goeasy SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

goeasy Bundle

goeasy's market position is bolstered by its strong brand recognition and extensive customer base, yet it faces challenges from evolving consumer credit preferences and increasing competition. Understanding these dynamics is crucial for strategic planning.

Want the full story behind goeasy's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

goeasy commands a dominant presence in Canada's non-prime lending market, a segment often overlooked by traditional financial institutions. This strategic positioning allows goeasy to cater to a significant population seeking credit solutions outside conventional banking channels.

The company’s loan book reflects this strength, demonstrating consistent expansion. For instance, as of Q1 2024, goeasy reported a total loan portfolio of $2.9 billion, a testament to its deep market penetration and successful customer acquisition in this specialized niche.

goeasy's strength lies in its diverse product and channel strategy, encompassing both unsecured and secured loans, auto loans, point-of-sale financing, and lease-to-own options through its easyfinancial and easyhome brands. This broad offering across different financial solutions and customer touchpoints significantly de-risks the business by not depending on a single income source.

The company's strategic expansion into various lending sectors, notably automotive financing, has been a key driver of its success. For instance, in the first quarter of 2024, goeasy reported a 21% increase in its automotive loan portfolio year-over-year, showcasing the impact of this diversification on loan originations and overall revenue growth.

goeasy's omnichannel strategy is a significant strength, seamlessly blending its extensive network of over 400 physical locations with a strong digital presence, including a mobile app. This multi-channel approach ensures customers can engage with goeasy through their preferred methods, whether online or in-person.

The company's strategic partnerships with more than 9,500 merchants further amplify its reach and customer accessibility. This expansive network, coupled with the growing success of online loan originations, underscores the effectiveness of goeasy's integrated business model in capturing a diverse customer base.

Consistent Strong Financial Performance & Growth

goeasy has showcased exceptional and consistent financial performance, with record revenues and loan portfolio growth continuing through 2024 and into Q1 2025. This strong trajectory is underscored by significant increases in key metrics, demonstrating the resilience and effectiveness of its business model.

- Record Revenues: goeasy achieved record revenues, with a notable increase reported in 2024, building on previous years' strong performance.

- Loan Portfolio Growth: The company's loan portfolio expanded significantly, reaching new highs in 2024 and continuing this positive trend into Q1 2025, reflecting successful market penetration and customer acquisition.

- Increased Loan Originations: goeasy saw substantial growth in loan originations, a key driver of its revenue and profitability, indicating strong demand for its services.

- Rising Adjusted Earnings Per Share: This sustained operational success has translated into a consistent increase in adjusted earnings per share, rewarding shareholders and highlighting operational efficiency.

Proven Risk Management and Underwriting

goeasy demonstrates robust risk management, consistently achieving stable credit performance even while serving a higher-risk customer segment. This resilience is a direct result of ongoing refinements to its credit modeling and underwriting processes.

The company's success in maintaining healthy credit metrics alongside significant loan expansion highlights a disciplined strategy for managing risk in the non-prime lending space. For instance, in Q1 2024, goeasy reported a net charge-off rate of 4.75%, a slight increase from 4.60% in Q1 2023, yet still within a manageable range given their customer profile and demonstrating effective control.

- Effective Credit Models: Continuous investment in advanced credit scoring and data analytics.

- Disciplined Underwriting: Stringent processes to assess borrower risk and ensure loan affordability.

- Stable Performance: Maintaining manageable net charge-off rates despite serving the non-prime market.

- Growth with Control: Balancing expansion of loan portfolio with prudent risk oversight.

goeasy's primary strength lies in its deep penetration and established dominance within Canada's non-prime lending market. This strategic focus allows the company to serve a substantial customer base that traditional banks often do not cater to, leading to consistent loan book expansion. As of Q1 2024, goeasy's loan portfolio reached $2.9 billion, reflecting its success in acquiring and retaining customers in this specialized segment.

