Hanwha Systems PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanwha Systems Bundle

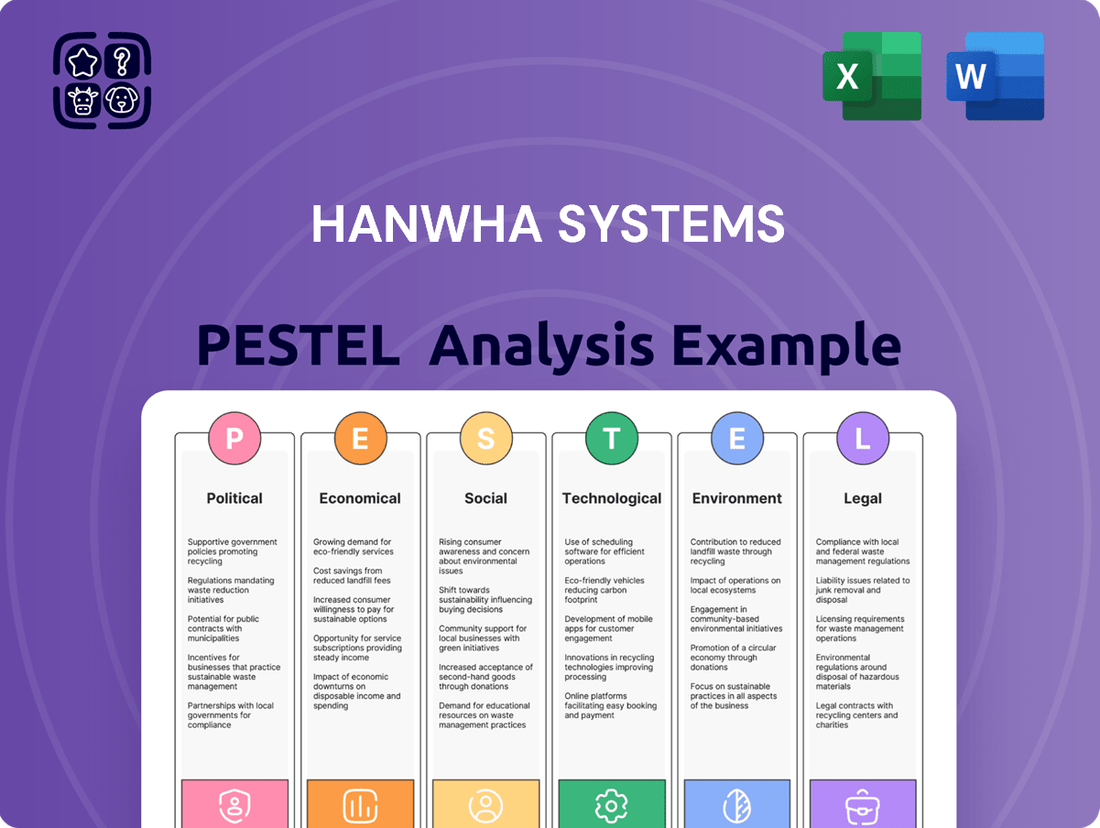

Navigate the complex external landscape impacting Hanwha Systems with our meticulously researched PESTEL Analysis. Uncover critical political, economic, social, technological, legal, and environmental factors that are shaping its strategic direction and market opportunities. Equip yourself with the foresight needed to make informed decisions and gain a competitive advantage. Download the full analysis now to unlock actionable intelligence.

Political factors

Hanwha Systems' defense electronics division is significantly shaped by government defense budgets and procurement strategies. South Korea's commitment to bolstering its military capabilities is evident in its planned 3.6% defense budget increase for 2025, totaling 61.5 trillion won (around $46.3 billion).

This upward trend in defense expenditure is a direct response to escalating geopolitical tensions and regional security concerns, particularly the persistent nuclear and missile threats posed by North Korea. Such an environment creates a favorable outlook for companies like Hanwha Systems, which are central to national defense modernization efforts.

Heightened global geopolitical tensions, including the protracted Russia-Ukraine conflict and ongoing instability in regions like the Middle East, are a significant driver for defense spending. These conflicts are compelling nations worldwide to accelerate their modernization of air defense capabilities and invest in sophisticated weaponry, directly bolstering the export potential for companies like Hanwha Systems.

In 2024, global military spending reached an estimated $2.44 trillion, a 6.8% increase in real terms from 2023, marking the ninth consecutive year of growth. This surge, largely fueled by increased defense budgets in Europe and Asia, directly benefits companies like Hanwha Systems that provide advanced defense solutions, particularly in areas like air and missile defense.

