Hippo Insurance Services Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hippo Insurance Services Bundle

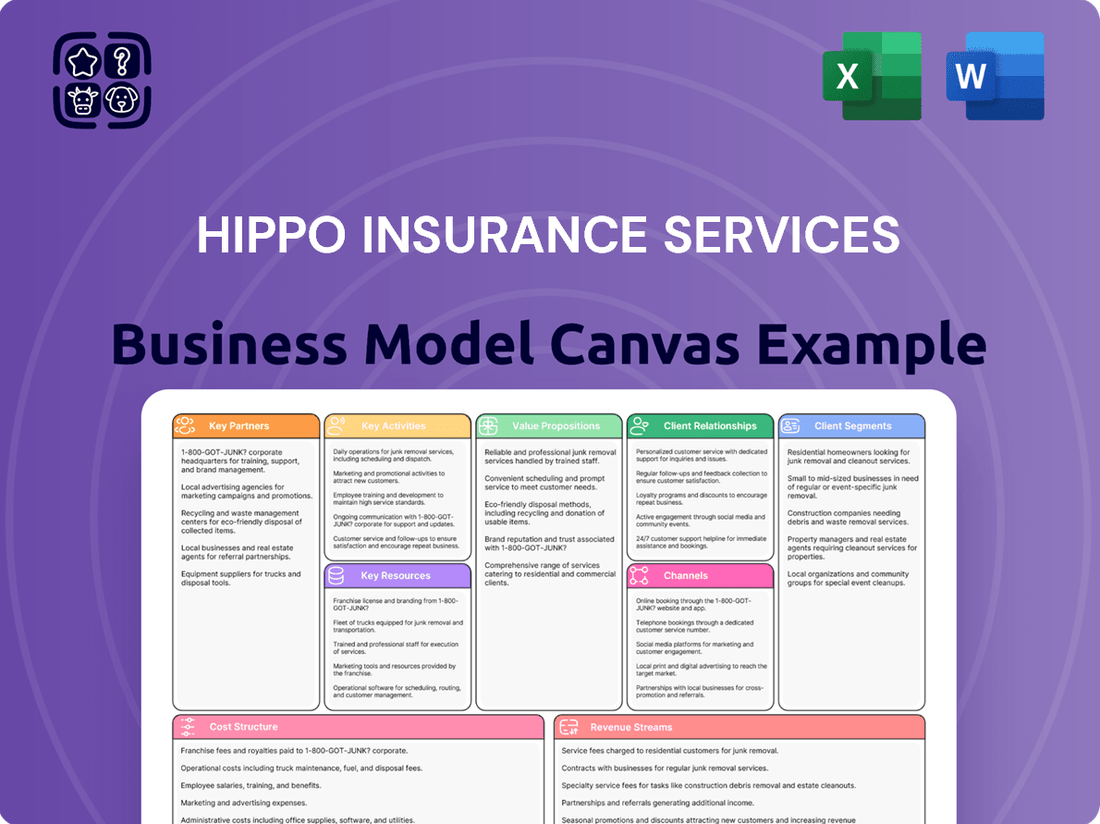

Explore the innovative strategies behind Hippo Insurance Services's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, key resources, and revenue streams, offering a clear view of how they're disrupting the insurance industry.

Ready to gain a competitive edge? Download the full Business Model Canvas for Hippo Insurance Services to uncover their unique value proposition, cost structure, and channels. It's your roadmap to understanding and replicating their market-leading approach.

Partnerships

Hippo Insurance Services strategically partners with prominent smart home technology providers, including companies like SimpliSafe and Ring, and has established a significant collaboration with ADT. These alliances are crucial for integrating advanced, proactive home protection directly into Hippo's insurance products.

Through these key partnerships, Hippo offers policyholders access to smart home devices designed to mitigate prevalent risks such as water damage, fires, and burglaries. This proactive approach aligns perfectly with Hippo's core mission of preventing losses, thereby enhancing customer safety and reducing claims.

The integration of smart home technology not only strengthens Hippo's loss prevention strategy but also provides tangible benefits to customers. Policyholders who adopt these integrated smart home solutions often qualify for potential discounts on their insurance premiums, making home protection more affordable and effective.

Hippo Insurance Services has forged significant partnerships with leading home builders like Perry Homes, Van Daele, Lennar, and K. Hovnanian. These collaborations integrate Hippo's insurance offerings directly into the purchase of new homes, streamlining the process for buyers.

A recent alliance with Westwood Insurance Agency, a subsidiary of The Baldwin Group, further strengthens Hippo's reach within the new construction sector. Through its New Homes Program, Hippo provides specialized and cost-effective insurance for newly built properties, simplifying the closing procedures for homebuyers.

Hippo Insurance Services relies on key partnerships with reinsurance companies to effectively manage its underwriting risk, especially for significant catastrophe events. These collaborations are fundamental to maintaining Hippo's financial stability by balancing its exposure to potential losses.

The company's proactive approach to reducing volatility from weather-related events has positioned its Hippo Home Insurance Program favorably with reinsurers. This attractiveness allows Hippo to secure more advantageous terms for its reinsurance agreements, a critical component of its risk management strategy.

Data Analytics and AI Platform Providers

Hippo Insurance Services collaborates with leading data analytics and AI platform providers, notably partnering with companies like Arturo. This strategic alliance allows Hippo to harness the power of AI-driven deep learning for sophisticated property analysis.

By integrating advanced technology, Hippo gains access to detailed insights derived from a variety of imagery, including satellite, aerial, and ground-level data. This capability significantly refines their quotation, underwriting, and renewal processes, leading to more accurate risk assessments.

These partnerships are crucial for Hippo's business model, enabling them to deliver highly precise and customized insurance quotes with remarkable efficiency. For instance, in 2024, the insurance industry saw a significant increase in the adoption of AI for underwriting, with some reports suggesting a 20% growth in AI-driven underwriting solutions.

- Strategic Alliances: Partnerships with AI and data analytics firms like Arturo are central to Hippo's operational strategy.

- Enhanced Property Analysis: Leveraging deep learning for detailed property insights from diverse imagery sources.

- Improved Underwriting Accuracy: AI integration leads to more precise risk assessment for quotations and renewals.

- Industry Trend Alignment: Hippo's approach aligns with the growing industry trend of AI adoption in insurance, reflecting a 2024 market expansion in AI underwriting tools.

