Hanwha Systems SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Systems Bundle

Hanwha Systems is a powerhouse in defense and aerospace, boasting strong technological capabilities and a growing global presence. However, understanding the nuances of its market position, potential threats, and untapped opportunities requires a deeper dive.

Want the full story behind Hanwha Systems' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hanwha Systems leverages a robust dual business model, spanning both defense electronics and Information and Communications Technology (ICT). This diversification is a significant strength, as it creates a stable revenue base and mitigates risks associated with over-reliance on a single industry. For instance, in 2023, the defense sector continued to see strong order growth, while the ICT segment benefited from ongoing digital transformation trends.

Hanwha Systems showcased exceptional financial performance in 2024, achieving record-high operating profit and sales. This surge was largely propelled by the robust contributions from its defense sector, highlighting the company's strategic focus and market position.

The company's strong financial footing is further evidenced by its impressive order backlog. Notably, Hanwha Systems secured a record 930 billion won in defense contracts in the fourth quarter of 2024 alone. This substantial influx of orders underscores a significant demand for its offerings and provides a solid base for sustained future growth.

Hanwha Systems stands out with its advanced and proprietary defense technologies, making it a key supplier of critical defense electronics. The company provides essential components like mission computers, multi-function displays, and infrared search and track equipment, notably for the advanced KF-21 fighter jet program.

A significant strength lies in Hanwha Systems' ability to achieve domestic production of these sophisticated systems, even when faced with technology transfer restrictions from other countries. This self-sufficiency underscores their deep technical expertise and commitment to national defense capabilities.

Their role in developing and producing the KF-21's Active Electronically Scanned Array (AESA) radar further demonstrates their technological leadership. This project, valued in the hundreds of millions of dollars, showcases their capacity to integrate complex, high-performance systems.

Strategic Global Partnerships and Acquisitions

Hanwha Systems has strategically bolstered its global presence and technological capabilities through key international partnerships and acquisitions. A prime example is its collaboration with Northrop Grumman, focusing on advanced Integrated Air and Missile Defense (IAMD) systems, a critical area for defense modernization. This partnership is designed to leverage the strengths of both companies to deliver cutting-edge solutions in a highly competitive global market.

The acquisition of Philly Shipyard in the United States represents a significant move to expand Hanwha Systems' footprint in the North American maritime sector. This acquisition provides Hanwha with direct access to the U.S. shipbuilding, maintenance, repair, and overhaul (MRO) market, opening up substantial growth opportunities. For instance, Philly Shipyard's order backlog, which stood at approximately $1.4 billion as of late 2023, underscores the immediate revenue potential and market access gained.

- Strategic Alliance: Partnership with Northrop Grumman for next-generation Integrated Air and Missile Defense (IAMD) systems.

- Market Expansion: Acquisition of Philly Shipyard to penetrate the U.S. shipbuilding and MRO market.

- Revenue Potential: Philly Shipyard's order backlog exceeding $1.4 billion (as of late 2023) highlights immediate market access and revenue streams.

Innovation in ICT and Digital Transformation Solutions

Hanwha Systems' ICT division is a powerhouse in driving digital transformation, offering advanced solutions like smart factory implementations, cloud-based data analytics, and a broad spectrum of enterprise IT services. This leadership is underscored by their significant investments and expansion into emerging technologies such as artificial intelligence, blockchain, and the metaverse, positioning them at the forefront of industrial digital innovation.

Their smart factory solutions are particularly noteworthy, integrating AI to significantly boost operational efficiency and enhance workplace safety. For instance, in 2024, Hanwha Systems reported that its AI-driven smart factory platforms achieved an average productivity increase of 15% for its clients, alongside a 10% reduction in operational errors.

- Leadership in Digital Transformation: Hanwha Systems is a recognized leader in providing digital transformation solutions, including smart factory, cloud analytics, and enterprise IT services.

