Gruma Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gruma Bundle

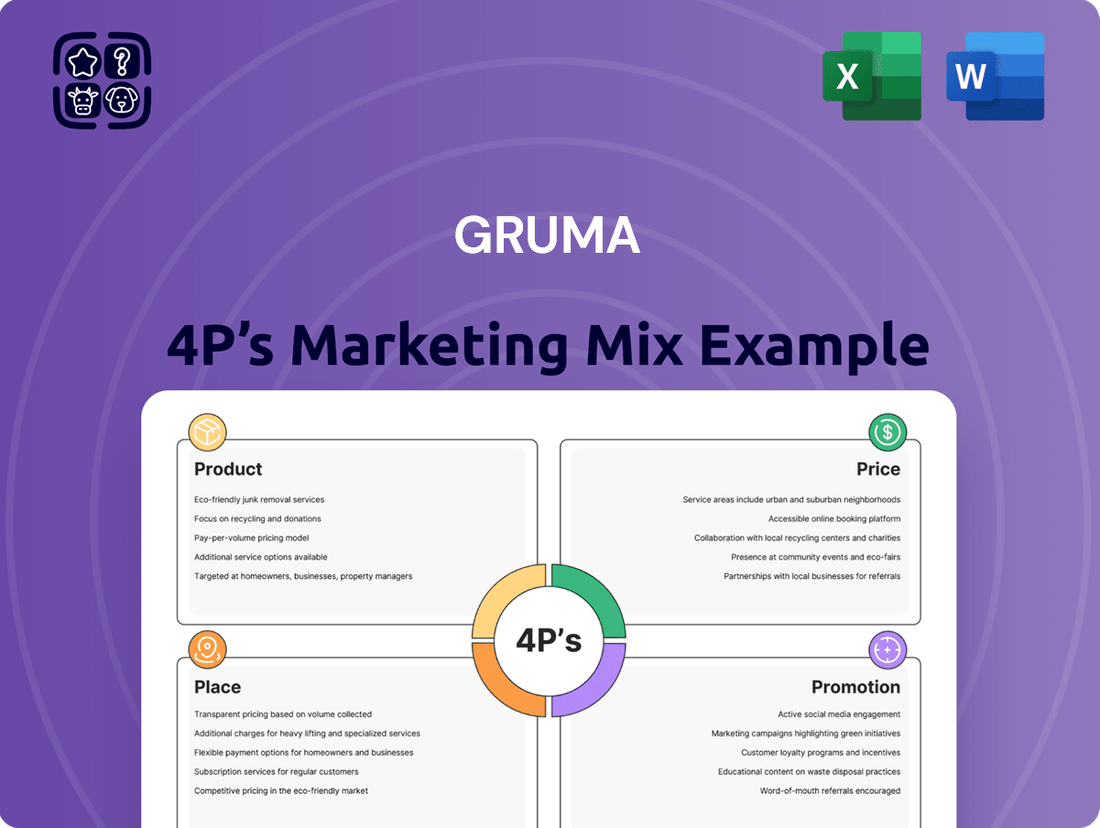

Gruma's marketing success is built on a robust 4Ps strategy, intricately weaving together their diverse product portfolio, strategic pricing, expansive distribution, and targeted promotions. Understanding these elements reveals how they dominate the global corn flour and tortilla market.

Dive deeper into Gruma's winning formula by exploring the full 4Ps Marketing Mix Analysis. This comprehensive report offers actionable insights, real-world examples, and a structured framework perfect for business professionals, students, and consultants seeking to understand and replicate Gruma's market leadership. Get instant access to this editable, presentation-ready document.

Product

Gruma's core product strength lies in corn flour, branded as Maseca, and a wide array of tortillas under popular names like Mission and Guerrero. This foundational product line is the bedrock of their global dominance in the corn flour and tortilla market, catering to both industrial needs and household consumption.

The company's commitment to innovation within these core offerings is evident in their development of healthier alternatives, such as 'Better For You' tortilla options, responding to growing consumer demand for nutritious choices. For instance, in 2023, Gruma reported significant growth in its value-added products, reflecting successful innovation strategies.

