Gruma PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gruma Bundle

Gruma's success hinges on its ability to navigate a complex external environment. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors impacting this global food giant. Understand the critical trends shaping Gruma's operations and future growth. Download the full analysis to gain a strategic advantage.

Political factors

Changes in international trade agreements, such as the USMCA which replaced NAFTA, directly influence Gruma's operational costs and market access for key ingredients like corn and its finished tortilla and corn flour products. For instance, shifts in agricultural import quotas or tariffs between the U.S. and Mexico can alter Gruma's sourcing expenses.

Trade disputes and geopolitical tensions, particularly those impacting major agricultural producers and consumers, create supply chain volatility and can affect Gruma's ability to import raw materials or export finished goods efficiently. The ongoing trade dynamics between the U.S. and China, for example, could indirectly influence global corn prices, a critical input for Gruma.

Government subsidies for corn production, particularly in major producing nations like the United States and Mexico, directly impact Gruma's raw material costs. For instance, in 2024, U.S. corn prices saw fluctuations influenced by government support programs, which can either stabilize or increase input expenses for Gruma's tortilla and corn flour operations.

Regulations concerning genetically modified organisms (GMOs) and conventional farming methods also play a significant role. These policies dictate the types of corn available and their associated costs, forcing Gruma to adapt its procurement strategies and product formulations to meet varying market demands and regulatory landscapes across its operating regions.

Compliance with diverse national agricultural policies is a critical operational consideration for Gruma. Navigating these varying regulations, from import restrictions to labeling requirements for GMO content, is essential for maintaining market access and ensuring product consistency across its global portfolio.

Gruma navigates a complex web of food safety standards and labeling laws across its global operations. For instance, in the European Union, regulations like the General Food Law (Regulation (EC) No 178/2002) mandate strict traceability and safety measures, while the Food Information to Consumers Regulation (EU) No 1169/2011 dictates detailed allergen and nutritional labeling. These varying requirements, such as specific allergen declarations for products like corn tortillas in Mexico versus those sold in the US or EU, demand flexible manufacturing and packaging solutions.

Adherence to these evolving legislative landscapes, including potential new rules on sugar content or origin labeling, can lead to increased compliance costs. For example, a 2024 report by the Food Standards Agency in the UK highlighted that implementing enhanced allergen labeling protocols can add an average of 5% to a food manufacturer's operational expenses. Gruma's commitment to continuous monitoring and adaptation is therefore crucial for maintaining market access and consumer confidence in its brands, such as Mission Foods.

Political Stability in Key Markets

Political instability, civil unrest, or abrupt changes in government leadership within Gruma's primary operating regions present significant uncertainty and operational risks. For instance, in 2024, Mexico, a core market for Gruma, navigated a period of significant political transition leading up to its general elections, which can sometimes correlate with shifts in economic policy or consumer sentiment. Such events can disrupt established supply chains, directly impacting Gruma's ability to source raw materials and distribute finished goods. Furthermore, political instability can erode consumer purchasing power through economic volatility, affecting demand for Gruma's products.

While Gruma's extensive global diversification, spanning markets like the United States and Europe, offers a degree of resilience against localized political disturbances, substantial political upheaval in its most critical markets remains a considerable concern. For example, in 2024, the ongoing geopolitical tensions impacting global trade routes could indirectly affect Gruma's operations even in more stable regions by increasing logistics costs and lead times. The company must remain agile in adapting to potential policy shifts, such as changes in trade agreements or agricultural subsidies, that could influence its cost structure and market access.

- Mexico's 2024 general elections introduced a period of political recalibration, potentially impacting economic policy.

- Disruptions to supply chains and consumer spending power are direct consequences of political instability in key markets.

- Gruma's diversified portfolio, including significant operations in the U.S. which saw steady economic growth projections through 2025, helps to buffer against localized political risks.

- Anticipating and adapting to potential policy changes, such as trade tariffs or food safety regulations, is crucial for maintaining operational efficiency.

Government Health and Nutrition Initiatives

Government health and nutrition initiatives significantly shape the food industry. Public health campaigns encouraging healthier eating, alongside potential taxes on ingredients like sodium or sugar, directly impact consumer choices. For Gruma, a major player in staple foods, this means adapting to evolving dietary recommendations. For instance, in 2024, several countries intensified efforts to combat obesity through public awareness programs, which could steer consumers toward products perceived as healthier.

Gruma must proactively align its product portfolio with these public health objectives. This might involve reformulating existing products or developing new ones that meet stricter nutritional guidelines. Failure to do so could result in decreased consumer appeal or even face punitive measures, impacting sales and market share. The global trend towards healthier diets, supported by government policies, is a critical factor for Gruma's long-term strategy.

- Government focus on reducing sugar and sodium intake globally.

- Potential for increased taxes on high-sugar or high-sodium food products in key markets.

- Growing consumer demand for transparency in food labeling and nutritional information.

- Public health campaigns encouraging consumption of whole grains and less processed foods.