- Investment in Future Technologies: The company is actively investing in and diversifying into AI, blockchain, and metaverse technologies to drive industrial innovation.

- AI-Powered Smart Factories: Their smart factory solutions utilize AI to improve efficiency and safety, with reported productivity gains of 15% in 2024.

Hanwha Systems boasts a strong dual business model, encompassing both defense electronics and ICT, which provides revenue stability and diversifies risk. The company demonstrated impressive financial performance in 2024, setting new records for operating profit and sales, largely driven by its defense segment. This financial strength is further solidified by a substantial order backlog, with a record 930 billion won in defense contracts secured in Q4 2024 alone, indicating robust demand and future growth potential.

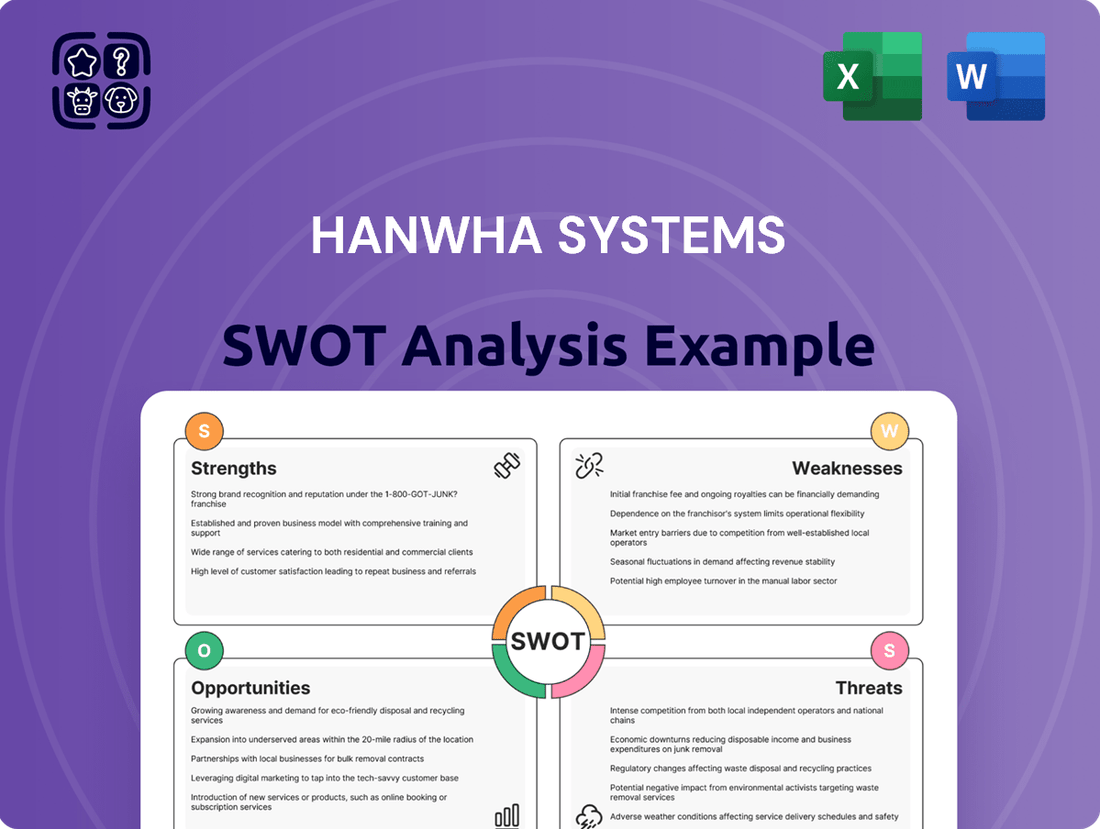

What is included in the product

Delivers a strategic overview of Hanwha Systems’s internal and external business factors, highlighting its technological strengths and market opportunities while acknowledging potential weaknesses and competitive threats.

