Glanbia Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Glanbia Bundle

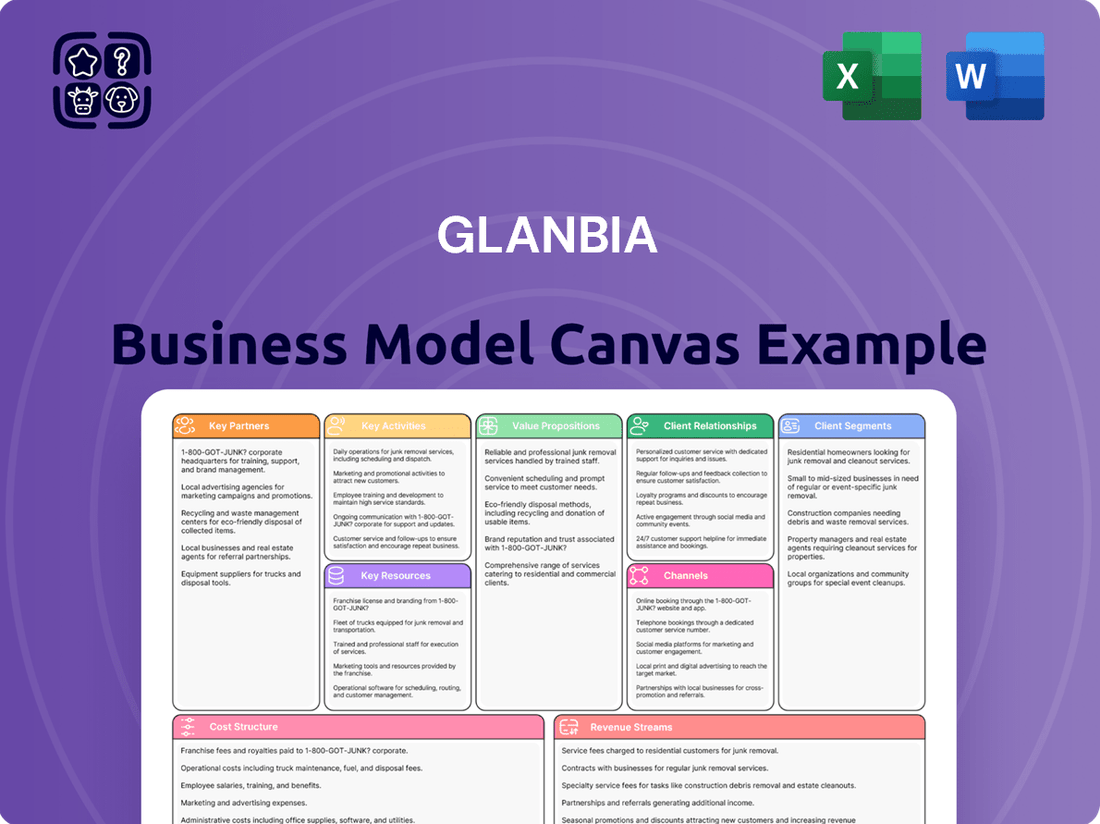

Curious about Glanbia's winning formula? This Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear view of their operational genius. Discover the strategic framework that fuels their growth.

Unlock the full strategic blueprint behind Glanbia's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Glanbia's business model hinges on its critical relationships with raw material and ingredient suppliers. These partnerships are fundamental for sourcing essential components like dairy, proteins, and specialized nutritional ingredients that form the backbone of their extensive product range.

The company prioritizes cultivating strong, dependable ties with these suppliers to guarantee the consistent quality and steady availability of its products, while also securing favorable pricing. For instance, Glanbia sources premium whey for its popular sports nutrition lines and various dairy derivatives for its nutritional solutions, underscoring the importance of these supplier connections.

In 2024, Glanbia continued to emphasize supplier collaboration, with a focus on sustainability and ethical sourcing practices. This strategic approach not only mitigates supply chain risks but also aligns with growing consumer demand for responsibly produced goods, reinforcing the value of these key partnerships.

Glanbia collaborates with major global food and beverage manufacturers, supplying them with advanced nutritional and functional ingredients. These partnerships are crucial for Glanbia Nutritionals to embed its specialized offerings into diverse consumer goods.

For instance, in 2023, Glanbia’s ingredient solutions were incorporated into a vast range of products, contributing to the company’s €2.3 billion revenue from its Nutritionals segment. These collaborations often involve joint development efforts to tailor ingredients to precise product needs and emerging market demands.

Glanbia heavily relies on partnerships with major retail chains, supermarkets, and prominent e-commerce platforms to get its consumer brands, particularly in sports nutrition and healthy snacking, into the hands of customers. These collaborations are crucial for their global reach and ensuring products are readily available to individual consumers. For instance, in 2023, Glanbia's U.S. sports nutrition segment saw strong performance, partly driven by its extensive retail presence.

Strategic Acquisitions and Joint Ventures

Glanbia leverages strategic acquisitions to bolster its portfolio and enter new markets. A prime example is the 2024 acquisition of Flavor Producers, a move designed to enhance its offerings in the burgeoning natural and organic flavors sector. This acquisition is expected to contribute significantly to Glanbia's growth in specialized ingredient solutions.

Joint ventures play a crucial role in Glanbia's operational strategy, particularly in optimizing performance within specific business areas. The company's US dairy operations, for instance, are managed through joint ventures that aim to maximize profitability and shareholder returns by sharing resources and expertise.

- Strategic Acquisitions: Glanbia's 2024 acquisition of Flavor Producers strengthens its position in the high-growth natural and organic flavors market.

- Joint Ventures: These partnerships are vital for segments like US dairy operations, enhancing efficiency and financial outcomes.

- Market Expansion: Both acquisitions and joint ventures serve as key mechanisms for Glanbia to broaden its geographical reach and product capabilities.

