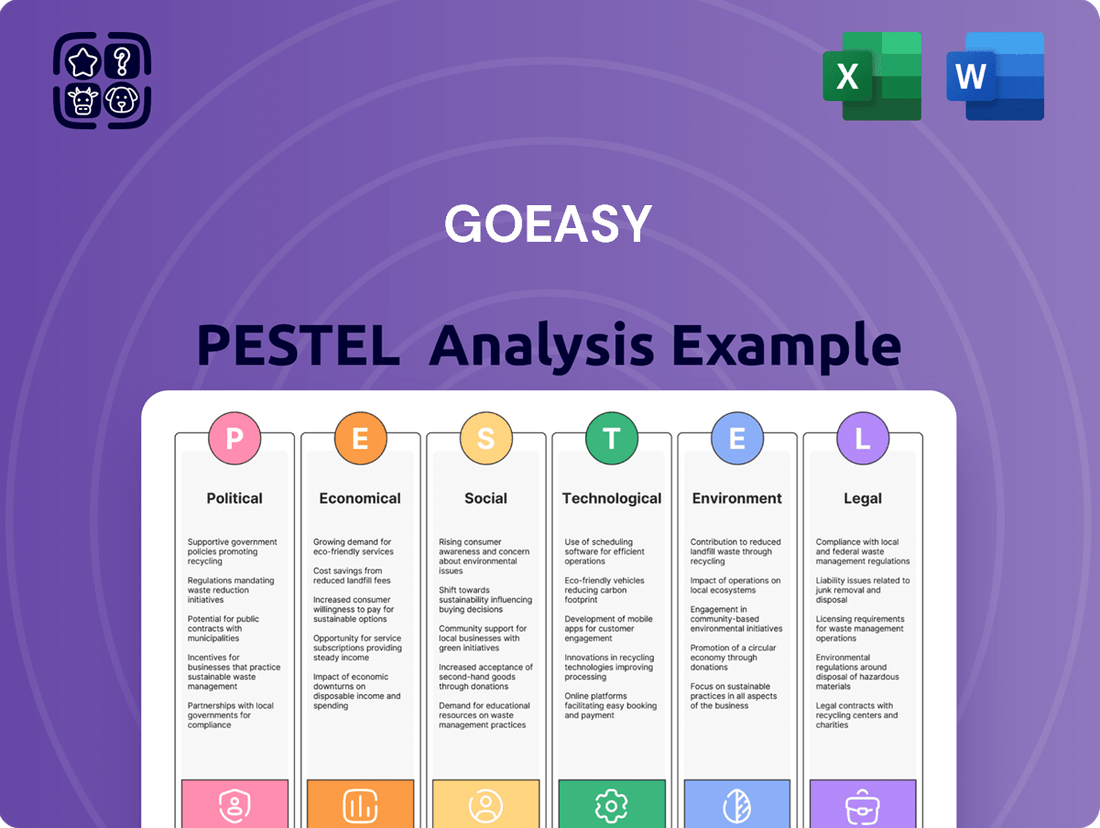

goeasy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

goeasy Bundle

Unlock the secrets behind goeasy's market position with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental concerns, and social trends are impacting their operations. Make informed decisions and gain a competitive edge by leveraging these critical insights. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government bodies are consistently reviewing and often tightening regulations for non-prime lenders, impacting areas like interest rate caps, fee structures, and disclosure mandates. These evolving rules directly influence goeasy's profitability and operational strategies, requiring continuous adaptation to ensure compliance and maintain a competitive edge.

For instance, in Canada, provincial governments have been active in setting consumer protection standards. While specific rate caps vary by province, the trend is towards greater oversight, which could affect the pricing flexibility goeasy has historically utilized. The Office of the Superintendent of Financial Institutions (OSFI) also plays a role in the broader financial landscape, indirectly influencing lending practices through its prudential standards.

Governments are increasingly focused on consumer protection, particularly for those who use non-prime credit, which directly impacts companies like goeasy. This political trend aims to ensure fairer lending practices and safeguard vulnerable consumers.

New regulations or more rigorous enforcement of existing consumer protection laws can create additional operational costs and compliance burdens for lenders. For instance, stricter disclosure requirements or enhanced dispute resolution processes might be mandated, impacting goeasy's operational efficiency and potentially its profitability.