Offers a clear, actionable framework to leverage Hanwha Systems' strengths and address weaknesses, thereby mitigating potential market disruptions.

Weaknesses

A significant vulnerability for Hanwha Systems lies in its considerable dependence on government defense contracts. This reliance means that a large chunk of the company's income is directly linked to national defense budgets and military spending, making it susceptible to shifts in government priorities or economic downturns that might affect these allocations.

For instance, while specific figures for 2024-2025 are still solidifying, historically, defense spending constitutes a major revenue stream. Any reduction in defense budgets or a change in procurement strategies by key governments could directly impact Hanwha Systems' financial performance and growth trajectory, creating a degree of revenue unpredictability.

The inherent nature of large-scale military projects also introduces uncertainty. These projects can face delays, scope changes, or even cancellations due to evolving geopolitical landscapes or technological advancements, all of which can disrupt long-term revenue stability and strategic planning for Hanwha Systems.

Hanwha Systems operates in highly competitive global defense and IT markets, facing formidable rivals. In the defense sector, established giants like Lockheed Martin and BAE Systems, with their vast R&D budgets and existing government contracts, present a significant challenge. Similarly, the IT services landscape is dominated by companies such as Accenture and IBM, boasting extensive global reach and deeply entrenched client bases.

Hanwha Systems' strategic acquisitions, like the one involving Philly Shipyard, while promising for future growth, introduce significant integration challenges. Merging distinct corporate cultures, operational systems, and technological infrastructures is a demanding process that can consume considerable resources.

These integration efforts can lead to unforeseen short-term inefficiencies and unexpected costs, potentially dampening overall performance in the immediate aftermath of the acquisition. For instance, the complex integration of Philly Shipyard's legacy systems with Hanwha's modern platforms could require substantial investment in IT upgrades and employee retraining, impacting profitability in the 2024-2025 fiscal periods.

Vulnerability to Cybersecurity Threats

Hanwha Systems' significant role in defense electronics and critical information infrastructure makes it a prime target for advanced cyber threats. A successful breach could lead to the compromise of highly sensitive military data, severe disruptions to essential operations, and substantial damage to its reputation and customer confidence. The company must maintain substantial and ongoing investment in robust cybersecurity protocols to effectively counter these evolving risks.

For instance, the global cybersecurity market was projected to reach over $300 billion in 2024, highlighting the increasing sophistication and prevalence of threats. Companies like Hanwha Systems, operating in high-stakes sectors, face particular scrutiny. A hypothetical breach, even if minor, could result in significant financial and operational repercussions, potentially impacting billions in defense contracts.

- High-Value Target: Hanwha Systems' defense and critical infrastructure solutions make it a lucrative target for state-sponsored and criminal hacking groups.

- Data Sensitivity: Compromised military data could have severe national security implications, impacting allied intelligence and operational security.

- Operational Disruption: Attacks on information infrastructure could cripple essential services, leading to widespread societal impact and economic loss.

- Reputational Damage: A significant cybersecurity incident could erode trust among government clients and partners, affecting future business opportunities.

Exposure to Equity-Method Losses from Affiliates

Hanwha Systems' financial results can be affected by its investments in other Hanwha Group companies, as these are accounted for using the equity method. This means that losses incurred by these affiliates can directly reduce Hanwha Systems' reported net income, even if its own core operations are performing well.

For example, the company has experienced equity-method losses from its stakes in Hanwha Ocean and Hanwha Phasor. These investments, while potentially strategic, have contributed to a drag on Hanwha Systems' overall profitability. In the first quarter of 2024, Hanwha Systems reported a net loss of 71.5 billion KRW, partly influenced by these equity method adjustments.

- Equity Method Impact: Losses from affiliates like Hanwha Ocean and Hanwha Phasor reduce Hanwha Systems' net profit.

- Q1 2024 Performance: The company recorded a net loss of 71.5 billion KRW in Q1 2024, with equity-method accounting playing a role.