Gruma's product strategy extends beyond its foundational corn tortillas, embracing a wide array of flatbreads such as wheat flour tortillas, naan, pita bread, wraps, chapatti, and pizza bases. This diversification is particularly evident in European, Asian, and Oceanian markets, reflecting a strategic effort to capture diverse culinary trends and consumer preferences.

This expansion allows Gruma to cater to a global palate, offering versatile options that fit various meal occasions and cooking styles. For instance, the demand for convenient and internationally recognized flatbreads like pizza bases and wraps has seen significant growth, with the global flatbread market projected to reach over $20 billion by 2027, indicating strong potential for Gruma's diversified offerings.

Gruma's product strategy extends beyond its core tortilla and corn flour offerings to include a diverse range of related food items. This includes snacks, pasta, rice, condiments, and palm hearts, broadening its appeal and market penetration. For instance, in 2023, Gruma's snack segment saw continued growth, contributing significantly to its overall revenue, with a strategic emphasis on healthier options.

The company's expansion into these categories is driven by a desire to capture additional market share and optimize its extensive distribution networks. A key initiative involves the development and promotion of low-fat and low-sodium snack lines, such as Tosty Activa-T in select markets, catering to evolving consumer preferences for healthier snacking choices. This focus aligns with a broader industry trend, where the global healthy snacks market was projected to reach over $150 billion by 2025.

Innovation and 'Better For You' Offerings

Gruma's commitment to innovation is evident in its continuous development of products tailored to specific consumer needs and regional preferences. A prime example is the introduction of specialized corn flours like Maseca Antojitos, designed to enhance the preparation of traditional Mexican snacks, demonstrating a deep understanding of its core markets.

The company has strategically prioritized 'Better For You' offerings, recognizing a significant consumer shift towards healthier options. This focus has yielded strong results, especially in the United States, where health-conscious consumers are actively seeking out products that align with their wellness goals.

This strategic pivot towards health-oriented products is supported by market trends. For instance, the global health and wellness food market was valued at approximately $900 billion in 2023 and is projected to grow steadily. Gruma's investment in this segment positions it to capitalize on this expanding demand.

- Product Development: Gruma actively innovates with products like Maseca Antojitos, catering to specific cultural tastes and culinary traditions.

- Health Focus: 'Better For You' product lines are a key growth driver, particularly resonating with health-conscious consumers in the U.S. market.

- Market Alignment: The company's innovation strategy directly addresses the growing global demand for healthier food options, a trend expected to continue its upward trajectory.

Brand Portfolio and Quality Standards

Gruma's brand portfolio is a cornerstone of its marketing strategy, featuring globally recognized names like Maseca and Mission alongside strong local brands such as Guerrero, TortiRicas, and Tosty. These brands resonate with consumers due to their consistent quality, appealing flavors, and increasing focus on health attributes. For example, Maseca, a leading corn flour brand, is fortified with essential vitamins and minerals, aligning with growing consumer demand for nutritious food options.

The company upholds rigorous quality standards across its entire product range. This commitment ensures consumer trust and brand loyalty. In 2024, Gruma continued to invest in product development and quality control, aiming to further enhance the nutritional profiles and sensory experiences of its offerings. This dedication to quality is a key differentiator in the competitive food industry.

Gruma's brand strength is evident in its market presence and consumer perception. The company actively manages its brand equity through targeted marketing and product innovation.

- Brand Recognition: Maseca, Mission, and Guerrero are household names in key markets.

- Product Fortification: Maseca products are fortified with vital nutrients, enhancing their health appeal.

- Quality Assurance: Gruma maintains strict quality control measures from sourcing to final product.

- Market Penetration: Strong local brands like TortiRicas and Tosty support Gruma's diverse market reach.

