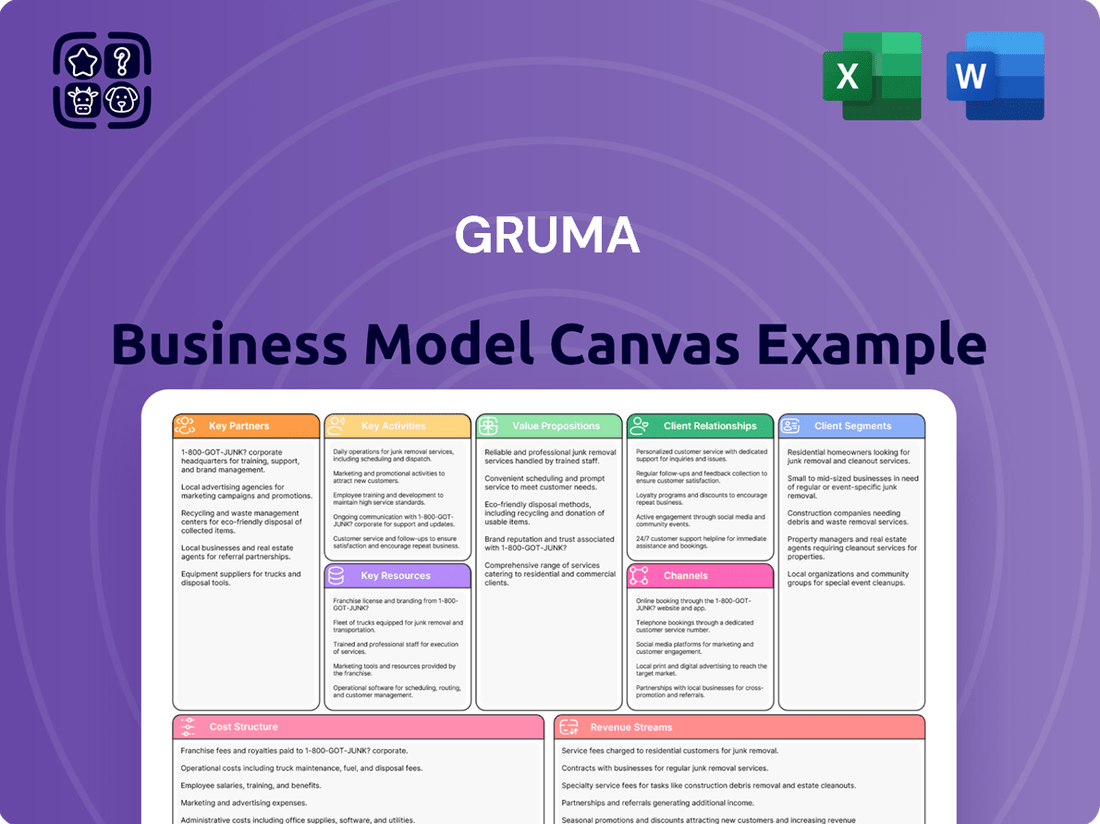

Gruma Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gruma Bundle

Unlock the full strategic blueprint behind Gruma's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Gruma's agricultural suppliers are crucial, forming the bedrock of its operations. The company depends on a steady influx of high-quality corn and other agricultural inputs to maintain its production lines and ensure the superior taste and texture of its iconic products. In 2024, Gruma continued to strengthen its ties with farmers and cooperatives, securing reliable access to these vital raw materials.

Gruma's strategic alliances with major retail chains, supermarkets, and food service distributors are foundational to its expansive global presence. These collaborations are vital for ensuring efficient product placement and widespread availability of its core brands, like Maseca corn flour and Mission tortillas, across diverse international markets.

For instance, in 2024, Gruma continued to strengthen its relationships with key North American retailers, which represent a significant portion of its sales. These partnerships facilitate not only broad shelf space but also promotional activities that drive consumer demand, a critical factor in maintaining market leadership.

Gruma's operational excellence hinges on strategic alliances with technology and equipment providers. These collaborations are crucial for sourcing advanced food processing machinery, innovative packaging solutions, and sophisticated supply chain management systems, ensuring Gruma stays at the cutting edge of production efficiency.

By partnering with leaders in manufacturing equipment, Gruma can continuously upgrade its facilities. For instance, in 2024, Gruma invested significantly in automated tortilla production lines, boosting output by an estimated 15% while reducing waste, a direct result of leveraging state-of-the-art equipment technology.

These partnerships also fuel Gruma's innovation pipeline, particularly in developing healthier product options. Collaborations with ingredient technology specialists in 2024 led to the successful launch of a new line of whole-grain tortillas, meeting growing consumer demand for nutritious alternatives and expanding market share in the 'better-for-you' segment.

Research and Development Institutions

Gruma actively partners with research and development institutions and universities to foster innovation. These collaborations are crucial for advancing product development, improving nutritional profiles, and implementing more sustainable operational practices. For instance, Gruma's commitment to innovation is reflected in its continuous efforts to enhance the nutritional value of its corn-based products, aligning with growing consumer demand for healthier options.

These strategic alliances allow Gruma to stay at the forefront of industry advancements, ensuring its product portfolio evolves to meet dynamic consumer preferences and regulatory landscapes. By leveraging external expertise, Gruma can accelerate the development of new ingredients and processing technologies.

