Hanwha Systems Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Systems Bundle

Hanwha Systems navigates a complex landscape shaped by intense rivalry and the ever-present threat of new entrants, particularly in its advanced technology sectors. Understanding the bargaining power of its buyers and suppliers is crucial for maintaining its competitive edge.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Hanwha Systems’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Hanwha Systems depends heavily on suppliers for specialized components and advanced technologies, especially in its defense electronics and C4I systems sectors. These unique inputs, like advanced radar modules or specialized communication semiconductors, are often sourced from a limited number of providers. This scarcity grants these suppliers considerable bargaining power, as finding viable alternatives can be challenging and costly for Hanwha Systems.

In specialized sectors crucial to Hanwha Systems, such as advanced defense electronics, the supplier landscape can be highly concentrated. A limited pool of highly qualified suppliers means these entities hold significant leverage. This can translate into their ability to set terms, influence pricing, and control delivery timelines, particularly if Hanwha Systems faces substantial costs or technical hurdles in switching to alternative providers. For example, the development of sophisticated radar systems or command, control, communications, computers, and intelligence (C4I) solutions often relies on a small number of global firms with unique technological expertise and manufacturing capacity.

When suppliers possess unique technology or intellectual property, they gain significant leverage over Hanwha Systems. This is clearly demonstrated in Hanwha Systems' collaborations with major defense contractors, such as Northrop Grumman, for advanced integrated air defense systems. These partnerships highlight Hanwha Systems' reliance on specialized, cutting-edge capabilities that these suppliers uniquely offer.

Switching Costs and Integration Complexity

The intricate nature of integrating defense and advanced IT systems significantly elevates switching costs for Hanwha Systems. This complexity demands extensive testing, certification processes, and potential redesigns of existing infrastructure, thereby bolstering the bargaining power of incumbent suppliers. For instance, replacing critical components in advanced avionics or sophisticated maritime systems would likely incur substantial operational disruptions and considerable financial investment, making such transitions a challenging proposition.

These high switching costs are a direct consequence of the deep integration required in Hanwha Systems' specialized product lines. The need for seamless interoperability between hardware and software components, often developed by a single supplier or a tightly integrated consortium, creates a lock-in effect. This means that even minor changes to a supplier's product could necessitate a complete overhaul of Hanwha's systems, a prospect that suppliers leverage to maintain favorable terms.

- High Integration Costs: The complexity of integrating specialized defense and IT systems means switching suppliers can cost millions, impacting Hanwha Systems' operational flexibility.

- Certification Hurdles: New suppliers require rigorous testing and certification for defense applications, a process that can take years and substantial financial resources.

- Operational Disruption: Replacing core system components, such as those in advanced radar or communication systems, could halt production or deployment, leading to significant revenue loss.

- Supplier Lock-in: The proprietary nature of many advanced technological components used by Hanwha Systems creates dependencies, giving suppliers considerable leverage in negotiations.

Backward Integration Potential of Suppliers

The potential for suppliers to integrate backward into Hanwha Systems' markets, particularly for specialized defense components, presents a nuanced threat. While direct backward integration by suppliers of highly specialized defense technology is less common, larger, more diversified technology firms could potentially leverage their capabilities to offer complete defense or IT solutions, thereby entering Hanwha Systems' competitive space.

This downstream expansion by suppliers would significantly bolster their bargaining power. By becoming direct competitors, these suppliers could dictate terms more aggressively, potentially impacting Hanwha Systems' pricing and market share. For instance, a major semiconductor manufacturer supplying critical chips could, in theory, pivot to offering integrated systems, directly challenging Hanwha Systems’ core business.

This looming threat underscores the strategic imperative for Hanwha Systems to cultivate robust supplier relationships. Moving beyond mere transactional exchanges to foster strategic collaborations and partnerships is crucial. This approach can mitigate the risk of suppliers becoming direct competitors and ensure a more stable supply chain, especially for critical technologies. For example, in 2024, Hanwha Systems announced a strategic partnership with a key AI software provider, aiming to co-develop next-generation defense solutions, thereby strengthening their mutual reliance.

- Supplier Integration Risk: Large technology suppliers may possess the capability to move downstream, offering complete defense or IT solutions.

