Glanbia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Glanbia Bundle

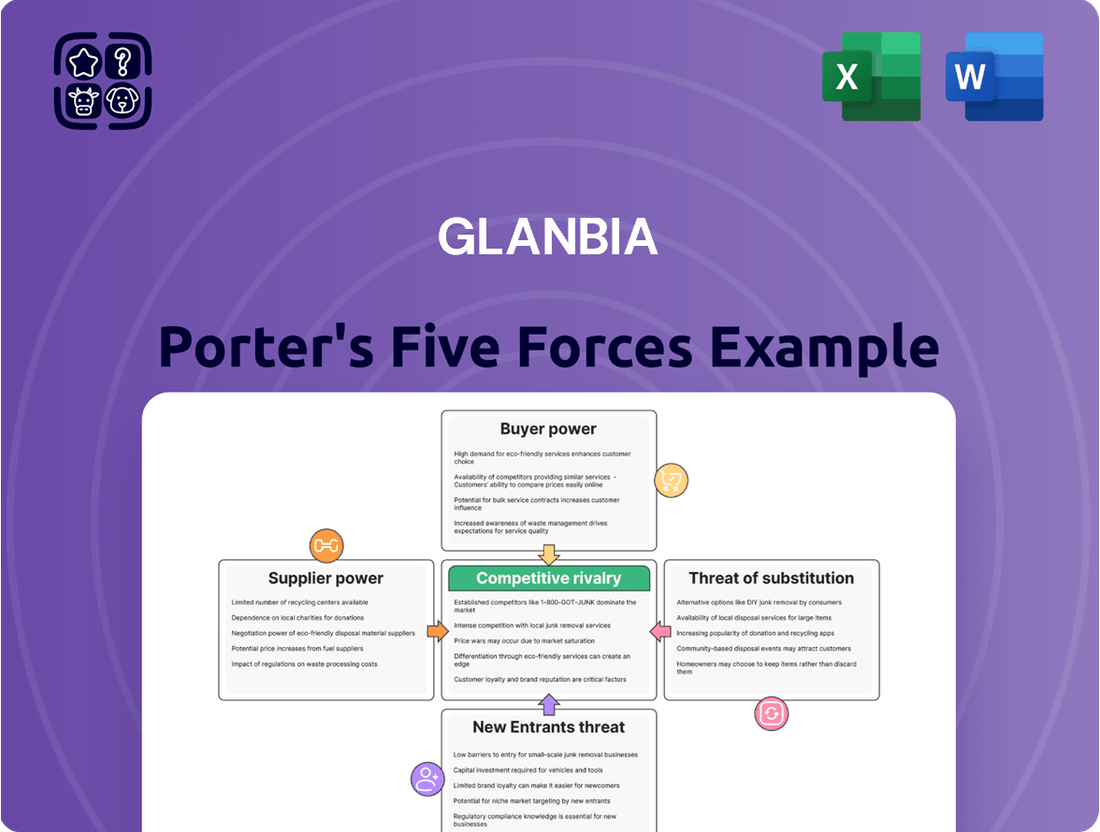

Glanbia's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers and suppliers to the ever-present threat of new entrants and substitutes. Understanding these dynamics is crucial for any stakeholder. The full Porter's Five Forces Analysis dives deep into each of these pressures, providing a comprehensive strategic overview of Glanbia's market position.

Ready to move beyond the basics? Get a full strategic breakdown of Glanbia’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Glanbia's reliance on essential raw materials like dairy, specifically milk and whey, places it at the mercy of its suppliers. A concentrated supplier base, where a few major players control the market, can significantly amplify their bargaining power. This is particularly true for specialized ingredients such as high-quality whey protein, where Glanbia might have fewer alternatives.

The global dairy ingredients market is a substantial and growing sector, expected to expand from $74.85 billion in 2024 to $80.38 billion in 2025. This growth is fueled by increasing demand for nutritional products, including specialized proteins like whey protein, which Glanbia heavily utilizes. If these key dairy suppliers are few and large, they can dictate terms, impacting Glanbia's costs and ingredient availability.

Glanbia anticipates navigating short-term input cost inflation in 2025, especially within its Performance Nutrition segment. This is largely driven by unprecedented cost increases for whey protein, a key ingredient. This situation highlights the significant bargaining power held by suppliers of such essential components, enabling them to push prices higher and directly affect Glanbia's profit margins.