Gruma's product portfolio is anchored by its flagship corn flour, Maseca, and a diverse range of tortillas under brands like Mission and Guerrero. The company actively innovates, introducing 'Better For You' options and expanding into various flatbreads and snacks to meet evolving consumer demands for healthier and convenient choices. This diversification strategy is supported by market trends, with the global healthy snacks market projected to exceed $150 billion by 2025, and Gruma's snack segment showing continued growth in 2023.

| Product Category | Key Brands | Innovation Focus | Market Trend Relevance | 2023 Performance Highlight |

|---|---|---|---|---|

| Corn Flour & Tortillas | Maseca, Mission, Guerrero | Healthier alternatives ('Better For You'), specialized flours (Maseca Antojitos) | Growing demand for staple foods with enhanced nutritional profiles | Core strength, driving consistent market presence |

| Flatbreads (non-corn) | Mission (wheat tortillas), regional brands | Expansion into naan, pita, pizza bases | Global demand for versatile meal components, flatbread market projected over $20 billion by 2027 | Capturing diverse culinary trends |

| Snacks | Tosty (Tosty Activa-T), other regional brands | Low-fat, low-sodium options, healthier formulations | Global healthy snacks market projected over $150 billion by 2025 | Continued growth, significant revenue contribution |

What is included in the product

This analysis provides a comprehensive examination of Gruma's marketing strategies, detailing their Product, Price, Place, and Promotion tactics with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of Gruma's market positioning, offering a benchmark for competitive analysis and strategic planning.

Simplifies complex marketing strategies into actionable insights, alleviating the burden of deciphering Gruma's market approach.

Place

Gruma's manufacturing prowess is evident in its expansive global network, comprising roughly 75 plants strategically located across the Americas, Europe, Asia, and Oceania. This robust infrastructure allows for efficient production and widespread distribution, solidifying its market leadership.

This extensive operational footprint is critical to Gruma's ability to serve a vast customer base, reaching over 100 countries with its core products. The company's significant investment in manufacturing capacity underscores its commitment to meeting global demand for corn flour and tortillas.

Gruma strategically employs a wide array of distribution channels to ensure its products are readily available. This includes traditional retail outlets like supermarkets, hypermarkets, and smaller convenience stores, catering to everyday consumer needs. For 2024, Gruma's net sales reached approximately $5.5 billion, a testament to the effectiveness of its broad market penetration through these channels.

Beyond brick-and-mortar, Gruma leverages the growing e-commerce landscape, making its brands accessible online. Furthermore, the company directly serves industrial clients and the foodservice sector, demonstrating a comprehensive approach that covers both consumer and business-to-business markets, thereby maximizing reach and sales opportunities.

Gruma's global footprint is organized around key subsidiaries, including Gruma Corporation in the U.S. and Grupo Industrial Maseca (GIMSA) in Mexico. Significant operations also span Central America, Europe, Asia, and Oceania, allowing for localized market approaches.

Distribution strategies are highly customized by region. For instance, Gruma is actively expanding its retail distribution network across Europe, while in Mexico, the company is focused on overcoming logistical hurdles to ensure efficient product delivery.

This regional structuring allows Gruma to adapt its marketing mix, particularly its place strategy, to the unique demands and opportunities present in each market, a key factor in its sustained growth.

Investment in Capacity and Logistics

Gruma's commitment to investment in capacity and logistics is a cornerstone of its marketing strategy, ensuring it can effectively serve its expanding customer base. This focus on production and distribution infrastructure directly supports its product availability and market reach, crucial elements of the 4Ps.

The company has been actively expanding its production capabilities. For instance, Gruma has invested in building new snack production centers and enhancing its tortilla plants within Mexico. These strategic expansions are designed to keep pace with the robust demand for its products.

Furthermore, Gruma is broadening its operational footprint by adding capacity in Central America. This move is specifically aimed at catering to incremental demand in those regions, demonstrating a proactive approach to market opportunities and solidifying its supply chain efficiency.

- Capacity Expansion: Gruma has been actively investing in new snack production centers and expanding its tortilla plants in Mexico.

- Regional Growth: The company is also adding production capacity in Central America to meet growing demand in that market.

- Logistical Efficiency: These investments are crucial for improving overall supply chain efficiency and ensuring product availability.

Supply Chain Management and Efficiency

Gruma's supply chain is a cornerstone of its marketing mix, ensuring its corn flour and tortilla products reach consumers efficiently. The company prioritizes operational excellence to control costs and maintain product availability across diverse markets. This focus is vital given the inherent variability in agricultural inputs and the complexities of global logistics.

