Gruma Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gruma Bundle

Curious about Gruma's strategic product portfolio? This glimpse into their BCG Matrix reveals the foundational insights into their market position. Understand which brands are driving growth and which require careful consideration.

To truly unlock Gruma's competitive advantage and make informed decisions, dive into the full BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, and equip yourself with actionable strategies.

Don't just see the surface; own the strategy. Purchase the complete Gruma BCG Matrix to receive detailed quadrant analysis, expert recommendations, and a clear roadmap for optimizing your investments and product development.

Stars

Gruma's 'Better For You' product category in the US is a standout performer, demonstrating robust growth and capturing an increasing market share. This segment is perfectly aligned with the growing consumer demand for healthier food options.

The company specifically highlighted the excellent performance of its 'Better For You' products in the US during both the fourth quarter of 2024 and the first quarter of 2025. This sustained strong showing suggests a high-growth market where Gruma is successfully expanding its presence.

With its strong alignment to health-conscious consumer trends and its current impressive trajectory, the 'Better For You' category is well-positioned to become a significant cash cow for Gruma in the coming years.

Gruma's European tortilla business is a shining example of a "Star" in its BCG matrix, demonstrating robust volume growth across the continent. This expansion points to a burgeoning market for tortillas in Europe and Gruma's dominant presence within it, reflecting a significant market share in a rapidly expanding sector.

In 2024, Gruma's European operations continued their impressive trajectory, fueled by a strategic distribution network and sustained consumer demand. This strong performance underscores the company's ability to capitalize on favorable market conditions and efficiently reach its customer base, solidifying its position as a leader in the European tortilla market.

Gruma's Asia and Oceania divisions, excluding China, have demonstrated robust performance, with Australia and Malaysia leading the charge. These markets have experienced consistent, strong volume growth, contributing positively to the company's overall financial results.

This upward trend signifies a burgeoning demand for Gruma's offerings in these key territories, indicating successful market penetration and a growing market share. For instance, in 2024, Gruma reported a notable increase in sales volume from these regions, underscoring their strategic importance.

Central America Division

Gruma's Central America division is a shining example of a star in the BCG matrix, demonstrating consistently strong performance. The region is experiencing robust demand, necessitating further investment in production capacity to keep pace.

This high-growth market is where Gruma is actively expanding its operations, reflecting a significant market share and substantial future potential.

- Strong Growth: The Central America division has shown consistent, robust results, indicating a high-growth market.

- Capacity Expansion: Gruma is investing in increasing production capacity to meet rising demand in this region.

- Market Position: This strategic investment signifies a strong market share and considerable growth potential for Gruma in Central America.

Maseca Corn Flour (Industrial & Retail)

Maseca Corn Flour, a flagship product for Gruma, holds a robust position within the company's portfolio. While the broader US corn flour market experienced fluctuations, Maseca's industrial segment is actively recovering, and its retail channel consistently delivers strong results. This dual performance highlights Maseca's entrenched market leadership in a vital category, even in mature segments, where targeted channel strategies can unlock further growth.

Gruma's dominance is starkly illustrated by its market share in Mexico, where it commands between 50% and 90% of corn flour sales across eight distinct regions. This substantial control underscores the brand's deep penetration and consumer preference in its home market, providing a solid foundation for its international operations.

- Market Dominance: Gruma controls 50-90% of corn flour sales in eight Mexican regions.

- Channel Resilience: Maseca's retail sales remain strong, while industrial sales show recovery.

- Growth Potential: Opportunities exist for Maseca, even in mature corn flour segments, through strategic channel focus.

Gruma's 'Better For You' product line in the US is a prime example of a Star. This category is experiencing significant growth, driven by increasing consumer preference for healthier food options. Gruma's strategic focus on this segment has led to a rising market share, positioning it for continued success.