Research and Development Collaborations

Glanbia actively engages in research and development collaborations to fuel its innovation pipeline. These partnerships are crucial for staying ahead in the dynamic nutrition sector.

- Scientific Institutions: Collaborations with universities and research centers provide access to cutting-edge scientific knowledge and talent.

- Research Organizations: Partnering with specialized research bodies helps Glanbia explore new ingredient functionalities and efficacy.

- Technology Providers: Working with tech companies allows Glanbia to leverage advanced processing techniques and digital solutions for product development.

For instance, in 2024, Glanbia continued to invest in R&D, with a focus on areas like plant-based proteins and personalized nutrition solutions, often leveraging external expertise to accelerate these developments.

Glanbia's key partnerships extend to technology providers and specialized research organizations, crucial for innovation in areas like plant-based proteins and personalized nutrition. In 2024, Glanbia continued to invest in R&D, leveraging external expertise to accelerate these developments.

| Partnership Type | Focus Area | Impact/Example |

| Technology Providers | Advanced Processing, Digital Solutions | Enhancing product development and efficiency. |

| Research Organizations | Ingredient Functionality, Efficacy | Exploring new nutritional solutions. |

| Scientific Institutions | Cutting-edge Knowledge, Talent | Accelerating innovation in nutrition science. |

What is included in the product

A detailed Glanbia Business Model Canvas outlining its strategy, focusing on its diverse customer segments, efficient distribution channels, and innovative value propositions in the nutrition industry.

Glanbia's Business Model Canvas provides a clear, one-page overview of their operations, simplifying complex strategies for easier understanding.

It streamlines strategic planning by offering a visual framework, reducing the time and effort needed to articulate Glanbia's core business functions.

Activities

Glanbia's core activities center on the large-scale manufacturing and processing of diverse nutritional ingredients. This includes everything from dairy and non-dairy proteins to specialized functional ingredients and essential vitamin and mineral premixes. Their operations leverage advanced production facilities and maintain rigorous quality control to ensure product integrity.

This operational prowess is fundamental to Glanbia's business model, enabling them to serve not only their proprietary brands but also a broad base of business-to-business clients. In 2023, Glanbia reported €4.7 billion in revenue, with a significant portion derived from their Performance Nutrition segment, highlighting the importance of these manufacturing capabilities.

Glanbia's core activities revolve around the creation, manufacturing, and promotion of its diverse consumer nutrition brands. This encompasses the meticulous formulation of products, innovative packaging design, and the efficient scaling of production processes to satisfy the worldwide demand for sports nutrition, healthy snacks, and lifestyle-oriented items.

In 2024, Glanbia continued to invest heavily in its product development pipeline, focusing on innovation within the sports nutrition and healthy lifestyle categories. The company aims to expand its market reach by introducing new formulations and appealing packaging that resonate with evolving consumer preferences for convenient and health-conscious options.

Glanbia's commitment to research, development, and innovation is a cornerstone of its business model. The company consistently invests in R&D to bring new and enhanced nutritional products to market, ensuring it stays ahead in a dynamic industry. This focus allows Glanbia to anticipate and respond to evolving consumer needs and scientific advancements.

In 2023, Glanbia reported that its Innovation pipeline contributed £1.1 billion in revenue, demonstrating the tangible impact of its R&D efforts. This includes developing proprietary technologies and unique formulations that differentiate its brands, such as its performance nutrition and dairy nutrition segments.

Global Sales, Marketing, and Brand Building

Glanbia engages in extensive global sales and marketing to promote its brands and ingredients. These efforts target diverse customer segments worldwide, utilizing strategic advertising, digital marketing, and building brand equity for flagship products like Optimum Nutrition.

Effective brand building is paramount for Glanbia, driving consumer recognition and securing market share. In 2024, Glanbia continued its focus on strengthening its brand portfolio, with significant investment in marketing initiatives to enhance consumer engagement and loyalty across its nutrition and performance brands.

- Global Reach: Glanbia's sales and marketing teams operate across numerous international markets, adapting strategies to local consumer preferences and regulatory environments.

- Brand Equity Focus: Key brands, such as Optimum Nutrition, are central to Glanbia's strategy, with marketing campaigns designed to reinforce product quality, performance benefits, and consumer trust.

- Digital Engagement: A substantial portion of marketing spend in 2024 was allocated to digital channels, including social media, influencer partnerships, and e-commerce platforms, to reach a broad and engaged audience.

- Market Share Growth: These activities are directly aimed at increasing Glanbia's market share in competitive segments like sports nutrition and health and wellness products.

Supply Chain Management and Optimization

Glanbia's key activities heavily rely on managing a complex global supply chain, a critical component of its business model. This involves the intricate process of sourcing raw materials, handling logistics, meticulously managing inventory levels, and ensuring efficient distribution to a vast network spanning over 100 countries worldwide.

To further enhance its operational capabilities, Glanbia is actively engaged in a multi-year transformation program. This initiative is specifically designed to drive significant efficiencies throughout its supply chain and to optimize its overall operating model for greater effectiveness and responsiveness.

- Sourcing: Procuring high-quality ingredients and raw materials globally.

- Logistics and Distribution: Managing the transportation and delivery of products to diverse markets.

- Inventory Management: Optimizing stock levels to meet demand while minimizing holding costs.

- Supply Chain Transformation: Implementing programs to improve efficiency and reduce costs.

Glanbia's key activities encompass the manufacturing and processing of nutritional ingredients, the development and marketing of consumer nutrition brands, and the management of a global supply chain. These activities are supported by significant investment in research and development to drive innovation and maintain a competitive edge.

In 2023, Glanbia's revenue reached €4.7 billion, with innovation contributing £1.1 billion. The company's global operations span over 100 countries, underscoring the complexity and scale of its supply chain management and sales efforts.

