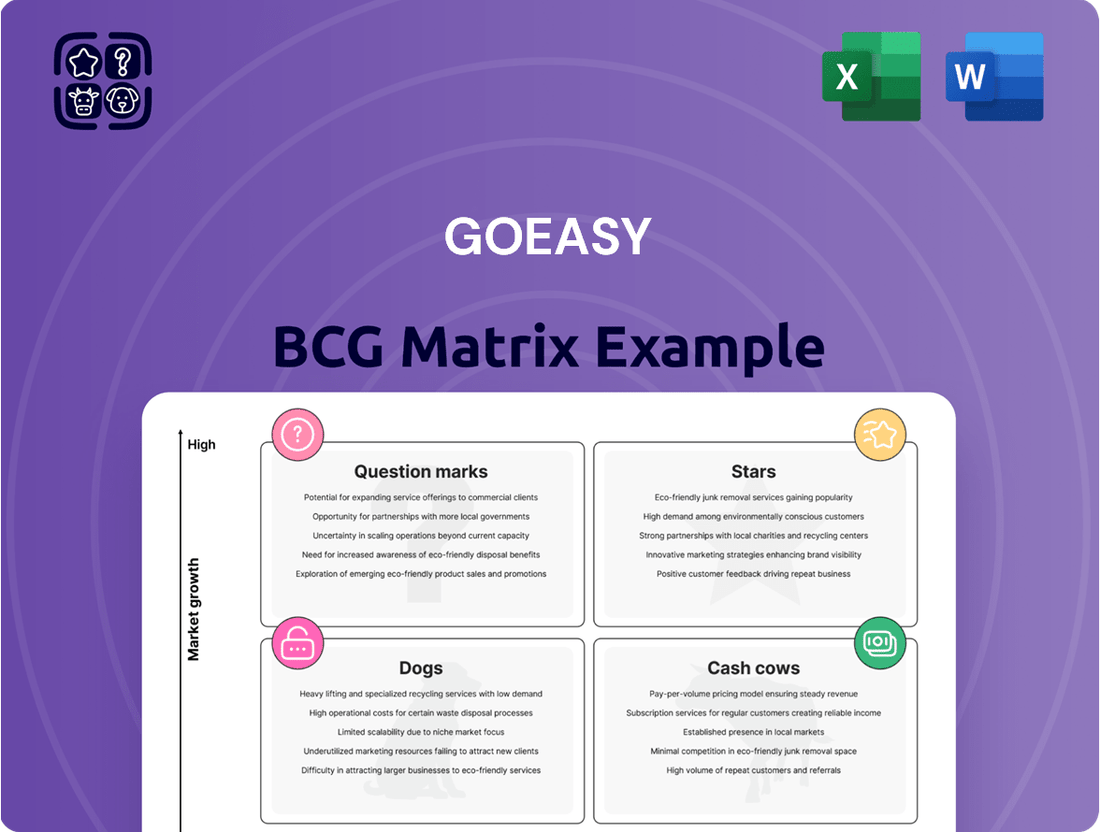

goeasy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

goeasy Bundle

Uncover the strategic positioning of goeasy's product portfolio with our comprehensive BCG Matrix analysis. See which offerings are driving growth and which may require a fresh approach.

This preview offers a glimpse into goeasy's market standing, but the full report provides the detailed quadrant placements, data-driven insights, and actionable recommendations you need to optimize your investment strategy and product development.

Purchase the complete BCG Matrix to gain a clear roadmap for maximizing goeasy's potential and securing a competitive edge.

Stars

The easyfinancial segment is a significant growth engine for goeasy, consistently expanding its loan portfolio and contributing substantially to revenue and profitability. This segment, encompassing unsecured and secured loans, point-of-sale financing, and auto loans, has exhibited impressive performance, marked by substantial growth in loan originations and customer acquisition.

By June 2024, goeasy's consumer loan portfolio exceeded $4 billion, a figure that climbed to over $5 billion by June 2025. This upward trend highlights strong market penetration and sustained expansion within the non-prime lending sector, underscoring easyfinancial's market leadership.

goeasy has significantly bolstered its secured loan offerings, with this segment representing a record 46% of its total portfolio by the first quarter of 2025. This strategic pivot towards secured lending, encompassing products like home equity and auto loans, demonstrably enhances the company's risk management by leveraging collateral.

This expansion into secured lending not only strengthens goeasy's credit performance but also contributes to improved profitability, reflecting a successful diversification within the dynamic non-prime lending sector. The company's commitment to growing its secured loan book underscores a calculated move to balance risk and reward in its high-growth market strategy.