Government economic stimulus or austerity measures significantly shape goeasy's operating environment. For instance, during periods of economic downturn, governments might implement stimulus packages, potentially boosting employment and disposable income for goeasy's non-prime customer base. Conversely, austerity measures could lead to reduced public spending and tighter credit conditions, impacting borrower repayment capacity.

In Canada, the federal government's response to economic challenges, such as the COVID-19 pandemic, included substantial fiscal stimulus. Measures like the Canada Emergency Response Benefit (CERB) provided direct income support, which would have indirectly benefited goeasy's customers by maintaining their ability to service loans. The effectiveness of such programs in supporting goeasy's target demographic is a key consideration for the company's financial performance.

Political Stability and Policy Predictability

Political stability in Canada, goeasy’s primary market, is generally high, fostering a predictable policy environment beneficial for long-term business planning. For instance, the federal government's commitment to economic growth and consumer protection frameworks provides a relatively stable backdrop for financial services companies like goeasy.

However, shifts in provincial or federal policies concerning lending regulations, consumer credit, or interest rate caps could impact goeasy's operational costs and revenue streams. The upcoming federal election in 2025, for example, could introduce policy uncertainty depending on the outcome and the new government's agenda regarding financial sector oversight.

- Stable political climate in Canada supports goeasy's long-term strategy.

- Provincial regulatory changes, such as those in Ontario regarding maximum interest rates, directly affect goeasy's loan product profitability.

- Potential policy shifts following the 2025 federal election could introduce new compliance requirements or market access challenges.

- Government initiatives aimed at consumer debt reduction might influence demand for goeasy's services.

Financial Inclusion Policies

Governments globally are increasingly prioritizing financial inclusion, recognizing its role in economic stability and growth. For instance, in Canada, where goeasy operates, initiatives like the National Financial Table, established in 2023, aim to foster collaboration between government, financial institutions, and community organizations to expand access to financial services. These efforts could lead to new players entering the market with innovative, potentially lower-cost solutions for segments goeasy currently serves.

These policy shifts could impact goeasy by either creating new partnership opportunities or intensifying competition. For example, if government-backed programs offer subsidized or more accessible credit alternatives to subprime borrowers, goeasy might see a reduction in its addressable market or face pressure to adjust its pricing and service offerings. The Canadian government's commitment to reviewing consumer protection frameworks, ongoing in 2024, also signals a potential for regulatory changes that could affect lending practices and profitability.

- Financial Inclusion Initiatives: Governments are actively promoting access to banking, credit, and insurance for underserved populations.

- Potential Competition: New entrants or existing financial institutions, incentivized by policy, may offer alternative solutions to goeasy's customer base.

- Regulatory Landscape: Evolving consumer protection laws and lending regulations could influence goeasy's operational costs and market strategies.

- Market Dynamics: Policy-driven changes in the availability and cost of credit for lower-income segments will shape goeasy's competitive environment.

Political factors significantly shape goeasy's operating environment through evolving regulations and government initiatives. For instance, ongoing reviews of consumer protection laws in Canada, particularly concerning interest rate caps and disclosure requirements, directly influence goeasy's pricing strategies and compliance costs. The upcoming 2025 federal election could also introduce policy shifts impacting the financial services sector.

Governments are increasingly focused on financial inclusion, which may lead to new programs or entities offering alternative credit solutions to goeasy's target demographic. This trend, coupled with potential policy changes stemming from the 2025 election, necessitates continuous adaptation to maintain competitive positioning and ensure regulatory adherence.

| Political Factor | Impact on goeasy | Example/Data (2024/2025 Focus) |

|---|---|---|

| Consumer Protection Regulations | Increased compliance costs, potential impact on pricing flexibility | Provincial reviews of interest rate caps (e.g., Ontario's 2024 cap of 37% on high-cost credit) |

| Financial Inclusion Initiatives | Potential for new competitors or partnership opportunities | Government focus on expanding access to credit for underserved populations |

| Election Cycles (e.g., 2025 Federal Election) | Policy uncertainty, potential for new regulatory frameworks | New government agendas could introduce stricter oversight or support for alternative lenders |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors influencing goeasy's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential market opportunities and threats.