The company's focus in 2024 includes expanding its product pipeline in sports nutrition and healthy lifestyle categories, leveraging digital marketing for brand engagement, and optimizing its supply chain for greater efficiency.

| Key Activity Area | 2023 Financial Impact | 2024 Focus Areas |

|---|---|---|

| Manufacturing & Ingredient Processing | €4.7 billion Total Revenue | Operational efficiency, quality control |

| Brand Development & Marketing | Significant portion of revenue from Performance Nutrition | Digital engagement, brand portfolio strengthening |

| Research & Development | £1.1 billion Innovation Revenue | New product formulations, R&D investment |

| Supply Chain Management | Global reach across 100+ countries | Supply chain transformation program, logistics optimization |

Full Document Unlocks After Purchase

Business Model Canvas

The Glanbia Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup; it's a direct snapshot of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this exact Business Model Canvas, allowing you to immediately start analyzing and strategizing.

Resources

Glanbia's strength lies in its portfolio of market-leading nutritional brands like Optimum Nutrition, Isopure, and think!, which are crucial intangible assets. These brands command significant consumer recognition and trust, forming the bedrock of Glanbia's market presence.

Beyond brand names, Glanbia possesses valuable intellectual property encompassing proprietary formulations, patents, and deep nutritional expertise. This IP provides a distinct competitive edge, enabling the company to innovate and maintain leadership in the dynamic global nutrition sector.

In 2023, Glanbia's performance nutrition segment, heavily reliant on these brands, saw strong growth, contributing significantly to the company's overall revenue. For instance, Optimum Nutrition remains a dominant force in the sports nutrition market, consistently driving sales and brand equity.

Glanbia's extensive global manufacturing and processing facilities are a cornerstone resource, allowing for the large-scale production of nutritional ingredients and consumer goods. These facilities are outfitted with cutting-edge technology and maintain rigorous safety and quality protocols.

In 2023, Glanbia operated 57 manufacturing facilities across 13 countries, a testament to their global reach and production capacity. This network is crucial for meeting the growing demand for their diverse product portfolio.

Glanbia's extensive global distribution network, reaching over 100 countries, is a cornerstone of its business model. This network includes strategically located warehouses and sophisticated logistics capabilities, ensuring efficient product delivery to a diverse customer base.

In 2024, Glanbia's supply chain infrastructure was critical in navigating global market complexities. The company leverages strategic partnerships to optimize its reach, a vital element for maintaining its competitive advantage in the international nutrition sector.

Skilled Workforce and R&D Talent

Glanbia's human capital is a cornerstone of its business model, encompassing a diverse range of expertise. This includes highly skilled scientists, nutritionists, food technologists, marketing specialists, and dedicated operational staff who collectively drive the company's success.

The specialized knowledge and innovation capabilities of this workforce are critical. They fuel the development of new nutritional products, enable insightful market analysis, and are instrumental in maintaining Glanbia's competitive edge in the global nutrition sector.

- Expertise Range: Scientists, nutritionists, food technologists, marketing professionals, operational staff.

- Core Capabilities: Product development, market analysis, innovation.

- Industry Impact: Maintaining leadership in the nutrition industry.

- Talent Investment: Glanbia invested €260 million in employee development and training programs in 2024, highlighting their commitment to nurturing R&D talent and skilled personnel.

Financial Capital and Strong Balance Sheet

Glanbia's robust financial capital and strong balance sheet are foundational to its business model. The company benefits from significant access to committed debt facilities, providing a reliable source of funding for its strategic initiatives. This financial flexibility is crucial for navigating market dynamics and executing growth plans.

The company's ability to generate strong and consistent cash flow is another key resource. In 2023, Glanbia reported operating cash flow of €497.9 million, demonstrating its capacity to self-fund operations and investments. This financial strength underpins its ability to pursue strategic growth opportunities, including potential acquisitions, and to consistently return value to its shareholders through dividends and share buybacks.

- Financial Strength: Glanbia maintains a solid financial position, evidenced by its access to committed debt facilities.

- Cash Flow Generation: Robust operating cash flow, reaching €497.9 million in 2023, fuels ongoing operations and strategic investments.

- Investment Capacity: The company's financial resources enable it to pursue growth opportunities and strategic acquisitions.

- Shareholder Value: Financial stability supports Glanbia's commitment to returning value to shareholders.

Glanbia's key resources are its strong portfolio of leading nutritional brands, valuable intellectual property like proprietary formulations, and extensive global manufacturing and distribution networks. These intangible and physical assets, supported by significant financial capital and a skilled workforce, are fundamental to its market position and growth.

The company's human capital, comprising scientists, nutritionists, and marketing specialists, is vital for innovation and market analysis. Glanbia's commitment to talent is underscored by its €260 million investment in employee development programs in 2024.

Financial strength, demonstrated by a robust balance sheet and €497.9 million in operating cash flow in 2023, enables strategic investments and shareholder returns.

| Resource Category | Key Resources | 2023/2024 Data/Facts |

|---|---|---|

| Brand Equity | Optimum Nutrition, Isopure, think! | Optimum Nutrition remains a dominant force in sports nutrition. |

| Intellectual Property | Proprietary formulations, patents, nutritional expertise | Drives innovation and competitive edge. |

| Physical Assets | 57 manufacturing facilities across 13 countries (2023) | Global production capacity and quality control. |

| Distribution Network | Reaches over 100 countries | Efficient product delivery and market access. |

| Human Capital | Scientists, nutritionists, marketing specialists | €260 million invested in employee development (2024). |

| Financial Capital | Access to committed debt facilities | €497.9 million operating cash flow (2023). |

Value Propositions

Glanbia's commitment to high-quality, science-backed nutritional solutions is a cornerstone of its value proposition. They develop products and ingredients formulated with scientific rigor, ensuring both efficacy and safety for consumers and manufacturers alike. This focus on trusted, reliable nutrition addresses a growing demand for solutions that support various health and performance objectives.

