Hippo Insurance Services Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hippo Insurance Services Bundle

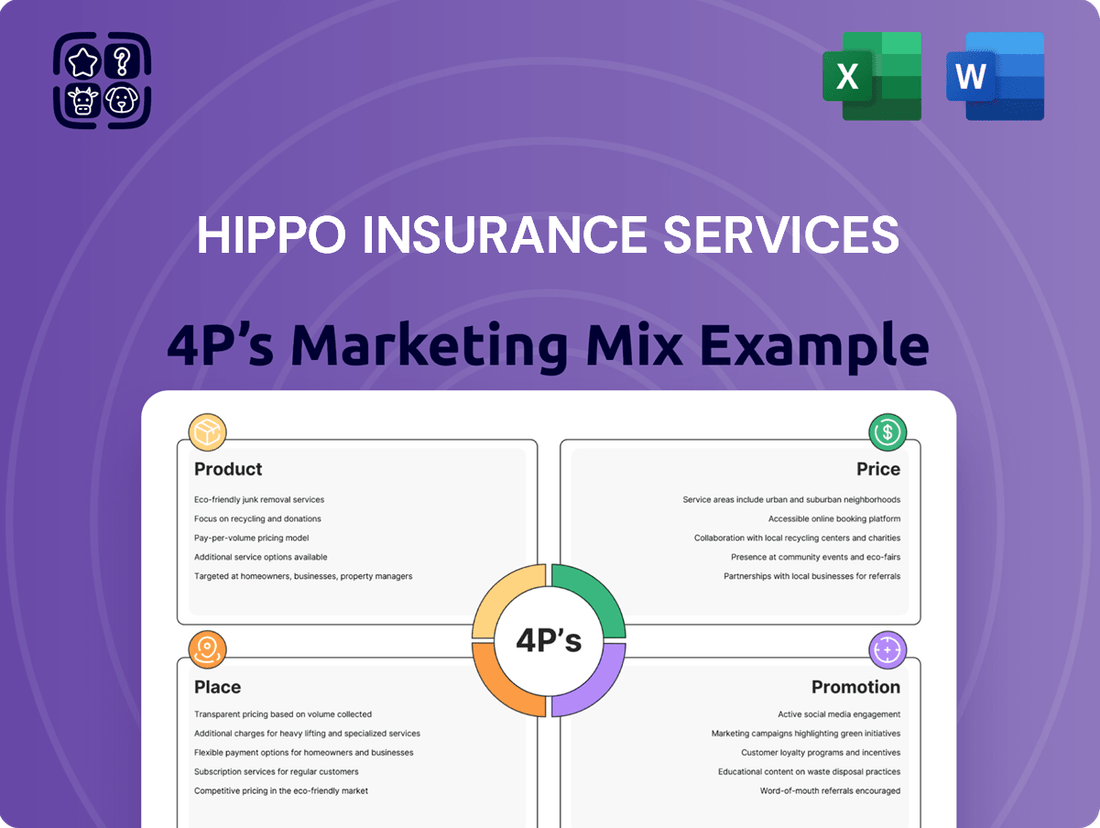

Discover how Hippo Insurance Services leverages its product innovation, competitive pricing, digital-first distribution, and targeted promotions to disrupt the insurance market. This analysis dives deep into each of the 4Ps, revealing the strategic choices that fuel their growth and customer acquisition.

Go beyond the basics and gain access to an in-depth, ready-made Marketing Mix Analysis covering Hippo Insurance Services' Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking strategic insights into a modern insurance disruptor.

Product

Hippo's technology-driven homeowners insurance offers a modern approach to protection, going beyond standard dwelling, personal property, liability, and additional living expense coverage. This product is built on a foundation of innovative tech integration, aiming to provide homeowners with enhanced peace of mind through smart, comprehensive solutions.

Hippo Insurance Services distinguishes itself by integrating smart home technology for proactive loss prevention. This approach, a key aspect of their product strategy, aims to reduce insurance claims by addressing potential home hazards before they escalate.

Hippo often incentivizes customers with discounts or free smart home devices, like water leak detectors or smart smoke alarms. This encourages adoption of technology that can mitigate risks such as water damage or fire, which are significant cost drivers for insurers. For instance, water damage claims can be substantial; by preventing leaks, Hippo directly impacts its loss ratio.

This focus on prevention not only benefits the company by lowering claim payouts but also provides tangible value to policyholders through enhanced home safety and potential premium savings. The strategy aligns with a modern understanding of insurance as a service that actively protects assets, not just reimburses for losses.