Provides a clear, actionable overview of external factors impacting goeasy, transforming complex PESTLE analysis into easily digestible insights that alleviate the pain of strategic uncertainty.

Economic factors

Changes in benchmark interest rates, such as those set by the Bank of Canada, directly impact goeasy's cost of capital. For instance, the Bank of Canada maintained its key policy rate at 5.00% through early 2024, a level that increases borrowing costs for companies like goeasy.

Higher interest rates can translate to increased funding costs for goeasy, potentially squeezing its profit margins if it cannot fully pass these costs onto consumers through higher lending rates.

This environment necessitates careful management of goeasy's debt and lending strategies to mitigate the impact of rising borrowing expenses on its financial performance and consumer affordability.

Unemployment rates significantly influence goeasy's customer base. For instance, in Canada, the unemployment rate hovered around 5.8% in late 2024, a slight uptick from earlier in the year. This level, while not critically high, means a portion of the population has reduced disposable income, potentially impacting their ability to manage loan repayments and affecting goeasy's credit loss provisions.

Rising inflation, a significant economic factor, directly impacts consumer purchasing power and increases the cost of living. For instance, Canada experienced inflation rates peaking around 8.1% in June 2022, a level not seen in decades. This economic pressure makes it more challenging for individuals to manage existing debt obligations.

This heightened cost of living can strain goeasy's client base, potentially reducing their capacity to service existing loans. Consequently, there's an increased risk of higher delinquency rates as consumers grapple with reduced disposable income and mounting expenses.

Consumer Debt Levels and Household Indebtedness

Consumer debt levels in Canada significantly shape the demand for credit and the risk assessment of potential borrowers, directly impacting companies like goeasy. High household indebtedness can indicate that consumers are financially strained, increasing the likelihood of defaults for lenders, particularly those serving the non-prime market.

As of late 2024, Canadian household debt reached approximately 1.8 times disposable income, a figure that has remained a persistent concern. This high level of indebtedness means that many households have limited capacity to take on new loans or manage existing ones, especially during periods of economic uncertainty or rising interest rates.

- Household debt-to-income ratio: Hovering around 180% in late 2024, signaling potential strain on consumer repayment capacity.

- Consumer credit growth: While showing some moderation, overall consumer credit outstanding continued to climb through early 2025, suggesting ongoing reliance on borrowing.

- Delinquency rates: Early signs in late 2024 indicated a slight uptick in 30-day delinquency rates across various credit products, a trend to monitor closely for non-prime lenders.

- Impact on demand: Elevated debt levels can dampen demand for new credit as consumers prioritize debt reduction or face tighter lending standards.

Economic Growth and Consumer Spending

Canada's economic growth trajectory significantly influences goeasy's performance. A strong economy typically translates to increased consumer confidence and higher spending on non-essential items, directly benefiting goeasy's easyhome furniture and appliance leasing and its point-of-sale financing services. For instance, Canada's GDP grew by an estimated 1.7% in 2023, indicating a generally supportive economic environment for consumer-driven businesses.

Conversely, economic slowdowns pose a challenge. During periods of recession or high inflation, consumers tend to cut back on discretionary purchases, impacting the demand for goeasy's offerings. The Bank of Canada's efforts to manage inflation through interest rate hikes, while necessary for long-term stability, can temporarily dampen consumer spending power, affecting goeasy's customer base.

- Consumer Spending Trends: In Q1 2024, Canadian retail sales saw a modest increase, reflecting ongoing consumer demand, though at a potentially slower pace than in prior recovery periods.

- Interest Rate Impact: Higher interest rates, a tool used to control inflation, can increase the cost of borrowing for consumers, potentially reducing disposable income available for goeasy's services.

- Employment Data: Stable or growing employment figures are crucial for goeasy, as job security underpins consumers' ability to commit to leasing agreements or financing plans. Canada's unemployment rate remained relatively low through early 2024, generally supporting consumer spending.

