Glanbia Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Glanbia Bundle

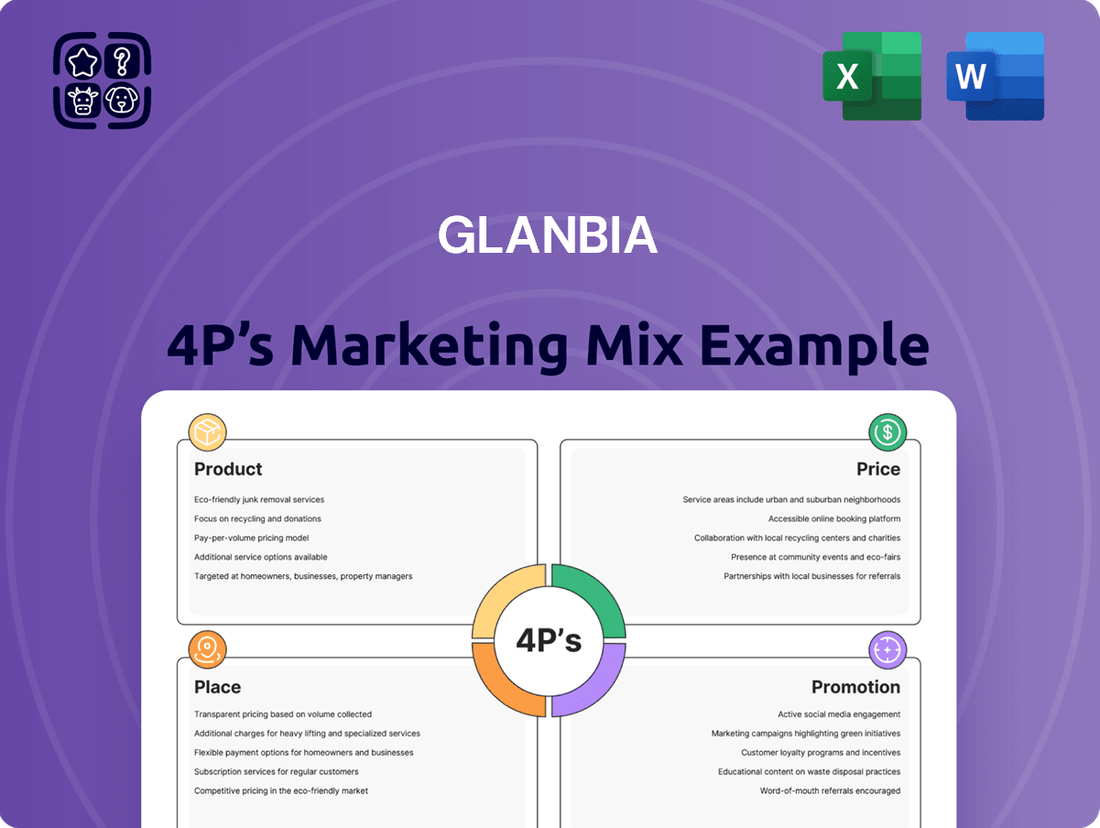

Glanbia's marketing success hinges on a carefully crafted 4Ps strategy, from its diverse product portfolio to its strategic pricing and widespread distribution. Understanding how they leverage promotion to connect with consumers is key to their market dominance.

Dive deeper into Glanbia's winning formula by exploring their product innovation, pricing tactics, distribution channels, and promotional campaigns. Get the full, editable analysis to unlock actionable insights for your own business.

Product

Glanbia's diverse product portfolio spans sports nutrition, healthy snacking, and dairy, catering to a wide array of consumer needs. This breadth is exemplified by its strong presence in the sports nutrition market with flagship brands such as Optimum Nutrition and Isopure, renowned for their high-quality protein powders and convenient ready-to-drink options. In 2023, Glanbia's performance nutrition segment, which includes these key brands, continued to be a significant revenue driver.