In 2024, Gruma continued to invest in optimizing its distribution networks. For instance, their Mexican operations, a significant market, rely on a robust logistics infrastructure to manage the vast quantities of corn needed for tortilla and masa harina production. The company’s ability to adapt to fluctuating corn prices, which saw some regional volatility in early 2024 due to weather patterns, directly impacts their cost management and pricing strategies.

- Distribution Network: Gruma operates extensive distribution centers and employs a fleet of vehicles to ensure timely delivery, particularly for perishable goods like fresh tortillas.

- Cost Management: By streamlining logistics and optimizing inventory, Gruma aims to mitigate rising transportation and fuel costs, which were a concern for many food companies in 2024.

- Product Availability: Ensuring consistent supply, even amidst potential disruptions like geopolitical tensions affecting global trade routes in 2024, is paramount for maintaining market share and customer loyalty.

- Agricultural Sourcing: Gruma's direct relationships with corn farmers and its hedging strategies help manage the impact of harvest yields and quality on its supply chain.

Gruma's place strategy is defined by its extensive global manufacturing and distribution network, ensuring product accessibility across diverse markets. This infrastructure, comprising approximately 75 plants worldwide, facilitates efficient production and reach into over 100 countries.

The company employs a multi-channel approach, utilizing traditional retail, e-commerce, and direct sales to industrial and foodservice clients. This comprehensive strategy, supported by net sales of around $5.5 billion in 2024, highlights Gruma's commitment to broad market penetration and customer convenience.

Gruma's regional structuring, with key operations in the U.S., Mexico, Central America, Europe, Asia, and Oceania, allows for tailored place strategies. Investments in capacity expansion, such as new snack centers and enhanced tortilla plants in Mexico, alongside growing capacity in Central America, underscore their focus on meeting regional demand and optimizing supply chains.

| Region | Key Distribution Channels | 2024 Sales Contribution (Approximate) |

|---|---|---|

| North America (U.S. & Mexico) | Supermarkets, Hypermarkets, Convenience Stores, E-commerce, Foodservice | 70% |

| Central America | Retail, Growing E-commerce | 15% |

| Europe, Asia, Oceania | Retail, Growing E-commerce, Industrial Clients | 15% |

Full Version Awaits

Gruma 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Gruma 4P's Marketing Mix Analysis covers product, price, place, and promotion strategies. You'll gain immediate access to this ready-to-use, in-depth analysis upon completing your purchase.

Promotion

Gruma's brand recognition is a cornerstone of its success, with Maseca and Mission holding leading positions in numerous global markets. This strong brand equity translates to significant market leadership.

Marketing efforts are strategically designed to solidify this leadership, highlighting the superior quality, authentic flavor, and deep cultural relevance of its flagship products, such as tortillas. For instance, in 2024, Mission tortillas continued to dominate the U.S. retail market, capturing an estimated 45% market share in the tortilla category.

Gruma's marketing approach is highly segmented, recognizing the distinct needs of its varied customer base. This targeted strategy is evident in how they position their brands, such as Mission Foods, which emphasizes artisan quality and nutritional advantages for the broader American market.

Conversely, the Guerrero brand is specifically tailored to resonate with the United States' Hispanic population, highlighting cultural relevance and traditional appeal. This careful brand differentiation allows Gruma to effectively capture market share across diverse consumer groups, a strategy that has proven successful. For example, in 2024, Gruma reported a net sales increase of 6.8% to $5.7 billion, reflecting the strength of its targeted marketing efforts.

Gruma's promotional campaigns emphasize Maseca's fortified nutritional value, including essential vitamins and minerals, positioning it as a healthier choice. This focus on health and welfare is a key differentiator.

Furthermore, Gruma highlights the 'Better For You' attributes of select tortilla and wrap lines, catering to consumer demand for convenient and pleasurable, yet health-conscious, food options.

Digital and Traditional Communication Channels

Gruma leverages a comprehensive communication strategy, blending digital and traditional channels to connect with consumers and stakeholders. For instance, Maseca, a key brand, actively engages audiences on social media platforms, fostering community and brand loyalty.

Beyond consumer-facing marketing, Gruma prioritizes robust investor relations, a crucial element of its corporate communication. These efforts aim to build trust and transparency with the financial community, impacting brand perception and investment appeal.