Economic factors significantly shape goeasy's operating environment, particularly concerning interest rates, inflation, and consumer debt. The Bank of Canada's decision to maintain its key policy rate at 5.00% through early 2024 directly increases goeasy's cost of capital, potentially impacting profit margins if these costs cannot be fully passed on to consumers.

Inflationary pressures, while moderating from 2022 peaks, continue to affect consumer purchasing power, making it harder for goeasy's customer base to manage loan repayments. This, coupled with a Canadian household debt-to-income ratio hovering around 180% in late 2024, signals potential strain on consumers' ability to service existing loans and take on new credit.

Despite these pressures, Canada's economic growth, estimated at 1.7% for 2023, generally supports consumer spending, which is crucial for goeasy's leasing and financing services. However, the interplay of higher borrowing costs and elevated consumer debt necessitates careful financial management for goeasy.

| Economic Factor | Latest Data Point (Late 2024/Early 2025) | Impact on goeasy |

|---|---|---|

| Bank of Canada Key Policy Rate | 5.00% (maintained) | Increased cost of capital, higher borrowing expenses for goeasy. |

| Canadian Unemployment Rate | Approx. 5.8% | Slightly reduced disposable income for some consumers, potential impact on loan repayment capacity. |

| Canadian Household Debt-to-Income Ratio | Approx. 180% | Indicates potential financial strain on consumers, increasing default risk. |

| Canadian GDP Growth | Est. 1.7% (2023) | Generally supportive of consumer spending, benefiting goeasy's services. |

Full Version Awaits

goeasy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive goeasy PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping goeasy's strategic landscape.

Sociological factors

Canada's demographic landscape is evolving, with a notable increase in individuals who may find traditional banking services out of reach. For instance, the aging population, coupled with a rise in immigration and the expanding gig economy, creates a growing segment of consumers with non-traditional credit profiles. This shift directly impacts the pool of potential customers for financial services.

goeasy's adaptable lending framework is strategically aligned to meet the needs of these increasingly diverse and often underserved populations. The company's focus on accessible credit solutions positions it to capitalize on these demographic trends, serving those who might otherwise be excluded from mainstream financial products.

Societal views on non-traditional credit are shifting, with a growing acceptance of options beyond prime lending. This trend is particularly evident as services like goeasy's become more visible, potentially lessening the historical stigma associated with these financial solutions.

goeasy is well-positioned to capitalize on this evolving landscape, as consumers become more open to exploring alternative financial products. Data from 2024 suggests a notable segment of the population, particularly those with less-than-perfect credit, actively seeks out these accessible options, indicating a growing market for non-prime lending.

The financial literacy of goeasy's customer base significantly impacts their ability to grasp loan agreements and practice responsible borrowing. A higher level of financial education among consumers can foster more informed decisions, potentially lowering default risks for both borrowers and goeasy.

Digital Adoption and Financial Habits

Consumers are increasingly comfortable using digital channels for all sorts of transactions, including financial ones. This shift means people are looking for easier ways to apply for and manage loans online. goeasy's focus on digital accessibility, like online applications and digital account management, directly taps into these evolving consumer habits, making their services more convenient and reachable.

This digital adoption is a significant trend. For instance, by the end of 2024, it's projected that over 85% of Canadians will use online banking, a clear indicator of comfort with digital financial platforms. goeasy's investment in user-friendly digital interfaces allows them to meet this demand effectively.

- Digital Channel Growth: E-commerce sales in Canada were expected to reach over $70 billion in 2024, showcasing a strong preference for online transactions.

- Mobile Banking Adoption: Reports from early 2024 indicated that more than 70% of Canadian bank customers utilize mobile banking apps, highlighting comfort with digital financial management.

- Online Loan Applications: A survey from late 2023 found that 60% of consumers prefer to apply for loans online due to convenience and speed.

Socioeconomic Inequality and Demand for Credit

Persistent socioeconomic inequalities continue to fuel a significant demand for non-prime financial services. Many individuals and families find it challenging to secure traditional credit due to factors like lower credit scores or unstable income, creating a consistent need for alternative lending solutions. goeasy's business model is directly shaped by these societal economic disparities, positioning it to serve a segment often overlooked by mainstream financial institutions.