Beyond direct-to-consumer offerings, Glanbia also plays a crucial role as a supplier of nutritional ingredients and premixes to other food and beverage manufacturers. This B2B segment allows the company to address diverse health and wellness trends across the industry, further expanding its market reach and impact. The company's commitment to innovation in nutritional solutions is a cornerstone of its strategy.

Glanbia's product strategy heavily emphasizes protein and performance nutrition, a cornerstone of its Performance Nutrition segment. This focus is evident in flagship brands such as Optimum Nutrition's Gold Standard 100% Whey, a market leader, and Isopure's specialized low-carb protein powders, catering to specific dietary needs.

Innovation is key, with Glanbia actively researching and developing new protein sources, including a growing range of plant-based alternatives and added functional ingredients to enhance performance and recovery. This commitment to evolving product offerings reflects the dynamic consumer demand in the health and wellness sector.

Glanbia's innovation in health and wellness ingredients extends beyond its consumer brands, positioning it as a vital supplier of nutritional components like dairy, non-dairy alternatives, and vitamin/mineral premixes. The company's commitment to science-backed development fuels tailor-made solutions addressing the dynamic consumer drive for improved health and well-being.

This focus includes pioneering research into bioactive ingredients designed for specific benefits such as enhanced energy levels, effective weight management, and targeted support for women's health. Glanbia Nutritionals reported a strong performance in 2023, with its Ingredients segment contributing significantly to the group's overall success, reflecting robust demand for these specialized offerings.

Strategic Portfolio Optimization

Glanbia's strategic portfolio optimization is a key element of its marketing mix, focusing on enhancing core strengths and divesting non-essential assets. This approach ensures resources are allocated to areas with the highest potential for future growth and profitability.

Recent strategic moves underscore this commitment. The acquisition of Flavor Producers in late 2023 significantly bolsters Glanbia's ingredient solutions segment, particularly in flavor development, a critical component for consumer product innovation.

Conversely, Glanbia has strategically exited underperforming or non-core brands. The divestment of SlimFast and Body & Fit in 2023 and early 2024, respectively, generated significant capital and allowed for a more concentrated investment in its performance nutrition and health ingredient businesses. These strategic adjustments are designed to improve overall financial performance and market positioning.

- Portfolio Realignment: Glanbia is actively managing its product offerings to align with market trends and growth opportunities.

- Acquisition Strategy: The integration of Flavor Producers enhances Glanbia's capabilities in a key growth area.

- Divestment Strategy: Exiting non-core businesses like SlimFast and Body & Fit streamlines operations and improves focus.

- Financial Impact: These strategic decisions are aimed at optimizing resource allocation and driving shareholder value.

Addressing Evolving Consumer Trends

Glanbia's product development actively addresses shifting consumer demands, exemplified by the significant growth in the plant-based protein sector. For instance, the global plant-based protein market was valued at approximately USD 50.5 billion in 2023 and is projected to reach USD 131.3 billion by 2030, growing at a CAGR of 14.5%.

The company prioritizes personalized nutrition, recognizing consumers' desire for tailored health solutions. This focus is crucial as the personalized nutrition market is expected to grow substantially, with projections indicating a market size of over USD 20 billion by 2027.

Glanbia's commitment to clean label products, featuring simple and recognizable ingredients, also resonates with consumer preferences for transparency and healthier options. This trend is supported by market data showing a strong consumer preference for products with fewer artificial ingredients.

- Plant-Based Growth: Glanbia's innovation pipeline reflects the robust expansion of the plant-based food and beverage market.

- Personalized Nutrition Demand: The company is investing in solutions that cater to individual dietary needs and health goals.

- Clean Label Appeal: Product formulations are increasingly focused on natural ingredients and minimal processing to meet consumer expectations.