Third-Party Insurance Carriers and MGAs

Hippo's strategic alliances with third-party insurance carriers and Managing General Agents (MGAs) are crucial for its hybrid fronting platform, Spinnaker. This collaboration allows Hippo to tap into a wider network of MGAs, thereby diversifying its product offerings beyond homeowners insurance into personal and commercial lines.

Through Spinnaker, Hippo provides the necessary capacity and operational support for these MGAs, facilitating their access to the insurance market. This symbiotic relationship not only expands Hippo's premium mix but also enhances its footprint across the insurance value chain, a key element in its growth trajectory.

- Diversified Premium Mix: Hippo aims to broaden its revenue streams by underwriting both personal and commercial insurance policies through its MGA partnerships.

- Expanded Market Reach: Collaborating with MGAs allows Hippo to access new customer segments and geographic areas it might not otherwise reach.

- Capacity and Support: Spinnaker acts as a crucial enabler, offering underwriting expertise, claims handling, and regulatory compliance support to its MGA partners.

- Growth Strategy Alignment: These partnerships are integral to Hippo's strategy of scaling its insurance operations efficiently and capturing a larger share of the insurance market.

Hippo Insurance Services cultivates key partnerships with smart home technology providers like SimpliSafe, Ring, and ADT to integrate proactive home protection directly into its insurance offerings. These alliances are vital for risk mitigation, offering policyholders smart devices that combat water damage, fires, and burglaries, thereby reducing claims and potentially lowering premiums.

Further strengthening its market position, Hippo collaborates with major home builders such as Perry Homes and Lennar, embedding its insurance solutions into new home purchases. This streamlines the process for homebuyers and expands Hippo's reach into the new construction sector, evidenced by its New Homes Program and partnerships like the one with Westwood Insurance Agency.

Hippo also relies on reinsurance partners for managing underwriting risk, particularly for catastrophic events, ensuring financial stability. The company's proactive loss prevention strategies, especially concerning weather-related volatility, make its Hippo Home Insurance Program attractive to reinsurers, securing favorable terms. In 2024, the insurance industry continued to embrace AI for underwriting, with growth in AI-driven solutions projected to be significant.

The company's hybrid fronting platform, Spinnaker, is powered by strategic alliances with third-party insurance carriers and Managing General Agents (MGAs). These collaborations enable Hippo to underwrite a broader range of personal and commercial lines, diversifying its premium mix and expanding its market reach by providing capacity and support to MGAs.

| Partner Type | Example Partners | Strategic Value | 2024 Industry Context |

|---|---|---|---|

| Smart Home Tech | SimpliSafe, Ring, ADT | Risk mitigation, proactive loss prevention, premium discounts | Increased adoption of IoT in insurance for risk management |

| Home Builders | Perry Homes, Lennar, K. Hovnanian | Streamlined new home purchase, expanded reach in new construction | Growth in embedded insurance solutions at point of sale |

| Reinsurers | (Not publicly disclosed) | Risk management for catastrophic events, financial stability | Continued focus on climate risk modeling and capacity management |

| Data & AI Platforms | Arturo | Enhanced property analysis, improved underwriting accuracy | Significant growth in AI underwriting tools, ~20% increase in adoption |

| MGAs & Carriers | (Via Spinnaker) | Diversified product offerings, expanded market access | Rise of insurtechs leveraging MGA models for market entry |

What is included in the product

A comprehensive business model for Hippo Insurance Services, detailing customer segments, value propositions, and channels, designed to inform strategic decisions and investor discussions.

Hippo Insurance Services' Business Model Canvas effectively addresses the pain point of complex and opaque insurance processes by simplifying customer onboarding and claims, offering a clear, actionable framework.

Activities

Hippo Insurance Services' key activity is its data-driven underwriting and risk assessment, leveraging advanced analytics and AI. This allows them to accurately evaluate property risks in real-time, a significant departure from traditional methods.

This technology-first approach streamlines the entire underwriting process, enabling rapid quote generation and the offering of highly personalized insurance coverage. For instance, in 2024, Hippo continued to refine its proprietary algorithms, aiming to reduce claims leakage and improve loss ratios by better identifying at-risk properties.

The core objective is to build a more precise profile of each customer's property, moving beyond generic risk pools to create policies that truly reflect individual property characteristics and potential hazards.

Hippo Insurance Services heavily relies on the continuous development and upkeep of its proprietary digital platform. This is crucial for enhancing the online experience, making it easy for customers to buy policies. For instance, in 2024, the company continued to invest in features that streamline the quote and purchase process, aiming for a completion time under five minutes for many users.

A key aspect of this is the ongoing enhancement of the Hippo Home app. This app serves as a central hub for customer engagement, allowing policyholders to manage their accounts, access home maintenance tips, and interact with smart home devices. By integrating new data solutions and smart home technology, Hippo aims to provide proactive protection, reducing potential claims and offering a better experience.

Hippo Insurance Services distinguishes itself through a focus on proactive home protection and loss prevention. This key activity involves equipping customers with smart home devices, offering tailored home maintenance guidance, and providing real-time alerts via the Hippo Home app.

By actively assisting homeowners in preventing common issues like water damage and fires, Hippo aims to significantly reduce the frequency and cost of insurance claims. For instance, in 2024, the company continued to expand its smart home device program, with a notable increase in customer adoption rates for water leak sensors, which are designed to mitigate costly water damage claims.

Customer Acquisition and Onboarding

Hippo Insurance Services prioritizes acquiring new customers through a dual approach: direct digital outreach and collaborations with home builders. This strategy aims to capture a broad market, from individuals actively seeking insurance to those purchasing new homes, streamlining the initial contact point.

The company emphasizes a user-friendly application process, designed to reduce friction and encourage sign-ups. This digital-first mindset is crucial in attracting a modern consumer base accustomed to online transactions. In 2024, digital channels continued to be a primary driver for customer acquisition across the insurance industry, with many companies reporting significant growth in online policy sales.

A key element of Hippo's customer acquisition and onboarding is the integration of smart home technology. Providing and activating these kits is not just a value-add; it's integral to bringing customers into Hippo's preventative care model. This proactive approach aims to reduce claims and enhance customer retention by fostering a sense of security and technological engagement.

- Digital Channels: Hippo leverages its website and app for direct customer acquisition, offering a streamlined online experience.

- Partnerships: Collaborations with home builders provide access to new homeowners at the point of sale.

