Hippo Insurance Services Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hippo Insurance Services Bundle

Hippo Insurance Services operates in a dynamic market shaped by intense competition and evolving customer expectations. Understanding the interplay of bargaining power, threats, and substitutes is crucial for navigating this landscape.

The complete report reveals the real forces shaping Hippo Insurance Services’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Hippo Insurance Services, like many insurers, depends significantly on reinsurers to manage its risk exposure, especially for large-scale, unpredictable events. The reinsurance sector demonstrated robust performance throughout 2024, with projections pointing towards continued strength into 2025. This favorable market condition for reinsurers translates into increased bargaining power, potentially leading to higher costs for Hippo when transferring risk.

Hippo Insurance Services relies heavily on technology and data providers, as its business model is built on data analytics and smart home technology. This dependence means that if these providers are limited in number or offer highly specialized services, they can wield significant bargaining power. This could lead to increased operational costs for Hippo or even hinder its ability to innovate and advance its technological offerings.

Hippo Insurance Services, despite its tech-forward approach, relies on external claims adjusters and service networks, particularly for significant events like wildfires. The cost and availability of these essential services directly impact Hippo's operational expenses and its ability to manage claims efficiently. For instance, in 2024, the average cost for a property claims adjuster can range from $500 to $1,500 per claim, a figure that can escalate dramatically in disaster zones.

Regulatory Bodies and Compliance Services

The insurance sector, including companies like Hippo Insurance Services, operates under a heavy regulatory umbrella, making compliance a paramount concern. This environment significantly influences the bargaining power of suppliers who offer specialized regulatory and compliance services.

Suppliers in this arena are typically law firms, consulting groups, and cybersecurity experts who possess deep knowledge of insurance regulations, data privacy laws like GDPR and CCPA, and evolving cybersecurity mandates. As regulations become more complex and stringent, the demand for these expert services escalates, granting these suppliers greater leverage.

- Increased Demand for Specialized Expertise: As of late 2024, the global regulatory compliance market for financial services was projected to reach over $50 billion, with insurance being a significant contributor. This growth underscores the critical need for specialized knowledge.

- Evolving Regulatory Landscape: For instance, the ongoing updates to data protection regulations and the increasing focus on AI governance in financial services create a continuous need for updated compliance strategies, strengthening supplier positions.

- High Switching Costs: Once an insurer establishes a relationship with a compliance service provider, switching can be costly and time-consuming due to the need to re-familiarize new providers with complex internal processes and regulatory histories.

- Concentration of Expertise: The market for highly specialized insurance regulatory and cybersecurity consulting often features a limited number of firms with proven track records, leading to a more concentrated supplier base and increased bargaining power.

Marketing and Distribution Partners

Hippo Insurance, while tech-focused, relies on marketing and distribution partners. These can include digital ad platforms, lead generators, and agencies. The bargaining power of these partners can significantly impact Hippo's customer acquisition costs and reach.

For instance, if a major digital advertising platform like Google or Meta significantly increases its ad prices, Hippo's marketing expenses would rise. In 2024, digital advertising spending globally was projected to reach over $600 billion, illustrating the substantial influence these platforms wield.

- Digital Advertising Platforms: Their ability to target specific demographics and their vast user bases give them considerable leverage.

- Lead Generation Services: The quality and volume of leads provided by these services directly affect conversion rates and marketing ROI.

- Insurance Agencies & Brokers: Traditional distribution channels can command higher commissions if they control access to significant customer segments.

- Technology Providers: Partners offering crucial marketing technology or data analytics tools can also exert influence if their solutions are indispensable.

Hippo Insurance Services' bargaining power with suppliers is influenced by several factors, including the concentration of specialized providers and the essential nature of their services. For instance, reinsurers, critical for risk management, saw a robust market in 2024, potentially increasing their leverage. Similarly, technology and data providers, foundational to Hippo's model, can exert significant power if their offerings are unique or if there are few alternatives.

The cost and availability of external claims adjusters, especially following events like wildfires, directly impact Hippo's expenses, with average adjuster costs in 2024 ranging from $500 to $1,500 per claim. Furthermore, suppliers of regulatory and compliance services are gaining power due to increasing complexity in data protection and AI governance, with the financial services compliance market projected to exceed $50 billion in late 2024.

