goeasy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

goeasy Bundle

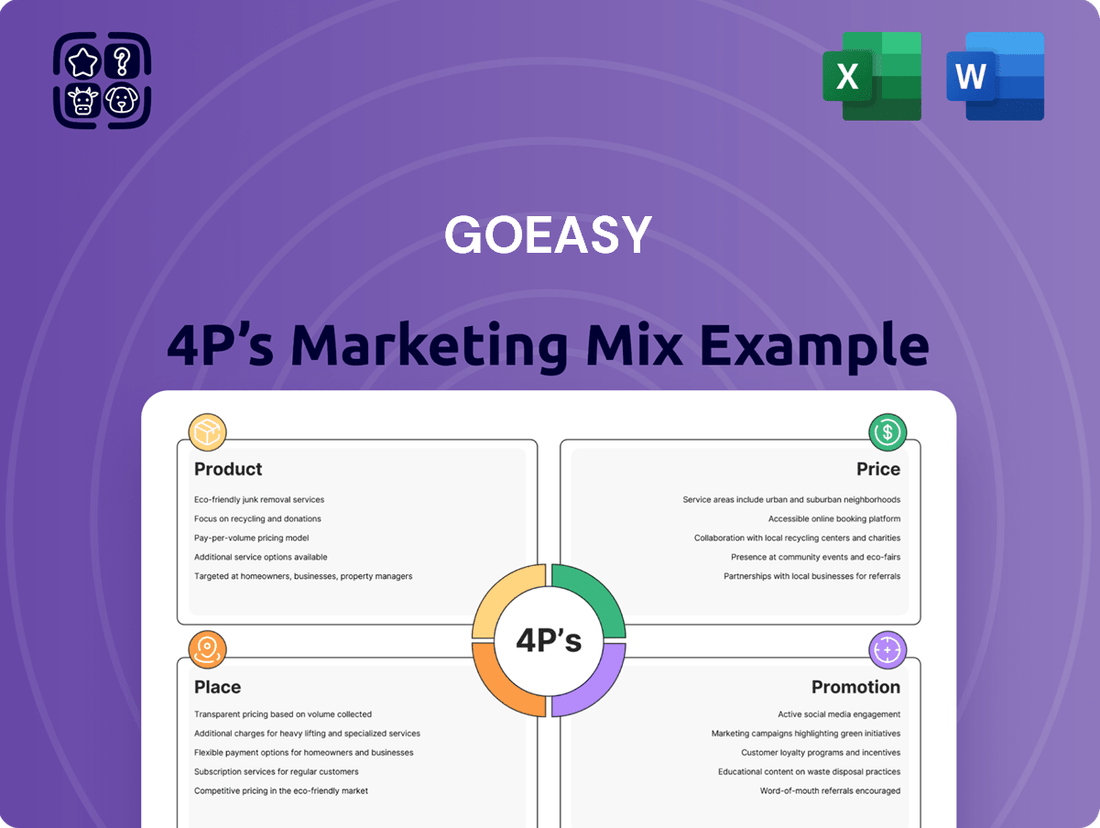

Discover how goeasy leverages its product offerings, competitive pricing, accessible distribution, and targeted promotions to capture its market. This glimpse into their strategy is just the beginning.

Unlock the complete goeasy 4Ps Marketing Mix Analysis, offering a comprehensive breakdown of their strategic decisions. Gain actionable insights and a ready-to-use framework for your own business planning or academic research.

Product

goeasy, primarily through its easyfinancial arm, provides a broad spectrum of financial solutions designed for consumers often overlooked by traditional lenders. This includes unsecured and secured installment loans, covering personal loans, home equity options, and auto financing.

These offerings are crucial for individuals seeking credit access who might not meet the stringent criteria of major banks. By offering these products, goeasy aims to help customers manage immediate financial needs and foster long-term financial health, potentially leading to credit score improvement.

In 2023, goeasy's loan portfolio demonstrated robust growth, with total loans receivable reaching $2.4 billion, up from $1.9 billion in 2022, underscoring the demand for their diverse financial products.

The easyhome division offers lease-to-own for furniture, appliances, and electronics, providing a flexible payment path for customers. This product directly addresses a segment seeking accessible ways to acquire household essentials, ultimately leading to ownership.

goeasy's lease-to-own model, particularly through easyhome, saw significant growth. For the first quarter of 2024, goeasy reported a 10.5% increase in revenue for its leasing segment, reaching $493.7 million, underscoring the product's market appeal and financial contribution.

goeasy, primarily through its LendCare brand, excels in point-of-sale (POS) financing, integrating seamlessly into the customer journey across numerous merchant locations. This strategy places financing directly at the moment of purchase decision, making it incredibly convenient for consumers. In 2024, LendCare reported significant growth in its POS financing volume, reflecting strong consumer adoption and merchant partner expansion.

