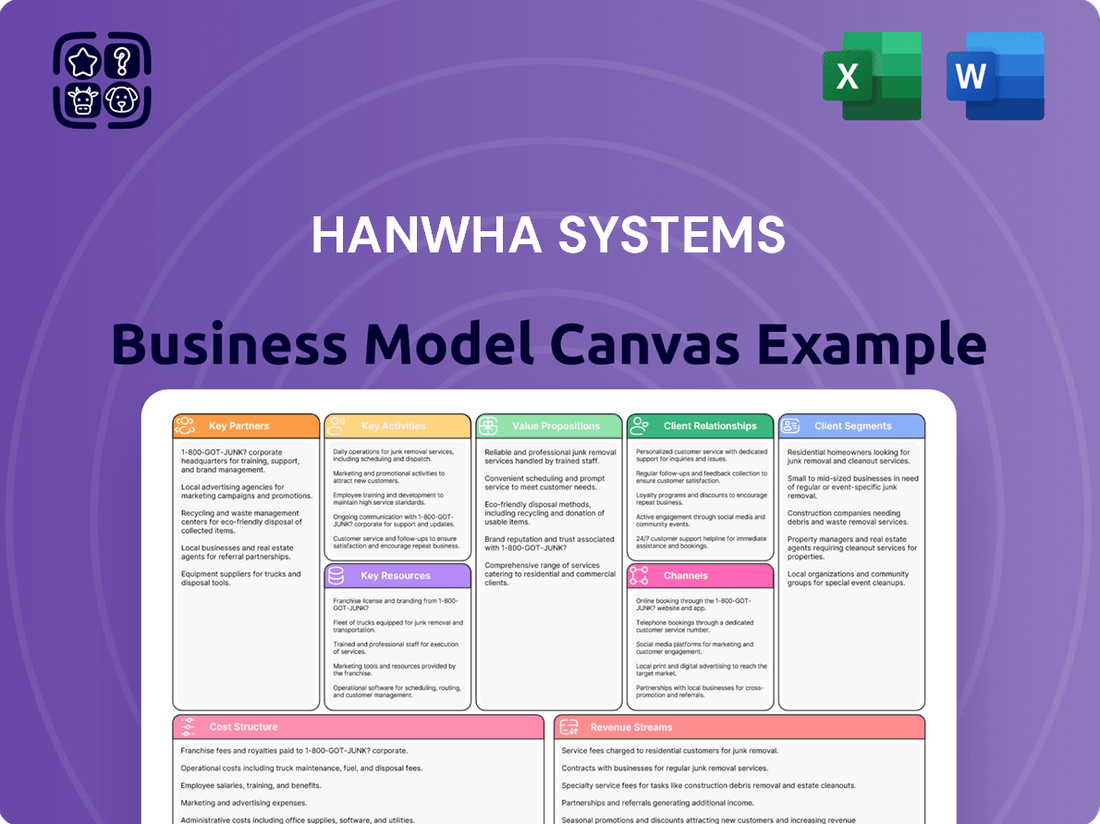

Hanwha Systems Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Systems Bundle

Discover the strategic core of Hanwha Systems with our comprehensive Business Model Canvas. This detailed breakdown unveils their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Ready to elevate your own business strategy?

Partnerships

Hanwha Systems actively cultivates strategic alliances with leading global defense contractors. These collaborations are crucial for co-developing cutting-edge military technologies, ensuring Hanwha Systems remains at the forefront of innovation.

A significant partnership exists with Northrop Grumman, focusing on next-generation Integrated Air and Missile Defense (IAMD) systems. This joint effort specifically targets the advancement of command-and-control technologies, a critical component for modern defense capabilities.

These strategic defense collaborations are designed to bolster capabilities and unlock new joint business opportunities. The primary focus for these ventures is often within the robust South Korean defense sector, leveraging mutual strengths.

Hanwha Systems cultivates essential domestic industrial alliances, notably with Korea Aerospace Industries (KAI). This partnership is critical for integrating Hanwha's advanced systems into KAI's flagship platforms, such as the cutting-edge KF-21 fighter jet.

Through these collaborations, Hanwha Systems supplies vital components including mission computers, multi-function displays, and infrared search and track equipment. For instance, Hanwha Systems secured a significant contract in 2023 to supply avionics systems for the KF-21, underscoring the depth of this alliance.

These strategic collaborations are instrumental in bolstering the capabilities of South Korea's domestically developed defense assets. By working closely with KAI, Hanwha Systems not only enhances the performance of these platforms but also strengthens the nation's indigenous defense industrial base.

Hanwha Systems actively collaborates with international supply chain partners to secure vital components and integrated solutions. A prime example is their long-standing relationship with HSW S.A. in Poland, a key partner for supplying chassis components and powerpacks for the Krab Self-Propelled Howitzers.

These strategic international partnerships are fundamental to Hanwha Systems' ability to broaden its global footprint and deliver complete defense systems. By leveraging these collaborations, the company ensures access to specialized manufacturing capabilities and maintains a competitive edge in the international defense market.

Inter-Group Synergies (Hanwha Group)

Hanwha Systems leverages significant inter-group synergies, notably with Hanwha Ocean. A prime example is their joint acquisition of Philly Shipyard in the U.S., a strategic move to bolster their presence in the American shipbuilding and Maintenance, Repair, and Overhaul (MRO) sectors. This collaboration capitalizes on shared expertise in maritime systems.

This partnership is designed to unlock substantial advantages in shipbuilding and MRO operations. By pooling resources and knowledge, Hanwha Systems and Hanwha Ocean aim to enhance efficiency and competitiveness.

- Strategic U.S. Market Entry: Joint acquisition of Philly Shipyard targets significant growth in the U.S. shipbuilding and MRO market.

- Synergistic Expertise: Combines Hanwha Systems' technology capabilities with Hanwha Ocean's shipbuilding prowess.

- Operational Efficiencies: Aims to create cost savings and operational improvements in shipbuilding and MRO.

