goeasy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

goeasy Bundle

goeasy operates in a competitive landscape shaped by moderate buyer power and significant rivalry among existing players in the non-prime lending sector. While supplier power is relatively low due to standardized services, the threat of substitutes is a key consideration for the company's long-term strategy.

The complete report reveals the real forces shaping goeasy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

goeasy's access to capital is a critical factor in its operations, as its primary suppliers are the financial institutions and investors that fund its lending activities. The company's ability to secure diverse and substantial funding significantly weakens the bargaining power of any single capital provider.

In December 2024, goeasy demonstrated this strength by increasing its automotive securitization warehouse facility by $200 million, bringing the total to $700 million and extending the maturity date to December 2026. This move highlights goeasy's robust funding capacity and its strategic approach to managing supplier relationships in the capital markets.

The cost of capital is a crucial factor influencing goeasy's profitability, as it dictates how much the company pays to borrow money or raise equity. For instance, if goeasy needs to secure a new loan, the interest rate it's offered directly impacts its expenses and therefore its bottom line.

Central bank policies, like those from the Bank of Canada, significantly shape these borrowing costs. While the Bank of Canada's benchmark rate saw a notable decrease from June 2024 to March 2025, the possibility of future adjustments due to persistent global trade uncertainties means goeasy must remain agile in managing its capital expenses.

Regulations impacting financial institutions directly influence the cost and availability of capital for companies like goeasy. Stricter lending rules or capital requirements can make it harder and more expensive to secure the funding necessary for operations and growth.

The Canadian government's proposed reduction of the maximum allowable interest rate from 47% to 35% is a significant development. This change, if enacted, could reshape the competitive landscape for lenders and potentially affect goeasy's funding costs and profitability.

Technology and Data Providers

goeasy's operations are heavily dependent on technology and data providers, essential for functions like credit scoring and managing customer relationships. The leverage these suppliers hold is directly tied to how unique and critical their services are to goeasy's core business. For instance, specialized credit assessment algorithms or proprietary customer relationship management (CRM) software can give suppliers significant power.

goeasy's strategic emphasis on a digital-first approach and enhancing operational efficiency means it likely relies on sophisticated technological solutions. This reliance can increase the bargaining power of providers offering these advanced systems, especially if switching costs are high or if the technology is not readily available from multiple sources. In 2024, the demand for advanced AI-driven credit assessment tools, for example, has been particularly strong, potentially empowering providers in this niche.

- Supplier Dependency: goeasy relies on technology and data providers for critical functions like credit assessment and customer management.

- Supplier Power Factors: The bargaining power of these suppliers hinges on the uniqueness and criticality of their offerings.

- Digital Strategy Impact: goeasy's digital-led strategy and focus on efficiency suggest a significant reliance on advanced technological solutions.

- Market Trends: Increased demand for AI-driven credit assessment tools in 2024 may amplify the bargaining power of specialized providers.

Human Capital and Talent Acquisition

The bargaining power of suppliers in the context of human capital for goeasy is influenced by the availability of skilled talent, especially within the financial services sector. A tight labor market for specialized roles can drive up recruitment and compensation costs, impacting operational efficiency. For instance, in 2024, the unemployment rate for finance and insurance occupations in Canada remained low, hovering around 2.5%, indicating a competitive talent landscape.

goeasy’s commitment to fostering a positive work environment is a key factor in mitigating this supplier power. Being recognized as one of Canada's Best Workplaces in 2025 by Great Place to Work® demonstrates a strong employer brand. This recognition helps goeasy attract and retain top talent, reducing its reliance on external recruitment agencies and potentially lowering the bargaining power of individual job seekers or specialized recruitment firms.

- Talent Availability: Shortages in specialized financial services roles can increase goeasy's recruitment costs.

- Employer Branding: goeasy's 'Best Workplace' status in 2025 enhances its ability to attract and retain skilled employees.

- Employee Retention: A strong culture reduces turnover, lessening the need for constant, costly recruitment.