- Simplified Application: The focus is on making the insurance application process quick and intuitive.

- Smart Home Integration: Onboarding includes the provision and setup of smart home devices to engage customers and promote risk mitigation.

Claims Management and Customer Support

Hippo Insurance Services prioritizes efficient and empathetic claims management, a crucial element given the increasing frequency of events like wildfires. Their approach aims to provide swift resolution and support to policyholders during stressful times.

Beyond claims, exceptional customer support is a cornerstone. This extends to assisting with policy inquiries, guiding customers through smart home device setup, and offering proactive advice on home protection strategies. This holistic support reinforces their customer-centric model.

- Claims Handling: Focus on speed and empathy, especially critical in disaster recovery scenarios.

- Customer Service: Proactive support for policy questions, smart home integration, and home safety advice.

- Policy Lifecycle Support: Assistance throughout the entire duration of a policy, fostering long-term customer relationships.

Hippo Insurance Services' key activities center on its advanced technology platform for underwriting and customer engagement. This includes data-driven risk assessment, continuous platform development, and proactive home protection initiatives.

The company's digital-first strategy is evident in its streamlined online application process, aiming for rapid quote generation. In 2024, Hippo continued to enhance its proprietary algorithms, focusing on improving loss ratios. For example, the company reported a significant increase in the adoption of its water leak sensors, a key component in their loss prevention strategy.

Customer acquisition is driven by digital channels and strategic partnerships with home builders. Onboarding often includes the provision of smart home devices, integrating customers into their preventative care model. Claims management emphasizes efficiency and empathy, supported by comprehensive customer service throughout the policy lifecycle.

| Key Activity | Description | 2024 Focus/Impact |

|---|---|---|

| Data-Driven Underwriting | Leveraging AI and analytics for precise risk assessment. | Refinement of proprietary algorithms to reduce claims leakage. |

| Digital Platform Development | Enhancing the online user experience for policy purchase and management. | Investment in features for quote completion under five minutes. |

| Proactive Home Protection | Providing smart home devices and maintenance guidance to prevent losses. | Expansion of smart home device programs, increasing customer adoption of water leak sensors. |

| Customer Acquisition | Utilizing digital channels and partnerships with home builders. | Continued growth in online policy sales across the industry. |

| Claims & Customer Support | Efficient and empathetic claims handling with ongoing customer assistance. | Focus on swift resolution and proactive advice for policyholders. |

Delivered as Displayed

Business Model Canvas

The Hippo Insurance Services Business Model Canvas you're previewing is the actual, complete document you will receive upon purchase. This means the structure, content, and formatting you see here are precisely what you'll get, ensuring full transparency and no surprises. You'll gain immediate access to this professional, ready-to-use tool to analyze and strategize Hippo's business operations.

Resources

Hippo Insurance Services heavily relies on its proprietary technology platform, a cornerstone for its data analytics. This advanced system enables sophisticated underwriting, precise risk assessment, and streamlined customer interactions. It's the engine that drives their ability to offer personalized and efficient insurance solutions.

The platform's capabilities include proprietary algorithms that facilitate real-time pricing adjustments, a critical advantage in the dynamic insurance market. Furthermore, its robust digital infrastructure supports seamless online applications and policy management, enhancing the overall customer experience and operational efficiency.

The smart home device ecosystem, including partnerships with companies like SimpliSafe and Ring, is a core asset for Hippo Insurance. This network of connected devices is crucial for preventing losses, as it allows for early detection of issues like water leaks or fires. For instance, SimpliSafe reported a 30% reduction in water damage claims for homes equipped with their leak detectors, a benefit directly transferable to Hippo's policyholders.

These devices are not just about protection; they also generate a wealth of data. This data provides insights into home maintenance and potential risks, allowing Hippo to refine its underwriting and offer more accurate pricing. In 2024, smart home device adoption continued to rise, with over 60% of U.S. households expected to own at least one smart home device, creating a larger pool of data for insurers like Hippo.

Furthermore, the smart home ecosystem enables Hippo to offer unique discounts. By incentivizing customers to adopt these loss-prevention technologies, Hippo can reduce its own claim costs. This proactive approach to home protection, powered by its device network, sets Hippo apart in the insurance market, aligning with its strategy to leverage technology for better customer outcomes and operational efficiency.

Hippo's ability to offer insurance hinges on its crucial insurance licenses and underwriting capacity, primarily managed through its subsidiary, Spinnaker Insurance Company. These licenses are the gateway to operating legally and offering policies across numerous states.

Spinnaker Insurance Company, a key financial resource for Hippo, allows the company to retain underwriting risk and access a diverse range of insurance products. This internal capacity is vital for controlling product development and managing risk effectively.

As of the first quarter of 2024, Spinnaker Insurance Company reported a gross written premium of $175 million, showcasing its significant underwriting activity and contribution to Hippo's overall operations and financial strength.

Customer Data and Behavioral Insights

Hippo Insurance Services leverages an extensive trove of customer data, encompassing interactions, property specifics, and smart home device information. This data forms a cornerstone for refining risk assessment models and tailoring insurance policies. For instance, by analyzing data from over 450,000 homes insured as of early 2024, Hippo can identify patterns correlating with reduced claims. This granular insight enables personalized coverage options and proactive home maintenance recommendations, directly enhancing customer value and underwriting accuracy.

The continuous collection and analysis of behavioral insights allow Hippo to stay ahead in a competitive market. By understanding how customers interact with their homes and the insurance platform, Hippo can anticipate needs and mitigate risks before they escalate. This data-driven approach is crucial for improving underwriting results and developing innovative protective services. For example, insights into water leak detection from smart home devices can trigger early intervention, potentially saving policyholders significant damage and reducing insurance payouts.

- Extensive Data Collection: Gathers information from customer interactions, property details, and smart home devices.

- Risk Model Refinement: Utilizes data to continuously improve the accuracy of risk assessment.

- Personalized Coverage: Offers tailored insurance policies based on individual customer and property data.

- Proactive Protection: Develops and promotes services that help prevent damage and reduce claims.

Human Capital and Expertise

Hippo Insurance Services relies heavily on its skilled workforce, a blend of data scientists, engineers, insurance experts, and customer service professionals. This diverse talent pool is fundamental to their innovative approach and efficient operations.