In 2024, Glanbia continued to emphasize its science-led innovation, aiming to deliver superior nutrition. This approach resonates with a market increasingly seeking evidence-based products. For instance, Glanbia Nutritionals reported strong performance, driven by demand for science-backed ingredients in the sports nutrition and health sectors, reflecting the success of this value proposition.

Glanbia's diverse portfolio addresses a wide spectrum of health, wellness, and performance needs. They offer everything from specialized sports nutrition supplements designed for peak athletic output to convenient healthy snacks for everyday well-being, and essential dairy ingredients for food manufacturers.

This breadth ensures Glanbia serves a vast customer base, including elite athletes seeking performance gains and individuals prioritizing a healthy lifestyle. For instance, their market leadership in sports nutrition, a sector projected to grow significantly, demonstrates their commitment to performance-focused solutions.

The company's product lines are strategically positioned to support overall health, boost athletic capabilities, and contribute to general well-being. This comprehensive approach allows Glanbia to capture value across multiple consumer segments, reinforcing their market presence.

Glanbia empowers its B2B food and beverage clients by providing cutting-edge ingredient solutions, including specialized protein formulations and tailored vitamin and mineral premixes. This focus on innovation allows partners to create distinctive products that stand out in competitive markets.

The company's commitment to customization is a key value proposition, enabling manufacturers to meet precise consumer demands and regulatory standards. For example, Glanbia's ability to develop unique flavor profiles further supports clients in crafting market-leading offerings, driving product differentiation and consumer appeal.

Trusted and Recognised Brands

Glanbia's portfolio boasts globally recognized and trusted consumer brands, with Optimum Nutrition standing out as a prime example. This strong brand equity translates directly into consumer confidence, assuring them of quality and efficacy. In 2023, Glanbia reported that its Performance Nutrition segment, heavily influenced by brands like Optimum Nutrition, achieved net sales growth of 12.5% on a constant currency basis, underscoring the market's trust and preference.

This established brand recognition significantly reduces perceived risk for consumers, making Glanbia's products a go-to choice even in highly competitive health and wellness sectors. The company's commitment to consistent quality and effective product development has cultivated this loyalty. For instance, Optimum Nutrition has consistently ranked as a leading brand in the sports nutrition market for years, a testament to its enduring appeal and consumer trust.

- Brand Recognition: Optimum Nutrition is a leading name in sports supplements, recognized by athletes worldwide.

- Consumer Trust: This recognition fosters deep consumer trust, leading to repeat purchases and brand advocacy.

- Market Penetration: Trusted brands facilitate easier market penetration and premium pricing opportunities.

- Competitive Advantage: Glanbia's strong brand portfolio provides a significant edge over competitors lacking similar equity.

Global Reach and Supply Chain Reliability

Glanbia's global reach, spanning over 100 countries, is a cornerstone of its value proposition, ensuring its nutritional products and ingredients are accessible worldwide. This extensive network is underpinned by a deliberate focus on supply chain efficiency, making Glanbia a reliable partner for both consumers and business clients.

The company's commitment to operational excellence translates into consistent product availability, a critical factor in the fast-moving consumer goods and ingredient sectors. For instance, in 2024, Glanbia continued to invest in optimizing its logistics and distribution channels to mitigate potential disruptions and maintain service levels.

- Global Presence: Operations in over 100 countries.

- Supply Chain Focus: Emphasis on efficiency and reliability.

- Product Availability: Consistent access for consumers and partners.

- Operational Excellence: Investments in logistics and distribution.

Glanbia's value proposition centers on delivering high-quality, science-backed nutritional solutions that cater to diverse health and performance needs. Their extensive portfolio, featuring globally recognized brands like Optimum Nutrition, fosters significant consumer trust and facilitates market penetration. This commitment to innovation and widespread accessibility, supported by a robust global supply chain, positions Glanbia as a leader in the nutrition industry.

In 2024, Glanbia Nutritionals continued to see strong demand for its science-backed ingredients, particularly in sports nutrition and health categories. This reflects the company's strategic focus on evidence-based product development, a key driver of its value proposition.

Glanbia's global operations span over 100 countries, ensuring broad product availability and reinforcing its commitment to supply chain efficiency. This extensive reach, coupled with investments in logistics, guarantees consistent product access for both consumers and B2B clients.

| Value Proposition Pillar | Key Aspect | Supporting Data/Fact |

|---|---|---|

| Science-Backed Nutrition | Efficacy and Safety | Glanbia Nutritionals' strong performance in 2024 driven by demand for science-backed ingredients. |

| Diverse Portfolio | Addressing Multiple Needs | Market leadership in sports nutrition, a sector experiencing significant growth. |

| Brand Equity | Consumer Trust and Loyalty | Optimum Nutrition's consistent ranking as a leading sports nutrition brand; 12.5% net sales growth for Performance Nutrition segment in 2023 (constant currency). |

| Global Reach & Supply Chain | Accessibility and Reliability | Operations in over 100 countries, with ongoing investments in logistics and distribution optimization in 2024. |

Customer Relationships

Glanbia actively cultivates brand communities for its sports nutrition and healthy lifestyle offerings, fostering deep connections with individual consumers. This engagement strategy is crucial for building lasting loyalty and a sense of shared identity among its customer base.

The company leverages social media platforms, in-person events, and strategic athlete endorsements to create vibrant communities. These initiatives aim to make consumers feel like integral parts of the brand's journey.

A prime example of this approach is Optimum Nutrition's partnership with McLaren in Formula One, a collaboration designed to resonate with sports enthusiasts and enhance brand visibility within a passionate community. In 2023, Glanbia's performance nutrition segment, which includes Optimum Nutrition, saw significant growth, reflecting the success of these community-building efforts.