The company benefits from a diversified product and channel strategy, offering a range of financial solutions including unsecured and secured loans, auto loans, and point-of-sale financing through its well-recognized easyfinancial and easyhome brands. This multi-faceted approach reduces reliance on any single product or market, enhancing business resilience. The strategic expansion into automotive financing further bolsters this, with a 21% year-over-year increase in its auto loan portfolio in Q1 2024.

goeasy's omnichannel approach, combining over 400 physical locations with a robust digital presence including a mobile app, ensures broad customer accessibility and engagement. This is further amplified by strategic partnerships with over 9,500 merchants, creating a powerful integrated model for customer acquisition and service delivery.

The company consistently demonstrates strong financial performance, with record revenues and loan portfolio growth continuing through 2024 and into Q1 2025. This sustained growth is supported by effective risk management, characterized by refined credit modeling and underwriting processes that maintain stable credit performance even within the non-prime sector. For instance, its Q1 2024 net charge-off rate was 4.75%, a controlled figure for its market segment.

| Metric | Q1 2024 | Q1 2023 | YoY Change |

|---|---|---|---|

| Total Loan Portfolio | $2.9 billion | $2.5 billion | 16.0% |

| Automotive Loan Portfolio | $750 million | $619 million | 21.1% |

| Net Charge-off Rate | 4.75% | 4.60% | 0.15 pp |

What is included in the product

This SWOT analysis provides a comprehensive look at goeasy's internal capabilities and external market dynamics, identifying key strengths and weaknesses alongside significant opportunities and threats.

Offers a clear, actionable framework to identify and leverage goeasy's competitive advantages, mitigating risks and capitalizing on opportunities.

Weaknesses

goeasy's focus on non-prime borrowers, while a strategic advantage, inherently means a higher risk customer base. This translates to a greater likelihood of defaults and delinquencies compared to lenders serving prime customers.

This elevated credit risk directly impacts goeasy's profitability. For instance, in Q1 2024, the company reported a net charge-off rate of 6.03%, a figure that, while managed, underscores the inherent risk in its lending portfolio.

goeasy's significant debt burden makes it particularly vulnerable to rising interest rates. As of the first quarter of 2024, the company's total debt stood at approximately $2.3 billion, a substantial figure that directly impacts its cost of borrowing.

Sustained periods of higher interest rates, a trend observed throughout 2023 and projected to continue into early 2025, could significantly increase goeasy's interest expenses. This increased cost of capital directly pressures profit margins, potentially reducing the company's net income and overall financial flexibility in a tightening credit market.

goeasy has seen its overall portfolio yield come under pressure. In the first quarter of 2025, the company observed a dip in yields when compared to the same period in 2024. This is partly due to a strategic move towards offering more secured loan products, which typically carry lower yields, and the impact of new interest rate caps that have been put in place.

Despite experiencing strong loan growth, managing this compression in portfolio yield is a key challenge for goeasy. The company needs to find ways to maintain its profitability even as the average return on its loan portfolio decreases. This situation highlights the delicate balance between expanding its loan book and ensuring the financial health of the business.

Regulatory Scrutiny and Rate Caps

goeasy faces significant headwinds from evolving regulatory landscapes. The Canadian government's ongoing review and potential further reductions to the maximum allowable interest rates for non-prime lending pose a direct threat to the company's revenue streams. For instance, the Office of the Superintendent of Financial Institutions (OSFI) has been actively discussing rate caps, which could directly impact goeasy's ability to price its loans profitably.

This regulatory uncertainty creates a challenging environment, potentially limiting goeasy's pricing power and impacting the overall yield generated from its extensive loan portfolio. Adapting to these mandated changes while striving to maintain robust profitability remains a critical and ongoing challenge for the company's strategic planning and operational execution.

- Regulatory Uncertainty: Potential further reductions in maximum allowable interest rates by the Canadian government.

- Impact on Yield: Reduced pricing power could directly affect goeasy's loan portfolio yields.

