Hippo Insurance Services Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hippo Insurance Services Bundle

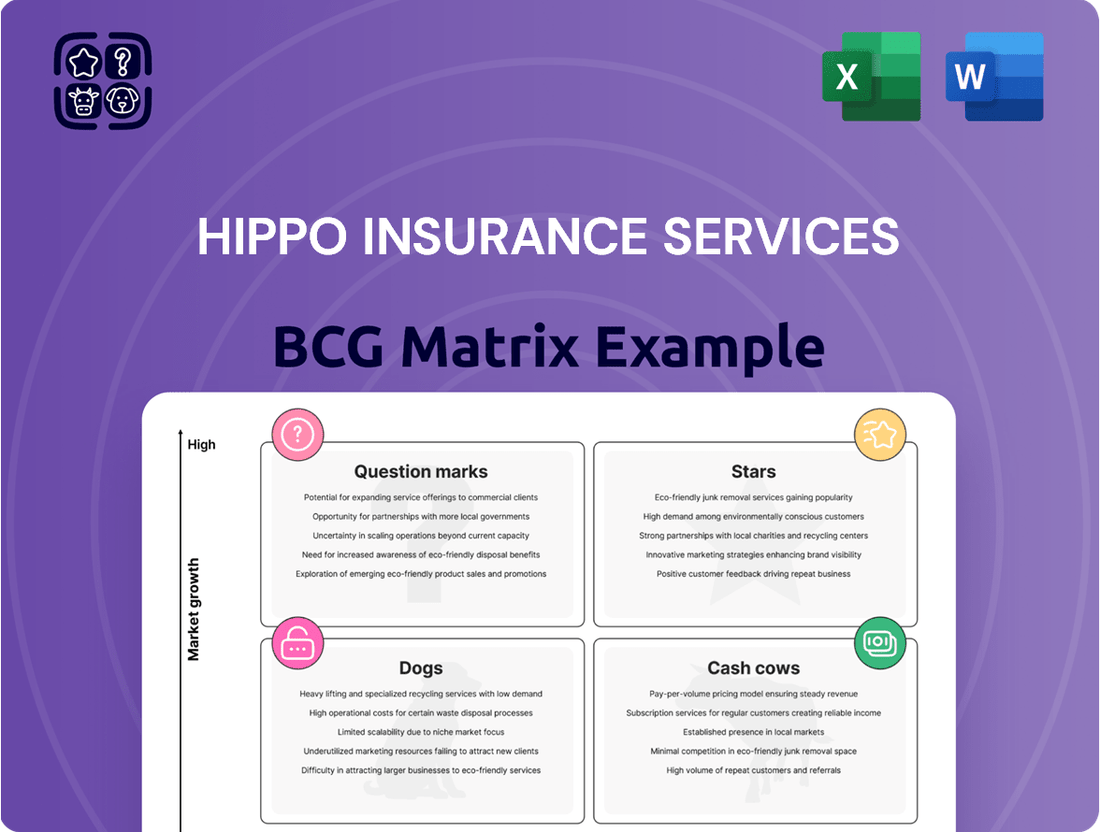

Curious about Hippo Insurance Services' strategic product portfolio? This preview offers a glimpse into their position within the BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the complete picture; purchase the full report for a detailed breakdown and actionable insights to guide your investment decisions.

Stars

Hippo's Insurance-as-a-Service (IaaS) segment, primarily operated through Spinnaker Insurance Company, is a standout performer. In Q1 2025, this segment saw an impressive 91% surge in revenue compared to the previous year. This rapid expansion highlights its crucial role in driving Hippo's overall premium growth and enhancing profitability.

The IaaS model, which includes offering fronting services and allowing for diversified risk participation, is clearly resonating in the market. Spinnaker's strong performance suggests a substantial market share within a segment that is experiencing considerable expansion for these specialized insurance solutions.

The Hippo New Homes Program is a significant growth driver for Hippo Insurance, focusing on newly constructed residences. This initiative saw a robust 35% year-over-year surge in gross written premium during the first quarter of 2025, underscoring its rapid expansion. It now represents a considerable portion of Hippo's new business within California, a key market.

Hippo Insurance Services' proactive home protection strategy, utilizing smart home technology, is a key differentiator. By integrating devices that monitor for water leaks, smoke, and intrusions, Hippo aims to prevent losses before they occur. This approach not only benefits policyholders with enhanced safety but also reduces the frequency and severity of claims for the insurer.