- Increased Bargaining Power: Supplier entry into Hanwha Systems' markets as direct competitors would enhance their leverage.

- Strategic Imperative: Hanwha Systems must prioritize strong supplier relationships and collaborations over simple transactional exchanges.

- Mitigation Strategy: Fostering partnerships, like the 2024 AI software collaboration, helps secure supply chains and align interests.

The bargaining power of suppliers for Hanwha Systems is significant, particularly for specialized components in defense and IT sectors. Limited suppliers with unique technologies, high switching costs for Hanwha Systems, and the potential for supplier downstream integration all contribute to this leverage. For instance, the reliance on advanced radar modules or specialized communication semiconductors from a select few global firms means these suppliers can influence pricing and terms, as seen in Hanwha Systems' 2024 strategic partnership with an AI software provider to secure critical technology.

| Factor | Impact on Hanwha Systems | Supplier Leverage |

|---|---|---|

| Supplier Concentration | Reliance on few specialized providers | High |

| Switching Costs | High due to integration complexity and certification | High |

| Proprietary Technology | Dependence on unique supplier IP | High |

| Potential Downstream Integration | Risk of suppliers becoming competitors | Moderate to High |

What is included in the product

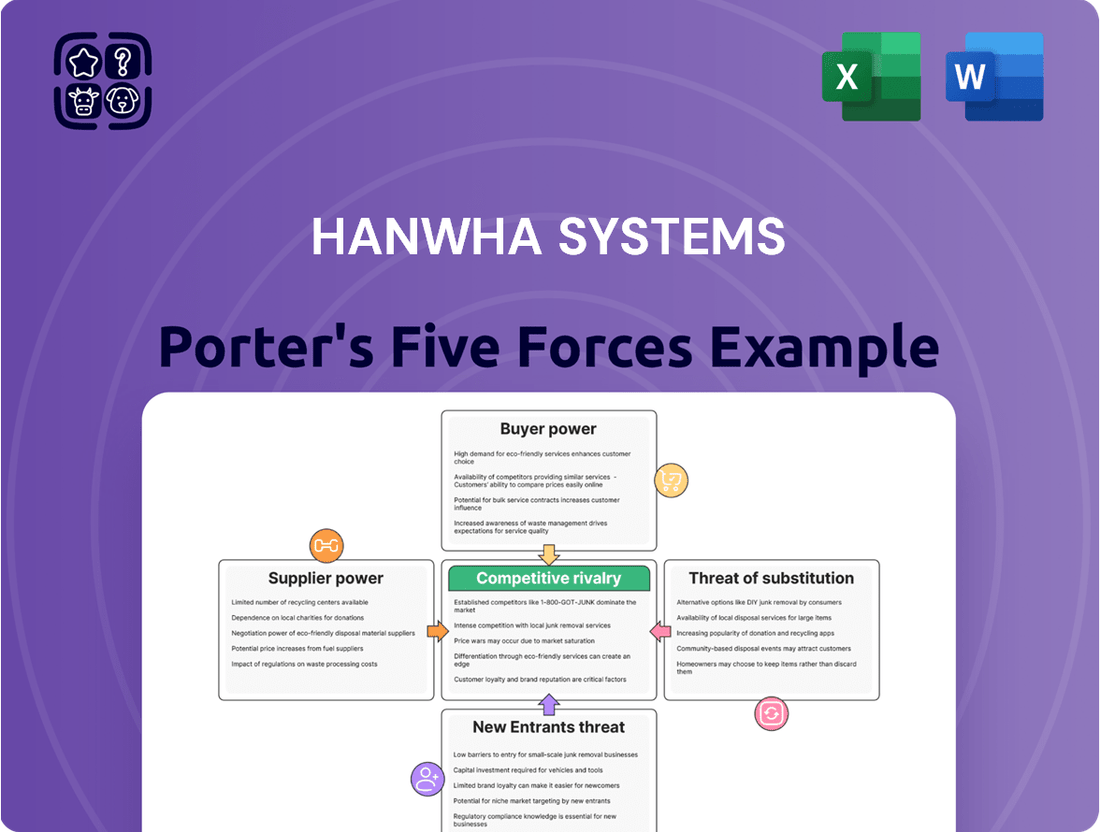

This analysis reveals the competitive intensity for Hanwha Systems by examining supplier power, buyer bargaining, the threat of new entrants and substitutes, and the rivalry among existing players in its markets.