Marketing and distribution partners, such as digital ad platforms, also hold considerable sway. A significant increase in ad prices by major platforms, which saw global digital ad spending exceed $600 billion in 2024, directly raises Hippo's customer acquisition costs.

| Supplier Category | Key Dependencies | Bargaining Power Factors | 2024 Data/Trends |

|---|---|---|---|

| Reinsurers | Risk transfer for large-scale events | Market strength, concentration | Robust market performance, continued strength projected for 2025 |

| Technology & Data Providers | Core business model, analytics | Specialization, limited alternatives | Essential for innovation and operational efficiency |

| Claims Adjusters & Service Networks | Claims processing, disaster response | Cost, availability, disaster impact | Average cost $500-$1,500 per claim; escalates in disaster zones |

| Regulatory & Compliance Services | Adherence to laws, data privacy | Expertise scarcity, regulatory complexity | Financial services compliance market > $50 billion (late 2024); evolving data protection and AI governance |

| Marketing & Distribution Partners | Customer acquisition, reach | Platform dominance, ad pricing | Global digital ad spending > $600 billion (2024) |

What is included in the product

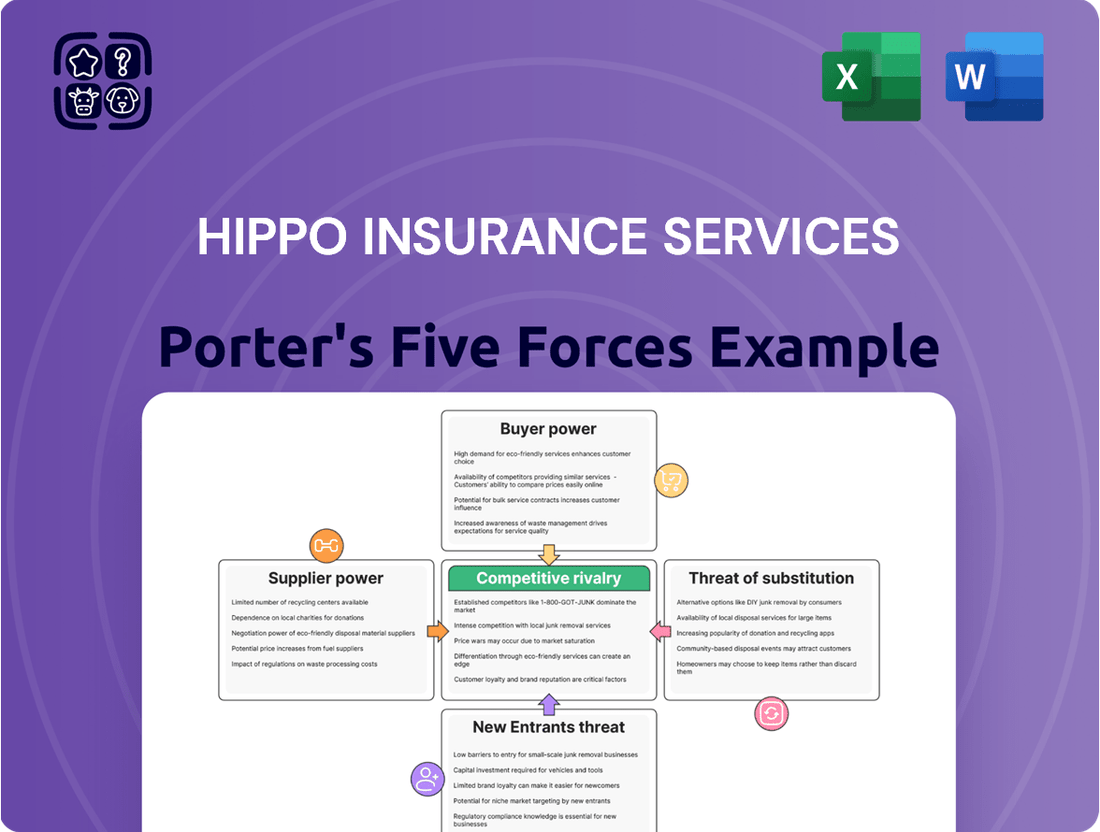

A comprehensive Porter's Five Forces analysis for Hippo Insurance Services, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Instantly identify competitive pressures and market opportunities with a visually intuitive Porter's Five Forces analysis for Hippo Insurance Services.