The reach of goeasy's POS financing is extensive, covering key consumer spending areas such as retail, powersports, automotive, home improvement, and healthcare. This broad application allows goeasy to capture a diverse customer base and tap into various economic cycles. By Q3 2024, LendCare’s merchant network had grown by over 15% year-over-year, indicating robust demand for its financing solutions.

Credit Rebuilding Focus

goeasy's product strategy is deeply rooted in empowering customers to rebuild their credit. This focus is evident in their accessible loan products designed for non-prime Canadians. Their commitment extends beyond simply providing funds; it's about fostering financial rehabilitation.

A significant outcome of this approach is the transformation of their borrowers' financial standing. goeasy reports that a substantial portion of their customers, around 60%, successfully graduate to prime credit status within a three-year period. This statistic highlights the tangible impact of their credit rebuilding initiatives.

- Credit Rebuilding: goeasy offers financial products specifically designed to help non-prime Canadians improve their creditworthiness.

- Graduation Rate: Approximately 60% of goeasy borrowers achieve prime credit status within three years of utilizing their services.

- Responsible Repayment: The product design encourages and supports responsible repayment habits, a cornerstone of credit improvement.

- Financial Empowerment: By providing accessible solutions, goeasy aims to empower individuals to take control of their financial future and build a stronger credit profile.

Omni-channel Access

goeasy excels in omni-channel access, ensuring customers can engage with its services through multiple touchpoints. This strategy blends a robust physical presence with a strong digital footprint, catering to diverse customer preferences and increasing accessibility.

The company boasts an extensive network of over 400 retail locations spread across Canada, offering a convenient option for in-person transactions and support. This physical accessibility is complemented by sophisticated online and mobile platforms.

These digital channels provide customers with the flexibility to apply for loans and manage leasing services at their convenience. For instance, as of Q1 2024, goeasy reported continued growth in digital engagement, with a significant portion of new customer acquisition originating from online channels.

- Extensive Physical Network: Over 400 retail locations across Canada.

- Digital Presence: Comprehensive online and mobile platforms for loan and leasing services.

- Customer Convenience: Offers flexibility for customers to access services anytime, anywhere.

- Growth in Digital Engagement: Significant portion of new customers acquired through online channels in early 2024.

goeasy's product strategy centers on providing accessible financial solutions, primarily through installment loans and lease-to-own services, targeting consumers often underserved by traditional banks. The company's offerings are designed to facilitate credit rebuilding, with a notable success rate in improving customer creditworthiness. This focus on financial empowerment is a core differentiator, aiming to transform borrowers' financial standing.

The company's diverse product suite includes personal loans, home equity loans, and auto financing under the easyfinancial brand, alongside lease-to-own options for furniture and appliances via easyhome. Additionally, LendCare provides point-of-sale financing across various retail sectors, integrating financing directly into the purchasing process.

goeasy's commitment to customer financial health is underscored by its success in helping borrowers improve their credit. By Q3 2024, goeasy reported that approximately 60% of its customers achieve prime credit status within three years, a testament to the effectiveness of its product design and customer support in fostering responsible financial behavior.

The company's product portfolio is designed to meet a wide range of consumer needs, from immediate credit access to acquiring household essentials. This broad appeal is reflected in goeasy's financial performance, with total loans receivable reaching $2.4 billion in 2023, indicating strong market demand for its diverse financial products.

| Product Segment | Key Offering | 2023 Performance/Data | 2024 Outlook/Data |

|---|---|---|---|

| easyfinancial | Unsecured & Secured Installment Loans | Total Loans Receivable: $2.4 billion (up from $1.9 billion in 2022) | Continued loan portfolio growth expected, driven by demand for accessible credit. |

| easyhome | Lease-to-Own (Furniture, Appliances, Electronics) | Significant growth in leasing segment revenue. | Q1 2024 leasing revenue increased 10.5% year-over-year. |

| LendCare | Point-of-Sale (POS) Financing | Extensive reach across retail, powersports, auto, home improvement, healthcare. | Q3 2024 merchant network grew over 15% year-over-year; strong consumer adoption. |

| Credit Rebuilding Initiative | Accessible Loans for Non-Prime Canadians | ~60% of borrowers achieve prime credit within 3 years. | Ongoing focus on financial rehabilitation and credit score improvement for customers. |

What is included in the product

This analysis delves into goeasy's Product, Price, Place, and Promotion strategies, offering a comprehensive understanding of their marketing positioning.