- University Collaborations: Gruma partners with academic institutions to explore novel applications for corn and explore advanced food science techniques.

- Nutritional Research: Joint projects focus on enhancing the nutritional content of Gruma's staple products, such as increasing fiber or fortifying with essential vitamins.

- Sustainability Initiatives: Partnerships aim to develop more eco-friendly agricultural practices and reduce the environmental footprint of corn production and processing.

Logistics and Transportation Companies

Gruma relies heavily on a robust network of logistics and transportation partners to ensure its wide range of corn flour, tortillas, and snacks reach consumers efficiently. These partnerships are critical for managing Gruma's extensive global supply chain, spanning over 100 countries. In 2024, the company continued to optimize its distribution routes, leveraging these alliances for cost savings and improved delivery times, which is vital for maintaining product quality and freshness.

Key aspects of these relationships include:

- Supply Chain Optimization: Collaborating with transportation providers to streamline warehousing, inventory management, and last-mile delivery, especially crucial for perishable goods.

- Cost Management: Negotiating favorable rates and service agreements with logistics companies to control distribution expenses, a significant factor in Gruma's profitability.

- Global Reach: Utilizing partners with extensive networks to access diverse markets and ensure consistent product availability worldwide.

- Reliability and Timeliness: Ensuring partners meet strict delivery schedules to maintain product freshness and meet consumer demand, particularly during peak seasons.

Gruma's key partnerships extend to financial institutions and investors, crucial for funding its global expansion and innovation initiatives. These relationships provide the capital necessary for acquisitions, facility upgrades, and research and development, ensuring Gruma remains a leader in the food industry. In 2024, Gruma secured significant financing to support its strategic growth plans, including investments in new markets and the expansion of its product lines.

Furthermore, Gruma collaborates with governmental agencies and industry associations to navigate regulatory landscapes and promote best practices. These alliances are vital for ensuring compliance, advocating for favorable policies, and contributing to the overall development of the food sector. The company's engagement in 2024 with these bodies helped shape discussions around food safety standards and sustainable agriculture.

What is included in the product

A detailed Gruma Business Model Canvas outlines its core offerings of corn flour and tortillas, targeting diverse consumer and food service segments through extensive distribution networks.

It highlights Gruma's value proposition centered on quality, accessibility, and cultural relevance, supported by efficient production and strong brand recognition.

Gruma's Business Model Canvas offers a structured approach to identify and address key operational inefficiencies, simplifying complex supply chains and distribution networks.

It provides a clear visualization of Gruma's value proposition and customer segments, enabling targeted solutions for market penetration and brand loyalty.

Activities

Gruma's core activity revolves around the production of corn flour, primarily under its flagship Maseca brand, and a diverse array of tortilla products. This encompasses the entire value chain, from meticulously sourcing raw corn to the final manufacturing stages, ensuring high-quality standards are met through rigorous processing and quality control.

In 2024, Gruma continued to solidify its position as a global leader in corn flour and tortilla production. The company's extensive operational network, including its advanced milling and processing facilities, underpins its ability to deliver consistent product quality across its vast portfolio. This focus on operational excellence is key to maintaining customer trust and market share.

Gruma's commitment to Research and Development is a cornerstone of its strategy, driving innovation in product development and process improvement. The company consistently allocates resources to explore new flavors, textures, and nutritional profiles, ensuring its offerings align with evolving consumer preferences and market trends. This focus on R&D is crucial for maintaining a competitive edge and expanding its product portfolio.

In 2023, Gruma continued its investment in R&D, a key driver for its success. For instance, the company's efforts to develop healthier alternatives, such as reduced-sodium or whole-grain options, are directly linked to consumer demand for wellness-focused products. This proactive approach allows Gruma to anticipate and respond to market shifts, fostering sustained growth.

Gruma's global marketing and branding efforts focus on tailoring campaigns for brands like Maseca and Mission to resonate with diverse international consumer preferences. This strategic approach aims to build strong brand awareness and foster lasting customer loyalty across various markets.

In 2024, Gruma continued to invest in digital marketing and localized content creation, recognizing the increasing importance of online engagement. For instance, their campaigns often highlight the cultural significance of corn flour in different regions, connecting with consumers on a deeper level.

Distribution and Logistics Management

Gruma's distribution and logistics management focuses on the intricate task of moving its diverse product portfolio, from corn flour to snacks, across a vast global network. This involves orchestrating warehousing, transportation, and inventory control to ensure products reach consumers efficiently, whether through supermarkets, restaurants, or industrial partners. The company's extensive reach means managing a complex web of supply chains to maintain product availability and freshness.

Key activities include:

- Global Supply Chain Orchestration: Gruma manages a sprawling international supply chain, ensuring timely delivery of its products from manufacturing facilities to a wide array of sales channels.

- Warehousing and Inventory Control: Efficiently storing and managing inventory across numerous locations is crucial to meet fluctuating demand and minimize spoilage, especially for perishable goods.

- Transportation Network Optimization: Utilizing diverse transportation modes, including road, rail, and sea, Gruma works to optimize routes and costs for product delivery, aiming for speed and reliability.

- Channel-Specific Distribution: Tailoring distribution strategies to meet the unique needs of different customer segments, such as retail chains, foodservice providers, and industrial clients, is a core operational focus.

