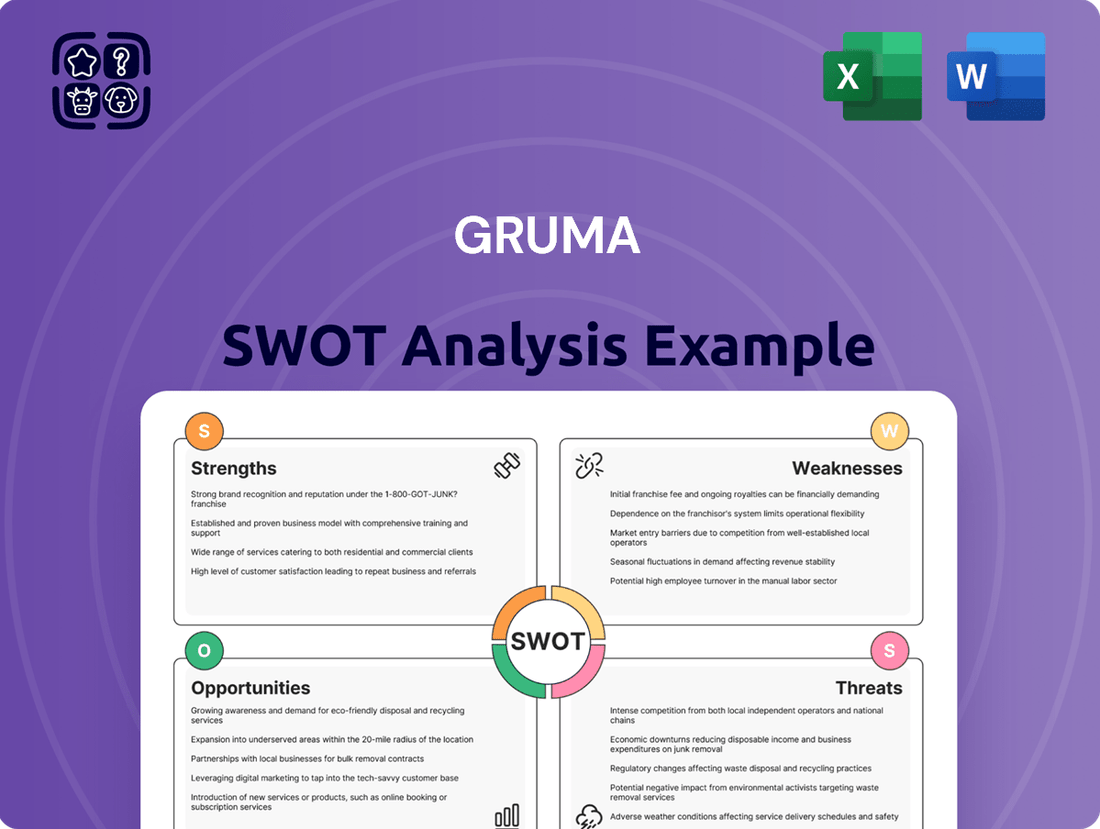

Gruma SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gruma Bundle

Gruma's robust brand recognition and extensive distribution network are significant strengths, but the company also faces challenges from fluctuating commodity prices and intense competition. Understanding these dynamics is crucial for anyone looking to invest or strategize in the food industry.

Want the full story behind Gruma's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Gruma's global market leadership is undeniable, especially in corn flour and tortillas, where it stands as the world's top producer. This strong position is backed by substantial market share, notably in Mexico, where its GIMSA subsidiary commands an impressive 74% of the corn flour industry. This dominance provides a significant competitive advantage and a stable revenue base.

Gruma has shown impressive financial performance, with net income rising by 15% to $350 million in fiscal year 2024. This growth was supported by a 10% increase in EBITDA, reaching $800 million.

Effective cost management strategies have been key, leading to a 200 basis point improvement in gross profit margins. This focus on efficiency has directly contributed to Gruma's enhanced overall profitability during the period.

Gruma's geographic diversification is a significant strength, with operations spanning the United States, Mexico, Central America, Europe, Asia, and Oceania. This broad global footprint effectively mitigates risks associated with over-reliance on any single market, providing a stable revenue base.

In 2024, Gruma's international operations outside of Mexico were a substantial contributor to its net sales, underscoring the success and reach of its global presence. This widespread market penetration demonstrates the company's ability to adapt and thrive in various economic environments.

