Glanbia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Glanbia Bundle

Glanbia operates in a dynamic global marketplace, and understanding the external forces at play is crucial for strategic success. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that are shaping Glanbia's future. Discover how shifts in consumer preferences, regulatory landscapes, and economic conditions can present both challenges and opportunities for the company.

Gain a competitive edge by leveraging our comprehensive PESTLE analysis of Glanbia. This in-depth report provides actionable intelligence on how global trends are impacting the nutrition and dairy sectors, enabling you to anticipate market changes and refine your own strategies. Download the full version now to unlock critical insights and make more informed business decisions.

Political factors

Glanbia navigates a complex web of global food and nutrition regulations that directly influence its operations. For instance, the European Union's General Food Law (Regulation (EC) No 178/2002) sets stringent standards for food safety and traceability, impacting everything from ingredient sourcing to finished product distribution. Similarly, the US Food and Drug Administration (FDA) mandates detailed labeling requirements, including nutritional information and allergen warnings, which Glanbia must meticulously adhere to across its diverse product lines.

Shifts in these regulatory landscapes, such as the ongoing evolution of front-of-pack nutrition labeling schemes in markets like the UK and Australia, necessitate ongoing adaptation. These changes can affect product formulation to meet new nutrient profiling criteria or require costly packaging redesigns to comply with updated information mandates. Failure to adapt can lead to recalls, fines, and significant damage to brand reputation, as seen with past instances of non-compliance in the food industry.

Glanbia, as a global nutrition company, faces significant exposure to evolving international trade policies and tariffs. Changes in these policies can directly impact the cost of raw materials, such as dairy and grains, and the pricing of finished goods in key markets. For instance, a 2024 report indicated that agricultural tariffs could add an average of 10% to import costs for companies like Glanbia, potentially squeezing profit margins.

Trade disputes and geopolitical tensions can further complicate Glanbia's global operations. Disruptions to established supply chains, like those seen in 2023 due to trade friction between major economic blocs, can lead to increased logistical costs and delays in product delivery. This necessitates agile supply chain management and diversification of sourcing to mitigate risks and maintain market access.

Political instability in key sourcing regions for Glanbia, such as parts of Eastern Europe or Africa, can disrupt the supply of essential ingredients like dairy or grains. For instance, ongoing geopolitical tensions in Eastern Europe, which saw significant trade flow disruptions in 2022-2023, directly impact raw material availability and cost for global food producers.

Changes in government policies, particularly concerning trade tariffs or agricultural subsidies, can also create uncertainty. A shift in agricultural policy in a major sourcing country, for example, could alter Glanbia's cost structure or necessitate changes in its supply chain strategy, impacting its competitive pricing in 2024.

Major political events, like elections in significant consumer markets such as the United States or the European Union, can lead to shifts in consumer confidence and spending habits. Glanbia's performance in 2024 could be influenced by how new administrations approach food safety regulations, labeling requirements, or consumer protection laws.

Agricultural and Dairy Subsidies

Government subsidies and policies directly impact Glanbia's raw material costs, especially for its dairy nutrition segment. For instance, the European Union's Common Agricultural Policy (CAP) provides significant support to dairy farmers, influencing milk prices. In 2024, the CAP continues to be a cornerstone of agricultural support, with ongoing discussions about its future direction and funding levels.

Changes in these subsidies, whether an increase or a reduction, can significantly alter the pricing of key inputs like milk and whey. This directly affects Glanbia's cost of goods sold and its ability to maintain competitive pricing for its extensive range of dairy-based products. For example, a decrease in dairy support could lead to higher raw material expenses, potentially squeezing profit margins if not passed on to consumers.

- Impact on Raw Material Costs: Agricultural and dairy subsidies directly influence the cost of milk and whey, essential inputs for Glanbia.

- Pricing Competitiveness: Fluctuations in subsidy levels can affect Glanbia's ability to price its dairy products competitively in the global market.

- Profitability of Dairy Segment: Changes in government support can have a direct bearing on the profitability of Glanbia's significant dairy nutrition business.

- Policy Uncertainty: Evolving agricultural policies, such as those within the EU's CAP, introduce an element of uncertainty for long-term cost planning.

Public Health Policies and Initiatives

Government public health policies significantly influence consumer choices, impacting companies like Glanbia. For instance, initiatives promoting reduced sugar intake or increased fiber consumption directly affect demand for Glanbia's dairy and sports nutrition products. In 2024, many nations continued to emphasize preventative health measures, with public health spending expected to remain a priority, creating opportunities for Glanbia to align its offerings with these national health agendas.

Glanbia must actively monitor and adapt to evolving public health priorities. Emerging trends, such as the growing consumer interest in plant-based alternatives and functional foods designed to support immunity, are often driven by government-backed health campaigns. By integrating these trends into product development and marketing, Glanbia can tap into new market segments and reinforce its position as a responsive nutrition provider.

- Public Health Spending: Global public health expenditure saw continued growth in 2024, with many governments allocating increased funds towards nutrition education and disease prevention programs.