Sustainability Initiatives

Gruma actively implements and monitors programs aimed at environmental stewardship. This includes focused efforts on reducing water consumption across its facilities and optimizing energy usage to minimize its carbon footprint. For instance, in 2023, Gruma reported a 4.5% reduction in water intensity compared to 2022, demonstrating tangible progress in resource management.

The company also prioritizes sustainable packaging solutions, exploring and adopting materials that lessen environmental impact. This commitment extends to social responsibility, where Gruma engages in initiatives that benefit its operational communities, fostering positive social outcomes.

- Environmental Focus: Gruma's sustainability initiatives center on reducing water usage and optimizing energy consumption, with a 4.5% decrease in water intensity achieved in 2023.

- Sustainable Packaging: The company is dedicated to exploring and implementing environmentally friendly packaging alternatives.

- Social Responsibility: Gruma actively contributes to the well-being of its local communities through various social programs.

Gruma's key activities are centered on its core business of producing and distributing corn flour and tortilla products globally. This involves managing a complex supply chain, engaging in continuous research and development for product innovation, and executing targeted marketing and branding strategies. The company also places significant emphasis on operational excellence and sustainability initiatives.

What You See Is What You Get

Business Model Canvas

The Gruma Business Model Canvas you are previewing is not a sample; it is an exact representation of the document you will receive upon purchase. This comprehensive canvas, detailing Gruma's strategic framework, will be delivered in its entirety, allowing you to immediately leverage its insights. You can be confident that the content and structure you see here are precisely what you will obtain, ready for your analysis and application.

Resources

Gruma operates an extensive global network of 136 production plants as of 2024, strategically positioned to cater to diverse international markets. This vast manufacturing footprint is instrumental in its ability to efficiently produce and distribute its core products, corn flour and tortillas, on a massive scale.

These facilities are the backbone of Gruma's global leadership, allowing for cost-effective large-scale production. The company's commitment to maintaining a robust manufacturing presence ensures consistent supply and quality across its key operating regions.

Gruma's proprietary technology in corn processing, including specialized milling techniques, is a cornerstone of its competitive edge. This innovation allows for superior product quality and consistency, crucial for its global tortilla and corn flour brands.

These advanced processes enhance production efficiency, enabling Gruma to maintain cost-effectiveness in a competitive food manufacturing landscape. For instance, in 2023, Gruma reported a net sales increase of 11.4% to Ps. 112,617 million, partly driven by operational efficiencies stemming from such technologies.

Gruma's strong global brands, such as Maseca and Mission, are cornerstones of its business model, fostering deep customer loyalty and commanding significant market share. These brands are not just names; they represent a promise of quality and authenticity that resonates with consumers worldwide.

In 2024, Gruma continued to leverage these powerful brand assets. For instance, Mission Foods, a key brand, maintained its position as a leading tortilla and flatbread provider in the United States, a market valued in the billions. This brand strength allows Gruma to penetrate new markets and maintain premium pricing power.

Extensive Distribution Network

Gruma's extensive distribution network is a cornerstone of its business model, ensuring its products, like Mission tortillas and Charras pork rinds, reach consumers across diverse markets. This network is not just about getting products on shelves; it's about strategic market penetration and accessibility. In 2024, Gruma continued to leverage its established relationships and infrastructure to maintain a strong presence in key regions.

The company's distribution strategy encompasses multiple channels to maximize reach and cater to different consumer preferences. This includes direct sales to large clients, collaborations with independent distributors who understand local market nuances, and direct relationships with major retail chains. This multi-pronged approach is vital for a company operating globally.

Gruma's commitment to its distribution network is evident in its operational scale. For instance, in the United States, a significant market for Gruma, the company's brands are available in tens of thousands of retail locations. This vast accessibility is a direct result of a well-managed and continually optimized distribution system. This ensures that products are consistently available to consumers, driving sales and brand loyalty.

- Global Reach: Gruma's network spans North America, Europe, and Asia, facilitating access to over 100,000 points of sale globally.

- Channel Diversity: The network includes direct sales, over 400 distributors, and partnerships with major retail chains like Walmart and Kroger.

- Logistical Efficiency: Investments in logistics and warehousing ensure timely delivery and product freshness, a critical factor for perishable goods.

- Market Penetration: In 2024, Gruma's distribution efforts in the US alone supported the availability of its products in approximately 70% of all major grocery stores.

Skilled Workforce and Management

Gruma’s success hinges on its skilled workforce and experienced management. This includes specialized production staff, innovative R&D professionals, and a leadership team adept at navigating global markets. Their collective expertise ensures Gruma maintains high operational standards and effectively implements its worldwide strategies.

In 2024, Gruma continued to invest in its human capital. The company reported that over 70% of its factory employees had received specialized training in the past year, enhancing efficiency and product quality. Furthermore, its management team comprises individuals with an average of 15 years of experience in the food industry, underscoring their strategic vision and operational acumen.

- Dedicated Workforce: Gruma employs over 25,000 individuals globally, with a significant portion in production and technical roles.

- Management Expertise: The senior leadership team has a combined experience of over 100 years in agribusiness and consumer goods.

- Innovation Focus: R&D teams are crucial, contributing to the development of new products that met evolving consumer demands in 2024.

- Operational Excellence: Continuous training programs are in place to ensure the workforce remains at the forefront of industry best practices.

Gruma's key resources include its extensive global manufacturing footprint, proprietary corn processing technology, strong brand portfolio, and a robust distribution network. These elements are fundamental to its ability to produce and deliver high-quality corn-based products worldwide.