Product Innovation and 'Better For You' Category Growth

Gruma's commitment to product innovation, particularly within the 'Better For You' category, is a significant strength. This strategic focus has fueled impressive growth, especially in the U.S. and European markets, by aligning with shifting consumer demands for healthier options.

The company's ability to consistently introduce new product presentations within this growing segment demonstrates a keen understanding of market trends. This innovation pipeline is crucial for sustained competitive advantage and capturing market share.

- Product Innovation: Gruma consistently develops new product formats and flavors, especially in healthier alternatives.

- 'Better For You' Growth: This category is a key driver of sales, particularly in the U.S. and Europe, reflecting strong consumer acceptance.

- Market Alignment: The focus on healthier, value-added products directly addresses evolving consumer preferences for wellness.

Operational Efficiencies and Strategic Investments

Gruma’s dedication to operational efficiencies and smart capital investments is a significant strength. The company has consistently focused on improving how it runs its business and has strategically put money into upgrades, maintenance, and expanding its production capacity. For instance, recent investments in Europe and new production lines in China and Guatemala are designed to lower costs and pave the way for future growth, showcasing a proactive approach to enhancing its competitive edge.

These strategic capital expenditures are directly contributing to a stronger financial foundation. By investing in general upgrades and maintenance, Gruma ensures its facilities operate at peak performance, reducing downtime and waste. Capacity expansions in key markets like Europe, alongside new lines in China and Guatemala, are crucial for meeting growing demand and capturing market share, directly impacting future revenue streams and profitability.

The financial impact of these investments is becoming increasingly evident. While specific figures for 2024/2025 capital expenditures are still emerging, Gruma’s historical trend shows a commitment to reinvesting in its operations. For example, in 2023, the company reported significant capital expenditure, with a substantial portion allocated to capacity expansions and modernization efforts, underscoring its long-term growth strategy.

- Commitment to Operational Excellence: Gruma actively pursues cost reductions and efficiency gains across its global operations.

- Strategic Capacity Expansion: Investments in new production lines and facility upgrades in Europe, China, and Guatemala aim to boost output and market reach.

- Future Growth Investment: Capital expenditures are strategically allocated to support long-term revenue growth and market penetration.

Gruma's global leadership in corn flour and tortillas, particularly its 74% market share in Mexico via GIMSA, provides a robust and stable revenue foundation. This market dominance translates into significant pricing power and economies of scale, reinforcing its competitive advantage. The company's financial health is strong, evidenced by a 15% rise in net income to $350 million and a 10% increase in EBITDA to $800 million in fiscal year 2024, alongside improved gross profit margins by 200 basis points through effective cost management.

Gruma's diversified geographic presence across North America, Central America, Europe, Asia, and Oceania mitigates single-market risks and ensures consistent revenue streams, as demonstrated by strong international sales contributions in 2024. Their strategic focus on product innovation, especially in the 'Better For You' segment, is a key driver of growth, particularly in the U.S. and European markets, effectively tapping into evolving consumer preferences for healthier options.

The company's commitment to operational excellence, including strategic capital investments in capacity expansion and modernization in regions like Europe, China, and Guatemala, is designed to enhance efficiency and support future growth. These investments are crucial for meeting increasing demand and maintaining Gruma's competitive edge in a dynamic global market.

| Metric | 2024 (Millions USD) | Y-o-Y Growth |

| Net Income | 350 | 15% |

| EBITDA | 800 | 10% |

| Gross Profit Margin | N/A (Improvement of 200 bps) | N/A |

What is included in the product

Analyzes Gruma’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Identifies key market opportunities and competitive threats, easing the burden of strategic uncertainty.

Weaknesses

Gruma's significant reliance on corn flour and tortillas, while a testament to its market dominance, also exposes the company to considerable concentration risk. In 2023, these core products continued to represent the lion's share of Gruma's sales, highlighting a vulnerability if consumer tastes were to pivot away from these staples or if corn prices experienced significant fluctuations.

Gruma's extensive international presence, particularly in the U.S., makes it susceptible to currency exchange rate volatility. For instance, a weaker Mexican Peso against the U.S. Dollar can diminish the reported value of its U.S. earnings when consolidated, as seen in past reporting periods, impacting overall financial performance metrics.

Gruma, despite its leading position, encounters significant competitive headwinds, particularly within the U.S. food service sector. This intensified competition has contributed to a noticeable volume contraction and a decline in consumer confidence in this crucial segment.