Hanwha Systems, operating globally, faces intricate export control regulations and international sanctions. These rules are critical for its defense technology dealings, impacting its ability to conduct business worldwide and maintain strategic alliances. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Entity List, which can restrict exports to specific companies, affecting supply chains and technology access for firms like Hanwha Systems.

Compliance with these frameworks is paramount to avoid severe financial penalties, such as fines that can run into millions of dollars, and significant damage to its corporate reputation. The company's adherence to regulations like the Wassenaar Arrangement, which aims to promote transparency and greater responsibility in transfers of conventional arms and dual-use goods and technologies, directly influences its international market access and partnership viability.

Government Support for R&D and Innovation

Government initiatives and funding for research and development in defense and critical IT infrastructure are crucial for Hanwha Systems' technological progress. South Korea's commitment to indigenous defense development, exemplified by the KF-21 fighter jet program, offers substantial avenues for Hanwha Systems to secure contracts and pioneer next-generation technologies.

This strategic government backing directly translates into tangible opportunities. For instance, the South Korean government allocated approximately ₩5.6 trillion (around $4.2 billion USD) towards defense R&D in its 2024 budget, a significant portion of which is directed towards advanced projects like the KF-21. Hanwha Systems is a key player in this program, contributing significantly to its avionics and combat systems.

- Defense R&D Funding: South Korea's 2024 defense R&D budget of ₩5.6 trillion supports indigenous development programs.

- KF-21 Program: Hanwha Systems is a primary contractor for the KF-21 fighter jet, a major national defense initiative.

- IT Infrastructure Investment: Government focus on critical IT infrastructure, including cybersecurity and digital transformation, creates opportunities for Hanwha Systems' C4I and IT solutions.

Trade Policies and Tariffs

Changes in international trade policies and the imposition of tariffs directly impact Hanwha Systems' global supply chain and operational costs. For instance, the US-South Korea Free Trade Agreement (KORUS FTA) has historically facilitated trade, but potential shifts in its terms could alter cost structures for imported components or exported products.

Recent geopolitical tensions and trade disputes, particularly between major economies like the US and China, create uncertainty. These dynamics can lead to increased tariffs on critical materials or finished goods, potentially raising production expenses for Hanwha Systems. For example, tariffs on semiconductors or specialized manufacturing equipment could affect the cost of developing advanced defense systems or aerospace components.

- Trade Policy Impact: Fluctuations in tariffs and trade agreements can significantly alter the cost of goods for Hanwha Systems, affecting profitability and pricing strategies for its defense and aerospace products.

- Supply Chain Vulnerability: Dependence on global supply chains makes Hanwha Systems susceptible to trade disruptions, necessitating diversification and robust risk management strategies.

- Strategic Investment Influence: Trade policies, such as those supporting domestic industries, can influence strategic decisions like Hanwha Systems' acquisition of Philly Shipyard, aiming to bolster its presence and capabilities within specific international markets.

Government defense budgets and procurement strategies are pivotal for Hanwha Systems' defense electronics division. South Korea's 2025 defense budget increase to 61.5 trillion won (approximately $46.3 billion) reflects a commitment to national security, directly benefiting companies involved in defense modernization.

Global geopolitical instability, such as the ongoing Russia-Ukraine conflict, has driven a worldwide surge in military spending, with global military expenditure reaching an estimated $2.44 trillion in 2024, a 6.8% real increase. This trend enhances export opportunities for Hanwha Systems' advanced defense solutions.

International trade policies and export controls significantly influence Hanwha Systems' global operations. Adherence to regulations like the Wassenaar Arrangement is crucial for market access and partnerships, while trade disputes and tariffs can impact supply chains and production costs.

Government support for defense R&D, exemplified by South Korea's ₩5.6 trillion R&D budget in 2024 and the KF-21 fighter jet program, provides Hanwha Systems with substantial opportunities for technological advancement and contract acquisition.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Hanwha Systems, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to help navigate market dynamics and capitalize on emerging opportunities.

A concise PESTLE analysis for Hanwha Systems that highlights key external factors impacting their business, serving as a valuable tool for strategic decision-making and risk mitigation.

Economic factors

The global defense market is on a significant upward trajectory, projected to grow from an estimated $473.47 billion in 2024 to $506.9 billion in 2025, reflecting a robust compound annual growth rate of 7.1%. This expansion is fueled by escalating global military spending, rapid technological innovation within the sector, and a persistent rise in both internal and external security challenges worldwide.