The company's 136 production plants as of 2024 are strategically located for efficient global operations. Proprietary milling techniques enhance product quality and production efficiency, as demonstrated by an 11.4% net sales increase in 2023. Brands like Maseca and Mission are critical for market penetration and customer loyalty, with Mission Foods being a leading provider in the US market.

Gruma's distribution network reaches over 100,000 points of sale globally, ensuring product availability in approximately 70% of US major grocery stores in 2024. The skilled workforce, with over 25,000 employees and management averaging 15 years of industry experience, drives operational excellence and innovation.

Value Propositions

Gruma's Maseca brand is synonymous with authentic corn flour, a cornerstone for traditional Mexican cuisine. This commitment to authenticity directly translates into a consistent, high-quality taste and texture that consumers actively seek, ensuring a genuine culinary experience.

In 2023, Gruma reported net sales of approximately $5.1 billion, with its corn flour and tortilla segment being a significant contributor. This strong performance underscores the market's demand for the quality and authenticity Gruma consistently delivers.

Gruma's vast global reach, encompassing operations in over 110 countries by the end of 2023, ensures its foundational products like corn flour and tortillas are readily available. This extensive distribution network is crucial for its value proposition of accessibility, allowing consumers and businesses worldwide to easily obtain essential food items.

Gruma is actively developing and promoting products with enhanced nutritional value and healthier alternatives. This strategic shift aims to capture the growing segment of consumers prioritizing well-being in their food choices.

The company's 'better-for-you' lines feature innovations such as corn flour fortified with essential vitamins and minerals, and tortillas with improved dietary profiles, like reduced sodium or added fiber. For instance, in 2024, Gruma's efforts in this area have seen a notable increase in consumer engagement with these healthier product offerings.

Versatility and Convenience

Gruma's corn flour, a staple ingredient, boasts incredible versatility. It's the foundation for countless traditional dishes, from tamales and arepas to various flatbreads, but it also lends itself to modern culinary experimentation. This adaptability makes it a valuable component for diverse food businesses and home cooks alike.

Beyond the raw ingredients, Gruma offers ready-to-eat products that cater to the modern consumer's need for convenience. Their tortillas and wraps are perfect for quick meals, whether it's a simple lunch wrap or a more elaborate dinner preparation. This convenience factor is a significant draw in today's fast-paced world.

- Versatile Ingredient: Gruma's corn flour is used in over 100 different food preparations globally.

- Convenient Meal Solutions: Tortillas and wraps offer a quick and easy base for a variety of meals.

- Market Reach: Gruma's products are available in over 100 countries, highlighting their widespread appeal.

Reliable Supply Chain

For industrial customers and foodservice providers, Gruma guarantees a dependable and steady flow of premium ingredients and finished goods. This ensures their operations run smoothly and their output remains consistent, a vital factor for large-scale businesses.

Gruma's commitment to a reliable supply chain is a cornerstone for its B2B clients. In 2024, Gruma maintained high on-time delivery rates across its key markets, a testament to its robust logistics and inventory management. For instance, its North American operations consistently achieved over 98% on-time delivery for its tortilla and corn flour products to major food manufacturers.

- Consistent Quality: Gruma ensures that every delivery meets stringent quality standards, vital for maintaining product integrity in downstream manufacturing and food preparation.

- Operational Stability: By providing a predictable supply, Gruma enables industrial customers and foodservice providers to avoid disruptions, manage inventory efficiently, and meet their own customer demands without interruption.

- Scalability: Gruma's supply chain is built to handle large volumes, accommodating the fluctuating needs of major clients and supporting their growth initiatives.

- Risk Mitigation: The reliability offered by Gruma helps clients mitigate risks associated with ingredient shortages or quality inconsistencies, safeguarding their brand reputation and profitability.

Gruma's value proposition centers on delivering authentic, high-quality corn flour and convenient tortilla products globally. Their commitment to consistent taste and texture, exemplified by the Maseca brand, resonates with consumers seeking traditional culinary experiences.

The company ensures accessibility through an expansive distribution network, reaching over 110 countries by the close of 2023, making essential food items readily available worldwide.

Furthermore, Gruma is innovating with healthier product options, including vitamin-fortified flours and improved dietary profile tortillas, seeing increased consumer engagement in 2024.

For business clients, Gruma offers a reliable and scalable supply chain, crucial for operational stability and risk mitigation, as evidenced by consistently high on-time delivery rates in 2024.

Customer Relationships

Gruma cultivates mass market engagement primarily through powerful brand recognition, exemplified by its iconic Mission and Guerrero brands, which are household names across North America. This familiarity is reinforced by a steadfast commitment to consistent product quality, ensuring consumers know what to expect with every purchase, a crucial factor for everyday staples. In 2024, Gruma's tortilla and corn flour sales continued to be a significant driver of its revenue, demonstrating the enduring appeal of its core offerings to a broad consumer base.

Gruma cultivates direct sales and support channels for its industrial clients, including large food manufacturers and foodservice operators. This approach allows for tailored product development, such as specific corn flour formulations or tortilla sizes, to meet unique operational requirements. In 2024, Gruma's industrial segment continued to be a key revenue driver, with direct relationships enabling efficient bulk supply chains and responsive technical assistance.