Hanwha Systems' Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces, perfect for quick decision-making and understanding competitive pressures.

Customers Bargaining Power

Hanwha Systems' defense sector faces significant bargaining power from government and military clients, particularly in South Korea. These entities are large, consolidated buyers who often dictate terms through long-term contracts and rigorous procurement processes. For instance, South Korea's defense budget for 2024 was projected at approximately 57.1 trillion KRW (around $43 billion USD), a substantial figure that empowers the government as a major customer with considerable leverage over suppliers like Hanwha Systems.

Hanwha Systems operates in the defense sector, supplying mission-critical electronics and C4I solutions. In this arena, the performance and unwavering reliability of its products are absolutely essential, directly impacting national security. This inherently high-stakes environment means that defense customers, such as governments and military branches, place immense value on proven capabilities and subject potential suppliers to exhaustive evaluation and selection procedures. For instance, in 2023, defense spending globally reached an estimated $2.4 trillion, underscoring the significant budgets and stringent requirements of these buyers.

The critical nature of these systems grants customers considerable leverage. They can often negotiate for comprehensive support packages, long-term maintenance agreements, and extensive product customization to meet specific operational needs. This is because a failure in a defense system can have severe consequences, making reliability and tailored solutions non-negotiable for the buyer.

In the defense industry, the bargaining power of customers is significantly amplified by the concentration of procurement. Government agencies, acting as the primary buyers, often consolidate purchasing power, meaning a few major customers represent a substantial portion of sales for companies like Hanwha Systems.

This concentration grants these government entities considerable leverage in negotiating prices and dictating contract terms. For instance, Hanwha Systems' substantial contracts with South Korea's Defense Acquisition Program Administration (DAPA) for critical defense systems, such as components for the L-SAM-II missile system or advanced frigate programs, highlight this buyer concentration.

In 2024, defense spending remains a key driver, and Hanwha Systems' reliance on DAPA for major projects means DAPA's demands can heavily influence Hanwha's profit margins and operational flexibility.

Customer's Ability to Dictate Specifications and Terms

In defense and large-scale IT projects, Hanwha Systems' customers frequently dictate highly specific requirements. These can include stringent performance metrics, robust security protocols, and complex integration needs, effectively shaping the project's scope and technological direction. This customer power means Hanwha Systems must closely align its research and development efforts with prevailing demands to secure vital contracts.

For instance, in the defense sector, government agencies often set non-negotiable technical specifications for advanced systems. Hanwha Systems' ability to meet these precise demands, such as those for next-generation communication or surveillance platforms, directly influences its success in winning bids. The contractual terms, including delivery schedules and acceptance criteria, are also heavily influenced by these powerful clients.

- Customer Specification Power: Defense and large IT clients can mandate detailed technical and performance requirements.

- Contractual Influence: Customers dictate terms regarding scope, technology standards, and integration.

- R&D Alignment Necessity: Hanwha Systems must tailor its innovation to meet these customer-driven demands.

- Market Impact: This ability of customers to dictate terms significantly shapes Hanwha Systems' project pipeline and strategic focus.

Potential for In-house Development or Alternative Suppliers

While developing complex systems like those Hanwha Systems specializes in internally is difficult, large customers, especially governments, may explore this option or seek multiple suppliers to lessen their reliance on a single provider. This strategy can significantly shift bargaining power towards the buyer.

The South Korean government's initiative to bolster domestic defense capabilities exemplifies this trend. For instance, Hanwha Systems successfully achieved domestic production for certain KF-21 fighter jet components following technology transfer refusals from international partners. This move underscores a strategic objective to minimize dependence on external sources, thereby enhancing the government's leverage as a customer.

- Government Initiatives: South Korea's focus on indigenous defense production aims to reduce reliance on foreign suppliers, potentially increasing buyer power for domestic defense contractors.

- Technological Independence: Hanwha Systems' success in domestically producing KF-21 components, despite prior technology refusal, demonstrates a capability that can be leveraged by buyers seeking greater control.

