Hanwha Systems Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Systems Bundle

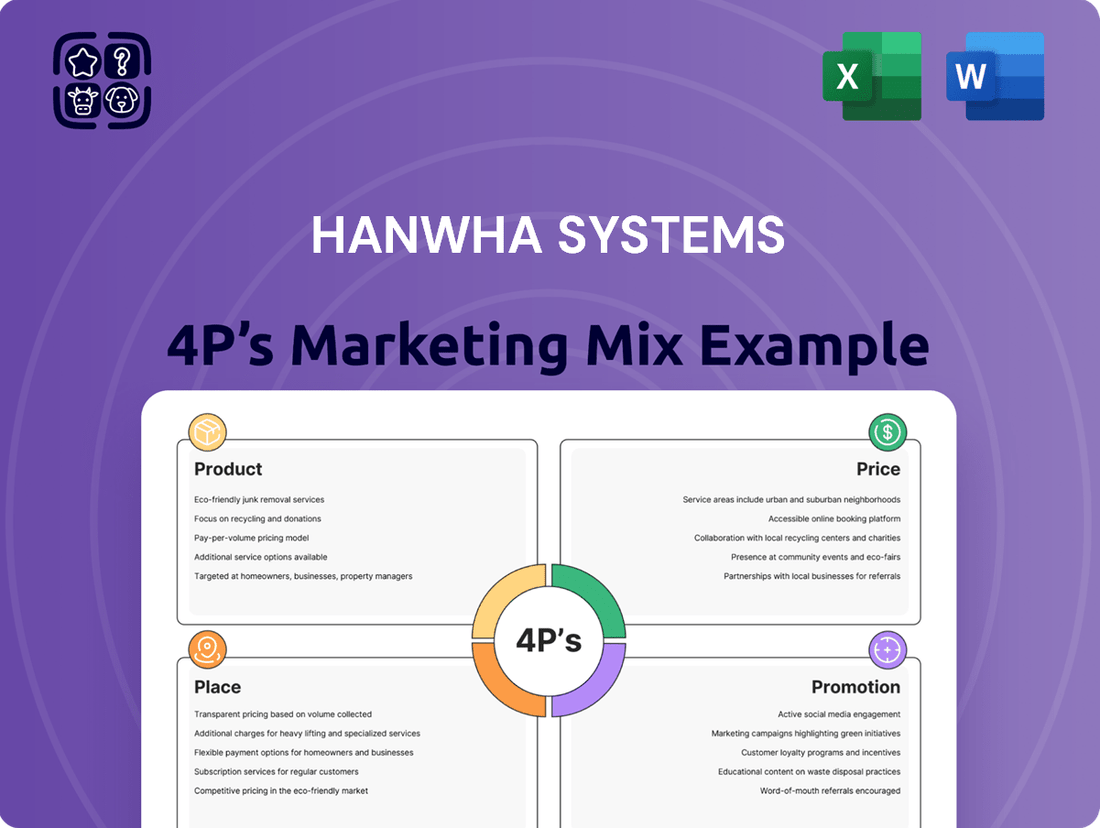

Discover how Hanwha Systems leverages its innovative product portfolio, strategic pricing, expansive distribution, and impactful promotional campaigns to dominate the market. This analysis delves deep into each element of their 4Ps strategy, offering actionable insights.

Go beyond the surface-level understanding; gain access to an in-depth, ready-made Marketing Mix Analysis covering Hanwha Systems' Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking strategic clarity.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning for Hanwha Systems.

Product

Hanwha Systems' defense electronics, covering advanced radar systems like their Multi-Function Radar (MFR) and AESA radars, represent a key product offering. These technologies are vital for modern defense capabilities, enhancing missile defense and fighter jet performance. The company's focus on surveillance, reconnaissance, and C4I solutions further solidifies its position in the global defense market.