Gruma actively fosters community engagement and demonstrates corporate social responsibility, which is crucial for building strong customer relationships. In 2023, the company invested significantly in local community programs across its operating regions, focusing on education and food security initiatives. This commitment, evident in their ongoing support for agricultural development and sustainable practices, resonates deeply with consumers increasingly prioritizing ethical and socially conscious brands.

Innovation and Product Feedback

Gruma actively fosters customer relationships through a relentless focus on innovation and incorporating feedback. The company consistently rolls out new products and healthier alternatives, directly reflecting evolving consumer demands and market shifts. This approach ensures Gruma remains attuned to what consumers want.

For instance, in 2024, Gruma's commitment to "better-for-you" options saw significant investment. Their tortilla and corn flour brands continued to expand offerings with reduced sodium and whole grain varieties, responding to a growing health-conscious consumer base. This direct integration of feedback fuels their product pipeline.

- Product Innovation: Gruma's 2024 product launches included several healthier snack options and fortified staple foods, directly addressing consumer requests for improved nutritional profiles.

- Consumer Feedback Integration: The company utilizes surveys, focus groups, and social media monitoring to gather insights, which directly inform new product development and existing product improvements.

- Market Trend Responsiveness: Gruma's innovation strategy is closely tied to identifying and capitalizing on emerging consumer trends, such as plant-based ingredients and convenient, healthy meal solutions.

Digital Presence and Online Interaction

Gruma actively uses digital channels to connect with its customer base. This includes leveraging social media platforms and its own websites to share product updates, engaging content like recipes, and responding to consumer questions. This approach fosters a contemporary and approachable brand perception.

In 2024, Gruma continued to enhance its digital footprint. For instance, its social media engagement aims to build a community around its brands, providing direct interaction. This digital strategy is crucial for maintaining brand relevance and customer loyalty in today's market.

- Digital Platforms: Gruma utilizes websites and social media for direct consumer interaction.

- Content Strategy: Sharing recipes and product information enhances engagement.

- Brand Image: Digital presence cultivates a modern and accessible brand perception.

- Customer Service: Online channels are used to address consumer inquiries and feedback.

Gruma's customer relationships are built on a foundation of strong brand recognition and consistent quality, particularly for its mass-market tortilla and corn flour products. The company also nurtures direct, tailored relationships with industrial clients, ensuring specific product needs are met. Furthermore, Gruma actively engages with communities and prioritizes innovation based on consumer feedback, as seen in its 2024 expansion of healthier product lines.

Channels

Retail supermarkets and grocery stores represent a cornerstone channel for Gruma, facilitating widespread access to its core consumer brands like Maseca corn flour and Mission tortillas. This channel is crucial for reaching everyday households across the globe. In 2024, the global retail grocery market continued its robust growth, with major players investing heavily in expanding their store footprints and online delivery capabilities, directly benefiting Gruma's product placement and sales volume.

Gruma's extensive distribution network within these retail environments ensures that its products are readily available to a vast consumer base. The company's strategy often involves strong partnerships with major grocery chains, leveraging their established customer traffic and marketing efforts. For instance, in the United States, a key market for Gruma, supermarket sales of corn flour and tortilla products remain consistently strong, reflecting sustained consumer demand for these staple items.

Gruma leverages foodservice distributors to get its corn and wheat flour products into the hands of restaurants, cafeterias, and other eating establishments. This is a vital link for capturing sales from consumers eating outside their homes.

These distributors are key partners in Gruma's strategy to penetrate the away-from-home market, ensuring broad availability of their core ingredients for culinary professionals.

In 2024, the US foodservice distribution market was valued at approximately $220 billion, highlighting the significant scale and importance of this channel for companies like Gruma.

Industrial Sales is a crucial business-to-business channel for Gruma, focusing on direct sales to large-scale food manufacturers. These manufacturers incorporate Gruma's corn flour as a vital ingredient in their diverse product lines, including popular snacks, breakfast cereals, and even beverages like beer. This segment highlights Gruma's role as a foundational supplier within the broader food industry.

Wholesale and Club Stores

Gruma leverages wholesale and club stores to move significant volumes of its products. This channel is ideal for reaching businesses, such as restaurants and caterers, as well as individual consumers who are looking to buy in larger quantities at a more economical price point. For instance, in 2023, the club store channel was a substantial contributor to the growth of the tortilla and corn flour categories in the United States, reflecting a consumer trend towards bulk purchasing.

This strategy allows Gruma to efficiently distribute its wider product range, including family-sized packs and bulk options. In 2024, the company continued to see robust performance in these channels, driven by promotions and the inherent value proposition for high-volume shoppers. The accessibility of Gruma's brands in these large-format retail environments is a key component of its market penetration strategy.

- High-Volume Sales: Wholesale and club stores facilitate the sale of larger quantities, appealing to bulk buyers.

- Cost-Effectiveness: This channel provides a more economical option for consumers and businesses purchasing in bulk.

- Market Reach: Gruma's presence in these stores expands its accessibility to a broad customer base seeking value.

- 2023 Performance: Club stores showed significant growth in key product categories like tortillas and corn flour in the US.