The company's European tortilla business also shines as a Star, showcasing robust volume growth across the continent. This expansion indicates a rapidly growing market for tortillas in Europe, where Gruma has established a strong presence and is effectively capitalizing on favorable market conditions. For instance, in 2024, Gruma's European operations saw continued strong performance, reinforcing its leadership.

Similarly, Gruma's Central America division is a Star, demonstrating consistent and strong performance. The region's robust demand necessitates increased production capacity, highlighting Gruma's significant market share and substantial future potential in this high-growth market.

| Gruma Star Products/Regions | Key Performance Indicators (2024/Early 2025) | Market Context | Strategic Outlook |

|---|---|---|---|

| US 'Better For You' Products | Robust volume growth, increasing market share | Growing consumer demand for healthier options | Well-positioned for future cash generation |

| European Tortilla Business | Strong volume growth across the continent | Burgeoning market, Gruma's dominant presence | Capitalizing on favorable market conditions |

| Central America Division | Consistently strong performance, robust demand | High-growth market, need for capacity expansion | Significant market share and future potential |

What is included in the product

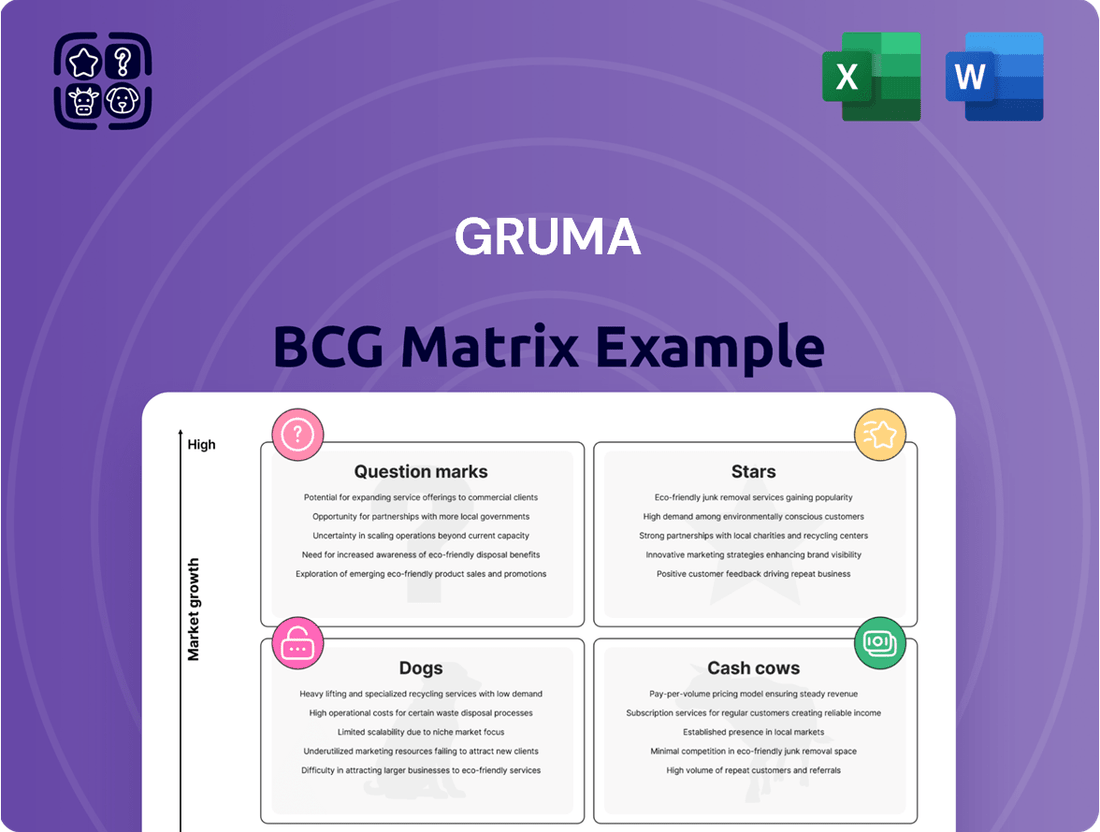

The Gruma BCG Matrix analyzes its product portfolio by market share and growth rate, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

Gruma's BCG Matrix provides a clear, one-page overview, relieving the pain of complex strategic analysis.