Political stability in key markets like Mexico, which held general elections in 2024, directly influences Gruma's operational environment and consumer confidence. Shifts in economic policy stemming from these political transitions can impact sourcing costs and demand for Gruma's products. For example, the U.S. market, a significant revenue driver for Gruma, experienced steady economic growth projections through 2025, offering a stable counterpoint to potential localized volatility.

Government trade policies and agricultural subsidies, particularly concerning corn, remain critical. For instance, U.S. corn prices in 2024 were subject to government support programs that affected input expenses. Gruma's diversified operations, including substantial presence in the U.S. and Europe, provide a buffer against localized political disturbances, but navigating evolving trade agreements and tariffs is essential for cost management.

Regulatory landscapes, including food safety standards and labeling laws across different countries, necessitate constant adaptation. For example, the EU's stringent General Food Law and labeling regulations require flexible manufacturing. Anticipating and complying with potential policy changes, such as new rules on sugar content or origin labeling, is vital for maintaining market access and operational efficiency, with compliance costs potentially rising by an average of 5% as observed in UK food manufacturing in 2024.

What is included in the product

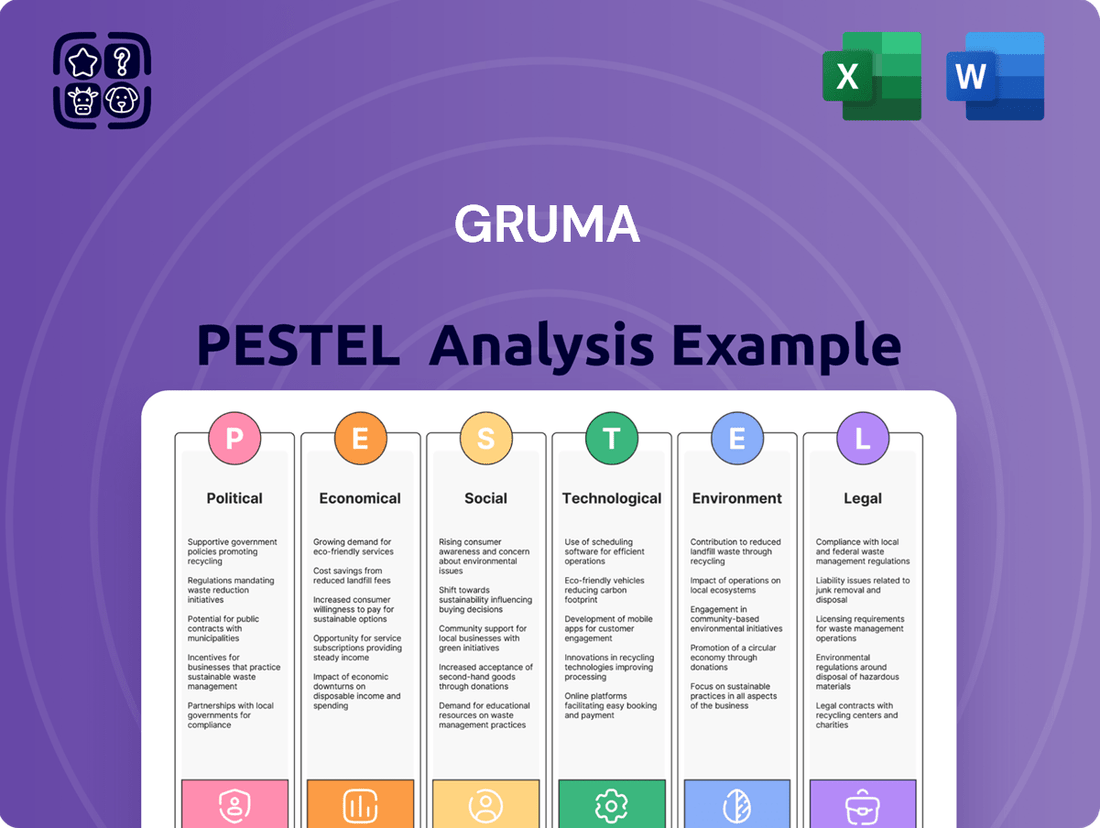

This Gruma PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic planning.

Provides a concise version of Gruma's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Helps support discussions on external risks and market positioning by offering a clear, categorized overview of Gruma's operating environment during planning sessions.

Economic factors

Global corn prices are a significant driver for Gruma, as corn is a core ingredient in many of its products. Fluctuations here directly impact the cost of goods sold. For instance, the average price of corn in 2023 saw considerable movement, influenced by factors like supply chain disruptions and geopolitical events, which can squeeze Gruma's profit margins if not effectively managed.

Weather patterns in major corn-producing regions, such as the United States and Brazil, are critical. Droughts or excessive rainfall can reduce yields, leading to higher prices. In 2024, forecasts suggest continued volatility due to anticipated climate shifts and ongoing demand from the biofuel sector, creating a challenging procurement environment for Gruma.

Energy costs for farming, including fuel for machinery and fertilizer production, also play a role in corn pricing. As energy prices remained elevated through much of 2023 and into early 2024, this added upward pressure on corn costs. Gruma's success hinges on its ability to mitigate these impacts through strategic sourcing and hedging to maintain stable production costs.