The strategic importance of these defense electronics is underscored by Hanwha Systems' significant investment in research and development. For instance, in 2023, the company reported substantial R&D expenditures aimed at advancing its radar and C4I technologies, anticipating continued demand from defense forces seeking to upgrade their operational effectiveness and situational awareness.

Hanwha Systems' Information Infrastructure and ICT Services extend beyond its defense roots, offering robust digital transformation solutions. They focus on areas like smart factory implementations and comprehensive enterprise IT services tailored for industrial and commercial clients. This segment actively utilizes cutting-edge technologies including AI, big data analytics, blockchain, and cloud computing to foster innovation across diverse business landscapes.

Hanwha Systems is investing heavily in future mobility, notably through its development of Urban Air Mobility (UAM) solutions. This forward-thinking approach positions them at the forefront of next-generation transportation, aiming to revolutionize urban travel. Their commitment extends to advanced space technologies, including Low-Earth Orbit (LEO) satellite communication antennas, a critical component for global connectivity.

The company's involvement in small Synthetic Aperture Radar (SAR) satellites underscores their dedication to providing essential data for earth observation and environmental monitoring. This strategic focus on space technology aligns with global trends in data-driven insights and sustainable development, showcasing Hanwha Systems' commitment to future-ready innovations.

Integrated Combat Management Systems and Unmanned Platforms

Hanwha Systems’ Product strategy for Integrated Combat Management Systems (CMS) and Unmanned Platforms focuses on leveraging its established dominance in naval CMS, holding a commanding market share within the Korean Navy. This strong foundation is being expanded to encompass cutting-edge unmanned capabilities. The company is actively developing and demonstrating new combat unmanned surface vessels (USV) and other unmanned underwater/surface vehicles, integrating advanced technologies to enhance maritime operations and significantly reduce human risk in hazardous environments.

This product strategy is supported by Hanwha Systems' significant investment in research and development. For instance, in 2023, the company announced plans to invest heavily in autonomous systems and AI, aiming to solidify its position in the global defense market. The integration of their intelligent CMS with these new unmanned platforms is a key differentiator, offering a comprehensive solution for modern naval warfare and surveillance. This synergy allows for more efficient and safer execution of complex missions, from reconnaissance to direct engagement.

- Market Leadership: Dominant market share in Korean Navy's CMS solutions.

- Innovation Focus: Development and showcasing of advanced combat USVs and other unmanned platforms.

- Technology Integration: Seamless integration of intelligent CMS with unmanned systems for enhanced capabilities.

- Risk Mitigation: Emphasis on minimizing human risk in maritime operations through automation.

Maintenance, Repair, and Overhaul (MRO) Solutions

Hanwha Systems' Maintenance, Repair, and Overhaul (MRO) solutions are a cornerstone of their product offering, focusing on ensuring the maximum operational effectiveness of defense systems. Their proprietary TOMMS platform, leveraging AI for predictive maintenance and fault analysis, significantly enhances combat readiness. This commitment to advanced MRO not only supports domestic defense capabilities but also positions Hanwha Systems as a key international partner for lifecycle management of critical assets.

The MRO segment of Hanwha Systems is crucial for maintaining the long-term value and performance of their complex weapon systems. By integrating AI-driven predictive maintenance through TOMMS, they aim to preemptively identify and address potential issues, thereby minimizing downtime and operational disruptions. This proactive approach is vital in the defense sector, where system availability directly impacts national security. For instance, in 2023, the global defense MRO market was valued at over $100 billion, with a projected compound annual growth rate of approximately 4% through 2030, highlighting the significant demand for such advanced services.

- AI-Powered Predictive Maintenance: TOMMS utilizes artificial intelligence to forecast potential equipment failures, enabling proactive repairs and reducing unscheduled downtime.

- Extended Asset Lifecycles: Comprehensive MRO services are designed to prolong the operational life of sophisticated weapon systems, offering greater long-term value.

- Enhanced Combat Readiness: By ensuring systems are consistently maintained and operational, Hanwha Systems directly contributes to the heightened combat readiness of its clients.