The company's communication mix also includes traditional advertising, ensuring broad reach and reinforcing brand messaging across various demographics. This multi-channel approach is designed for maximum impact and audience engagement.

- Digital Engagement: Maseca's social media presence drives consumer interaction and brand visibility.

- Investor Relations: Gruma's commitment to transparent investor communication enhances its corporate image.

- Traditional Reach: Advertising efforts complement digital strategies for wider market penetration.

Public Relations and Corporate Social Responsibility

Gruma's commitment to public relations and corporate social responsibility (CSR) significantly bolsters its brand image. Initiatives like the 'For a Better Tomorrow' program, which champions sustainability and community development, are central to this strategy. These actions are designed to foster trust and enhance Gruma's standing with both its customer base and broader stakeholder groups.

In 2023, Gruma reported significant progress in its sustainability efforts, with a notable reduction in water consumption by 15% across its operations compared to 2020 benchmarks. The company also invested over $5 million in community projects globally, focusing on education and food security, further solidifying its role as a responsible corporate citizen.

- Sustainability Focus: Gruma's 'For a Better Tomorrow' program prioritizes environmental stewardship and community well-being.

- Brand Image Enhancement: CSR activities are crucial for building a positive and trustworthy brand reputation.

- Stakeholder Engagement: These initiatives aim to strengthen relationships with consumers, investors, and local communities.

- Measurable Impact: Gruma's 2023 sustainability report highlighted a 15% reduction in water usage and $5 million invested in community programs.

Gruma's promotional strategy is multi-faceted, focusing on brand building, targeted consumer engagement, and investor relations. They leverage digital platforms like social media for direct consumer interaction, especially with brands like Maseca, to foster loyalty and community. This approach is complemented by traditional advertising to ensure broad market reach across diverse demographics.

The company also emphasizes the nutritional benefits and "Better For You" attributes of its products, appealing to health-conscious consumers. Furthermore, strong investor relations and corporate social responsibility initiatives, such as their sustainability programs, are integral to building a positive and trustworthy brand image, as evidenced by their 2023 sustainability report detailing a 15% reduction in water usage and significant community investments.

| Brand/Initiative | Key Promotional Focus | 2024/2025 Data Point | Channel Emphasis |

|---|---|---|---|

| Maseca | Nutritional fortification, community engagement | Strong social media interaction | Digital (Social Media) |

| Mission Foods | Artisan quality, broad market appeal | 45% U.S. retail market share (tortilla category) | Digital, Traditional Advertising |

| Guerrero | Cultural relevance, traditional appeal | Targeted to Hispanic population | Digital, Traditional Advertising |

| Corporate/CSR | Sustainability, community development | 15% water usage reduction (vs. 2020), $5M+ invested in community projects (2023) | Public Relations, Investor Relations |

Price

Gruma strategically sets prices by closely monitoring market demand, competitor pricing, and broader economic trends. This approach ensures their products remain competitive and aligned with consumer willingness to pay.

For instance, in 2024, the company navigated fluctuating input costs for corn, a key ingredient, which directly impacts their pricing decisions for corn flour and tortilla products. Gruma's ability to manage these costs is crucial for maintaining profitable pricing.

Despite facing scrutiny from Mexico's antitrust commission regarding market dominance in corn flour, Gruma maintains its operations are compliant with all regulations. This highlights the delicate balance Gruma strikes between market influence and competitive pricing practices.

Gruma's pricing strategy heavily leans on value-based pricing, reflecting how consumers perceive the quality and brand reputation of its corn flour and tortilla products. This approach means prices are set not just on production costs, but on what customers are willing to pay based on the overall experience and brand trust.

For instance, in 2024, Gruma's premium tortilla brands, like Mission, often command higher prices due to their established market presence and perceived superior taste and texture. This strategy directly supports their market leadership in the corn flour and tortilla sector, where brand loyalty is a significant driver of sales.

The company understands that perceived value extends beyond the product itself, encompassing factors like convenience, packaging, and brand marketing. This holistic view allows Gruma to maintain strong profit margins even in competitive markets, as customers associate their products with reliability and quality.