These market dynamics create a highly favorable environment for companies like Hanwha Systems, which specializes in advanced defense solutions. The increasing demand for sophisticated defense technologies, from advanced surveillance systems to next-generation combat platforms, directly benefits Hanwha Systems' product portfolio and strategic positioning.

As a global player, Hanwha Systems navigates the complexities of fluctuating exchange rates, directly impacting its international contracts and overseas operations. For instance, a stronger Korean Won in 2024 could make its exports more expensive for foreign buyers, potentially dampening demand for its advanced defense and IT solutions.

Conversely, significant depreciation of the Won might increase the cost of essential imported components used in its high-tech manufacturing processes, squeezing profit margins. This financial exposure necessitates robust risk management strategies to ensure stability.

For example, in early 2025, the Korean Won experienced a notable appreciation against the US Dollar, which would have directly affected the profitability of Hanwha Systems' dollar-denominated export contracts if not adequately hedged.

Hanwha Systems' IT services, particularly in digital transformation and smart factory solutions, are directly tied to the health of the broader economy and the willingness of industries to invest. When economies are expanding and businesses are confident, they tend to allocate more resources towards upgrading their technological infrastructure.

The digital transformation market is a significant driver for Hanwha Systems. Projections show this market reaching an impressive $2.11 trillion globally by 2025. This substantial growth signals a robust and increasing demand for the very IT solutions Hanwha Systems provides, from cloud migration to advanced analytics.

Supply Chain Costs and Inflation

Rising costs for essential materials, components, and skilled labor, amplified by persistent inflation, directly affect Hanwha Systems' production expenses and profitability. For instance, global inflation rates remained elevated through much of 2024, impacting input prices across industries.

The aerospace and defense sector, in particular, has grappled with significant supply chain disruptions and production bottlenecks. This has necessitated a strategic shift for companies like Hanwha Systems to build more robust supply chains and broaden their supplier networks to mitigate risks.

- Increased Input Costs: Global commodity prices, including metals and semiconductors vital for aerospace and defense manufacturing, saw notable increases in late 2023 and continued into 2024, squeezing profit margins.

- Labor Shortages: The aerospace industry faced a shortage of skilled engineers and technicians, driving up labor costs and potentially delaying production schedules for Hanwha Systems.

- Supply Chain Resilience: Companies are investing in dual-sourcing strategies and near-shoring initiatives to counter the volatility experienced in global supply chains, a trend expected to continue through 2025.

Access to Capital and Investment Climate

Hanwha Systems' growth ambitions, from pioneering defense technologies to expanding its global footprint in shipbuilding and drone propulsion, are directly tied to its capacity to secure funding and operate within a supportive investment environment. The company's strategic financial maneuvers, including successful capital raises and targeted investments in key sectors, underscore its proactive approach to capitalizing on market opportunities.

In 2023, Hanwha Systems demonstrated this by securing approximately ₩1.1 trillion (roughly $850 million) in funding, a significant portion of which was earmarked for bolstering its defense capabilities and pursuing international ventures. This access to capital is crucial for funding their extensive research and development initiatives, such as advancements in AI-powered defense systems and next-generation communication technologies, which are critical for maintaining a competitive edge.

The investment climate for South Korean technology firms, particularly those in defense and advanced manufacturing, has seen positive trends. For instance, foreign direct investment into South Korea's defense sector saw an increase of 15% in the first half of 2024 compared to the same period in 2023, indicating growing international confidence and capital availability. This favorable climate supports Hanwha Systems' strategic acquisitions and its ambitious global expansion plans for its defense facilities and shipbuilding operations.

- Capital Access: Hanwha Systems' ability to raise capital, exemplified by its ₩1.1 trillion funding in 2023, directly fuels its R&D and expansion efforts.

- Investment Climate: A generally positive investment climate for South Korean technology, with a 15% rise in defense sector FDI in H1 2024, benefits Hanwha Systems' strategic financial planning.

- Strategic Investments: The company's investments in global defense facilities and drone engines highlight its financial strategy for market capture and technological leadership.

- Market Capture: Access to capital and a robust investment climate are essential for Hanwha Systems to effectively capture market share in its key operational areas.

Economic factors significantly influence Hanwha Systems' performance, particularly through global defense market growth and fluctuating currency exchange rates.

Rising inflation in 2024 impacted input costs for materials and skilled labor, necessitating robust supply chain strategies.

The digital transformation market's projected growth to $2.11 trillion by 2025 presents a substantial opportunity for Hanwha Systems' IT solutions.