- Dietary Guidelines: Numerous countries updated their national dietary guidelines in 2024, often emphasizing reduced intake of processed foods, added sugars, and saturated fats, directly impacting the food and beverage industry.

- Health & Wellness Market Growth: The global health and wellness market, including functional foods and beverages, was projected to reach over $4.5 trillion by the end of 2024, indicating strong consumer alignment with health-focused initiatives.

- Plant-Based Demand: Consumer demand for plant-based alternatives continued its upward trajectory in 2024, with market research indicating sustained double-digit growth in this sector, often spurred by health and environmental awareness campaigns.

Government policies on trade and tariffs significantly impact Glanbia's global operations, influencing raw material costs and product pricing. For instance, in 2024, agricultural tariffs continued to be a concern, potentially increasing import costs for key ingredients like dairy and grains by an average of 10%, according to industry reports. Geopolitical tensions and trade disputes can further disrupt supply chains, as observed in 2023, leading to higher logistical expenses and delivery delays.

Political stability in sourcing regions is crucial for Glanbia's ingredient supply. Instability in areas like Eastern Europe, which experienced trade flow disruptions in 2022-2023, directly affects the availability and cost of raw materials. Changes in agricultural subsidies, such as those within the EU's Common Agricultural Policy (CAP), also play a vital role, directly influencing milk and whey prices, which are core inputs for Glanbia's dairy nutrition segment. Policy uncertainty surrounding these subsidies creates planning challenges for cost management and competitive pricing.

Public health policies and government-backed health campaigns are increasingly shaping consumer choices, aligning with Glanbia's focus on nutrition. Initiatives promoting reduced sugar or increased fiber intake, for example, directly influence demand for Glanbia's products. The global health and wellness market was projected to exceed $4.5 trillion by the end of 2024, reflecting strong consumer engagement with health-focused trends, often amplified by government awareness programs.

Major political events, such as elections in key consumer markets like the US or EU, can affect consumer confidence and spending. New administrations may introduce shifts in food safety regulations, labeling requirements, or consumer protection laws, all of which Glanbia must monitor to adapt its strategies. The continued emphasis on preventative health in 2024 means that aligning product development with national health agendas presents significant opportunities for growth.

| Political Factor | Impact on Glanbia | 2024/2025 Relevance |

| Trade Policies & Tariffs | Affects raw material costs and product pricing. | Continued concern over agricultural tariffs potentially increasing import costs by ~10% (industry estimates). |

| Geopolitical Stability | Impacts supply chain reliability and ingredient availability. | Disruptions observed in 2022-2023 due to regional tensions highlight ongoing supply chain risks. |

| Agricultural Subsidies (e.g., CAP) | Influences dairy and grain input costs. | CAP remains a cornerstone of EU support; discussions on future funding levels introduce policy uncertainty. |

| Public Health Initiatives | Shapes consumer demand for healthier products. | Growing consumer alignment with health trends, driven by government campaigns, supports the health and wellness market ($4.5T+ projected for 2024). |