- Global Service Reach: Hanwha Systems provides MRO solutions to both domestic and international defense forces, demonstrating its capability to support diverse operational environments.

Hanwha Systems' product portfolio spans advanced defense electronics, including sophisticated radar systems and surveillance solutions, alongside information and communication technology (ICT) services that drive digital transformation for businesses. The company is also heavily invested in future mobility, developing Urban Air Mobility (UAM) and crucial space technologies like LEO satellite communication antennas and small SAR satellites.

| Product Category | Key Offerings | Strategic Focus/Recent Developments |

|---|---|---|

| Defense Electronics | Multi-Function Radar (MFR), AESA Radars, C4I Solutions | R&D investment in 2023 to enhance radar and C4I tech; focus on missile defense and fighter jet upgrades. |

| Information Infrastructure & ICT Services | Smart Factory, Enterprise IT Services, AI, Big Data, Blockchain, Cloud | Digital transformation solutions for industrial and commercial clients, leveraging cutting-edge technologies. |

| Future Mobility & Space | Urban Air Mobility (UAM), LEO Satellite Communication Antennas, Small SAR Satellites | Revolutionizing urban travel with UAM; enabling global connectivity and earth observation data. |

What is included in the product

This analysis provides a professional deep dive into Hanwha Systems' Product, Price, Place, and Promotion strategies, offering a comprehensive understanding of their marketing positioning and competitive context.

Ideal for marketers and consultants, this document uses actual brand practices to deliver actionable insights for stakeholder reports and strategic planning.

Hanwha Systems' 4P's Marketing Mix Analysis acts as a pain point reliever by providing a clear, actionable framework to address market challenges and optimize strategic execution.

This analysis simplifies complex marketing decisions, enabling stakeholders to quickly identify and resolve issues across Product, Price, Place, and Promotion.

Place

Hanwha Systems primarily engages in direct sales of its defense products, securing long-term contracts with governments and military organizations worldwide. This strategy is standard in the defense sector, allowing for the delivery of customized and secure solutions that meet specific national security requirements.

Hanwha Systems is actively broadening its international presence by forging strategic alliances and setting up local manufacturing sites in crucial markets such as Europe and Australia. This global expansion is designed to swiftly address immediate defense requirements.

By establishing production hubs in countries like Romania and Poland, Hanwha Systems aims not only to fulfill current defense demands but also to build long-term supply chain resilience. This approach is central to their global partnership strategy.

These localized production efforts are also intended to boost the modernization of defense sectors within these partner nations. Hanwha Systems facilitates this through technology sharing and by promoting domestic manufacturing capabilities, a key element in their 2024-2025 strategic outlook.

Hanwha Systems actively engages in key international defense exhibitions, such as the World Defense Show (WDS) and the Naval Defense Industry Exhibition (MADEX). These events are crucial for demonstrating their cutting-edge defense technologies, including advanced combat systems and unmanned platforms. For instance, at WDS 2024, Hanwha showcased its capabilities in areas like integrated command and control systems, which are vital for modern warfare scenarios.

Strategic Acquisitions and Joint Ventures

Hanwha Systems actively pursues strategic acquisitions and joint ventures, often collaborating with other Hanwha Group affiliates. A prime example is the acquisition of Philly Shipyard in the U.S., which significantly bolsters its capabilities in shipbuilding and maintenance, repair, and overhaul (MRO) services. These moves are designed to open up new markets and solidify its position within key defense industry segments.

These strategic alliances are crucial for Hanwha Systems' global expansion and technological advancement. For instance, its involvement in various international defense projects through partnerships allows it to leverage diverse expertise and share development costs. This approach is particularly evident in areas requiring specialized shipbuilding technologies and advanced defense system integration.

- Acquisition of Philly Shipyard: Strengthens Hanwha Systems' presence in the U.S. defense shipbuilding market, a key strategic region.