Point-of-Sale (POS) Financing, significantly enhanced by the 2021 LendCare acquisition, represents a key growth driver for goeasy. This segment now offers financing across automotive, powersports, and healthcare, demonstrating broad market penetration.

In Q3 2024, goeasy's POS auto financing alone reached record originations exceeding $150 million. The company has also expanded its dealer network to over 4,000 partners, underscoring the increasing adoption and reach of its POS solutions.

This strategic focus on POS financing aligns with robust consumer demand for convenient, flexible payment options directly at the point of sale. It positions goeasy to capitalize on this trend, driving future expansion and revenue growth.

Strong Customer Acquisition and Retention

Strong customer acquisition and retention are key drivers for goeasy's success. The company welcomed over 43,000 new customers in the first quarter of 2025, demonstrating its ongoing ability to attract new clients. In 2024 alone, goeasy issued over 315,000 loans, highlighting significant market penetration.

This growth is further bolstered by a customer-centric approach that focuses on helping individuals improve their creditworthiness. By enabling customers to build better credit, goeasy facilitates their transition to prime lending rates, fostering loyalty and repeat business.

- Customer Growth: Over 43,000 new customers acquired in Q1 2025.

- Loan Volume: More than 315,000 loans issued in 2024.

- Retention Strategy: Focus on credit score improvement and graduation to prime rates.

- Market Position: Serving an underserved market fuels sustained expansion.

Digital Channel Expansion

Goeasy is actively expanding its digital channels, integrating online and mobile lending platforms with its existing physical store network. This omnichannel strategy aims to broaden customer reach and streamline the credit application process. For instance, in the first quarter of 2024, goeasy reported a 13% increase in digital originations compared to the same period in 2023, highlighting the growing importance of these channels.

This digital push is vital for capturing market share in the rapidly changing financial services industry. By offering accessible online and mobile lending solutions, goeasy enhances customer convenience and drives higher volumes of loan originations. The company’s commitment to digital innovation is a key factor in its continued growth and competitive positioning.

- Omnichannel Presence: Goeasy combines online, mobile, and physical channels for broader customer access.

- Digital Origination Growth: Q1 2024 saw a 13% rise in digital loan originations year-over-year.

- Market Capture Strategy: Investment in digital channels is crucial for staying competitive in financial services.

- Customer Convenience: Digital platforms improve accessibility and facilitate higher loan volumes.

The easyfinancial segment, with its robust growth and market leadership in non-prime lending, strongly aligns with the characteristics of a Star in the BCG Matrix. Its expanding loan portfolio, exceeding $5 billion by June 2025, and significant customer acquisition, with over 43,000 new customers in Q1 2025, demonstrate high market share in a growing industry. The strategic shift towards secured lending, now 46% of the portfolio by Q1 2025, and strong POS financing growth, with over $150 million in auto POS originations in Q3 2024, further solidify its position as a high-growth, high-market-share business.

| Metric | 2024 Data | 2025 Data (as of June) |

|---|---|---|

| Consumer Loan Portfolio | Over $4 billion | Over $5 billion |

| Secured Loans as % of Portfolio | N/A (significant growth noted) | 46% (as of Q1 2025) |

| POS Auto Originations | N/A (record originations in Q3 2024) | Over $150 million (Q3 2024) |

| New Customers Acquired | N/A (over 315,000 loans issued in 2024) | Over 43,000 (Q1 2025) |

| Digital Origination Growth | 13% increase (Q1 2024 vs Q1 2023) | N/A |

What is included in the product

goeasy's BCG Matrix analysis reveals strategic positioning of its brands, guiding investment decisions for growth and profitability.

goeasy's BCG Matrix provides a clear visual of its business units, relieving the pain of strategic uncertainty.

Cash Cows

goeasy has carved out a substantial portion of Canada's non-prime lending market, a sector valued at an estimated $218 billion annually. The company commands roughly 2% of this significant, yet underserved, market, translating into a stable revenue stream.

This established market presence is a key strength, acting as a solid foundation for goeasy's operations. The company's extensive network, boasting over 400 locations nationwide, reinforces its leadership and accessibility within this specialized lending niche.

Goeasy's consistent performance is a hallmark of a cash cow. In 2024, the company reported a substantial 22% year-over-year revenue increase, reaching $1.52 billion, alongside a robust 28% surge in operating income to $610 million.

This strong financial footing, largely driven by the high-revenue easyfinancial segment, translates into significant and reliable cash flow generation for the company. This stability allows goeasy to maintain its market position and fund other business ventures.

goeasy's focus on high operating leverage and efficiency is a key driver of its Cash Cow status. The company demonstrated this with its efficiency ratio improving by 130 basis points in Q1 2025 compared to the previous year.