- Operational vs. Financial: This weakness highlights a potential disconnect between strong operational performance in core areas and overall reported financial results.

Hanwha Systems faces intense competition from established global players in both defense and IT sectors. Companies like Lockheed Martin and BAE Systems in defense, and Accenture and IBM in IT services, possess significant advantages in R&D, market share, and client relationships, posing a substantial challenge to Hanwha Systems' growth and market penetration efforts.

The integration of acquired entities, such as Philly Shipyard, presents considerable operational and financial hurdles. Merging diverse corporate cultures and systems requires significant investment and can lead to short-term inefficiencies, potentially impacting profitability. For instance, the 2024-2025 integration costs related to legacy system upgrades and retraining could affect financial performance.

Hanwha Systems' significant reliance on government defense contracts makes it vulnerable to fluctuations in national defense budgets and procurement policies. Changes in government spending priorities or economic downturns can directly impact revenue streams, creating financial unpredictability and hindering long-term strategic planning.

The company's exposure to cybersecurity threats is a critical weakness, given its role in defense and critical infrastructure. A successful cyberattack could compromise sensitive military data, disrupt operations, and severely damage its reputation, impacting billions in potential contracts. The global cybersecurity market's rapid growth, projected to exceed $300 billion in 2024, underscores the escalating nature of these threats.

Hanwha Systems' financial health is also influenced by its equity investments in other Hanwha Group companies. Losses from affiliates, such as Hanwha Ocean and Hanwha Phasor, directly reduce its net income. This was evident in Q1 2024, where a net loss of 71.5 billion KRW was partly attributed to these equity-method adjustments.

Full Version Awaits

Hanwha Systems SWOT Analysis

This is a real excerpt from the complete Hanwha Systems SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a comprehensive overview of their Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

Rising geopolitical tensions and a global emphasis on military modernization create a strong tailwind for Hanwha Systems' defense sector. Nations worldwide are actively seeking to enhance their air defense capabilities and acquire cutting-edge military hardware, directly boosting demand for Hanwha's specialized defense electronics and C4I systems.

This upward trend in defense expenditure is projected to persist, opening up substantial export avenues for the company. For instance, in 2023, global military spending reached an estimated $2.44 trillion, a 9% increase from 2022, marking the ninth consecutive year of growth according to the Stockholm International Peace Research Institute (SIPRI). This environment is ripe for companies like Hanwha Systems to capitalize on increased procurement cycles and upgrade programs across various international markets.

Hanwha Systems is strategically poised to grow its presence in key defense sectors across the United States, Europe, and the Middle East. The company's successful track record, including supplying radar systems to Saudi Arabia and fire control systems to Poland, provides a strong foundation for further international expansion.

These established relationships and proven product performance are expected to facilitate deeper market penetration and new contract acquisition in these lucrative regions. By leveraging these successes, Hanwha Systems aims to solidify its position as a global defense solutions provider.

Hanwha Systems is strategically investing in emerging technologies like Urban Air Mobility (UAM) and Synthetic Aperture Radar (SAR) satellites. This forward-looking approach positions the company to capitalize on rapidly expanding markets beyond traditional defense sectors.

The development of UAM and SAR satellites opens up significant new revenue streams, with applications ranging from environmental monitoring to disaster management. Hanwha Systems' commitment to these advanced fields underscores its ambition for technological leadership and diversified growth in the coming years.

Accelerated Digital Transformation in Industrial and Commercial Sectors

The accelerating digital transformation across industrial and commercial sectors presents a significant opportunity for Hanwha Systems. The global push for smart factory solutions and enhanced enterprise IT services creates a substantial market for their ICT division. For instance, the global industrial IoT market was valued at approximately USD 21.4 billion in 2023 and is projected to reach USD 127.5 billion by 2030, showcasing robust growth. Hanwha Systems' proficiency in cloud data analytics, AI, and integrated security directly addresses the growing need for intelligent automation.