- Supplier Power Mitigation: By building a desirable workplace, goeasy can decrease the leverage of potential employees and recruitment agencies.

goeasy's primary suppliers are financial institutions and investors, whose bargaining power is diminished by the company's diverse and substantial access to capital. Its ability to secure varied funding sources, such as the $200 million increase to its automotive securitization warehouse facility in December 2024, demonstrates this strength.

The cost of capital, influenced by Bank of Canada policies and potential future adjustments due to global trade uncertainties, directly impacts goeasy's profitability. Regulations, like the proposed reduction in Canada's maximum allowable interest rate from 47% to 35%, also shape funding costs and the competitive landscape for lenders.

Technology and data providers hold leverage based on the uniqueness and criticality of their services, especially with goeasy's digital-first strategy and reliance on advanced solutions like AI-driven credit assessment tools, which saw strong demand in 2024.

The bargaining power of human capital suppliers is moderated by goeasy's strong employer brand, highlighted by its recognition as one of Canada's Best Workplaces in 2025. This helps attract and retain talent, reducing reliance on external recruitment and mitigating the leverage of job seekers in a competitive market where finance and insurance unemployment remained low at around 2.5% in 2024.

What is included in the product

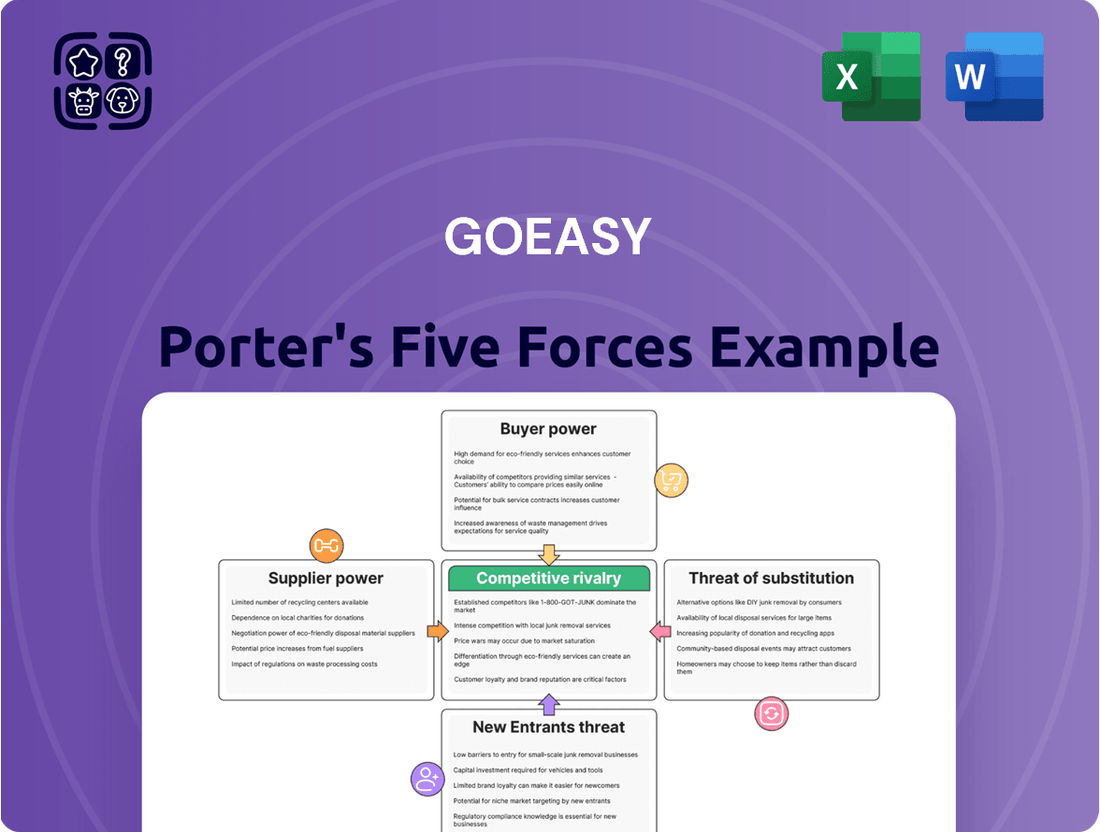

This analysis delves into goeasy's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the lending and home goods sectors.