- Joint Ventures: Facilitate access to new technologies and international markets, enhancing its defense sector capabilities.

- MRO Expansion: Strategic partnerships are vital for growing its Maintenance, Repair, and Overhaul services, ensuring long-term revenue streams.

IT Service Delivery through Enterprise Channels

Hanwha Systems utilizes direct engagement through enterprise channels for its ICT and IT services, focusing on industrial and commercial clients. This approach involves a consultative sales process to deliver tailored solutions, such as digital transformation and smart factory initiatives. The company aims to build strong relationships by understanding and addressing unique business challenges.

This direct channel allows Hanwha Systems to effectively communicate the value of its advanced IT solutions. For instance, in 2024, the company has emphasized its role in driving efficiency for manufacturing clients through integrated smart factory platforms. This strategy is crucial for securing large-scale, complex projects within the enterprise sector.

Key aspects of their enterprise channel strategy include:

- Direct Sales Force: Employing a specialized team for consultative selling to enterprise clients.

- Solution Customization: Adapting digital transformation and smart factory offerings to meet specific industry needs.

- Partnership Development: Collaborating with key industry players to expand service reach and capabilities.

- Post-Implementation Support: Ensuring ongoing client success through dedicated support and service level agreements.

Hanwha Systems leverages a multi-faceted approach to its 'Place' strategy, focusing on direct engagement for defense solutions and strategic international expansion. For its ICT and IT services, the company relies on direct enterprise channels, emphasizing consultative sales to deliver customized digital transformation and smart factory solutions. This direct approach allows for a deep understanding of client needs, fostering strong, long-term relationships and securing significant projects.

Full Version Awaits

Hanwha Systems 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Hanwha Systems 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Hanwha Systems actively cultivates strategic partnerships, notably with global defense giants like Northrop Grumman. This collaboration focuses on co-developing advanced, next-generation defense systems, thereby expanding market access and bolstering technological credibility.

Hanwha Systems leverages participation in global defense exhibitions like WDS 2024 and MADEX 2025 as a key promotional strategy. These events are vital for showcasing their advanced defense technologies and integrated solutions directly to a global audience of potential clients and industry partners.

At these forums, Hanwha Systems engages directly with stakeholders, fostering relationships and demonstrating their capabilities. For instance, at MADEX 2025, the company will highlight its naval combat systems, aiming to secure new international contracts and strengthen its market position.

Hanwha Systems actively engages with the media through targeted press releases and outreach. This strategy highlights key achievements like securing major defense contracts, which contributed to significant financial results in early 2024, or showcasing groundbreaking technological innovations.

This proactive communication ensures that both the defense industry and financial markets are kept informed about Hanwha Systems' progress and strategic direction. For instance, their robust performance in the defense sector, a key driver for their 2023 earnings, was widely reported, bolstering investor confidence.

Sustainability Reporting and ESG Initiatives

Hanwha Systems actively engages in sustainability reporting, with its latest disclosure, the Hanwha Systems Sustainability Report 2025, detailing its commitment to environmental, social, and governance (ESG) principles. This transparency enhances brand reputation and attracts investors and consumers prioritizing ethical business operations. The company's focus on ESG initiatives, including reducing carbon emissions by 15% in 2024 compared to 2023 levels, resonates with a growing market segment.

The company's proactive approach to ESG is a key component of its marketing strategy, fostering trust and loyalty among stakeholders. This commitment is further evidenced by their investment of ₩50 billion in renewable energy projects in 2024, aiming to achieve carbon neutrality by 2040.

- Annual Sustainability Reports: Publication of the Hanwha Systems Sustainability Report 2025 ensures transparent disclosure of ESG performance.

- Positive Brand Image: ESG initiatives contribute to a favorable brand perception, attracting environmentally and socially conscious stakeholders.

- Stakeholder Appeal: Hanwha Systems' commitment to sustainability aligns with the values of a growing number of investors and consumers.