Glanbia's product strategy centers on its performance nutrition and health ingredient segments, driven by innovation and strategic portfolio management. Flagship brands like Optimum Nutrition offer high-quality protein, while the ingredients division supplies vital nutritional components. The company is actively expanding into plant-based alternatives and personalized nutrition solutions, responding to evolving consumer demands.

| Brand/Segment | Key Product Focus | Market Trend Alignment | 2023 Performance Highlight |

|---|---|---|---|

| Optimum Nutrition | Whey protein, performance supplements | Growth in sports nutrition | Continued revenue driver |

| Isopure | Low-carb, specialized protein | Dietary specificity | Caters to niche needs |

| Glanbia Nutritionals (Ingredients) | Dairy, plant-based proteins, premixes | Health & wellness ingredients, B2B supply | Strong contribution to group success |

| Plant-Based Innovations | Alternative protein sources | Plant-based protein market growth (USD 50.5B in 2023) | Key area for R&D |

What is included in the product

This analysis provides a comprehensive examination of Glanbia's marketing strategies, detailing their approach to Product, Price, Place, and Promotion.

It offers a deep dive into Glanbia's actual brand practices and competitive positioning, making it ideal for marketers and consultants seeking strategic insights.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of information overload for Glanbia's marketing teams.

Provides a clear framework to identify and address potential market gaps, easing concerns about competitive positioning and growth opportunities.

Place

Glanbia leverages a robust global distribution network, reaching both individual consumers and major food and beverage manufacturers across continents. This expansive infrastructure ensures their diverse product portfolio, from nutritional ingredients to consumer health products, is readily available in key international markets, facilitating broad market penetration.

In 2023, Glanbia's branded consumer business, a significant portion of its global reach, saw strong performance, with brands like Optimum Nutrition and SlimFast contributing to its international presence. The company's strategic focus on expanding its direct-to-consumer channels further solidifies this global distribution capability, aiming for enhanced customer accessibility and engagement.

Glanbia's consumer brands thrive on a multi-channel retail strategy, ensuring broad accessibility. Products are strategically placed in specialty stores, major online marketplaces, and traditional food, drug, mass, and club retail environments. This widespread distribution is crucial for reaching a diverse customer base.

The company further strengthens its market presence through direct-to-consumer (DTC) e-commerce, offering a personalized shopping experience. This DTC channel, as of early 2024, continues to be a significant growth driver, complementing its traditional retail partnerships. For instance, Glanbia's online sales saw a notable increase in 2023, reflecting the growing consumer preference for digital purchasing.

Glanbia Nutritionals, the company's ingredients division, primarily engages in a direct-to-business (B2B) model. They supply essential nutritional and functional ingredients to food and beverage manufacturers worldwide.

This B2B focus is supported by dedicated sales teams and a sophisticated supply chain infrastructure designed to meet the demands of industrial-scale clients. In 2023, Glanbia's Performance Nutrition segment, which includes many B2B ingredient sales, reported net sales of €1.8 billion, highlighting the scale of their operations.

Strategic Partnerships and Joint Ventures

Glanbia actively pursues strategic partnerships and joint ventures to bolster its market standing and streamline operations. A prime example is its significant US joint venture focused on cheese and dairy nutrition, which significantly expands its reach and distribution efficiency.

These alliances are crucial for tapping into specialized market segments and optimizing supply chain logistics, thereby enhancing Glanbia's competitive edge. For instance, in 2023, Glanbia’s performance nutrition segment, a key area for such collaborations, saw strong growth, contributing to the company's overall positive financial performance.

- US Joint Venture: Glanbia's US cheese and dairy nutrition joint venture enhances its market penetration and distribution networks.

- Market Access: Partnerships facilitate access to niche markets and specialized consumer bases.

- Operational Efficiency: Collaborations improve logistics and supply chain management, reducing costs and increasing speed to market.

- Growth Driver: Strategic alliances are instrumental in driving growth, particularly within Glanbia's performance nutrition division, which reported robust sales in 2023.