Instantly understand goeasy's competitive landscape with a visual Porter's Five Forces analysis, highlighting key threats and opportunities for strategic advantage.

Customers Bargaining Power

goeasy's primary customer base is the non-prime segment, individuals who often face challenges securing credit from traditional financial institutions. This inherent need translates into a consistent and robust demand for goeasy's accessible lending products, which can temper the individual bargaining power of these customers.

The company's extensive reach, having served over 1.5 million Canadians, underscores the significant market demand for its services. In the first quarter of 2025 alone, goeasy welcomed more than 43,000 new customers, highlighting the ongoing reliance of this demographic on their offerings and, consequently, limiting their collective ability to dictate terms.

Customers who cannot secure loans from traditional banks often find themselves with very limited choices. This lack of alternatives makes them more dependent on lenders like goeasy, giving goeasy a degree of power in setting loan terms. For instance, in 2023, the average interest rate for unsecured personal loans from non-bank lenders often exceeded 20%, a stark contrast to prime rates from traditional banks.

While customers in the non-prime segment might typically have less bargaining power, initiatives focused on transparency and financial literacy can shift this dynamic. goeasy's own goeasy Academy aims to educate consumers, potentially leading to a more informed customer base that can better assess loan terms and compare offerings.

Credit Improvement and Graduation Programs

goeasy's mission to help customers improve their credit and graduate to prime lending rates directly impacts customer bargaining power. As customers successfully improve their creditworthiness, they gain access to a broader array of financial institutions, reducing their long-term dependence on goeasy and increasing their leverage with other lenders.

This strategy, while beneficial for customer financial health, inherently shifts the power dynamic. For instance, if a significant portion of goeasy's customer base graduates to prime lending, they can negotiate more favorable terms elsewhere, diminishing goeasy's pricing power. In 2023, goeasy reported a loan portfolio of $2.7 billion, with a focus on non-prime borrowers who are typically more sensitive to interest rates and thus have less initial bargaining power.

- Customer Empowerment: goeasy's programs aim to elevate customers' financial standing.

- Reduced Reliance: Successful credit improvement lessens dependence on non-prime lenders.

- Increased Leverage: Graduated customers gain bargaining power with a wider financial market.

- Strategic Impact: This long-term strategy can influence goeasy's future pricing and market position.

Impact of Macroeconomic Conditions on Customer Solvency

Economic downturns and rising inflation, like the persistent high inflation seen throughout 2023 and into 2024, directly impact the solvency of goeasy's non-prime customer base. Increased cost of living pressures can lead to higher delinquency rates, as consumers struggle to meet their financial obligations.

This financial strain on customers can indirectly bolster their collective bargaining power. When a significant portion of the customer base faces hardship, it can prompt regulatory bodies to consider interventions or increase demand for more flexible repayment terms from lenders.

For instance, in 2023, Canada experienced inflation rates that, while moderating from their 2022 peaks, still presented challenges for households. This environment can make customers more sensitive to interest rates and loan terms, potentially leading them to seek out more favorable conditions or delay repayment, thus exerting pressure on lenders.

- Impact of Inflation: Persistent inflation in 2023-2024 has eroded consumer purchasing power, particularly for lower-income households.

- Delinquency Risk: Economic pressures can lead to an increase in loan delinquency rates for lenders like goeasy.

- Customer Leverage: Widespread financial distress can give customers indirect bargaining power through potential regulatory action or demand for flexible terms.

The bargaining power of goeasy's customers is generally low due to their non-prime status and limited alternatives, but this can shift. While goeasy's accessibility provides a crucial service, customers' ability to negotiate is constrained by their need for credit, as demonstrated by the 2023 average interest rates for non-bank lenders often exceeding 20%.