Research and Development Institutions

Hanwha Systems actively collaborates with leading research and development institutions, including government-backed agencies and esteemed academic bodies. These strategic alliances are crucial for driving innovation and enhancing its technological prowess in defense electronics and information infrastructure.

These partnerships are instrumental in developing next-generation solutions, ensuring Hanwha Systems remains a leader in addressing future defense and technology challenges. For example, collaborations with institutions like the Agency for Defense Development (ADD) in South Korea are vital for advancing capabilities in areas such as radar and electronic warfare systems.

- Fostering Innovation: Partnerships with R&D institutions accelerate the development of new technologies and solutions.

- Technological Advancement: Collaborations enable Hanwha Systems to stay at the cutting edge of defense electronics and information infrastructure.

- Resource and Expertise Sharing: These alliances facilitate the pooling of knowledge and resources for long-term technological progress.

Hanwha Systems' key partnerships are foundational to its defense and technology advancements. Collaborations with major global defense contractors, like Northrop Grumman, focus on co-developing advanced systems such as Integrated Air and Missile Defense (IAMD). Domestically, partnerships with entities like Korea Aerospace Industries (KAI) are vital for integrating Hanwha's avionics into platforms like the KF-21 fighter jet, with Hanwha having secured a significant contract in 2023 for KF-21 avionics.

The company also leverages international supply chains, notably with HSW S.A. for components of the Krab Howitzer, enhancing its global reach. Furthermore, inter-group synergies with Hanwha Ocean, including the joint acquisition of Philly Shipyard in 2023, bolster their U.S. market presence in shipbuilding and MRO. These alliances are critical for innovation, evidenced by collaborations with institutions like South Korea's Agency for Defense Development (ADD) to advance radar and electronic warfare capabilities.

| Partner | Focus Area | Key Contribution/Outcome | Year of Significance |

|---|---|---|---|

| Northrop Grumman | Integrated Air and Missile Defense (IAMD) | Co-development of command-and-control technologies | Ongoing |

| Korea Aerospace Industries (KAI) | Aerospace Systems Integration | Supply of avionics for KF-21 fighter jet (2023 contract) | 2023 |

| HSW S.A. (Poland) | Supply Chain/Component Manufacturing | Chassis and powerpack supply for Krab Howitzers | Ongoing |

| Hanwha Ocean | Shipbuilding & MRO | Joint acquisition of Philly Shipyard (2023) for U.S. market expansion | 2023 |

| Agency for Defense Development (ADD) | R&D Collaboration | Advancement of radar and electronic warfare systems | Ongoing |

What is included in the product

A comprehensive, pre-written business model tailored to Hanwha Systems' strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of Hanwha Systems, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

Hanwha Systems' Business Model Canvas acts as a pain point reliever by offering a high-level view of their complex operations with editable cells, enabling quick identification of core components and strategic adjustments.

Activities

Hanwha Systems' key activity is advanced defense electronics R&D, focusing on AESA radar, C4I, surveillance, reconnaissance, and electronic warfare. This dedication to innovation keeps their military solutions cutting-edge. For instance, they are developing multi-function radars crucial for missile defense systems and advanced avionics for next-generation fighter jets.

A primary activity for Hanwha Systems is the manufacturing and mass production of a diverse range of defense systems and their components. This encompasses crucial elements like tactical information communication systems, advanced military radios, sophisticated fire control systems for armored vehicles, and vital radar systems designed for air defense.

These production capabilities are fundamental to Hanwha Systems' ability to secure and execute substantial domestic and international defense contracts. For instance, in 2023, Hanwha Systems secured a significant contract for the production of next-generation tactical communication systems for the South Korean military, highlighting the scale and importance of their manufacturing operations.

Hanwha Systems actively engages in Information and Communication Technology (ICT) services, extending its expertise beyond defense to encompass digital transformation and smart factory solutions. In 2024, the company continued to invest in developing AI, cloud, and big data capabilities to support clients in modernizing their operations.

These enterprise IT services are designed to boost efficiency and cybersecurity for businesses across various industries. The company's focus on leveraging advanced technologies aims to drive innovation and improve operational effectiveness for its clientele.

Integrated Logistics Support and MRO

Hanwha Systems provides integrated logistics support (ILS) and robust maintenance, repair, and overhaul (MRO) services, crucial for sustaining the operational readiness of its advanced defense systems. This commitment ensures that complex military equipment remains effective throughout its lifecycle. For instance, the company actively performs MRO for the Cheonma missile system and offers comprehensive support for naval vessels.

These services are vital for maintaining high availability rates of military assets, reducing downtime, and extending the service life of equipment. Hanwha Systems' dedication to ILS and MRO underpins its value proposition by offering end-to-end solutions that guarantee performance and reliability in demanding operational environments.

- Integrated Logistics Support (ILS): Ensuring seamless supply chains and lifecycle management for defense platforms.

- Maintenance, Repair, and Overhaul (MRO): Providing specialized services for critical defense systems like the Cheonma missile and naval platforms.

- Operational Readiness: Guaranteeing sustained high performance and availability of military equipment through expert MRO.

Global Market Expansion and Export Initiatives

Hanwha Systems is aggressively expanding its global footprint, actively seeking and securing international defense contracts. This strategic push is a cornerstone of their business model, aiming to diversify revenue streams beyond domestic markets. The company's presence at key global defense exhibitions underscores its commitment to showcasing advanced technological capabilities to a worldwide audience.

In 2023, Hanwha Systems reported substantial revenue growth, with international defense contracts playing a pivotal role. Regions like the Middle East and Europe have been particularly strong performers, demonstrating the company's success in penetrating established defense markets. This growth highlights the effectiveness of their export initiatives and the global demand for their specialized solutions.

The company's approach involves meticulous identification of new overseas markets and a flexible strategy for adapting its technological solutions. This ensures that Hanwha Systems can effectively meet the unique and evolving defense requirements of various nations. By tailoring offerings, they enhance their competitive edge and build stronger international partnerships.