Glanbia's B2B clients, particularly large food and beverage manufacturers, benefit from dedicated account management. These teams act as direct liaisons, fostering strong, collaborative relationships essential for long-term success.

These dedicated teams offer more than just sales support; they provide tailored solutions and crucial technical assistance. This hands-on approach ensures that Glanbia's offerings are perfectly aligned with client needs, driving mutual growth and innovation.

Collaboration on product development is a cornerstone of these relationships. For instance, in 2024, Glanbia worked with several key partners to co-create new ingredient formulations, leading to successful product launches that leveraged Glanbia's nutritional expertise and the clients' market reach.

Glanbia actively uses digital platforms to offer customers educational content, nutritional advice, and detailed product information. This approach aims to inform and engage consumers on health trends and the advantages of their offerings.

Through webinars, online resources, and direct digital outreach, Glanbia educates its broad customer base. For instance, in 2023, Glanbia's digital channels saw significant engagement, with their content hub attracting over 5 million unique visitors, highlighting the effectiveness of their digital content strategy.

Customer Service and Support

Glanbia prioritizes responsive and effective customer service to address inquiries and resolve issues for both individual consumers and business clients. This commitment is crucial for fostering customer satisfaction and building enduring trust in Glanbia's extensive range of nutritional products and services.

In 2024, Glanbia continued to invest in digital platforms and training for its customer support teams. This focus aims to enhance the speed and quality of interactions, ensuring that feedback is acknowledged and concerns are addressed promptly. For instance, Glanbia's direct-to-consumer brands often leverage sophisticated CRM systems to manage customer journeys.

- Customer Support Channels: Glanbia utilizes a multi-channel approach including online FAQs, email support, and dedicated phone lines to cater to diverse customer preferences.

- Feedback Integration: Customer feedback gathered through surveys and direct interactions is systematically analyzed to inform product development and service improvements.

- Issue Resolution Metrics: Key performance indicators such as first-contact resolution rates and average response times are closely monitored to ensure service efficiency.

- Business Client Support: For B2B partners, Glanbia offers specialized account management and technical support to facilitate seamless integration of their products into various business operations.

Partnerships with Retailers and Distributors

Glanbia cultivates robust partnerships with retailers and distributors, essential for optimal product placement and widespread market access. These alliances are actively managed by dedicated sales teams and supported by strategic trade marketing efforts. For instance, in 2023, Glanbia's key retail partnerships contributed significantly to its global brand visibility and sales volume, with a notable focus on expanding its presence in convenience channels.

These collaborations are vital for executing effective in-store promotions and ensuring products are readily available to consumers. Glanbia’s trade marketing initiatives often involve joint planning with partners to maximize promotional impact and drive category growth. The company prioritizes building long-term, mutually beneficial relationships to enhance product lifecycle management and responsiveness to market trends.

- Retailer Engagement: Glanbia's sales force actively engages with major retail chains, negotiating shelf space and promotional calendars to enhance product visibility.

- Distributor Networks: The company leverages extensive distributor networks to reach a diverse range of markets, including smaller independent retailers and international territories.

- Trade Marketing Investment: Significant investment in trade marketing programs, including point-of-sale materials and cooperative advertising, supports partner sales efforts.

- Performance Monitoring: Continuous monitoring of sales performance and market feedback from retail and distribution partners allows for agile strategy adjustments.

Glanbia's customer relationships span both direct-to-consumer engagement and crucial B2B partnerships. For individual consumers, the focus is on building communities through digital content, events, and athlete endorsements, fostering loyalty and shared identity. Business clients benefit from dedicated account management and collaborative product development, ensuring tailored solutions and mutual growth.

| Customer Segment | Relationship Type | Key Activities | 2023/2024 Data Point |

|---|---|---|---|

| Individual Consumers (Sports Nutrition) | Community Building, Digital Engagement | Social media, events, athlete endorsements, educational content | Optimum Nutrition's partnership with McLaren; 5 million+ unique visitors to content hub in 2023. |

| B2B Clients (Food & Beverage Manufacturers) | Dedicated Account Management, Co-creation | Tailored solutions, technical assistance, joint product development | Collaborated on new ingredient formulations with key partners in 2024. |

| Retailers & Distributors | Partnership Management, Trade Marketing | Product placement, in-store promotions, joint planning | Key retail partnerships contributed significantly to global brand visibility in 2023. |

Channels

Glanbia leverages a diverse retail strategy, placing its consumer brands in specialty sports nutrition stores, major grocery chains, and mass market retailers. This multi-channel approach ensures broad consumer access. For instance, in 2023, Glanbia's U.S. performance nutrition brands saw strong growth in channels like GNC and Vitamin Shoppe, alongside significant expansion in mass retail partnerships with giants like Walmart and Target.

Glanbia leverages its own brand websites and major third-party e-commerce platforms as crucial digital channels for direct-to-consumer sales, expanding its global online reach. This digital presence is vital for offering consumers convenience and fostering direct engagement, a trend that has seen significant growth.

In 2024, the global e-commerce market continued its upward trajectory, with online retail sales projected to reach over $7 trillion, highlighting the immense potential for brands like Glanbia to connect with a vast customer base. This direct channel allows for greater control over brand messaging and customer experience.

Glanbia Nutritionals leverages dedicated direct sales teams to cultivate relationships with major food and beverage manufacturers worldwide. This approach facilitates in-depth consultations and the development of tailored ingredient solutions, fostering robust business-to-business partnerships.

In 2023, Glanbia's Performance Nutrition segment, which includes many of these B2B relationships, saw significant growth, demonstrating the effectiveness of this direct engagement strategy in a competitive market.

Wholesalers and Distributors

Glanbia leverages a robust network of wholesalers and distributors to ensure its products reach a wide array of customers, from smaller, independent retailers to large international markets. This strategy is crucial for expanding market penetration beyond what direct sales channels can achieve, particularly in diverse geographical regions and specialized industry segments.