Gruma faces significant challenges from high inflation rates in its primary markets. For instance, Mexico, a key operating country, experienced an average inflation rate of 4.8% in 2023, impacting the cost of essential inputs like corn and energy. This rise in operational expenses directly squeezes profit margins if not effectively passed on to consumers.

Fluctuating exchange rates pose another substantial risk. The Mexican Peso's volatility against the US Dollar, for example, directly influences Gruma's cost of imported raw materials and the repatriation of earnings from its substantial US operations. In early 2024, the Peso saw periods of strengthening, which could reduce the dollar value of Gruma's reported revenues from the U.S.

Effective currency risk management is therefore paramount for Gruma's financial stability. By employing hedging strategies, the company aims to mitigate the impact of adverse currency movements on its international profitability and the cost of goods sold, ensuring more predictable financial outcomes in a dynamic global economic landscape.

Consumer purchasing power is a key economic driver for Gruma. During periods of economic downturn, such as the projected slowdowns in certain emerging markets in late 2024 and early 2025, consumers may reduce spending on discretionary items, potentially impacting Gruma's higher-margin products. For instance, if inflation continues to impact real wages, consumers might opt for Gruma's more basic corn flour offerings over pre-packaged meals or snacks.

Conversely, economic expansion generally benefits Gruma. As disposable incomes rise, consumers are more likely to purchase Gruma's value-added products, like tortilla chips and ready-to-eat meals, which often carry higher profit margins. For example, if unemployment rates decrease and wage growth accelerates in key markets like the United States in 2024, Gruma could see a significant uplift in sales across its diverse product portfolio.

Global Economic Growth and Recession Risks

The global economic outlook for 2024 and 2025 presents a mixed picture, with varying growth rates across regions. While some economies are showing resilience, the risk of recession remains a concern, particularly in major markets. For Gruma, this means that while opportunities for expansion exist, a synchronized global slowdown could significantly impact consumer spending and, consequently, sales volumes and revenue.

The International Monetary Fund (IMF) projected global growth at 3.2% for 2024, with a slight uptick expected in 2025. However, this forecast is subject to considerable uncertainty, with geopolitical tensions and persistent inflation posing headwinds. A significant downturn in key markets like the United States or Europe could curb demand for Gruma's products, affecting its top-line performance.

- Global Growth Projections: The IMF's forecast of 3.2% global growth for 2024 highlights a moderate but potentially fragile recovery.

- Recessionary Risks: Persistent inflation and geopolitical instability continue to elevate the risk of localized or even broader economic contractions.

- Impact on Consumer Spending: A global recession would likely lead to reduced discretionary spending, directly affecting demand for food products like those offered by Gruma.

- Gruma's Diversification Strategy: While Gruma's presence in diverse geographical markets offers some insulation, a widespread economic shock remains a systemic risk to its operations.

Interest Rates and Access to Capital

Changes in interest rates directly affect Gruma's expenses. For instance, if the US Federal Reserve raises its benchmark interest rate, Gruma's cost of borrowing for new projects or managing existing debt will likely increase. This was evident in 2023, where global central banks continued their tightening cycles, leading to higher borrowing costs across various markets where Gruma operates.

Higher interest rates can squeeze Gruma's profitability by increasing the burden of debt servicing. This means less money is available for reinvestment in the business or for distribution to shareholders. For example, a 1% increase in interest rates on a substantial portion of Gruma's debt could translate into millions of dollars in additional annual interest payments, impacting net income.

Gruma's ability to secure capital at favorable rates is vital for its growth plans. Access to credit markets allows the company to fund acquisitions, build new facilities, or upgrade existing ones. In 2024, Gruma's financial strategy will likely focus on managing its debt levels and ensuring it can access capital efficiently, especially in a market where interest rates, while potentially stabilizing, remain elevated compared to recent years.

- Impact on Debt Servicing: Higher interest rates increase the cost of servicing Gruma's existing and future debt, potentially reducing profitability.

- Capital Expenditure Financing: Borrowing costs influence Gruma's decisions on capital investments, such as building new plants or acquiring new technologies.

- Financial Flexibility: Maintaining access to favorable credit markets is crucial for Gruma to pursue strategic growth opportunities and manage unforeseen financial needs.

Gruma's profitability is closely tied to global economic growth and consumer spending power. The IMF's projection of 3.2% global growth for 2024, while moderate, carries risks from persistent inflation and geopolitical instability. Any significant economic slowdown in key markets like the US or Europe could directly reduce demand for Gruma's diverse product portfolio, impacting its revenue streams.

Changes in interest rates significantly impact Gruma's financial operations. Higher borrowing costs, as seen through global central bank tightening cycles in 2023, increase debt servicing expenses and can affect the feasibility of capital expenditures. Managing debt levels and ensuring efficient access to capital markets remains crucial for Gruma's strategic growth in 2024.

