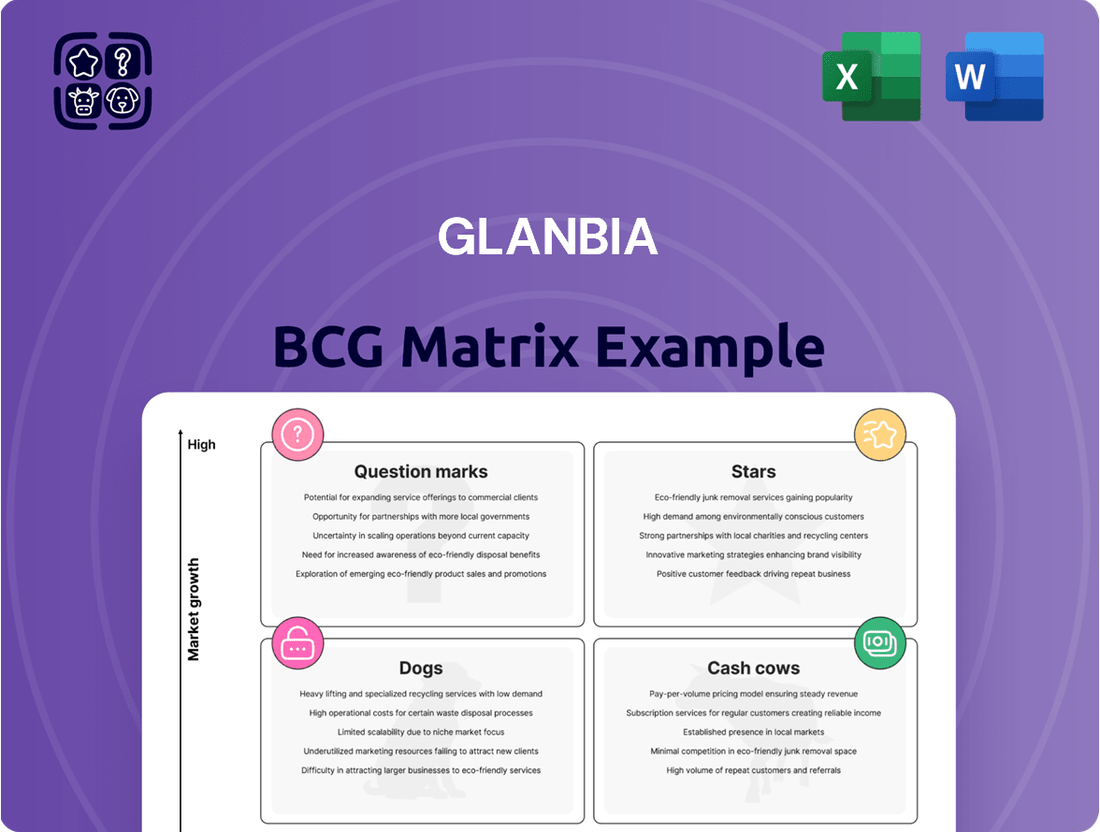

Glanbia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Glanbia Bundle

Curious about Glanbia's product portfolio performance? This snapshot offers a glimpse into their strategic positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. To truly unlock actionable insights and understand how to optimize Glanbia's market share and resource allocation, purchase the full BCG Matrix report.

Stars

Optimum Nutrition (ON) stands as Glanbia's leading brand and the undisputed top player in the global sports nutrition market, showcasing exceptional market dominance.

In 2024, ON achieved a solid 7.5% revenue growth on a constant currency basis, fueled by impressive double-digit volume increases.

The brand's strategic focus on expanding its worldwide distribution network and enhancing sales velocity positions it for continued prosperity within the rapidly expanding sports nutrition industry.

Isopure stands out as a significant growth brand within Glanbia's Performance Nutrition segment, demonstrating robust momentum. In 2024, it achieved impressive double-digit volume growth, underscoring its strong performance and contribution to Glanbia's healthy lifestyle offerings.

This protein-focused brand is a prime example of Glanbia's strategy to capitalize on the expanding active nutrition market. Isopure effectively captures evolving consumer preferences for high-quality protein products, solidifying its position as a key player.

Nutritional Solutions - Protein Solutions is a key growth driver for Glanbia. In 2024, this segment saw robust volume expansion, directly fueling a significant uptick in overall revenue.