It's designed for professionals seeking a grounded, data-driven overview of goeasy's marketing approach, perfect for strategic planning and benchmarking.

goeasy's 4P's Marketing Mix Analysis acts as a pain point reliever by providing a clear, actionable framework to address customer acquisition and retention challenges.

This analysis simplifies complex marketing strategies, offering a tangible solution to overcome obstacles in reaching and satisfying target audiences.

Place

goeasy boasts an impressive physical presence with over 400 easyfinancial and easyhome store locations strategically positioned across Canada. This vast retail network is a cornerstone of their marketing strategy, facilitating direct engagement with customers seeking accessible financial solutions and lease-to-own services.

The extensive footprint ensures goeasy is readily available to a broad customer base, particularly those who may not qualify for traditional prime lending. In 2023, goeasy continued to expand its reach, demonstrating a commitment to physical accessibility as a key differentiator in the non-prime lending and consumer goods sectors.

goeasy's robust online and mobile platforms are a critical component of its marketing strategy. These digital channels allow customers to easily apply for loans or explore lease-to-own products, offering unparalleled convenience. This digital presence is vital for reaching a broader customer base across Canada, complementing their physical store footprint.

goeasy's strategic merchant partnerships are a cornerstone of its marketing mix, particularly for its point-of-sale financing through LendCare. By collaborating with over 10,000 merchants across Canada, goeasy ensures its financing solutions are integrated directly into the customer's buying journey.

These extensive collaborations span key sectors such as automotive, retail, and home improvement. This broad reach means customers can access goeasy's financing options seamlessly at the point of purchase, making it convenient and accessible.

Omni-channel Distribution Model

goeasy's omni-channel distribution model seamlessly blends its physical store network, robust online presence, and strategic merchant partnerships. This integrated approach ensures customers can interact with goeasy's offerings across various touchpoints, from browsing online to completing transactions in-store or through partner channels, enhancing overall convenience and accessibility.

This strategy is designed to capture sales opportunities wherever the customer chooses to engage. By offering a consistent and convenient experience across all channels, goeasy aims to boost customer loyalty and maximize its market reach. For instance, in the first quarter of 2024, goeasy reported a 12.7% increase in total revenue, driven in part by the effectiveness of its multi-channel engagement strategies.

- Physical Stores: Over 400 locations across Canada provide a tangible point of service and product access.

- Online Platform: A user-friendly website and mobile app facilitate browsing, applications, and account management.

- Merchant Partnerships: Collaborations with retailers extend reach and offer goeasy's financing solutions at the point of sale.

- Customer Convenience: Options like buy online, pick up in-store (BOPIS) and flexible payment solutions cater to diverse customer preferences.

Geographic Reach Across Canada

goeasy's geographic reach is a cornerstone of its market strategy, enabling widespread accessibility to its financial services. Headquartered in Mississauga, Ontario, the company operates an extensive network of branches strategically positioned throughout Canada, ensuring its offerings are within reach for a broad demographic. This extensive footprint is crucial for serving the non-prime consumer segment, often overlooked by conventional lenders.

As of early 2024, goeasy had over 400 retail locations across all Canadian provinces and territories. This physical presence is complemented by a robust digital platform, allowing customers to access services conveniently from anywhere in the country. By maintaining this dual approach, goeasy effectively penetrates diverse markets, from major urban centers to more remote communities.

- Extensive Network: Over 400 retail locations as of early 2024, covering all Canadian provinces and territories.

- Headquarters: Mississauga, Ontario, serving as the central hub for operations.

- Accessibility: Ensures non-prime lending and leasing services are available to a significant portion of the Canadian population.

- Market Penetration: Reaches both urban and rural areas, addressing underserved financial needs.

goeasy's physical presence is defined by its extensive network of over 400 easyfinancial and easyhome stores across Canada as of early 2024. This broad geographic reach, with locations in all provinces and territories, is vital for serving the non-prime market. Their headquarters in Mississauga, Ontario, orchestrates this widespread accessibility.

| Channel | Description | Reach/Scale | Key Benefit |

|---|---|---|---|

| Physical Stores | easyfinancial and easyhome locations | Over 400 stores across Canada (early 2024) | Direct customer interaction, tangible service point |

| Online Platform | Website and mobile app | National accessibility | Convenience, broad customer reach |

| Merchant Partnerships | Point-of-sale financing via LendCare | Over 10,000 merchants | Integrated financing at purchase point |

Same Document Delivered

goeasy 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive goeasy 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use.