However, goeasy's own initiatives like goeasy Academy and its mission to help customers improve credit can empower them. As customers graduate to prime lending, they gain more options and leverage with other institutions, potentially reducing their reliance on goeasy. This long-term strategy could impact goeasy's pricing power.

Economic conditions, such as the persistent inflation seen through 2023 and into 2024, also influence this dynamic. Increased financial strain on the non-prime segment can lead to higher delinquency rates and indirectly bolster customer bargaining power by increasing sensitivity to terms and potentially prompting calls for regulatory flexibility.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Limited Alternatives | Lowers bargaining power | Non-prime borrowers often have few other credit options. |

| Financial Literacy Programs | Potentially increases bargaining power | goeasy Academy aims to educate consumers, enabling better assessment of loan terms. |

| Credit Improvement | Increases bargaining power over time | Graduating to prime lending allows access to more competitive offers. |

| Economic Pressures (Inflation 2023-2024) | Indirectly increases bargaining power | Higher cost of living can lead to increased demand for flexible terms or regulatory intervention. |

Preview the Actual Deliverable

goeasy Porter's Five Forces Analysis

This preview displays the complete goeasy Porter's Five Forces Analysis, offering a thorough examination of competitive forces impacting the company. You are looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file. This means you will receive the same in-depth insights into threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry within goeasy's industry.

Rivalry Among Competitors

The Canadian non-prime lending sector, while featuring established entities like goeasy, can still be considered somewhat fragmented. This fragmentation stems from the presence of numerous smaller lenders and emerging online platforms competing for market share. goeasy's significant market penetration, evidenced by originating over $16.6 billion in loans to more than 1.5 million Canadians, highlights its leadership position amidst this diverse competitive landscape.

The consumer lending sector is intensely competitive, with companies like goeasy actively pursuing aggressive growth strategies. goeasy's loan portfolio reached $4.79 billion in Q1 2025, marking a significant 24% year-over-year increase and exceeding $5 billion by June 2025. This rapid expansion highlights a market where players are vying for greater market share, intensifying rivalry.

goeasy's extensive product diversification, encompassing unsecured, secured, auto loans, point-of-sale financing, and lease-to-own options, significantly reduces the threat of direct rivalry. This broad product suite allows goeasy to serve a wide spectrum of customer financial needs, making it less susceptible to competitors specializing in only one or two lending areas. For instance, in 2023, goeasy's loan portfolio continued to grow, demonstrating the broad appeal of its diversified offerings.

The company's robust omni-channel presence, with over 400 physical locations complemented by strong online and mobile platforms, further solidifies its competitive standing. This integrated approach provides customers with convenient access to goeasy's services through their preferred channel, a critical factor in the competitive lending landscape. By offering multiple touchpoints, goeasy enhances customer loyalty and captures a larger market share compared to less integrated competitors.

Regulatory Scrutiny and Interest Rate Caps

The Canadian government's initiative to lower maximum allowable interest rates, with a proposed cap at 35% APR, directly challenges the core profitability of non-prime lenders like goeasy. This regulatory shift is poised to intensify competition as businesses must adapt their models to a tighter margin environment.

This regulatory pressure can force lenders to seek greater operational efficiencies and explore innovative product offerings to remain competitive, potentially squeezing profit margins. For instance, the Office of the Superintendent of Financial Institutions (OSFI) has been actively reviewing lending practices, signaling a heightened environment of oversight for the sector.

- Regulatory Impact: Planned reduction in maximum interest rates to 35% APR by the Canadian government.

- Competitive Pressure: Forces lenders to innovate and operate more efficiently under tighter margin constraints.

- Profitability Concerns: Potential for squeezed profit margins due to mandated rate reductions.

- Industry Oversight: Increased focus from regulatory bodies like OSFI on lending practices.