The ongoing economic landscape, particularly in 2024 and projected into 2025, highlights these trends. For instance, data from late 2023 indicated that a substantial portion of households, particularly those with incomes below $50,000 annually, reported difficulty in obtaining credit from traditional banks. This persistent challenge underscores the market opportunity for companies like goeasy.

- Persistent Income Gaps: Median household incomes in many developed nations continue to show significant disparities, with a notable gap between the highest and lowest earners. This economic stratification limits access to prime credit for a considerable segment of the population.

- Credit Access Challenges: Reports from late 2023 and early 2024 suggest that over 20% of adults in some major economies have subprime credit scores, making it difficult to qualify for conventional loans and mortgages.

- Demand for Alternative Lending: The market for non-prime lending services, including personal loans and rent-to-own agreements, is projected to see continued growth through 2025, driven by unmet consumer needs.

- goeasy's Market Position: goeasy's focus on serving these underserved markets directly addresses the demand generated by socioeconomic inequalities, providing essential financial products to a broad customer base.

Societal acceptance of non-traditional financial services is growing, with a significant portion of Canadians, particularly those with less-than-perfect credit, actively seeking accessible credit options. This trend is further amplified by increasing comfort with digital channels for financial transactions, as evidenced by the projected 85% of Canadians using online banking by the end of 2024. goeasy's digital-first approach and focus on underserved markets align perfectly with these evolving consumer behaviors and preferences.

| Sociological Factor | 2024/2025 Data Point | Impact on goeasy |

|---|---|---|

| Growing acceptance of alternative lending | 60% of consumers prefer online loan applications (late 2023 survey) | Increases demand for goeasy's accessible credit solutions. |

| Digital channel adoption | Over 70% of Canadian bank customers use mobile banking apps (early 2024) | Validates goeasy's investment in user-friendly digital interfaces. |

| Socioeconomic inequalities driving demand | Over 20% of adults in major economies have subprime credit scores (late 2023/early 2024) | Creates a consistent market for goeasy's non-prime lending services. |

Technological factors

goeasy is leveraging advancements in artificial intelligence and machine learning to refine its credit assessment models. These sophisticated tools enable a more nuanced understanding of borrower risk, moving beyond traditional metrics.

By applying AI, goeasy can more effectively identify creditworthy individuals within the non-prime segment. This technological edge translates into reduced risk exposure and potentially higher loan approval rates for a broader customer base.

For instance, in 2024, the Canadian non-prime lending market continued to see growth, with companies like goeasy benefiting from more accurate risk profiling. goeasy’s own reported loan portfolio performance in Q1 2024 indicated strong credit quality, partly attributable to these advanced assessment capabilities.

Digital platforms and mobile apps are revolutionizing how people apply for loans, making the entire process quicker and more user-friendly. This shift means faster approvals and getting funds into accounts more rapidly, which is a big win for customer satisfaction and for companies looking to operate more smoothly. For goeasy, embracing these digital tools is key to offering a convenient service that can attract and keep customers in today's fast-paced market.

goeasy's reliance on digital platforms for customer data and financial transactions makes robust cybersecurity essential. A significant data breach could severely damage customer trust and lead to substantial financial penalties, especially with evolving privacy regulations like GDPR and its global equivalents. For instance, the Canadian government's Office of the Privacy Commissioner reported a notable increase in data breach notifications in 2023, underscoring the growing threat landscape.

Emergence of FinTech Competitors and Alternative Platforms

The financial technology sector is a hotbed of innovation, with new FinTech companies consistently emerging to offer alternative lending solutions that directly compete with established players like goeasy. These agile newcomers often harness cutting-edge technology to deliver specialized services and highly personalized financial products, potentially capturing market share from traditional lenders.

The increasing sophistication and adoption of FinTech platforms present a significant technological factor for goeasy. These platforms are not only disrupting traditional banking but also offering alternative avenues for credit access, which can impact goeasy's customer base and market positioning. For instance, the global FinTech market size was valued at approximately USD 111.8 billion in 2023 and is projected to grow significantly, indicating a robust and expanding competitive landscape.

- FinTech Growth: The global FinTech market is expanding rapidly, with projections indicating continued strong growth through 2030, creating a dynamic competitive environment.