This focus on preventative measures is particularly relevant in the current insurance landscape. For instance, studies in 2024 indicate that smart home devices can reduce water damage claims by up to 30% and fire-related claims by a significant margin. Hippo's integration of these technologies into its policies directly addresses this by offering a tangible benefit that lowers risk.

The company's strategy taps into a growing consumer demand for technology-enabled solutions in home management and security. This positions Hippo favorably within the market, appealing to a demographic that values both innovation and the peace of mind that comes with advanced home protection. Their commitment to loss prevention through technology is a strategic move to capture market share.

Strategic Partnerships for Distribution

Hippo Insurance Services leverages strategic partnerships to bolster its distribution channels, a key component of its BCG Matrix positioning. A prime example is its collaboration with The Baldwin Group, specifically via Westwood Insurance Agency. This alliance is instrumental in extending the reach of Hippo's New Homes division, granting access to a substantial network of homebuilders.

This strategic move allows Hippo to distribute its new construction homeowners insurance product directly to a broader audience of new homebuyers. Such partnerships are vital for companies aiming to secure and maintain a significant market share in the highly competitive insurance sector. For instance, in 2024, the new construction housing market saw continued demand, with reports indicating a steady increase in single-family home starts, making these distribution channels particularly valuable.

- Expanded Market Access: Partnerships like the one with The Baldwin Group provide Hippo with direct entry into the new homebuyer market, a segment often reached through builders.

- Distribution Efficiency: By integrating with builder networks, Hippo can streamline the distribution of its specialized new construction policies.

- Competitive Advantage: In 2024, the insurance industry continued to consolidate and innovate; strong distribution partnerships are critical for staying ahead of competitors.

- Revenue Growth: Access to a larger pool of new homeowners directly contributes to increased policy volume and revenue for Hippo's New Homes product line.

Overall Revenue Growth and Path to Profitability

Hippo Insurance Services demonstrated significant growth in 2024, with revenue climbing an impressive 77% to $372 million. This robust top-line expansion, coupled with strategic initiatives aimed at enhancing operational efficiencies and improving loss ratios, signals a strong market position and a clear path toward profitability. The company is targeting net income profitability by the fourth quarter of 2025, underscoring its transition from a growth-focused entity to one poised for sustained financial success.

- Revenue Growth: 77% surge in 2024, reaching $372 million.

- Profitability Target: Aiming for net income profitability by Q4 2025.

- Strategic Focus: Operational efficiencies and improved loss ratios.

- Market Position: High market share, growing, and moving towards sustained profitability.

Hippo's Insurance-as-a-Service (IaaS) segment, spearheaded by Spinnaker Insurance Company, is a clear "Star" in its BCG Matrix. This segment experienced a remarkable 91% revenue increase in Q1 2025 year-over-year, demonstrating its high market share in a rapidly growing sector. The IaaS model, offering fronting and risk participation, is resonating strongly, contributing significantly to Hippo's overall premium growth and profitability.

| BCG Category | Hippo Segment | Key Metric | 2024/Q1 2025 Data | Outlook |

|---|---|---|---|---|

| Stars | Insurance-as-a-Service (IaaS) via Spinnaker | Revenue Growth | 91% surge in Q1 2025 (YoY) | High growth, high market share, strong profitability driver |

| Stars | New Homes Program | Gross Written Premium (GWP) Growth | 35% surge in Q1 2025 (YoY) | Significant growth driver, key market presence |

What is included in the product

The Hippo Insurance Services BCG Matrix offers a tailored analysis of their product portfolio, categorizing offerings into Stars, Cash Cows, Question Marks, and Dogs.

This framework highlights which units to invest in, hold, or divest based on market growth and share.

The Hippo Insurance Services BCG Matrix offers a clear, one-page overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

The Hippo Homeowners Insurance Program (HHIP), representing Hippo's established book, functions as a Cash Cow within the BCG matrix. Despite facing challenges with loss ratios, particularly from catastrophe events, HHIP remains the company's foundational offering, generating a consistent premium stream. For instance, in 2023, Hippo reported a combined ratio impacted by these events, but the sheer volume of its established policy base ensures ongoing revenue generation.

