rules for technological advancements. This can affect the speed at which innovative offerings are brought to market.

| Legal Factor | Impact on Hippo | Relevant Data/Trend (2023-2024) |

| Regulatory Compliance | Dictates operational procedures, policy terms, and claims handling. | State insurance departments enforce unique rules, requiring constant adaptation. |

| Underwriting & Non-Renewal Scrutiny | Requires clear justification for policy changes and terminations. | States increasingly demand transparent reasons for non-renewals, impacting Hippo's practices. |

| Data Privacy & Cybersecurity | Essential for protecting customer data and avoiding breaches. | US data breaches averaged $4.45 million in 2023; fines can reach 4% of global revenue under GDPR. |

| Product Approval & Market Entry | Involves obtaining necessary approvals for new offerings and geographic expansion. | NAIC is modernizing regulations for tech advancements, potentially affecting product launch timelines. |

Environmental factors

The escalating impact of climate change and weather events presents a significant environmental challenge for Hippo Insurance Services. Increased frequency and intensity of events like wildfires, hurricanes, and floods directly translate to higher claims payouts, impacting the company's loss ratios. For instance, 2023 saw record-breaking insured losses from natural catastrophes globally, estimated to be around $110 billion, a substantial increase from previous years, directly affecting insurers' profitability.

Hippo Insurance Services is strategically adapting its underwriting model to better account for climate change impacts and reduce exposure to weather-related volatility. This proactive approach is essential given the increasing frequency and intensity of extreme weather events impacting the insurance industry.

In response to these evolving risks, Hippo has implemented measures such as adjusting its reinsurance strategies to secure adequate coverage against catastrophic events. Furthermore, the company has been raising rates in certain areas and, in some instances, non-renewing policies in regions identified as having exceptionally high weather-related risks, aiming to maintain financial stability and solvency.

Homeowners are increasingly seeking specialized coverage, particularly for perils like flooding. This trend is driven by a growing awareness of extreme weather events. For instance, in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $92.9 billion in damages, according to NOAA's National Centers for Environmental Information. This heightened concern creates a clear market opening for insurers like Hippo to adapt their policies.

Hippo can capitalize on this demand by developing and promoting tailored policies that address specific, high-impact risks. By offering robust flood insurance options, for example, alongside other specialized coverages, Hippo can differentiate itself. This strategic alignment with evolving consumer needs and the increasing frequency of severe weather events positions Hippo for growth in a more risk-aware market.

Loss Prevention through Smart Home Technology

Hippo Insurance Services leverages smart home technology to proactively address environmental risks, a key component of its loss prevention strategy. This integration allows for real-time monitoring of potential hazards such as water leaks, smoke, and carbon monoxide, thereby minimizing property damage and the associated environmental footprint. For instance, a study by the National Institute of Building Sciences in 2024 indicated that smart water leak detectors can reduce water damage claims by up to 40%, directly translating to less waste and resource consumption.

Hippo's approach directly tackles environmental factors by promoting a more resilient built environment. By encouraging policyholders to adopt devices that can detect and alert them to issues before they escalate, the company helps prevent the need for extensive repairs or rebuilding, which often have significant environmental consequences. The adoption of such technologies is growing, with the global smart home market projected to reach over $200 billion by 2025, underscoring a broader societal shift towards sustainability and risk mitigation.

- Reduced Water Damage: Smart leak detectors can prevent costly water damage, saving resources and reducing the environmental impact of repairs.

- Fire Prevention: Smart smoke and carbon monoxide detectors offer early warnings, minimizing the environmental devastation caused by uncontrolled fires.

- Energy Efficiency: Some smart home devices also contribute to energy efficiency, further reducing a household's environmental impact.

- Data-Driven Risk Assessment: Hippo can use data from these devices to better understand and underwrite environmental risks.

Influence of Green Building and Energy Efficiency Trends

The increasing adoption of green building practices and homeowner demand for energy-efficient upgrades are reshaping the insurance landscape for properties. This shift influences the types of risks Hippo Insurance Services needs to underwrite, as newer, more sustainable constructions may present different risk profiles compared to older, less efficient homes. For instance, the integration of advanced materials and systems in green buildings could alter repair costs and claims frequency.

Government incentives play a significant role in accelerating these sustainable home improvement trends. In 2024, programs like the Inflation Reduction Act in the United States continued to offer tax credits for energy-efficient retrofits, encouraging homeowners to invest in upgrades such as solar panels and improved insulation. These incentives can lead to a greater number of insured properties with these features, potentially impacting insurance risk assessments and the demand for specialized policies.

The influence of these environmental factors can be seen in market data. By early 2025, a notable percentage of new residential construction in many developed nations is expected to incorporate green building standards, reflecting a sustained commitment to sustainability. This growing segment of the housing market requires insurers to adapt their underwriting models and product offerings to accurately price the associated risks and meet evolving customer needs.

- Green Building Growth: Expect a continued rise in properties built to LEED or similar green standards, influencing repair cost assessments.

- Energy Efficiency Investments: Homeowners are increasingly prioritizing upgrades like smart thermostats and solar power, potentially reducing utility-related claims but introducing new technology risks.

- Government Support: Tax credits and rebates for energy-efficient home improvements, such as those available through the 2024/2025 federal energy tax credits, will continue to drive adoption.

- Risk Profile Evolution: Insurers must adapt to the changing risk profiles of homes with advanced energy systems and sustainable materials.

The increasing frequency and severity of natural disasters, such as wildfires and floods, directly impact Hippo Insurance Services through higher claims. Global insured losses from natural catastrophes in 2023 reached an estimated $110 billion, highlighting the financial strain on insurers. Hippo's strategy involves adjusting underwriting to account for climate change and modifying reinsurance to cover catastrophic events, including rate increases in high-risk areas.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hippo Insurance Services is built on data from reputable sources including government regulatory bodies, financial institutions, and leading industry research firms. We analyze economic indicators, technological advancements, and societal trends to provide a comprehensive overview.