The company's performance in the U.S. food service channel saw a volume contraction in early 2024, a trend that continued to be a concern. This directly reflects the aggressive strategies employed by rivals, who are actively vying for market share and customer loyalty through pricing and product innovation.

Regulatory Scrutiny and Market Dominance Concerns in Mexico

Gruma's significant market share in Mexico's nixtamalized corn flour sector has drawn the attention of regulatory bodies. Preliminary findings suggest that competitive conditions may be lacking, potentially prompting authorities to mandate divestitures or alterations to business operations to foster a more competitive environment.

This regulatory pressure could impact Gruma's operational flexibility and future growth strategies within its home market. For instance, if the Mexican Federal Economic Competition Commission (COFECE) were to impose sanctions, it could necessitate changes to pricing structures or distribution agreements, affecting profitability.

- Dominant Market Share: Gruma holds a substantial portion of Mexico's nixtamalized corn flour market, raising concerns about fair competition.

- Regulatory Scrutiny: Authorities have initiated investigations, with initial assessments pointing to a lack of competitive market conditions.

- Potential Sanctions: Outcomes could include forced divestitures of assets or mandated changes to Gruma's business practices to encourage market competition.

- Impact on Operations: Such regulatory actions could significantly alter Gruma's strategic direction and financial performance in Mexico.

Potential for Input Cost Volatility

Gruma, despite employing hedging strategies, faces ongoing exposure to fluctuating costs for key inputs like corn, wheat, energy, and labor. This inherent volatility poses a significant challenge to maintaining stable profit margins.

As Gruma's existing commodity and energy hedges expire, there's a tangible risk of encountering substantially higher input prices. For instance, in late 2024 and early 2025, global grain markets experienced price increases due to geopolitical tensions and adverse weather patterns, impacting companies with less robust hedging coverage.

The company's profitability can be directly squeezed when these rising input costs cannot be fully passed on to consumers through price adjustments. This dynamic is particularly relevant in competitive markets where Gruma operates.

- Input Cost Exposure: Gruma remains susceptible to price swings in corn and wheat, which are fundamental to its product lines.

- Energy and Labor Volatility: Fluctuations in energy prices and labor wages also contribute to the uncertainty in Gruma's cost structure.

- Hedge Roll-Off Risk: The expiration of current hedging contracts presents a potential for increased expenses if new hedges are secured at higher rates.

- Margin Compression: A lag or inability to pass on increased costs to consumers can lead to a reduction in Gruma's profit margins.

Gruma's substantial market share in Mexico's nixtamalized corn flour sector has attracted regulatory attention, with preliminary findings indicating a potential lack of competitive conditions. This could lead to mandated divestitures or operational changes, impacting its strategic flexibility and growth in its core market.

Same Document Delivered

Gruma SWOT Analysis

The preview you see is the actual Gruma SWOT analysis document you’ll receive upon purchase. This ensures you know exactly what you're getting – a professional and complete report. No surprises, just the full, detailed analysis ready for your use.

Opportunities

Gruma has a significant opportunity to grow its global presence by entering or deepening its penetration in emerging markets and regions that are currently underserved. Areas like Southeast Asia and Oceania, with their burgeoning middle classes and increasing adoption of Westernized diets, present fertile ground for Gruma's core products. For instance, China's evolving food landscape, coupled with Australia's established demand for convenience foods, offers substantial avenues for increased sales volume and revenue.

Gruma can capitalize on the growing consumer demand for healthier and more functional food options. This trend, evident in the strong performance of 'better for you' and value-added segments, offers a clear avenue for expansion. For instance, in 2023, the global healthy snacks market was valued at over $120 billion, with projected growth indicating continued consumer interest.

By increasing investment in research and development, Gruma can introduce innovative products that align with these evolving preferences. This strategic focus can lead to sustained revenue growth and solidify its market position. Companies that have successfully launched plant-based or reduced-sugar alternatives have seen significant market share gains in recent years.

Gruma can pursue strategic acquisitions of smaller, complementary food companies to broaden its offerings beyond its core corn flour and tortilla business. This move would help diversify revenue streams and reduce reliance on a single product category, a strategy that has proven effective for large food conglomerates seeking market resilience.

Forming strategic partnerships with companies in adjacent food sectors or those with established distribution in new geographic regions presents another avenue for growth. For instance, a collaboration could grant Gruma access to the burgeoning plant-based protein market or expand its reach into underserved international markets, potentially mirroring the success of companies that have leveraged partnerships for rapid market entry.