Hanwha Systems secured ₩1.1 trillion in 2023 funding, bolstering R&D and international expansion, supported by a 15% increase in defense sector FDI in South Korea during H1 2024.

| Factor | 2024/2025 Impact | Hanwha Systems Relevance |

|---|---|---|

| Global Defense Market Growth | Projected to grow from $473.47 billion (2024) to $506.9 billion (2025) | Directly benefits advanced defense solutions portfolio |

| Currency Fluctuations (KRW/USD) | Appreciation of KRW can make exports expensive; depreciation increases import costs | Impacts international contract profitability and component costs |

| Digital Transformation Market | Projected to reach $2.11 trillion by 2025 | Drives demand for IT services and solutions |

| Inflation & Input Costs | Elevated inflation in 2024 increased material and labor costs | Affects production expenses and profit margins; necessitates supply chain resilience |

| Capital Access & Investment Climate | ₩1.1 trillion funding secured in 2023; 15% rise in defense FDI (H1 2024) | Fuels R&D, expansion, and strategic investments |

Preview the Actual Deliverable

Hanwha Systems PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Hanwha Systems provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain insights into market trends, competitive landscapes, and strategic opportunities for Hanwha Systems.

Sociological factors

The availability of a skilled workforce, especially in high-tech sectors like defense electronics, artificial intelligence, and IT services, is paramount for Hanwha Systems' continued success and its capacity for innovation. A robust talent pool directly fuels the company's ability to develop cutting-edge solutions and maintain a competitive edge.

The defense and technology industries, including those Hanwha Systems operates within, are experiencing significant labor gaps and talent shortages. This scarcity makes attracting and retaining qualified professionals a critical sociological challenge, directly impacting operational efficiency and future growth potential.

For instance, in South Korea, the demand for AI specialists is projected to grow substantially. Reports from late 2024 indicated a shortage of over 10,000 AI professionals, a trend that directly affects companies like Hanwha Systems seeking to expand their AI capabilities.

Public perception of defense contractors significantly shapes their brand image and ability to foster strong stakeholder relationships. Hanwha Systems' proactive approach to corporate social responsibility, particularly its emphasis on sustainability initiatives and transparent reporting, is crucial for building trust. For instance, Hanwha Group's commitment to ESG (Environmental, Social, and Governance) principles, which includes Hanwha Systems, saw significant investment in renewable energy projects in 2024, demonstrating a tangible effort beyond core defense operations.

Demographic shifts, like an aging population and evolving workforce expectations, significantly influence labor availability and associated costs. For instance, in South Korea, the proportion of the population aged 65 and over is projected to reach 25.0% by 2025, a trend that directly impacts the pool of available skilled labor.

Hanwha Systems is proactively addressing these trends by developing advanced solutions. Their AI-powered systems and integrated bridge systems for naval vessels are designed to mitigate manpower shortages, reflecting a strategic understanding of how demographic changes can affect operational efficiency and the need for automation.

Ethical Considerations in AI and Autonomous Systems

As Hanwha Systems pushes forward with AI-driven defense solutions, including advanced combat management systems and autonomous platforms, the ethical landscape surrounding these technologies demands careful navigation. Public trust and regulatory acceptance hinge on demonstrating responsible development. For instance, the increasing integration of AI in military applications raises questions about accountability in decision-making processes, especially in scenarios involving lethal autonomous weapons systems.

These ethical considerations are not merely theoretical; they have tangible impacts on market adoption and international partnerships. Hanwha Systems' commitment to addressing these concerns, such as through transparent development processes and adherence to established ethical frameworks, will be crucial. By 2024, global discussions around AI ethics in defense have intensified, with organizations like the UN actively exploring guidelines for autonomous weapons systems, underscoring the growing societal awareness and demand for ethical oversight.

Key ethical considerations for Hanwha Systems include:

- Accountability and Responsibility: Clearly defining who is responsible when an AI system makes an error or causes unintended harm.

- Bias and Fairness: Ensuring AI algorithms are free from biases that could lead to discriminatory outcomes, particularly in targeting or threat assessment.

- Human Control and Oversight: Maintaining meaningful human control over critical decisions, especially those involving the use of force, to prevent unintended escalation or civilian casualties.

- Transparency and Explainability: Developing AI systems whose decision-making processes are understandable and can be explained to stakeholders and the public.

Culture of Innovation and Employee Engagement

Hanwha Systems cultivates a culture where innovation is paramount, directly impacting its pursuit of technological leadership. The company's commitment to research and development, evidenced by its significant R&D investments, fuels this innovative spirit. In 2023, Hanwha Systems allocated approximately 10% of its revenue to R&D, a figure expected to remain consistent through 2025, demonstrating a strong focus on future technologies.