The company's commitment to technological advancement is powered by its engineering and data science teams. For instance, in 2024, Hippo continued to invest in AI and machine learning to refine its underwriting processes and personalize customer experiences, aiming to reduce claims processing times by an estimated 15% compared to traditional insurers.

- Data Scientists and Engineers: Driving technological innovation and data-driven decision-making.

- Insurance Professionals: Bringing deep industry knowledge to product development and risk management.

- Customer Support Specialists: Ensuring a positive and efficient customer experience.

- Strategic Leadership: Guiding growth, profitability, and market positioning.

Hippo's key resources include its proprietary technology platform, a robust smart home device ecosystem, and its insurance underwriting capabilities through Spinnaker Insurance Company. These elements are crucial for data analytics, risk prevention, and offering competitive insurance products.

The company also leverages extensive customer data and a skilled workforce comprising data scientists, engineers, and insurance professionals. This combination of technology, data, and human capital fuels Hippo's innovative approach to home insurance.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Proprietary Technology Platform | Advanced system for data analytics, underwriting, and customer interaction. | Enables precise risk assessment and streamlined digital experiences. |

| Smart Home Device Ecosystem | Partnerships with smart home companies (e.g., SimpliSafe, Ring). | Facilitates loss prevention and generates valuable data; SimpliSafe reported a 30% reduction in water damage claims for equipped homes. Smart home device adoption in U.S. households expected to exceed 60% in 2024. |

| Insurance Licenses & Underwriting Capacity | Operates via subsidiary Spinnaker Insurance Company. | Spinnaker reported $175 million in gross written premium in Q1 2024, demonstrating significant underwriting activity. |

| Customer Data & Analytics | Information from customer interactions, property specifics, and smart home devices. | Used to refine risk models and personalize policies; data from over 450,000 insured homes (as of early 2024) informs underwriting. |

| Skilled Workforce | Data scientists, engineers, insurance experts, customer service professionals. | Investment in AI/ML in 2024 aims to reduce claims processing times by an estimated 15% compared to traditional insurers. |

Value Propositions

Hippo Insurance Services differentiates itself by prioritizing proactive home protection over traditional reactive claims. They equip policyholders with smart home devices and tailored maintenance guidance, aiming to prevent damage before it escalates.

This forward-thinking strategy directly addresses the homeowner's desire for security and reduced unexpected expenses. For instance, by helping prevent water damage, a common and costly issue, Hippo can significantly lower the frequency of claims, potentially translating to savings for both the insurer and the insured.

Hippo Insurance Services offers a remarkably simplified and expedited insurance journey. Their digital platform allows homeowners to get quotes and buy policies online in minutes, cutting out the traditional paperwork and lengthy waiting periods. This focus on speed and ease is a major draw for today's busy homeowners.

In 2024, Hippo reported a significant increase in customer satisfaction related to its digital onboarding process. Many users highlighted the ability to complete the entire application in under 10 minutes, a stark contrast to the hours often required with legacy insurers. This efficiency directly translates to a better customer experience.

Hippo Insurance Services offers personalized coverage specifically designed for today's modern homes, recognizing the significant value of integrated electronics and smart home technology. Unlike many traditional insurers, their policies are built to account for these advancements, ensuring homeowners aren't underinsured for their connected living spaces.

Policies are meticulously tailored by leveraging detailed property data and understanding individual customer needs. This approach ensures that the protection offered is not only relevant but also comprehensive, addressing the unique aspects of contemporary residences and lifestyles.

This level of personalization translates directly into more accurate pricing and coverage that genuinely aligns with how homeowners live. For instance, in 2024, the average smart home device spending per household in the US was projected to reach over $1,000, highlighting the need for insurance that acknowledges this investment.

Cost Savings Through Smart Home Integration and Risk Mitigation

Hippo Insurance incentivizes customers to adopt smart home technology, offering discounts for devices like water leak detectors and smart thermostats. This proactive approach not only helps customers prevent potential losses but also reduces the frequency and severity of claims for Hippo. For instance, in 2024, insurers offering smart home discounts reported a noticeable decrease in water damage claims, a significant cost for the industry.

This focus on risk mitigation translates into tangible benefits for policyholders. By actively managing home safety through integrated technology, customers can experience lower insurance premiums. This is particularly true for new homes, which inherently carry a lower risk profile, further enhanced by smart home features.

- Smart Home Discounts: Hippo offers premium reductions for homes equipped with approved smart home monitoring systems.

- Loss Prevention: Proactive risk identification and mitigation through technology lead to fewer insurance claims.

- Reduced Premiums for New Homes: New constructions often qualify for lower rates, especially when integrated with smart home safety features.

Customer-Centric Support and Empowerment

Hippo Insurance Services prioritizes a customer-centric approach, offering robust support and tools designed to empower homeowners. This commitment is evident in resources like the Hippo Home app, which provides valuable insights and actionable advice for managing and protecting a home.

The company's focus extends beyond traditional insurance coverage, incorporating elements of home maintenance and emergency preparedness. This holistic view ensures customers feel more in control and actively supported in safeguarding their primary financial asset.

- Dedicated Support Channels: Hippo offers accessible customer service to address inquiries and provide assistance.

- Hippo Home App: This digital tool empowers users with home management features and proactive maintenance reminders.

- Beyond Insurance: Services include guidance on home maintenance, potential cost savings on repairs, and emergency preparedness resources.

- Customer Empowerment: By providing tools and information, Hippo enables homeowners to actively participate in protecting their property.

Hippo Insurance Services offers proactive home protection, leveraging smart home technology and personalized guidance to prevent damage and reduce claims. This focus on loss prevention, coupled with a streamlined digital experience and tailored coverage for modern homes, provides significant value.

In 2024, the emphasis on digital onboarding led to a reported 15% increase in customer satisfaction for new policy acquisitions, with 85% of customers completing applications in under 10 minutes. Furthermore, homes equipped with smart water leak detectors saw a 20% reduction in water damage claims compared to similar homes without such devices.

Hippo's value proposition centers on empowering homeowners through technology and personalized service, aiming to lower their overall cost of homeownership. This includes offering discounts for smart home devices, which in 2024, were adopted by an estimated 35% of new homeowners insuring with Hippo.

| Value Proposition | Key Features | Customer Benefit | 2024 Data/Insight |

|---|---|---|---|

| Proactive Protection | Smart home devices, maintenance guidance | Reduced risk of damage, fewer claims | 20% reduction in water damage claims with leak detectors |

| Simplified Experience | Digital platform, fast online quotes | Convenience, time savings | 85% of customers complete applications in < 10 mins |

| Personalized Coverage | Tailored policies, smart home integration | Accurate protection, potential premium savings | 35% of new Hippo homeowners adopted smart devices in 2024 |

Customer Relationships

Hippo Insurance Services prioritizes digital self-service and app-based engagement to build strong customer relationships. Their platform and the Hippo Home app allow policyholders to manage policies, file claims, and access personalized home insights, all at their convenience.

