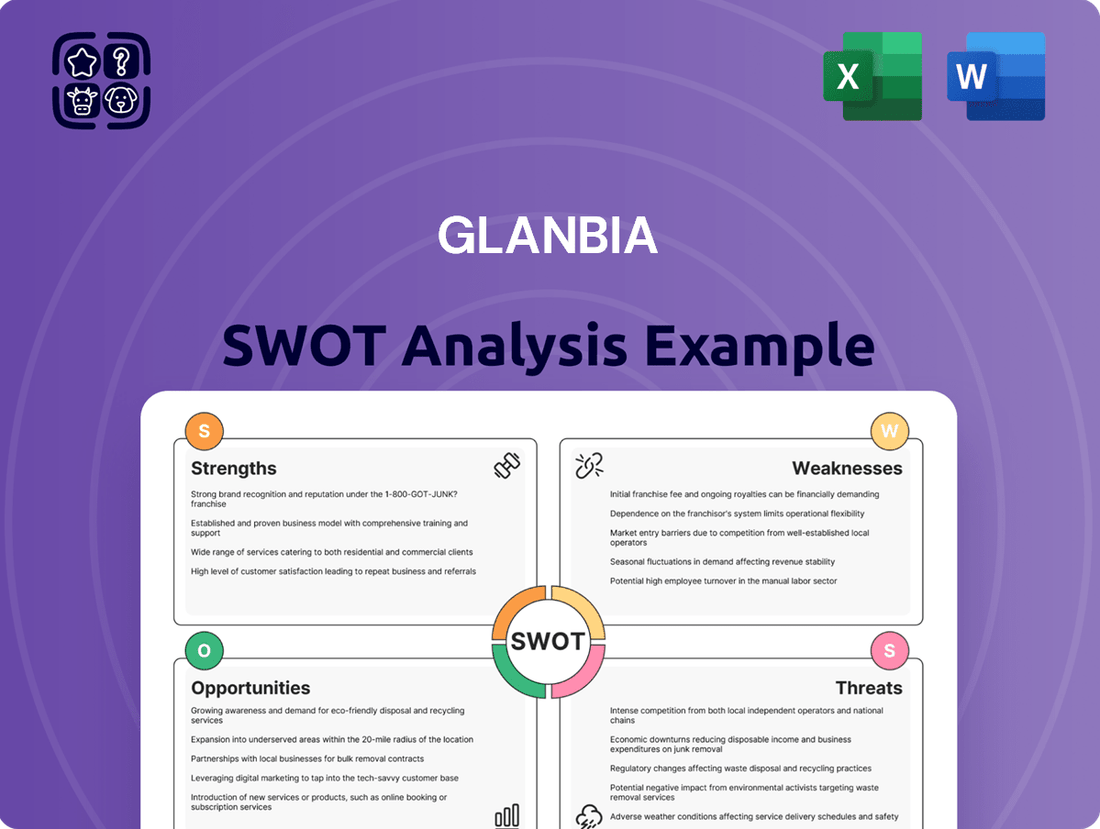

Glanbia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Glanbia Bundle

Glanbia's strengths lie in its strong brand portfolio and global reach, but its weaknesses include reliance on certain markets. Understanding these dynamics is crucial for navigating the competitive nutrition industry. Discover the complete picture behind Glanbia’s market position with our full SWOT analysis, revealing actionable insights and strategic takeaways ideal for investors and analysts.

Strengths

Glanbia stands as the undisputed global leader in sports nutrition, a position solidified by its flagship Optimum Nutrition brand. This brand alone achieved impressive volume growth in 2023, underscoring its market dominance and broad consumer appeal worldwide.

Glanbia's strength lies in its exceptionally diversified portfolio, spanning sports nutrition, healthy snacking, and dairy sectors. This broad offering caters to both individual consumers and large-scale manufacturers, creating multiple revenue streams.

This strategic diversification significantly reduces the company's vulnerability to market fluctuations or downturns in any single product category. For instance, as of the first half of 2024, Glanbia's performance nutrition segment continued to show robust growth, while its dairy ingredients business provided a stable foundation, demonstrating the benefits of this varied approach.

Glanbia showcased impressive financial results in 2024, exceeding its own mid-term financial goals. The company reported significant adjusted earnings per share (EPS) growth and demonstrated strong operational cash flow conversion, reaching 90% for the year. This financial strength underpins its capacity for strategic investments and consistent returns to shareholders.

Strategic Transformation and Efficiency Programs

Glanbia's commitment to strategic transformation is a significant strength, with a multi-year, group-wide program designed to boost efficiency and optimize its operational structure. This initiative is projected to deliver substantial annual cost savings, targeting €350 million by 2027, demonstrating a clear focus on improving profitability and resource allocation.