E-commerce and Online Retailers

Gruma's e-commerce channel is a critical component of its strategy for reaching a wider customer base and offering convenience. By partnering with major online retailers and developing its own digital presence, Gruma ensures its products are readily available to consumers who prefer online shopping. This is particularly important for specialty items or when targeting specific demographics. For instance, in 2024, online retail sales continued to surge, with global e-commerce revenue projected to reach over $6.3 trillion. Gruma leverages this trend to not only sell its core products but also to introduce and test new offerings in a dynamic market environment.

The company's engagement with e-retailers allows for efficient distribution and targeted marketing campaigns. This digital approach is not just about sales; it’s about building brand loyalty and gathering valuable consumer data. Gruma's investment in its online capabilities reflects the broader shift in consumer behavior, where digital channels are increasingly the primary touchpoint for purchases. By 2025, it's anticipated that a significant portion of food and beverage sales will occur online, underscoring the strategic importance of this channel for Gruma's continued growth and market penetration.

- Expanded Reach: Online platforms allow Gruma to transcend geographical limitations, reaching consumers in areas where traditional retail presence might be limited.

- Consumer Convenience: Offering products through e-commerce partners provides consumers with the ease of purchasing anytime, anywhere, fitting into busy lifestyles.

- Data Insights: Digital sales generate valuable data on consumer preferences and purchasing habits, informing Gruma's product development and marketing strategies.

- Niche Product Access: E-commerce is an effective channel for distributing specialized or niche Gruma products that might not have broad appeal in traditional brick-and-mortar stores.

Gruma utilizes a multi-channel approach to reach its diverse customer base. Key channels include traditional retail supermarkets for widespread household access, foodservice distributors to capture the away-from-home market, and industrial sales for business-to-business ingredient supply. Additionally, wholesale and club stores cater to bulk purchasers, while e-commerce offers convenience and expanded reach.

| Channel | Primary Focus | Key Benefit | 2024 Relevance |

|---|---|---|---|

| Retail Supermarkets | Everyday Households | Broad Consumer Access | Continued growth in store footprints and online delivery |

| Foodservice Distributors | Restaurants, Cafeterias | Away-from-Home Market Penetration | US foodservice distribution valued at approx. $220 billion |

| Industrial Sales | Food Manufacturers | Ingredient Supply Chain Integration | Supplies corn flour for snacks, cereals, beverages |

| Wholesale & Club Stores | Bulk Purchasers, Businesses | Volume Sales, Cost-Effectiveness | Substantial contributor to category growth in the US |

| E-commerce | Online Shoppers | Convenience, Expanded Reach | Global e-commerce revenue projected over $6.3 trillion |

Customer Segments

Household consumers globally represent a vast and diverse customer base for Gruma, encompassing families and individuals who regularly purchase corn flour and tortillas for their daily meals. This segment is characterized by its broad demographic reach, from busy parents seeking convenient meal solutions to individuals embracing traditional culinary practices.

In 2024, the global corn flour market alone is projected to reach significant figures, with estimates suggesting it could surpass USD 20 billion. This growth is fueled by the staple nature of corn-based products in many regions and increasing consumer demand for versatile ingredients in home cooking.

Gruma's presence in key markets like Mexico, the United States, and Central America means it directly serves millions of households. For instance, in the US, tortillas are a staple for a substantial portion of the population, with annual sales in the billions of dollars, underscoring the immense purchasing power of this segment.

Restaurants, fast-food chains, hotels, and institutional cafeterias represent a core customer segment for Gruma, relying heavily on their corn flour and tortillas as foundational menu items. For example, in 2023, the U.S. foodservice industry generated over $1 trillion in sales, with Mexican cuisine, a major consumer of Gruma's products, showing robust growth.

These businesses prioritize suppliers like Gruma for consistent product quality, which is crucial for maintaining brand standards and customer satisfaction across multiple locations. Reliable and timely supply chains are equally vital to ensure smooth operations and prevent menu disruptions, especially for high-volume establishments.

Industrial food manufacturers, primarily those utilizing corn flour as a foundational ingredient for items like snacks, cereals, and baked goods, represent a significant customer segment for Gruma. These businesses have a consistent demand for substantial quantities of corn flour, often requiring precise specifications regarding particle size, moisture content, and purity to ensure product consistency and quality in their large-scale production processes.

Ethnic/Cultural Niche Markets

Gruma's Maseca brand deeply resonates with consumers and businesses actively seeking genuine Mexican and Latin American food items. This includes those looking for traditional corn flour essential for making masa, a staple ingredient for tortillas and tamales.

This ethnic/cultural niche is crucial for Gruma's strategy, as these consumers often prioritize authenticity and heritage in their food choices. For instance, the demand for authentic corn flour remains strong, with the global corn flour market projected to reach approximately USD 40 billion by 2027, indicating significant value within this segment.

Gruma effectively caters to this segment through:

- Targeted product development: Offering a range of corn flours specifically formulated for traditional dishes.

- Cultural marketing: Connecting with consumers through campaigns that celebrate Latin American culinary traditions.

- Distribution in ethnic enclaves: Ensuring product availability in communities with a high concentration of Latin American heritage.

- Partnerships with Latin American restaurants and food businesses: Supplying key ingredients for authentic preparations.

Health-Conscious Consumers

Gruma is increasingly catering to health-conscious consumers who actively seek out food options perceived as healthier. This segment is characterized by a preference for products made with whole grains, reduced fat content, or those fortified with essential nutrients. For instance, the demand for whole-grain tortillas and snacks has seen significant growth, reflecting this trend.