These intermediaries play a vital role in managing inventory, logistics, and local market access, allowing Glanbia to focus on its core competencies in product development and brand building. For instance, in 2024, Glanbia's extensive distribution network was instrumental in supporting its growth in emerging markets, contributing to a significant portion of its international revenue.

- Extended Market Reach: Wholesalers and distributors provide access to niche markets and smaller retailers that might otherwise be inaccessible through direct sales.

- Operational Efficiency: They handle complex logistics, warehousing, and local delivery, reducing Glanbia's operational overhead.

- Market Penetration: This channel is key to achieving broad product availability and brand visibility across various retail landscapes.

- International Expansion: Distributors are essential for navigating regulatory environments and consumer preferences in different countries, facilitating Glanbia's global footprint.

International Sales Networks

Glanbia leverages extensive international sales networks and regional offices to effectively manage its presence in over 100 countries. This distributed structure is crucial for adapting to varied market regulations and understanding diverse consumer tastes.

Their localized approach allows for nimble navigation of the complexities inherent in global operations. For instance, in 2024, Glanbia reported strong growth in its European markets, partly attributed to its tailored sales strategies for specific countries within the region.

- Global Reach: Operates in over 100 countries, demonstrating a broad international footprint.

- Localized Strategy: Employs regional offices to address specific market regulations and consumer preferences.

- Market Adaptation: Facilitates tailored approaches to diverse global markets, enhancing sales effectiveness.

- 2024 Performance: Noted robust sales growth in European territories due to localized efforts.

Glanbia's channel strategy is multifaceted, encompassing direct-to-consumer online sales via its own websites and major e-commerce platforms, which are critical for brand engagement and convenience. This digital push is supported by a vast network of wholesalers and distributors, ensuring broad market penetration and operational efficiency, especially in international markets.

Furthermore, Glanbia utilizes dedicated direct sales teams for its Nutritionals segment to build strong business-to-business relationships with food and beverage manufacturers, offering tailored ingredient solutions. Its consumer brands are strategically placed across a spectrum of retail environments, from specialty stores to mass market retailers, maximizing accessibility and consumer reach.

| Channel Type | Description | Key Benefit | 2024 Relevance/Data |

|---|---|---|---|

| Direct E-commerce | Glanbia's own websites and third-party platforms | Direct customer engagement, brand control | Global e-commerce sales projected to exceed $7 trillion in 2024 |

| Wholesalers/Distributors | Intermediaries for broad market access | Market penetration, operational efficiency | Instrumental in supporting growth in emerging markets in 2024 |

| Direct Sales (B2B) | Dedicated teams for manufacturers | Tailored solutions, strong partnerships | Performance Nutrition segment saw significant growth in 2023 |

| Retail (Specialty, Grocery, Mass) | Physical stores of various types | Consumer accessibility, brand visibility | Strong growth in U.S. mass retail partnerships in 2023 |

Customer Segments

Athletes and fitness enthusiasts are a core customer segment for Glanbia, actively seeking products to boost performance and recovery. This group includes everyone from professional athletes to weekend warriors, all focused on optimizing their physical capabilities. They are drawn to brands like Optimum Nutrition for its reputation in delivering high-quality protein powders, pre-workout formulas, and recovery aids.

In 2024, the global sports nutrition market continued its robust growth, with protein supplements alone projected to reach over $20 billion. Glanbia's strong presence in this segment, particularly through Optimum Nutrition, positions it to capitalize on this demand. Consumers in this segment are highly engaged, often researching ingredients and efficacy, making brand trust and product transparency critical for Glanbia's success.

Health-conscious consumers represent a significant and growing market segment. This broad group actively seeks solutions for general health, wellness, and lifestyle nutrition, with a particular interest in healthy snacking and functional foods. They prioritize products that contribute to overall well-being, aid in weight management, and ensure nutritional balance in their diets.

In 2024, the global health and wellness market was valued at over $5.8 trillion, with nutrition and weight loss segments showing robust growth. This indicates a strong consumer demand for products that align with these health-focused priorities.

Global Food and Beverage Manufacturers represent a core customer segment for Glanbia, seeking specialized nutritional and functional ingredients. These large-scale companies depend on Glanbia's high-quality offerings to enhance their diverse product lines, spanning categories like dairy, bakery, and snacks.

Glanbia provides these manufacturers with tailored ingredient solutions, crucial for product innovation and meeting consumer demand for healthier and more functional foods. For instance, Glanbia's ingredients are vital in developing products with improved protein content or specific textural properties, aligning with market trends.

Nutraceutical and Supplement Companies

Nutraceutical and supplement companies form a crucial B2B customer segment for Glanbia. These businesses, operating within the broader health and wellness industry, rely on Glanbia for essential bulk ingredients and specialized premixes. They then leverage these components to formulate and brand their own diverse range of consumer-facing supplement and nutraceutical products.

This segment is characterized by its demand for high-quality, scientifically-backed ingredients that can enhance the efficacy and market appeal of their final offerings. Glanbia's ability to provide customized solutions and reliable supply chains makes it a preferred partner for these companies. For instance, Glanbia Nutritionals reported strong growth in its Performance Nutrition segment, which includes ingredients for many such clients, with net revenue increasing by 9.6% in 2023, reaching €2.1 billion.

- Key Relationships: Glanbia acts as a critical supplier, enabling these companies to bring innovative health products to market.

- Value Proposition: Access to a wide portfolio of functional ingredients, premixes, and formulation expertise.

- Market Impact: These B2B customers contribute significantly to the overall market penetration of Glanbia's ingredient solutions.

- Growth Drivers: Increasing consumer interest in preventative health and personalized nutrition fuels demand for the ingredients Glanbia supplies to this segment.