Fluctuating exchange rates, particularly the Mexican Peso against the US Dollar, directly affect Gruma's costs for imported materials and the repatriation of earnings. Effective currency risk management through hedging strategies is essential for maintaining stable profitability and predictable financial outcomes in its international operations.

| Economic Factor | Impact on Gruma | Data/Trend (2023-2025) |

| Global Growth | Influences consumer spending and demand for Gruma's products. | IMF projected 3.2% global growth for 2024, with potential for slowdowns. |

| Inflation | Increases input costs (corn, energy) and impacts consumer purchasing power. | Mexico's 2023 average inflation was 4.8%; elevated energy costs persisted. |

| Interest Rates | Affects borrowing costs for debt servicing and capital investments. | Central banks continued tightening cycles in 2023, leading to higher borrowing costs. |

| Exchange Rates | Impacts cost of imported raw materials and repatriation of earnings. | Mexican Peso volatility against USD affects Gruma's US operations' reported value. |

Preview the Actual Deliverable

Gruma PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Gruma PESTLE analysis provides a comprehensive overview of the political, economic, social, technological, legal, and environmental factors influencing the company's operations and strategic decisions.

Sociological factors

Consumers are increasingly prioritizing health and nutrition, leading to a greater demand for whole grains, non-GMO, and gluten-free products. This shift directly impacts food manufacturers like Gruma, who must innovate to meet these evolving preferences. For instance, the global health and wellness market reached an estimated $4.5 trillion in 2023, with food and beverages being a significant segment.

Gruma's corn-based product lines face a direct challenge and opportunity from these trends. Adapting by offering healthier tortilla options, perhaps with reduced sodium or enriched with fiber, or exploring new product categories that align with wellness goals, is crucial. Failure to pivot could see Gruma losing ground to competitors who are quicker to respond to this growing consumer consciousness, potentially impacting market share by 2025.

Gruma faces evolving consumer tastes, with a growing interest in plant-based and international foods potentially impacting demand for traditional corn-based products. For instance, the global plant-based food market was valued at approximately $29.4 billion in 2023 and is projected to reach $162 billion by 2030, indicating a significant shift in consumer preferences that Gruma must address through innovation.

The company's success hinges on its ability to adapt to these changing dietary habits, perhaps by expanding its portfolio to include healthier or more diverse options. Understanding and catering to specific regional food preferences remains crucial for Gruma's localized market strategies, ensuring its products resonate with diverse consumer bases.

Global demographic shifts are profoundly reshaping Gruma's operating landscape. By 2025, the world's population is projected to exceed 8.1 billion, with a significant portion concentrated in urban centers. This ongoing urbanization, particularly in emerging markets where Gruma has a strong presence, directly influences consumer behavior, driving demand for convenient, ready-to-eat food options.

The increasing concentration of people in cities by 2025, with over 60% of the global population expected to live in urban areas, presents both opportunities and challenges for Gruma. Urban consumers often have different shopping habits, favoring smaller, more frequent purchases and seeking products that fit busy lifestyles. Gruma's strategy must adapt by offering appropriately sized packaging and ensuring efficient distribution networks to reach these dense consumer bases.

Cultural Significance of Corn-Based Foods

In key Gruma markets, especially Latin America, corn-based foods such as tortillas are deeply ingrained in culture and tradition. This cultural importance ensures a steady demand for Gruma's products. For instance, in Mexico, tortillas are a staple, consumed daily by millions, reflecting their central role in the national diet and heritage.

Maintaining the authenticity and quality of these core corn-based products is paramount for Gruma to resonate with consumers. This commitment is crucial for fostering brand loyalty and ensuring market acceptance. Gruma's continued investment in traditional corn processing methods, like nixtamalization, underscores this dedication.

Respecting these cultural connections is vital for Gruma's success. The company actively engages in initiatives that celebrate and preserve culinary traditions, reinforcing its brand image. In 2024, Gruma continued its support for local corn farmers, ensuring sustainable sourcing that aligns with cultural practices and product integrity.

- Cultural Staple: Corn tortillas are a daily food for over 100 million people in Mexico alone.

- Brand Loyalty: Gruma's focus on authentic taste and texture drives repeat purchases.

- Market Acceptance: Respecting traditions helps Gruma integrate into diverse communities.

Sustainability and Ethical Consumption Concerns

Consumers are increasingly prioritizing sustainability and ethical practices, significantly impacting purchasing behavior. This trend is evident in the growing demand for products with reduced environmental footprints and transparent, fair labor practices. For instance, a 2024 Nielsen report indicated that 66% of global consumers are willing to pay more for sustainable brands.

Gruma can leverage this by highlighting its commitment to these values. Brands demonstrating genuine efforts in areas like reduced water usage in corn farming or ethical sourcing of ingredients are likely to resonate more strongly with this consumer segment. In 2023, Gruma reported a 5% reduction in water intensity across its operations, a fact that directly addresses these growing concerns.

- Growing Consumer Demand: Over two-thirds of global consumers are willing to pay a premium for sustainable products as of 2024.

- Ethical Sourcing Importance: Consumers actively seek brands that ensure fair labor and responsible sourcing throughout their supply chains.

- Gruma's Water Reduction: The company achieved a 5% reduction in water intensity in 2023, aligning with environmental sustainability expectations.

- Brand Image Enhancement: Transparency in sustainability initiatives can significantly boost brand perception and attract environmentally conscious customers.