Gruma's pricing strategy is significantly shaped by evolving market dynamics. For instance, in the U.S., a key market for Gruma, persistent inflationary pressures in 2024 and early 2025 continue to impact consumer purchasing power and sentiment, forcing adjustments in how products are priced to remain competitive yet profitable.

The company's ability to achieve cost efficiencies and operational improvements is a crucial lever in its pricing decisions. By optimizing its supply chain and production processes, Gruma can better absorb rising input costs, allowing for more stable pricing for consumers and protecting its profit margins, a strategy particularly relevant as it navigates the economic landscape of 2024-2025.

Discounts and Promotional Pricing

Gruma's approach to discounts and promotional pricing is strategic, aiming to boost sales and market share. While concrete details are often kept under wraps, it's understood that these tactics are employed to draw in consumers, particularly in crowded markets where differentiation is key.

For instance, during the 2024 holiday season, Gruma's brands, like Mission Foods, often feature special bundle deals or limited-time price reductions. These promotions can significantly influence purchasing decisions, especially for staple goods where price sensitivity is a factor.

Key aspects of Gruma's promotional pricing strategy include:

- Targeted Discounts: Offering price reductions on specific product lines or during key sales periods to drive immediate volume.

- Volume Incentives: Potentially using buy-one-get-one-free or multi-buy offers to encourage larger purchases.

- Competitive Response: Adjusting pricing and promotions to counter competitor activities and maintain market position.

Global and Regional Pricing Adjustments

Gruma strategically adjusts its pricing across different global and regional markets to align with local economic conditions and consumer purchasing power. This approach acknowledges that price sensitivity varies significantly, allowing Gruma to optimize revenue streams.

For example, in markets with high price sensitivity, Gruma might focus on value-oriented product lines or promotional pricing. Conversely, regions with robust economies and strong demand for premium products can support higher price points, reflecting the perceived value and product mix offered.

- 2024 Data: Gruma's net sales in 2024 reached approximately $5.1 billion, with pricing strategies playing a crucial role in this performance across its diverse geographic segments.

- Regional Variations: Pricing for tortilla products in the US, a key market, often differs from that in Mexico or Europe due to variations in input costs, competition, and consumer willingness to pay.

- Product Mix Impact: The introduction of new or premium product offerings, such as gluten-free or whole-wheat tortillas, allows Gruma to implement differentiated pricing strategies, capturing higher margins in segments willing to pay a premium.

Gruma's pricing strategy is a dynamic blend of value-based and competitive approaches, heavily influenced by market conditions and consumer perception. The company aims to balance profitability with market share by aligning prices with perceived quality and brand reputation, as seen with premium brands like Mission commanding higher price points in 2024.

Navigating economic fluctuations, such as the inflationary pressures in the U.S. during 2024-2025, Gruma strategically adjusts pricing to maintain competitiveness while ensuring profitability. This involves leveraging cost efficiencies and operational improvements to mitigate rising input costs for key ingredients like corn.

Promotional pricing, including targeted discounts and bundle deals during periods like the 2024 holiday season, is a key tactic to drive sales volume and market penetration. These promotions are carefully calibrated to respond to competitive activities and consumer price sensitivity.

Gruma's net sales reached approximately $5.1 billion in 2024, with pricing strategies varying significantly across regions like the US, Mexico, and Europe to account for local economic factors and consumer purchasing power. This regional pricing differentiation is further enhanced by product mix, with premium offerings supporting higher margins.

| Metric | 2024 Value | Key Influences |

|---|---|---|

| Net Sales | ~$5.1 Billion | Pricing strategy, market demand, product mix |

| Key Ingredient Cost (Corn) | Fluctuating | Impacts pricing of corn flour and tortillas |

| U.S. Market Inflation | Persistent (2024-2025) | Influences consumer purchasing power and pricing adjustments |

| Premium Product Pricing | Higher | Driven by brand reputation, perceived quality (e.g., Mission) |

4P's Marketing Mix Analysis Data Sources

Our Gruma 4P's Marketing Mix Analysis is grounded in a comprehensive review of company disclosures, including annual reports and investor presentations, alongside market intelligence from industry research and competitive analysis.