Brand Reputation and Customer Trust

In the financial services sector, particularly when serving potentially vulnerable consumers, a strong brand reputation and established customer trust are paramount. These elements act as significant competitive differentiators, influencing customer acquisition and retention.

goeasy has actively cultivated its brand image. For instance, its recognition as a 'Best Workplace' in recent years, including accolades in 2023 and 2024, speaks to its internal culture, which can translate into better customer service. Furthermore, the company's commitment to financial literacy initiatives aims to build trust and empower its customer base.

- Brand Reputation: goeasy's focus on employee well-being and financial education strengthens its public image.

- Customer Trust: Initiatives promoting financial literacy can foster deeper trust with a consumer base often seeking guidance.

- Competitive Advantage: A solid reputation and trust can attract customers away from competitors with less established or less reputable brands.

- Market Position: In 2023, goeasy reported servicing over 1.7 million customers, underscoring the scale of trust it has already garnered.

The competitive rivalry within goeasy's operating environment is significant, driven by both established players and emerging digital lenders. goeasy's substantial market presence, with a loan portfolio exceeding $5 billion by mid-2025 and over 1.5 million Canadians served, positions it as a leader but also a target for rivals. The sector's fragmentation means numerous smaller entities compete for market share, intensifying the need for goeasy to maintain its aggressive growth and diversified product offerings.

| Metric | goeasy (Q1 2025) | Canadian Non-Prime Lending Sector (Est. 2024) |

|---|---|---|

| Loan Portfolio Value | $4.79 billion | Varied, with significant fragmentation |

| Customer Base | Over 1.5 million Canadians | Broad, but goeasy holds significant share |

| Physical Locations | 400+ | Varies by competitor |

SSubstitutes Threaten

Traditional banks and credit unions pose a significant threat of substitution for goeasy, particularly as customers' creditworthiness improves or if these prime lenders relax their lending standards. For instance, if a customer's credit score rises, they may no longer qualify for goeasy's services and instead opt for lower-interest loans from a traditional institution. This shift is amplified when economic conditions improve, making prime lending more accessible.

The Bank of Canada's monetary policy plays a crucial role here. Recent rate cuts, such as those seen in 2024, can make borrowing from traditional banks more attractive due to lower interest rates. Furthermore, a potential resurgence in housing demand, a common driver of credit activity, could lead traditional lenders to increase their loan origination, directly competing with goeasy's customer base.

The increasing presence of fintech lenders and digital platforms represents a substantial threat of substitution for traditional non-prime lenders like goeasy. These nimble competitors often provide more efficient application processes, potentially more competitive interest rates, and novel product offerings that can attract borrowers away from established players.

In 2023, Canadian fintech startups secured over $1 billion in funding, indicating robust investor confidence and the capacity for these companies to scale their operations and innovate further. This trend suggests that the competitive pressure from digital alternatives is likely to intensify, forcing incumbents to adapt or risk losing market share.

Peer-to-peer (P2P) lending platforms, while not yet a dominant force in Canada, represent a potential substitute for goeasy's services. These platforms allow individuals to borrow directly from other individuals, bypassing traditional lenders and goeasy's established model. For instance, as of early 2024, platforms like Lending Loop have been facilitating business loans in Canada, indicating a growing interest in alternative financing models.

Informal Lending and Family/Friends

Informal lending from family and friends presents a viable substitute for goeasy, especially for individuals in the non-prime segment facing smaller, short-term financial needs. This avenue often bypasses interest charges and the rigors of formal credit assessments, offering a seemingly more accessible solution.

While appealing due to its lack of formal requirements, this informal channel is inherently limited in its scalability and the amounts it can provide. For instance, while a family member might lend a few hundred dollars, it's unlikely to cover the larger loan amounts goeasy specializes in, limiting its direct competitive impact on goeasy's core business.

- Limited Scale: Family and friends typically provide smaller loan amounts, insufficient for major purchases or debt consolidation needs that goeasy addresses.

- Relationship Dependency: This substitute relies heavily on personal relationships and trust, which can be strained by financial transactions.