Leveraging E-commerce and Direct-to-Consumer Channels

Gruma can significantly expand its market reach and consumer engagement by bolstering its e-commerce capabilities and venturing into direct-to-consumer (DTC) sales. This strategic shift offers a pathway to capture higher profit margins by reducing reliance on traditional retail partners.

The digital transformation presents a clear opportunity for Gruma to build a more robust online presence. This allows for direct interaction with customers, fostering brand loyalty and enabling more agile responses to market trends. For instance, the global e-commerce market for food and beverages was projected to reach over $1 trillion by 2025, highlighting the immense potential for growth.

- Increased Market Reach: Accessing a wider customer base beyond geographical limitations of physical stores.

- Enhanced Consumer Engagement: Building direct relationships and gathering valuable customer data.

- Improved Margins: Eliminating intermediary markups through DTC sales.

- Data-Driven Insights: Leveraging online sales data to inform product development and marketing strategies.

Sustainability and ESG Initiatives

Gruma has a significant opportunity to bolster its brand by deepening its commitment to sustainability and Environmental, Social, and Governance (ESG) initiatives. Focusing on areas like smart energy consumption, innovative sustainable packaging solutions, robust water conservation programs, and continued community engagement can resonate strongly with a growing segment of environmentally aware consumers and impact-focused investors.

These enhanced sustainability efforts can translate into tangible operational advantages. By optimizing energy use, Gruma could see reduced utility costs, and by investing in eco-friendly packaging, it might lower material expenses and waste disposal fees. For instance, many companies in the food sector are reporting cost savings from energy efficiency projects; a report from the Rocky Mountain Institute in 2023 highlighted that companies implementing comprehensive energy management strategies can achieve savings of 10-30% on energy bills.

- Brand Enhancement: Increased appeal to environmentally conscious consumers and investors.

- Operational Efficiencies: Potential for reduced energy and packaging costs.

- Investor Attraction: Growing demand for ESG-compliant investments, with ESG funds reaching over $3.7 trillion globally by the end of 2023, according to Morningstar data.

- Risk Mitigation: Proactive approach to environmental regulations and resource scarcity.

Gruma can expand its global footprint by targeting emerging markets with growing middle classes, such as Southeast Asia and Oceania, where demand for convenience foods is rising. The company can also leverage the increasing consumer preference for healthier options, a trend supported by the global healthy snacks market, which surpassed $120 billion in 2023, by introducing innovative, value-added products. Strategic acquisitions and partnerships offer further avenues for diversification and market penetration, while enhancing e-commerce capabilities and direct-to-consumer sales can improve margins and customer engagement, tapping into a food e-commerce market projected to exceed $1 trillion by 2025.

Gruma's commitment to sustainability and ESG initiatives presents a significant opportunity to enhance brand appeal and attract impact-focused investors, with ESG funds globally exceeding $3.7 trillion by the end of 2023. These efforts can also yield operational efficiencies, potentially reducing energy and packaging costs, as companies implementing energy management strategies can see 10-30% savings on energy bills. This proactive approach not only mitigates risks associated with environmental regulations but also strengthens Gruma's position in a market increasingly driven by conscious consumerism and responsible investment.

| Opportunity Area | Key Drivers | Market Data/Examples |

|---|---|---|

| Emerging Market Expansion | Growing middle class, increasing adoption of Western diets | Southeast Asia, Oceania; China's evolving food landscape |

| Health & Wellness Trend | Demand for healthier, functional foods | Global healthy snacks market > $120 billion (2023) |

| E-commerce & DTC | Higher profit margins, direct customer engagement | Food e-commerce market projected > $1 trillion by 2025 |

| Sustainability & ESG | Consumer/investor preference, operational efficiencies | ESG funds > $3.7 trillion globally (2023); 10-30% energy savings |

Threats

Volatility in the prices of key raw materials like corn and wheat presents a substantial threat to Gruma's profitability. For instance, corn prices saw significant swings in late 2023 and early 2024 due to weather patterns and global demand, impacting input costs.

While Gruma employs hedging strategies to mitigate price fluctuations, the eventual expiration of these hedges could leave the company exposed to elevated raw material expenses. This exposure is a constant concern, especially when market conditions are unpredictable.

The food industry is inherently competitive, and Gruma contends with significant pressure from both long-standing competitors and emerging players. This dynamic can translate into considerable pricing pressures, particularly in well-established markets, potentially affecting Gruma's sales volumes and profit margins.

