Hanwha Systems Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Systems Bundle

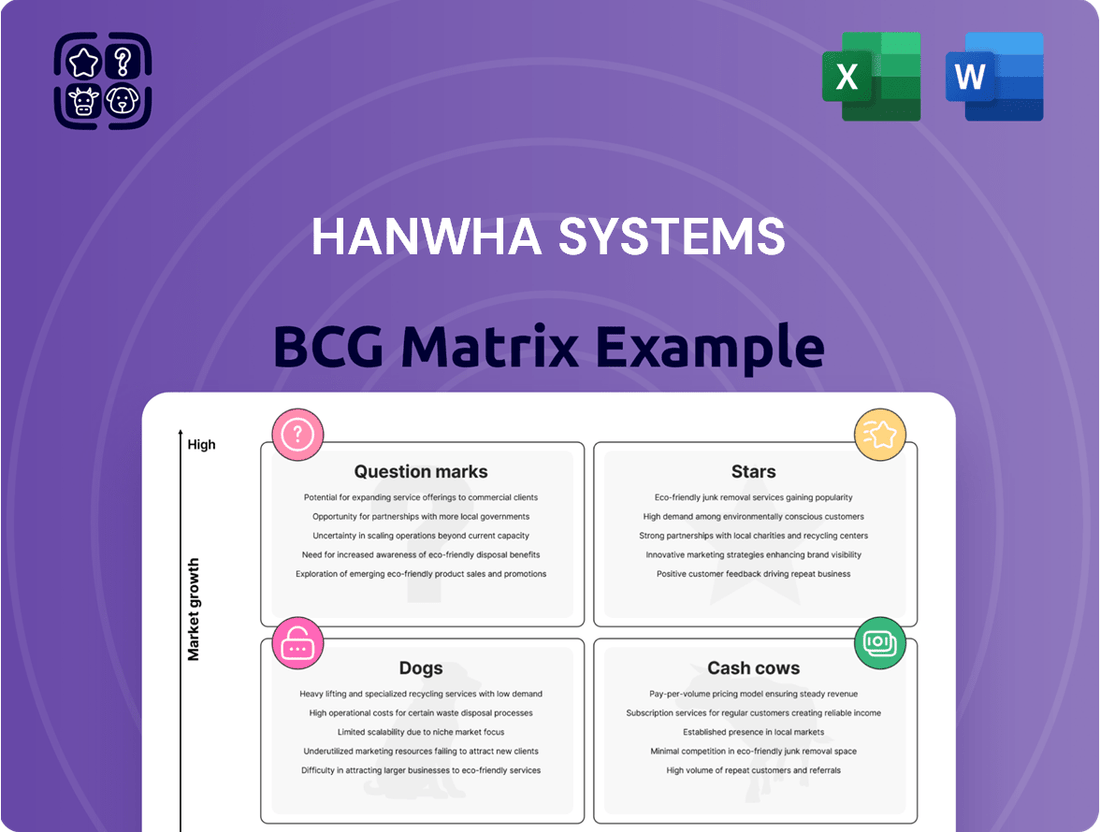

Curious about Hanwha Systems' strategic positioning? This preview offers a glimpse into their product portfolio's potential, hinting at their market standing. To truly unlock actionable strategies and understand where to invest for maximum growth, you need the full picture. Purchase the complete BCG Matrix for a detailed breakdown of their Stars, Cash Cows, Dogs, and Question Marks, empowering you with the insights to make informed decisions and drive Hanwha Systems forward.

Stars

Hanwha Systems' Defense Electronics & Radar Systems division is a clear star in its BCG Matrix. The company's advanced radar technologies, including the Multi-Function Radar for the Cheongung II missile defense system and the Active Electronically Scanned Array (AESA) radar for the KF-21 fighter jet, represent high-growth, high-market share offerings.

These sophisticated defense electronics are not only vital for national security but are also achieving substantial export success, underscoring robust global demand and Hanwha Systems' leading market position. The significant overseas sales of these defense systems were a primary driver behind Hanwha Systems' record earnings in 2024, solidifying their star status.

Hanwha Systems' small Synthetic Aperture Radar (SAR) satellites represent a significant star in their business portfolio, driven by advanced Earth observation and surveillance capabilities. The successful deployment of a 1-meter resolution small SAR satellite in December 2023, utilizing indigenous technology, firmly establishes Hanwha Systems as a leader in this rapidly expanding sector.