Supply Chain Efficiency and Optimization

Glanbia's commitment to supply chain efficiency is a cornerstone of its marketing mix, ensuring timely and cost-effective product availability. The company actively manages inventory levels, aiming to balance stock to meet demand without incurring excessive holding costs. This focus is critical for maintaining competitive pricing and customer satisfaction.

To achieve this, Glanbia is implementing new operating models designed to streamline its business processes and boost overall efficiency. These initiatives are geared towards reducing lead times and improving the flow of both raw ingredients and finished goods. For instance, in 2023, Glanbia reported a 5.1% increase in its Own Brand sales, underscoring the importance of a robust supply chain to support this growth.

- Inventory Management: Glanbia employs advanced forecasting and stock control systems to optimize inventory levels across its network, minimizing both stockouts and overstock situations.

- Logistics Optimization: The company invests in logistics infrastructure and partnerships to ensure efficient transportation and warehousing, reducing delivery times and costs.

- Operating Model Innovation: Glanbia is piloting and rolling out new operational frameworks aimed at enhancing agility and responsiveness within its supply chain operations.

- Sustainability Integration: Efficiency efforts also extend to environmental impact, with a focus on reducing waste and emissions throughout the supply chain.

Glanbia's place strategy is characterized by a dual approach: extensive global distribution for its consumer brands and direct engagement for its nutritional ingredients. This ensures broad accessibility for end-users while facilitating tailored solutions for business clients.

The company's consumer products are available through a multi-channel retail strategy, encompassing online marketplaces, specialty stores, and traditional grocery outlets. This widespread availability is key to capturing diverse customer segments.

Glanbia Nutritionals, conversely, operates on a direct-to-business (B2B) model, supplying ingredients to food and beverage manufacturers globally. This B2B focus is supported by dedicated sales and robust supply chain infrastructure.

Strategic partnerships and joint ventures, such as its US cheese and dairy nutrition venture, further enhance Glanbia's market reach and operational efficiency, particularly within its performance nutrition division.

| Segment | Distribution Channel Focus | Key Markets/Examples |

|---|---|---|

| Consumer Brands (e.g., Optimum Nutrition, SlimFast) | Multi-channel Retail (Online, Specialty Stores, Mass Retail) | Global, with strong presence in North America, Europe, and Asia |

| Glanbia Nutritionals (Ingredients) | Direct-to-Business (B2B) | Global food and beverage manufacturers |

| Performance Nutrition | Global Retail & E-commerce | Reported net sales of €1.8 billion in 2023 |

Same Document Delivered

Glanbia 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Glanbia 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you get precisely what you need to understand Glanbia's marketing strategy.

Promotion

Glanbia heavily invests in marketing to bolster its key brands, with a significant focus on Optimum Nutrition. This strategy aims to cement Optimum Nutrition's position as the leading global sports nutrition brand.

In 2023, Glanbia's marketing expenditure supported brand building initiatives, contributing to the continued global recognition of its portfolio. These efforts are designed to elevate brand recall and foster enduring customer relationships.

Glanbia leverages digital marketing extensively, particularly for its performance nutrition segment. This includes robust social media engagement and targeted online advertising campaigns designed to highlight product benefits and unique selling propositions to health-conscious consumers.

In 2023, Glanbia reported strong digital sales growth, with online channels becoming increasingly significant for customer acquisition and retention. For instance, their Optimum Nutrition brand saw a substantial uplift in engagement through influencer collaborations and content marketing on platforms like Instagram and TikTok.

The company's online strategy focuses on building communities and fostering direct relationships with consumers. This approach is crucial for conveying the science-backed benefits of their products and differentiating them in a competitive market, as evidenced by the over 15% year-over-year increase in website traffic for key brands in late 2024.

Glanbia excels at targeted communication, crafting distinct promotional messages for its varied customer segments. This approach ensures that whether engaging with individual consumers focused on sports nutrition or B2B clients needing specialized food ingredients, the messaging hits home.