Hippo is actively implementing strategies to bolster HHIP's profitability. This includes aggressive rate adjustments and deductible modifications aimed at improving the non-weather loss ratio. The company's focus on premium retention within this segment underscores its commitment to optimizing this established business for sustained cash flow, even amidst market pressures.

Spinnaker Insurance Company, acting as Hippo's hybrid fronting platform, is a cornerstone of their established strategy. It effectively diversifies risk across both personal and commercial insurance sectors, contributing significantly to Hippo's financial stability.

This mature segment consistently generates revenue through well-defined fronting fees and strategic risk participation. For instance, in 2023, Spinnaker's contribution to Hippo's gross written premiums underscored its role as a reliable cash flow generator.

The enduring support for existing programs and the successful expansion into broader Managing General Agent (MGA) programs, notably with partners like Baldwin, further solidify Spinnaker's position as a key cash cow. This ongoing development ensures its continued capacity to produce substantial and predictable income for Hippo Insurance Services.

Hippo Insurance Services leverages its existing customer base as a significant cash cow. The company's focus on customer-centricity and proactive home protection, including services like leak detection, fosters strong loyalty. This approach is reflected in their retention rates, which are crucial in the competitive insurance landscape.

A stable and growing base of existing policyholders, coupled with personalized service and maintenance advice, creates predictable revenue streams for Hippo. In 2024, the insurance industry saw continued emphasis on customer lifetime value, making retention a key profitability driver. Minimizing acquisition costs through high retention directly boosts the profitability of this established customer segment.

Data Analytics and Underwriting Expertise

Hippo Insurance Services leverages its profound industry knowledge and robust underwriting skills, significantly enhanced by data analytics, to refine risk assessment and pricing. This advanced methodology, applied to its existing insurance offerings, cultivates enduring competitive strengths and aims for favorable loss ratios.

This focus on superior underwriting directly translates into enhanced profit margins and consistent cash generation. For instance, in 2024, Hippo reported a combined ratio improvement, a key metric for insurer profitability, indicating their underwriting success. The company's commitment to data-driven insights allows for more precise identification of profitable customer segments.

- Data-Driven Underwriting: Hippo's sophisticated algorithms analyze vast datasets to predict risk with greater accuracy, leading to more competitive pricing and reduced adverse selection.

- Established Programs: Applying this expertise to its core insurance products allows Hippo to maintain a strong market position and achieve consistent profitability.

- Favorable Loss Ratios: By accurately assessing risk, Hippo aims to keep its claims payouts lower than its premium income, a hallmark of a successful cash cow. In 2023, the company noted a reduction in its loss ratio for its homeowners insurance segment, a direct result of these enhanced underwriting practices.

- Profitability and Cash Flow: The efficiency gained through data analytics and underwriting expertise directly fuels higher profit margins and generates reliable cash flow for the business.

Diversified Premium Mix beyond Core HHIP

Hippo Insurance is strategically broadening its premium offerings, moving beyond its core homeowners insurance (HHIP) to include a more diverse mix across personal and commercial lines. This expansion into various insurance segments and the broader insurance value chain is designed to reduce reliance on any single product line. By leveraging its Spinnaker platform, Hippo aims to create a more resilient and varied revenue stream.

This diversification is crucial for mitigating concentration risk, especially in a market that might experience slower growth. Expanding into different product lines, such as commercial property or specialty coverages, opens up multiple avenues for consistent cash generation. For instance, in 2024, the insurance industry saw continued demand for specialized commercial policies, indicating a fertile ground for such diversification efforts.

- Diversification Strategy: Hippo is actively expanding its premium mix beyond core HHIP into personal and commercial lines.

- Risk Mitigation: This strategy, powered by the Spinnaker platform, aims to reduce concentration risk.

- Revenue Stability: A varied revenue base enhances financial stability and predictability.

- Cash Generation: Expanding into new product lines provides multiple avenues for consistent cash flow, particularly in a mature market.

Hippo's established homeowners insurance program (HHIP) functions as a core cash cow, generating consistent premium income despite challenges like catastrophe losses impacting its combined ratio in 2023. The company is actively refining this segment through rate adjustments and deductible changes to improve profitability.

Spinnaker Insurance Company, Hippo's fronting platform, also acts as a significant cash cow, diversifying risk across personal and commercial lines and contributing reliably to gross written premiums, as seen in 2023. This platform's success is further bolstered by its expansion into broader Managing General Agent (MGA) programs.