Promotion

goeasy utilizes integrated marketing campaigns, blending traditional and digital approaches to boost brand awareness and draw in new clientele. This strategy aims to create a cohesive message across all touchpoints, reinforcing brand identity and driving customer engagement.

The company's dedication to promotional activities is evident in its substantial marketing investment. In the first quarter of 2024, goeasy increased its marketing expenditure by 28%, signaling a strong focus on customer acquisition and market penetration.

goeasy's digital marketing is robust, covering content, SEO, paid ads, and email. In 2024, digital channels are vital for reaching a broad customer base, with a significant portion of marketing spend allocated here to drive lead generation and online sales.

Social media and influencer collaborations are key to boosting brand visibility and customer interaction. goeasy leverages these platforms to build community and promote its diverse product and service offerings, aiming for increased engagement metrics throughout 2024.

goeasy actively fosters financial literacy through initiatives like the goeasy Academy, aiming to build trust and support its core mission. This commitment to education reinforces its brand as a responsible financial partner.

Long-standing partnerships, such as the over $6.5 million donated to BGC Canada since 2004, are crucial for goeasy's community engagement. These collaborations not only enhance brand visibility but also underscore the company's dedication to social responsibility, a key element in building customer loyalty and trust.

Brand Recognition through Awards

goeasy's recognition as a 'Best Workplace' in Canada for both 2024 and 2025 is a powerful marketing tool. This accolade directly enhances brand recognition by showcasing a positive internal culture, which often correlates with superior customer experiences and reinforces goeasy's reputation as a reliable financial services provider.

This award acts as a tangible endorsement, differentiating goeasy in a competitive market. It signals to potential customers that the company prioritizes employee well-being, a factor that can indirectly translate to better service quality and customer trust.

- 2024 & 2025 'Best Workplace' Recognition: goeasy has been formally acknowledged as a top employer in Canada for two consecutive years.

- Enhanced Brand Image: This award strengthens goeasy's brand perception, associating it with a positive and supportive company culture.

- Customer Trust and Service Quality: A strong workplace culture is often linked to improved employee engagement, which can lead to better customer interactions and service delivery.

- Competitive Differentiation: Being a recognized 'Best Workplace' provides a unique selling proposition, helping goeasy stand out to both potential employees and customers.

Data-Driven Customer Acquisition

goeasy excels in customer acquisition by deeply understanding its audience. They segment customers and personalize marketing messages, making outreach more effective. This data-driven approach ensures resources are focused on the most receptive audiences.

The company's use of proprietary customer scoring models, powered by machine learning, is a key differentiator. These models enhance risk assessment, directly contributing to more efficient and successful customer acquisition campaigns. For instance, in Q1 2024, goeasy reported a 13% increase in total revenue, underscoring the effectiveness of their strategies.

- Customer Segmentation: goeasy divides its customer base into distinct groups for targeted marketing.

- Personalized Messaging: Tailored communications resonate better with specific customer segments.

- Machine Learning Scoring: Proprietary models improve risk assessment for acquisition.

- Efficient Acquisition: Data-driven insights lead to better allocation of marketing spend.

goeasy's promotional strategy is multifaceted, integrating digital marketing, social media engagement, and corporate social responsibility to build brand awareness and foster customer loyalty.

The company's investment in marketing saw a significant 28% increase in Q1 2024, underscoring its commitment to reaching and acquiring new customers through various channels.

goeasy's digital marketing efforts, including SEO and paid advertising, are crucial for lead generation, while social media and influencer collaborations aim to enhance brand visibility and customer interaction throughout 2024.

Furthermore, goeasy's recognition as a 'Best Workplace' in Canada for 2024 and 2025 serves as a powerful promotional tool, enhancing its brand image and signaling a positive company culture that can translate to superior customer service.

| Promotional Tactic | Objective | 2024/2025 Data/Insight |

|---|---|---|

| Integrated Marketing Campaigns | Brand Awareness, Customer Acquisition | 28% increase in marketing expenditure in Q1 2024 |

| Digital Marketing (SEO, Paid Ads, Content) | Lead Generation, Online Sales | Significant portion of marketing spend allocated to digital channels |

| Social Media & Influencer Marketing | Brand Visibility, Customer Engagement | Key platforms for community building and product promotion |

| Financial Literacy Initiatives (goeasy Academy) | Build Trust, Brand as Responsible Partner | Reinforces brand reputation |

| Corporate Social Responsibility (BGC Canada Partnership) | Brand Visibility, Social Responsibility, Customer Loyalty | Over $6.5 million donated since 2004 |

| 'Best Workplace' Recognition | Brand Image Enhancement, Competitive Differentiation | Awarded for 2024 and 2025 |

Price

goeasy employs a sophisticated risk-based pricing strategy for its loan offerings. This allows them to serve the entire spectrum of the non-prime credit market by adjusting interest rates based on individual borrower risk profiles.