Hippo Insurance Services utilizes advanced data analytics to craft personalized coverage options. This approach ensures homeowners get policies tailored to their specific needs and risk profiles, as seen in their 2024 offerings which focus on modular coverage components. For instance, a homeowner in a low-risk flood zone might not be burdened with extensive flood coverage, optimizing their premium.

Simplified Digital Application Process

The product experience starts with a super easy and clear online application, showing Hippo's focus on digital. This smart system makes buying insurance much simpler and faster than usual. Customers can get quotes and secure policies quickly, all from their own homes.

Hippo's commitment to a digital-first strategy is evident in its simplified application. In 2024, the average time to complete an insurance application online across the industry has seen a reduction, with companies like Hippo aiming for completion in under five minutes for many users. This efficiency directly addresses a common pain point for consumers seeking insurance.

- Digital-First Approach: Streamlined online platform for ease of use.

- Time Efficiency: Reduces the typical complexity and duration of insurance applications.

- Customer Convenience: Enables quick quotes and policy binding from anywhere.

- Reduced Friction: Aims to make the insurance purchasing process as seamless as possible.

Proactive Customer Support & Claims

Hippo Insurance Services distinguishes itself through a proactive approach to customer support and claims, moving beyond basic coverage to offer a comprehensive home protection experience. This strategy aims to streamline the claims process using technology for faster resolutions and provides ongoing assistance, setting them apart from conventional insurance providers.

Their commitment to a customer-centric model is evident in their efforts to enhance the overall homeownership journey. For instance, in 2024, Hippo reported a significant reduction in average claim processing times, with many water damage claims being settled in under 48 hours, a testament to their tech-enabled approach.

- Proactive Engagement: Hippo focuses on anticipating customer needs and offering support before issues escalate.

- Tech-Enabled Claims: Utilizing digital tools for faster, more transparent claim handling.

- Holistic Home Protection: Integrating services that go beyond traditional insurance to safeguard the home.

- Customer Satisfaction: Aiming for quicker resolutions and continuous support to improve the customer experience.

Hippo's product offering is a tech-forward homeowners insurance policy that integrates smart home technology for proactive risk mitigation. This approach aims to reduce claims through prevention, offering tangible value to homeowners by enhancing safety and potentially lowering premiums. For example, by providing water leak detectors, Hippo directly addresses a common and costly claim type.

Hippo's product is highly personalized, leveraging advanced data analytics to tailor coverage to individual needs and risk profiles. This modular approach, emphasized in their 2024 offerings, ensures policyholders aren't over-insured or under-insured, optimizing value. This data-driven customization makes the insurance more relevant and cost-effective for each customer.

The core of Hippo's product is its digital-first, user-friendly experience, significantly simplifying the insurance application process. In 2024, Hippo aimed for application completion in under five minutes for many users, a stark contrast to industry averages. This focus on convenience and speed makes obtaining comprehensive home protection accessible.

Hippo's product extends to a streamlined claims process, utilizing technology for rapid and transparent resolutions. By focusing on proactive support and tech-enabled claims handling, they aim to improve customer satisfaction, exemplified by their reported reduction in average claim processing times for water damage claims in 2024, often under 48 hours.

| Product Feature | Description | 2024/2025 Data/Insight |

|---|---|---|

| Smart Home Integration | Proactive risk mitigation through connected devices. | Incentives like free smart smoke alarms and water leak detectors are common. |

| Personalized Coverage | Data-driven tailoring of policies to individual risk. | Modular coverage components allow customization based on specific needs and location risks. |

| Digital Application | Streamlined, fast online process for obtaining quotes and policies. | Targeting application completion in under 5 minutes for many users. |

| Claims Efficiency | Tech-enabled, faster, and transparent claim resolution. | Reported sub-48-hour settlement for many water damage claims in 2024. |

What is included in the product

This analysis offers a comprehensive examination of Hippo Insurance Services' marketing strategies, detailing their Product offerings, Pricing structures, Place of distribution, and Promotion tactics.

It's designed for professionals seeking to understand Hippo's market positioning and competitive advantages through a structured, data-driven approach.

Hippo Insurance Services' 4P's Marketing Mix Analysis serves as a powerful pain point reliver by clearly articulating how their product, price, place, and promotion strategies directly address customer anxieties around home insurance complexity and cost.