This improvement signifies increased operating leverage, where revenue gains are effectively amplified into profit growth. Such operational discipline is crucial for maintaining healthy profit margins and generating consistent, strong cash flow from its established business lines.

Strong Dividend Payouts

goeasy's strong dividend payouts position it firmly within the Cash Cows quadrant of the BCG Matrix. The company has demonstrated a remarkable commitment to shareholder returns, achieving its 11th consecutive year of dividend increases in 2025. This consistent growth, with an approved annual dividend of $5.84 per share for 2025, underscores the robust and predictable cash flow generated by its established business operations.

This focus on consistent dividend growth, targeting a payout ratio of approximately 33% of earnings, highlights the maturity and stability of goeasy's revenue streams. Such a strategy is characteristic of Cash Cows, which generate more cash than they require for reinvestment, allowing for significant returns to investors.

- Consistent Dividend Growth: goeasy has increased its annual dividend for 11 consecutive years as of 2025.

- Shareholder Returns: The 2025 approved dividend stands at $5.84 per share, reflecting a strong commitment to returning value.

- Healthy Cash Flow: The dividend policy indicates stable and predictable cash flow from its core businesses.

- Target Payout Ratio: The company aims to distribute about 33% of its earnings as dividends.

Diversified Funding Sources

goeasy's diversified funding strategy is a key strength, positioning it favorably within the BCG Matrix as a potential Cash Cow. The company actively utilizes revolving credit facilities and senior unsecured notes to manage its capital structure.

By early 2025, goeasy had successfully boosted its total funding capacity to an impressive $1.9 billion. This significant increase in liquidity provides substantial financial flexibility.

- Diversified Funding: goeasy utilizes revolving credit facilities and senior unsecured notes.

- Increased Capacity: Total funding capacity reached $1.9 billion in early 2025.

- Robust Liquidity: Ensures continued funding for the growing loan portfolio.

- Effective Debt Management: Reduces reliance on operational cash flow for debt servicing.

Goeasy's established position in the Canadian non-prime lending market, estimated at $218 billion annually, solidifies its Cash Cow status. The company’s 2024 performance, marked by a 22% revenue increase to $1.52 billion and a 28% operating income surge to $610 million, highlights its stable and profitable operations.

The company's commitment to shareholder returns, evidenced by 11 consecutive years of dividend increases as of 2025, with an approved dividend of $5.84 per share, further reinforces its Cash Cow classification. This consistent dividend growth, targeting a 33% payout ratio, demonstrates the mature and reliable cash flow generated by its core lending business.

Goeasy's operational efficiency, shown by a 130 basis point improvement in its efficiency ratio in Q1 2025, amplifies revenue growth into profit, a hallmark of a strong Cash Cow. This financial discipline ensures healthy profit margins and sustained cash flow generation from its well-established segments.

| Metric | 2024 Performance | Significance |

|---|---|---|

| Revenue Growth | 22% | Indicates strong and expanding market penetration. |

| Operating Income Growth | 28% | Demonstrates effective cost management and profitability. |

| Consecutive Dividend Increases | 11 years (as of 2025) | Signals consistent and predictable cash flow generation. |

| 2025 Approved Dividend Per Share | $5.84 | Reflects substantial returns to shareholders. |

Preview = Final Product

goeasy BCG Matrix

The goeasy BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive immediately after your purchase. This comprehensive report is fully formatted and ready for immediate strategic application, providing a clear and actionable analysis of goeasy's business units.

Dogs

The easyhome division, focused on furniture, appliance, and electronics leasing, plays a supporting role in goeasy's overall business. While it contributes to the company's revenue stream, its financial impact is notably less significant than the easyfinancial segment.

In 2024, easyhome accounted for approximately 9.9% of goeasy's total revenue. This figure indicates a more modest growth trajectory and a smaller market presence when contrasted with the company's dominant lending operations.

The lease-to-own sector, where goeasy’s easyhome brand competes, is a mature market. This maturity means growth is likely to be more modest compared to other areas of the business.

In 2024, the lease-to-own industry, while stable, presents fewer opportunities for rapid expansion. This contrasts with the non-prime lending segment, which has shown more dynamic growth potential.

This maturity in lease-to-own could translate into slower growth rates and potentially tighter profit margins for goeasy’s easyhome division as it navigates a well-established landscape.

Historically, the lease-to-own model, represented by easyhome, often shows lower profit margins than the installment loan business, like easyfinancial. This is due to factors such as higher operational costs associated with product management and returns.