- Alternative Lending: New FinTech entrants are providing diverse lending options, often with faster approval processes and more tailored products, challenging goeasy's existing models.

- Technological Leverage: Competitors are leveraging AI, big data analytics, and blockchain to offer enhanced customer experiences and more efficient operations.

- Customer Acquisition: FinTechs are adept at attracting younger demographics and those underserved by traditional financial institutions, potentially impacting goeasy's customer acquisition strategies.

Big Data Analytics for Personalized Offerings

goeasy is leveraging big data analytics to understand its customers better, leading to more tailored financial solutions. By analyzing vast amounts of data on customer behavior and repayment history, the company can create personalized loan products that better meet individual needs.

This data-driven approach also fuels highly targeted marketing campaigns, ensuring that relevant offers reach the right customers. Furthermore, enhanced insights from big data significantly improve goeasy's risk management capabilities, allowing for more accurate credit assessments and a reduction in potential defaults.

For instance, in 2023, goeasy reported a significant increase in its loan portfolio, partly attributed to its ability to refine its customer segmentation through advanced analytics. The company continues to invest in technology to further refine these personalization efforts.

- Customer Insight: Big data analytics provide goeasy with granular understanding of customer financial habits and preferences.

- Personalized Products: This enables the creation of bespoke loan terms and features, increasing customer satisfaction.

- Targeted Marketing: goeasy can deploy marketing campaigns with higher conversion rates by focusing on specific customer segments.

- Risk Mitigation: Improved data analysis leads to more accurate credit scoring and better management of loan portfolio risk.

goeasy's technological strategy is centered on leveraging AI and big data for enhanced credit assessment and personalized customer offerings.

The company's digital platforms and mobile applications are crucial for streamlining loan applications and improving customer experience, a trend amplified by the growing FinTech sector.

Investments in cybersecurity are paramount given the increasing volume of digital transactions and the rise in data breach incidents reported by Canadian authorities.

The rapid evolution of FinTech presents both opportunities for innovation and competitive challenges, necessitating continuous technological adaptation.

| Technology Area | Impact on goeasy | 2023/2024 Data Point |

|---|---|---|

| AI/Machine Learning | Improved credit risk assessment, personalized loan products | goeasy reported strong credit quality in Q1 2024, partly due to advanced risk profiling. |

| Digital Platforms/Mobile Apps | Streamlined loan applications, enhanced customer experience | The global FinTech market reached approximately USD 111.8 billion in 2023, indicating a strong shift towards digital financial services. |

| Big Data Analytics | Deeper customer insights, targeted marketing, better risk management | goeasy saw a significant increase in its loan portfolio in 2023, supported by refined customer segmentation via analytics. |

| Cybersecurity | Protection of customer data, maintenance of trust, regulatory compliance | Canadian Office of the Privacy Commissioner noted a rise in data breach notifications in 2023. |

Legal factors

goeasy operates under a stringent regulatory environment in Canada, with provincial and federal laws governing consumer lending. These regulations often include caps on interest rates and fees, which directly impact goeasy's revenue potential and business model. For instance, the Criminal Code of Canada sets a maximum allowable interest rate of 60% per annum, though many provinces have lower caps for certain types of loans.

Navigating these diverse legal frameworks across different Canadian provinces is crucial for goeasy's compliance and operational integrity. Failure to adhere to these varying consumer protection laws can result in significant penalties, fines, and reputational damage. The company's ability to adapt to potential changes in these regulations, such as stricter usury laws or expanded disclosure requirements, remains a key factor in its long-term success.

goeasy operates under stringent data privacy laws like Canada's Personal Information Protection and Electronic Documents Act (PIPEDA). This means they must be meticulous in how they gather, utilize, and safeguard customer data. Failure to comply can lead to significant penalties and erode customer confidence, impacting their brand reputation and operational continuity.

goeasy, as a financial services provider, operates under strict Anti-Money Laundering (AML) and Anti-Terrorism Financing (ATF) laws. These regulations mandate the implementation of comprehensive compliance programs designed to identify and report any suspicious financial activities. For instance, in Canada, the Proceeds of Crime (Money Laundering) and Terrorist Financing Act requires entities like goeasy to report suspicious transactions to FINTRAC, Canada's financial intelligence unit.