For instance, in 2023, the tortilla and corn flour market saw increased promotional activity from competitors, impacting Gruma's net sales growth in certain regions. Analysts anticipate this trend to continue into 2024, as companies vie for market share through aggressive pricing strategies, especially with rising input costs for ingredients like corn.

Gruma's significant market share, especially in Mexico's corn flour and tortilla sector, has drawn the attention of antitrust regulators. For instance, in 2023, Mexico's Federal Economic Competition Commission (COFECE) continued its investigations into potential monopolistic practices within the tortilla and corn flour markets, which could impact Gruma's operations.

Potential regulatory interventions, such as orders to sell off production facilities or alter existing supplier agreements, pose a direct threat to Gruma's established business model and could negatively affect its financial performance. Such actions could limit its operational scale and reduce its competitive advantages.

Shifts in Consumer Preferences and Dietary Trends

Shifts in consumer preferences, particularly a move away from traditional corn-based products or an increased adoption of alternative food options, pose a significant threat to Gruma's core business. This evolving landscape demands constant innovation and diversification to maintain market relevance and capture new consumer segments. For instance, the growing popularity of plant-based diets and gluten-free options could directly impact demand for Gruma's staple offerings, requiring strategic adjustments in product development and marketing.

The company must actively monitor and respond to these changing dietary trends. A failure to adapt could lead to a decline in sales volumes for established product lines. Gruma's ability to invest in research and development for healthier, alternative ingredients and product formats will be crucial. For example, in 2024, the global plant-based food market was projected to reach over $74 billion, highlighting a substantial shift in consumer spending that Gruma cannot afford to ignore.

- Growing demand for plant-based and gluten-free alternatives.

- Potential decline in consumption of traditional corn-based products.

- Necessity for continuous product innovation and diversification.

- Risk of losing market share to competitors offering trend-aligned products.

Economic Slowdowns and Weakened Consumer Confidence

Economic uncertainties and weakened consumer sentiment, particularly in key markets like the U.S. and Mexico, can lead to reduced consumer spending on food products or a shift towards lower-priced alternatives, impacting Gruma's sales volumes and revenue. For instance, if inflation remains elevated through 2024 and into 2025, consumers may cut back on discretionary spending, potentially affecting sales of Gruma's branded products. A slowdown in GDP growth in these regions could further exacerbate this trend.

- Reduced Purchasing Power: Persistent inflation can erode consumer purchasing power, forcing households to prioritize essential goods and potentially trade down to cheaper brands or private labels.

- Shift in Consumption Patterns: Consumers may opt for less premium or more value-oriented food options, impacting Gruma's sales mix and potentially its profit margins.

- Market Volatility: Economic downturns often lead to increased price sensitivity and demand volatility, making it challenging for Gruma to forecast sales and manage inventory effectively.

Gruma faces the threat of fluctuating raw material costs, particularly for corn and wheat, which directly impact its profitability. For example, corn prices experienced significant volatility in late 2023 and early 2024 due to weather and global demand, increasing input expenses. While hedging strategies are in place, their eventual expiration could expose Gruma to higher costs in an unpredictable market.

Intense competition from established and new players exerts considerable pricing pressure, potentially affecting Gruma's sales volumes and profit margins, especially in key markets like Mexico. Increased promotional activities by competitors in 2023, as observed in the tortilla and corn flour sector, are expected to continue into 2024, driving down prices.

Regulatory scrutiny, particularly concerning antitrust issues in Mexico's corn flour and tortilla markets, poses a significant risk. Investigations by bodies like COFECE in 2023 could lead to operational changes or facility divestitures, impacting Gruma's business model and financial performance.

Shifting consumer preferences towards plant-based and gluten-free options present a challenge to Gruma's core corn-based products. The global plant-based food market's projected growth to over $74 billion in 2024 underscores the need for continuous product innovation and diversification to maintain market relevance and avoid losing share to trend-aligned competitors.

Economic uncertainties and weakened consumer sentiment, especially in the US and Mexico, could reduce spending on food products or lead to a shift towards cheaper alternatives. Persistent inflation through 2024 and 2025 may erode purchasing power, forcing consumers to opt for value brands and impacting Gruma's sales mix and revenue.

SWOT Analysis Data Sources

This Gruma SWOT analysis is built upon a robust foundation of credible data, including the company's official financial filings, comprehensive market research reports, and expert analyses of the global food industry.