- Lack of Formal Structure: Informal loans lack the legal recourse and structured repayment plans offered by regulated lenders like goeasy.

Government Programs and Social Services

Government programs and social services can act as substitutes for non-prime lenders like goeasy, particularly for individuals facing financial hardship. These services address the fundamental need for financial stability, offering alternatives to high-interest loans.

While not direct financial products, these entities provide crucial support that can reduce the demand for short-term, high-cost credit. For instance, in 2024, various government initiatives continued to focus on financial literacy and consumer protection, aiming to steer vulnerable populations away from predatory lending practices.

- Financial Aid Programs: Government agencies and non-profits often provide grants, emergency funds, or low-interest loans to individuals in crisis, lessening their reliance on commercial lenders.

- Debt Counseling Services: Free or subsidized credit counseling can help individuals manage existing debt and avoid taking on new, expensive loans.

- Social Safety Nets: Unemployment benefits, welfare programs, and food assistance can alleviate immediate financial pressures, reducing the need for immediate cash infusions through high-interest loans.

- Community Support: Local charities and community organizations frequently offer assistance, from emergency housing to utility bill support, acting as a buffer against financial distress.

The threat of substitutes for goeasy is multifaceted, encompassing traditional financial institutions, emerging fintech lenders, and even informal lending channels. As economic conditions improve and creditworthiness rises, borrowers may shift to prime lenders offering lower rates, a trend potentially accelerated by monetary policy adjustments like rate cuts seen in 2024.

Fintech platforms, fueled by significant venture capital, such as over $1 billion invested in Canadian fintechs in 2023, present a growing challenge with their efficient processes and innovative products. Even informal lending from friends and family, while limited in scale, can serve as a substitute for smaller, short-term needs, bypassing formal credit checks.

Government programs and social services also act as substitutes by addressing underlying financial needs, thereby reducing reliance on high-cost credit. These initiatives, often emphasizing financial literacy and consumer protection, aim to steer vulnerable populations away from predatory lending practices, as seen in ongoing government efforts in 2024.

| Substitute Type | Key Characteristics | Impact on goeasy | Supporting Data/Trend |

|---|---|---|---|

| Traditional Banks/Credit Unions | Lower interest rates for prime borrowers | Loss of creditworthy customers | Bank of Canada rate adjustments in 2024 influenced borrowing costs. |

| Fintech Lenders | Digital-first, efficient processes, potentially competitive rates | Competition for non-prime borrowers, market share erosion | Over $1 billion invested in Canadian fintechs in 2023. |

| Informal Lending (Family/Friends) | No interest, accessible for small amounts, relationship-based | Limited impact on larger loan needs, but can meet minor short-term demands | Typically for amounts less than goeasy's core offerings. |

| Government/Social Programs | Financial aid, debt counseling, social safety nets | Reduces demand for high-cost credit by addressing financial hardship | Focus on financial literacy and consumer protection in 2024 initiatives. |

Entrants Threaten

The Canadian financial services landscape presents formidable regulatory hurdles for aspiring competitors. Navigating the intricate web of licensing requirements, stringent consumer protection mandates, and caps on interest rates, like the 35% Annual Percentage Rate (APR), demands significant investment and expertise, effectively deterring many potential entrants.

Establishing a consumer lending and leasing business demands significant capital investment for loan origination, risk management systems, and operational infrastructure. For instance, goeasy's substantial $5 billion loan portfolio as of early 2024 underscores the immense financial scale required to enter and compete effectively in this sector, presenting a formidable barrier for potential new players.

Building brand recognition and trust in financial services, particularly for the non-prime segment, is a lengthy and costly endeavor. goeasy, with its 34-year history and extensive network of over 400 Canadian locations, has cultivated a significant level of customer confidence and familiarity. This established presence acts as a substantial deterrent for new companies attempting to enter the market.