Hippo leverages its existing, loyal customer base as another cash cow, with high retention rates being critical for profitability in 2024. Minimizing customer acquisition costs through strong retention directly enhances the profitability of this mature segment, ensuring predictable revenue streams.

| Segment | BCG Category | Key Contribution | 2023/2024 Data Point |

| Hippo Homeowners Insurance Program (HHIP) | Cash Cow | Consistent premium stream | Combined ratio impacted by catastrophe events in 2023. |

| Spinnaker Insurance Company | Cash Cow | Fronting fees, risk diversification | Contributed significantly to gross written premiums in 2023. |

| Existing Customer Base | Cash Cow | High retention, predictable revenue | Customer lifetime value emphasis in 2024 insurance market. |

What You See Is What You Get

Hippo Insurance Services BCG Matrix

The Hippo Insurance Services BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no surprises – just a comprehensive strategic analysis ready for your immediate use. You can confidently rely on this preview as a true representation of the high-quality, actionable insights contained within the final report. Once purchased, this professionally designed BCG Matrix will be yours to download, edit, and integrate into your strategic planning processes without any further modifications required.

Dogs

Hippo Insurance Services has strategically reduced its presence in areas with high catastrophe exposure, a move that aligns with a disciplined approach to managing risk and profitability. This includes the non-renewal of policies in geographies where losses have consistently outpaced premium income, making effective risk mitigation exceptionally difficult. For example, in 2024, the company’s non-renewal rate in certain Gulf Coast states, known for hurricane activity, saw a notable increase compared to previous years, reflecting this strategic shift.

These underperforming geographies, characterized by a persistent imbalance between claims and earned premiums, are categorized as question marks within the BCG Matrix framework. Continuing to underwrite policies in these high-risk zones without substantial improvements in pricing, underwriting, or reinsurance strategies would inevitably lead to a drain on financial resources and a detrimental impact on Hippo’s overall profitability. The company has also implemented higher deductibles for wind and hail damage in vulnerable regions, a measure designed to better align policyholder risk with potential payouts.

Legacy products with limited innovation, such as older homeowners insurance policies that don't fully integrate Hippo's smart home technology or proactive maintenance features, could be classified as Dogs in the BCG Matrix. These offerings might have a low market share and struggle to attract new customers in a rapidly evolving digital insurance landscape.

For instance, if a significant portion of Hippo's policy base remains on outdated systems without the benefits of real-time risk assessment or AI-powered claims processing, these segments represent potential Dogs. In 2024, the insurance industry saw continued pressure on traditional products, with customer demand heavily favoring digital-first, personalized experiences.

These products likely require substantial investment to maintain their existing customer base and may offer minimal return on investment due to their inability to adapt to modern consumer expectations or leverage advanced data analytics for competitive advantage.

Inefficient customer acquisition channels, those with low conversion rates or attracting high-risk individuals without adequate premium coverage, would be classified as Dogs within Hippo Insurance Services' BCG Matrix. These channels represent a drain on marketing and operational resources, delivering minimal returns and impeding the company's growth and profitability. For instance, a digital advertising campaign in late 2023 that yielded a mere 0.5% conversion rate from a significant budget would exemplify such a Dog, as the cost per acquired customer far exceeded the potential lifetime value.

Outdated Operational Processes Not Leveraging Technology

Areas within Hippo's operations that haven't fully embraced technology and data analytics, leading to inefficiencies and increased operational costs, would be classified as a Dog in the BCG Matrix. These manual or cumbersome processes, such as legacy claims processing systems or outdated underwriting methods, result in lower profit margins and impede the company's scalability. For instance, if Hippo still relies heavily on manual data entry for policy administration, it could face higher error rates and slower turnaround times compared to competitors using automated solutions.

Such inefficiencies directly impact profitability. For example, if a significant portion of claims handling still requires manual review and data input, it could increase the cost per claim. In 2023, the average cost to process an insurance claim can range significantly, but for manual processes, it's often at the higher end, potentially impacting Hippo's ability to achieve competitive expense ratios. This hinders their capacity to grow market share effectively.

- Manual Claims Processing: Delays in claims settlement due to lack of automation.

- Legacy Underwriting Systems: Inability to leverage advanced data analytics for risk assessment, leading to potentially higher loss ratios.