Cash Cows

Gruma's Maseca corn flour in Mexico remains a dominant force, consistently delivering substantial cash flow due to its entrenched market position and unwavering consumer demand. This product is a classic example of a cash cow, benefiting from a high market share in a mature, stable industry.

While specific operating profit and EBITDA figures for Maseca in Mexico may fluctuate year-to-year, its strategic importance as a cash generator is undeniable. Gruma's significant control, often holding between 50% and 90% of the corn flour market across different Mexican regions, solidifies its cash cow status.

The US retail tortilla business is a strong performer within Gruma's portfolio, fitting the profile of a cash cow. Its resilience and consistent solid performance, even in a mature market, highlight a significant market share. This stability translates into dependable cash flow, requiring less promotional spending due to high brand recognition and customer loyalty. The retail tortilla segment continued to show solid performance in the second quarter of 2025.

Mission Brand Tortillas in the US operates as a strong Cash Cow within Gruma's portfolio. Its leading position in the market, serving both Hispanic and Anglo consumers, ensures consistent demand. This established presence in a mature segment allows for high profit margins and significant cash generation, with the company noting positive results driven by growing consumer interest in tortillas and their versatile applications.

Established Tortilla Products (Mexico)

Gruma's established tortilla products in Mexico, including brands like Guerrero and Tortiricas, are prime examples of Cash Cows within its BCG Matrix. These offerings likely dominate a mature domestic market, boasting substantial market shares due to extensive distribution networks and deep consumer loyalty.

The consistent demand for these staple food items translates into predictable and robust cash flows for Gruma. For instance, Gruma's Mexican operations have historically been a significant contributor to its global revenue, with tortillas forming a core part of its product mix.

- High Market Share: Gruma's tortilla brands in Mexico are leaders in a mature market.

- Stable Cash Flow: Widespread distribution and consumer familiarity ensure consistent revenue generation.

- Brand Strength: Guerrero and Tortiricas are well-recognized and trusted names among Mexican consumers.

- Mature Market Dominance: These products benefit from Gruma's long-standing presence and operational efficiency in its home market.

GIMSA (Grupo Industrial Maseca) Operations

GIMSA, Gruma's Mexican operations, represents a classic cash cow within the company's portfolio. Its consistent performance, mirroring historical trends, signifies a dominant market share in a mature, low-growth sector. This stability ensures a dependable contribution to Gruma's overall cash flow, necessitating minimal reinvestment for ongoing operations.

In the second quarter of 2025, GIMSA's operational results remained steady, reinforcing its position as a reliable generator of earnings. This segment requires limited capital expenditure for maintenance, allowing Gruma to direct resources to other strategic areas. The predictable nature of GIMSA's cash generation makes it a cornerstone of Gruma's financial stability.

- GIMSA's stable performance in 2Q25 aligns with its historical trajectory.

- The Mexican market for GIMSA's products is characterized by low growth and maturity.

- GIMSA reliably contributes significant cash flow to Gruma with low investment needs.

- This operational segment is classified as a Cash Cow in Gruma's BCG Matrix.

Gruma's established corn flour operations in Mexico, particularly under the Maseca brand, are quintessential cash cows. These segments boast high market share in a mature industry, generating substantial and consistent cash flow with minimal need for further investment. Gruma's significant market control, often exceeding 50% in various regions, underscores this strength.