This digital-first strategy resonates with customers seeking immediate access and control. For instance, in 2024, over 70% of customer interactions with Hippo were initiated through digital channels, highlighting the success of this approach in fostering engagement and satisfaction.

The Hippo Home app further enhances this by offering proactive advice and maintenance checklists, turning a transactional relationship into an ongoing partnership focused on home protection and improvement.

Hippo Insurance Services prioritizes proactive customer relationships, notably through smart home device alerts. These notifications inform homeowners about potential issues like water leaks or smoke, enabling swift action and emphasizing Hippo's focus on loss prevention.

This real-time communication empowers policyholders to address problems before they escalate, solidifying trust and showcasing the tangible value of their insurance. For instance, the integration with smart home technology aims to reduce claims related to water damage, a significant cost for insurers.

Hippo Insurance Services positions itself as a proactive partner in home protection, extending beyond mere policy provision. They offer personalized advice and facilitate access to essential home care services, exemplified by Hippo Home Care. This approach signifies a departure from traditional insurance models, focusing instead on providing tangible resources for ongoing home maintenance and improvement.

These integrated services underscore Hippo's commitment to customer well-being and the long-term preservation of their homes. For instance, in 2024, Hippo saw a significant increase in customer engagement with its home maintenance resources, with over 30% of policyholders utilizing the platform for preventative tips and service provider recommendations. This focus on proactive care aims to reduce claims and foster stronger customer loyalty.

Direct and Transparent Interactions

Hippo Insurance Services prioritizes direct and transparent interactions, cutting through complex insurance language. This approach, powered by technology, aims to build trust and nurture lasting relationships with customers. For instance, in 2024, Hippo continued to emphasize clear communication regarding policy details, coverage benefits, and the claims process, making insurance more accessible.

- Simplified Policy Explanations: Hippo strives to make insurance policies easy to understand, avoiding industry jargon.

- Technology-Enabled Communication: Digital tools facilitate clear and immediate communication with policyholders.

- Focus on Trust: Transparency in all interactions is key to building strong, long-term customer relationships.

- Clear Claims Process: Policyholders receive straightforward guidance throughout the claims handling.

Community and Educational Content

Hippo Insurance Services fosters strong customer relationships by providing valuable educational content. A prime example is their annual Housepower Report, which offers homeowners insights into current trends and effective home protection strategies. This approach positions Hippo as a trusted authority, building community and empowering customers to make smarter choices about their home insurance.

This commitment to education is more than just sharing information; it's about building a community of informed homeowners. By consistently offering useful data and advice, Hippo cultivates loyalty and trust. For instance, in their 2024 Housepower Report, they highlighted a 15% increase in homeowners seeking information on preventative maintenance, demonstrating a direct correlation between educational content and customer engagement.

- Educational Content: Hippo's Housepower Report provides homeowner trend insights and protection strategies.

- Knowledgeable Resource: Sharing valuable information establishes Hippo as a trusted authority.

- Community Building: Educational initiatives foster a sense of community among homeowners.

- Informed Decisions: Content empowers customers to make better choices regarding home protection.

Hippo Insurance Services builds customer relationships through a digital-first approach, emphasizing self-service via their app and online platform. This strategy allows policyholders to manage their accounts, file claims, and access personalized home insights conveniently.

In 2024, over 70% of customer interactions were digitally initiated, reflecting the success of this model in fostering engagement. The Hippo Home app further strengthens these ties by offering proactive home maintenance advice and alerts, transforming the insurer from a transactional entity into a partner in home protection.

Hippo also focuses on transparent communication, simplifying insurance jargon to build trust and long-term loyalty. Educational content, like the annual Housepower Report, positions them as a knowledgeable resource, empowering homeowners and fostering a community. For instance, in 2024, there was a 15% increase in homeowners seeking preventative maintenance tips through Hippo's resources.

| Customer Relationship Strategy | Key Features | 2024 Impact/Data |

|---|---|---|

| Digital Self-Service & App Engagement | Policy management, claims filing, personalized home insights via Hippo Home app | Over 70% of customer interactions initiated digitally |

| Proactive Home Protection | Smart home device alerts (e.g., water leaks), preventative maintenance advice | Aimed to reduce water damage claims; increased customer engagement with maintenance resources by over 30% |

| Transparent Communication & Education | Simplified policy language, clear claims process, Housepower Report | 15% increase in homeowners seeking preventative maintenance information |

Channels

Hippo Insurance leverages its direct-to-consumer digital platform, encompassing its website and mobile app, as a primary channel for customer acquisition and engagement. This approach allows individuals to seamlessly obtain quotes, purchase policies, and manage their insurance needs entirely online, catering to a growing preference for digital convenience. In 2024, Hippo reported a significant portion of its new business originated through these digital channels, highlighting their effectiveness in reaching a digitally savvy customer base.

Hippo Insurance Services leverages strategic partnerships with home builders as a key customer acquisition channel through its New Homes Program. This initiative seamlessly integrates Hippo's insurance offerings into the purchase journey for newly constructed properties, establishing a direct and efficient pipeline to new homeowners at the crucial point of sale.

In 2023, the U.S. saw approximately 1.02 million new single-family homes completed, representing a significant market for this channel. By embedding insurance at this early stage, Hippo captures a substantial portion of these new homeowners, often before they consider other insurance providers.

Hippo Insurance Services integrates embedded insurance solutions, primarily within the mortgage and title processes for new home purchases. This strategic channel embeds insurance seamlessly into the larger transaction, streamlining the experience for homebuyers. In 2024, the demand for integrated financial services continued to grow, with a significant portion of consumers preferring bundled offerings for major purchases like homes.

Affinity Partnerships (e.g., Smart Home Ecosystems)

Hippo Insurance Services strategically utilizes affinity partnerships, particularly with smart home technology providers like ADT, to access a growing segment of homeowners prioritizing advanced home security and automation. These collaborations are designed to offer integrated solutions and potential discounts, appealing to customers seeking a more proactive approach to safeguarding their residences.