What is included in the product

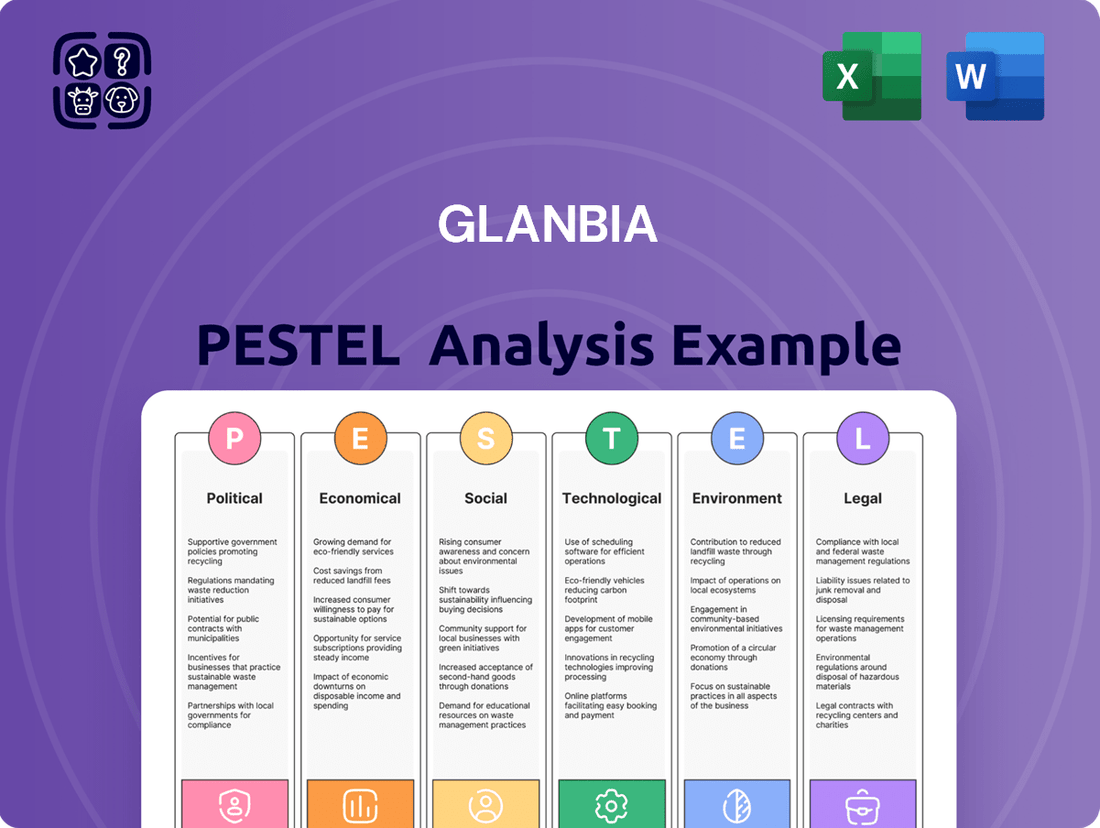

Glanbia's PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations, providing a comprehensive view of the external landscape.

This analysis offers actionable insights for strategic decision-making, highlighting potential risks and growth avenues for Glanbia within its operating markets.

Provides a concise version of Glanbia's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Helps support discussions on external risk and market positioning by offering a clear, summarized Glanbia PESTLE analysis for strategic decision-making.

Economic factors

Global economic growth is a significant driver for Glanbia. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023 but still indicating expansion. This growth directly impacts consumer confidence and their ability to spend on discretionary items like health and nutrition products.

Consumer spending patterns are closely tied to economic conditions. In 2024, while inflation showed signs of moderating in many regions, elevated interest rates continued to put pressure on household budgets. This can lead consumers to prioritize essential spending over premium nutrition products, potentially affecting Glanbia's Performance Nutrition segment, which relies on consumers with disposable income.

Economic slowdowns or recessions pose a direct risk. For example, if a significant market experiences a contraction in GDP, such as a projected 0.5% decline in a specific European country during a hypothetical downturn, it would likely translate to reduced sales volumes for Glanbia. Consumers tend to cut back on non-essential purchases during such periods.

Inflationary pressures are a significant concern for Glanbia, directly impacting its production expenses. For instance, the price of key commodities like whey protein, a core ingredient in many of its products, has seen considerable volatility. Managing these rising input costs is paramount to safeguarding the company's profitability.

Glanbia has explicitly highlighted that elevated whey prices are anticipated to pose a substantial challenge throughout 2025. This necessitates the development and implementation of robust strategies to effectively mitigate the financial impact on the company's bottom line and maintain healthy profit margins.

Currency exchange rate fluctuations significantly impact Glanbia, a global entity operating in over 100 countries. These shifts directly affect its reported revenues and overall profitability due to international trade transactions. For instance, a strengthening US dollar can make Glanbia's products more expensive for international buyers, potentially reducing sales volumes in those markets.

Furthermore, a strong dollar can also increase the cost of raw materials or ingredients that Glanbia imports for its production processes. In 2023, for example, the US dollar experienced periods of strength against various global currencies, which likely presented cost management challenges for multinational corporations like Glanbia, impacting their cost of goods sold and profit margins.

Interest Rates and Access to Capital

Changes in interest rates directly impact Glanbia's cost of borrowing, affecting its ability to finance investments, acquisitions, and day-to-day operations. For instance, if central banks maintain or increase benchmark rates, Glanbia's expenses for securing new loans or refinancing existing debt will likely rise. This increased cost of capital could put a damper on ambitious expansion projects or reduce the expected profitability of new business ventures.

The company's strategic financial maneuvers, such as funding its ongoing transformation program or executing share buyback initiatives, are also sensitive to the prevailing interest rate environment. Higher rates can make debt financing more expensive, potentially leading Glanbia to reassess the timing or scale of these capital-intensive activities. For example, if Glanbia needs to raise significant capital for a major acquisition in 2025, a higher interest rate environment would directly increase the cost of that capital.

Recent trends indicate a fluctuating interest rate landscape. For example, the US Federal Reserve kept its benchmark interest rate in the 5.25%-5.50% range through early 2024, but signals suggest potential rate cuts later in the year or into 2025, which could ease borrowing costs. Conversely, the European Central Bank maintained its key rates at 4.50% in early 2024, with discussions around potential cuts also on the horizon. These shifts directly influence Glanbia's financial planning and the attractiveness of various funding options.

- Borrowing Costs: Higher interest rates increase the expense of debt financing for Glanbia's investments and operations.

- Strategic Initiatives: The cost and feasibility of funding programs like transformation or share buybacks are influenced by interest rate levels.

- Capital Availability: Interest rate changes can affect the overall ease and cost of accessing capital markets for strategic growth.

- Profitability Impact: Increased financing costs due to higher rates can reduce the profitability of new ventures and expansion plans.