- Profitability Challenge: The need to adapt to regulatory changes while maintaining profitability is a key operational hurdle.

Economic Cyclicality

goeasy's business is sensitive to economic ups and downs. When the economy slows, people are more likely to struggle with loan payments, leading to higher default rates and less demand for new loans. This can make goeasy's financial performance quite unpredictable.

For instance, during economic downturns, a rise in unemployment can directly impact a borrower's ability to repay loans. In 2023, while specific goeasy default rate data isn't publicly broken down by economic cycle phase, broader industry trends suggest that economic slowdowns generally correlate with increased credit risk across the lending sector.

- Economic Sensitivity: goeasy's revenue and profitability are closely linked to the health of the overall economy.

- Increased Default Risk: Recessions often lead to higher rates of loan defaults, directly impacting goeasy's bottom line.

- Reduced Credit Demand: During economic contractions, consumers and businesses tend to borrow less, dampening revenue growth opportunities.

- Earnings Volatility: The cyclical nature of the economy can introduce significant fluctuations in goeasy's financial results year over year.

goeasy's reliance on a non-prime customer base inherently exposes it to higher credit risk, which can lead to increased net charge-off rates. For example, the company reported a net charge-off rate of 6.03% in Q1 2024, indicating a significant portion of its loan portfolio is at risk of default.

The company's substantial debt, approximately $2.3 billion as of Q1 2024, makes it vulnerable to rising interest rates. This increased cost of borrowing directly pressures profit margins, especially with interest rate hikes continuing into 2025, potentially reducing net income and financial flexibility.

goeasy faces regulatory headwinds, particularly potential further reductions in maximum allowable interest rates by the Canadian government. This uncertainty impacts pricing power and loan portfolio yields, creating a challenge in maintaining profitability amidst evolving regulations.

The company's performance is sensitive to economic downturns, which can increase default rates and reduce credit demand, leading to earnings volatility. For instance, economic slowdowns generally correlate with higher credit risk across the lending sector, impacting goeasy's financial results.

| Metric | Q1 2024 Data | Implication |

|---|---|---|

| Net Charge-off Rate | 6.03% | Higher risk of loan defaults. |

| Total Debt | ~$2.3 billion | Vulnerability to rising interest rates. |

| Portfolio Yield | Observed dip vs. Q1 2024 | Pressure on profitability due to lower average loan returns. |