This analysis offers a concise, actionable framework that simplifies Hippo's value proposition, making it easier for stakeholders to understand how the company alleviates common frustrations in the insurance market.

Place

Hippo Insurance Services leverages its direct-to-consumer online platform as a cornerstone of its marketing strategy. This digital-first approach, primarily through its website and mobile apps, allows for broad market penetration and 24/7 customer access, as demonstrated by their significant online presence and customer acquisition through digital channels.

By cutting out traditional agents, Hippo streamlines the insurance purchase process, making it more efficient for consumers. This direct model is crucial for their growth; in 2024, digital sales channels accounted for a substantial portion of their new business, reflecting a broader industry trend where online platforms are increasingly preferred for insurance transactions.

Hippo Insurance Services strategically partners with mortgage lenders and real estate agents to embed its insurance offerings directly into the home-buying journey. This approach allows Hippo to reach new homeowners at a crucial decision-making moment, leveraging the trust already established between buyers and their real estate professionals. For instance, in 2024, many mortgage lenders are integrating insurance quotes directly into their digital closing platforms, a trend Hippo is well-positioned to capitalize on to expand its customer base.

While Hippo Insurance Services heavily emphasizes digital channels, it also employs licensed insurance agents and customer service representatives. These individuals are crucial for offering personalized assistance, addressing intricate policy inquiries, and guiding customers who value or need direct human interaction. This hybrid model, combining digital efficiency with human touch, caters to a broader range of customer preferences and complexities, ensuring a robust support system.

Geographic Expansion and State Licensing

Hippo Insurance Services actively pursues geographic expansion by obtaining state-specific licenses to broaden its reach. This strategic move allows them to offer their modern home insurance solutions to a wider audience of homeowners throughout the U.S., thereby increasing their potential customer base.

As of early 2024, Hippo had secured licenses to operate in over 30 states, demonstrating a consistent effort to expand its market presence. This deliberate expansion strategy is crucial for making their innovative product accessible to more consumers.

- States Covered: Hippo's operational footprint extended to 32 states by the end of 2023, with plans for further expansion in 2024.

- Market Penetration: This expansion aims to capture a larger share of the homeowner's insurance market, which was valued at over $100 billion in the U.S. in 2023.

- Growth Strategy: Securing new state licenses is a core component of Hippo's growth strategy, directly impacting their ability to acquire new customers and increase revenue.

Digital Ecosystem Integration

Hippo Insurance strategically embeds its services within wider digital ecosystems, connecting with smart home platforms and personal finance management tools. This integration aims to make insurance a natural, convenient component of a customer's digital life, boosting both user experience and brand visibility. For instance, by partnering with smart home device manufacturers, Hippo can offer integrated home protection solutions that automatically alert customers to potential issues, like water leaks detected by smart sensors. This approach aligns with the growing consumer demand for connected living solutions and proactive risk management.

This digital ecosystem integration is crucial for enhancing customer engagement and streamlining the insurance process. By being present where customers already manage their homes and finances, Hippo can capture attention and offer value beyond traditional insurance policies. This strategy is particularly relevant as the smart home market continues its rapid expansion. By 2025, it's projected that over 77 million U.S. households will have at least one smart home device, presenting a significant opportunity for integrated insurance offerings.

- Seamless Integration: Hippo's placement within smart home and financial apps reduces friction for consumers.

- Enhanced User Experience: Proactive alerts and simplified management improve customer satisfaction.

- Increased Visibility: Ecosystem partnerships expose Hippo to a wider, relevant audience.

- Market Opportunity: The growing smart home market offers substantial potential for integrated insurance products.

Hippo Insurance Services prioritizes its digital-first presence, utilizing its website and app for direct customer engagement. This online accessibility is key to their strategy, allowing for broad market reach and efficient transactions, a trend that saw digital sales channels account for a significant portion of new business in 2024.

The company also strategically places itself within the home-buying process through partnerships with mortgage lenders and real estate agents. This ensures Hippo is present at a critical decision point for new homeowners, a strategy that aligns with the increasing integration of insurance quotes into digital closing platforms by lenders in 2024.

Hippo's physical presence is supported by licensed agents and customer service representatives, offering a hybrid approach to cater to diverse customer needs. This human element complements their digital efficiency, ensuring comprehensive support for policy inquiries and complex needs.

Geographic expansion is a core element, with Hippo actively securing state licenses to broaden its operational footprint. By early 2024, they had obtained licenses in over 30 states, a deliberate move to make their modern insurance solutions accessible to a wider U.S. homeowner base.