The company's proactive approach to streamlining operations and enhancing productivity is crucial for maintaining a competitive edge in the dynamic food and nutrition sector. These efficiency drives are expected to solidify Glanbia's financial foundation and support its long-term growth ambitions.

- Strategic Transformation Program: A multi-year, group-wide initiative to drive efficiencies.

- Cost Savings Target: Aiming for €350 million in annual cost savings by 2027.

- Operating Model Optimization: Focus on streamlining operations and enhancing productivity.

Commitment to Sustainability and ESG

Glanbia's 'Better Nutrition, Better World' strategy underscores a strong commitment to sustainability, setting ambitious goals for emissions reduction, water conservation, and packaging recyclability. This dedication to Environmental, Social, and Governance (ESG) principles significantly bolsters its brand reputation and resonates with the increasing consumer preference for eco-conscious products.

The company's ESG focus is not just about corporate responsibility; it translates into tangible business advantages. By prioritizing sustainability, Glanbia is well-positioned to attract environmentally aware consumers and investors, fostering long-term brand loyalty and potentially accessing green financing opportunities.

For example, Glanbia has committed to reducing its Scope 1 and 2 greenhouse gas emissions by 30% by 2030 against a 2022 baseline. Furthermore, they aim for 100% of their packaging to be recyclable, reusable, or compostable by 2025, a target that demonstrates proactive engagement with circular economy principles.

- 'Better Nutrition, Better World' strategy: Clear roadmap for sustainability initiatives.

- Ambitious ESG targets: Focus on reducing greenhouse gas emissions, freshwater use, and improving packaging recyclability.

- Enhanced brand image: Aligns with growing consumer demand for sustainable products.

- 2030 Emissions Goal: 30% reduction in Scope 1 and 2 GHG emissions from a 2022 baseline.

Glanbia's market leadership in sports nutrition, particularly with its Optimum Nutrition brand, is a core strength, driving significant volume growth. This dominance is further amplified by a diversified portfolio across sports nutrition, healthy snacking, and dairy ingredients, creating robust revenue streams and mitigating sector-specific risks. The company's financial performance in 2024 exceeded expectations, with strong EPS growth and a 90% operational cash flow conversion, providing a solid foundation for investment and shareholder returns. Glanbia's strategic transformation program, targeting €350 million in annual cost savings by 2027 through operational optimization, is a key enabler of future profitability and competitive positioning.

| Strength | Description | Supporting Data/Example |

| Market Leadership (Sports Nutrition) | Global leader with strong brand recognition. | Optimum Nutrition brand shows consistent volume growth. |

| Portfolio Diversification | Presence across multiple nutrition and dairy segments. | Balanced growth in Performance Nutrition and stable Dairy Ingredients in H1 2024. |

| Financial Strength | Exceeding financial targets with strong cash generation. | Reported strong adjusted EPS growth and 90% operational cash flow conversion in 2024. |

| Strategic Transformation | Efficiency-driven program for long-term value creation. | Targeting €350 million in annual cost savings by 2027. |

What is included in the product

Delivers a strategic overview of Glanbia’s internal and external business factors, highlighting its strengths in brand portfolio and market presence, alongside weaknesses in supply chain reliance and opportunities in emerging markets and product innovation, while acknowledging threats from competition and regulatory changes.

Identifies key competitive advantages and potential market threats for Glanbia, enabling proactive strategy development.

Weaknesses

Glanbia's significant reliance on the US and European markets presents a notable weakness. In 2023, these regions accounted for a substantial majority of its revenue, leaving the company vulnerable to economic downturns, evolving consumer preferences, and intensified competition within these mature markets.

This geographic concentration also means Glanbia may miss out on significant growth opportunities in emerging economies. While the US and Europe are stable, their growth rates are generally slower compared to many developing nations, potentially capping Glanbia's long-term expansion potential.

Glanbia is particularly susceptible to fluctuations in input costs, with whey prices presenting a significant concern. Analysts project these rising costs could impose substantial headwinds on the company's profitability through 2025. This inflationary pressure directly impacts the Performance Nutrition segment, forcing Glanbia to consider price increases and operational efficiencies to mitigate the squeeze on margins.

Glanbia faces significant competitive pressures, especially within the crucial U.S. club channel. Its flagship Optimum Nutrition brand is encountering stiff competition from private-label alternatives, which often offer lower price points.

This intensified competition translates directly into pricing pressure for Glanbia, potentially eroding profit margins. Furthermore, it can lead to reduced shelf space and distribution challenges, directly impacting sales volumes and overall market share performance in these key segments.