Customers Bargaining Power

Home insurance customers, particularly with premiums on the rise, are showing heightened price sensitivity and a greater inclination to compare offerings. This means companies like Hippo Insurance Services must remain competitive on price.

The ease of obtaining quotes online significantly amplifies customer power. Data from a 2024 J.D. Power survey indicated that 65% of homeowners actively shopped for insurance when their policies renewed, a testament to low switching barriers.

While some homeowners may be less actively engaged, the underlying ability to switch providers with relative ease, often facilitated by digital tools, still grants them considerable leverage over insurers. This dynamic forces Hippo to focus on value and customer retention.

The insurance market's digital transformation, fueled by insurtech, grants customers unprecedented access to information. Platforms now offer side-by-side policy comparisons and customer reviews, making it simpler than ever to find the best fit. For instance, in 2024, comparison sites saw a significant uptick in usage, with some reporting over a 30% increase in customer inquiries driven by readily available data.

This heightened transparency directly bolsters customer bargaining power. Armed with detailed information on pricing, coverage, and service quality, consumers can more effectively negotiate or switch providers. This shift means insurers must actively demonstrate value and competitive pricing to retain their customer base, as switching costs are often minimal in the digital realm.

Hippo Insurance's emphasis on proactive and personalized service, driven by smart home technology, caters to a growing segment of consumers who desire more than just standard insurance. This focus on advanced features can reduce price sensitivity for these customers, as they are willing to pay for enhanced protection and convenience.

Impact of Catastrophic Events on Customer Behavior

In areas prone to natural disasters, such as Florida or California, customers are increasingly scrutinizing their insurance options. The difficulty in obtaining and maintaining coverage, especially after events like hurricanes or wildfires, drives a greater tendency for policyholders to shop around. This heightened awareness translates to a demand for insurers who offer more streamlined and transparent claims processes, as seen in the increased customer complaints regarding claim delays following major weather events in 2023.

The bargaining power of customers is amplified when catastrophic events disrupt the insurance market. For instance, following the intense hurricane season in 2022, many homeowners in affected coastal regions experienced significant premium increases or even non-renewal of policies. This forced many to actively seek out alternative providers, giving them more leverage to negotiate terms or switch to companies perceived as more stable and responsive.

- Increased Shopping Behavior: Homeowners in disaster-prone areas are more likely to compare quotes and switch insurers after experiencing coverage gaps or price hikes.

- Demand for Transparency: Customers expect clearer communication and faster processing of claims, especially following significant losses.

- Heightened Expectations: The experience of dealing with insurance claims after a catastrophe raises customer expectations regarding insurer reliability and efficiency.

- Market Volatility Impact: Insurers that fail to meet these elevated expectations risk losing customers to competitors who demonstrate greater resilience and customer focus.

Influence of Embedded Insurance and Digital Experiences

The growing trend of embedded insurance, where coverage is seamlessly integrated into other purchases, significantly impacts customer bargaining power. For instance, a consumer buying a new car might be offered insurance directly through the dealership’s digital platform. This convenience sets a new standard, pushing insurers like Hippo to offer equally intuitive, technology-driven application and policy management processes. Failure to provide a superior digital experience can lead customers to favor competitors who offer this integrated convenience, thus increasing their leverage.

Customers now expect a frictionless, digital-first approach to insurance, influenced by their experiences in other sectors. This expectation translates into a demand for insurers that can deliver on speed, ease of use, and accessibility through online portals or mobile apps. Hippo’s commitment to a digital-first strategy, evidenced by its focus on streamlined onboarding and policy servicing, directly addresses this evolving customer preference. In 2024, digital channels are increasingly becoming the primary touchpoint for insurance consumers, further amplifying the bargaining power of those who prioritize convenience and technological sophistication.

- Embedded insurance integration: Insurance offered as part of a larger transaction, like purchasing a home or a vehicle, simplifies the customer journey.

- Digital experience expectations: Customers, accustomed to seamless online interactions, now demand similar ease from their insurance providers.

- Competitive pressure on Hippo: Hippo must continuously innovate its digital platform to meet and exceed these rising customer expectations.