Competitive Pricing and Market Saturation

The global nutrition market is a crowded space, with many companies offering very similar products. This high level of competition, particularly in more developed regions, can really squeeze Glanbia's ability to set prices and maintain healthy profit margins. For instance, the sports nutrition segment, a key area for Glanbia, saw significant growth but also increased competition from both established brands and new entrants throughout 2024.

To combat this, Glanbia needs to keep coming up with new and unique products. Staying ahead means not just selling what everyone else does, but offering something special that catches consumers' eyes and keeps them loyal. Market saturation in developed economies means that simply being present isn't enough; distinct value propositions are crucial for holding onto and growing market share. Glanbia's focus on science-backed ingredients and a strong digital presence are key strategies here.

- Intense Competition: The nutrition sector features numerous brands vying for consumer attention, often with comparable product lines.

- Pricing Pressure: Market saturation, especially in North America and Europe, can force price adjustments, impacting profitability.

- Innovation Imperative: Continuous product development and differentiation are vital for Glanbia to stand out and secure market share.

- Developed Market Saturation: As of early 2025, many developed markets show signs of maturity, increasing the challenge of organic growth.

Global economic growth influences Glanbia's performance, with projections for 2024 indicating continued expansion, albeit at a moderated pace. This growth directly affects consumer spending power and their willingness to invest in health and nutrition products. Elevated interest rates in 2024 and early 2025 continue to strain household budgets, potentially shifting consumer priorities towards essentials over premium offerings.

Inflationary pressures remain a key concern, impacting Glanbia's operational costs, particularly for vital ingredients like whey protein. The company anticipates that elevated whey prices will continue to be a significant challenge through 2025, necessitating proactive cost management strategies to protect profit margins. Currency fluctuations also present ongoing risks, as a strong US dollar can increase the cost of imported materials and affect the competitiveness of products in international markets.

The competitive landscape within the global nutrition market is intensifying, with widespread product parity. This saturation, especially in mature markets, exerts downward pressure on pricing and Glanbia's ability to maintain healthy profit margins. Continuous innovation and differentiation are therefore critical for the company to capture and retain market share, with a focus on science-backed ingredients and digital engagement being key strategies as of early 2025.

What You See Is What You Get

Glanbia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Glanbia PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a thorough understanding of the external forces shaping Glanbia's business environment.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights for strategic planning and risk management related to Glanbia's global presence.

Sociological factors

Consumers are increasingly focused on health and wellness, driving demand for products that support active lifestyles. This trend is evident globally, with a significant portion of the population actively seeking out nutritional solutions. For instance, the global sports nutrition market was valued at approximately $60 billion in 2023 and is projected to grow substantially in the coming years.

This heightened health consciousness directly fuels the demand for ingredients and finished goods that promote well-being, such as protein powders, vitamins, and fortified foods. Glanbia's strategic focus on 'better nutrition' and its extensive portfolio of sports nutrition and performance ingredients are well-positioned to capitalize on this evolving consumer preference.

Consumer preferences are increasingly leaning towards plant-based diets and alternative proteins, driven by growing awareness of health benefits, ethical concerns for animal welfare, and environmental sustainability. This shift is a significant sociological trend shaping the food industry.

Glanbia has actively responded to this evolving consumer demand. In 2023, the global plant-based food market was valued at approximately $48.1 billion and is projected to reach $162 billion by 2030, demonstrating substantial growth. Glanbia’s strategic expansion of its vegan sports nutrition portfolio and the development of innovative protein blends directly address this expanding market segment, positioning the company to capitalize on these changing consumer habits.

Global demographics are changing, with many developed nations experiencing an aging population. This trend presents a significant opportunity for Glanbia to innovate in nutritional products that support healthy aging, muscle maintenance, and overall well-being. For instance, in 2024, the global population aged 60 and over was projected to reach 1.2 billion, highlighting a growing market segment.

Furthermore, distinct generational preferences, particularly among Millennials and Gen Z, shape demand for protein and health-focused products. Glanbia needs to develop targeted marketing and product formulations to resonate with these younger demographics, who often prioritize plant-based options and sustainable sourcing. By 2025, it's estimated that Gen Z will represent a substantial portion of consumer spending, making their preferences crucial.

Influence of Social Media and Digital Trends

Social media platforms and digital influencers are increasingly dictating consumer preferences in the nutrition sector. Glanbia needs to harness these channels for effective marketing and to gauge evolving consumer tastes, especially for its consumer-facing brands. This digital shift also necessitates adaptation to new online sales avenues.

The influence of digital trends is undeniable. For instance, by the end of 2024, it's projected that global social commerce sales will reach approximately $2.9 trillion, highlighting the critical importance of online engagement for brands like Glanbia. Understanding how these platforms shape perceptions is key to maintaining market relevance.

- Shaping Consumer Preferences: Digital influencers and social media trends directly impact what consumers seek in nutrition products, from ingredients to lifestyle associations.

- Marketing and Engagement: Glanbia must actively utilize platforms like Instagram, TikTok, and YouTube for targeted marketing campaigns and direct consumer interaction.

- E-commerce Adaptation: The growth of social commerce and direct-to-consumer online sales requires Glanbia to optimize its digital storefronts and online presence.