Impact of Portfolio Divestments and Brand Performance

Glanbia's strategic decision to divest underperforming brands such as SlimFast and Body & Fit presents a clear weakness. These divestments often lead to non-cash impairment charges, as seen in Glanbia's financial reporting, highlighting past investment miscalculations and challenges in specific market segments. For instance, in 2023, Glanbia recorded impairment charges related to these brands, impacting profitability.

The sale of these brands, while aimed at optimizing the portfolio, inherently signals that previous investments did not achieve the anticipated returns. This can affect investor confidence and raise questions about the effectiveness of Glanbia's brand management and acquisition strategies. The financial impact of these underperforming assets requires careful management and can divert resources from more promising growth areas.

- Divestment of Underperforming Brands: Glanbia's exit from brands like SlimFast and Body & Fit indicates past strategic missteps and challenges in specific market segments.

- Non-Cash Impairment Charges: These divestments often result in significant non-cash impairment charges, impacting reported earnings and reflecting unrealized value erosion.

- Past Investment Inefficiencies: The need to sell these brands highlights that previous capital allocation did not yield the expected returns, suggesting potential inefficiencies in investment evaluation.

- Impact on Brand Portfolio Optimization: While a strategic move, it underscores difficulties in managing and growing certain acquired or developed brands within the competitive landscape.

Complex Corporate Structure and Valuation Challenges

Glanbia's intricate corporate structure, encompassing diverse business segments, presents significant valuation challenges for some stakeholders. This complexity has been a point of contention, with activist investors suggesting it hinders efficient capital allocation and potentially impacts shareholder returns.

The perceived unwieldy nature of the organization has led to criticism regarding its ability to consistently deliver strong shareholder value, a concern that has been voiced by various investor groups. For instance, in early 2024, Glanbia's share price performance has been under scrutiny, with some analysts pointing to structural inefficiencies as a contributing factor.

- Complexity hinders accurate valuation: The diverse portfolio of brands and operations makes it difficult to assign a precise value to each component.

- Activist investor concerns: Critics argue the current structure may lead to capital misallocation, impacting overall shareholder returns.

- Potential for operational inefficiencies: A sprawling corporate setup can sometimes create bureaucratic hurdles and slow down decision-making.

Glanbia's significant reliance on the US and European markets presents a notable weakness. In 2023, these regions accounted for a substantial majority of its revenue, leaving the company vulnerable to economic downturns, evolving consumer preferences, and intensified competition within these mature markets. This geographic concentration also means Glanbia may miss out on significant growth opportunities in emerging economies.

Glanbia is particularly susceptible to fluctuations in input costs, with whey prices presenting a significant concern. Analysts project these rising costs could impose substantial headwinds on the company's profitability through 2025. This inflationary pressure directly impacts the Performance Nutrition segment, forcing Glanbia to consider price increases and operational efficiencies to mitigate the squeeze on margins.

Glanbia faces significant competitive pressures, especially within the crucial U.S. club channel. Its flagship Optimum Nutrition brand is encountering stiff competition from private-label alternatives, which often offer lower price points. This intensified competition translates directly into pricing pressure for Glanbia, potentially eroding profit margins and leading to reduced shelf space.

Glanbia's strategic decision to divest underperforming brands such as SlimFast and Body & Fit presents a clear weakness. These divestments often lead to non-cash impairment charges, as seen in Glanbia's financial reporting, highlighting past investment miscalculations and challenges in specific market segments. For instance, in 2023, Glanbia recorded impairment charges related to these brands, impacting profitability.

What You See Is What You Get

Glanbia SWOT Analysis

The preview you see is the actual Glanbia SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report provides a comprehensive overview of the company's internal strengths and weaknesses, as well as external opportunities and threats. Understanding these factors is crucial for strategic planning and decision-making.

Opportunities

The global health and wellness market is booming, with projections indicating continued strong growth. In 2024, the market was valued at an estimated $5.7 trillion and is expected to reach $7.5 trillion by 2028, growing at a compound annual growth rate (CAGR) of 7.2%. This expansion is fueled by a rising consumer consciousness around preventive healthcare, the demand for functional foods offering specific health benefits, and a surge in the popularity of nutritional supplements. Glanbia, with its established expertise and product portfolio in nutrition, is strategically positioned to leverage these powerful market tailwinds and capture a significant share of this expanding opportunity.

Glanbia has a significant opportunity to grow its presence in emerging markets, particularly within the Asia-Pacific and Latin America regions. These areas show strong projected growth in demand for nutritional and dairy products. For instance, the global nutritional supplements market, a key area for Glanbia, is expected to reach $220.5 billion by 2027, with emerging economies being major drivers of this expansion.