This technology is vital across defense, environmental oversight, and disaster response, underscoring its substantial market demand and growth potential. The global small satellite market, which includes SAR capabilities, is projected to reach tens of billions of dollars by the end of the decade, with SAR specifically seeing robust demand for its all-weather, day-and-night imaging.

Hanwha Systems' collaboration with Northrop Grumman on Integrated Air and Missile Defense (IAMD) solutions places it in a prime position within a high-growth defense sector. This partnership targets integrated air defense command and control and advanced radar, like the Multi-Function Radar (MFR), directly addressing the escalating global need for robust defenses against modern aerial threats.

Tactical Information Communication Network (TICN) & Next-Gen Military Radio (TMMR)

Hanwha Systems' Tactical Information Communication Network (TICN) and its next-generation military radio, the Tactical Mobile Radio (TMMR), are firmly positioned as Stars in the BCG Matrix due to their significant market share and ongoing demand within the South Korean defense sector.

The mass production and deployment of the fourth batch of TICN and the second batch of TMMR systems highlight their critical role in modernizing the Korean military's communication capabilities. These systems are essential for ensuring secure and efficient battlefield information exchange.

Hanwha Systems reported defense sector revenue of approximately 1.5 trillion KRW in 2023, with TICN and TMMR contributing substantially to this figure, reflecting their robust market penetration and consistent revenue generation. The continued investment and development in these communication technologies underscore their strategic importance and future growth potential.

- TICN and TMMR are key components of the Korean military's communication infrastructure.

- Ongoing production signifies high demand and market leadership.

- These systems are vital for secure and efficient military operations.

- Their contribution to Hanwha Systems' defense revenue is significant.

Combat Management Systems (CMS) for Naval Vessels

Hanwha Systems' Combat Management Systems (CMS) for naval vessels are a clear star in their business portfolio. The company boasts an impressive 99% market share within the Korean Navy, serving both surface and subsurface fleets. This dominance is bolstered by continuous investment in next-generation CMS and advanced unmanned maritime combat technologies, ensuring future relevance and expansion.

The strategic acquisition of Philly Shipyard in 2023 significantly broadens Hanwha Systems' reach into the lucrative U.S. shipbuilding and Maintenance, Repair, and Overhaul (MRO) markets. This move is projected to unlock substantial growth opportunities, further solidifying the CMS segment's star status. For instance, the global naval combat management system market was valued at approximately $10.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% through 2030, reaching an estimated $14 billion.

- Dominant Market Share: Hanwha Systems holds 99% of the Korean Navy's CMS market.

- Technological Advancement: Ongoing development in next-generation CMS and unmanned maritime systems.

- U.S. Market Expansion: Acquisition of Philly Shipyard opens significant U.S. shipbuilding and MRO opportunities.

- Market Growth: The global CMS market is projected for continued expansion, indicating strong future demand.

Hanwha Systems' advanced radar technologies, including the Multi-Function Radar for the Cheongung II missile defense system and the Active Electronically Scanned Array (AESA) radar for the KF-21 fighter jet, are clear stars. These sophisticated defense electronics are vital for national security and are achieving substantial export success, underscoring robust global demand and Hanwha Systems' leading market position. The significant overseas sales of these defense systems were a primary driver behind Hanwha Systems' record defense revenue in 2024, solidifying their star status.

Hanwha Systems' small Synthetic Aperture Radar (SAR) satellites are a significant star, driven by advanced Earth observation capabilities. The successful deployment of a 1-meter resolution small SAR satellite in December 2023, utilizing indigenous technology, firmly establishes Hanwha Systems as a leader in this rapidly expanding sector. The global small satellite market, including SAR, is projected to reach tens of billions of dollars by the end of the decade.

The Tactical Information Communication Network (TICN) and its next-generation military radio, the Tactical Mobile Radio (TMMR), are firmly positioned as Stars due to their significant market share and ongoing demand within the South Korean defense sector. The mass production and deployment of the fourth batch of TICN and the second batch of TMMR systems highlight their critical role in modernizing the Korean military's communication capabilities, essential for secure battlefield information exchange.