- Diversification Strategy: Large customers, particularly in the defense sector, may actively seek to diversify their supplier base, creating competitive pressure on existing vendors like Hanwha Systems.

Hanwha Systems' customers, particularly government entities in the defense sector, wield significant bargaining power due to their consolidated purchasing and the critical nature of the products supplied. These buyers can dictate terms, demand extensive customization, and even explore in-house production or multi-sourcing strategies to enhance their leverage.

This customer power is evident in Hanwha Systems' reliance on major contracts with the South Korean government, such as those for the KF-21 fighter jet program. The government's substantial defense budget, projected at approximately 57.1 trillion KRW for 2024, underscores its capacity to influence supplier terms and pricing.

| Customer Type | Leverage Factors | Impact on Hanwha Systems |

|---|---|---|

| Government/Military (Defense) | Consolidated procurement, critical product need, rigorous selection processes | Price negotiation, contract terms, R&D alignment |

| Large IT Project Clients | Specific technical requirements, integration complexity, long-term support needs | Project scope definition, innovation direction, service level agreements |

What You See Is What You Get

Hanwha Systems Porter's Five Forces Analysis

This preview showcases the comprehensive Hanwha Systems Porter's Five Forces Analysis, detailing the competitive landscape of its operating environment. You're looking at the actual document, which meticulously examines the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within its industry. The document you see here is exactly what you’ll be able to download after payment, providing actionable insights for strategic decision-making.

Rivalry Among Competitors

The defense electronics and C4I systems sectors are dominated by a handful of major global and domestic companies. Hanwha Systems competes fiercely with established giants like LIG Nex1, Northrop Grumman, and Lockheed Martin, all of whom possess deep ties with government defense agencies and substantial research and development resources. This concentration naturally fuels intense competition for lucrative government contracts.

A prime example of this rivalry is the ongoing competition between Hanwha Systems and LIG Nex1, particularly in the critical area of missile defense systems. These high-stakes bids often involve billions of dollars and are crucial for national security, making the competition exceptionally fierce and a key indicator of market dynamics.

Competitive rivalry in the defense and technology sectors is intensely fueled by a relentless pursuit of technological innovation and product differentiation. Companies are constantly pushing boundaries to deliver superior performance, seamless integration, and enhanced efficiency in their offerings. This dynamic environment means that staying ahead requires continuous investment in research and development.

Hanwha Systems exemplifies this trend with its strategic emphasis on advanced radar technologies, sophisticated C4I (Command, Control, Communications, Computers, and Intelligence) solutions, and cutting-edge smart factory capabilities. These areas are crucial for differentiating its products and securing a significant market share. For instance, the development and potential upgrades of systems like the L-SAM-II MFR (Long-range Surface-to-Air Missile-II Multi-Function Radar) represent key competitive maneuvers, showcasing the company's commitment to technological advancement.

Hanwha Systems operates in sectors like defense and advanced IT, which demand significant initial investments. These include substantial spending on research and development, state-of-the-art manufacturing plants, and highly skilled employees, all contributing to elevated fixed costs. For instance, the defense industry's R&D budgets alone can run into billions, as seen with major global defense contractors consistently allocating over 10% of their revenue to innovation.

The specialized nature of assets and the sheer scale of these investments create formidable exit barriers. Companies find it incredibly difficult and costly to divest or repurpose specialized equipment and facilities. This situation compels them to remain active and competitive, even when market conditions are unfavorable, to avoid incurring massive losses from shutting down operations. This dynamic directly fuels intense rivalry as firms strive to maintain capacity utilization.

Strategic Partnerships and Mergers & Acquisitions

Companies frequently pursue strategic partnerships and mergers and acquisitions (M&A) to secure competitive advantages, acquire new technologies, or broaden their market presence. Hanwha Systems exemplifies this by forming collaborations with industry giants like Northrop Grumman and BAE Systems, and notably, by acquiring Philly Shipyard. These strategic moves are pivotal in reshaping the competitive arena, leading to the consolidation of capabilities and the emergence of more formidable market participants.

These strategic alliances can significantly alter the competitive landscape. For instance, Hanwha Systems' acquisition of Philly Shipyard in 2021 for approximately $100 million aimed to bolster its shipbuilding capabilities and expand its footprint in the defense sector. Such consolidation can lead to increased market concentration and a heightened barrier to entry for smaller competitors.