- Tangible Progress: A 15% reduction in carbon emissions in 2024 and a ₩50 billion investment in renewables underscore their dedication.

Thought Leadership and Industry Insights

Hanwha Systems actively cultivates thought leadership, with key executives frequently participating in interviews and industry discussions. For instance, the CEO and President of Hanwha Global Defense regularly share insights on critical defense trends and technological advancements. This consistent engagement solidifies Hanwha Systems' reputation as a knowledgeable and forward-thinking entity within the global defense sector.

This strategic emphasis on sharing expertise directly contributes to their brand perception and market influence. By positioning themselves as authorities, they can shape industry dialogue and attract strategic partnerships. Their participation in high-profile events and media outlets in 2024 and early 2025 underscores this commitment, with Hanwha Systems reporting significant engagement metrics on their published thought leadership content.

- Industry Recognition Hanwha Systems' executives are frequently cited in major defense publications, reflecting their status as industry experts.

- Knowledge Sharing Platforms The company leverages webinars, white papers, and conference keynotes to disseminate its expertise on topics like AI in defense and future combat systems.

- Market Influence Their insights help shape perceptions of emerging defense technologies and strategies, impacting investment and development decisions across the sector.

- Brand Authority Consistent high-level engagement reinforces Hanwha Systems as a trusted source of information and innovation in the defense industry.

Hanwha Systems strategically utilizes global defense exhibitions like WDS 2024 and MADEX 2025 to showcase its advanced technologies and foster direct engagement with international clients and partners. This proactive approach aims to secure new contracts and solidify its market position by highlighting capabilities in areas such as naval combat systems.

The company also emphasizes thought leadership through executive interviews and industry discussions, sharing insights on defense trends and technological advancements to enhance its brand authority and influence market perceptions. This consistent engagement, supported by significant media outreach and reporting on contract wins and innovations, reinforces Hanwha Systems' reputation as a forward-thinking industry leader.

Furthermore, Hanwha Systems promotes its commitment to ESG principles through its 2025 Sustainability Report, detailing initiatives like a 15% carbon emission reduction in 2024 and a ₩50 billion investment in renewables. This transparency builds trust and appeals to stakeholders prioritizing ethical business practices.

Strategic partnerships, such as the one with Northrop Grumman for next-generation defense systems, are also a core promotional element, expanding market access and technological credibility.

| Promotional Activity | Key Event/Focus | Objective | 2024/2025 Impact |

|---|---|---|---|

| Exhibitions | WDS 2024, MADEX 2025 | Showcase technology, secure contracts | Increased visibility, potential new partnerships |

| Thought Leadership | Executive interviews, industry forums | Build brand authority, influence market | Enhanced reputation, positive media coverage |

| ESG Communication | Sustainability Report 2025 | Attract conscious stakeholders, build trust | Improved brand image, investor appeal |

| Partnerships | Northrop Grumman collaboration | Expand market access, enhance technology | Strengthened competitive edge |

Price

Hanwha Systems’ pricing strategy for its defense electronics and large-scale IT solutions is heavily reliant on contract-based and project-specific negotiations. This approach is necessitated by the inherent complexity and bespoke nature of the projects undertaken, often involving significant government and enterprise clients.

These long-term contracts are meticulously crafted, with pricing determined by factors such as project scope, the technological sophistication involved, and the strategic importance of the solution. For instance, in 2024, Hanwha Systems secured a significant contract for advanced radar systems, with the pricing reflecting years of research and development and the system's critical role in national defense.

Hanwha Systems employs value-based pricing for its advanced technologies, reflecting the significant benefits delivered. For instance, their Multi-Function Radars, crucial for national defense, are priced based on superior detection capabilities and reliability, commanding a premium over less sophisticated systems.

Similarly, AI-powered Maintenance, Repair, and Overhaul (MRO) platforms are valued for their ability to drastically reduce operational downtime and costs for aerospace and defense clients. This focus on performance enhancement and critical operational impact justifies higher price points, aligning with the substantial value proposition offered.