Sociological factors significantly influence Gruma's market position, driven by evolving consumer health consciousness and dietary trends. The global demand for healthier options, including whole grains and non-GMO products, directly impacts Gruma's corn-based offerings, necessitating innovation to meet these preferences. For instance, the health and wellness market reached an estimated $4.5 trillion in 2023, highlighting this consumer shift.

Demographic shifts, particularly increasing urbanization, also shape Gruma's strategy by driving demand for convenient, ready-to-eat foods. By 2025, over 60% of the global population is expected to reside in urban areas, requiring Gruma to adapt packaging and distribution for these busy lifestyles. Furthermore, cultural significance of corn-based foods in markets like Mexico ensures a baseline demand, with tortillas being a daily staple for over 100 million people in the country.

| Sociological Factor | Impact on Gruma | Supporting Data (2023-2025) |

|---|---|---|

| Health & Wellness Trend | Increased demand for healthier, natural ingredients; potential pressure on traditional corn products. | Global health and wellness market: $4.5 trillion (2023). |

| Urbanization | Growing need for convenient, ready-to-eat options; requires efficient distribution. | Projected 60%+ global urban population by 2025. |

| Cultural Importance of Corn | Sustains demand for core products like tortillas; emphasizes authenticity. | Tortillas: daily staple for >100 million in Mexico. |

| Sustainability Concerns | Consumer willingness to pay more for sustainable brands; impacts sourcing and production. | 66% of global consumers willing to pay more for sustainable brands (2024). |

Technological factors

Gruma's integration of advanced automation and robotics in its production facilities, particularly noted in its corn flour and tortilla operations, is a key technological driver. This adoption directly impacts efficiency, aiming to boost output and ensure consistent product quality across its global brands like Mission and Guerrero. For instance, by 2024, companies in the food manufacturing sector are increasingly investing in automated packaging lines, which can reduce labor needs by up to 30% and increase throughput by 15-20%.

The company's investment in cutting-edge manufacturing technologies, including predictive maintenance systems, allows Gruma to optimize operational uptime and reduce unexpected stoppages. This strategic move enables Gruma to scale production effectively, respond more agilely to market demand shifts, and maintain a competitive advantage through both cost control and enhanced output volumes, crucial in the high-volume tortilla and corn flour markets.

Gruma's adoption of digital supply chain solutions, including IoT sensors and blockchain, is crucial for optimizing logistics and inventory. For instance, by 2024, the global supply chain management market was projected to reach over $32 billion, highlighting the significant investment in these technologies. These advancements allow for real-time tracking, reducing spoilage and improving delivery efficiency for Gruma's perishable goods.

The implementation of advanced analytics further empowers Gruma to make data-driven decisions across its extensive global operations. In 2023, companies leveraging predictive analytics in their supply chains reported an average of 10% reduction in operational costs. This translates to enhanced transparency, minimized waste, and a more agile response to market demands, ensuring fresh products consistently reach consumers.

Gruma leverages continuous innovation in food processing to enhance its product portfolio. Advancements in nixtamalization, preservation, and ingredient science are key to creating new items, refining existing ones, and extending shelf life, all while preserving taste and nutritional quality. For instance, in 2024, Gruma's investment in R&D focused on developing plant-based protein alternatives within their corn-based product lines, responding to growing consumer interest in sustainable and healthy options.

E-commerce and Digital Sales Platforms

The increasing prevalence of e-commerce and digital sales platforms offers Gruma significant avenues for growth. By establishing strong online retail channels, Gruma can expand its customer base and achieve more direct engagement. For instance, global e-commerce sales are projected to reach $7.4 trillion by 2025, highlighting the substantial market potential for food products online.

To capitalize on this trend, Gruma needs to invest strategically in its digital infrastructure and online marketing efforts. This includes developing user-friendly e-commerce websites and mobile applications, as well as optimizing supply chains for efficient online order fulfillment. The company's ability to adapt to evolving consumer purchasing habits, which increasingly favor digital convenience, will be crucial for maintaining a competitive edge.

- Market Reach Expansion: E-commerce allows Gruma to bypass traditional retail limitations and reach consumers directly, potentially increasing market share.

- Direct-to-Consumer (DTC) Opportunities: Developing online platforms enables Gruma to build direct relationships with customers, gather valuable data, and offer personalized experiences.

- Investment in Digital Capabilities: Success hinges on investing in digital marketing, data analytics, and logistics to support online sales and manage customer expectations effectively.

Agricultural Technology and Crop Yield Improvement

Technological advancements are significantly reshaping agriculture, directly influencing the availability and cost of corn, Gruma's core ingredient. Innovations like precision farming, utilizing GPS and sensors, optimize resource use and boost yields, while biotechnology, exemplified by drought-resistant corn varieties developed through genetic engineering, enhances crop resilience. For instance, the adoption of advanced irrigation techniques, a facet of precision agriculture, saw a 15% increase in water efficiency in key corn-producing regions in 2024, according to the USDA. Furthermore, data analytics platforms are increasingly being used to monitor soil health, predict pest outbreaks, and tailor nutrient application, leading to an estimated 5-10% improvement in crop yields in early adopters.