- Data-Driven Insights: Monitoring social media sentiment and digital trends provides valuable, real-time data on emerging consumer needs and product feedback.

Evolving Consumer Preferences for Convenience and Transparency

Consumers increasingly prioritize convenience, seeking nutrition that fits their busy lifestyles. This trend is evident in the growing demand for ready-to-drink beverages and easily digestible snack formats. For instance, the global functional foods market, which often caters to convenience, was projected to reach over $250 billion by 2024, highlighting a significant shift in purchasing habits.

Alongside convenience, there's a strong push for transparency. Consumers want to know exactly what they are consuming, where it comes from, and how it's made. Brands that offer clear ingredient lists, details on ethical sourcing, and traceable supply chains are building stronger connections with their customer base. In 2023, studies showed that over 70% of consumers considered ingredient transparency a key factor in their purchasing decisions.

- Convenience-driven demand: Growth in ready-to-drink and grab-and-go nutrition products.

- Transparency imperative: Consumers value clear labeling, sourcing information, and ethical production.

- Brand loyalty factors: Transparency and convenience are key drivers for building consumer trust and repeat business.

- Market impact: The functional foods market, a key segment for convenient nutrition, is experiencing substantial growth.

Sociological factors significantly influence Glanbia's market position, driven by evolving consumer priorities. The rising global emphasis on health and wellness, particularly among younger demographics like Gen Z, fuels demand for specialized nutrition products. For instance, the global sports nutrition market was valued at approximately $60 billion in 2023 and continues its upward trajectory. This trend is further amplified by a growing preference for plant-based diets, with the global plant-based food market projected to reach $162 billion by 2030, a substantial increase from its $48.1 billion valuation in 2023. Glanbia's strategic alignment with these shifts, by expanding its vegan offerings and focusing on performance ingredients, positions it favorably to meet these changing consumer needs.

Demographic shifts, such as aging populations in developed countries, create opportunities for products supporting healthy aging and muscle maintenance, a market segment projected to grow as the global population aged 60 and over reaches 1.2 billion in 2024. Furthermore, digital influence and social media trends are paramount, with social commerce sales expected to hit $2.9 trillion by the end of 2024. Glanbia's engagement with these platforms for marketing and consumer insights is crucial for staying relevant and adapting to rapid shifts in consumer preferences, including the demand for convenience in formats like ready-to-drink beverages, within the functional foods market valued at over $250 billion by 2024. Transparency in sourcing and ingredients is also a key differentiator, with over 70% of consumers in 2023 citing it as a critical purchasing factor.

| Sociological Factor | Trend Description | Market Impact/Opportunity | Glanbia's Response/Relevance | Relevant Data (2023-2025) |

| Health & Wellness Focus | Growing consumer emphasis on active lifestyles and nutritional support. | Increased demand for sports nutrition, protein, and performance ingredients. | Glanbia's strong portfolio in sports nutrition and performance solutions. | Global sports nutrition market valued at ~$60 billion (2023). |

| Plant-Based Diets | Shift towards veganism and alternative proteins for health, ethical, and environmental reasons. | Expansion of the plant-based food and protein supplement market. | Glanbia's development of vegan sports nutrition products and protein blends. | Global plant-based food market projected to reach $162 billion by 2030 (from $48.1 billion in 2023). |

| Demographic Shifts (Aging Population) | Increasing proportion of older adults in developed nations. | Demand for products supporting healthy aging, bone health, and muscle maintenance. | Opportunity for Glanbia to innovate in age-specific nutritional solutions. | Global population aged 60+ projected to reach 1.2 billion (2024). |

| Digital Influence & Social Media | Social media and influencers shaping consumer preferences and purchasing behavior. | Importance of targeted digital marketing, e-commerce, and online engagement. | Glanbia's need to leverage digital channels for marketing and consumer insights. | Global social commerce sales projected to reach $2.9 trillion (end of 2024). |

| Convenience & Transparency | Consumer preference for easy-to-consume formats and clear product information. | Growth in ready-to-drink products and demand for transparent sourcing/ingredients. | Glanbia's focus on convenient formats and clear labeling. | Functional foods market projected to exceed $250 billion (2024); >70% consumers prioritize transparency (2023). |

Technological factors

Glanbia benefits significantly from ongoing advancements in food science and ingredient technology, which fuel the development of innovative nutritional products. This includes breakthroughs in protein processing, like improved plant-based protein isolates, and sophisticated flavor encapsulation techniques. The company’s commitment to R&D, evidenced by its 2023 investment of €115 million in innovation and capital expenditure, ensures it remains competitive in leveraging these scientific leaps.

Glanbia's manufacturing operations are increasingly benefiting from automation and digital transformation, leading to enhanced efficiency and cost reduction. For instance, the company's investment in smart factory technologies aims to streamline production lines and improve overall output quality.

The optimization of Glanbia's supply chain through digital tools is a key focus, improving logistics and inventory management. This digital push also enhances productivity, with data analytics playing a crucial role in refining operational strategies and informing better business decisions.