- Strategic Alliances: Hanwha Systems' partnerships with Northrop Grumman and BAE Systems enhance its technological prowess and global reach in defense systems.

- Mergers & Acquisitions: The acquisition of Philly Shipyard in 2021 for around $100 million strengthened Hanwha Systems' position in the maritime defense industry.

- Market Consolidation: These M&A activities contribute to industry consolidation, potentially leading to fewer, but stronger, competitors.

- Competitive Advantage: Such moves allow Hanwha Systems to leverage combined expertise and resources, creating a more competitive offering.

Growing Defense Spending and Market Opportunities

The aerospace and defense sector, both in South Korea and globally, is witnessing a substantial upswing. This growth is fueled by heightened geopolitical anxieties and ongoing military modernization programs. For instance, South Korea's defense budget for 2024 reached approximately 57.1 trillion KRW (around $43 billion USD), marking a 4.4% increase from the previous year, reflecting a commitment to bolstering its defense capabilities.

This expanding market presents a double-edged sword. While it opens doors for increased revenue and strategic partnerships, it simultaneously intensifies competition. Companies are aggressively pursuing new contracts and investments, leading to a more cutthroat environment. Hanwha Systems, as a key player, faces this heightened rivalry directly as it navigates opportunities within this dynamic landscape.

Furthermore, the smart factory market, another area of interest for Hanwha Systems, is also experiencing robust expansion. This burgeoning sector is attracting a growing number of competitors, further fragmenting the market and increasing competitive pressures. The influx of new entrants, eager to capitalize on the digital transformation trend in manufacturing, means Hanwha Systems must continuously innovate to maintain its competitive edge.

- Defense Spending Surge: South Korea's 2024 defense budget is approximately $43 billion USD, a 4.4% rise year-on-year.

- Geopolitical Drivers: Increased global tensions are a primary catalyst for defense market growth.

- Smart Factory Expansion: The smart factory market is also growing, drawing in more companies.

- Intensified Rivalry: Market expansion in both defense and smart factories leads to fiercer competition for contracts and market share.

The competitive rivalry for Hanwha Systems is characterized by intense competition from established global and domestic players in the defense and IT sectors. Companies like LIG Nex1, Northrop Grumman, and Lockheed Martin are significant rivals, possessing deep government ties and substantial R&D resources, leading to fierce bidding for lucrative contracts, particularly in areas like missile defense systems.

This rivalry is driven by a constant need for technological innovation and product differentiation, pushing companies to invest heavily in R&D to maintain a competitive edge. Hanwha Systems focuses on advanced radar, C4I solutions, and smart factory capabilities to stand out, as exemplified by its work on systems like the L-SAM-II MFR.

| Competitor | Key Sectors | Notable Strengths |

|---|---|---|

| LIG Nex1 | Defense Electronics, C4I Systems | Strong domestic presence, advanced missile systems |

| Northrop Grumman | Aerospace, Defense Electronics, Cyber | Global reach, advanced radar and C4I technologies |

| Lockheed Martin | Aerospace, Defense Systems | Extensive defense portfolio, significant government contracts |

SSubstitutes Threaten

Governments might explore alternative defense procurement strategies, opting for less technologically advanced or more conventional weaponry instead of acquiring sophisticated C4I or electronic warfare systems. This could involve prioritizing readily available, lower-cost solutions over cutting-edge, expensive platforms.

While core defense capabilities remain paramount, budget constraints or evolving geopolitical priorities could steer some nations towards simpler, more economical defense approaches. For instance, a nation facing significant economic challenges might delay or scale back purchases of advanced electronic warfare suites, impacting demand for Hanwha Systems' high-end products. In 2023, global defense spending reached an estimated $2.29 trillion, a 9% increase from 2022, highlighting the overall market growth but also the potential for budget-conscious shifts in specific segments.

In the IT services sector, especially for digital transformation and enterprise IT, generic or open-source solutions pose a significant threat of substitution against Hanwha Systems' tailored offerings. Clients might opt for these less customized alternatives, particularly for functions that aren't core to their operations, thereby reducing the demand for specialized services.