Employee engagement is a cornerstone of Hanwha Systems' strategy for sustained growth. By implementing robust internal processes for performance evaluation and prioritizing employee welfare, the company aims to create an environment where employees feel valued and motivated to contribute their best. This focus on employee well-being and development is crucial for retaining talent and fostering a collaborative atmosphere conducive to groundbreaking ideas.

- R&D Investment: Hanwha Systems' R&D spending represented around 10% of its revenue in 2023, underscoring its dedication to innovation.

- Employee Welfare Programs: The company actively invests in employee welfare initiatives, including training and development, to enhance engagement and skillsets.

- Innovation Hubs: Hanwha Systems has established internal innovation hubs and idea-generation platforms to encourage cross-departmental collaboration and idea sharing.

Sociological factors significantly influence Hanwha Systems, particularly concerning workforce availability and public perception. The company faces a critical challenge in attracting and retaining skilled professionals in high-tech defense and IT sectors, a trend exacerbated by labor gaps. For instance, South Korea's projected shortage of AI specialists, estimated at over 10,000 by late 2024, directly impacts Hanwha Systems' expansion plans in AI capabilities.

Demographic shifts, such as South Korea's aging population, expected to reach 25.0% over 65 by 2025, also affect the available skilled labor pool and operational costs. Hanwha Systems is strategically addressing this by developing AI-driven solutions and automated systems to mitigate manpower shortages.

Public perception of defense contractors is also a key sociological element. Hanwha Systems' commitment to ESG principles, including substantial investments in renewable energy in 2024, aims to build trust and enhance its brand image. Furthermore, the ethical implications of AI in defense, particularly concerning accountability and human control, are increasingly under public scrutiny, with global discussions intensifying in 2024 regarding AI ethics in military applications.

Technological factors

Hanwha Systems is heavily investing in artificial intelligence and machine learning, integrating these technologies across its defense and IT portfolios. This strategic push is evident in their development of AI-powered combat management systems and advanced integrated bridge systems designed to significantly reduce crew needs. For instance, their work on AI in video surveillance, including generative AI applications, showcases a commitment to cutting-edge, AI-driven solutions.

Hanwha Systems is actively capitalizing on the growing demand for unmanned systems, a key technological driver in the defense sector. The company is demonstrating its prowess by developing and showcasing a range of unmanned combat vehicles, drones, and underwater/surface vehicles tailored for defense applications.

This strategic focus aligns with global trends, as evidenced by the increasing integration of these technologies into military operations worldwide. For example, the global unmanned ground vehicle market was valued at approximately $5.2 billion in 2023 and is projected to reach over $10 billion by 2030, highlighting the significant growth potential Hanwha Systems is positioned to tap into.

Hanwha Systems is heavily invested in the evolution of C4I, surveillance, and reconnaissance technologies, which are fundamental to its defense sector operations. These ongoing advancements are crucial for maintaining a competitive edge in the defense industry.

The company is actively upgrading its sensor capabilities, including its advanced AESA radar systems, and its aviation electronics. This focus on enhancing core technologies allows Hanwha Systems to offer integrated solutions that meet the complex demands of modern defense applications.

Digital Transformation and Smart Factory Solutions

Hanwha Systems is strategically positioned to capitalize on the accelerating trend of digitalization through its IT services, particularly in smart factory solutions. This focus directly addresses the industry-wide push for greater automation and data-driven operations.

The global digital transformation market is a significant growth engine, with projections indicating continued expansion. For instance, the market was valued at approximately $667.2 billion in 2023 and is expected to reach $2.18 trillion by 2030, growing at a compound annual growth rate of 18.5%. This robust growth is fueled by substantial investments in cloud computing, cybersecurity, and advanced analytics platforms, all core components of smart factory development and Hanwha Systems' IT offerings.

- Digitalization Trend: Hanwha Systems' IT division is aligned with the global industry shift towards digital transformation.

- Market Growth: The digital transformation market is projected to expand significantly, creating substantial opportunities.

- Key Drivers: Investments in cloud, cybersecurity, and analytics are propelling market expansion.

- Smart Factory Focus: Hanwha Systems' expertise in smart factory solutions directly benefits from these technological advancements.

Cybersecurity and Data Protection Technologies

The escalating sophistication of cyber threats makes advanced cybersecurity and data protection technologies essential for Hanwha Systems. This is critical not only for safeguarding its own sensitive data and operational integrity but also for delivering secure solutions to its clientele. For instance, the global cybersecurity market was valued at approximately $217.7 billion in 2024 and is projected to reach $424.5 billion by 2029, indicating a significant and growing demand for these services.