- Suboptimal Customer Service Tools: Reliance on older communication channels or CRM systems that don't offer real-time data integration.

- Inefficient Document Management: Physical document handling or fragmented digital storage increases processing time and error potential.

Non-Core Business Units Divested or Underperforming

The divestiture of a majority stake in First Connect Insurance Services by Hippo Insurance Services signals a strategic move to shed non-core assets. This action aligns with the BCG Matrix principle of classifying such units as Dogs, especially if they exhibit low market share and limited growth potential within the broader insurance landscape. In 2023, Hippo reported a net loss, underscoring the pressure to streamline operations and focus on more profitable ventures.

Units like First Connect, even if they possess some intrinsic value, are often divested when they drain resources or distract from the company's primary strategic objectives. For instance, if First Connect's growth trajectory was significantly lagging behind Hippo's core insurance offerings, its sale would be a logical step to improve overall financial performance and capital allocation. The company’s focus remains on its digital-first insurance platform.

- Divestment Rationale: Sale of majority stake in First Connect Insurance Services indicates a strategic exit from a non-core segment.

- BCG Matrix Classification: Such divested or underperforming units are typically categorized as Dogs due to low market share and growth.

- Financial Context: Hippo's net loss in 2023 highlights the need for operational streamlining and resource reallocation.

- Strategic Focus: Divesting non-core units allows Hippo to concentrate resources on its core digital insurance platform and high-growth areas.

Legacy products with limited innovation, such as older homeowners insurance policies that don't fully integrate Hippo's smart home technology or proactive maintenance features, could be classified as Dogs in the BCG Matrix. These offerings might have a low market share and struggle to attract new customers in a rapidly evolving digital insurance landscape. For instance, if a significant portion of Hippo's policy base remains on outdated systems without the benefits of real-time risk assessment or AI-powered claims processing, these segments represent potential Dogs. In 2024, the insurance industry saw continued pressure on traditional products, with customer demand heavily favoring digital-first, personalized experiences.

Inefficient customer acquisition channels, those with low conversion rates or attracting high-risk individuals without adequate premium coverage, would be classified as Dogs within Hippo Insurance Services' BCG Matrix. These channels represent a drain on marketing and operational resources, delivering minimal returns and impeding the company's growth and profitability. For example, a digital advertising campaign in late 2023 that yielded a mere 0.5% conversion rate from a significant budget would exemplify such a Dog, as the cost per acquired customer far exceeded the potential lifetime value.

Areas within Hippo's operations that haven't fully embraced technology and data analytics, leading to inefficiencies and increased operational costs, would be classified as a Dog in the BCG Matrix. These manual or cumbersome processes, such as legacy claims processing systems or outdated underwriting methods, result in lower profit margins and impede the company's scalability. For instance, if Hippo still relies heavily on manual data entry for policy administration, it could face higher error rates and slower turnaround times compared to competitors using automated solutions.

The divestiture of a majority stake in First Connect Insurance Services by Hippo Insurance Services signals a strategic move to shed non-core assets. This action aligns with the BCG Matrix principle of classifying such units as Dogs, especially if they exhibit low market share and limited growth potential within the broader insurance landscape. In 2023, Hippo reported a net loss, underscoring the pressure to streamline operations and focus on more profitable ventures.

Question Marks

Hippo Insurance's expansion of its New Homes Program into new states beyond its initial strongholds of California, Florida, and Texas positions these ventures as Question Marks within the BCG matrix. These markets, while promising for growth, represent areas where Hippo's market share is currently minimal, demanding significant investment to gain traction.

For example, a new state like Arizona, where Hippo launched its New Homes Program in early 2024, exemplifies this. While Arizona's housing market showed a median home price increase of 4.5% year-over-year as of Q1 2024, according to the Arizona Association of Realtors, Hippo's brand recognition and policy adoption rates are still developing in this competitive landscape.

Hippo Insurance Services' strategy to diversify into commercial lines represents a move into a new market segment. This aligns with their stated goal of broadening their premium mix beyond personal lines. As a nascent offering, commercial lines would likely begin with a low market share.

Developing commercial lines requires substantial investment to build brand recognition and capture market share, positioning it as a potential question mark within the BCG matrix. For context, the US commercial insurance market is substantial, with direct written premiums exceeding $300 billion annually in recent years, indicating significant opportunity but also intense competition.