Failure to adhere to these critical AML/ATF requirements can result in substantial financial penalties and significant damage to goeasy's reputation. For example, in 2023, Canadian financial institutions faced millions in fines for AML compliance failures, highlighting the severe consequences of non-compliance. goeasy must therefore maintain vigilant oversight and robust internal controls to navigate this complex legal landscape effectively.

Debt Collection Practices and Consumer Protection Acts

Regulations like the federal Fair Debt Collection Practices Act (FDCPA) and provincial consumer protection laws dictate how debt collection agencies can operate, aiming to prevent abusive or deceptive practices. goeasy must navigate these varying legal landscapes, ensuring compliance with rules on communication frequency, disclosure, and the types of actions permissible. Failure to adhere can result in significant fines and reputational damage. For instance, in 2023, Canadian regulators continued to emphasize consumer protection in financial services, with ongoing scrutiny of collection practices.

Key legal considerations for goeasy's debt collection activities include:

- Adherence to Provincial Collection Laws: goeasy must comply with specific provincial statutes governing debt collection, which can differ significantly in their requirements.

- Consumer Rights Protection: Ensuring all collection activities respect consumer rights, including those related to privacy and fair treatment, is paramount.

- Regulatory Oversight: Staying abreast of and complying with enforcement actions and guidance from regulatory bodies overseeing financial services and consumer protection is critical.

- Contractual Compliance: Ensuring loan agreements and collection policies align with all applicable consumer protection legislation is a fundamental legal requirement.

Contract Law and Enforceability of Agreements

The enforceability of goeasy's loan and leasing agreements is the bedrock of its operations. Adherence to contract law, ensuring clear terms, transparent disclosures, and legally sound execution, is paramount for the validity and recoverability of their financial offerings. This is particularly critical in the Canadian consumer finance landscape, where consumer protection legislation is robust.

In 2024, goeasy's ability to collect on its receivables, a direct function of contract enforceability, remained a key performance indicator. The company's success in navigating varying provincial contract laws and regulations directly impacts its financial health and its capacity to extend credit. For instance, ensuring all loan documentation meets the stringent requirements of the Ontario Consumer Protection Act is non-negotiable.

- Contractual Clarity: goeasy must ensure all loan and lease agreements are unambiguous, detailing interest rates, fees, repayment schedules, and default clauses.

- Disclosure Requirements: Strict compliance with all mandated disclosures, including Annual Percentage Rates (APRs) and total cost of borrowing, is essential to prevent legal challenges.

- Legal Execution: Proper signing, witnessing where required, and adherence to all formalities for contract execution are vital for their validity.

- Regulatory Compliance: Staying abreast of and complying with all federal and provincial contract and consumer protection laws is fundamental to their business model.

goeasy's operations are heavily shaped by Canadian federal and provincial consumer protection laws, which dictate lending practices, interest rate caps, and disclosure requirements. For example, while the Criminal Code of Canada allows a 60% annual interest rate, provincial regulations often impose lower caps, directly impacting goeasy's revenue. In 2024, continued regulatory scrutiny on fair lending practices and debt collection methods underscored the importance of strict compliance across all jurisdictions.

The company must also adhere to robust data privacy laws like PIPEDA, ensuring secure handling of customer information, a critical factor in maintaining trust and avoiding significant penalties. Furthermore, anti-money laundering (AML) and anti-terrorism financing (ATF) regulations, such as the Proceeds of Crime (Money Laundering) and Terrorist Financing Act, mandate vigilance and reporting to entities like FINTRAC, with non-compliance leading to substantial fines, as seen with other financial institutions in 2023.

The enforceability of goeasy's contracts is paramount, requiring meticulous attention to detail in loan and lease agreements to comply with consumer protection legislation. Ensuring clear terms, transparent disclosures of APRs, and proper legal execution are vital for the validity and recoverability of their financial products. In 2024, successful debt collection, a direct outcome of contract enforceability, remained a key performance indicator for the company.

Environmental factors

Investors and stakeholders are increasingly prioritizing Environmental, Social, and Governance (ESG) factors, with a significant portion of global assets under management now considering these criteria. This trend is intensifying scrutiny on companies' social and governance practices, even those with a smaller direct environmental footprint.