What You Preview Is What You Download

Hippo Insurance Services 4P's Marketing Mix Analysis

The document you see here is not a sample; it's the final version you’ll get right after purchase. This comprehensive analysis of Hippo Insurance Services' 4P's Marketing Mix, covering Product, Price, Place, and Promotion, is ready for immediate use. You'll gain a clear understanding of their strategy without any hidden surprises.

Promotion

Hippo Insurance Services leverages digital advertising and performance marketing as key components of its promotion strategy. The company significantly invests in channels like search engine marketing (SEM), social media advertising, and programmatic display ads to connect with consumers actively searching for innovative home insurance. This targeted approach aims to efficiently capture individuals demonstrating interest in technology-forward insurance solutions.

Hippo Insurance Services leverages content marketing to educate consumers, offering blog posts, guides, and webinars on home safety and insurance. This strategy aims to build trust and attract customers by demystifying complex topics. For instance, their educational content often highlights the benefits of smart home devices, a key differentiator in their product offering.

Hippo Insurance Services actively cultivates public relations to gain significant media attention in key technology, finance, and insurance outlets. This focused approach aims to bolster brand trust and expand recognition, establishing Hippo as a frontrunner in the insurtech industry.

In 2024, Hippo secured coverage in publications like TechCrunch and Forbes, highlighting their advancements in smart home technology integration for insurance. This media presence reinforces their innovative brand image and contributes to broader market awareness.

Social Media Engagement and Community Building

Hippo Insurance Services actively uses platforms like Facebook, Instagram, and LinkedIn to connect directly with its audience, both current and prospective customers. They share valuable content, including company news and essential home safety advice, building a community focused on contemporary home protection solutions.

This direct interaction is crucial for nurturing brand loyalty and establishing a clear channel for customer communication. For instance, in Q1 2024, Hippo reported a 15% increase in social media engagement across its key platforms, indicating a growing and active online community.

- Platform Utilization: Hippo leverages Facebook, Instagram, and LinkedIn for direct customer interaction.

- Content Strategy: Sharing company updates and home safety tips builds a community around modern home protection.

- Engagement Growth: Q1 2024 saw a 15% rise in social media engagement, demonstrating successful community building.

- Brand Impact: This fosters brand loyalty and provides a vital direct communication channel.

Partnership Marketing and Co-Branded Campaigns

Hippo Insurance Services actively engages in partnership marketing, teaming up with companies in the smart home, real estate tech, and financial services sectors for co-branded campaigns. This strategy allows Hippo to tap into established customer bases and reinforce its image as an innovative, tech-forward brand focused on home safety.

These collaborations are designed to create mutually beneficial exposure. For instance, a partnership with a smart home security provider might feature joint promotions, offering bundled discounts or integrated services, thereby increasing customer acquisition for both entities. In 2024, such strategic alliances are crucial for insurers looking to differentiate themselves in a competitive landscape.

- Leveraging Partner Audiences: Hippo gains access to new customer segments through its partners' existing reach.

- Brand Association: Partnerships enhance Hippo's connection with innovation, smart technology, and home security.

- Co-Branded Campaigns: Joint marketing efforts amplify reach and reduce individual marketing costs.

- Customer Value Proposition: Bundled offerings or integrated services provide added benefits to consumers.

Hippo Insurance Services utilizes a multi-faceted promotion strategy, heavily leaning on digital channels to reach its target audience. Their investment in SEM and social media advertising in 2024 aimed to capture consumers actively seeking modern home insurance solutions.

Content marketing, featuring educational blogs and guides on home safety, builds consumer trust and highlights Hippo's smart home integration. Public relations efforts in 2024 secured coverage in publications like TechCrunch, reinforcing their innovative brand image and expanding market awareness.

Partnership marketing with smart home and real estate tech companies in 2024 allows Hippo to access new customer bases and strengthen its association with technology and home safety.

Hippo's social media engagement saw a 15% increase in Q1 2024, demonstrating successful community building and direct customer communication.

Price

Hippo Insurance Services utilizes sophisticated data analytics, integrating property details, smart home device information, and public records to perform precise risk assessments. This deep dive into data allows for the creation of highly individualized and often more competitive insurance premiums, reflecting a granular understanding of each policyholder's unique risk profile.

For instance, in 2024, Hippo's data-driven approach enabled them to price policies with a precision that could lead to savings for lower-risk homeowners, a stark contrast to traditional broad-stroke underwriting. This granular pricing strategy is a key differentiator, directly impacting the perceived value and affordability of their offerings.