The company highlights specific benefits like improved wellness, enhanced athletic performance, or unique functional attributes of its ingredients, directly addressing the needs and aspirations of each group. For instance, in 2024, Glanbia's consumer brands likely emphasized performance gains and recovery, while its B2B communications would focus on innovation and supply chain reliability.

Public Relations and Industry Presence

Glanbia actively cultivates its industry standing through robust public relations and strategic participation in key sector events. This approach underscores their commitment to sharing progress in nutritional science, environmental stewardship, and groundbreaking product development. For instance, in 2023, Glanbia's participation in major health and wellness expos across Europe and North America highlighted their latest performance nutrition innovations, drawing significant media attention and reinforcing their brand narrative.

Their public relations efforts are instrumental in shaping perceptions, positioning Glanbia as a reliable leader in the global nutrition landscape. By proactively communicating advancements, such as their 2024 sustainability targets which aim for a 30% reduction in Scope 1 and 2 greenhouse gas emissions by 2030, the company builds trust and credibility with stakeholders.

- Industry Event Engagement: Glanbia consistently participates in major nutrition and health conferences, showcasing new product lines and research findings.

- Public Relations Focus: Communications highlight advancements in nutritional science, sustainability initiatives, and product innovation to build brand reputation.

- Reputation Building: These efforts solidify Glanbia's image as a trusted and forward-thinking global nutrition company.

- Sustainability Communication: Publicly shared sustainability goals, like the 2030 emissions reduction targets, demonstrate corporate responsibility and attract environmentally conscious consumers and investors.

Leveraging Health and Wellness Trends in Messaging

Glanbia's promotional strategies heavily lean into the booming health and wellness sector, a smart move given its robust growth. Messaging consistently highlights the nutritional advantages of their products and the quality of their ingredients, directly appealing to consumers increasingly focused on well-being. This approach taps into a significant market shift, as evidenced by the global health and wellness market projected to reach over $7 trillion by 2025, with nutritional products forming a substantial segment.

The company effectively communicates how its offerings support diverse nutritional needs across different life stages and personal health objectives. For instance, campaigns might feature athletes using their protein powders for recovery or families incorporating their fortified dairy products into daily diets for essential nutrients. This targeted messaging resonates with consumers actively seeking solutions for improved physical performance, healthy aging, and overall vitality.

- Consumer Demand: Global health and wellness market expected to exceed $7 trillion by 2025.

- Product Alignment: Glanbia's portfolio, including Performance Nutrition and Nutrition & Health, directly addresses this trend.

- Messaging Focus: Emphasis on nutritional benefits for various life stages and fitness goals.

- Market Penetration: Strong alignment allows Glanbia to capture a significant share of health-conscious consumers.

Glanbia's promotional efforts are deeply intertwined with its digital-first strategy, particularly for its performance nutrition brands like Optimum Nutrition. They leverage social media, influencer marketing, and targeted online advertising to connect with health-conscious consumers, driving significant engagement and online sales growth. This digital focus is crucial for building brand communities and communicating the science-backed benefits of their products, as seen in the substantial website traffic increases for key brands in late 2024.

Price

Glanbia utilizes a competitive pricing strategy, carefully balancing market demand, competitor pricing, and the inherent value of its nutritional products. This approach ensures their offerings are both appealing and readily available to their target consumers.

Glanbia's pricing for its nutritional ingredients, like those used in sports nutrition or infant formula, is likely anchored in the value they deliver to manufacturers. This means prices aren't just based on cost, but on how much those ingredients enhance the final product's performance, health benefits, or brand appeal for the end consumer. For instance, a high-purity whey protein isolate that improves texture and bioavailability might command a premium over a standard concentrate.