Preview Before You Purchase

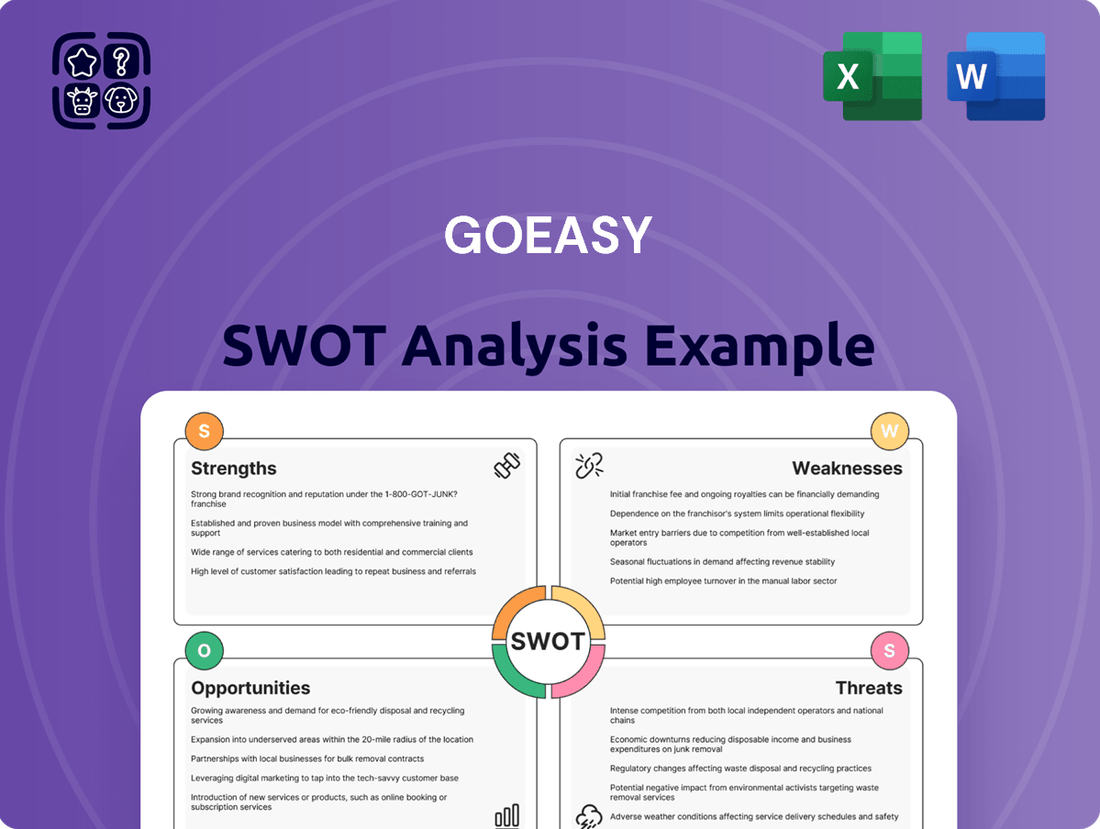

goeasy SWOT Analysis

This is the actual goeasy SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full goeasy SWOT report you'll get. Purchase unlocks the entire in-depth version, offering strategic insights.

This is a real excerpt from the complete goeasy SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning needs.

Opportunities

The demand for non-prime lending in Canada remains robust, especially as traditional financial institutions may adopt more stringent lending criteria. This creates a fertile ground for companies like goeasy to grow their presence.

With an estimated 11% of Canadian adults considered to have subprime credit, the market for accessible financial solutions is substantial. goeasy’s focus on this segment allows it to tap into a persistent need, potentially increasing its market share in 2024 and beyond.

goeasy has a significant opportunity to expand its product offerings. The company is exploring the introduction of a general-purpose credit card, which could tap into a new customer base and provide a recurring revenue stream. This move aligns with goeasy's strategy to become a more comprehensive financial services provider.

Further diversification into secured lending, such as auto loans and home equity loans, presents another avenue for growth. In 2024, the Canadian auto loan market alone was valued at over CAD 100 billion, indicating substantial potential. These products can attract customers seeking larger financing needs and strengthen goeasy's market position.

By broadening its product suite, goeasy can attract new customer segments and deepen relationships with its existing clientele. This strategy aims to cater to a wider range of financial needs and preferences, thereby increasing customer lifetime value and overall market penetration.

goeasy has a significant opportunity to leverage digital innovation. By investing further in advanced technology, digital platforms, and AI, the company can boost operational efficiency and streamline customer interactions. For example, in Q1 2024, goeasy reported a 14% increase in digital loan originations, highlighting the growing importance of their online channels.

Enhancing its omnichannel capabilities presents another avenue for growth. A strong digital presence not only improves customer reach but also builds operational resilience, a critical factor in today's dynamic market. This strategic focus on digital transformation is expected to further solidify goeasy's competitive position in the lending sector.

Potential for International Expansion

goeasy has a significant opportunity to expand its reach into international markets, particularly the United States and the United Kingdom. These countries represent substantial untapped markets with large populations of non-prime borrowers, mirroring the customer base that has driven goeasy's domestic success.

The potential for international expansion is underpinned by the sheer size of these markets. For instance, the US non-prime auto loan market alone is valued in the hundreds of billions of dollars. By adapting its successful lending and operational strategies, goeasy could tap into this considerable demand.