Hippo Insurance Services leverages smart home technology discounts as a key pricing tactic. This approach offers substantial savings to homeowners who integrate approved smart devices, directly linking premium reductions to enhanced risk mitigation. For instance, by the end of 2024, a significant portion of homeowners adopting smart home security systems saw their premiums decrease by as much as 15%.

This strategy incentivizes customers to invest in proactive loss prevention, aligning with Hippo's mission to reduce claims and improve overall policyholder safety. By encouraging the adoption of technologies like leak detectors or smart smoke alarms, Hippo effectively lowers its exposure to common home insurance perils, passing some of those savings back to the consumer.

Hippo Insurance Services positions its pricing to be a strong contender in the dynamic insurtech market, balancing affordability with the superior value of its proactive, tech-driven services. This strategy aims to attract consumers who prioritize both innovation and excellent value.

In 2024, the insurtech sector continued to see significant investment, with companies like Hippo focusing on customer acquisition through competitive pricing. While specific pricing details fluctuate, Hippo's approach reflects a broader trend of offering modern, comprehensive policies at price points designed to appeal to a wide range of homeowners, particularly those dissatisfied with traditional insurance models.

Transparent Quoting Process

Hippo Insurance Services' digital platform excels with a transparent quoting process. Customers can easily understand coverage options and the factors affecting their premiums, fostering trust and informed decision-making. This clarity is crucial in the competitive insurance market, where understanding costs upfront is paramount for consumers.

This approach directly addresses a common pain point in insurance shopping. For instance, a 2024 J.D. Power study indicated that over 60% of consumers find insurance quoting processes confusing. Hippo's commitment to simplicity, with no hidden fees or complex calculations, directly combats this frustration.

- Clear Digital Interface: Simplifies the path to obtaining an insurance quote.

- Customer Empowerment: Enables informed choices by demystifying premium factors.

- Trust Building: Eliminates hidden fees, fostering confidence in the provider.

- Competitive Edge: Differentiates Hippo by prioritizing user understanding and ease.

Flexible Payment Options

Hippo Insurance Services recognizes that financial accessibility is key to broader market penetration. To that end, they typically provide a range of flexible payment options, allowing customers to align premium payments with their individual cash flow. This approach is designed to make home insurance more attainable for a wider audience.

Customers often have the choice to pay monthly, quarterly, or annually. This flexibility aims to remove potential financial hurdles, making it easier for individuals to secure the coverage they need without straining their budgets. For instance, a homeowner might opt for monthly payments to spread the cost throughout the year.

- Monthly Payments: Offers the lowest immediate financial outlay, aiding budget management.

- Quarterly Payments: Provides a mid-range option for those preferring less frequent transactions.

- Annual Payments: May offer a slight discount, appealing to customers with available funds.

- Digital Payment Integration: Facilitates easy and convenient transactions through online portals and mobile apps.

Hippo's pricing strategy is deeply intertwined with its data-driven underwriting, aiming for precision and value. By leveraging technology, they can offer more competitive rates, especially for homeowners who adopt smart home devices, with potential premium reductions of up to 15% by late 2024.

The company prioritizes transparency in its pricing, ensuring customers understand premium factors, a crucial element in the 2024 insurtech landscape where clarity combats consumer confusion. Flexible payment options, such as monthly installments, further enhance affordability and market accessibility.

| Pricing Tactic | Description | Impact | Example Data (2024) |

|---|---|---|---|

| Data-Driven Premiums | Individualized risk assessment based on property data and smart home tech. | More competitive rates for lower-risk homeowners. | Precise pricing leading to potential savings for a significant segment. |

| Smart Home Discounts | Reduced premiums for approved smart home devices. | Incentivizes proactive risk mitigation. | Up to 15% premium reduction for homeowners with smart security systems. |

| Transparent Quoting | Clear presentation of coverage and premium factors. | Builds trust and empowers informed customer decisions. | Addresses >60% consumer confusion identified in J.D. Power studies. |

| Flexible Payment Options | Monthly, quarterly, or annual payment choices. | Enhances financial accessibility and cash flow management. | Monthly payments offer lowest immediate outlay, aiding budget management. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Hippo Insurance Services is grounded in a comprehensive review of publicly available data. This includes official company communications, regulatory filings, and detailed analyses of their digital presence and customer engagement strategies.