Hanwha Systems is well-positioned to leverage this trend due to its established expertise in:

- Cloud-based data analysis and AI integration for optimizing industrial processes.

- Developing and implementing secure, end-to-end enterprise IT solutions.

- Providing smart factory technologies that enhance efficiency and productivity.

- Offering integrated security platforms crucial for connected industrial environments.

Expansion into the Maintenance, Repair, and Overhaul (MRO) Market

Hanwha Systems is strategically expanding into the Maintenance, Repair, and Overhaul (MRO) market, a sector known for its consistent revenue streams. This move is significantly bolstered by their acquisition of Philly Shipyard, a key player in the U.S. shipbuilding industry.

Securing MRO contracts for naval vessels, especially within the lucrative U.S. defense market, further solidifies this expansion. This diversification allows Hanwha Systems to tap into long-term revenue opportunities that extend well beyond the initial sale of equipment, creating a more stable and predictable income base.

The MRO market offers substantial growth potential, with global defense MRO spending projected to reach significant figures. For instance, the U.S. defense MRO market alone represents a substantial portion of this global expenditure, making it a prime target for Hanwha Systems' strategic initiatives.

- Strategic Acquisitions: Philly Shipyard acquisition positions Hanwha Systems for significant growth in the U.S. MRO sector.

- Naval MRO Contracts: Securing contracts for naval vessel maintenance provides a steady, long-term revenue stream.

- Market Profitability: The MRO sector is highly profitable, offering consistent income beyond initial product sales.

- U.S. Defense Market Focus: Targeting the U.S. defense MRO market capitalizes on a large and stable customer base.

Hanwha Systems' strategic investments in emerging technologies like Urban Air Mobility (UAM) and Synthetic Aperture Radar (SAR) satellites are opening up substantial new markets beyond traditional defense. The global UAM market is expected to grow significantly, with projections indicating a value of over $10 billion by 2030. Similarly, the demand for satellite-based Earth observation, including SAR data, is rapidly increasing for applications in environmental monitoring, disaster management, and defense intelligence.

The company is also capitalizing on the global digital transformation trend, particularly within the industrial sector. The increasing adoption of smart factory solutions and the expansion of the Industrial Internet of Things (IIoT) create a robust demand for Hanwha Systems' ICT capabilities. The global IIoT market, valued at an estimated $21.4 billion in 2023, is projected to reach $127.5 billion by 2030, offering significant growth avenues for their cloud data analytics, AI, and integrated security services.

Furthermore, Hanwha Systems' expansion into the Maintenance, Repair, and Overhaul (MRO) sector, notably through its acquisition of Philly Shipyard, provides access to consistent and profitable revenue streams. The U.S. defense MRO market alone is a substantial segment of global defense spending, offering Hanwha Systems a strong foothold for long-term contracts and stable income generation. This diversification strategy positions the company to benefit from recurring service revenues, complementing its product-based sales.

Threats

Global political instability, evidenced by ongoing regional conflicts in 2024, directly impacts defense spending and contract continuity. Hanwha Systems, like other defense contractors, faces the threat of unpredictable shifts in national defense policies or alliances, potentially leading to contract cancellations or budget reductions. For instance, the evolving security landscape in the Indo-Pacific region could alter procurement priorities, affecting Hanwha's established defense programs.

The defense electronics and IT industries are in a constant state of flux, with new technologies emerging at a breakneck pace. This means that what is cutting-edge today can be outdated tomorrow, creating a significant challenge for companies like Hanwha Systems.

To stay competitive, Hanwha Systems needs to pour substantial resources into research and development. This commitment to innovation is crucial for developing next-generation products, but it also comes with the inherent risk that these investments might not translate into profitable commercial successes.

In 2023, Hanwha Systems reported R&D expenses of approximately 340 billion KRW (roughly $250 million USD), highlighting the significant financial commitment required to navigate this threat.