- Global Defense Contract Acquisition: Hanwha Systems focuses on winning international defense contracts to drive growth and market share.

- Key Market Performance: Significant revenue increases were observed in 2023, largely attributed to defense deals in the Middle East and Europe.

- Technology Showcase: Participation in major international defense exhibitions is crucial for demonstrating technological prowess and attracting global clients.

- Market Adaptation: The company actively identifies new overseas markets and tailors its defense solutions to meet diverse global requirements.

Hanwha Systems' key activities center on advanced defense electronics research and development, focusing on areas like AESA radar and electronic warfare, alongside the mass production of sophisticated defense systems. They also actively pursue global defense contracts, demonstrating success in markets like the Middle East and Europe, with significant revenue growth reported in 2023 due to these international deals. Furthermore, the company leverages its expertise in Information and Communication Technology (ICT) to offer digital transformation and smart factory solutions, investing in AI and cloud capabilities in 2024.

| Key Activity Area | Description | 2023/2024 Data Point |

|---|---|---|

| Defense R&D | Developing cutting-edge military electronics like AESA radar and electronic warfare systems. | Continued development of multi-function radars for missile defense. |

| Defense Manufacturing | Mass production of tactical communication systems, fire control systems, and radar systems. | Secured major contract for next-generation tactical communication systems in 2023. |

| Global Market Expansion | Acquiring international defense contracts and showcasing technology globally. | Significant revenue growth in 2023 driven by Middle East and European defense contracts. |

| ICT Services | Providing digital transformation and smart factory solutions using AI, cloud, and big data. | Continued investment in AI, cloud, and big data capabilities in 2024. |

Full Version Awaits

Business Model Canvas

The Hanwha Systems Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. You'll gain full access to this professionally structured and formatted Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

Hanwha Systems holds a significant collection of proprietary technologies and intellectual property, particularly in defense electronics and information and communication technology (ICT). This extensive portfolio includes cutting-edge radar systems, sophisticated electro-optics, advanced avionics, and robust multi-layered hyperconnected communication and C4I systems.

These technological capabilities are fundamental to Hanwha Systems' competitive advantage, enabling the company to consistently develop and deliver innovative solutions. For instance, their investments in advanced defense electronics are critical for securing contracts and maintaining leadership in a rapidly evolving global defense market.

Hanwha Systems' highly skilled human capital is a cornerstone of its operations. The company boasts a robust team of professional engineers, researchers, and technical specialists who are adept at integrating deep industry knowledge with advanced technological capabilities. This expertise is crucial for fostering innovation and guaranteeing the superior quality of their products and services.

In 2023, Hanwha Systems reported that approximately 80% of its employees held bachelor's degrees or higher, with a significant portion specializing in engineering and technology fields. The company consistently allocates substantial resources towards talent development, including specialized training programs and research initiatives, to maintain its competitive edge.

Hanwha Systems leverages advanced manufacturing and testing facilities, including specialized smart factories. A prime example is their new facility dedicated to F414 engine components, highlighting a commitment to cutting-edge production capabilities. These sites are crucial for efficiently producing complex defense systems with rigorous quality assurance.

Strategic Partnerships and Global Network

Hanwha Systems leverages a robust network of strategic partnerships as a core resource. These alliances with leading global and domestic defense contractors, alongside esteemed academic and research institutions, are crucial. They grant access to cutting-edge, complementary technologies and shared expertise, significantly broadening market reach and innovation potential.

These collaborations are vital for staying ahead in the competitive defense and technology sectors. For instance, Hanwha Systems' partnerships enable the co-development of advanced systems and the exploration of new market segments. This interconnected approach fuels growth and solidifies its position as a key player.

- Defense Industry Alliances: Collaborations with major defense contractors like Northrop Grumman provide access to advanced avionics and sensor technologies, enhancing Hanwha Systems' capabilities in areas such as fighter jet modernization.

- Naval Technology Integration: Partnerships with entities like Hanwha Ocean facilitate the integration of sophisticated combat management systems and sensors into naval platforms, improving maritime defense solutions.

- Research and Development Synergy: Alliances with academic and research bodies foster innovation by enabling joint R&D projects, leading to breakthroughs in areas like artificial intelligence and advanced materials for defense applications.

Strong Financial Capital and Investment Capacity

Hanwha Systems leverages its robust financial capital and significant investment capacity to fuel innovation and market expansion. This financial muscle allows for substantial commitments to research and development, crucial for staying ahead in competitive technology sectors.

The company's financial health is underscored by its impressive performance. For instance, Hanwha Systems reported record operating profit in 2023, reaching KRW 446.4 billion, a significant increase from KRW 290.9 billion in 2022. This consistent revenue growth, with sales reaching KRW 1.46 trillion in 2023, provides the stability necessary to undertake ambitious projects and strategic acquisitions.

- Record Profitability: 2023 operating profit of KRW 446.4 billion, up from KRW 290.9 billion in 2022.

- Revenue Growth: 2023 sales reached KRW 1.46 trillion, demonstrating sustained top-line expansion.

- Investment Focus: Financial strength enables significant R&D investment and strategic global expansion efforts.

- Strategic Acquisitions: Capacity to pursue and integrate key acquisitions to bolster market position.

Hanwha Systems' key resources include a deep well of proprietary technologies and intellectual property, especially in defense electronics and ICT. Their skilled workforce, comprising numerous engineers and researchers, is crucial for innovation and product quality. The company also utilizes advanced manufacturing facilities, including smart factories, and maintains a strong network of strategic partnerships with global players and research institutions.