Gruma can leverage these technological shifts by forging partnerships with agricultural technology firms or making strategic investments in these burgeoning sectors. Such collaborations can secure a more predictable and cost-effective supply of premium corn, aligning with Gruma's operational efficiency goals. This strategic approach also bolsters sustainability efforts by promoting resource-efficient farming practices.

Key technological factors impacting Gruma's supply chain include:

- Precision Farming Adoption: Increased use of sensors and GPS technology in corn cultivation to optimize water, fertilizer, and pesticide application, leading to yield improvements and cost reductions.

- Biotechnology Advancements: Development and deployment of genetically modified or conventionally bred corn varieties with enhanced traits like drought tolerance and pest resistance, mitigating weather-related risks.

- Data Analytics in Agriculture: Utilization of big data and AI for predictive analytics in crop management, disease forecasting, and yield optimization, enabling more informed decision-making for farmers.

- Automation and Robotics: Growing implementation of automated machinery for planting, harvesting, and monitoring, potentially reducing labor costs and increasing operational efficiency in corn production.

Gruma's technological strategy is deeply intertwined with automation and digital integration. By 2024, investments in automated packaging lines are projected to cut labor needs by up to 30% and boost throughput by 15-20% in food manufacturing. Predictive maintenance systems are also crucial, aiming to minimize operational downtime and ensure consistent output, supporting Gruma's global brands like Mission and Guerrero.

The company leverages digital supply chain solutions, including IoT and blockchain, to optimize logistics. The global supply chain management market was expected to exceed $32 billion by 2024, underscoring the importance of these technologies for real-time tracking and reduced spoilage. Advanced analytics further refine operations, with companies using predictive analytics reporting an average 10% reduction in operational costs in 2023.

Gruma is also innovating in food processing, focusing on areas like nixtamalization and ingredient science to improve product quality and shelf life. By 2024, R&D efforts included developing plant-based protein alternatives in corn-based products, responding to consumer demand for healthier options. Furthermore, Gruma is capitalizing on the e-commerce boom, with global online sales projected to reach $7.4 trillion by 2025, necessitating investment in digital infrastructure and online marketing.

| Technology Area | Impact on Gruma | Data/Projection (2024/2025) |

| Automation & Robotics | Increased production efficiency, consistent quality, reduced labor costs | Up to 30% reduction in labor needs; 15-20% increase in throughput |

| Digital Supply Chain (IoT, Blockchain) | Optimized logistics, real-time tracking, reduced spoilage | Global SCM market > $32 billion |

| Advanced Analytics | Data-driven decision making, cost reduction, waste minimization | 10% average operational cost reduction for users |

| E-commerce | Expanded market reach, direct customer engagement | Global e-commerce sales projected to reach $7.4 trillion |

Legal factors

Gruma operates under a complex web of food labeling and advertising regulations that differ significantly across its global markets. These rules dictate everything from nutritional claims and allergen declarations to origin labeling, directly shaping how Gruma's products are presented to consumers. For instance, the European Union's stringent regulations on health claims, which are subject to scientific substantiation, require careful attention to avoid non-compliance.

Failure to adhere to these diverse legal frameworks can lead to severe consequences, including hefty fines, costly product recalls, and significant damage to Gruma's brand reputation. In 2023, for example, the U.S. Food and Drug Administration (FDA) continued to enforce strict guidelines on "healthy" claims, impacting how companies like Gruma can market their products. Ensuring absolute accuracy and legal compliance in all product information is therefore paramount for Gruma's sustained market access and consumer trust.

Gruma navigates a complex web of global labor laws, from minimum wage mandates in Mexico to stringent working condition regulations in the EU. For instance, in 2024, the average minimum wage across OECD countries varied significantly, impacting Gruma's labor expenses in its various operational hubs. These diverse employment regulations directly influence Gruma's operational costs and its capacity for workforce management.

Shifts in these labor statutes, such as potential increases in minimum wages or new mandates on employee benefits, can directly impact Gruma's bottom line. Consider the ongoing discussions in several countries about raising minimum wages; if implemented, this could add millions to Gruma's payroll expenses. Furthermore, Gruma's commitment to fair labor practices is under increasing scrutiny, with consumers and investors alike demanding transparency and ethical treatment of employees, as evidenced by growing ESG (Environmental, Social, and Governance) investment trends in 2024-2025.

Gruma, as a major global producer of corn flour and tortillas, operates under strict anti-trust and competition laws across numerous countries. These regulations are designed to prevent market manipulation, such as price-fixing and other anti-competitive behaviors that could harm consumers and smaller businesses. For instance, in 2024, regulatory bodies worldwide continue to scrutinize large food conglomerates for their market share and pricing strategies, ensuring a level playing field.

Compliance with these laws is crucial for Gruma's sustained growth and market stability. Any deviation, whether in pricing, distribution, or even through mergers and acquisitions, can lead to significant legal repercussions, including hefty fines and forced divestitures, which could severely impact its operations and financial performance. The company must proactively ensure its business practices align with the evolving legal landscape of fair competition.