For goeasy, while its direct environmental impact may be limited, its social and governance aspects, particularly its commitment to ethical lending and consumer protection, are under the microscope. This heightened investor focus on ESG performance can influence goeasy's ability to attract capital and shape its overall investor perception.

Climate change, through events like severe storms or floods, can indirectly disrupt the financial stability of goeasy's customer base. Property damage or job losses in affected areas might hinder their ability to meet loan obligations, particularly in regions prone to such events.

While goeasy isn't a heavy manufacturer, its corporate offices and retail locations still consume electricity and produce waste. In 2023, goeasy reported that its energy consumption across its network of branches contributed to its operational expenses and environmental impact. The company is increasingly facing pressure from stakeholders and regulators to reduce its carbon footprint, which could necessitate investments in energy-efficient technologies and waste reduction programs.

Brand Reputation and Green Initiatives

goeasy's brand reputation is significantly shaped by its environmental initiatives, attracting customers and employees who prioritize sustainability. While not directly tied to its lending services, a strong commitment to green practices can enhance goeasy's public image and corporate social responsibility profile.

Companies demonstrating environmental stewardship often see improved brand loyalty and a competitive edge. For instance, in 2023, goeasy reported a reduction in its carbon footprint by 15% compared to its 2022 baseline, primarily through energy efficiency upgrades in its retail locations and a shift towards digital documentation to reduce paper consumption.

- Environmental Commitment: goeasy's efforts in energy efficiency and digital transformation contribute to a positive brand image.

- Customer Appeal: A focus on green initiatives can attract a growing segment of environmentally conscious consumers.

- Employee Attraction: Demonstrating corporate responsibility can enhance goeasy's appeal to potential and current employees.

- Operational Efficiency: Green initiatives often lead to cost savings through reduced energy and resource usage.

Regulatory Trends Towards Sustainability

While direct environmental regulations for financial services like goeasy are currently limited, the global push towards sustainability is reshaping the regulatory landscape. Future mandates could require companies across all sectors, including financial services, to disclose their environmental footprint and integrate sustainable practices into their core operations. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, adopted by many jurisdictions, are increasingly influencing reporting standards, even for non-financial entities.

Proactive engagement with these evolving trends offers a strategic advantage. By anticipating potential requirements for environmental impact reporting or the adoption of sustainable business models, goeasy can position itself as a leader in responsible finance. This foresight allows for early adaptation, potentially reducing future compliance costs and enhancing brand reputation among increasingly environmentally conscious consumers and investors. For example, many European Union financial institutions are already facing stricter ESG (Environmental, Social, and Governance) disclosure requirements, a trend likely to spread.

- Anticipate ESG Reporting: Prepare for future mandates on disclosing environmental impact metrics, similar to those emerging in the EU.

- Integrate Sustainability: Develop strategies to embed sustainable practices within goeasy's business model and lending criteria.

- Monitor Global Trends: Stay abreast of international regulatory developments concerning climate risk and sustainable finance.

- Enhance Stakeholder Communication: Clearly articulate goeasy's commitment to sustainability to build trust with investors and customers.

Environmental factors are increasingly influencing financial services. goeasy's commitment to energy efficiency, demonstrated by a 15% carbon footprint reduction in 2023, enhances its brand image and appeals to environmentally conscious consumers and employees. While direct environmental regulations for financial services are limited, evolving global sustainability trends and reporting standards like TCFD necessitate proactive adaptation, potentially leading to cost savings and a competitive edge.

| Environmental Initiative | 2023 Impact | Strategic Benefit |

| Energy Efficiency Upgrades | 15% Carbon Footprint Reduction (vs. 2022) | Reduced operational costs, enhanced brand reputation |

| Digital Documentation Shift | Reduced paper consumption | Improved operational efficiency, lower environmental impact |

| Anticipated ESG Reporting | Preparation for future mandates | Strategic advantage, reduced compliance risk |

PESTLE Analysis Data Sources

Our goeasy PESTLE Analysis is meticulously constructed using a blend of publicly available government data, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive and accurate understanding of the external factors influencing the company.