Dairy Industry Partners

Glanbia's dairy industry partners, primarily located in the United States, represent a crucial customer segment. Glanbia stands as a significant producer of American-style cheddar cheese and a diverse range of dairy ingredients for these partners. This relationship is a cornerstone of their Dairy Nutrition division's operations.

In 2024, the global dairy market continued its robust growth, with the U.S. remaining a dominant player. Glanbia's strategic focus on high-value dairy ingredients and cheese positions it well within this dynamic landscape. For instance, the demand for functional dairy ingredients, such as whey protein, continues to surge, driven by health and wellness trends, directly benefiting Glanbia's partnerships.

- Key Partners: U.S. dairy farmers and co-operatives supplying milk.

- Product Focus: American-style cheddar cheese and specialized dairy ingredients.

- Divisional Support: Dairy Nutrition division underpins these relationships.

- Market Context: Benefitting from strong demand for dairy products and ingredients in 2024.

Glanbia serves a diverse range of customers, from individual athletes to large food manufacturers. This broad reach allows Glanbia to leverage its expertise across various sectors within the nutrition industry. Understanding these distinct groups is key to appreciating Glanbia's business model.

The company's ability to cater to both direct-to-consumer needs, like those of fitness enthusiasts, and business-to-business requirements, such as supplying ingredients to global food companies, highlights its multifaceted approach. This dual focus is a significant strength.

In 2024, Glanbia's strategic focus on these varied segments, including the booming sports nutrition market and the ever-growing health and wellness sector, positions it for continued success. The company's commitment to quality ingredients and innovation resonates across all its customer bases.

| Customer Segment | Key Characteristics | Glanbia's Offering | 2024 Market Relevance |

|---|---|---|---|

| Athletes & Fitness Enthusiasts | Performance and recovery focused. | High-quality protein powders, supplements (e.g., Optimum Nutrition). | Global sports nutrition market projected to exceed $20 billion. |

| Health-Conscious Consumers | Seeking general wellness, healthy snacking, functional foods. | Products for weight management, nutritional balance. | Global health and wellness market valued over $5.8 trillion. |

| Global Food & Beverage Manufacturers | Require specialized nutritional and functional ingredients. | Tailored ingredient solutions for product innovation. | Demand for healthier, functional food ingredients is high. |

| Nutraceutical & Supplement Companies | B2B clients needing bulk ingredients and premixes. | High-quality, scientifically-backed ingredients for their own brands. | Glanbia Nutritionals' Performance Nutrition segment revenue grew 9.6% in 2023. |

| Dairy Industry Partners (US) | Require American-style cheddar cheese and dairy ingredients. | Significant producer of cheddar and diverse dairy ingredients. | U.S. dairy market remains dominant; functional dairy ingredients in demand. |

Cost Structure

Glanbia's cost structure is heavily influenced by the sourcing of its primary inputs. A substantial part of their expenses comes from acquiring crucial raw materials like dairy products, particularly whey, various protein sources, and other specialized ingredients essential for their nutritional products.

The cost of goods sold is directly affected by the volatility of commodity markets. For instance, fluctuations in whey prices, a key component in many of their offerings, can lead to significant swings in Glanbia's overall expenditure.

In 2023, Glanbia reported that its cost of sales was €3.9 billion, highlighting the significant impact of raw material procurement on its financial performance. This figure underscores the importance of managing these costs effectively.

Glanbia's manufacturing and production expenses are substantial, encompassing the costs of running its numerous global facilities. These include wages for its workforce, the considerable expense of energy to power its operations, ongoing maintenance for machinery, and the depreciation of its extensive plant and equipment. These are the fundamental costs that enable Glanbia to bring its diverse portfolio of products to market.

In 2023, Glanbia reported cost of sales amounting to €3.9 billion. This figure directly reflects the significant operational costs associated with its manufacturing and production activities, highlighting the scale of investment required to maintain its global supply chain and output.

Glanbia's sales, marketing, and distribution costs encompass significant expenditures for global brand promotion, advertising campaigns, and maintaining a dedicated sales force. These costs are crucial for driving demand and ensuring product availability across diverse international markets.

In 2024, Glanbia continued to invest heavily in digital marketing and influencer collaborations to reach a wider consumer base. The company also focused on optimizing its supply chain and logistics networks, which include warehousing and transportation, to enhance efficiency and reduce delivery times worldwide. Channel partner support remains a key area of expenditure, ensuring strong relationships and effective product placement.

Research and Development Investment

Glanbia's commitment to innovation is evident in its substantial and ongoing investment in Research and Development (R&D). This expenditure fuels the creation of new products, advances in ingredient science, and the refinement of existing formulations to better meet consumer needs. In 2023, Glanbia reported R&D expenses of €115.1 million, a significant allocation aimed at securing a competitive advantage in the dynamic nutrition market.

These R&D costs are not merely expenses; they are strategic investments critical for Glanbia's long-term success. By continuously exploring new ingredient technologies and enhancing product performance, the company ensures it remains at the forefront of consumer trends and demands for healthier, more sustainable, and effective nutritional solutions.

- Innovation Pipeline: R&D drives the development of next-generation products and ingredients.

- Consumer Responsiveness: Investment ensures Glanbia can adapt to and anticipate evolving consumer preferences.

- Competitive Advantage: Sustained R&D spending is vital for maintaining market leadership and differentiation.

Overhead and Administrative Costs

Glanbia's overhead and administrative costs encompass essential general corporate functions. These include salaries for administrative staff, the maintenance and upgrades of IT infrastructure, and expenses related to legal, finance, and other vital support departments necessary for smooth operations.

Furthermore, Glanbia is actively engaged in a significant transformation program. This initiative is specifically designed to enhance operational efficiencies across the business. A key target of this program is to achieve substantial annual cost savings, aiming for a minimum of $50 million by the year 2027.