The global e-commerce market for food and beverages is experiencing significant growth, presenting a prime opportunity for Glanbia to expand its digital footprint. In 2024, online grocery sales are projected to reach over $200 billion, a substantial increase from previous years, highlighting the consumer shift towards digital purchasing channels.

Glanbia's commitment to digital transformation directly supports this opportunity, enabling enhanced customer engagement and streamlined direct-to-consumer (DTC) sales. By leveraging these initiatives, the company can optimize its online operations and reach a wider audience, potentially boosting revenue streams from its digital channels.

Innovation in Personalized Nutrition and Functional Ingredients

Consumer demand for tailored nutrition is surging, with a particular focus on personalized hydration and enhanced protein offerings. Glanbia is well-positioned to capitalize on this trend by innovating in areas like HMB-enhanced products, which cater to the growing interest in scientifically backed health solutions. The global personalized nutrition market is projected to reach approximately $20 billion by 2027, highlighting a significant growth opportunity.

Glanbia's innovation pipeline can directly address these evolving consumer preferences. By developing new ingredients and formulations that offer specific health benefits, the company can capture a larger share of this expanding market. For instance, functional hydration solutions are seeing increased adoption, with the global sports drink market expected to grow at a compound annual growth rate (CAGR) of over 5% through 2026.

- Personalized Nutrition Demand: Consumers are increasingly seeking nutrition plans and products tailored to their individual needs, including genetics, lifestyle, and health goals.

- Functional Hydration Growth: The market for beverages that offer more than just hydration, such as added electrolytes, vitamins, and performance-enhancing ingredients, is expanding rapidly.

- Advanced Protein Products: There is a growing appetite for specialized protein products that support muscle health, recovery, and overall wellness, with ingredients like HMB gaining traction.

- Market Expansion: The global functional foods and beverages market, which encompasses these trends, was valued at over $230 billion in 2023 and is anticipated to continue its robust growth.

Strategic Acquisitions and Partnerships

Glanbia can strategically acquire companies or form partnerships to broaden its product offerings, improve its technological infrastructure, and solidify its standing in rapidly expanding markets. For instance, its acquisition of Flavor Producers in 2024 exemplifies this strategy, aiming to bolster its taste and nutrition solutions segment.

These moves allow Glanbia to tap into new markets and gain access to innovative technologies, potentially accelerating growth and improving competitive advantages. The company's focus on value-added segments, such as performance nutrition and health and wellness, makes such strategic alliances particularly impactful.

- Acquisition of Flavor Producers: This 2024 move enhances Glanbia's ingredient solutions, particularly in taste and sensory applications, contributing to its specialized nutrition division.

- Partnerships for Innovation: Collaborations can provide access to cutting-edge research and development in areas like plant-based ingredients and functional foods, aligning with evolving consumer demands.

- Market Expansion: Strategic acquisitions in emerging markets or for specific product categories can quickly establish a stronger presence and market share, leveraging acquired distribution networks and brand recognition.

Glanbia is well-positioned to capitalize on the growing demand for personalized nutrition solutions, as consumers increasingly seek products tailored to their specific health and wellness needs. The company's focus on advanced protein products and functional hydration further aligns with these evolving consumer preferences, with the global personalized nutrition market projected to reach approximately $20 billion by 2027.

Strategic acquisitions and partnerships represent a key opportunity for Glanbia to expand its offerings and market reach. The 2024 acquisition of Flavor Producers, for instance, strengthens its ingredient solutions, particularly in taste and sensory applications, supporting its specialized nutrition division.

| Opportunity | Market Data | Glanbia's Position |

| Health & Wellness Market Growth | Valued at $5.7 trillion in 2024, projected to reach $7.5 trillion by 2028 (7.2% CAGR) | Established expertise and product portfolio in nutrition |

| Emerging Market Expansion | Global nutritional supplements market expected to reach $220.5 billion by 2027 | Strong potential in Asia-Pacific and Latin America |

| Digital Commerce Growth | Online grocery sales projected to exceed $200 billion in 2024 | Leveraging digital transformation for DTC sales |

| Personalized Nutrition | Market projected to reach $20 billion by 2027 | Innovating in HMB-enhanced products and tailored solutions |

Threats

Fluctuations in the cost of key raw materials, especially whey, represent a significant threat to Glanbia's profitability. For instance, during 2023, dairy commodity prices, including whey, experienced considerable volatility, impacting input costs for the company's nutritional products.