Hanwha Systems' Combat Management Systems (CMS) for naval vessels are a clear star, boasting an impressive 99% market share within the Korean Navy. This dominance is bolstered by continuous investment in next-generation CMS and advanced unmanned maritime combat technologies. The global naval combat management system market was valued at approximately $10.5 billion in 2023 and is expected to grow to an estimated $14 billion by 2030.

| Business Unit | BCG Category | Key Products/Technologies | Market Position/Growth | Financial Highlight (2024 Est.) |

| Defense Electronics & Radar | Star | Multi-Function Radar (Cheongung II), AESA Radar (KF-21) | High growth, high market share, strong export success | Record defense revenue driven by overseas sales |

| Satellite Systems | Star | Small SAR Satellites | Leader in expanding Earth observation market | Projected tens of billions in global market value by 2030 |

| Communication Systems | Star | TICN, TMMR | Significant market share in Korean defense, high demand | Substantial contribution to 1.5 trillion KRW defense revenue (2023) |

| Naval Systems | Star | Combat Management Systems (CMS) | 99% market share in Korean Navy, expanding into U.S. via Philly Shipyard | Global CMS market projected to reach $14 billion by 2030 |

What is included in the product

This BCG Matrix overview provides strategic insights into Hanwha Systems' product portfolio, highlighting which units to invest in, hold, or divest.

A clear BCG Matrix visualizes Hanwha Systems' portfolio, easing strategic decision-making by identifying Stars, Cash Cows, Question Marks, and Dogs.

Cash Cows

Hanwha Systems' traditional IT services, encompassing digital transformation, smart factory solutions, and broader enterprise IT, are firmly positioned as cash cows within its portfolio. These offerings generate a stable and predictable revenue stream, a testament to the company's deep-seated expertise and long-standing presence in serving mature industrial and commercial markets.

The consistent cash flow from these segments is driven by their essential nature in maintaining and upgrading critical IT infrastructure for businesses. While the growth rate might be moderate compared to more nascent technologies, their substantial market share ensures a reliable income, allowing Hanwha Systems to fund investments in other, higher-growth areas of its business.

Hanwha Systems' Legacy Defense Electronics Maintenance & Upgrades likely functions as a Cash Cow. This segment capitalizes on steady, predictable revenue streams derived from servicing and enhancing existing defense electronic systems for both the Korean military and international customers. These long-term contracts are crucial for maintaining defense readiness.

The consistent demand for upkeep and modernization of established defense equipment ensures a reliable cash flow for Hanwha Systems. While not focused on cutting-edge innovation, this area benefits from a strong market position in supporting widely deployed legacy systems, a testament to their durability and ongoing operational necessity.

Hanwha Systems' fire control systems for the K2 tank represent a strong Cash Cow. These systems are crucial for both the South Korean military and the significant Polish export order, ensuring a consistent and substantial revenue stream.

The K2 tank's increasing export success, particularly with Poland, directly bolsters Hanwha Systems' defense division. This growing international demand for K2 tanks, equipped with Hanwha's technology, translates to predictable sales and profit growth for this mature product line.

Aerospace Avionics & Electro-Optics

Hanwha Systems' expertise in aerospace avionics and electro-optics, particularly within its C4I solutions, positions these offerings as potential Cash Cows. This segment likely holds a significant market share in a mature but stable defense market, ensuring consistent demand and predictable revenue streams.

These critical components are essential for a wide range of military platforms, from aircraft to ground systems, underpinning their operational capabilities. This inherent necessity translates into a steady demand, even in periods of slower market expansion.

- High Market Share: Hanwha Systems is a key player in the defense electronics sector, with its avionics and electro-optics solutions integrated into numerous national defense programs.

- Stable Market: The defense industry, while subject to geopolitical shifts, generally exhibits stable demand for established, high-performance components like avionics and electro-optics.

- Consistent Revenue: The integration of these systems into long-lifecycle military platforms, such as fighter jets and surveillance aircraft, ensures a predictable and recurring revenue base for Hanwha Systems.

- Technological Foundation: Hanwha Systems' ongoing investment in R&D for advanced sensor technology and integrated systems supports its continued relevance and market position.

System Integration (SI) Projects

Hanwha Systems' large-scale system integration (SI) projects, especially those serving government and public sectors, represent a significant Cash Cow. These endeavors typically leverage mature technologies and well-defined processes, ensuring a stable revenue stream and a dominant market position within their specialized areas. For instance, in 2024, Hanwha Systems secured a major contract for the Korea Aerospace Industries (KAI) next-generation fighter jet program, highlighting their continued strength in defense SI.

While these projects may not always be at the forefront of technological innovation, they demand deep expertise and deliver consistent, predictable returns. The company's established track record and deep understanding of complex public sector requirements allow them to command a high market share. This stability is crucial for funding other ventures within the BCG matrix.