Intellectual Property Rights and Patents

Protecting Gruma's intellectual property, including proprietary manufacturing processes, product formulations, and brand trademarks, is crucial for sustaining its competitive edge. This involves navigating a complex global landscape of intellectual property laws.

Gruma must actively manage and defend its patents and trademarks against infringement, which can vary significantly by jurisdiction. For instance, in 2023, the World Intellectual Property Organization (WIPO) reported a substantial increase in international patent filings, highlighting the growing importance of IP protection.

- Global IP Landscape: Gruma operates in diverse legal environments, each with unique IP protection and enforcement mechanisms.

- Patent and Trademark Defense: The company invests in legal strategies to safeguard its innovations and brand identity from unauthorized use.

- Licensing Agreements: Gruma also engages in licensing agreements, requiring careful legal structuring to ensure mutual benefit and IP security.

International Trade Laws and Customs Regulations

Gruma's vast global footprint means its operations are deeply intertwined with a complex web of international trade laws and customs regulations. These rules, covering everything from tariffs and import quotas to sanctions and export controls, directly affect the cost and efficiency of moving essential raw materials like corn and wheat, as well as finished products across borders. For instance, a sudden increase in import duties on corn in a key market could significantly raise Gruma's production costs, impacting profitability. Staying compliant is paramount; failure to adhere to these regulations can lead to costly delays, hefty fines, and severe disruptions to Gruma's intricate global supply chain, potentially halting production or preventing product distribution. In 2023, the World Trade Organization reported that global trade facilitation measures, aimed at streamlining customs procedures, saw varying levels of implementation across regions, highlighting the ongoing complexity Gruma navigates.

Key considerations for Gruma regarding international trade laws include:

- Tariff and Duty Structures: Navigating differing tariff rates on agricultural inputs and finished goods across Gruma's operating regions, such as Mexico, the United States, and Europe.

- Import/Export Licensing and Quotas: Managing the requirements for obtaining necessary licenses and adhering to any volume restrictions for key commodities and products.

- Sanctions and Embargoes: Ensuring strict compliance with international sanctions that may restrict trade with specific countries or entities, a critical factor for a company with global reach.

- Customs Valuation and Classification: Accurately declaring the value and classification of goods to ensure correct duty payments and avoid penalties.

Gruma must navigate a complex landscape of food safety and quality regulations, which are critical for consumer trust and product integrity. These laws, enforced by bodies like the FDA in the US and EFSA in Europe, dictate standards for ingredients, manufacturing processes, and hygiene. For instance, the U.S. Food Safety Modernization Act (FSMA) mandates preventative controls, impacting Gruma's supply chain management and production facilities. Adherence to these evolving standards is non-negotiable, as non-compliance can result in severe penalties, product recalls, and significant reputational damage, as seen in industry-wide recalls for undeclared allergens.

Environmental factors

Climate change presents substantial risks to Gruma's corn sourcing, with extreme weather events like droughts and floods becoming more common. These events directly threaten crop yields, leading to increased raw material price volatility. For instance, the 2023 drought in parts of Mexico, a key sourcing region, significantly impacted corn harvests, highlighting this vulnerability.

To counter these environmental challenges, Gruma must actively diversify its corn sourcing regions. Implementing and supporting climate-resilient farming practices, such as drought-resistant seed varieties and improved water management technologies, is crucial for ensuring supply stability and managing costs effectively. These proactive measures are essential for navigating the unpredictable agricultural landscape of the coming years.

Corn, a primary ingredient for Gruma, requires significant water, making scarcity a pressing environmental issue in key sourcing areas. For instance, regions like the US Midwest, a major corn belt, have experienced periods of drought, impacting yields. Gruma's sustainability reports for 2023 highlighted ongoing initiatives to improve water efficiency in its Mexican and US operations, aiming for a 15% reduction in water intensity by 2025 compared to a 2020 baseline.

Effective water management across Gruma's value chain, from farm-level irrigation techniques to manufacturing processes, is crucial for mitigating operational risks from water shortages. The company is investing in technologies like drip irrigation and promoting drought-resistant corn varieties among its suppliers. This proactive approach is essential as global freshwater availability is projected to decline by 40% by 2030 according to UN Water, directly impacting agricultural output.

Increasing regulatory scrutiny on water usage presents another challenge. Governments worldwide are implementing stricter regulations on water extraction and discharge, which could lead to higher operational costs for Gruma. For example, California’s water regulations, which impact agricultural sourcing, have become more stringent in recent years, necessitating adaptive strategies for companies operating in or sourcing from the state.

Gruma faces increasing scrutiny regarding its sourcing of corn and other ingredients, with a strong emphasis on preventing deforestation and protecting biodiversity. This means ensuring that supply chains are managed responsibly to avoid negative environmental impacts. For example, by 2024, many major food companies were reporting on their progress towards deforestation-free supply chains, with targets often set for 2025 and beyond.

To showcase its dedication to ethical and environmentally conscious sourcing, Gruma can implement robust certifications and advanced traceability systems. These initiatives provide tangible proof of commitment to consumers and investors alike. The market is increasingly rewarding companies that demonstrate transparency in their environmental practices, with some ESG funds actively divesting from those with poor sourcing records.