Financial capital is another vital resource, enabling significant R&D investments and market expansion. The company's financial performance supports these endeavors, with 2023 seeing record operating profit and substantial revenue growth.

| Resource Category | Key Assets/Activities | 2023 Data/Examples |

| Intellectual Property & Technology | Proprietary defense electronics & ICT technologies (radar, electro-optics, avionics, C4I) | Extensive portfolio of patented technologies |

| Human Capital | Skilled engineers, researchers, technical specialists | Approx. 80% of employees hold bachelor's degrees or higher; significant R&D investment in talent |

| Physical Assets | Advanced manufacturing & testing facilities (smart factories) | New facility for F414 engine components |

| Partnerships | Global & domestic defense contractors, academic & research institutions | Collaborations with Northrop Grumman, Hanwha Ocean, R&D synergy |

| Financial Capital | Investment capacity, R&D funding, strategic acquisitions | KRW 446.4 billion operating profit (up from KRW 290.9 billion in 2022); KRW 1.46 trillion sales |

Value Propositions

Hanwha Systems delivers cutting-edge defense electronics and integrated C4I solutions, acting as the central nervous system for modern military operations. These sophisticated systems significantly boost situational awareness and accelerate decision-making, directly improving battlefield effectiveness. In 2023, Hanwha Systems secured a significant contract worth approximately ₩1.2 trillion (around $900 million USD) for its advanced C4I systems, highlighting the strong demand for its capabilities.

Hanwha Systems' advanced technologies directly bolster military operational readiness and provide a decisive battlefield advantage. Their mission computers, multi-function displays, and fire control systems equip platforms with cutting-edge capabilities.

These critical components ensure that military assets are always prepared for action, offering superior targeting, tracking, and overall combat effectiveness. For instance, Hanwha Systems' integration of AI into their fire control systems has demonstrated a significant reduction in engagement times, a key metric for battlefield advantage.

Hanwha Systems extends its value proposition beyond defense by spearheading digital transformation across industrial and commercial enterprises through its comprehensive IT services. This involves deploying advanced solutions like smart factories and robust cloud infrastructure, directly addressing the evolving needs of businesses in 2024.

The company's IT services are designed to optimize operations and boost efficiency. For instance, their smart factory implementations aim to streamline production processes, a critical factor as many industries continue to invest heavily in automation and IoT in the current economic climate.

Furthermore, Hanwha Systems' commitment to securing sensitive information is paramount. In an era where cyber threats are constantly evolving, their enterprise IT services provide essential layers of security, ensuring data integrity and business continuity for their clients.

Reliable and Comprehensive Lifecycle Support

Hanwha Systems offers robust lifecycle support, encompassing Integrated Logistics Support (ILS), maintenance, repair, and overhaul (MRO) services. This commitment ensures the sustained operational capability and cost efficiency of sophisticated defense platforms for its clientele.

This comprehensive support framework is vital for maintaining peak mission readiness throughout the extended operational life of complex defense assets. For instance, in 2024, Hanwha Systems continued its focus on enhancing MRO capabilities, aiming to reduce turnaround times for critical components by an estimated 15% compared to previous years.

- Integrated Logistics Support (ILS): Providing end-to-end supply chain management and technical documentation.

- Maintenance, Repair, and Overhaul (MRO): Ensuring system availability through expert servicing and component refurbishment.

- Long-Term Functionality: Guaranteeing that advanced systems perform optimally over their entire service life.

- Cost-Effectiveness: Managing operational expenses through efficient maintenance and repair strategies.

Commitment to National and Global Security

Hanwha Systems’ dedication to national and global security is evident through its advanced defense technologies. These solutions are crucial for protecting critical infrastructure and maintaining a competitive edge in an increasingly complex threat landscape.

The company actively collaborates with allied nations, enhancing collective defense capabilities and contributing to international stability. For instance, Hanwha Systems’ participation in joint defense exercises and technology sharing initiatives underscores this commitment.

- Robust Defense Technologies: Providing advanced systems for national defense.

- Evolving Threat Mitigation: Developing solutions to counter modern security challenges.

- Critical Infrastructure Protection: Safeguarding essential assets and systems.

- International Collaboration: Strengthening collective security through partnerships with allied nations.

Hanwha Systems provides advanced defense electronics and C4I solutions, enhancing military operational effectiveness and decision-making speed. Their IT services drive digital transformation for businesses, optimizing operations and ensuring data security.

The company also offers comprehensive lifecycle support, including ILS and MRO, guaranteeing long-term functionality and cost-efficiency for defense platforms.

Hanwha Systems' commitment to national security is demonstrated through its cutting-edge defense technologies and international collaborations, crucial for protecting critical infrastructure and mitigating evolving threats.

| Value Proposition | Description | Example/Data Point |

|---|---|---|

| Defense Electronics & C4I | Enhancing military situational awareness and decision-making. | ₩1.2 trillion (approx. $900 million USD) contract for C4I systems in 2023. |

| IT Services for Digital Transformation | Optimizing industrial and commercial operations with smart factory and cloud solutions. | Focus on streamlining production processes through smart factory implementations in 2024. |

| Lifecycle Support (ILS & MRO) | Ensuring sustained operational capability and cost-efficiency for defense assets. | Aiming for a 15% reduction in critical component turnaround times by 2024 through enhanced MRO. |

| National & Global Security Solutions | Protecting critical infrastructure and strengthening collective defense through advanced technologies. | Active participation in joint defense exercises and technology sharing initiatives. |

Customer Relationships

Hanwha Systems fosters enduring strategic alliances with governments worldwide, particularly within the defense sector. These collaborations are anchored in a proven track record of delivering dependable, high-quality solutions that meet stringent security requirements. For instance, in 2024, Hanwha Systems secured significant contracts with multiple nations for advanced radar systems, demonstrating the depth of trust and commitment in these governmental partnerships.

Hanwha Systems prioritizes its key clients through dedicated account management and technical support teams. This personalized approach ensures swift problem-solving and clear communication about project status and system efficiency, fostering strong customer bonds and satisfaction.

Hanwha Systems actively partners with clients on a collaborative development path, enabling the co-creation of defense solutions tailored to specific needs. This ensures that systems are optimized for unique operational contexts and evolving security challenges. For instance, in 2024, Hanwha Systems continued its focus on adapting its advanced radar and electronic warfare technologies based on direct customer feedback, enhancing their relevance and effectiveness in diverse military applications.