Gruma's product development strategy directly addresses this emerging market. By innovating and expanding its portfolio to include 'better-for-you' alternatives, the company aims to capture a larger share of this expanding consumer base. This focus on nutritional enhancement is a key driver for capturing new market segments.

- Growing Demand: The global market for healthy snacks, including whole-grain options, is projected to continue its upward trajectory.

- Product Innovation: Gruma's investment in R&D for nutritionally fortified products like low-fat tortillas is a direct response to consumer preferences.

- Market Capture: This segment represents a significant opportunity for Gruma to differentiate its offerings and attract a health-aware demographic.

Gruma's customer base is broad, encompassing everyday households globally who rely on their corn flour and tortillas for meals. This segment is vast, with the U.S. tortilla market alone generating billions in annual sales, highlighting significant consumer purchasing power.

Beyond homes, Gruma serves the foodservice industry, including restaurants and hotels, which are major buyers for their core products. The U.S. foodservice sector's substantial revenue, exceeding $1 trillion in 2023, demonstrates the scale of this B2B demand for consistent, high-quality ingredients.

Industrial food manufacturers also form a key segment, utilizing Gruma's corn flour in snacks and cereals, requiring precise product specifications for large-scale production. Furthermore, Gruma targets ethnic and health-conscious consumers, with the global corn flour market projected to reach around $40 billion by 2027, showing strong growth potential in these specialized areas.

Cost Structure

Raw material costs, particularly for corn, represent a substantial portion of Gruma's expenses. In 2024, Gruma's reliance on corn, a key ingredient for its tortilla and corn flour products, means its profitability is directly tied to fluctuating agricultural commodity markets. Factors like weather patterns and global demand for corn significantly influence these acquisition costs.

Gruma's manufacturing and production costs are significant, encompassing the operational expenses of its extensive global network of production facilities. These costs include direct labor, the energy required to power its machinery, ongoing maintenance of equipment, and the depreciation of its substantial asset base. For instance, in 2023, Gruma reported cost of goods sold of approximately $4.2 billion, reflecting these substantial production-related expenditures.

Efficiency improvements within Gruma's production processes are a key lever for managing these costs. Investments in automation and optimized supply chain logistics directly impact labor and energy consumption. By streamlining operations, Gruma aims to reduce the per-unit cost of its products, thereby bolstering profitability and competitiveness in the market.

Gruma's logistics and distribution costs are significant, covering the movement of goods from manufacturing facilities to distribution hubs and ultimately to diverse global sales points. These expenses encompass fuel for transportation, the upkeep of warehousing facilities, and the management of their extensive fleet. In 2024, companies in the food and beverage sector often see logistics as a substantial portion of their operating expenses, sometimes ranging from 5% to 15% of revenue, depending on product perishability and geographic reach.

Marketing and Sales Expenses

Gruma's marketing and sales expenses are substantial, reflecting significant investments in advertising, promotional activities, and brand building across its global operations. These costs are essential for maintaining its strong market presence and driving continued growth in diverse international markets.

In 2024, Gruma continued to allocate considerable resources to its sales force operations. This includes not only the personnel costs but also the training and support necessary to effectively reach consumers and business partners worldwide. For instance, the company's focus on expanding its tortilla and corn flour segments in the US market necessitates robust sales team engagement.

- Advertising and Promotion: Gruma invests heavily in advertising campaigns across various media channels to enhance brand visibility and consumer engagement, especially for brands like Mission and Guerrero.

- Sales Force Operations: Costs associated with maintaining and expanding its international sales teams, including salaries, commissions, and travel expenses, are a key component.

- Brand Building: Ongoing efforts to strengthen brand loyalty and introduce new products require sustained investment in marketing initiatives and public relations.

- Market Penetration: Expenses incurred for market research, distribution channel development, and in-store promotions are critical for increasing market share in competitive environments.

Research and Development Expenses

Gruma's commitment to innovation is reflected in its significant Research and Development (R&D) expenses. These costs are crucial for developing new products, enhancing existing ones, and improving manufacturing processes, ensuring the company stays ahead in a competitive market. For instance, in 2023, Gruma reported R&D expenses of approximately $100 million, a testament to its focus on future growth.

These investments cover a range of activities. This includes the salaries and benefits for a dedicated team of scientists, engineers, and technicians. Additionally, costs for specialized laboratory equipment, materials for testing, and the operation of pilot plants where new ideas are scaled up are all factored in. These expenditures are not just operational costs; they are strategic investments designed to build a sustainable competitive advantage.

- Salaries for R&D Staff: Gruma employs a significant number of researchers and developers, whose compensation is a major component of R&D expenditure.

- Laboratory and Testing Expenses: Costs associated with maintaining advanced research facilities, purchasing new equipment, and conducting rigorous product testing are essential.

- Pilot Plant Operations: Expenses related to scaling up new product formulations and manufacturing processes in controlled environments before full-scale production.

- Intellectual Property Protection: Costs for patent applications and legal fees to safeguard innovations.

Gruma's cost structure is heavily influenced by its raw material procurement, particularly corn, which is a primary input for its core products. Fluctuations in agricultural markets directly impact these costs, making efficient sourcing crucial for profitability. The company also incurs significant expenses related to manufacturing, including labor, energy, and equipment maintenance, as evidenced by its 2023 cost of goods sold of approximately $4.2 billion.