The global protein market is experiencing a boom, with consumers increasingly prioritizing personalized nutrition, energy boosts, and weight management solutions. This trend underpins the strong demand for protein-based products.

Glanbia's established expertise in developing and supplying high-quality protein ingredients positions it advantageously to capitalize on this expanding market. The company is well-equipped to meet the evolving needs of consumers seeking protein-rich options.

Nutritional Solutions - Premix Business

Glanbia's premix business, a key component of its Nutritional Solutions segment, experienced robust volume growth throughout 2024. This performance is a testament to the increasing demand for specialized nutritional ingredients across various industries.

The broader Health & Nutrition segment, which encompasses the premix operations, reported a significant 12% revenue increase in 2024. This financial uplift underscores the segment's strategic importance and its ability to capitalize on market trends.

The market for customized nutritional solutions is expanding rapidly, and Glanbia's premix business is well-positioned to capture a larger share. This strategic advantage provides a strong platform for sustained growth and enhanced market penetration.

- 2024 Revenue Growth: The Health & Nutrition segment, including premix, achieved a 12% revenue increase.

- Volume Expansion: Glanbia's premix business saw notable volume growth in 2024.

- Market Opportunity: The segment benefits from the growing demand for tailored nutritional products.

- Strategic Positioning: This business unit is poised for continued expansion and market share gains.

International Performance Nutrition Business

Glanbia's international Performance Nutrition business is a significant player, with its Optimum Nutrition brand leading the charge. In 2024, this division saw a revenue increase of 2.3% compared to the previous year. This growth is particularly encouraging given the robust expansion of the global sports nutrition market, with Europe emerging as the fastest-growing region.

The strategic focus on expanding its presence in key international markets outside the Americas is paying off. This geographic diversification highlights the substantial growth potential for Glanbia's performance nutrition offerings. The company is capitalizing on strong brand recognition and increasing consumer demand for health and wellness products worldwide.

- 2.3% revenue growth for the international Performance Nutrition division in 2024.

- Optimum Nutrition identified as a key driver of this growth.

- Europe recognized as the fastest-growing region in the global sports nutrition market.

- High growth potential indicated by expansion in priority markets outside the Americas.

Optimum Nutrition (ON) is Glanbia's flagship brand and a dominant force in the global sports nutrition sector. In 2024, ON delivered a strong performance with a 7.5% revenue increase on a constant currency basis, driven by significant double-digit volume growth. This success is attributed to Glanbia's ongoing efforts to broaden its international distribution and enhance sales efficiency, positioning ON for continued expansion in the dynamic sports nutrition landscape.

Isopure, another key brand within Glanbia's Performance Nutrition portfolio, demonstrated robust momentum in 2024, achieving impressive double-digit volume growth. This performance highlights its significant contribution to Glanbia's healthy lifestyle offerings and its ability to resonate with consumers seeking high-quality protein products.

Glanbia's Nutritional Solutions segment, particularly its Protein Solutions and premix businesses, experienced substantial volume expansion in 2024, directly contributing to a notable increase in overall revenue. The Health & Nutrition segment, encompassing these operations, reported a significant 12% revenue growth for the year, underscoring the market's strong demand for customized nutritional ingredients and protein-based products.

| Glanbia Brand/Segment | 2024 Performance Highlights | Market Position |

|---|---|---|

| Optimum Nutrition (ON) | 7.5% revenue growth (constant currency), double-digit volume increases | Global leader in sports nutrition |

| Isopure | Double-digit volume growth | Significant growth brand in Performance Nutrition |

| Nutritional Solutions - Protein Solutions | Robust volume expansion, fueling revenue growth | Key growth driver capitalizing on protein market boom |

| Nutritional Solutions - Premix Business | Robust volume growth, contributing to 12% segment revenue increase | Well-positioned for expansion in customized nutritional solutions market |

What is included in the product

The Glanbia BCG Matrix analyzes its business units based on market growth and share, guiding investment and divestment decisions.

The Glanbia BCG Matrix provides a clear visual of business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Glanbia's US Cheese business, now integrated into its Dairy Nutrition segment, stands as a prime example of a Cash Cow within the BCG framework. This operation holds a substantial share in the mature US cheddar cheese market, a segment known for its stability and consistent demand. The business is a significant revenue generator, leveraging the strength of robust protein markets to maintain its profitability.