While expansion carries inherent risks, the strategic alignment of these markets with goeasy's core competencies presents a compelling growth avenue. Successful entry could lead to diversified revenue streams and a broadened geographical footprint, enhancing overall business resilience.

Key considerations for international expansion include:

- Market Research: Thorough analysis of regulatory environments, competitive landscapes, and consumer credit behaviors in target countries.

- Adaptation of Business Model: Tailoring product offerings, risk assessment methodologies, and customer service approaches to local nuances.

- Capital Investment: Allocating sufficient resources for market entry, operational setup, and initial growth phases.

- Risk Mitigation: Developing strategies to manage currency fluctuations, geopolitical uncertainties, and varying credit risk profiles.

Strategic Acquisitions and Market Share Growth

goeasy's strong financial position, evidenced by its consistent revenue growth and access to capital markets, allows it to actively seek strategic acquisitions. In 2024, the company continued to demonstrate its capacity for inorganic growth, potentially acquiring smaller competitors or distressed loan portfolios. This approach is particularly attractive given potential industry consolidation, allowing goeasy to expand its reach and solidify its dominance in the non-prime lending market.

The company's robust funding capacity, which has supported its expansion efforts, positions it favorably to capitalize on market opportunities. For instance, if competitors face increased regulatory scrutiny or funding challenges in 2024-2025, goeasy could acquire them at attractive valuations. This strategy not only increases market share but also diversifies its customer base and product offerings.

- Strategic Acquisitions: goeasy's financial strength provides a solid foundation for acquiring smaller lenders or portfolios.

- Market Consolidation: Industry headwinds for some competitors present opportunities for goeasy to gain market share through acquisitions.

- Inorganic Growth: This strategy accelerates expansion and reinforces goeasy's leadership in the non-prime lending sector.

goeasy can significantly expand its product offerings by introducing new financial solutions like a general-purpose credit card, which could create a recurring revenue stream and attract new customer segments. Further diversification into secured lending, such as auto and home equity loans, offers access to larger financing needs, tapping into markets like the Canadian auto loan sector valued at over CAD 100 billion in 2024.

Leveraging digital innovation is a key opportunity, with goeasy seeing a 14% increase in digital loan originations in Q1 2024, indicating strong customer adoption of online channels. Enhancing omnichannel capabilities will further improve customer reach and operational resilience.

International expansion into markets like the United States and United Kingdom presents a substantial growth avenue, given their large non-prime borrower populations. The US non-prime auto loan market alone is valued in the hundreds of billions of dollars, offering significant untapped demand.

goeasy's strong financial position allows for strategic acquisitions, especially amidst potential industry consolidation. This inorganic growth strategy, supported by robust funding capacity, enables the company to gain market share and diversify its offerings by acquiring competitors or distressed loan portfolios in 2024-2025.

Threats

goeasy faces a significant threat from increasing regulatory scrutiny, especially concerning potential further reductions in maximum allowable interest rates by the Canadian government. These changes could directly impact the company's ability to generate revenue by compressing yields, necessitating potentially costly adjustments to its core business model. For instance, in 2023, the Office of the Superintendent of Financial Institutions (OSFI) continued its review of uninsured mortgage lending practices, which, while not directly targeting goeasy's consumer lending, signals a broader trend of increased oversight across financial services.

goeasy operates in the non-prime lending sector, which is experiencing a significant uptick in competition. This includes established banks expanding their offerings and a surge of agile fintech startups entering the space, eager to capture market share.

This intensified competition presents a tangible threat to goeasy. We can anticipate potential pricing wars as lenders vie for customers, which could squeeze profit margins. Furthermore, increased marketing efforts by rivals will likely drive up customer acquisition costs, impacting goeasy's profitability and potentially eroding its market share if it fails to adapt.

For instance, the Canadian non-prime lending market saw a notable increase in new entrants during 2024, with several fintechs reporting substantial funding rounds aimed at expanding their reach. This influx of capital and innovation means goeasy must continually enhance its product offerings and customer experience to stay ahead.