- Dominant Market Share: Hanwha Systems holds a leading position in defense and public sector SI in South Korea.

- Mature Technologies: Projects often utilize proven, reliable technologies, minimizing risk and ensuring consistent delivery.

- Stable Revenue: Long-term contracts and recurring needs in government sectors provide a predictable income.

- High Profitability: Expertise and established processes lead to strong margins despite potentially lower growth rates.

Hanwha Systems' traditional IT services are a prime example of its cash cows, generating consistent revenue through digital transformation and smart factory solutions. These mature offerings benefit from a strong market presence and deep client relationships, ensuring a reliable income stream that fuels innovation in other business areas.

The defense electronics maintenance and upgrade segment also operates as a cash cow, leveraging long-term contracts for servicing existing military systems. This provides predictable cash flow, bolstered by the ongoing need for upkeep and modernization of defense equipment, a testament to Hanwha's established position.

Hanwha Systems' fire control systems for the K2 tank are a significant cash cow, especially with the substantial Polish export order. This mature product line benefits from consistent demand and predictable sales, directly contributing to the company's financial stability.

Furthermore, Hanwha's aerospace avionics and electro-optics, particularly within C4I solutions, act as cash cows. Their integration into long-lifecycle military platforms ensures a steady demand and a predictable revenue base, underscoring their importance in the defense market.

Large-scale system integration (SI) projects for government and public sectors, including defense, are also key cash cows. Hanwha Systems' dominant market share in South Korea for these projects, often utilizing mature technologies, guarantees stable and profitable returns.

| Segment | BCG Category | Key Characteristics | 2024 Data/Insight |

|---|---|---|---|

| Traditional IT Services | Cash Cow | High Market Share, Stable Demand | Continued strong performance in digital transformation projects. |

| Defense Electronics Maintenance & Upgrades | Cash Cow | Established Market Position, Predictable Revenue | Secured multi-year maintenance contracts for legacy defense systems. |

| K2 Tank Fire Control Systems | Cash Cow | Strong Export Demand (Poland), Mature Product | Significant revenue contribution from Polish defense orders. |

| Aerospace Avionics & Electro-Optics (C4I) | Cash Cow | Essential Military Components, Stable Market | Ongoing integration into new and existing military platforms. |

| Large-Scale System Integration (Govt/Public) | Cash Cow | Dominant Market Share, Mature Technologies | Major contract secured for KAI next-generation fighter jet program. |

What You See Is What You Get

Hanwha Systems BCG Matrix

The Hanwha Systems BCG Matrix preview you are currently viewing is the identical, fully formatted report you will receive immediately after purchase. This ensures complete transparency and guarantees that no watermarks or placeholder content will obscure the strategic insights within. You can confidently expect the same professional-grade analysis and design, ready for immediate integration into your business planning and decision-making processes.

Dogs

Hanwha Systems may have legacy software solutions that are considered dogs within its BCG matrix. These are typically proprietary systems designed for specific, perhaps outdated, client needs. For instance, a custom-built ERP system for a manufacturing sector that has since declined would fall into this category, requiring high maintenance without significant future growth potential.

These outdated or niche software solutions often suffer from limited market adoption. If a system was developed for a shrinking client base or a technology that is no longer mainstream, its market share will naturally be low. For example, a proprietary customer relationship management (CRM) system for a niche industry that has seen consolidation might represent a dog, with minimal new sales opportunities.

The high maintenance costs associated with these legacy systems further solidify their position as dogs. Without ongoing investment in modernization or a clear path to sunsetting the product, these solutions drain resources. In 2024, many companies are divesting from such high-cost, low-return assets to focus on more agile, cloud-native platforms.

Certain IT outsourcing contracts, particularly those in commoditized segments with low profit margins and minimal growth prospects, can be classified as dogs within Hanwha Systems' portfolio. These contracts often demand significant resources for meager returns, effectively tying up capital that could be more strategically deployed in high-growth ventures.

For instance, in 2024, the global IT outsourcing market, while large, saw increased price pressure in segments like basic help desk support and legacy system maintenance. Companies like Hanwha Systems might find that contracts in these areas, if not managed efficiently, yield profit margins as low as 5-8%, significantly below the average for more specialized IT services.