Access to Customer Data and Credit Scoring Models

Existing players in the non-prime lending sector, such as goeasy, possess a significant competitive advantage through their vast repositories of customer data and finely tuned credit scoring models. These assets enable more precise risk evaluation and pricing, creating a substantial barrier for newcomers. For instance, goeasy’s focus on refining its credit assessment capabilities led to a dollar-weighted average credit score of $632 million for its Q1 2025 loan originations, the highest in its operational history.

New entrants face the daunting task of replicating or acquiring comparable data and modeling expertise. Without this foundational capability, they would struggle to compete effectively on risk management and customer acquisition. The investment required to build this infrastructure from scratch is considerable, further deterring potential new competitors.

- Proprietary Data: goeasy's extensive customer transaction history and repayment patterns are invaluable for risk assessment.

- Advanced Scoring Models: Years of data analysis have allowed goeasy to develop sophisticated algorithms that accurately predict creditworthiness in the non-prime segment.

- High Entry Cost: Developing similar data analytics and credit scoring capabilities requires substantial investment in technology and specialized talent.

- Operational History: goeasy's long-standing presence provides a track record that builds trust and offers a competitive edge over nascent operations.

Economies of Scale and Operational Efficiency

Established companies like goeasy leverage significant economies of scale in critical areas such as loan servicing, marketing, and technology infrastructure. This allows them to spread their fixed costs over a larger volume of business, leading to lower per-unit costs.

New entrants face a substantial hurdle in replicating these efficiencies. For instance, goeasy's focus on operational efficiency is evident in its Q1 2025 results, where its efficiency ratio saw improvement, indicating enhanced operating leverage. This means that for every dollar of revenue, a smaller proportion is consumed by operating expenses.

Consequently, new competitors would find it challenging to match goeasy's cost structure, making it difficult to compete effectively on price or achieve comparable profitability from the outset. The capital investment required to build a comparable operational scale can be prohibitive.

- Economies of Scale: goeasy benefits from lower per-unit costs due to its large operational footprint in loan servicing, marketing, and technology.

- Operational Efficiency: goeasy's efficiency ratio improved in Q1 2025, demonstrating increased operating leverage and cost control.

- Barriers to Entry: New entrants would struggle to achieve similar cost efficiencies, hindering their ability to compete on price or profitability.

The threat of new entrants in goeasy's market remains low due to substantial capital requirements, stringent regulations, and the difficulty of building brand trust. These factors create significant barriers, protecting incumbent players like goeasy.

New entrants would need to overcome considerable financial hurdles, including the immense capital needed for loan portfolios and sophisticated risk management systems, as exemplified by goeasy's $5 billion portfolio in early 2024. Furthermore, replicating goeasy's established brand loyalty, cultivated over 34 years and supported by over 400 locations, is a costly and time-consuming challenge for any newcomer aiming to gain traction in the non-prime lending sector.

The competitive advantage derived from proprietary data and advanced credit scoring models, such as goeasy's focus on refining credit assessment leading to a $632 million dollar-weighted average credit score for Q1 2025 originations, presents a significant barrier. New entrants would struggle to match these capabilities without substantial investment in technology and specialized talent, making it difficult to compete effectively on risk management and customer acquisition.

| Barrier Type | Description | Example for goeasy |

|---|---|---|

| Capital Requirements | High initial investment for operations and loan portfolios. | $5 billion loan portfolio (early 2024). |

| Brand Recognition & Trust | Building customer confidence in financial services. | 34-year history, 400+ locations. |

| Proprietary Data & Scoring | Developing sophisticated credit assessment capabilities. | $632 million dollar-weighted average credit score (Q1 2025). |

| Regulatory Environment | Navigating licensing and consumer protection laws. | APR caps, stringent licensing demands. |

Porter's Five Forces Analysis Data Sources

Our goeasy Porter's Five Forces analysis is built upon a foundation of publicly available data, including goeasy's annual reports, investor presentations, and regulatory filings. We also incorporate industry-specific market research reports and competitor financial disclosures to provide a comprehensive view of the competitive landscape.