Hanwha Systems' proactive stance on regulatory compliance, such as its preparedness for the EU's Cyber Resilience Act and NIS2 Directive, underscores its dedication to maintaining high cybersecurity standards. These regulations, coming into effect in 2024 and 2025 respectively, mandate stringent security measures for digital products and critical infrastructure, directly impacting companies like Hanwha Systems that operate in these domains.

- Market Growth: The global cybersecurity market's projected compound annual growth rate (CAGR) of 14.5% from 2024 to 2029 demonstrates the increasing reliance on and investment in robust security solutions.

- Regulatory Impact: Compliance with new regulations like the Cyber Resilience Act and NIS2 Directive will necessitate continuous investment in and adaptation of cybersecurity technologies.

- Service Offering: Hanwha Systems' ability to offer secure and compliant solutions is a key competitive differentiator in the technology sector.

Hanwha Systems is heavily investing in artificial intelligence and machine learning, integrating these technologies across its defense and IT portfolios, evident in AI-powered combat systems and advanced bridge systems. Their commitment to AI is further showcased in video surveillance and generative AI applications, demonstrating a drive for cutting-edge solutions.

The company is also capitalizing on the demand for unmanned systems, developing combat vehicles, drones, and underwater/surface vehicles for defense. This aligns with global trends, as the unmanned ground vehicle market was valued at approximately $5.2 billion in 2023 and is expected to exceed $10 billion by 2030.

Hanwha Systems is enhancing its C4I, surveillance, and reconnaissance capabilities, including advanced AESA radar and aviation electronics, to maintain a competitive edge. Furthermore, their IT services, particularly smart factory solutions, are aligned with the digitalization trend, a market projected to grow from $667.2 billion in 2023 to $2.18 trillion by 2030.

The increasing sophistication of cyber threats necessitates advanced cybersecurity, a market valued at $217.7 billion in 2024 and projected to reach $424.5 billion by 2029. Hanwha Systems' preparation for regulations like the EU's Cyber Resilience Act and NIS2 Directive highlights their focus on secure, compliant technology offerings.

| Technology Area | Hanwha Systems Focus | Market Context (2023/2024 Data) | Projected Growth |

|---|---|---|---|

| Artificial Intelligence & Machine Learning | AI-powered combat systems, advanced bridge systems, AI in video surveillance | Integral to defense and IT advancements | Significant growth across sectors |

| Unmanned Systems | Unmanned combat vehicles, drones, underwater/surface vehicles | Global unmanned ground vehicle market ~$5.2 billion (2023) | Projected to exceed $10 billion by 2030 |

| Digitalization & Smart Factories | Smart factory solutions, cloud, cybersecurity, analytics | Digital transformation market ~$667.2 billion (2023) | Projected to reach $2.18 trillion by 2030 (18.5% CAGR) |

| Cybersecurity | Secure solutions, compliance with new regulations | Global cybersecurity market ~$217.7 billion (2024) | Projected to reach $424.5 billion by 2029 (14.5% CAGR) |

Legal factors

Hanwha Systems' defense operations are intrinsically tied to a web of national and international defense procurement laws and stringent compliance mandates. Navigating these complex legal landscapes, which dictate everything from product specifications to bidding processes, is paramount for success in this sector. For instance, the company's involvement in significant projects like supplying components for the KF-21 fighter jet necessitates meticulous adherence to a rigorous legal framework governing defense contracts, ensuring all specifications and quality standards are met.

Hanwha Systems, as a key player in IT services and advanced technology, faces a complex web of data privacy and cybersecurity regulations. Compliance with frameworks like GDPR and emerging laws such as the EU's Cyber Resilience Act and NIS2 is paramount. These regulations, which are increasingly shaping how companies handle sensitive information, demand robust security protocols and transparent data management practices. For instance, the EU's NIS2 directive, set to be fully implemented by October 2024, significantly expands the scope of cybersecurity requirements for a broader range of sectors.

Protecting its intellectual property (IP) and respecting the IP rights of others is paramount for Hanwha Systems to maintain its competitive edge and foster innovation. As of early 2024, the company actively manages a robust portfolio of patents, particularly in areas like advanced aerospace propulsion and next-generation defense technologies. This strategic IP management is vital for safeguarding its R&D investments and securing market exclusivity for its groundbreaking solutions.