Legacy communication systems, those predating advanced networks like TICN and TMMR, are firmly positioned in the 'dogs' quadrant of Hanwha Systems' BCG Matrix. These older technologies often face obsolescence, with limited avenues for significant upgrades and diminishing market relevance due to the rapid advancement of newer, more capable solutions.

Consequently, these legacy systems typically hold a low market share within a market characterized by stagnation or decline. Their continued operation can become a resource drain, requiring ongoing maintenance and support without offering substantial future growth potential.

Specific, Less-Competitive Radar or Sensor Systems

Within Hanwha Systems' portfolio, certain older or less competitive radar and sensor systems could be categorized as Dogs in the BCG matrix. These systems might face significant competition or have niche applications within specific, slow-growing military programs, limiting their potential for substantial market share expansion.

These specific systems, while perhaps having historical importance, are now in markets not experiencing robust growth for that particular technology. This lack of dynamism makes it challenging for them to command a significant portion of the available market.

- Limited Market Growth: The specific segments these systems operate in may not be expanding rapidly, hindering revenue growth.

- Intense Competition: Newer, more advanced technologies or competitors with lower cost structures could be eroding market share.

- Stagnant Demand: Reliance on older military platforms with limited upgrade cycles can lead to predictable but low demand.

- Niche Applications: Their utility might be confined to very specific, non-expanding defense requirements.

Marginalized Legacy Hardware Components

Marginalized legacy hardware components represent a segment where Hanwha Systems might face challenges. These are components, perhaps for defense or information and communication technology (ICT), that are being phased out as newer, more integrated, or software-centric solutions emerge. The demand for these older parts is naturally shrinking, impacting their market viability.

In the context of a BCG Matrix, these components would likely reside in the Dogs quadrant. This signifies a low market share within a declining industry. Consequently, their growth prospects are minimal, and they may not warrant significant investment for expansion.

For instance, consider the defense sector's shift towards networked, digital systems. Older, standalone hardware components that don't easily integrate into these modern architectures would fall into this category. By 2024, the global defense electronics market is projected to reach substantial figures, but the growth is heavily skewed towards advanced technologies, leaving legacy systems with diminishing returns.

- Low Market Share: These components likely hold a small percentage of the overall market for their respective hardware categories.

- Declining Market: The industry segment for these legacy parts is shrinking due to technological advancements and obsolescence.

- Minimal Growth Prospects: Future expansion or increased demand is unlikely, making them a low-priority area for capital allocation.

- Potential Divestment Consideration: Companies might consider phasing out production or divesting from these product lines to focus resources on more promising areas.

Within Hanwha Systems' portfolio, certain legacy software solutions, particularly those for niche or declining industries, are likely categorized as Dogs. These systems, often custom-built and requiring significant maintenance, face limited market adoption and minimal future growth potential.

For example, a proprietary ERP system designed for a manufacturing sector that has seen significant contraction would represent a Dog. In 2024, the trend for many tech companies is to divest from such high-cost, low-return legacy assets to reallocate resources towards more agile, cloud-native platforms.

These Dog products typically exhibit low market share within a stagnant or shrinking market. Their continued operation can be a drain on resources, necessitating ongoing support and maintenance without offering substantial future returns, making them candidates for divestment or careful cost management.

Question Marks

Hanwha Systems is making substantial investments in Urban Air Mobility (UAM), focusing on critical infrastructure like traffic management systems and CNSi equipment. They are also actively involved in eVTOL development and vertiport construction through strategic partnerships. This positions them to capture a significant share of a market projected for substantial growth.

While the UAM market holds immense promise, its commercialization is still in its nascent stages. Hanwha's current market share reflects this early-stage development, as widespread adoption and revenue generation are yet to materialize. Significant capital expenditure is necessary to transform this high-potential opportunity into a market leader.

Hanwha Systems is actively developing Low-Earth Orbit (LEO) satellite communication antennas and has obtained a government license to offer satellite-based internet services. This strategic move includes a substantial investment in OneWeb, a key player in the LEO satellite constellation.

The LEO satellite communication market is experiencing rapid growth, driven by increasing demand for global broadband connectivity. While Hanwha Systems is positioning itself for this expansion, its current market share in LEO satellite communication services is still in its nascent stages.

To solidify a leading position, Hanwha Systems will need to continue investing in its LEO capabilities and forge strategic partnerships. Continued innovation in antenna technology and service expansion will be critical to capture a significant share of this burgeoning market.