Post-Delivery Service and Sustainment

Hanwha Systems prioritizes post-delivery service and sustainment, offering robust maintenance, repair, and overhaul (MRO) agreements. This dedication ensures the long-term operational effectiveness and longevity of their complex systems, particularly vital for high-value defense assets. For instance, in 2024, Hanwha Systems continued to secure significant MRO contracts, reflecting the critical need for ongoing support in the defense sector.

- Maximizing Asset Value: Long-term sustainment services are essential for defense clients to get the most out of their substantial investments in advanced systems.

- Operational Readiness: Consistent maintenance and repair by Hanwha Systems directly contribute to maintaining high levels of operational readiness for critical defense platforms.

- Customer Loyalty: A strong post-delivery support network fosters trust and encourages repeat business, reinforcing customer relationships.

- Revenue Stream Diversification: MRO services provide a stable and recurring revenue stream, complementing initial system sales.

Investor Relations and Transparency

Hanwha Systems prioritizes open dialogue with its investors, holding frequent investor relations events and earnings presentations. This dedication to clarity ensures stakeholders have access to thorough financial information, fostering a strong foundation of trust. For example, in the first quarter of 2024, Hanwha Systems reported a notable increase in its defense sector revenue, highlighting successful project execution.

The company's commitment extends to detailed financial disclosures, empowering financially-literate decision-makers with the data needed for informed analysis. These disclosures are crucial for understanding the company's trajectory, especially as Hanwha Systems continues to invest heavily in advanced technologies like AI and space exploration.

- Regular Investor Relations Events: Hanwha Systems conducts quarterly earnings calls and investor conferences to discuss performance and future plans.

- Transparent Financial Disclosures: Detailed financial reports are readily available, providing in-depth insights into revenue streams and operational efficiency.

- Strategic Outlook Updates: Investors receive consistent updates on the company's strategic direction, including its expansion into new markets and technological advancements.

Hanwha Systems cultivates deep, collaborative relationships with its government clients, particularly in defense, built on trust and a history of delivering reliable, high-quality solutions. This is exemplified by significant contract wins in 2024 for advanced radar systems, underscoring the robust nature of these partnerships.

The company also prioritizes key clients through dedicated account management and technical support, ensuring prompt issue resolution and clear communication, which fosters significant customer satisfaction and loyalty.

Furthermore, Hanwha Systems engages in co-development with clients, tailoring defense solutions to specific operational needs and evolving security landscapes. This collaborative approach, evident in 2024's focus on adapting radar and EW technologies based on direct feedback, enhances system relevance and effectiveness.

Hanwha Systems ensures long-term system viability through comprehensive post-delivery support, including maintenance, repair, and overhaul (MRO) services. This commitment is crucial for high-value defense assets, as demonstrated by the continued securing of MRO contracts in 2024.

Channels

Hanwha Systems primarily secures its defense business through direct contracts with government and military entities, both within South Korea and across global markets. These agreements are often the result of competitive bidding or direct negotiations for substantial defense system procurements.

The company's robust technological expertise and established track record are crucial for winning these high-stakes, large-scale defense projects. For instance, in 2024, Hanwha Systems continued to play a vital role in South Korea's defense modernization efforts, securing significant contracts for advanced surveillance and communication systems.

Hanwha Systems leverages major international defense exhibitions like IDEX (International Defence Exhibition & Conference) and WDS (World Defense Show) as key channels. In 2023, IDEX reported over 1,300 exhibitors and significant deal announcements, highlighting the scale of these platforms for showcasing advanced defense solutions.

These trade fairs are critical for Hanwha Systems to demonstrate its technological prowess, including its capabilities in areas like intelligent combat systems and advanced communication platforms. The company uses these events to directly engage with a global clientele, fostering relationships that can lead to substantial international sales contracts.

Participation in these high-profile events is instrumental for Hanwha Systems’ global market penetration strategy. It significantly boosts brand visibility and establishes the company as a key player in the international defense sector, facilitating brand recognition and trust among potential partners and buyers.

Hanwha Systems leverages its strategic partnership networks as a crucial channel for market access and joint business development. By collaborating with industry leaders like Northrop Grumman, the company gains entry into complex projects and markets that might otherwise be out of reach.

These alliances are vital for expanding the scope of Hanwha Systems' offerings and fostering innovation. For instance, their partnership with Northrop Grumman on defense systems allows for the integration of advanced technologies, enhancing capabilities and market competitiveness.

Direct Sales and Consulting for ICT Clients

Hanwha Systems leverages direct sales and consulting to serve its Information and Communication Technology (ICT) clients, primarily industrial and commercial enterprises. This hands-on approach allows them to deeply understand each client's unique digital transformation journey and craft bespoke IT solutions. The focus is on building strong relationships and delivering precisely what each business needs to thrive in the digital landscape.

This direct engagement model is crucial for addressing complex client requirements. For instance, in 2024, Hanwha Systems reported significant growth in its ICT sector, driven by major digital transformation projects for large corporations. Their ability to offer tailored consulting ensures that clients receive not just technology, but strategic guidance for integrating new systems effectively.

- Direct Sales Teams: Dedicated teams for in-depth client engagement and solution presentation.

- Consulting Approach: Understanding client-specific digital transformation needs to offer tailored IT solutions.

- Customized Service Delivery: Ensuring solutions are precisely matched to business objectives.

- Client Relationship Focus: Building long-term partnerships through personalized support and expertise.

Acquired Entities and Subsidiaries

Hanwha Systems leverages strategic acquisitions to directly enter new markets and broaden its service offerings. A prime example is the acquisition of the Philly Shipyard, now operating as Hanwha Philly Shipyard. This move was instrumental in expanding Hanwha Ocean's footprint in the North American shipbuilding sector.

These acquired entities are crucial as they bring pre-existing infrastructure, established market positions, and ready customer relationships. This accelerates Hanwha Systems' growth trajectory and diversifies its business operations more efficiently than organic expansion alone.