- Customer leverage: A superior digital experience becomes a key differentiator, giving customers more power to choose insurers that offer it.

Customers possess significant bargaining power due to increased price sensitivity and the ease of switching providers, especially with rising premiums. In 2024, a J.D. Power survey found 65% of homeowners shopped for insurance at renewal, highlighting low switching barriers.

The digital transformation in insurance, driven by insurtech, empowers customers with readily available information and comparison tools. This transparency allows consumers to easily assess pricing, coverage, and service quality, directly increasing their leverage over insurers.

| Factor | Impact on Customer Bargaining Power | Example/Data (2024 unless specified) |

|---|---|---|

| Price Sensitivity | High | Rising premiums encourage comparison shopping. |

| Switching Ease | High | Digital tools simplify quote comparison and policy changes. |

| Information Access | High | Online comparison sites and reviews offer transparent data. |

| Digital Experience Expectation | High | Consumers expect seamless, tech-driven interactions. |

Full Version Awaits

Hippo Insurance Services Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape for Hippo Insurance Services through Porter's Five Forces, analyzing the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. This in-depth analysis will equip you with critical insights into the strategic positioning and potential challenges faced by Hippo in the insurance market.

Rivalry Among Competitors

The homeowners insurance sector is a mature market, heavily influenced by established traditional insurers. These companies, like State Farm and Allstate, boast significant brand loyalty and vast financial reserves, making them formidable competitors. In 2024, the U.S. property and casualty insurance industry, which includes homeowners insurance, generated over $700 billion in direct written premiums, underscoring the scale of these incumbents.

These long-standing players benefit from deep customer relationships built over decades and offer a wide array of insurance products beyond just homeowners coverage. Their extensive distribution networks and established trust provide a significant barrier to entry for newer companies like Hippo. For instance, State Farm alone reported over $100 billion in revenue in 2023, showcasing the immense resources available to traditional insurers.

Hippo Insurance Services operates in a dynamic insurtech landscape, a sector brimming with innovative startups and tech-forward insurers. These newcomers frequently employ advanced technology, sophisticated data analytics, and novel business strategies to challenge established players. For instance, Lemonade, another prominent insurtech, reported a 24% year-over-year increase in gross written premiums in Q1 2024, reaching $400 million, showcasing the rapid growth and competitive pressure within this space.

The emergence of these other insurtech companies intensifies rivalry by introducing diverse methods for underwriting, pricing, and engaging with customers. Many focus on specific niches or offer streamlined digital experiences, forcing companies like Hippo to continuously innovate to maintain market share and attract policyholders. This constant influx of new ideas and technologies means the competitive bar is perpetually being raised.

Competitive rivalry in the insurance sector is increasingly fueled by product differentiation through advanced technology. Hippo Insurance, for instance, leverages smart home integration for proactive loss prevention and offers personalized pricing models, setting itself apart. This technological edge is crucial, but it's a dynamic landscape.

Other insurers are also pouring resources into similar technological advancements, creating an intense race to offer superior customer value and innovative solutions. This means that while Hippo's tech focus is a strong differentiator now, staying ahead requires continuous investment and adaptation. For example, the insurtech market saw significant funding in 2024, with companies like Lemonade and Root Insurance continuing to innovate in digital customer experiences and data analytics, intensifying the competitive pressure.

Pricing Strategies and Profitability Pressures

The homeowners insurance sector faces persistent challenges, notably escalating claims costs stemming from an increase in natural disasters and ongoing inflation. This dynamic directly translates to higher premiums for consumers and, consequently, significant pressure on insurer profitability. For Hippo Insurance Services, this means navigating a landscape where competitive pricing is paramount, yet maintaining healthy loss ratios remains a critical balancing act.

In 2024, this pressure is particularly acute. For instance, the average cost of homeowners insurance in the U.S. saw a notable increase, with some states experiencing double-digit percentage hikes year-over-year. This intensified competition forces insurers to carefully consider their pricing strategies, as undercutting rivals can lead to unsustainable underwriting results.

- Rising Claims Costs: Natural disasters, such as severe storms and wildfires, contributed to billions in insured losses in 2023, a trend expected to continue impacting 2024.