Consumer and investor demand for sustainable supply chains is a significant factor, directly influencing brand reputation and market perception. A company’s stance on deforestation and responsible sourcing can impact its ability to attract investment and maintain customer loyalty. Reports from 2024 indicated that over 70% of consumers consider sustainability when making purchasing decisions, highlighting the commercial imperative for Gruma to address these concerns.

Waste Management and Packaging Pollution

Gruma's operations, like many in the food manufacturing sector, produce waste streams from production and contribute to packaging pollution. The company faces pressure to manage these environmental impacts effectively.

Key initiatives for Gruma include enhancing waste reduction programs, boosting recycling rates, and innovating with sustainable packaging, such as biodegradable or easily recyclable materials. For instance, many food companies are exploring plant-based plastics and reduced plastic content in their packaging to meet evolving consumer expectations and regulatory demands.

Compliance with increasingly stringent waste disposal regulations is a significant factor, as is the growing consumer preference for products with minimal environmental footprints. Reports from 2024 indicate a substantial rise in consumer willingness to pay a premium for sustainable packaging, influencing market trends and corporate strategy.

- Waste Reduction: Implementing programs to minimize manufacturing waste.

- Recycling Efforts: Increasing the proportion of waste that is recycled.

- Sustainable Packaging: Developing and utilizing biodegradable or recyclable packaging materials.

- Regulatory Compliance: Adhering to government regulations on waste disposal and packaging.

Carbon Footprint and Energy Consumption

Gruma's extensive operations, spanning from corn farming to the production and distribution of corn flour and tortillas, inherently involve significant energy consumption. This energy use directly translates into a carbon footprint, a key environmental consideration for the company. For instance, in 2023, the agricultural sector, a major supplier for Gruma, saw global energy prices fluctuate, impacting operational costs and indirectly Gruma's supply chain energy intensity.

Stakeholders, including investors and consumers, are increasingly demanding that Gruma actively reduce its greenhouse gas emissions. This pressure is driving investments in cleaner energy sources and operational efficiencies. Gruma has been exploring initiatives such as improving energy efficiency in its manufacturing plants, which could lead to substantial reductions in kilowatt-hour consumption per unit of production. Optimizing logistics to reduce fuel usage in transportation is another critical area of focus.

Transparency in reporting carbon emissions and setting ambitious reduction targets are becoming industry norms. Gruma's commitment to these practices is vital for maintaining its social license to operate and for attracting environmentally conscious investors. As of early 2024, many food processing companies are aiming for specific emission reduction percentages by 2030, aligning with global climate goals.

- Energy Intensity: Gruma's energy consumption across its value chain contributes to its overall carbon footprint.

- Stakeholder Pressure: Growing demand from investors and consumers pushes Gruma to lower greenhouse gas emissions.

- Mitigation Strategies: Investments in renewable energy, plant efficiency, and logistics optimization are key to reducing environmental impact.

- Reporting Standards: Transparent reporting of carbon emissions and setting reduction targets are becoming essential expectations.

Climate change poses significant risks to Gruma's corn supply, with extreme weather events like droughts and floods becoming more frequent, directly impacting crop yields and increasing raw material price volatility. For instance, the 2023 drought in parts of Mexico, a key sourcing region, significantly impacted corn harvests, underscoring this vulnerability.

Water scarcity is a pressing environmental issue, as corn cultivation requires substantial water. Regions like the US Midwest have experienced droughts, affecting yields. Gruma's 2023 sustainability reports highlighted initiatives to improve water efficiency, aiming for a 15% reduction in water intensity by 2025 compared to a 2020 baseline.

Gruma faces increasing scrutiny regarding deforestation and biodiversity protection in its sourcing. By 2024, many major food companies were reporting on their progress toward deforestation-free supply chains, with targets often set for 2025 and beyond.

Waste management and packaging pollution are also key environmental concerns for Gruma. The company is enhancing waste reduction programs, boosting recycling rates, and innovating with sustainable packaging, such as biodegradable or easily recyclable materials, to meet evolving consumer expectations and regulatory demands.

| Environmental Factor | Impact on Gruma | Data/Trend (2023-2025) |

|---|---|---|

| Climate Change & Weather Volatility | Threatens corn yields, increases price volatility. | 2023 drought in Mexico impacted harvests. |

| Water Scarcity | Affects corn cultivation, impacts yields. | Gruma aims for 15% water intensity reduction by 2025 (vs. 2020). |

| Deforestation & Biodiversity | Scrutiny on sourcing practices. | Industry trend: reporting on deforestation-free supply chains by 2024/2025. |

| Waste & Packaging | Pressure for effective management and sustainable solutions. | Consumer demand for sustainable packaging increasing; exploration of plant-based plastics. |

PESTLE Analysis Data Sources

Our Gruma PESTLE analysis is meticulously constructed using data from international financial institutions like the IMF and World Bank, alongside reports from leading market research firms and official government publications. This ensures a comprehensive understanding of global economic trends, political landscapes, and regulatory environments impacting Gruma.