Similarly, Gruma's US retail tortilla business, featuring brands like Mission, functions as a robust cash cow. Despite market maturity, these products maintain strong brand recognition and consumer loyalty, leading to dependable cash generation. The positive performance noted in Q2 2025 further solidifies their cash cow status.

| Product Segment | Market Share | Market Growth | Cash Flow Generation |

|---|---|---|---|

| Maseca Corn Flour (Mexico) | High | Low | High |

| Mission Tortillas (US Retail) | High | Low | High |

| Guerrero & Tortiricas Tortillas (Mexico) | High | Low | High |

| GIMSA (Mexico Operations) | Dominant | Low | Stable & High |

Delivered as Shown

Gruma BCG Matrix

The Gruma BCG Matrix preview you are viewing is the identical, complete document you will receive immediately after purchase. This means you'll get the fully formatted analysis, ready for strategic application, without any watermarks or demo content. The report is designed for professional use, providing clear insights into Gruma's product portfolio.

Dogs

Gruma's US foodservice channel has historically been a challenging segment, characterized by volume contraction stemming from inflationary pressures and heightened price sensitivity among consumers. This situation suggests a relatively low market share within a segment experiencing sluggish growth.

In the fourth quarter of 2024, the US foodservice business continued to grapple with persistent inflationary headwinds and a pronounced price sensitivity from customers. This trend is expected to persist into the first half of 2025, impacting overall sales performance.

Further illustrating these difficulties, sales volume within the US foodservice channel experienced a notable decline in the second quarter of 2025. This segment has historically been a cash consumer, often without delivering substantial returns on investment, a pattern that has continued to be a concern for Gruma.

Within Gruma's vast product lineup, specific niche or older product SKUs that haven't kept pace with evolving consumer tastes or market shifts would fall into the dog category of the BCG matrix. These items typically exhibit low market share and minimal growth, representing an inefficient use of company resources.

For instance, if Gruma were to identify a particular regional corn chip flavor that has seen declining sales due to new flavor introductions or changing dietary habits, it might be classified as a dog. Such products, failing to align with Gruma's stated commitment to innovation and regional adaptation, could become obsolete and drain capital.

Within Gruma's diverse regional portfolio, certain smaller operations might be classified as 'dogs' if they consistently exhibit low sales volumes and profitability. These underperforming areas could also be characterized by intense local competition where Gruma struggles to gain significant market share, necessitating substantial investment for meager returns.

While Gruma generally demonstrates robust regional performance, specific markets like China have shown less consistent results compared to broader Asia and Oceania growth trends. This inconsistency in China's performance, potentially due to local market dynamics or competitive pressures, could position it as a 'dog' category requiring careful strategic review.

Products with High Logistics Costs and Low Margins

Products that face significant logistical hurdles and offer slim profit margins can often be found in the 'Dogs' quadrant of the BCG matrix. These items, especially when competing in crowded markets, might just cover their costs or even drain resources due to inefficiencies, rather than contributing meaningfully to profits.

Gruma USA, for instance, experienced an increase in its Selling, General, and Administrative (SG&A) expenses in the fourth quarter of 2024, with rising logistics costs being a contributing factor. This highlights the real-world impact of high distribution expenses on a company's bottom line, potentially pushing certain products into the 'Dog' category.

- High Logistics Costs: Products with substantial transportation, warehousing, and handling expenses that eat into sales revenue.

- Low Profit Margins: Items that generate minimal profit per unit sold, making it difficult to absorb operational costs.

- Operational Inefficiencies: Situations where the cost of getting the product to market outweighs its profitability, leading to cash consumption.

- Market Dynamics: Competitive environments can exacerbate the 'Dog' status by limiting pricing power and increasing the pressure to maintain efficient supply chains.

Obsolete Production Facilities or Technologies

Obsolete production facilities or technologies can be classified as 'dogs' within Gruma's asset portfolio, particularly if they are inefficient and costly to maintain. This inefficiency directly translates to higher production costs, eroding Gruma's competitive edge in the market. For instance, if a facility relies on older machinery that consumes more energy or requires more manual labor compared to newer, automated systems, its operational expenses will be significantly higher.