International Trade Laws and Export Controls

Hanwha Systems' global operations mean it must meticulously follow international trade laws, including complex export control regulations and sanctions. Failure to comply can lead to severe penalties, impacting its access to critical technologies and markets.

For instance, the United States Export Administration Regulations (EAR) govern the export of dual-use items, and Hanwha Systems, like many tech companies, must ensure its products and technologies are not transferred to sanctioned entities or countries without proper authorization. In 2023, global trade disputes and the increasing complexity of sanctions, particularly those related to advanced technology, highlighted the need for robust compliance frameworks.

- Adherence to International Trade Laws: Hanwha Systems must navigate a web of regulations governing cross-border transactions, including tariffs, customs, and import/export licensing.

- Export Control Compliance: Strict adherence to export control regimes, such as those imposed by the US and EU, is crucial for sensitive technologies Hanwha Systems may develop or utilize.

- Sanctions Regime Navigation: The company must stay updated on and comply with evolving global sanctions, ensuring no business dealings violate these restrictions.

- Market Access and Legal Repercussions: Non-compliance risks significant fines, loss of export privileges, and reputational damage, directly impacting its ability to operate in key international markets.

Corporate Governance and Compliance Frameworks

Hanwha Systems operates within a robust corporate governance structure designed to ensure ethical conduct and minimize legal exposure. The company's commitment to transparent management is underscored by its establishment of dedicated compliance committees and the execution of regular risk assessments, crucial for maintaining regulatory adherence and upholding high ethical standards.

In 2023, Hanwha Systems reported a significant focus on ESG (Environmental, Social, and Governance) initiatives, with corporate governance being a cornerstone. The company's adherence to South Korean corporate governance codes, which are increasingly stringent, requires proactive measures to ensure compliance across all operations. This includes detailed reporting on board diversity and executive compensation, aligning with global best practices and investor expectations.

- Board Oversight: Hanwha Systems maintains a board of directors with diverse expertise, tasked with overseeing strategic decisions and ensuring compliance with legal and ethical guidelines.

- Compliance Programs: The company invests in comprehensive compliance programs, including anti-corruption training and data privacy protocols, to navigate complex international regulations.

- Risk Management: Regular audits and risk assessments are conducted to identify and mitigate potential legal liabilities, ensuring the company operates within the bounds of applicable laws and industry standards.

- Shareholder Rights: Hanwha Systems is committed to protecting shareholder rights through transparent communication and fair governance practices, fostering investor confidence.

Hanwha Systems' legal environment is shaped by defense procurement regulations, data privacy laws like GDPR and the EU's NIS2 directive (fully effective by October 2024), and intellectual property protection. The company must also navigate international trade laws, including US export controls, and adhere to robust corporate governance standards, as evidenced by its 2023 ESG focus and compliance with South Korean governance codes.

| Legal Area | Key Regulations/Considerations | Impact on Hanwha Systems |

|---|---|---|

| Defense Procurement | National and international defense contracts, KF-21 component supply mandates | Strict adherence to specifications, quality standards, and bidding processes. |

| Data Privacy & Cybersecurity | GDPR, EU Cyber Resilience Act, NIS2 Directive (Oct 2024) | Robust security protocols, transparent data management, expanded compliance scope. |

| Intellectual Property | Patent portfolio management, IP rights protection | Safeguarding R&D investments, securing market exclusivity for innovations. |

| International Trade | US Export Administration Regulations (EAR), global sanctions | Compliance with export controls, avoiding penalties from trade disputes and sanctions. |

| Corporate Governance | South Korean corporate governance codes, ESG initiatives | Transparent management, risk assessments, board diversity, shareholder rights protection. |

Environmental factors

Hanwha Systems is proactively addressing climate change by setting ambitious greenhouse gas (GHG) emission reduction targets. The company's participation in the Carbon Disclosure Project (CDP) underscores its commitment to transparency in environmental performance.

Aligning with the 2050 Net Zero Roadmap, Hanwha Systems is developing strategic plans to significantly cut its carbon footprint. This focus on sustainability is becoming increasingly crucial for businesses operating in the current global landscape.

The availability and sustainable sourcing of critical raw materials, like rare earth elements essential for advanced electronics and defense systems, pose significant environmental challenges for Hanwha Systems. In 2024, global supply chains for these materials faced ongoing volatility due to geopolitical tensions and increased demand, impacting manufacturing costs and operational continuity.

Hanwha Systems is actively addressing these concerns by investing in energy efficiency across its production facilities, aiming to reduce its carbon footprint. For instance, their commitment to eco-friendly product development, including components for renewable energy solutions, helps mitigate the risks associated with resource scarcity and aligns with growing market demand for sustainable technologies.