Glanbia's group-wide digital transformation program underpins these technological advancements, signaling a commitment to leveraging cutting-edge solutions. This strategic approach is expected to solidify its competitive edge in the dynamic global food and beverage market.

The surge in e-commerce and direct-to-consumer (DTC) sales has fundamentally reshaped the nutrition product landscape. Glanbia is actively navigating this, prioritizing online and food, drug, and mass (FDM) channels to counter pressures in traditional retail. This strategic pivot is crucial as global e-commerce sales are projected to reach $8.1 trillion by 2024, underscoring the channel's growing significance.

Glanbia's adaptation includes strategic divestments, such as exiting non-core e-commerce ventures, to sharpen its focus on high-growth areas. For instance, in 2023, the company continued to streamline its portfolio, a move that supports its commitment to optimizing its DTC and online presence. This strategic pruning allows for greater investment in capabilities that enhance customer reach and engagement through digital platforms.

Data Analytics and Personalized Nutrition

Glanbia can harness big data and analytics to gain a granular understanding of consumer habits, emerging market shifts, and how its products are performing. This data-driven approach is crucial for developing personalized nutrition offerings that align with individual health objectives and tastes, a significant growth area for the company.

The global personalized nutrition market is projected to reach $25.1 billion by 2027, growing at a compound annual growth rate of 11.7%. Glanbia's investment in data analytics directly supports its strategy to capture a share of this expanding market by tailoring products to specific consumer needs.

- Data-driven product innovation: Glanbia can leverage analytics to identify unmet consumer needs and preferences in the personalized nutrition space.

- Enhanced consumer engagement: Personalized insights can foster stronger customer relationships and loyalty through tailored recommendations and content.

- Optimized marketing strategies: Analyzing consumer data allows for more precise targeting of marketing campaigns, improving ROI.

- Predictive trend analysis: Big data can help Glanbia anticipate future market demands and adapt its product portfolio proactively.

Supply Chain Technologies and Traceability

Technological advancements in supply chain management are critical for companies like Glanbia. Solutions such as blockchain technology and sophisticated logistics software are enhancing traceability, operational efficiency, and overall supply chain resilience. For Glanbia, these tools are vital for optimizing the management of raw materials, inventory levels, and distribution networks, particularly in the face of ongoing global supply chain disruptions.

The integration of these technologies allows Glanbia to gain deeper visibility into its operations. For instance, blockchain can provide an immutable record of product journeys, from farm to fork, ensuring authenticity and quality. Advanced logistics software, including AI-powered route optimization and predictive analytics, helps Glanbia to navigate complexities, reduce transit times, and minimize waste. This technological adoption is not just about efficiency; it's about building a more robust and responsive supply chain capable of withstanding unforeseen challenges, a key consideration for a global food and nutrition company.

- Blockchain adoption in supply chains is projected to grow significantly, with the global market expected to reach $13.96 billion by 2028, up from $1.2 billion in 2021, indicating a strong trend towards enhanced traceability.

- Glanbia's investment in digital transformation initiatives aims to streamline operations, with a focus on leveraging data analytics for improved forecasting and inventory management.

- The increasing demand for transparency in food products, driven by consumer concerns about safety and sustainability, makes advanced traceability technologies a strategic imperative for Glanbia.

Technological advancements are reshaping Glanbia's product development and manufacturing. Innovations in food science, particularly in plant-based proteins and flavor technologies, are key drivers for new product launches. Glanbia's 2023 innovation investment of €115 million highlights its commitment to leveraging these scientific leaps for competitive advantage.

Digital transformation is enhancing Glanbia's operational efficiency through automation and smart factory technologies. This focus on digital tools extends to supply chain optimization, with data analytics playing a vital role in improving logistics and inventory management, thereby boosting overall productivity.

The company is strategically leveraging big data and analytics to understand consumer behavior and personalize nutrition offerings, a market projected to reach $25.1 billion by 2027. Furthermore, technologies like blockchain are being integrated to improve supply chain transparency and resilience, a critical factor in today's global market.

| Technological Factor | Impact on Glanbia | Supporting Data/Trend |

| Food Science & Ingredient Tech | Drives innovation in nutritional products | 2023 Investment: €115 million in innovation & capex |

| Automation & Digitalization | Enhances manufacturing efficiency & cost reduction | Smart factory technologies adoption |

| Data Analytics & Big Data | Enables personalized nutrition & optimized marketing | Global personalized nutrition market to reach $25.1B by 2027 |

| Supply Chain Technologies (e.g., Blockchain) | Improves traceability, efficiency, and resilience | Blockchain market to reach $13.96B by 2028 |

Legal factors

Glanbia operates within a complex web of global food safety and quality regulations, encompassing everything from manufacturing standards to ingredient traceability and product recall procedures. These rules are paramount for safeguarding consumer health and preventing costly legal repercussions. For instance, the company’s commitment to adhering to the European Food Safety Authority (EFSA) guidelines and the U.S. Food and Drug Administration (FDA) regulations ensures product integrity.