The acquisition strategy allows for rapid market penetration and diversification. For instance, Hanwha Ocean's acquisition of Philly Shipyard in 2022, for approximately $100 million, provided immediate access to a skilled workforce and significant shipbuilding capacity in the United States, a key strategic market.

- Acquisitions for Market Expansion Hanwha Systems utilizes acquisitions like Hanwha Philly Shipyard to gain immediate access to new geographical markets and customer segments.

- Leveraging Existing Infrastructure Acquired entities provide established operational infrastructure and a ready market presence, reducing the time and cost of market entry.

- Diversification of Services Through acquisitions, Hanwha Systems can quickly diversify its service portfolio, integrating new capabilities and expertise into its existing business model.

- Accelerated Growth Strategy This approach enables faster business growth and market share capture compared to building capabilities from the ground up.

Hanwha Systems employs a multi-faceted channel strategy. For its defense sector, direct government contracts and participation in major international defense exhibitions like IDEX are paramount for showcasing advanced technologies and securing large-scale procurements.

In the ICT realm, the company relies on direct sales and consulting, fostering deep client relationships to deliver tailored digital transformation solutions. This approach emphasizes understanding specific business needs to provide customized IT services.

Strategic acquisitions serve as a critical channel for market expansion and service diversification, as seen with the acquisition of Philly Shipyard, which provided immediate access to the North American shipbuilding market.

| Channel | Defense Sector Focus | ICT Sector Focus | Acquisition Example |

|---|---|---|---|

| Direct Contracts/Sales | Government & Military Procurement | Industrial & Commercial Enterprises | N/A |

| International Exhibitions | Showcasing Advanced Systems (e.g., IDEX) | N/A | N/A |

| Partnerships | Joint Project Development | N/A | N/A |

| Acquisitions | N/A | N/A | Hanwha Philly Shipyard (2022) |

Customer Segments

Hanwha Systems' domestic military and defense forces segment, primarily the Republic of Korea Armed Forces and its associated agencies, represents a core customer base. This segment relies on Hanwha Systems for advanced Command, Control, Communications, Computers, and Intelligence (C4I) systems, alongside vital surveillance, reconnaissance, and electronic warfare equipment.

The company provides integrated defense solutions tailored for land, maritime, and air operations. In 2023, Hanwha Systems secured significant contracts, including a notable deal for the next-generation Korean destroyer's combat system, underscoring the ongoing demand for its sophisticated defense technologies within the domestic market.

International governments and allied militaries represent a burgeoning customer base for Hanwha Systems, driven by a global demand for sophisticated defense technologies. The company's success in securing substantial export contracts for its radar and fire control systems, particularly in the Middle East and Europe, underscores this segment's importance.

In 2023, Hanwha Systems reported significant growth in its defense sector, with export sales playing a crucial role. This diversification into international markets is a primary engine for the company's expansion, allowing it to leverage its technological prowess beyond its domestic base.

Hanwha Systems serves the Aerospace and Aviation Industry by providing advanced avionics and integrated systems. Key customers include major manufacturers like Korea Aerospace Industries (KAI), who incorporate Hanwha's technology into their aircraft, from commercial planes to sophisticated fighter jets.

The company's contribution is vital for the development of next-generation aviation platforms, supplying essential components that enhance aircraft performance and capabilities. This segment represents a highly specialized, technology-driven customer base with stringent requirements.

In 2024, the global aerospace market was projected to reach over $900 billion, highlighting the significant demand for advanced technologies that Hanwha Systems provides. Their role in supplying fighter jet components underscores their position in a high-value, defense-focused niche within this expansive industry.

Industrial and Commercial Enterprises

Hanwha Systems' ICT division actively partners with industrial and commercial enterprises, offering solutions that drive digital transformation. These businesses, spanning manufacturing, logistics, and beyond, are looking to leverage technology to boost efficiency and gain a competitive edge. For instance, Hanwha Systems delivered a smart factory solution to a major automotive manufacturer in 2023, reportedly increasing production line efficiency by 15%.

The company provides specialized IT services and smart factory implementations tailored to the unique operational demands of each sector. This focus on customization ensures that clients receive technology that directly addresses their challenges. In 2024, Hanwha Systems secured a significant contract to upgrade the IT infrastructure for a large retail chain, aiming to enhance their supply chain visibility and customer experience.

- Digital Transformation: Enabling businesses to adopt new technologies for improved processes.

- Smart Factory Solutions: Implementing IoT, AI, and automation for optimized manufacturing.

- Enterprise IT Services: Providing cloud, cybersecurity, and data management for large organizations.

- Sector-Specific Customization: Tailoring technology offerings to diverse industrial and commercial needs.

Naval and Shipbuilding Sector

The Naval and Shipbuilding Sector encompasses shipyards, naval forces, and maritime defense organizations. Hanwha Systems is strategically targeting this specialized, high-value market. This focus is underscored by their acquisition of Philly Shipyard, which significantly enhances their capacity to deliver maritime systems and MRO (Maintenance, Repair, and Overhaul) services for naval vessels, including those operated by the U.S. Navy.

This expansion positions Hanwha Systems to capitalize on the growing global demand for advanced naval capabilities and sustainment. For instance, the U.S. Navy's shipbuilding and repair budget for fiscal year 2024 includes substantial investments in new vessel construction and modernization efforts, presenting a significant opportunity for Hanwha Systems.

- Target Market: Shipyards, naval forces, and maritime defense organizations globally.

- Strategic Acquisition: Philly Shipyard acquisition strengthens Hanwha Systems' presence in the U.S. naval market.

- Service Offerings: Provision of advanced maritime systems and comprehensive MRO services for naval vessels.

- Market Opportunity: Leveraging increased defense spending and demand for modern naval assets.

Hanwha Systems' customer base is diverse, spanning critical sectors like defense, aerospace, and information and communication technology (ICT). The company's primary domestic client remains the Republic of Korea Armed Forces, which relies on Hanwha for advanced C4I systems and surveillance equipment. Internationally, governments and allied militaries are increasingly important, with significant export contracts in radar and fire control systems.