The established market position of Glanbia's US Cheese business translates into reliable and substantial cash flow. In 2024, the dairy sector, including cheese production, continued to demonstrate resilience, with U.S. cheese production reaching approximately 13.4 billion pounds in the first half of 2024. This consistent financial performance allows Glanbia to strategically allocate these earnings towards funding growth initiatives in other, more dynamic parts of its portfolio.

Glanbia's mature dairy ingredients portfolio, extending beyond cheese, forms a significant and dependable revenue stream within its Dairy Nutrition segment. This segment consistently supplies essential components to a wide array of food and beverage producers, guaranteeing a predictable and robust demand. For instance, in 2023, Glanbia's overall revenue reached €6.5 billion, with its Dairy Ireland segment, which includes these mature ingredients, demonstrating resilience.

Glanbia Nutritionals boasts a deep heritage in providing a wide array of nutritional ingredients. These mature product lines, though not positioned in hyper-growth sectors, maintain significant market dominance and deliver steady, predictable cash generation.

These established ingredients are crucial for Glanbia's ingredient solutions business, offering a stable base. For instance, in 2023, Glanbia Nutritionals reported strong performance in its established ingredient segments, contributing significantly to overall profitability.

Overall Glanbia Nutritionals (pre-2025 segmentation)

Glanbia Nutritionals, prior to its 2025 segmentation, stood out as a powerful cash cow for the group. In 2024, this segment demonstrated robust financial health, achieving a notable 14.0% increase in revenue. Its operational efficiency was equally impressive, reflected in an EBITDA margin of 19.8%, highlighting its strong profitability.

The consistent and significant cash generation from Glanbia Nutritionals played a crucial role in bolstering the overall profitability of the Glanbia group. This segment's performance before its strategic division in 2025 firmly established it as a substantial contributor to the company's financial strength.

- 2024 Revenue Growth: 14.0%

- 2024 EBITDA Margin: 19.8%

- Cash Generation: Consistently significant

- Role: Key cash cow prior to 2025 split

Global Operational and Distribution Network

Glanbia's global operational and distribution network, spanning over 100 countries, is a significant asset. This extensive reach facilitates the efficient delivery of its broad product range, from performance nutrition to dairy ingredients.

The established presence in numerous markets means Glanbia can rely on its existing infrastructure, reducing the necessity for substantial new promotional spending in many regions. This allows for a consistent generation of revenue and robust cash flow conversion.

- Global Reach: Operations and distribution in over 100 countries.

- Efficiency: Minimizes aggressive promotional investments due to established presence.

- Revenue Generation: Leverages infrastructure for consistent revenue and strong operating cash conversion.

Glanbia's established dairy ingredients business, particularly its US cheese operations, functions as a strong cash cow. This segment benefits from a mature market with stable demand, ensuring consistent revenue generation. The significant cash flow produced allows Glanbia to invest in other growth areas.

The US cheese market, a key component of Glanbia's Dairy Nutrition segment, represents a stable revenue source. In the first half of 2024, U.S. cheese production was substantial, underscoring the consistent demand. This financial stability is crucial for funding Glanbia's strategic initiatives.

Glanbia's broader mature dairy ingredients portfolio also acts as a dependable cash cow. These ingredients are essential for many food and beverage manufacturers, guaranteeing predictable sales. In 2023, Glanbia reported overall revenues of €6.5 billion, with its established segments contributing significantly.

| Segment | Market Position | Cash Flow Generation | 2024 Relevance |

| US Cheese Business | High Share in Mature Market | Consistent & Substantial | Supports Growth Initiatives |

| Mature Dairy Ingredients | Stable Demand from Food/Bev | Predictable & Robust | Key Revenue Stream |

| Glanbia Nutritionals (Pre-2025) | Market Dominance | Significant & Steady | Bolstered Group Profitability |

Delivered as Shown

Glanbia BCG Matrix

The Glanbia BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises—just the complete strategic tool ready for your business analysis. You can confidently use this preview as an accurate representation of the professional-grade document that will be yours to edit, present, or integrate into your planning processes.

Dogs

Glanbia's decision to exit the SlimFast brand, a move announced in 2024, underscores its position as a Question Mark or potentially a Dog in the BCG Matrix. The company recorded a substantial non-cash impairment charge of $91.4 million related to SlimFast in 2024, signaling significant value erosion.

The brand has been grappling with declining sales, particularly in the crucial US market. This downturn is widely seen as being exacerbated by the growing popularity and accessibility of weight-loss drugs, which offer alternative solutions for consumers.