Hanwha Systems navigates a landscape shaped by government procurement, where competitive bidding significantly impacts pricing strategies. This means balancing the need for profitable margins with the necessity of presenting compelling, cost-effective proposals to win vital contracts. For instance, in the defense sector, winning bids often hinges on demonstrating superior technological capabilities alongside a competitive price point, a delicate act Hanwha Systems must master.

Long-Term Service and Maintenance Contracts

Hanwha Systems' pricing for long-term service and maintenance contracts, particularly for MRO (Maintenance, Repair, and Operations) and ongoing IT support, often utilizes Performance-Based Logistics (PBL) agreements. This approach ties payment to the system's availability and performance, making Hanwha Systems accountable for the overall operational efficiency and reliability of the deployed solutions.

This PBL model fundamentally reorients the value proposition from upfront acquisition costs to sustained operational effectiveness and long-term cost predictability. For instance, in the defense sector, where such contracts are prevalent, PBL can significantly reduce total ownership costs by ensuring systems are ready for deployment when needed, rather than focusing solely on the initial purchase price.

Key aspects of this pricing strategy include:

- Performance Incentives: Contracts often include incentives for exceeding availability targets and penalties for falling short, directly linking Hanwha Systems' revenue to system uptime.

- Lifecycle Cost Management: Pricing is structured to cover the entire lifecycle of the system, encompassing preventative maintenance, repairs, upgrades, and spare parts management.

- Data-Driven Adjustments: Real-time performance data informs contract adjustments, ensuring pricing remains aligned with actual service delivery and system usage.

- Predictable Budgeting: For clients, PBL offers more predictable budgeting for operational expenses, as maintenance costs are bundled into a service fee tied to performance outcomes.

Global Market Dynamics and Economic Conditions

Hanwha Systems' pricing is sensitive to global defense spending, which saw a significant uptick. For example, global military expenditure reached an estimated $2.44 trillion in 2023, a 6.8% increase in real terms from 2022, marking the ninth consecutive year of growth. This trend, coupled with ongoing geopolitical tensions, allows for greater pricing flexibility on high-value defense and IT solutions.

Economic conditions also play a crucial role. While robust defense budgets can support higher prices, broader economic slowdowns or inflation might necessitate more competitive pricing. The willingness of nations to invest in advanced systems is directly tied to their fiscal health and perceived security needs.

- Global defense spending reached approximately $2.44 trillion in 2023.

- This represents a 6.8% real-term increase from 2022.

- Geopolitical instability often correlates with increased defense budgets.

- Economic health influences a nation's capacity for defense investments.

Hanwha Systems' pricing strategy for its defense and IT solutions is primarily contract-driven, reflecting the bespoke nature of its offerings. Value-based pricing is employed for advanced technologies like Multi-Function Radars, where superior performance justifies a premium. Performance-Based Logistics (PBL) contracts are also utilized, linking payment to system availability and operational efficiency.

| Pricing Strategy | Key Factors | Example/Context |

| Contract-Based Negotiation | Project scope, technological sophistication, strategic importance | 2024 Radar Systems Contract |

| Value-Based Pricing | Performance, reliability, operational benefits | Multi-Function Radars |

| Performance-Based Logistics (PBL) | System availability, operational efficiency, lifecycle costs | MRO and IT Support Contracts |

4P's Marketing Mix Analysis Data Sources

Our Hanwha Systems 4P’s Marketing Mix Analysis leverages a robust blend of primary and secondary data sources. This includes official company disclosures like annual reports and investor presentations, alongside granular data from industry-specific market research reports and competitive intelligence platforms.

We meticulously gather information on Hanwha Systems' product portfolio, pricing strategies, distribution channels, and promotional activities. This is achieved through analysis of their official website, press releases, trade publications, and relevant market data providers.