Hanwha Systems prioritizes robust waste management and pollution control, particularly crucial for its manufacturing and R&D sites. The company is committed to reducing its environmental footprint by actively enhancing its Safety, Health, and Environment (SHE) management system. In 2023, Hanwha Systems reported a 5% decrease in total waste generation compared to the previous year, with a focus on increasing recycling rates for electronic components.

Biodiversity Conservation and Environmental Impact Assessment

Hanwha Systems is increasingly integrating biodiversity conservation into its sustainability strategy, reflecting a move towards more comprehensive environmental impact assessments. This aligns with global trends and standards, such as those proposed by the International Sustainability Standards Board (ISSB), which emphasize reporting on a wider range of environmental factors beyond climate change.

The company's focus on biodiversity signifies a growing understanding of its operational footprint and its responsibility to protect natural ecosystems. This proactive approach is crucial as regulatory bodies and investors worldwide place greater scrutiny on corporate environmental stewardship. For instance, the Convention on Biological Diversity (CBD) has set ambitious targets, and companies are expected to demonstrate their contributions to these goals.

- ISSB Standards: Hanwha Systems is considering assessments aligned with ISSB standards, which include requirements for reporting on biodiversity and ecosystem impacts.

- Global Biodiversity Goals: The company's efforts are in line with international biodiversity targets, such as those outlined by the Kunming-Montreal Global Biodiversity Framework, aiming to halt and reverse biodiversity loss by 2030.

- Investor Expectations: Investors are increasingly demanding transparency on biodiversity risks and opportunities, driving companies like Hanwha Systems to enhance their assessment and reporting practices.

Transition to Green Technologies and Eco-friendly Solutions

Hanwha Systems is deeply invested in advancing green technologies, aligning with the Hanwha Group's commitment to sustainability. This strategic focus is evident in their research into green hydrogen production, a critical component for decarbonizing industries. For instance, Hanwha Solutions, a sister company, aims to produce 1.2 million tons of green hydrogen annually by 2030, a significant undertaking in the global energy transition.

The company's engagement extends to innovative eco-friendly solutions like cultured meat. This pioneering work addresses environmental concerns associated with traditional agriculture, offering a more sustainable protein source. Hanwha Systems' investments in climate tech further underscore their dedication to developing and deploying solutions that combat climate change, positioning them at the forefront of the green revolution.

- Green Hydrogen Production: Hanwha Solutions targets 1.2 million tons of annual green hydrogen output by 2030.

- Cultured Meat Development: Advancing sustainable protein alternatives to reduce environmental impact.

- Climate Tech Investment: Hanwha Systems actively invests in technologies that address climate change challenges.

Hanwha Systems is actively engaging with climate change by setting ambitious greenhouse gas (GHG) emission reduction targets and participating in the Carbon Disclosure Project (CDP) for transparency. The company is also focusing on sustainable sourcing of critical raw materials, which faced volatility in 2024 due to geopolitical factors.

The company is investing in energy efficiency and eco-friendly product development, including components for renewable energy. Waste management and pollution control are prioritized, with a 5% decrease in total waste generation reported in 2023. Hanwha Systems is also integrating biodiversity conservation into its strategy, aligning with global standards like those from the ISSB and the Kunming-Montreal Global Biodiversity Framework.

Furthermore, Hanwha Systems is advancing green technologies, such as investing in green hydrogen production, with sister company Hanwha Solutions targeting 1.2 million tons of annual green hydrogen output by 2030. Their commitment to climate tech and innovative solutions like cultured meat demonstrates a forward-looking approach to environmental challenges.

| Environmental Factor | Hanwha Systems' Action/Focus | Relevant Data/Target |

| Climate Change & Emissions | GHG emission reduction targets, CDP participation | Aligning with 2050 Net Zero Roadmap |

| Resource Management | Sustainable sourcing, energy efficiency | Addressing 2024 supply chain volatility for rare earth elements |

| Waste & Pollution | Waste management, pollution control, SHE system enhancement | 5% decrease in total waste generation (2023); increased recycling rates |

| Biodiversity | Integrating biodiversity conservation | Alignment with ISSB standards and Kunming-Montreal Global Biodiversity Framework |

| Green Technology | Investing in green hydrogen, cultured meat, climate tech | Hanwha Solutions: 1.2 million tons annual green hydrogen by 2030 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Hanwha Systems is meticulously crafted using data from reputable sources including government publications, international financial institutions, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.