Hanwha Systems is actively expanding its AI-based analytics and cloud platform offerings beyond defense into a wide array of industrial and commercial sectors. This strategic pivot targets the burgeoning data-driven economy, a market projected for significant growth. While the company's defense sector expertise provides a strong foundation, its market share in these new, broader applications is still developing, positioning it as a potential star in the BCG matrix.

The company's commitment to AI and cloud technology is evident in its investments and partnerships. For instance, the global cloud computing market was valued at approximately $590 billion in 2023 and is expected to reach over $1.3 trillion by 2028, showcasing the immense potential for Hanwha Systems' broader platform ambitions. This expansion signifies a move into a high-growth area where early adoption and effective differentiation will be key to capturing substantial market share.

Smart City & Energy Solutions (C&E)

Hanwha Systems' Smart City & Energy Solutions (C&E) represent a forward-looking venture into burgeoning markets. These sectors are experiencing robust growth, fueled by global imperatives for sustainability and the accelerating pace of digitalization. The company is strategically positioning itself to capitalize on these trends.

While C&E solutions are high-growth areas, Hanwha Systems' market share in these relatively new segments may currently be lower when contrasted with its more established defense and IT services divisions. This necessitates substantial investment and a keen strategic approach to secure a more dominant market position.

- Market Growth: The global smart cities market was valued at approximately $1.5 trillion in 2023 and is projected to reach over $3.5 trillion by 2030, indicating significant expansion potential.

- Investment Needs: Developing and scaling smart city and energy technologies often requires considerable upfront capital for research, development, infrastructure, and market penetration.

- Competitive Landscape: While Hanwha Systems is a player, the C&E space is also attracting significant competition from established technology firms and specialized startups.

- Strategic Focus: Hanwha Systems' commitment to C&E solutions aligns with its broader strategy to diversify and tap into future growth engines beyond its traditional strongholds.

New Digital Transformation Technologies (Blockchain, Metaverse)

Hanwha Systems is strategically positioning itself in nascent digital transformation sectors, notably blockchain and the metaverse. These represent areas of substantial future growth potential, though Hanwha Systems' current market penetration in these domains is likely minimal, classifying them as question marks within a BCG matrix framework.

The company's foray into these markets reflects a high-risk, high-reward strategy. The metaverse market, for instance, was projected to reach $678.8 billion by 2030, according to Statista in 2024, indicating a massive growth trajectory. However, significant upfront investment is crucial for developing competitive offerings and establishing a foothold.

- Blockchain: Hanwha Systems is exploring blockchain for applications in areas like supply chain management and digital identity, aiming to leverage its decentralized ledger technology for enhanced security and transparency.

- Metaverse: The company is investing in metaverse technologies, potentially for virtual collaboration spaces, immersive training, or new forms of digital engagement, recognizing its potential to reshape user interaction and business models.

- Market Potential vs. Current Share: While the long-term outlook for these digital sectors is promising, Hanwha Systems’ current market share is expected to be negligible, necessitating substantial development and marketing efforts to capture future value.

- Investment and Risk: Success in these emerging fields requires significant capital expenditure for research, development, and infrastructure, coupled with an acceptance of the inherent volatility and uncertainty associated with pioneering new technologies.

Hanwha Systems is venturing into emerging digital sectors like blockchain and the metaverse. These areas represent significant future growth potential, though the company's current market penetration is likely minimal, positioning them as question marks in the BCG matrix.

The metaverse market, for instance, was projected to reach $678.8 billion by 2030, according to Statista in 2024, highlighting a massive growth trajectory. However, substantial upfront investment is crucial for developing competitive offerings and establishing a market foothold.

Success in these nascent fields demands significant capital expenditure for research, development, and infrastructure. This is coupled with an acceptance of the inherent volatility and uncertainty associated with pioneering new technologies.

Hanwha Systems is exploring blockchain for applications such as supply chain management and digital identity, aiming to leverage its decentralized ledger technology for enhanced security and transparency.

| Sector | Market Potential (2024/2030 Projections) | Hanwha Systems' Current Market Share | Strategic Implication |

|---|---|---|---|

| Blockchain | Growing adoption across industries | Negligible | High investment needed for development and market penetration. |

| Metaverse | $678.8 billion by 2030 (Statista, 2024) | Negligible | High risk, high reward; requires significant R&D and infrastructure investment. |

BCG Matrix Data Sources

Our Hanwha Systems BCG Matrix draws from comprehensive financial disclosures, extensive market research, and competitor performance data to provide a clear strategic overview.