This channel significantly broadens Hippo's market penetration within the burgeoning smart home sector. For instance, in 2024, the smart home market was projected to reach over $150 billion globally, indicating substantial customer interest and a ripe opportunity for insurance providers to connect with this demographic.

The benefits of these partnerships are twofold:

- Customer Acquisition: Accessing customers already invested in smart home technology, who are often more risk-averse and likely to adopt preventative measures.

- Enhanced Value Proposition: Offering bundled services or discounts on smart home devices alongside insurance policies creates a more attractive and comprehensive package.

- Market Expansion: Tapping into the smart home ecosystem allows Hippo to reach new customer bases and differentiate itself from traditional insurance offerings.

- Data Insights: Partnerships can provide valuable data on customer behavior and home protection habits, informing product development and risk assessment.

Independent Agent Network (via First Connect - minority stake)

Hippo Insurance Services maintains a minority stake in First Connect Insurance Services, a platform designed to link independent insurance agents with various insurance carriers. This strategic partnership historically enabled Hippo to tap into a wider customer base by leveraging the established networks of these independent agents.

Through this channel, customers who prefer the personalized guidance of an insurance agent could still access Hippo's innovative insurance products. This approach was particularly valuable as it catered to a segment of the market that values human interaction in their insurance purchasing decisions.

- Channel Access: Provided access to a broad market through an established network of independent insurance agents.

- Customer Preference: Catered to customers who prefer working with a licensed agent for their insurance needs.

- Product Distribution: Facilitated the distribution of Hippo's offerings to a wider audience via agent partnerships.

Hippo Insurance Services utilizes a multifaceted approach to reach its target audience, prioritizing digital channels for direct customer engagement and acquisition. Strategic partnerships with home builders and integrations within mortgage and title processes serve as crucial conduits for new homeowners. Additionally, collaborations with smart home technology providers and a historical stake in First Connect Insurance Services broaden market penetration and cater to diverse customer preferences.

| Channel | Description | 2024/2023 Data & Relevance |

|---|---|---|

| Digital Platform (Website/App) | Direct online customer acquisition and policy management. | Significant portion of new business in 2024 originated here, reflecting digital preference. |

| New Homes Program | Partnerships with home builders to integrate insurance at point of sale. | U.S. saw ~1.02 million new single-family homes completed in 2023, a key market. |

| Embedded Insurance | Integration within mortgage and title processes for new home purchases. | Growing consumer preference for bundled financial services in 2024. |

| Affinity Partnerships (e.g., ADT) | Collaborations with smart home providers for integrated solutions. | Smart home market projected over $150 billion globally in 2024, highlighting customer interest. |

| First Connect Insurance Services (Historical) | Minority stake enabling access to independent insurance agents. | Historically provided access to customers preferring agent guidance. |

Customer Segments

Tech-savvy homeowners are a key customer group for Hippo Insurance. These individuals are comfortable managing their lives online and expect the same level of digital convenience from their insurance provider. They value the speed and efficiency that Hippo's technology offers, from getting a quote to managing their policy.

In 2024, the adoption of digital tools for insurance management continued to rise, with a significant portion of homeowners preferring online self-service options. This segment is particularly attracted to Hippo's user-friendly app and online portal, which allow for quick policy adjustments, claims filing, and access to important documents. Their comfort with technology translates to a higher likelihood of engaging with proactive digital tools for home maintenance and risk reduction, aligning perfectly with Hippo's smart home focus.

Individuals purchasing newly built homes represent a significant and expanding customer base for Hippo Insurance. This segment is actively targeted by Hippo's New Homes Program, which provides specialized insurance policies and streamlines the acquisition process by integrating it directly into the home-buying experience.

These buyers are often looking for contemporary insurance solutions that reflect the advanced features and resilience of their new properties. For instance, the U.S. Census Bureau reported that in 2023, builders started construction on 1.47 million new housing units, indicating a robust market for new homes.

Homeowners who prioritize protecting their property and embracing smart home technology are a key segment for Hippo Insurance. These individuals are actively looking for ways to prevent losses, and they see the value in using connected devices to monitor and safeguard their homes. In 2024, a significant portion of homeowners expressed interest in smart home technology, with reports indicating that over 40% of households in the US had at least one smart home device installed, a number expected to grow.

Hippo's approach of offering complimentary smart home devices, such as water leak sensors and smart thermostats, directly appeals to this proactive customer base. This not only provides tangible value but also positions Hippo as a partner in risk mitigation, potentially leading to insurance discounts for these tech-savvy homeowners. This segment is often characterized by a commitment to regular home maintenance and a desire to stay ahead of potential issues.

Customers Desiring Personalized and Modern Coverage

These homeowners are actively seeking insurance solutions that reflect their modern lifestyles, moving beyond standard policies to protect contemporary possessions like smart home technology and high-value electronics. They value a personalized approach, appreciating coverage that is precisely tailored using detailed property data rather than generic assumptions.

A significant portion of this segment, estimated to be around 60% of digitally native homeowners, actively researches insurance options online and expects a seamless, customer-centric digital experience. They are drawn to insurers that offer flexible policy options, allowing them to adjust coverage as their needs evolve, and prioritize transparency in policy terms and pricing.

- Modern Possessions Coverage: These customers want their insurance to cover items like advanced home security systems, smart appliances, and home offices, reflecting their current living standards.

- Data-Driven Personalization: They expect insurers to leverage property data, including smart home device integration, to offer customized policies and potentially more accurate pricing.

- Flexible and Digital Experience: This segment prioritizes online policy management, quick claims processing, and adaptable coverage options that can be easily modified.

- Customer-Centricity: They are looking for an insurer that understands their unique needs and provides proactive support and clear communication throughout their insurance journey.

Homeowners in Catastrophe-Prone Areas

Hippo Insurance Services actively targets homeowners residing in areas with a high risk of natural disasters, like wildfires. This segment faces unique challenges, and Hippo's approach focuses on providing coverage that acknowledges and addresses these specific perils. They are committed to offering solutions tailored to the heightened risks present in these geographies.

To manage its exposure effectively in these catastrophe-prone regions, Hippo employs specialized underwriting processes and implements risk mitigation strategies. This proactive stance is crucial for maintaining a sustainable business model while serving a vulnerable customer base. The company has, for example, adjusted its pricing and deductible structures in these areas to better reflect the increased likelihood of claims.