- Inflationary Impact: Increased costs for building materials and labor directly inflate repair and replacement expenses, pushing up claim payouts.

- Premium Adjustments: Insurers are compelled to raise premiums to offset these rising costs, creating a challenging environment for affordability and competitive positioning.

- Profitability Squeeze: The need to remain competitive on price while absorbing higher claims expenses puts a strain on profit margins for companies like Hippo.

Regulatory Environment and Market Exits/Entries

The regulatory environment significantly shapes competition, particularly in states susceptible to natural disasters. Stricter regulations in these areas can increase operational costs for insurers, influencing their willingness to enter or remain in the market.

In 2024, several states continued to grapple with the solvency of their insurance markets due to escalating catastrophic event losses. For instance, reports from the Insurance Information Institute indicated that homeowners' insurance premiums in California, a state frequently hit by wildfires, saw an average increase of 30% in early 2024 compared to the previous year, pushing some insurers to reassess their exposure.

This dynamic has led to market exits by some established players, creating openings for nimble competitors. Insurtechs like Hippo have been able to capitalize on these shifts, offering innovative solutions in areas where traditional insurers have scaled back. However, these market exits also concentrate remaining competition in less volatile regions, intensifying rivalry there.

- Regulatory Hurdles: Increased compliance costs in disaster-prone states can deter new entrants and pressure existing ones.

- Market Exits: Traditional insurers withdrawing from high-risk areas, such as Florida due to hurricane activity, create market gaps.

- Insurtech Opportunities: Companies like Hippo can leverage technology to underwrite risk more effectively in these vacated markets.

- Concentrated Competition: As some insurers leave high-risk zones, competition intensifies in more stable, less exposed markets.

The competitive landscape for Hippo Insurance Services is intense, marked by the presence of large, established traditional insurers and agile insurtech rivals. These incumbents, such as State Farm, which reported over $100 billion in revenue in 2023, leverage deep customer loyalty and extensive resources, creating significant barriers. Meanwhile, other insurtechs like Lemonade, which saw a 24% year-over-year increase in gross written premiums in Q1 2024, are rapidly innovating with technology and data analytics, forcing constant adaptation.

| Competitor Type | Key Strengths | Example (2023/2024 Data) | Impact on Hippo |

|---|---|---|---|

| Traditional Insurers | Brand loyalty, financial reserves, broad product offerings | State Farm (>$100B revenue in 2023) | High barrier to entry, established customer base |

| Insurtech Competitors | Technological innovation, data analytics, agile strategies | Lemonade (400M gross written premiums in Q1 2024) | Pressure to innovate, drive for digital customer experience |

SSubstitutes Threaten

Self-insurance and increased risk retention present a significant threat to traditional insurers like Hippo Insurance Services, particularly for high-net-worth individuals or those managing multiple properties. These sophisticated clients may opt to fund potential losses internally rather than pay premiums, especially when insurance costs escalate or coverage options become restrictive.

For instance, in 2024, the rising cost of homeowners insurance premiums, driven by inflation and increased claims frequency from severe weather events, has made self-insuring a more attractive proposition for some. This strategy allows entities to retain capital that would otherwise be paid to insurers, potentially yielding better returns if losses are infrequent or manageable.

Government-backed insurance programs, such as FEMA's National Flood Insurance Program (NFIP), can present a significant threat of substitution for private insurers like Hippo. These programs often step in to provide coverage in high-risk areas where private market options are scarce or prohibitively expensive. For instance, the NFIP covered over 5 million policies as of early 2024, demonstrating its substantial reach in areas private insurers might avoid.

Beyond traditional policies, alternative risk transfer (ART) mechanisms pose a significant threat. Catastrophe bonds, insurance-linked securities, and parametric solutions are increasingly used to manage large, specific risks, directly accessing capital markets. For instance, the catastrophe bond market saw substantial issuance in 2023, with total market capacity reaching over $100 billion by year-end, demonstrating a growing appetite for these capital market-based risk solutions.

Focus on Loss Prevention and Mitigation

The threat of substitutes for Hippo Insurance Services, particularly concerning loss prevention and mitigation, is significant. Homeowners increasingly adopt smart home technology and structural hardening measures to reduce their risk exposure. For instance, in 2024, the smart home market was projected to reach over $150 billion globally, with a substantial portion dedicated to security and safety devices that directly impact insurance risk.