This divestiture clearly marks SlimFast as an underperforming asset. It possesses a low market share within the broader health and wellness sector and faces diminishing growth prospects, aligning it with the characteristics of a Dog in the BCG framework.

Glanbia's decision to exit its Body & Fit direct-to-consumer e-commerce business, acquired in 2017, signals a strategic shift. This move is a key component of their broader portfolio optimization, suggesting Body & Fit was not a star performer within the Glanbia structure.

The divestment indicates Body & Fit likely held a low market share and failed to meet Glanbia's growth projections. This aligns with the characteristics of a 'Dog' in the BCG matrix, a business unit with low growth and low market share, which often become candidates for divestment to free up capital for more promising ventures.

The Weight Management category within Glanbia Performance Nutrition (GPN) has seen its distinct reporting segment largely dissolved due to what is described as abysmal recent performance. This indicates a significant downturn in market share and growth for products once categorized here.

Glanbia's 2023 annual report, for instance, does not feature Weight Management as a standalone segment, reflecting this strategic shift away from a historically underperforming area. This move suggests a reallocation of resources towards more promising GPN segments.

GPN Americas - US Club and Specialty Channels

Glanbia Performance Nutrition's GPN Americas segment, specifically its US Club and Specialty Channels, faced headwinds in early 2025. Revenue saw a dip in the first quarter, largely attributed to reduced volumes within these key distribution networks.

The company's strategic decision to deprioritize specialty retail in the US market signals difficulties in either capturing or retaining market share within these particular sales avenues. This suggests a challenging environment for growth in these channels.

- Revenue Decline: GPN Americas reported a revenue decrease in Q1 2025, with wholesale club and specialty channels being primary contributors to the decline due to lower volumes.

- Strategic Shift: Glanbia has actively deprioritized specialty retail in the US, indicating a strategic move away from channels where market share gains are proving difficult.

- Competitive Pressures: The club channel, in particular, is experiencing intensified competition, notably from private label brands, which is impacting Glanbia's profitability in this segment.

Underperforming Joint Ventures/Associates

Glanbia's joint ventures and associates have faced significant headwinds, with their share of profit after tax pre-exceptional items seeing a substantial decrease in 2024. This downturn is primarily attributed to escalating input costs and challenging market pricing conditions that have compressed margins.

These underperforming entities may represent Glanbia's Dogs in the BCG Matrix. This classification suggests they are operating in markets with limited growth potential and are struggling with profitability, potentially consuming capital without generating adequate returns. For instance, the company's 2024 financial reports indicated a notable dip in profitability from these ventures, underscoring the severity of the issue.

- Profit Decline: Glanbia's share of profit after tax from joint ventures and associates fell significantly in 2024.

- Contributing Factors: Higher input costs and unfavorable market pricing dynamics were the primary drivers of this underperformance.

- Strategic Implications: These ventures may be candidates for strategic review, including potential divestiture, if performance does not show a marked improvement.

- Cash Trap Potential: The current situation suggests these partnerships could be acting as cash traps rather than value-generating assets for the group.

Glanbia's divestment of SlimFast in 2024, marked by a $91.4 million impairment charge, highlights its classification as a Dog. Declining sales, exacerbated by the rise of weight-loss drugs, indicate low market share and growth prospects.

Similarly, the exit from Body & Fit, acquired in 2017, points to this e-commerce business also being a Dog, failing to meet growth targets and holding a low market share.

The dissolution of the Weight Management reporting segment in 2023 reflects its abysmal performance, further solidifying the Dog classification for these formerly key areas.

Glanbia's joint ventures and associates experienced a substantial profit decline in 2024 due to rising input costs and challenging market pricing, suggesting they too may be Dogs requiring strategic review.

| Business Unit | BCG Classification | Key Indicators |

| SlimFast | Dog | $91.4M impairment (2024), declining sales, impact of weight-loss drugs |

| Body & Fit | Dog | Divested (2024), low market share, failed growth projections |

| Weight Management (GPN) | Dog | Segment dissolved (2023), abysmal performance |

| Joint Ventures/Associates | Dog (Potential) | Profit decline (2024), rising input costs, market pricing pressure |

Question Marks

Glanbia's acquisition of Flavor Producers in April 2024 positions it within the question mark category of the BCG matrix. This strategic move targets the growing demand for organic and natural flavors, a market projected for significant expansion driven by evolving consumer preferences for healthier and more natural ingredients.