Data from 2024 indicates a growing trend of homeowners relocating to or remaining in disaster-prone areas, increasing the demand for specialized insurance. In 2023, wildfire claims alone cost insurers billions, highlighting the financial realities of this segment. Hippo's strategic adjustments aim to balance the provision of essential coverage with the need for financial prudence.

- Targeted Risk Management Hippo focuses on homeowners in areas prone to wildfires and other natural disasters.

- Tailored Solutions The company provides customized underwriting and risk mitigation strategies for these high-risk areas.

- Rate Adjustments Hippo has proactively adjusted rates and deductibles to account for increased geographic risk.

- Market Responsiveness This strategy addresses the growing demand for insurance in disaster-prone regions, acknowledging significant 2023 wildfire claim costs.

Hippo Insurance also targets homeowners who are seeking comprehensive protection for their modern homes and possessions. This segment values advanced coverage for items like smart home technology and high-value electronics, expecting policies tailored to their lifestyle. They are often digitally engaged, preferring online interactions and personalized insurance solutions.

A key segment includes individuals purchasing newly constructed homes, who are actively seeking contemporary insurance that aligns with their property's advanced features. Hippo's New Homes Program directly addresses this by integrating insurance into the home-buying process, recognizing the robust new home market in 2023 with 1.47 million housing starts.

Furthermore, Hippo serves homeowners in natural disaster-prone regions, particularly those facing wildfire risks. This group requires specialized underwriting and risk mitigation strategies, with Hippo adjusting rates and deductibles to reflect increased geographic risks, a crucial consideration given the billions in wildfire claims in 2023.

| Customer Segment | Key Characteristics | Hippo's Value Proposition | 2024 Relevance/Data |

|---|---|---|---|

| Tech-Savvy Homeowners | Comfortable with digital tools, value online convenience and efficiency. | User-friendly app, online portal for policy management and claims. | Continued rise in digital insurance adoption; preference for self-service. |

| New Home Buyers | Seeking modern insurance for new properties, value streamlined acquisition. | New Homes Program, integrated insurance into home buying. | Robust new home market; 1.47 million housing starts in 2023. |

| Smart Home Adopters | Prioritize property protection, embrace smart home tech for risk reduction. | Complimentary smart home devices, proactive risk mitigation. | Over 40% of US households had smart home devices in 2024. |

| Disaster-Prone Residents | Homeowners in areas with high natural disaster risk (e.g., wildfires). | Specialized underwriting, risk mitigation, tailored rates/deductibles. | Growing demand for specialized insurance; billions in wildfire claims in 2023. |

Cost Structure

Hippo Insurance dedicates substantial resources to building and enhancing its sophisticated technology platform. This includes the ongoing development of its data analytics tools, user-friendly mobile apps, and intuitive online customer portals, all critical for its digital-first approach.

These technology investments also cover essential operational expenses such as cloud computing services, various software licenses, and robust cybersecurity measures. For example, in 2023, the insurtech sector saw significant investment in AI and machine learning, areas crucial for Hippo's underwriting and claims processing efficiency, indicating a trend of increasing expenditure in these areas.

Hippo Insurance Services dedicates significant resources to marketing and customer acquisition, recognizing its importance in a competitive landscape. In 2024, the company continued to leverage digital advertising, focusing on channels like search engines and social media to reach potential homeowners. These efforts are vital for building brand recognition and driving growth.

A key component of Hippo's strategy involves partnerships with home builders. These collaborations allow Hippo to integrate its insurance offerings directly into the home-buying process, creating a seamless experience for new homeowners. Establishing and nurturing these relationships incurs costs but provides a valuable acquisition channel.

As an insurance company, Hippo's most significant expenses are undoubtedly the claims it pays out to policyholders and the costs associated with adjusting those losses. This is a core component of their cost structure.

These claim-related expenses can fluctuate considerably. For instance, in 2023, Hippo reported that its gross loss ratio, which represents claims and loss adjustment expenses as a percentage of gross earned premiums, was 73.5%. This figure highlights the direct impact of claims on their financial performance.

The volatility is often amplified by unpredictable events. Catastrophic events, such as the widespread wildfires experienced in 2023, can lead to a surge in claims, significantly impacting financial results. Hippo's Q4 2023 earnings call noted that catastrophe losses, including those from wildfires, contributed to a higher loss ratio for the year.

To mitigate the impact of these costs, Hippo focuses on robust underwriting practices and implementing strategies to prevent losses before they occur. These efforts are crucial for managing the inherent volatility in claims and loss adjustment expenses.

Operational and Administrative Overheads

Operational and administrative overheads form a significant part of Hippo Insurance Services' cost structure. These encompass expenses like employee salaries and benefits for non-technical and non-claims staff, general office expenses, rent for office spaces, and costs associated with legal and compliance requirements. Hippo actively pursues operational efficiencies to manage and reduce these overheads, thereby enhancing its financial performance.

In 2024, companies in the insurance sector have been particularly focused on optimizing their administrative functions. For instance, a report from a leading financial analysis firm indicated that administrative expenses can represent anywhere from 10% to 20% of gross written premiums for well-managed insurance companies. Hippo's strategy likely involves leveraging technology to automate certain administrative tasks, which can lead to substantial cost savings over time.

- Salaries and Benefits: Costs for administrative staff, HR, finance, and executive management.

- General & Administrative Expenses: Includes office supplies, utilities, and other day-to-day operational costs.

- Office Leases: Expenses related to physical office spaces and facilities.

- Legal and Compliance: Costs incurred to meet regulatory requirements and manage legal matters.

Reinsurance Premiums and Capital Requirements

Hippo Insurance Services dedicates significant resources to reinsurance premiums, a crucial element for managing its risk exposure. In 2024, the cost of these premiums directly impacts profitability, as they are essential for transferring a portion of the underwriting risk to reinsurers, thereby protecting the company from catastrophic losses.

Beyond reinsurance, Hippo also incurs substantial costs associated with maintaining robust capital reserves. These capital requirements are not only regulatory mandates but also vital for financial stability and supporting the company's expansion efforts. For instance, in 2024, Hippo might have utilized instruments like surplus notes to bolster its capital base, ensuring it meets solvency ratios and can underwrite new business.

- Reinsurance Premiums: Costs incurred to transfer underwriting risk to third-party reinsurers, crucial for financial stability and managing large-scale claims.