This proactive approach by homeowners can lead them to seek minimal insurance coverage or explore alternative risk financing models. If a homeowner invests heavily in, say, advanced fire suppression systems or robust flood defenses, their perceived need for comprehensive insurance diminishes. This trend pressures insurers like Hippo to demonstrate the added value of their services beyond basic risk transfer.

- Smart Home Adoption Growth: The global smart home market is expected to continue its upward trajectory, with safety and security segments showing strong growth in 2024.

- Risk Mitigation Investment: Homeowners are increasingly willing to invest upfront in mitigation efforts, viewing them as long-term cost savings compared to potential insurance premiums or uninsured losses.

- Alternative Risk Financing: The rise of peer-to-peer insurance and parametric insurance offers substitutes for traditional coverage, especially for well-mitigated risks.

- Value Proposition Challenge: Hippo must continuously innovate its offerings to prove its value proposition against homeowners' self-sufficiency in risk management.

Financial Self-Sufficiency and Savings

Homeowners with significant savings can act as a substitute for traditional insurance. For instance, a homeowner with $100,000 in liquid assets might choose a higher deductible or even self-insure for minor repairs, using their savings instead of paying for comprehensive coverage. This reduces the perceived need for a full insurance policy, especially for predictable, smaller-scale losses.

This threat is amplified for individuals who prioritize financial self-sufficiency. In 2024, the average savings rate for households in developed economies remained robust, with some nations reporting rates above 10%. This pool of personal capital directly competes with the financial security provided by insurance products, particularly when deductibles are set at levels that are easily absorbed by personal reserves.

- Self-Insurance Capability: Homeowners with ample liquid assets can absorb smaller losses, reducing reliance on insurance.

- High Deductible Preference: A substantial savings cushion allows for higher deductibles, lowering premiums and acting as a substitute for full coverage.

- Reduced Demand for Low-Impact Coverage: The availability of personal funds diminishes the appeal of insurance for minor damages.

- Financial Resilience as an Alternative: Strong personal financial health can be viewed as a direct alternative to the financial protection offered by insurance.

The threat of substitutes for Hippo Insurance Services is multifaceted, encompassing self-insurance, government programs, alternative risk transfer, and homeowner mitigation efforts. As of early 2024, the rising cost of premiums makes self-insurance a more appealing option for some, especially those with substantial savings. Government programs like FEMA's NFIP, which covered over 5 million policies in early 2024, also serve as substitutes in high-risk areas.

Alternative risk transfer mechanisms, such as catastrophe bonds, with a global market capacity exceeding $100 billion by the end of 2023, offer capital market solutions. Furthermore, homeowners are increasingly investing in smart home technology, a market projected to surpass $150 billion globally in 2024, and structural hardening to reduce their own risk exposure.

| Substitute Type | Description | 2024 Relevance/Data Point |

|---|---|---|

| Self-Insurance | Individuals or businesses funding potential losses internally. | Attractive due to rising premiums; robust household savings rates (e.g., >10% in some developed nations). |

| Government Programs | Publicly administered insurance schemes. | FEMA's NFIP covered over 5 million policies in early 2024, substituting private flood insurance. |

| Alternative Risk Transfer (ART) | Capital market solutions like catastrophe bonds. | Global market capacity exceeded $100 billion by end of 2023. |

| Risk Mitigation Technology | Homeowner investments in safety and security devices. | Global smart home market projected over $150 billion in 2024, with significant safety segment growth. |

Entrants Threaten

Entering the insurance market as a full-stack provider demands immense capital. For instance, establishing adequate reserves to cover potential claims and meet stringent solvency regulations, like those mandated by the NAIC in the US, requires billions of dollars. This financial barrier alone significantly deters many potential new players.

Beyond capital, the insurance industry is burdened by complex and ever-evolving regulatory frameworks. Obtaining necessary licenses, adhering to consumer protection laws, and navigating state-specific compliance rules creates substantial operational hurdles. These regulatory complexities act as a significant deterrent, requiring specialized legal and compliance expertise that new entrants may lack.