A weakening economic climate, marked by increasing unemployment and consumer debt, poses a significant threat to goeasy. As a lender to non-prime customers, goeasy's borrower base is inherently more susceptible to economic downturns. This vulnerability could translate into a substantial rise in loan defaults and credit losses, directly impacting the company's financial health.

For instance, if the Canadian unemployment rate, which stood at 6.2% in April 2024 according to Statistics Canada, were to climb significantly, it would place greater strain on goeasy's customers. This increased financial pressure on its clientele could lead to a deterioration in asset quality and a negative impact on goeasy's profitability, potentially affecting its net charge-off rates.

Rising Funding Costs

While goeasy has successfully diversified its funding avenues, a persistent rise in interest rates, as seen in the Bank of Canada's policy rate hikes throughout 2022 and 2023, could elevate its borrowing expenses. For instance, if goeasy's average cost of funds were to increase by 100 basis points, it could directly compress its net interest margin.

Higher funding costs directly squeeze goeasy's profitability by increasing the expense side of its operations. This could impact the company's ability to maintain its current dividend payout or reinvest in growth initiatives.

Managing these rising funding costs is paramount for goeasy's sustained financial health. This involves strategies like optimizing its securitization programs and potentially exploring new, cost-effective funding sources.

- Interest Rate Sensitivity: goeasy's reliance on wholesale funding markets makes it susceptible to fluctuations in benchmark interest rates.

- Margin Compression: An increase in funding costs directly reduces the net interest margin, impacting profitability.

- Capital Market Conditions: A less favorable capital market environment can lead to higher yields demanded by investors, increasing goeasy's cost of capital.

- Profitability Impact: Elevated borrowing expenses can hinder the company's ability to achieve its profit targets and maintain competitive pricing on its loan products.

Changes in Consumer Borrowing Habits

Changes in consumer borrowing habits pose a significant threat to goeasy. A shift towards prime credit availability or evolving attitudes towards debt could shrink the market for non-prime lending. For instance, if economic conditions improve to a point where a larger segment of the population accesses traditional banking with better rates, goeasy’s core customer base might contract.

Furthermore, the rise of alternative lending solutions, potentially offering greater flexibility or lower perceived costs, could divert customers. goeasy needs to stay attuned to these evolving preferences and the broader economic landscape to maintain its market position.

- Reduced Addressable Market: If more consumers qualify for prime credit, the pool of individuals needing non-prime lending services may decrease.

- Shifting Debt Attitudes: A societal move away from leveraging debt or a preference for different financial products could impact demand for goeasy's offerings.

- Competitive Alternatives: The emergence of new or more attractive lending platforms could siphon customers away from goeasy.

Intensified competition from both traditional banks and agile fintech startups presents a significant threat, potentially leading to pricing wars and increased customer acquisition costs. A weakening economy with rising unemployment and consumer debt could also substantially increase loan defaults and credit losses, directly impacting goeasy's financial health. Furthermore, changes in consumer borrowing habits, such as a shift towards prime credit availability or alternative lending solutions, could shrink goeasy's addressable market.

| Threat Category | Specific Threat | Potential Impact | Relevant Data/Context |

|---|---|---|---|

| Competition | Increased competition from fintechs and banks | Margin compression, higher customer acquisition costs | New fintech entrants securing significant funding in 2024 |

| Economic Conditions | Deteriorating economy, rising unemployment | Increased loan defaults and credit losses | Canadian unemployment rate at 6.2% in April 2024 |

| Regulatory Environment | Potential reduction in maximum allowable interest rates | Revenue compression, need for business model adjustments | OSFI's continued review of lending practices |

| Consumer Behavior | Shift towards prime credit or alternative lending | Reduced addressable market for non-prime lending | Potential contraction of core customer base if economic conditions improve |

SWOT Analysis Data Sources

This goeasy SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry analysis. These sources provide a well-rounded perspective on goeasy's operational landscape and competitive positioning.