Maintaining consumer trust hinges on unwavering compliance with these stringent requirements. Glanbia actively pursues and maintains globally recognized third-party certifications, such as those from the British Retail Consortium (BRC) or the Safe Quality Food (SQF) program, demonstrating its dedication to exceeding baseline legal mandates. In 2024, the global food safety market was valued at over $200 billion, highlighting the significant economic and regulatory landscape companies like Glanbia navigate.

Glanbia must navigate a complex web of labeling and marketing laws, particularly critical for its nutrition and health-focused products. For instance, the European Union's Regulation (EC) No 1924/2006 on nutrition and health claims sets strict guidelines for what can be stated on product packaging, impacting how Glanbia markets its performance nutrition and dairy segments.

Adherence to country-specific regulations on nutritional information, health claims, and allergen declarations is paramount to prevent misrepresentation and potential legal repercussions. In the US, the Food and Drug Administration (FDA) oversees these aspects, with recent updates in 2024 focusing on clearer allergen labeling and updated Nutrition Facts panel requirements, which Glanbia must integrate into its product development and marketing strategies.

Furthermore, advertising standards and consumer protection laws, such as the UK's Advertising Standards Authority (ASA) guidelines, dictate permissible marketing practices. Glanbia's global operations mean it must continuously monitor and adapt to these evolving legal landscapes to ensure its marketing campaigns are both effective and compliant, avoiding penalties that could impact its revenue, which in 2023 reached €4.4 billion.

Glanbia's competitive edge hinges on safeguarding its intellectual property, encompassing unique product formulations, advanced manufacturing techniques, and established brand trademarks. This requires diligent navigation of global patent and trademark regulations, coupled with proactive measures against potential infringements.

In 2023, Glanbia continued to invest in R&D, a critical component for generating and protecting new intellectual property. While specific R&D expenditure figures for IP protection aren't typically disclosed separately, the company's overall investment in innovation underpins its strategy to maintain a technological lead and secure market exclusivity through patents.

Employment and Labor Laws

Glanbia, as a significant global employer, navigates a complex web of employment and labor laws. These regulations cover critical areas such as minimum wage requirements, working hours, health and safety standards, and the provision of employee benefits. For instance, in 2024, many countries are seeing updates to minimum wage laws, impacting payroll costs for companies like Glanbia.

Compliance extends to ensuring fair labor practices and prohibiting discrimination based on race, gender, age, or disability. Glanbia's commitment to these principles is vital for fostering a productive workforce and mitigating the risk of costly litigation.

Key areas of focus for Glanbia’s legal teams include:

- Wage and Hour Compliance: Ensuring adherence to national and regional minimum wage laws and overtime regulations.

- Workplace Safety: Implementing robust health and safety protocols to meet or exceed legal mandates.

- Non-Discrimination and Equal Opportunity: Upholding policies that prevent unfair treatment and promote diversity.

- Employee Benefits and Leave: Complying with laws regarding statutory sick pay, parental leave, and retirement contributions.

Data Privacy and Cybersecurity Regulations

Glanbia, like all companies operating in the digital space, faces stringent data privacy and cybersecurity regulations. The General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States are prime examples, mandating how personal data is collected, processed, and stored. Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher. This increased regulatory scrutiny is a direct response to the growing volume of digital interactions and data collection, making robust cybersecurity measures essential for Glanbia's operations and reputation.

Protecting sensitive customer and business data from evolving cyber threats is paramount. The financial impact of data breaches can be substantial, not only through direct fines but also through reputational damage and loss of customer trust. In 2023, the average cost of a data breach globally reached $4.45 million according to IBM's Cost of a Data Breach Report. With Glanbia's ongoing digital transformation initiatives, such as enhancing its direct-to-consumer channels and leveraging data analytics, the attack surface expands, necessitating continuous investment in advanced cybersecurity protocols and employee training to mitigate risks.

- GDPR Fines: Up to 4% of global annual turnover or €20 million.

- CCPA Impact: Focuses on consumer rights regarding personal information.

- Average Data Breach Cost (2023): $4.45 million globally.

- Digital Transformation Risk: Increased data collection and online presence elevate cybersecurity needs.

Glanbia’s operations are heavily influenced by global food safety and labeling regulations, requiring strict adherence to standards set by bodies like the EFSA and FDA. The company’s 2023 revenue of €4.4 billion underscores the scale of its compliance efforts, especially with evolving US FDA allergen labeling rules introduced in 2024. Maintaining consumer trust through certifications like BRC or SQF is crucial in a market where food safety is valued at over $200 billion globally in 2024.

Environmental factors

Glanbia is actively addressing climate change by setting ambitious greenhouse gas (GHG) emissions reduction targets, validated by the Science Based Targets initiative (SBTi) and aligned with the critical goals of the Paris Agreement. This commitment translates into substantial investments and strategic initiatives across its operations and, crucially, its extensive dairy supply chain.