While Flavor Producers operates in a promising sector, its current contribution to Glanbia's overall revenue likely represents a modest market share, characteristic of a question mark. Substantial investment will be necessary to scale its operations, enhance its product development, and fully integrate its capabilities into Glanbia's broader product lines to realize its growth potential.

Glanbia Nutritionals is heavily investing in novel bioactive ingredients such as creatine, curcumin, collagen, probiotics, and prebiotics. These are aimed at capitalizing on surging consumer demand for products supporting energy levels, women's health, and healthy aging.

While these represent high-growth market opportunities, Glanbia's individual new ingredient solutions are likely to begin with a minimal market share. Significant investment in research and development, alongside robust marketing efforts, will be crucial for these offerings to establish a strong foothold.

Glanbia's 2025 megatrends emphasize a significant demand for personalized protein and innovative hydration solutions, signaling a robust growth trajectory for these segments. This focus positions these offerings as potential stars within the company's portfolio, aligning with evolving consumer preferences for tailored health and wellness products.

However, as Glanbia develops and scales new products in these specialized niches, such as ready-to-drink protein beverages or advanced hydration solutions, they are likely to begin with a low market share. This initial phase necessitates dedicated investment to cultivate brand awareness and secure consumer adoption in a competitive landscape.

Products for Women's Life Stages Health

The women's health market is experiencing significant growth, driven by increased awareness and demand for products catering to specific life stages such as fertility, pregnancy, and menopause. Glanbia is actively investigating novel bioactives to address this expanding segment. This focus positions Glanbia's offerings as potential stars within its portfolio, characterized by low current market share but substantial high growth potential.

- Market Growth: The global women's health market was valued at approximately $40 billion in 2023 and is projected to reach over $60 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 6%.

- Glanbia's Opportunity: Glanbia's exploration of new bioactives for fertility, pregnancy, and menopause aligns with this upward trend, suggesting a strategic move into a high-potential, albeit currently nascent, product category for the company.

- BCG Matrix Placement: These specialized women's health products are likely categorized as Questions Marks due to their low current market share in a rapidly expanding market, indicating a need for significant investment to capture future growth.

Strategic Investments in Digital Transformation and Automation

Glanbia's strategic investments in digital transformation and automation position it within the question mark quadrant of the BCG matrix. The appointment of a Chief Digital and Transformation Officer and the launch of a group-wide transformation program underscore a commitment to future growth through enhanced efficiencies and digitalization.

These initiatives represent significant capital allocation towards building foundational capabilities. While their immediate impact on market share or direct revenue is not yet fully evident, they are crucial for long-term competitive advantage. For instance, Glanbia's 2023 annual report highlighted increased investment in technology and innovation, a key component of its digital transformation strategy.

- Strategic Focus: Digitalization and automation are key pillars for Glanbia's future growth and operational efficiency.

- Investment Rationale: These are foundational investments aimed at building long-term capabilities rather than immediate market share gains.

- BCG Matrix Placement: Such initiatives typically fall into the question mark category due to high growth potential but uncertain immediate returns.

- Financial Implication: Ongoing capital allocation is required, reflecting the long-term nature of realizing the full benefits of these transformations.

Glanbia's ventures into emerging nutritional areas, such as personalized protein and advanced hydration, are classic examples of question marks. These segments are characterized by high growth potential but currently hold a small market share for Glanbia.

Significant investment in research, development, and marketing is essential for these products to gain traction and potentially become future stars. For instance, Glanbia's 2024 strategic priorities include expanding its offerings in these high-demand niches.

The company's focus on digital transformation and automation also fits the question mark profile. While these investments aim to boost efficiency and competitiveness, their direct impact on market share is not yet established, requiring sustained capital outlay.

| Glanbia's Question Mark Areas | Market Growth Potential | Current Market Share (Estimated) | Investment Focus |

|---|---|---|---|

| Flavor Producers (Acquired April 2024) | High (organic & natural flavors) | Low | Scaling operations, product development |

| Novel Bioactive Ingredients (Creatine, Curcumin, etc.) | High (energy, women's health, aging) | Low | R&D, marketing |

| Personalized Protein & Hydration Solutions | High (tailored health) | Low | Product development, brand awareness |

| Digital Transformation & Automation | High (efficiency, competitiveness) | Nascent | Technology investment, capability building |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Glanbia's financial reports, internal sales figures, and detailed market research to provide a clear strategic overview.