Gruma's commitment to general upgrades and maintenance across its global plants suggests a strategic approach to asset management. Facilities that are not part of these regular investment cycles risk becoming less viable. By 2024, Gruma operates numerous corn and wheat flour mills and tortilla production facilities worldwide. Those facilities not receiving ongoing capital expenditure for modernization could face declining efficiency and increased susceptibility to obsolescence, impacting overall profitability.

- Asset Underutilization: Facilities with outdated technology that cannot meet current production demands or quality standards are underutilized, even if physically operational.

- Increased Operating Costs: Older equipment often leads to higher energy consumption, increased waste, and more frequent breakdowns, driving up per-unit production costs.

- Reduced Competitiveness: Higher production costs stemming from obsolete facilities make Gruma's products less price-competitive against rivals utilizing more modern, efficient manufacturing processes.

- Investment Lag: A consistent lag in reinvesting in certain facilities can signal a strategic decision to phase them out or a failure to adapt to technological advancements, a key indicator of a 'dog' asset.

Within Gruma's portfolio, products or business units categorized as Dogs are those with low market share in slow-growing industries. These often represent underperforming assets that consume resources without generating significant returns. Identifying and managing these 'dogs' is crucial for optimizing capital allocation and improving overall profitability.

In 2024, Gruma's US foodservice channel, facing persistent inflation and consumer price sensitivity, exemplified a market with low growth. Sales volume declines in Q2 2025 within this segment, coupled with its historical role as a cash consumer, strongly suggest that certain Gruma offerings within this channel could be considered Dogs, demanding strategic evaluation.

Specific regional product SKUs with declining sales due to changing consumer preferences or new product introductions are prime candidates for the Dog category. For instance, a niche corn chip flavor that fails to resonate with current tastes could be a Dog, especially if it requires significant marketing to maintain minimal sales, thereby draining capital.

Gruma's operational efficiency is key; facilities with obsolete technology or those not part of regular upgrade cycles risk becoming Dogs. By 2024, Gruma operates numerous mills and production facilities globally. Those not receiving ongoing capital expenditure for modernization face declining efficiency and higher operating costs, potentially making their output less competitive and thus 'dog' assets.

| Category | Characteristics | Gruma Example (Potential) | Financial Implication |

|---|---|---|---|

| Dogs | Low Market Share, Low Market Growth | Underperforming regional product SKUs, older tortilla lines in mature markets | Cash consumers, low profitability, require divestment or turnaround strategy |

| Dogs | High Operating Costs, Low Profit Margins | Products with complex supply chains, high logistics costs (e.g., certain foodservice items) | Erode margins, strain working capital, may require price increases or cost reduction |

| Dogs | Obsolete Assets, Inefficient Operations | Older production facilities not receiving capital investment, outdated machinery | Higher energy consumption, increased maintenance, reduced output quality, lower competitiveness |

Question Marks

Gruma's 'Better For You' product lines, a star performer in the US market, present a compelling opportunity for international expansion. This category, driven by increasing consumer demand for healthier alternatives, demonstrates significant growth potential beyond American borders. For instance, the global health and wellness market is projected to reach over $7 trillion by 2025, indicating a fertile ground for such offerings.

However, venturing into new international territories with these specific products positions them as question marks within Gruma's BCG matrix. While demand for healthier options is on the rise globally, Gruma's current market share in many of these regions remains relatively low. This necessitates substantial investment in marketing, distribution, and product localization to effectively compete and capture market share.

Gruma's exploration into emerging markets with limited current presence represents a classic question mark. These regions, often characterized by growing middle classes and increasing demand for staple foods like corn flour and tortillas, present substantial growth opportunities. For instance, Southeast Asian nations, with their burgeoning economies and large populations, could offer significant untapped potential, mirroring Gruma's successful expansion in other developing regions.

The challenge lies in the significant investment required to establish robust supply chains, distribution networks, and brand recognition in these new territories. Gruma's existing global operational expertise, however, provides a solid foundation for navigating these complexities. By 2024, many emerging markets saw significant GDP growth, with countries like India and Vietnam projected to continue strong economic expansion, indicating fertile ground for Gruma's product expansion.