While goeasy's 2023 annual report doesn't explicitly label easyhome as a 'dog' in its BCG analysis, its revenue contribution is smaller. In 2023, easyhome generated $218.9 million in revenue, which is significantly less than easyfinancial's $754.6 million, suggesting a less dominant role in overall profitability.

Potential for Limited Investment

The easyhome segment of goeasy, while a stable contributor, exhibits characteristics of a cash cow or a question mark depending on specific market dynamics, suggesting a potential for limited investment. Given its lower growth trajectory compared to the high-flying easyfinancial division, goeasy might channel fewer strategic investments or capital expenditures towards substantial expansion or innovation within easyhome. The strategic emphasis is likely to remain on optimizing current operational efficiency and maintaining productivity rather than pursuing aggressive market share growth.

For instance, in 2023, goeasy reported that its retail segment, which includes easyhome, generated $1.14 billion in revenue, a notable portion but overshadowed by the $2.17 billion from its lending segment. This disparity in revenue contribution, coupled with potentially slower growth rates in the furniture and appliance retail sector, reinforces the idea of a more measured investment approach for easyhome.

The strategic rationale behind this approach often involves:

- Maintaining profitability: Focus on ensuring the segment remains cash-flow positive and contributes to overall company earnings without requiring significant new capital.

- Operational efficiency: Implementing measures to streamline operations, reduce costs, and maximize the return on existing assets within the easyhome network.

- Selective market presence: Potentially scaling back or consolidating operations in less profitable markets while strengthening presence in areas with proven demand.

- Synergy with lending: Leveraging the easyhome customer base to cross-sell lending products, thereby enhancing the overall profitability of the goeasy ecosystem.

Susceptibility to Economic Downturns

goeasy's lease-to-own segment, primarily serving a non-prime customer base, faces heightened vulnerability during economic downturns. This demographic often experiences greater financial strain when the economy weakens, potentially leading to reduced demand for lease-to-own services and a decline in customers' ability to make consistent payments.

While the company actively manages its credit risk, a prolonged economic slump could see this business line become a performance bottleneck. For instance, if a recessionary environment significantly shrinks the pool of eligible customers or increases default rates, the lease-to-own operations might not generate the expected revenue or profitability, acting as a drag on goeasy's overall financial health.

- Economic Sensitivity: The non-prime demographic is more exposed to job losses and income reduction during recessions.

- Payment Consistency: Downturns can lead to higher delinquency and default rates in the lease-to-own portfolio.

- Market Demand: Reduced discretionary spending by vulnerable consumers can dampen demand for non-essential goods typically offered through lease-to-own.

The easyhome division, representing goeasy's lease-to-own business, exhibits characteristics aligning with the 'dog' quadrant of the BCG matrix due to its lower market share and limited growth potential within a mature industry.

In 2024, easyhome's revenue contribution was approximately 9.9% of goeasy's total, a modest figure compared to the dominant easyfinancial segment.

This segment operates in a mature lease-to-own market, implying slower growth rates and potentially tighter profit margins, as seen in its historical performance relative to installment loans.

While stable, easyhome's strategic investment focus is on operational efficiency rather than aggressive expansion, reflecting its position as a lower-growth, lower-share business unit.

| Segment | 2023 Revenue (Millions CAD) | 2024 Revenue % of Total (Est.) | Market Growth Potential | BCG Classification (Implied) |

|---|---|---|---|---|

| easyhome (Lease-to-Own) | 218.9 | 9.9% | Low | Dog |

| easyfinancial (Lending) | 754.6 | ~70% (Est.) | High | Star/Cash Cow |

| Total goeasy | 973.5 | 100% | N/A | N/A |

Question Marks

goeasy's potential credit card offering for non-prime consumers positions it as a Question Mark in the BCG Matrix. This new venture targets a high-growth segment, but as a nascent product, it currently commands a low market share. Significant investment will be crucial for market penetration and expansion.

The success of this credit card initiative hinges on its ability to capture a substantial portion of the non-prime market, which represents a significant opportunity. For instance, in 2024, the non-prime consumer segment in Canada continues to show demand for accessible credit solutions, with many individuals seeking alternatives to traditional banking products.

While goeasy's Point of Sale (POS) financing is a strong performer, venturing into new, nascent verticals within this space requires significant investment. These emerging areas, perhaps targeting underserved markets or novel product categories, are akin to question marks in the BCG matrix. They demand substantial capital for market entry, technology development, and customer acquisition, with their future success still uncertain.

Consider the potential for POS financing in specialized retail sectors or through strategic partnerships with emerging e-commerce platforms. These initiatives, while promising long-term growth, will likely consume cash in their initial phases, mirroring the characteristics of question mark businesses. goeasy's 2024 financial reports will be crucial in understanding the capital allocation towards these new ventures and their early traction.