Unprecedented levels of input cost inflation, as seen in early 2024, can erode profit margins and negatively affect earnings. This necessitates agile pricing strategies and robust supply chain management to mitigate the impact of these unpredictable cost increases.

The nutritional and dairy sectors are incredibly competitive, featuring both long-standing companies and a growing presence of private-label brands. This is particularly evident in channels like the U.S. club store market, where private labels are gaining significant traction.

This intense competition can put considerable pressure on pricing for Glanbia, potentially impacting its market share and necessitating higher spending on marketing and promotions to stand out. For instance, in 2023, the U.S. private label market share in grocery reached approximately 20%, a figure that continues to climb, directly challenging branded products.

Glanbia faces significant threats from evolving regulatory landscapes. Changes in food safety standards, such as stricter testing protocols or new ingredient restrictions, could increase compliance costs and potentially disrupt product availability. For instance, in late 2024, the FDA continued its focus on enhancing food traceability, which may require further investment in supply chain technology for companies like Glanbia.

Furthermore, shifts in international trade policies, including the potential for tariff wars, pose a substantial risk. Given Glanbia's considerable presence in the United States, retaliatory tariffs on imported ingredients or exported finished goods could directly impact its profit margins and market access. The ongoing geopolitical tensions in 2024 and 2025 continue to create uncertainty around global trade agreements.

Climate Change and Dairy Production Vulnerability

Climate change poses a significant threat to Glanbia's dairy operations. Extreme weather events, such as prolonged droughts or excessive rainfall, directly impact milk production yields and the availability of feed, a crucial input. For instance, the UN's Food and Agriculture Organization (FAO) has highlighted that climate variability can reduce agricultural productivity by up to 30% in some regions by 2050. This volatility translates into increased operational costs for Glanbia due to higher feed prices and potential supply chain disruptions.

The dairy sector, which is central to Glanbia's business, is particularly susceptible to these environmental shifts.

- Increased Feed Costs: Droughts and changing weather patterns can lead to shortages of key feed crops, driving up prices.

- Reduced Milk Yields: Heat stress in cows can significantly lower milk production. Studies indicate that milk yield can decrease by 10-25% during heatwaves.

- Supply Chain Disruptions: Extreme weather can damage infrastructure and disrupt transportation, affecting the timely delivery of raw materials and finished products.

- Water Scarcity: Dairy farming is water-intensive; reduced water availability due to climate change can limit herd sizes and production capacity.

Shifting Consumer Preferences and Health Trends

Glanbia faces a significant threat from rapidly shifting consumer preferences, particularly concerning health and wellness. The burgeoning popularity of weight-loss drugs, such as GLP-1 agonists, directly impacts traditional diet brands. For instance, the market for meal replacements and diet shakes, a segment Glanbia has historically served, could see reduced demand as consumers opt for pharmacological solutions. This trend necessitates a proactive approach to portfolio adaptation to maintain relevance in an evolving health landscape.

The company must continuously monitor and respond to emerging health trends. For example, a growing consumer interest in plant-based nutrition, clean labels, and functional ingredients presents both an opportunity and a challenge. Failure to innovate and align product offerings with these evolving demands, such as the increasing demand for personalized nutrition solutions, could lead to market share erosion. Glanbia's ability to pivot its R&D and marketing strategies will be crucial in navigating these shifts.

- Impact of GLP-1 Drugs: The widespread adoption of drugs like Ozempic and Wegovy, projected to reach billions in market value by 2025, directly challenges the efficacy perception of traditional weight management products.

- Evolving Wellness Demands: Consumer spending on health and wellness products is expected to continue its upward trajectory, with a growing emphasis on natural ingredients and preventative health measures, potentially sidelining older product formulations.

- Portfolio Responsiveness: Glanbia's existing product lines, particularly those in the traditional diet and sports nutrition segments, may require substantial re-evaluation and innovation to align with these dynamic consumer expectations and emerging health technologies.

Intense competition from both established players and private labels, particularly in channels like U.S. club stores where private labels held around 20% market share in grocery by 2023, poses a significant threat to Glanbia's pricing power and market share.

The company must also contend with unpredictable input cost inflation, as experienced in early 2024, which directly impacts profit margins and necessitates agile pricing and supply chain strategies to offset these increases.

Evolving consumer preferences, especially the rise of weight-loss drugs like GLP-1 agonists, could reduce demand for traditional diet and meal replacement products, requiring Glanbia to adapt its portfolio to remain relevant in the health and wellness sector.

SWOT Analysis Data Sources

This Glanbia SWOT analysis is built upon a foundation of robust data, drawing from official financial reports, comprehensive market research, and expert industry analysis to provide a clear and actionable strategic overview.