While Gruma's foundation is built on corn flour and tortillas, the company also offers a range of other food items, including snacks and pasta. Expanding aggressively or innovating within these related categories, particularly in high-growth segments where Gruma currently holds a smaller market share, would position these ventures as question marks within the BCG Matrix. These initiatives will likely demand significant investment in marketing and distribution to gain traction and achieve success.

Gruma's strategic move to invest in a new snack production center underscores its commitment to growing this segment. This investment signals an intent to capture a larger share of the snack market, which is often characterized by rapid consumer trend shifts and competitive pressures. Such a move aligns with the characteristics of a question mark, requiring careful management and substantial resources to transform into a star or cash cow.

Advanced Sustainable Packaging Solutions

Gruma's investment in advanced sustainable packaging solutions, such as biodegradable or compostable materials, fits within its 'For a Better Tomorrow' program. These innovations, while aligning with growing consumer demand for eco-friendly products, represent significant upfront costs. The market adoption rate and the long-term cost-effectiveness of these materials are still developing, placing them as potential question marks in the BCG matrix.

The company's commitment to reducing its environmental footprint through packaging means exploring technologies that may not yet offer immediate returns. For instance, if Gruma were to invest heavily in a new plant-based plastic alternative in 2024, and its production costs were 30% higher than traditional plastics with only moderate consumer willingness to pay a premium, this would exemplify a question mark.

- High initial investment costs for new sustainable materials.

- Uncertainty regarding market adoption and consumer willingness to pay for premium packaging.

- Need for ongoing research and development to optimize cost and performance.

Investments in New Production Lines in Developing Regions (e.g., China)

Gruma's decision to invest in new production lines in China signals a strategic bet on the region's burgeoning market. This move suggests Gruma perceives significant growth potential within China's food sector, likely driven by evolving consumer preferences and increasing disposable incomes.

However, the classification of these investments as a 'question mark' in the BCG matrix hinges on Gruma's current market penetration. If Gruma holds a relatively small market share in China, despite the market's overall expansion, these new lines represent a significant opportunity but also a considerable risk. Success will necessitate aggressive strategies to capture market share and effectively compete against established local players.

In 2024, Gruma's capital expenditures included substantial allocations towards expanding its production capabilities in emerging markets, with China being a key focus area. For instance, reports indicated a planned investment of over $100 million in new facilities across Asia, with a significant portion earmarked for China to meet anticipated demand for its core products.

- Market Growth Potential: China's processed food market was projected to grow at a compound annual growth rate (CAGR) of approximately 7-9% leading into 2025, according to industry analyses from 2024.

- Competitive Landscape: Gruma faces intense competition from domestic Chinese food manufacturers who often have established distribution networks and strong brand loyalty, making market share acquisition challenging.

- Investment Strategy: The expansion into new production lines reflects a commitment to localize production, potentially reducing costs and improving responsiveness to local market demands.

- Risk Factor: The success of these investments is contingent on Gruma's ability to execute effective market penetration strategies and adapt its product offerings to local tastes and regulatory environments.

Question marks in Gruma's BCG matrix represent ventures with low market share in high-growth industries. These require significant investment to gain traction and potentially become stars. Without careful management and strategic execution, they risk becoming dogs.

Gruma's expansion into new international markets with its 'Better For You' products exemplifies a question mark. While the global health and wellness market is booming, Gruma's current presence in many of these regions is minimal, necessitating substantial investment to build brand awareness and distribution.

Investing in new product categories or expanding into untapped emerging markets, such as Southeast Asia, also places ventures in the question mark quadrant. These areas offer high growth potential but demand considerable capital for supply chain development and market penetration.

Gruma's strategic investments in areas like sustainable packaging or new snack production facilities also fall into the question mark category. These initiatives require substantial upfront costs and face uncertainties in market adoption and competitive response, demanding careful resource allocation and strategic oversight.

BCG Matrix Data Sources

Our Gruma BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.