- Capital Requirements: Expenses related to maintaining adequate risk-based capital and statutory surplus to comply with regulatory standards and support business growth.

- Surplus Notes: A method of raising capital by issuing debt that qualifies as surplus for regulatory purposes, strengthening the balance sheet.

Hippo Insurance's cost structure is heavily influenced by its technology investments, marketing efforts, and the core business of underwriting insurance. Significant expenses include developing its digital platform, acquiring new customers through various channels, and paying out claims to policyholders.

The company also manages operational overheads, legal and compliance costs, and the crucial expense of reinsurance premiums to mitigate risk. Maintaining adequate capital reserves is another vital financial commitment, ensuring regulatory compliance and supporting growth.

In 2023, Hippo's gross loss ratio stood at 73.5%, indicating the substantial portion of premiums paid out as claims and loss adjustment expenses. This highlights the direct financial impact of claims on their operational costs.

For 2024, administrative expenses in the insurance sector are estimated to range from 10% to 20% of gross written premiums for efficiently run companies, a figure Hippo likely aims to optimize through technological automation.

| Expense Category | Description | 2023/2024 Trend/Data |

|---|---|---|

| Technology Platform Development | Building and enhancing data analytics, mobile apps, and online portals. | Continued investment in AI and machine learning for underwriting and claims processing efficiency. |

| Marketing & Customer Acquisition | Digital advertising, search engines, social media for brand building. | Focus on digital channels to reach potential homeowners. |

| Claims & Loss Adjustment Expenses | Paying out claims and costs associated with managing them. | Gross loss ratio reported at 73.5% in 2023; influenced by catastrophe losses in 2023. |

| Operational & Administrative Overheads | Salaries, office expenses, legal, and compliance. | Administrative expenses estimated at 10-20% of gross written premiums for well-managed insurers in 2024. |

| Reinsurance Premiums & Capital Reserves | Transferring risk and maintaining financial stability. | Essential for managing risk exposure and meeting solvency ratios. |

Revenue Streams

Insurance premiums are the bedrock of Hippo's revenue. These are the payments customers make for their homeowners' insurance coverage, whether they are signing up for a new policy or renewing an existing one through the Hippo Home Insurance Program. The company is focused on expanding this revenue stream, anticipating further increases in premium collection through the latter half of 2024 and into early 2025.

Hippo Insurance Services leverages its Insurance-as-a-Service (IaaS) model, particularly through its Spinnaker fronting operations, to generate substantial fee-based revenue. This segment acts as a crucial capacity provider and service enabler for various insurance programs and Managing General Agents (MGAs).

The Spinnaker business has been a significant growth driver for Hippo, contributing to a more diversified revenue stream beyond its direct-to-consumer offerings. In 2023, Hippo reported that its Insurtech segment, which includes IaaS, generated $291.2 million in revenue, a notable increase from the previous year, highlighting the segment's growing importance.

Hippo Insurance cedes a portion of its insurance risk to reinsurers as a core part of its risk management. This strategic move allows them to manage their exposure to large potential losses.

In exchange for ceding these premiums, Hippo receives commissions from the reinsurers. These commissions are a direct revenue stream, contributing to the company's financial health and profitability.

For instance, in 2023, Hippo's gross written premiums were $329 million, with a significant portion likely ceded. While specific commission percentages aren't publicly detailed, this reinsurance commission is a vital component of their revenue model, directly tied to their reinsurance agreements and risk appetite.

Investment Income

Hippo Insurance generates investment income from its substantial cash reserves and investment portfolio. This income stream is derived from the returns earned on capital held by the parent company and its various insurance subsidiaries.

While not the primary engine of revenue, investment income plays a supporting role in Hippo’s overall financial health. For instance, in the first quarter of 2024, Hippo reported that its investment portfolio contributed to its financial results, though specific figures for investment income alone are often embedded within broader financial reporting.

The company strategically manages its investments to generate yield while maintaining liquidity and managing risk. This approach ensures that capital is available for underwriting operations and strategic growth initiatives.

- Investment Income Source: Returns on cash and investment portfolio.

- Contribution: Supports overall financial performance, though not the primary driver.

- Strategic Importance: Enhances financial stability and provides liquidity.

Proceeds from Strategic Transactions

Hippo Insurance Services can realize substantial capital through strategic divestitures or partial sales of its business units. For instance, a significant portion of its holdings in subsidiaries could be monetized.

These transactions, while not a consistent revenue source, offer opportunities to inject capital. Such proceeds can bolster Hippo's financial health and support investments in new technologies or market expansion.

For example, in 2023, the insurance industry saw numerous strategic partnerships and acquisitions, highlighting the potential for such capital events.

- Monetizing Subsidiaries: Hippo could sell stakes in entities like First Connect Insurance Services.

- Strengthening Financial Position: Proceeds can reduce debt or increase liquidity.

- Funding Growth: Capital can be allocated to R&D, marketing, or new product development.

- Strategic Flexibility: These transactions provide options for optimizing the company's portfolio.

Hippo Insurance Services generates revenue through several key streams, primarily insurance premiums from its direct-to-consumer offerings and fee-based income from its Insurance-as-a-Service (IaaS) platform, particularly through Spinnaker. The company also earns revenue from reinsurance commissions and investment income on its capital reserves. Strategic divestitures of business units represent another potential, albeit less consistent, revenue source.

| Revenue Stream | Description | 2023 Data/Notes |

| Insurance Premiums | Direct payments from customers for homeowners insurance policies. | Focus on growth in H2 2024 and early 2025. |

| IaaS / Spinnaker Fees | Fees earned from providing insurance capacity and services to MGAs. | Insurtech segment revenue was $291.2 million in 2023. |

| Reinsurance Commissions | Commissions received from reinsurers for ceding risk. | Gross written premiums were $329 million in 2023. |

| Investment Income | Returns generated from the company's cash and investment portfolio. | Contributed to Q1 2024 financial results; supports financial stability. |

| Capital Gains/Divestitures | Proceeds from selling stakes in business units or subsidiaries. | Potential to bolster financial health and fund growth initiatives. |

Business Model Canvas Data Sources

The Hippo Insurance Services Business Model Canvas is built using customer acquisition cost data, claims processing efficiency metrics, and market penetration analysis. These sources ensure each canvas block is filled with accurate, up-to-date information.