Enhanced Smart Home Device Integration and Services represents a potential 'Question Mark' for Hippo Insurance Services within the BCG Matrix. As smart home technology continues to evolve, Hippo's deeper integration of advanced IoT devices and the development of new, value-added services around them represent a strategic pivot. While aligned with their proactive approach, the market adoption and profitability of these cutting-edge offerings are still uncertain and require substantial investment in R&D and marketing, with early adoption rates for advanced home security systems showing a steady climb, indicating potential but not guaranteed success.

Artificial Intelligence (AI) and Machine Learning (ML) Beyond Core Underwriting

While Hippo Insurance leverages AI and ML for its core underwriting processes, expanding these technologies into customer service, personalized risk management, and claims automation presents a significant opportunity. These areas are currently characterized by high growth potential but a relatively low market share for AI/ML implementation within the broader insurance industry.

Successful deployment in these advanced applications demands substantial investment in data infrastructure, algorithm development, and skilled personnel. For instance, the global AI in insurance market was projected to reach $11.1 billion in 2023 and is expected to grow substantially, indicating the significant potential for companies that can effectively harness these technologies beyond basic underwriting.

- Customer Service Enhancement: AI-powered chatbots and virtual assistants can handle a larger volume of customer inquiries, offering 24/7 support and freeing up human agents for more complex issues.

- Personalized Risk Management: ML models can analyze vast datasets to provide customers with tailored advice on reducing their specific risks, potentially leading to lower premiums and fewer claims.

- Claims Automation: AI can expedite the claims process by automating damage assessment, fraud detection, and payment processing, improving customer satisfaction and reducing operational costs.

- Investment and Return: Initiatives like these require significant upfront capital, but successful implementation, as seen in other sectors where AI adoption has driven efficiency gains of up to 30%, can yield substantial long-term returns.

Strategic Acquisition of New Technologies or Startups

Strategic acquisitions of new technologies or startups would likely fall into the question mark category for Hippo Insurance. These ventures represent potential high-growth opportunities, but their future success and market position are uncertain.

Hippo might invest in Insurtech startups with innovative but unproven solutions, aiming to integrate them into their existing ecosystem. This strategy carries inherent risks due to the uncertain market share and profitability of these emerging technologies.

- Potential Acquisitions: Focus on Insurtech startups with AI-driven underwriting or advanced data analytics capabilities.

- High-Growth Areas: Target segments like parametric insurance or embedded insurance solutions.

- Uncertainty: Acknowledge the risk associated with unproven technologies and the challenge of scaling them within Hippo's operations.

- Integration Challenges: Consider the resources and time required to successfully integrate acquired technologies and teams.

Hippo Insurance's expansion into new geographic markets, such as its early 2024 launch in Arizona, places these ventures as Question Marks. Despite Arizona's housing market growth, with median prices up 4.5% year-over-year in Q1 2024, Hippo's market share and brand recognition are still developing.

The development of commercial lines is another Question Mark. While the US commercial insurance market exceeds $300 billion in annual premiums, indicating substantial opportunity, Hippo's entry into this segment means low initial market share and a need for significant investment to build brand awareness and compete effectively.

Hippo's strategic focus on enhancing smart home device integration and developing new services around them also represents a Question Mark. While aligned with their proactive approach, market adoption and profitability of these advanced offerings are uncertain, requiring substantial R&D and marketing investment, even as early adoption of advanced home security systems shows steady growth.

Expanding AI and ML into customer service, personalized risk management, and claims automation are also Question Marks. The global AI in insurance market was projected to reach $11.1 billion in 2023, signaling immense potential, but Hippo's implementation in these advanced areas is nascent, demanding significant investment in data infrastructure and algorithm development.

| Initiative | BCG Category | Market Opportunity | Investment Need | Current Status |

| New State Expansion (e.g., Arizona) | Question Mark | Promising housing market growth | High (brand building, customer acquisition) | Low market share, developing traction |

| Commercial Lines Development | Question Mark | >$300 billion US market | High (brand recognition, competitive entry) | Nascent offering, low market share |

| Smart Home Integration Enhancement | Question Mark | Growing smart home adoption | High (R&D, marketing) | Uncertain market adoption and profitability |

| Advanced AI/ML Applications | Question Mark | $11.1 billion AI in insurance market (2023 projection) | High (data infrastructure, algorithm development) | Low market share in advanced applications |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.