This value-based strategy is crucial in B2B markets where ingredient quality directly impacts a manufacturer's product differentiation and market share. Glanbia's focus on innovation and scientific backing for its ingredients, such as patented micronized whey protein, supports this premium positioning. In 2023, Glanbia reported strong performance in its Global Nutrition segment, with revenue growth reflecting the demand for high-quality, functional ingredients that justify a value-based pricing model.

Glanbia's pricing strategy is significantly shaped by input cost inflation, with the rising cost of key ingredients like whey being a prime example. For instance, in 2023, global dairy commodity prices, including whey, experienced volatility, directly impacting production expenses.

To counter these pressures, Glanbia focuses on a dual approach: strategic price adjustments to reflect increased costs and robust operational efficiencies to streamline processes and reduce internal expenditure. This allows them to maintain profitability while managing market dynamics.

Strategic Adjustments and Portfolio Optimization

Glanbia actively refines its product portfolio through strategic pricing adjustments and divestitures. A prime example is the divestment of SlimFast, a brand that encountered significant headwinds due to evolving consumer preferences and intense competition in the weight management sector. This move allows Glanbia to reallocate capital and management focus towards areas demonstrating stronger growth potential and profitability.

These strategic portfolio adjustments directly impact pricing strategies by concentrating on brands with clearer competitive advantages and pricing power. For instance, Glanbia's Performance Nutrition segment, which includes brands like Optimum Nutrition, often commands premium pricing due to strong brand equity and innovation. This focus on high-margin categories supports overall revenue growth and profitability.

- Divestment of SlimFast: Glanbia completed the sale of the SlimFast business in early 2023, a move aimed at simplifying its portfolio and improving overall financial performance.

- Focus on Growth Segments: The company continues to invest in and prioritize its Performance Nutrition and Better Nutrition segments, which exhibit robust market demand and higher margin potential.

- Pricing Power in Key Categories: Glanbia leverages its strong brand presence in categories like sports nutrition to maintain and potentially increase pricing, reflecting product innovation and consumer loyalty.

Shareholder Returns and Capital Allocation

Glanbia's commitment to shareholder returns is a key aspect of its capital allocation strategy. The company's financial performance, including its revenue and profitability, directly informs how it balances reinvestment in the business with returning value to its owners.

In 2023, Glanbia reported a strong financial performance. For instance, its adjusted earnings per share (EPS) saw a notable increase, driven by strategic growth initiatives and operational efficiencies. This financial health allows for a robust approach to capital deployment.

- Glanbia's 2023 performance demonstrated revenue growth and improved profitability, enabling strategic capital allocation.

- The company actively returns value to shareholders through a combination of dividends and share buyback programs.

- This approach signifies a balanced strategy, prioritizing both business investment and direct shareholder rewards.

- For example, Glanbia's dividend per share for 2023 reflected its confidence in sustained earnings and cash flow generation.

Glanbia employs a value-based pricing strategy, particularly for its nutritional ingredients, where price reflects the enhanced performance and health benefits they offer to manufacturers. This is evident in their Performance Nutrition segment, where brands like Optimum Nutrition command premium pricing due to strong brand equity and innovation. For example, Glanbia's 2023 financial results showed revenue growth, partly supported by the demand for these high-value ingredients.

| Pricing Strategy Element | Description | Impact on Glanbia |

| Value-Based Pricing | Prices reflect the benefits and quality of ingredients for B2B customers. | Supports premium positioning and profitability in segments like Performance Nutrition. |

| Competitive Pricing | Balancing market demand, competitor pricing, and product value. | Ensures appeal and availability to target consumers across various markets. |

| Input Cost Management | Adjusting prices due to rising costs of raw materials like whey. | Requires strategic price adjustments and operational efficiencies to maintain margins. |

4P's Marketing Mix Analysis Data Sources

Our Glanbia 4P's Marketing Mix Analysis leverages a comprehensive suite of data sources, including annual reports, investor presentations, and official company press releases. We also incorporate insights from industry-specific market research reports and competitor benchmarking to ensure a thorough understanding of Glanbia's strategic positioning.