While Hanwha Systems excels in areas like smart factories and cloud services, businesses can increasingly leverage readily available, often lower-cost open-source software or build internal IT capabilities. This trend is driven by the growing maturity and accessibility of these alternatives, potentially impacting Hanwha Systems' market share for certain projects.

For some clients, sticking with older, less integrated systems or manual processes can serve as a substitute for adopting Hanwha Systems' advanced, interconnected solutions. While this often leads to reduced efficiency, the perceived cost of upgrading or a general resistance to change can hinder adoption.

Hanwha Systems must effectively communicate the long-term advantages of digital transformation to overcome this substitute threat. For instance, in 2024, many businesses reported that inefficiencies from legacy systems cost them an average of 15% in lost productivity, highlighting the tangible benefits of modernization.

Non-Technological Solutions to Security Threats

The threat of substitutes for Hanwha Systems' security solutions extends beyond direct technological competitors. Non-technological approaches, such as diplomatic resolutions and human intelligence gathering, can also mitigate security threats. These methods, while not direct product replacements, offer alternative pathways to achieving security objectives, potentially influencing the demand for advanced technological systems.

For instance, increased reliance on international cooperation or successful de-escalation through diplomacy might reduce the perceived need for certain high-tech defense investments. Similarly, the effectiveness of human intelligence networks in preempting threats could lessen the immediate urgency for sophisticated electronic surveillance or cyber warfare capabilities. This dynamic suggests that the overall security landscape, influenced by geopolitical factors and non-technical strategies, can indirectly impact the market for Hanwha Systems' offerings.

- Diplomatic Solutions: International agreements and treaties can reduce the need for military hardware.

- Human Intelligence: Effective espionage and informant networks can preempt threats before technological intervention is required.

- Conventional Deterrence: Traditional military strength and the threat of retaliation can dissuade adversaries, lessening reliance on advanced systems.

- Economic Sanctions: These can be used to curb aggressive actions, potentially reducing the demand for defense technologies aimed at countering those actions.

Emerging Disruptive Technologies from Non-Traditional Players

The threat of substitutes for Hanwha Systems is amplified by the relentless pace of technological evolution, where non-traditional players can introduce disruptive innovations. Commercial advancements in areas like artificial intelligence and advanced satellite communications could potentially offer comparable or even superior capabilities, thereby eroding the distinctiveness of Hanwha's specialized defense and IT solutions.

For instance, the proliferation of commercial AI platforms and enhanced satellite imagery services presents a viable alternative for certain intelligence, surveillance, and reconnaissance (ISR) functions that Hanwha Systems traditionally addresses. This dynamic necessitates continuous innovation and adaptation to maintain a competitive edge.

- Emerging AI-driven analytics platforms from tech giants could offer cost-effective ISR solutions.

- Commercial satellite constellations are rapidly increasing resolution and data accessibility, posing a substitute for dedicated military imaging.

- Advancements in private 5G networks and secure communication protocols might offer alternatives to some of Hanwha's secure communication systems.

The threat of substitutes for Hanwha Systems is significant, particularly as commercial technology advances rapidly. For instance, the increasing sophistication of open-source software in IT services can serve as a direct alternative to Hanwha's tailored solutions, especially for less critical business functions. This trend is further exacerbated by the potential for businesses to develop in-house IT capabilities, bypassing the need for external specialized services.

In the defense sector, budgetary pressures can drive governments towards less advanced, more economical weaponry, thereby substituting for Hanwha's high-end C4I and electronic warfare systems. While global defense spending is rising, specific segments might shift towards lower-cost alternatives. For example, in 2023, global defense spending reached an estimated $2.29 trillion, but economic constraints could still lead to a preference for simpler solutions.

Furthermore, non-technological approaches like diplomacy and human intelligence can act as substitutes for advanced defense technologies. Successful de-escalation or effective espionage might reduce the perceived need for sophisticated electronic surveillance or cyber warfare capabilities, impacting demand for Hanwha's offerings.

Entrants Threaten

Entering the defense electronics and advanced IT sectors demands substantial capital for research, development, and specialized manufacturing. Hanwha Systems' significant expenditures, for instance, on advanced radar and C4I systems underscore the high barrier to entry, making it difficult for newcomers to compete effectively.