Global supply chain vulnerabilities remain a significant concern for Hanwha Systems. Shortages of critical components, such as advanced semiconductors and specialized raw materials, exacerbated by geopolitical tensions and the lingering effects of global health events, directly threaten production capabilities. For instance, the ongoing semiconductor shortage, which saw lead times for certain chips extend to over a year in late 2023 and early 2024, could severely impact Hanwha Systems' ability to deliver its defense and aerospace systems on schedule.

These disruptions can lead to increased manufacturing costs due to expedited shipping or the need to source from alternative, potentially more expensive suppliers. Furthermore, delays in project completion could result in penalties and damage Hanwha Systems' reputation for reliability, particularly within the defense sector where timely delivery is paramount. The company's reliance on a complex, global network for its advanced technology products makes it particularly susceptible to these external shocks.

Intensifying Cybersecurity and Data Breaches

As a key player in defense and IT, Hanwha Systems is a prime target for sophisticated cyber threats. The increasing frequency and complexity of these attacks pose a significant risk to the company's operations and sensitive data.

A successful cyberattack could result in the compromise of critical defense systems, theft of valuable intellectual property, and disruption of essential IT services. This would not only lead to substantial financial losses but also severely damage Hanwha Systems' reputation and trustworthiness in the market.

- Global cybersecurity spending is projected to reach $300 billion by the end of 2024, highlighting the escalating threat landscape.

- The average cost of a data breach in 2024 is estimated to be around $4.73 million, a figure that could significantly impact Hanwha Systems.

- In 2023, ransomware attacks alone cost organizations an estimated $1.7 trillion globally.

Regulatory Hurdles and International Trade Barriers

Hanwha Systems faces significant regulatory hurdles and international trade barriers as it pursues global expansion. Navigating the complex and varied legal frameworks across different nations, particularly concerning defense technology, can be a major challenge. For instance, the US International Traffic in Arms Regulations (ITAR) and similar controls in other countries can restrict technology transfers, impacting Hanwha's ability to collaborate or export critical components. These barriers can directly impede market access and inflate operational expenses due to compliance requirements and potential tariffs, as seen in ongoing trade disputes affecting global supply chains in the aerospace and defense sectors.

These challenges can manifest in several ways:

- Export Control Compliance: Adhering to stringent export control regulations, such as those from the Wassenaar Arrangement, is critical for Hanwha Systems when dealing with sensitive defense technologies.

- Tariffs and Trade Restrictions: Imposition of tariffs or outright bans on specific technologies can directly impact the cost-competitiveness and market entry of Hanwha's products in key international markets.

- Localization Requirements: Some countries may mandate local production or technology sharing as a condition for market access, posing operational and intellectual property risks.

- Geopolitical Instability: Shifting geopolitical alliances and trade policies can create sudden and unpredictable barriers, affecting long-term strategic planning and investment.

The rapid evolution of technology presents a constant threat of obsolescence, necessitating continuous, high-cost R&D investment with no guarantee of commercial success. For example, Hanwha Systems' 2023 R&D expenditure was approximately 340 billion KRW, underscoring this challenge. Furthermore, global supply chain disruptions, such as the prolonged semiconductor shortage extending lead times into 2024, directly impact production schedules and increase costs.

Cybersecurity threats are escalating, with global spending projected to reach $300 billion by the end of 2024. A data breach could cost millions, as seen in the 2024 average cost of $4.73 million, and ransomware attacks alone cost $1.7 trillion globally in 2023, posing significant financial and reputational risks to Hanwha Systems.

Navigating complex international regulations, like ITAR, and potential trade barriers creates significant hurdles for market access and collaboration. These restrictions, coupled with geopolitical instability, can disrupt long-term strategies and increase operational expenses due to compliance and tariffs.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and insights from industry experts to provide a robust and accurate strategic overview.