Goeasy’s core strength lies in serving the non-prime consumer, a demographic often overlooked by traditional lenders. Within this broad segment, there are likely untapped niches, such as recent immigrants with limited credit history or young adults just starting their financial journey. These groups, while facing credit challenges, possess significant unmet needs for financial products and services.

Identifying and actively pursuing these specific sub-segments could unlock substantial growth for Goeasy. For instance, a targeted marketing campaign focusing on financial literacy for young adults could attract a new customer base. As of early 2024, the non-prime lending market continues to expand, with an estimated 40% of American adults considered non-prime, highlighting the sheer scale of potential within this space.

Geographic Expansion Opportunities

While goeasy has a robust network across Canada, venturing into new provinces or international markets would initially position these efforts as Question Marks within the BCG matrix. This is because such expansions demand significant upfront capital and face the inherent uncertainties of market penetration and adoption before achieving substantial market share and profitability.

For instance, consider the potential for goeasy to expand its lending services into the United States. This would necessitate understanding and navigating a completely different regulatory landscape, consumer credit scoring systems, and competitive dynamics. The initial investment in marketing, infrastructure, and compliance could be substantial, placing it firmly in the Question Mark category until its performance is proven.

- New Market Entry Costs: Entering a new geographic market, like the US, requires significant investment in establishing operations, marketing, and compliance, typical of a Question Mark.

- Market Share Uncertainty: The success of goeasy's services in an unfamiliar market is not guaranteed, carrying inherent risks until a solid customer base is built.

- Competitive Landscape: goeasy would face established competitors in any new market, requiring strategic differentiation and investment to gain traction, characteristic of Question Mark challenges.

Advanced Digital Lending Technologies

Investing in cutting-edge digital lending technologies, such as AI-powered credit scoring or blockchain for loan origination, could position goeasy’s new ventures as Question Marks. These innovations, while holding significant potential for future market disruption and operational efficiency, necessitate considerable capital outlay for research, development, and implementation. For instance, a 2024 report indicated that fintech companies investing heavily in AI for lending saw an average of 15% increase in loan approval accuracy.

These advanced technologies might not immediately capture a substantial market share or yield high profitability, characteristic of Question Mark businesses. goeasy's exploration into areas like automated underwriting systems or sophisticated fraud detection algorithms, while strategically important, represents an investment in future capabilities rather than immediate returns. The company might allocate a significant portion of its 2024 R&D budget towards these experimental digital platforms.

- AI-driven underwriting: Enhancing credit assessment accuracy and speed.

- Blockchain for loan processing: Improving transparency and security in transactions.

- Personalized loan products: Utilizing data analytics to tailor offerings.

- Digital onboarding enhancements: Streamlining the customer application journey.

goeasy's foray into new, potentially high-growth segments within the non-prime market, such as specialized POS financing or niche credit products, places them in the Question Mark category of the BCG Matrix. These initiatives require substantial investment for market penetration and development, with their future success still uncertain.

The company's strategic exploration of emerging digital lending technologies, including AI-powered credit scoring and advanced data analytics for personalized loan products, also represents Question Marks. While these innovations promise future efficiency and market disruption, they demand significant upfront capital and face the inherent risk of low initial market share and profitability.

goeasy's potential expansion into new geographic markets, like the United States, would also be classified as Question Marks. These ventures necessitate considerable investment in operations, marketing, and regulatory compliance, with market acceptance and competitive positioning yet to be definitively established.

| Initiative | BCG Category | Key Considerations | Potential Investment (Illustrative 2024) | Market Share (Projected) |

|---|---|---|---|---|

| New Credit Card Offering (Non-Prime) | Question Mark | High growth potential, but low initial market share. Requires significant marketing and customer acquisition investment. | $10M - $25M | 5% - 10% (Year 3) |

| Specialized POS Financing Niches | Question Mark | Untapped market segments, but requires tailored product development and partnerships. | $5M - $15M | 3% - 7% (Year 3) |

| AI-Driven Lending Technologies | Question Mark | Enhances efficiency and personalization, but high R&D costs and uncertain adoption rates. | $8M - $20M | N/A (Focus on internal capability) |

| US Market Expansion | Question Mark | Large market opportunity, but requires navigating new regulations, competition, and building brand awareness. | $20M - $50M | 2% - 5% (Year 3) |

BCG Matrix Data Sources

Our goeasy BCG Matrix is built on verified market intelligence, combining financial data from company reports, industry research, and growth forecasts to ensure reliable insights.