The defense sector presents formidable barriers to entry due to its stringent regulatory environment. Companies must navigate complex certification processes, secure high-level security clearances, and adhere to numerous national and international standards. For instance, in 2024, the U.S. Department of Defense continued to emphasize cybersecurity compliance, requiring extensive vetting for all contractors, a process that can take years and significant investment.

These extensive regulatory hurdles and the need for specialized certifications create a substantial deterrent for new players. Lacking the established track record and deep understanding of government procurement processes, newcomers face immense challenges in gaining approval. Hanwha Systems, as a seasoned defense contractor, has already invested heavily in meeting these requirements, giving it a significant advantage over potential new entrants.

The defense electronics and advanced IT sectors, where Hanwha Systems operates, are characterized by an intense need for specialized expertise. This includes deep knowledge in areas like radar systems, command and control, cybersecurity, and complex software development. For instance, in 2024, the global demand for skilled cybersecurity professionals was projected to reach 4.7 million, highlighting the scarcity of talent.

Any new company looking to enter Hanwha Systems' market would face significant hurdles in acquiring and retaining this highly specialized talent. The cost associated with recruiting, training, and offering competitive compensation packages for engineers and IT specialists with defense sector experience is substantial. Hanwha Systems itself invests heavily in its talent development programs, such as its dedicated training centers, to maintain its competitive edge, a clear indicator of the importance and difficulty of securing this human capital.

Established Customer Relationships and Switching Costs

Hanwha Systems leverages deeply ingrained customer relationships, particularly with government and major industrial clients. These partnerships are built on years of reliable performance and a nuanced understanding of complex system requirements, making it challenging for newcomers to gain traction. For instance, Hanwha Systems has a significant history of supplying defense systems to the South Korean military, a sector characterized by stringent qualification processes and long-term commitments.

The high switching costs further deter new entrants. Customers invest heavily in integrating and operating Hanwha Systems' solutions, and changing providers would necessitate substantial re-engineering, training, and validation efforts. These barriers are especially pronounced in critical infrastructure and defense sectors where system reliability and interoperability are paramount. In 2023, Hanwha Systems reported significant backlog in its defense sector, underscoring the stickiness of its customer base.

- Deeply established relationships with key government and industrial clients.

- High integration complexity and criticality of existing systems create significant switching costs.

- Proven track record and trust are difficult for new entrants to replicate quickly.

- Substantial investment required by customers to change suppliers acts as a deterrent.

Economies of Scale and Experience Curve Benefits

Established players like Hanwha Systems leverage significant economies of scale in manufacturing, procurement, and research and development. This allows them to achieve lower per-unit costs and invest more heavily in innovation, creating a substantial barrier for newcomers. For instance, Hanwha Systems' extensive experience in complex defense and aerospace projects translates into an experience curve advantage, further reducing costs and improving efficiency with each successive project.

New entrants would struggle to match these cost efficiencies and operational expertise without substantial upfront investment and time.

- Economies of Scale: Hanwha Systems benefits from bulk purchasing power and optimized production processes, leading to lower costs per unit compared to smaller or newer competitors.

- Experience Curve: Years of successfully delivering large-scale, technologically advanced projects have honed Hanwha Systems' operational capabilities and project management, reducing learning costs and improving execution speed.

- Cost Disadvantage for Entrants: New companies would face higher initial production and R&D costs, making it difficult to compete on price or quality without achieving similar scale and experience.

- Hanwha Systems' Backlog: A significant contract backlog, as reported by the company, demonstrates its established market position and the scale of its operations, reinforcing these entry barriers.

The threat of new entrants into Hanwha Systems' defense electronics and advanced IT markets is considerably low. This is primarily due to the immense capital investment required for research, development, and specialized manufacturing, coupled with stringent regulatory hurdles and the need for high-level security clearances. For example, in 2024, the ongoing emphasis on cybersecurity compliance in the defense sector meant extensive vetting for contractors, a process that demands significant time and financial resources, effectively creating a high barrier to entry.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hanwha Systems is built upon a foundation of diverse data sources, including company annual reports, investor presentations, and industry-specific market research from reputable firms. We also leverage publicly available financial data and regulatory filings to ensure a comprehensive understanding of the competitive landscape.