Established insurers benefit from decades of brand recognition and customer trust, assets that are incredibly difficult for new entrants to replicate swiftly. For instance, in 2024, major insurance providers continued to leverage their long-standing reputations, with many reporting high customer retention rates, underscoring the power of ingrained trust.

Homeowners often gravitate towards insurers with a proven track record and a history of reliable service. This preference presents a significant hurdle for new players, who must invest heavily in marketing and customer acquisition to even begin chipping away at the market share held by these trusted incumbents.

The threat of new entrants in the insurance sector, particularly concerning data access and underwriting expertise, remains a significant consideration for companies like Hippo Insurance Services. Hippo's core strategy hinges on its advanced data analytics capabilities, which are crucial for its personalized underwriting approach. New players entering the market face a substantial hurdle in acquiring the vast amounts of historical claims data needed to build robust risk assessment models.

Developing the sophisticated underwriting algorithms that Hippo utilizes requires not only data but also specialized expertise, which can be difficult and time-consuming for newcomers to replicate. For instance, in 2024, the insurance industry continued to see significant investment in AI and machine learning for underwriting, highlighting the technical barrier to entry. Companies lacking this deep analytical bench and access to comprehensive datasets will find it challenging to compete on pricing and risk accuracy.

Distribution Channels and Customer Acquisition Costs

Establishing effective distribution channels and acquiring customers represents a significant hurdle for new insurance entrants. The cost and time involved in building a robust customer base, even with digital avenues, demand substantial investment in marketing, technology, and strategic partnerships. For instance, in 2024, customer acquisition costs (CAC) in the insurtech space continued to be a major factor, with some companies reporting CACs ranging from $100 to over $500 depending on the customer segment and marketing channel.

These high upfront costs create a barrier, particularly for smaller startups lacking the capital reserves of established players. Hippo Insurance, like many in the industry, has navigated this by leveraging technology for more efficient customer onboarding and by forming partnerships to expand reach. However, the ongoing need for marketing spend and platform development means that even with digital efficiencies, scaling remains a capital-intensive endeavor.

- High Customer Acquisition Costs: Many insurtechs in 2024 faced customer acquisition costs exceeding $300, impacting profitability in early stages.

- Digital Channel Investment: Building and optimizing digital distribution platforms requires continuous investment in technology and user experience.

- Partnership Reliance: New entrants often rely on partnerships with real estate agents, mortgage brokers, or other financial services firms to gain access to customers, which can involve revenue sharing or upfront fees.

- Brand Building Expense: Establishing trust and brand recognition in a competitive market necessitates significant marketing and advertising expenditure.

Technological Innovation and Specialization

New entrants, especially insurtech startups, pose a significant threat by utilizing cutting-edge technologies such as AI and advanced data analytics. These innovations allow them to create novel products and optimize operations, potentially undercutting established players. Hippo, as an insurtech itself, is particularly vulnerable to even newer, more nimble competitors entering the market with similar or superior technological advantages.

The insurtech landscape is dynamic, with significant venture capital flowing into new companies. For instance, in 2023, insurtech funding reached approximately $10 billion globally, demonstrating the attractiveness of the sector to new players. These startups often focus on specific market segments or customer needs, offering specialized solutions that can erode market share from broader insurers.

- Disruptive Technology Adoption: Newer entrants can bypass legacy systems, integrating AI for underwriting and claims processing, offering faster and more accurate services.

- Niche Market Focus: Startups often target underserved or specialized markets, building a loyal customer base before expanding.

- Agile Business Models: Leaner structures allow new entrants to adapt quickly to market changes and customer demands, a challenge for larger, more established companies.

- Customer Experience Innovation: Digital-first approaches and personalized offerings can attract customers seeking a more seamless and modern insurance experience.

The insurance industry presents a formidable barrier to new entrants due to the substantial capital requirements for reserves and regulatory compliance. Furthermore, navigating complex licensing and consumer protection laws demands significant legal and compliance resources. Established players benefit from deep-rooted customer trust and brand recognition, making it challenging for newcomers to gain traction. In 2024, the continued emphasis on digital transformation and customer experience means new entrants must also invest heavily in technology and marketing to compete effectively.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hippo Insurance Services is built upon a foundation of publicly available financial statements, industry analysis reports from firms like AM Best and Fitch Ratings, and regulatory filings from state insurance departments.