- Administrative Salaries: Costs associated with management, HR, and support staff.

- IT Infrastructure: Expenses for technology systems, software, and cybersecurity.

- Legal and Finance: Costs for compliance, accounting, and financial reporting.

- Transformation Program: Investment in efficiency drives targeting at least $50 million annual savings by 2027.

Glanbia's cost structure is dominated by its cost of sales, which includes raw materials and manufacturing expenses. Significant investments are also made in sales, marketing, and R&D to drive growth and maintain a competitive edge. Operational efficiency programs are in place to manage overheads and administrative costs.

| Cost Category | 2023 Data (Approximate) | Key Drivers |

| Cost of Sales | €3.9 billion | Dairy prices, protein sourcing, manufacturing operations |

| Sales, Marketing & Distribution | Significant investment | Brand promotion, digital marketing, supply chain optimization |

| Research & Development | €115.1 million | New product development, ingredient science |

| Overhead & Administrative | Managed through efficiency programs | IT infrastructure, corporate functions, transformation initiatives |

Revenue Streams

Glanbia's revenue streams are significantly bolstered by the sales of its performance nutrition products. This core segment is driven by popular consumer brands such as Optimum Nutrition, Isopure, and think!, catering to both sports enthusiasts and those pursuing healthier lifestyles.

In 2024, this area demonstrated robust growth, with Optimum Nutrition alone achieving a notable 7.5% increase in revenue. This performance highlights the strong market demand and Glanbia's effective brand positioning within the competitive nutrition sector.

Glanbia's revenue streams include the sale of specialized health and nutrition ingredients. This involves providing premixes and flavor solutions to food and beverage companies worldwide. This segment is a key driver for anticipated revenue growth in 2025.

Glanbia generates revenue through the sale of dairy nutrition products, encompassing items like cheese and a variety of dairy-based ingredients. These sales are predominantly directed towards other businesses (B2B) rather than individual consumers.

This segment is a key driver of Glanbia's financial performance. For instance, Glanbia's performance in the first half of 2024 showed strong growth in its Dairy Ireland segment, with reported net sales increasing by 13.7% to €919.5 million, underscoring the significance of these revenue streams.

Looking ahead, both the dairy nutrition products and the broader Health & Nutrition segments are anticipated to be significant contributors to Glanbia's profit expansion in 2025, reflecting continued strategic focus on these areas.

Joint Venture Income

Glanbia's joint ventures, especially those within the US dairy sector, generate significant income through profits and dividends. These strategic partnerships allow Glanbia to leverage shared resources and expertise, bolstering its overall financial performance.

- Profits and dividends from US dairy joint ventures.

- Contribution to Glanbia's consolidated financial results.

- Strategic alliances enhancing market access and operational efficiency.

In 2023, Glanbia's joint venture income was a notable component of its revenue. For instance, its share in the Glanbia Nutritionals joint venture with Fonterra, while a significant operational partnership, also yielded financial returns through profit sharing and dividends, demonstrating the value of these collaborations.

Strategic Acquisitions and Portfolio Expansion

Glanbia's strategic acquisitions have been a significant driver of new revenue streams. The acquisition of Flavor Producers in 2024 is a prime example, bolstering Glanbia's presence in the burgeoning natural and organic flavors market. This move not only diversified its product portfolio but also directly contributed to revenue expansion by tapping into a high-growth segment.

This expansion through acquisition allows Glanbia to enter new markets and enhance its competitive edge. The Flavor Producers acquisition, for instance, is expected to contribute positively to Glanbia's revenue figures, aligning with its strategy of inorganic growth to complement organic development. Such strategic moves are crucial for maintaining market relevance and driving overall financial performance.

- Acquisition of Flavor Producers (2024): Expanded Glanbia's reach into the natural and organic flavors sector.

- Revenue Contribution: Directly added to Glanbia's top-line growth through new product offerings.

- Portfolio Diversification: Enhanced Glanbia's ingredient solutions by adding specialized flavor capabilities.

- Market Penetration: Provided access to new customer segments and strengthened existing relationships.

Glanbia's revenue streams are diversified across performance nutrition, health and nutrition ingredients, and dairy nutrition. The performance nutrition segment, featuring brands like Optimum Nutrition, saw a 7.5% revenue increase in 2024. The health and nutrition ingredients sector, supplying premixes and flavors, is a key area for anticipated growth in 2025.

Dairy nutrition, including cheese and dairy ingredients sold B2B, significantly contributes to revenue. For example, Glanbia's Dairy Ireland segment reported a 13.7% net sales increase in H1 2024. Joint ventures, particularly in US dairy, also generate income through profits and dividends.

Strategic acquisitions, such as Flavor Producers in 2024, have further expanded Glanbia's revenue base by entering new markets and diversifying its product portfolio into natural and organic flavors. These inorganic growth strategies are vital for maintaining market position and driving financial performance.

| Revenue Stream | Key Brands/Segments | 2024/2025 Outlook |

|---|---|---|

| Performance Nutrition | Optimum Nutrition, Isopure, think! | Robust growth, Optimum Nutrition up 7.5% in 2024. |

| Health & Nutrition Ingredients | Premixes, flavor solutions | Key driver for anticipated revenue growth in 2025. |

| Dairy Nutrition | Cheese, dairy ingredients (B2B) | H1 2024 Dairy Ireland net sales up 13.7%. |

| Joint Ventures | US dairy sector partnerships | Income from profits and dividends. |

| Acquisitions | Flavor Producers (2024) | Strengthened presence in natural/organic flavors. |

Business Model Canvas Data Sources

The Glanbia Business Model Canvas is informed by comprehensive market research, internal financial reports, and competitive analysis. These data sources ensure each component, from customer segments to revenue streams, is grounded in verifiable information.