In the aerospace sector, Hanwha Systems is a key supplier to manufacturers like Korea Aerospace Industries (KAI), providing essential avionics for both commercial and military aircraft. The ICT division focuses on industrial and commercial enterprises, offering digital transformation solutions and smart factory implementations. Hanwha's strategic expansion into the naval and shipbuilding sector, notably through the acquisition of Philly Shipyard, targets global naval forces and defense organizations, capitalizing on increased defense spending.

| Customer Segment | Key Offerings | 2023/2024 Data Points |

|---|---|---|

| Domestic Military & Defense | C4I systems, surveillance, reconnaissance, EW equipment | Secured combat system contract for next-gen Korean destroyer (2023) |

| International Governments | Radar and fire control systems | Significant export contracts in Middle East and Europe (2023) |

| Aerospace & Aviation | Avionics, integrated systems for aircraft | Supplied components for fighter jets; global aerospace market projected >$900B (2024) |

| Industrial & Commercial (ICT) | Digital transformation, smart factory solutions, enterprise IT | Delivered smart factory solution to automotive manufacturer (2023); IT infrastructure upgrade for retail chain (2024) |

| Naval & Shipbuilding | Maritime systems, MRO services | Acquired Philly Shipyard; U.S. Navy shipbuilding budget significant (FY2024) |

Cost Structure

Hanwha Systems dedicates a substantial portion of its financial resources to intensive research and development (R&D). This commitment fuels the creation of advanced defense electronics and sophisticated ICT solutions, positioning the company at the forefront of technological innovation.

In 2024, Hanwha Systems continued its significant R&D investment, particularly in emerging sectors. For instance, their focus on Urban Air Mobility (UAM) and satellite communication highlights a strategic allocation of capital towards future growth engines, aiming to secure a competitive edge in these rapidly evolving markets.

Manufacturing and production expenses represent a significant portion of Hanwha Systems' cost structure. These costs include the procurement of raw materials, essential components, and the specialized machinery required for producing advanced defense systems such as radar, C4I units, and fire control systems.

For instance, the defense industry, in general, sees substantial investment in capital equipment and skilled labor. Hanwha Systems likely leverages economies of scale and robust supply chain management to optimize these production costs, aiming for efficiency in delivering complex technological solutions.

Hanwha Systems invests heavily in its highly skilled workforce, recognizing that top talent is the bedrock of innovation in defense electronics and ICT. These costs encompass competitive salaries, comprehensive benefits packages, and ongoing training for engineers, scientists, and specialized technicians. For instance, in 2023, the company's R&D expenditure, largely driven by human capital, reached approximately 580 billion KRW, underscoring the significant financial commitment to its intellectual assets.

Sales, Marketing, and Global Expansion Costs

Hanwha Systems allocates substantial resources to its Sales, Marketing, and Global Expansion efforts. These expenditures are critical for building brand presence and driving revenue growth in international defense markets. For instance, participation in major global defense exhibitions, such as Eurosatory or IDEX, represents a significant investment in showcasing their advanced capabilities and networking with potential clients and partners.

The company's strategy involves establishing overseas offices and support centers to better serve regional customers and navigate local market dynamics. This physical presence is crucial for securing complex export contracts, which often require extensive negotiation and localized support. These investments directly fuel the expansion of market reach and bolster international sales figures.

- Global Defense Exhibitions: Hanwha Systems actively participates in key international defense trade shows to promote its products and technologies, such as the biennial Eurosatory defense exhibition in Paris.

- Overseas Office Establishment: The company invests in setting up and maintaining regional offices and subsidiaries to facilitate market access and customer support in strategic international locations.

- Export Contract Acquisition: Significant resources are dedicated to the business development and sales processes required to win large-scale export contracts, which are vital for revenue generation.

- Market Entry Investments: Strategic market entry initiatives, including market research, localization efforts, and building local partnerships, demand considerable upfront financial commitment.

Strategic Acquisition and Initial Investment Costs

Hanwha Systems' strategic growth often involves significant upfront capital outlays. For instance, the acquisition of Philly Shipyard in late 2024 represented a substantial initial investment, encompassing the purchase price and projected costs for facility modernization and operational integration. This type of strategic move, while vital for expanding capabilities and market reach, directly influences the company's cost structure.

These initial investments, though essential for future revenue streams, can create short-term financial pressures. The impact is evident in financial reporting, such as the Q2 2025 operating profit decline, which was partly attributed to these integration and upgrade expenses. Managing these costs effectively is key to balancing immediate financial performance with long-term strategic objectives.

- Acquisition Costs: Direct expenses related to purchasing new businesses or assets.

- Integration Expenses: Costs associated with merging acquired entities, including IT systems and personnel.

- Capital Expenditures: Investments in upgrading or expanding facilities and equipment post-acquisition.

- Impact on Profitability: Short-term reduction in operating profit due to these significant upfront investments.

Hanwha Systems' cost structure is heavily influenced by its substantial investments in research and development, particularly in cutting-edge defense electronics and ICT solutions. Manufacturing and production expenses, including raw materials and specialized machinery, also form a significant part of their outlays. Furthermore, the company invests considerably in its highly skilled workforce, offering competitive compensation and benefits to attract and retain top talent, as evidenced by their R&D expenditure in 2023.