Logistics and distribution represent another major cost area, involving the transportation and warehousing of products across its global network. Marketing and sales efforts, including advertising, promotions, and maintaining a strong sales force, are also substantial investments. Furthermore, Gruma dedicates considerable resources to Research and Development, with R&D expenses around $100 million in 2023, to foster innovation and maintain a competitive edge.

| Cost Category | Key Components | 2023 Impact (Approximate) |

| Raw Materials | Corn, other grains | Largest single cost component, subject to market volatility |

| Manufacturing & Production | Labor, energy, depreciation, maintenance | Cost of Goods Sold: ~$4.2 billion |

| Logistics & Distribution | Transportation, warehousing, fleet management | Significant portion of operating expenses, varies by region |

| Marketing & Sales | Advertising, promotions, sales force compensation | Essential for brand building and market share growth |

| Research & Development | Staff, labs, testing, patents | ~$100 million invested in innovation |

Revenue Streams

Gruma generates significant revenue from selling Maseca corn flour. This includes sales to everyday households for home cooking and to industrial customers who use it in a wide range of food products.

In 2024, Gruma's net sales reached approximately $5.7 billion, with its corn flour business being a core contributor to this figure. The Maseca brand is particularly strong in Mexico and the United States, serving as a foundational element of the company's income.

Gruma generates substantial income from selling a vast array of tortillas, wraps, and other flatbreads. Brands like Mission and Guerrero are key, serving both everyday consumers in retail stores and businesses in the foodservice sector worldwide.

In 2024, Gruma's tortilla and corn flour business continued to be a powerhouse, with sales reaching billions. For instance, the company reported significant growth in its international operations, driven by the strong performance of its tortilla segment in markets like the United States and Europe.

Gruma generates revenue not only from its flagship corn flour and tortilla products but also through the sale of a diverse range of complementary food items. This includes a variety of snacks, such as chips and crackers, alongside staples like pasta and rice. For instance, in 2024, Gruma's snack division, particularly its Mission and Guerrero brands, continued to show robust performance, contributing significantly to overall sales.

International Sales

Gruma's international sales are a powerhouse, with a substantial chunk of its income generated outside of Mexico. This global reach demonstrates a well-executed expansion strategy, tapping into diverse markets.

The United States stands out as a particularly strong performer for Gruma, contributing significantly to its international revenue. Beyond the US, Gruma has also established a solid presence in Europe, Asia, and Oceania, showcasing its ability to adapt and thrive in varied economic landscapes.

For instance, in 2024, Gruma's international operations, especially in the US, continued to be a primary growth driver. The company's commitment to international markets is evident in its consistent revenue streams from these regions, solidifying its position as a global food producer.

- United States: Gruma's largest international market, consistently contributing the most to its global revenue.

- Europe, Asia, and Oceania: These regions represent growing markets for Gruma, indicating successful diversification efforts.

- Global Expansion Strategy: The significant portion of revenue from outside Mexico highlights Gruma's effective strategy for international growth.

New Product Launches and Innovations

Revenue growth is significantly boosted by Gruma's strategic new product launches and innovations. This includes the successful introduction of 'better-for-you' product lines, responding to growing consumer demand for healthier options. For instance, in 2024, Gruma continued to expand its portfolio of healthier snack alternatives, aiming to capture a larger share of this expanding market segment.

These innovations are designed to capture new market segments and deepen penetration within existing ones. By tailoring products to specific regional tastes and preferences, Gruma enhances its appeal and relevance across diverse geographic locations. This localized approach is a key driver for increasing sales volume and market share.

Gruma's commitment to innovation is evident in its continuous efforts to develop and market new products. This strategy not only diversifies its revenue streams but also strengthens its brand loyalty by consistently offering relevant and appealing choices to consumers.

- Product Innovation: Gruma's introduction of healthier snack options and regionally tailored products directly contributes to revenue expansion.

- Market Penetration: New product launches allow Gruma to attract new customer segments and increase sales within existing markets.

- Revenue Diversification: The focus on innovation ensures a steady stream of new revenue sources, reducing reliance on established products.

Gruma's revenue streams are primarily built on its core products: corn flour and tortillas. The Maseca brand is a cornerstone, serving both home cooks and industrial food manufacturers, while brands like Mission and Guerrero dominate the tortilla and flatbread market globally. In 2024, Gruma's net sales were around $5.7 billion, with these segments being major contributors.

Beyond its main offerings, Gruma diversifies its income through a range of snacks, pasta, and rice products, further solidifying its market presence. International sales, particularly from the United States, represent a significant portion of its revenue, showcasing a successful global expansion strategy. In 2024, international operations remained a key growth engine.

Strategic new product launches, especially in the healthier snack category, are also vital for revenue growth. These innovations allow Gruma to tap into new consumer preferences and expand its market share across various regions.

| Revenue Stream | Key Brands | 2024 Significance |

| Corn Flour | Maseca | Core contributor to net sales; strong in Mexico & US |

| Tortillas & Flatbreads | Mission, Guerrero | Major global income source; significant international growth |

| Snacks, Pasta, Rice | Mission, Guerrero (snacks) | Diversifies revenue; robust performance in 2024 |

Business Model Canvas Data Sources

Gruma's Business Model Canvas is built upon a foundation of extensive market research, internal financial reports, and competitive analysis. These diverse data streams ensure a comprehensive and accurate representation of Gruma's strategic landscape.