In its 2023 sustainability report, Glanbia detailed progress in curbing its Scope 1 and Scope 2 emissions, demonstrating a tangible effort to improve environmental performance. For instance, the company reported a 10.4% reduction in its absolute Scope 1 and 2 GHG emissions in 2023 compared to its 2022 baseline, reaching 159.2 ktCO2e.

Water is absolutely essential for Glanbia's operations, particularly in dairy and food production where it's used for everything from cleaning to processing. Recognizing this, Glanbia has established specific goals to cut down on how much fresh water they use and to make their consumption more efficient, especially in areas where water is already scarce. For instance, as of their 2023 reporting, they were working towards a 15% reduction in freshwater withdrawal intensity by 2025 compared to a 2019 baseline across their sites.

Responsible water management is a major part of Glanbia's environmental plan. This includes not just reducing usage but also focusing on treating wastewater effectively and exploring ways to reuse water within their facilities. This approach helps them minimize their environmental footprint and ensures they are being good stewards of this vital resource, particularly important as global water stress continues to be a concern.

Glanbia is actively pursuing waste reduction, targeting TRUE Zero Waste certification by 2025 and a substantial decrease in food waste by 2030. This commitment is being realized through the adoption of circular economy principles, focusing on reducing, reusing, and recycling packaging materials throughout its supply chain.

Sustainable Packaging Requirements

Consumers and regulators are increasingly demanding eco-friendly packaging. This trend is pushing companies like Glanbia to rethink their material choices and design processes. The focus is on reducing waste and minimizing environmental impact throughout the product lifecycle.

Glanbia has set a significant target: by 2030, all its consumer packaging must be either recyclable, reusable, or compostable. This commitment directly addresses environmental concerns and aligns with global sustainability goals. Achieving this will require substantial investment in new materials and potentially redesigning product lines.

- Consumer Demand: Growing consumer preference for brands with sustainable practices.

- Regulatory Pressure: Increasing legislation worldwide mandating reduced plastic use and improved recyclability.

- Glanbia's 2030 Goal: 100% of consumer packaging to be recyclable, reusable, or compostable.

- Industry Trend: Shift towards circular economy principles in packaging design and material sourcing.

Responsible Sourcing and Biodiversity Protection

Glanbia's commitment to sustainability is deeply intertwined with its sourcing practices, especially for dairy, a core ingredient. The company actively engages with suppliers to promote responsible farming, focusing on animal welfare and the crucial aspect of soil health. This approach is vital for long-term supply chain resilience and environmental stewardship.

Protecting biodiversity is another key pillar of Glanbia's environmental strategy. By encouraging sustainable farming methods among its suppliers, Glanbia aims to minimize its ecological footprint and contribute to the preservation of natural habitats. This focus is increasingly important as consumers and regulators demand greater environmental accountability from food producers.

To bolster these efforts, Glanbia partners with organizations like EcoVadis, a leading platform for assessing business sustainability. These collaborations are instrumental in developing and refining robust sourcing programs that meet high environmental and social standards. For instance, in 2023, Glanbia reported that 84% of its total dairy volume was sourced from suppliers participating in its sustainability programs, a significant increase from previous years.

Glanbia's sustainability goals also encompass reducing greenhouse gas emissions from its supply chain. By working with farmers on practices like improved manure management and optimized fertilizer use, the company targets a reduction in emissions intensity. This aligns with broader climate action goals and enhances the environmental profile of its products.

Glanbia is actively tackling climate change with science-based targets for greenhouse gas (GHG) reduction, aiming for alignment with the Paris Agreement. This commitment is evident in their 2023 sustainability report, which showed a 10.4% reduction in absolute Scope 1 and 2 GHG emissions compared to a 2022 baseline, reaching 159.2 ktCO2e.

Water stewardship is a priority, with Glanbia aiming for a 15% reduction in freshwater withdrawal intensity by 2025 from a 2019 baseline. They are also focusing on efficient water use and wastewater treatment to minimize impact, especially in water-scarce regions.

Waste reduction is another key environmental focus, with Glanbia targeting TRUE Zero Waste certification by 2025 and a significant reduction in food waste by 2030, embracing circular economy principles for packaging.

The company is committed to making 100% of its consumer packaging recyclable, reusable, or compostable by 2030, responding to increasing consumer demand for sustainable products and regulatory pressures on plastic use.

| Environmental Factor | Glanbia's Commitment/Action | Key Data/Target |

|---|---|---|

| Climate Change | GHG emissions reduction | 10.4% reduction in Scope 1 & 2 emissions (2023 vs 2022) |

| Water Management | Reduce freshwater withdrawal intensity | Targeting 15% reduction by 2025 (vs 2019 baseline) |

| Waste & Packaging | Reduce waste, improve packaging sustainability | 100% recyclable, reusable, or compostable packaging by 2030; TRUE Zero Waste by 2025 |

| Sustainable Sourcing | Promote responsible farming, biodiversity | 84% of dairy volume from sustainability program suppliers (2023) |

PESTLE Analysis Data Sources

Our Glanbia PESTLE analysis is built on a comprehensive review of data from reputable sources including government publications, international organizations, and leading market research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are well-researched and current.