By assessing each customer's creditworthiness, goeasy can align interest rates with the perceived risk. This dynamic approach also aims to facilitate a pathway for customers to access lower interest rates as their financial standing improves over time.

goeasy's pricing strategy focuses on making credit available to those often overlooked by traditional lenders. This means offering financial solutions that are more accessible than typical bank loans for individuals with less-than-perfect credit histories.

The company's weighted average interest rate stood at 28.4% in the first quarter of 2025, a slight decrease from 30% in the same period of 2024. This pricing reflects a commitment to providing competitive terms, especially when compared to the often-higher rates found in the payday loan market.

goeasy's easyhome division excels by offering adaptable lease-to-own agreements for household essentials like furniture, appliances, and electronics. This approach allows customers to acquire needed items without the hurdle of large upfront payments or stringent credit assessments, making purchases more attainable.

The company's commitment to flexible financing is a cornerstone of its customer acquisition strategy. For instance, in Q1 2024, goeasy reported a 12.9% increase in its loan portfolio for its lending segment, demonstrating a growing demand for accessible credit solutions, which translates to their lease-to-own offerings.

Impact of Interest Rate Caps and Market Conditions

goeasy's pricing strategy is directly impacted by external forces like new interest rate caps and prevailing macroeconomic conditions. For instance, the company observed a decline in its total portfolio yield during the first quarter of 2025. This was influenced by a strategic shift towards secured loan products, which typically feature lower interest rates, and the direct effect of the newly implemented interest rate cap.

The company's financial performance in Q1 2025 reflected these pressures. The total portfolio yield saw a decrease, with a significant portion of this reduction attributed to the growing proportion of secured loans within the overall portfolio. These loans, by nature, come with lower interest rates compared to unsecured alternatives.

- Q1 2025 Portfolio Yield: Declined due to product mix shift and interest rate caps.

- Secured Loans Growth: Contributed to lower average yield as these products carry lower interest rates.

- Interest Rate Caps: Directly impacted the maximum allowable interest revenue on certain loan products.

Focus on Customer Graduation to Lower Rates

goeasy's pricing strategy actively supports customer financial improvement, aiming for their transition to more favorable lending terms. This approach underscores a commitment to long-term customer value by facilitating their graduation to prime lending rates, a core tenet of their mission.

This customer-centric pricing model is designed to foster financial well-being, enabling clients to access lower interest rates as their creditworthiness improves. For instance, goeasy's loan products are structured to potentially help borrowers build a positive credit history, a crucial step in qualifying for lower rates from traditional lenders.

- Customer Credit Improvement: goeasy's pricing is intrinsically linked to helping customers enhance their credit profiles.

- Graduation to Prime Rates: A key objective is enabling customers to eventually qualify for lower, prime lending rates.

- Long-Term Value Proposition: This strategy offers a sustained benefit beyond the initial loan term, focusing on financial upliftment.

goeasy's pricing strategy is fundamentally about accessibility and risk management. They offer a range of loan products with interest rates that are adjusted based on a borrower's credit profile, ensuring that individuals who might be excluded by traditional banks can still access credit. This risk-based approach allows them to serve a broad segment of the non-prime market.

The company's pricing also reflects a commitment to customer financial progress. By offering terms that can improve as a borrower's creditworthiness increases, goeasy aims to provide a pathway to more favorable lending conditions over time. This strategy is evident in their weighted average interest rate, which was 28.4% in Q1 2025, down from 30% in Q1 2024, showing a competitive stance against alternatives like payday loans.

However, external factors significantly influence goeasy's pricing. New interest rate caps and a strategic shift towards lower-yield secured loans impacted their total portfolio yield in Q1 2025. For example, the introduction of interest rate caps directly limited the revenue potential on certain products, while the increasing proportion of secured loans, which inherently carry lower rates, also contributed to a reduced overall yield.

| Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| Weighted Average Interest Rate | 30.0% | 28.4% | -1.6 pp |

| Loan Portfolio Growth (Lending Segment) | 12.9% | N/A | N/A |

| Total Portfolio Yield | N/A | Declined | N/A |

4P's Marketing Mix Analysis Data Sources

Our goeasy 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company disclosures, investor relations materials, and detailed product catalog information. We also incorporate insights from industry reports and competitive analysis to reflect goeasy's strategic positioning.