Sales, marketing, and global expansion efforts are crucial cost drivers, with significant spending on international defense exhibitions and establishing overseas offices. Strategic acquisitions, such as Philly Shipyard in late 2024, represent substantial upfront capital outlays that impact the company's financial performance in the short term.

| Cost Category | Key Components | 2024/2023 Data/Examples |

| Research & Development | New technology development, innovation | ~580 billion KRW R&D expenditure (2023) |

| Manufacturing & Production | Raw materials, components, machinery | Procurement for radar, C4I systems |

| Human Capital | Salaries, benefits, training for skilled staff | Investment in engineers, scientists |

| Sales, Marketing & Expansion | Exhibitions, overseas offices, market entry | Participation in Eurosatory, IDEX |

| Strategic Investments | Acquisitions, facility upgrades | Acquisition of Philly Shipyard (late 2024) |

Revenue Streams

Hanwha Systems' core revenue generation stems from selling sophisticated defense electronics and complete systems to military and governmental bodies. This encompasses significant deals for C4I systems, crucial for command, control, communications, computers, and intelligence operations, alongside surveillance, reconnaissance, and advanced electronic warfare solutions.

The company also generates substantial income from its radar systems, which are integral to modern defense capabilities. Hanwha Systems achieved a notable milestone by securing record defense contracts in the fourth quarter of 2024, underscoring the strong demand for its specialized products.

International export revenue is a rapidly expanding and crucial element for Hanwha Systems. The company's advanced defense systems, such as its multi-function radars and fire control systems, have seen significant success in global markets, notably in the Middle East and Europe. This international demand is a testament to the quality and competitiveness of Hanwha's offerings.

Looking ahead, export sales are anticipated to represent a substantial portion of Hanwha Systems' overall revenue by 2025. This strategic focus on international markets demonstrates the company's ambition to diversify its revenue streams and solidify its position as a global defense contractor. For instance, in 2024, export contracts are expected to contribute over 30% of the total revenue, a figure projected to climb further in the coming year.

Hanwha Systems generates revenue through a broad spectrum of IT services catering to both industrial and commercial clients. These fees stem from crucial areas like digital transformation consulting, which helps businesses modernize their operations, and the implementation of advanced smart factory solutions designed to boost efficiency and productivity.

Ongoing enterprise IT services, including system maintenance, support, and upgrades, also form a significant part of this revenue. This diversified income stream from IT services acts as a strong complement to Hanwha Systems' foundational defense business, offering stability and growth opportunities across different market segments.

For instance, in 2023, Hanwha Systems reported significant growth in its IT division, with revenues from its digital transformation and smart factory initiatives contributing substantially to its overall financial performance, demonstrating the increasing importance of these service fees.

Logistics Support and MRO Service Fees

Hanwha Systems generates recurring revenue through integrated logistics support (ILS) and maintenance, repair, and overhaul (MRO) contracts. These long-term service agreements are crucial for ensuring the operational readiness of defense systems and naval vessels, providing a stable and predictable income stream. For instance, in 2023, Hanwha Systems secured a significant contract for the maintenance and support of naval vessels, underscoring the importance of these revenue streams.

These service fees are vital for the company's financial stability, offering a consistent revenue base that complements its product sales. The ongoing nature of these contracts means Hanwha Systems benefits from repeat business and strengthens its relationships with defense clients.

- Recurring Revenue: Driven by ILS and MRO contracts for defense systems and naval vessels.

- Operational Readiness: Services ensure long-term functionality and support for key assets.

- Stable Income: Long-term service agreements provide predictable revenue.

- Client Relationships: Ongoing support fosters strong, lasting partnerships.

Future Technology and New Business Ventures

Hanwha Systems is actively cultivating future revenue streams through significant investments in emerging technologies and new business ventures. A prime example is their push into urban air mobility (UAM), a sector poised for substantial growth. The company is also developing advanced satellite communication solutions, aiming to capture a significant share of this expanding market.

These strategic initiatives are designed to create entirely new market opportunities and build a more diversified income base for Hanwha Systems over the long term. For instance, their work on small Synthetic Aperture Radar (SAR) satellites and electronically steerable antennas is a testament to this forward-looking approach.

- Urban Air Mobility (UAM): Hanwha Systems is investing in the development of UAM infrastructure and aircraft, anticipating future demand for advanced aerial transportation.

- Satellite Communications: The company is expanding its capabilities in satellite technology, including the development of small SAR satellites and electronically steerable antennas, to offer advanced communication services.

- Diversification Strategy: These ventures are part of a broader strategy to reduce reliance on existing business areas and tap into high-growth potential markets.

Hanwha Systems' revenue is primarily driven by its defense electronics and systems, with significant contributions from C4I, surveillance, and electronic warfare solutions. The company also earns substantial income from its advanced radar systems, a sector that saw record contract wins in late 2024.

International exports represent a growing segment, with Middle Eastern and European markets showing strong demand for Hanwha's multi-function radars and fire control systems. By 2025, export sales are projected to exceed 30% of total revenue, highlighting a strategic global expansion.

The IT services division, including digital transformation consulting and smart factory solutions, provides a diversified income stream. This sector experienced notable revenue growth in 2023, complementing the core defense business.

Recurring revenue is secured through long-term Integrated Logistics Support (ILS) and Maintenance, Repair, and Overhaul (MRO) contracts for defense systems and naval vessels, ensuring stable financial performance. These service agreements are crucial for maintaining operational readiness and client relationships.

Emerging revenue streams are being cultivated through investments in Urban Air Mobility (UAM) and advanced satellite communications, including small SAR satellites and electronically steerable antennas, positioning Hanwha Systems for future market growth.

| Revenue Segment | Key Offerings | 2024 Outlook/Notes |

| Defense Electronics & Systems | C4I, Surveillance, EW, Radar | Record Q4 2024 contract wins; strong demand |

| International Exports | Radars, Fire Control Systems | Projected >30% of revenue in 2024; growth in ME & Europe |

| IT Services | Digital Transformation, Smart Factories | Significant growth in 2023; stable complement to defense |

| Recurring Services | ILS, MRO for Defense & Naval | Provides stable, predictable income; enhances client relationships |

| Emerging Technologies | UAM, Satellite Communications | Strategic investments for future growth |

Business Model Canvas Data Sources

The Hanwha Systems Business Model Canvas is informed by a blend of internal financial reports, market intelligence gathered from industry analysis, and strategic insights derived from competitive benchmarking. This triangulation ensures a robust and data-driven foundation for each element of the canvas.