The uniqueness of ingredients plays a crucial role in supplier bargaining power. For highly specialized or proprietary nutritional ingredients, suppliers often hold significant sway because there are few, if any, readily available substitutes. This is particularly relevant for Glanbia, given its strategic focus on what it terms 'better nutrition brands and ingredients,' which inherently implies a reliance on inputs that may not be easily sourced elsewhere.

Switching Costs for Glanbia

Glanbia's reliance on specialized ingredients or proprietary technologies from certain suppliers can significantly elevate switching costs. If Glanbia has deeply integrated specific supplier inputs into its production processes or product formulations, the expense and operational disruption involved in finding and qualifying alternative suppliers can be substantial. This dependency grants those suppliers greater leverage in price negotiations and contract terms.

Glanbia's strategic initiatives, such as its multi-year transformation program focused on efficiency and portfolio optimization, likely include efforts to diversify its supplier base and reduce dependence on single sources. By actively managing these relationships and exploring alternative sourcing options, Glanbia aims to mitigate the bargaining power of its suppliers and ensure greater supply chain flexibility. For instance, in 2023, Glanbia reported a focus on strengthening its supply chain resilience, which would inherently involve addressing supplier dependencies.

- High Switching Costs: Glanbia faces elevated switching costs if its operations are heavily tied to specific supplier ingredients or technologies, making it difficult and expensive to change suppliers.

- Supplier Leverage: This dependency directly increases the bargaining power of existing suppliers, enabling them to potentially dictate terms and pricing.

- Mitigation Efforts: Glanbia's ongoing transformation programs are designed to reduce these dependencies through diversification and optimization of its supplier relationships.

Supplier's Forward Integration Threat

The threat of suppliers engaging in forward integration, meaning they could start producing Glanbia's finished nutritional ingredients or consumer goods themselves, can significantly boost their bargaining power. This risk is generally less pronounced for suppliers of basic raw materials, but it becomes a more tangible concern when dealing with providers of specialized, high-value ingredients that are critical to Glanbia's product lines.

For instance, consider the dairy sector where Glanbia is a major processor. If a large dairy cooperative, a key supplier of milk, were to invest in its own advanced processing facilities to create specialized whey proteins or other nutritional ingredients, it could directly challenge Glanbia's market position. Glanbia's own substantial presence in the ingredient and consumer product space can also shape these supplier dynamics, potentially making some suppliers more hesitant to pursue integration due to Glanbia's own competitive capabilities.

- Supplier Forward Integration: Suppliers may leverage their expertise to produce Glanbia's finished goods, increasing their leverage.

- Specialized Ingredient Risk: The threat is higher for suppliers of unique or proprietary nutritional components.

- Glanbia's Market Position: Glanbia's own scale in ingredient production can influence supplier integration decisions.

Glanbia's bargaining power with suppliers is influenced by the concentration of its supplier base and the uniqueness of the ingredients it sources. A limited number of suppliers for critical components like whey protein can give these suppliers significant leverage, impacting Glanbia's costs and availability of raw materials. This was evident in 2025 with reported cost increases for whey protein affecting the Performance Nutrition segment.

The global dairy ingredients market, valued at $74.85 billion in 2024, is expected to grow, driven by demand for nutritional products. This growth, coupled with Glanbia's reliance on specialized ingredients, means suppliers of these unique inputs hold considerable power. Glanbia's efforts to diversify its supplier base and optimize its supply chain are crucial for mitigating this supplier influence.

| Factor | Impact on Glanbia | Mitigation Strategy |

| Supplier Concentration | High leverage for few suppliers of key ingredients (e.g., whey protein) | Supplier diversification, strengthening supply chain resilience |

| Ingredient Uniqueness | Elevated switching costs for specialized or proprietary ingredients | Exploring alternative sourcing, managing supplier relationships |

| Forward Integration Risk | Potential for specialized ingredient suppliers to enter Glanbia's market | Leveraging Glanbia's own market position to influence supplier decisions |

What is included in the product

This analysis dissects Glanbia's competitive environment by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitute products.

Instantly identify and mitigate competitive threats by visualizing Glanbia's Porter's Five Forces with a dynamic dashboard, allowing for proactive strategy adjustments.

Customers Bargaining Power

Glanbia's strength lies in its diverse customer base, which includes everyday consumers of its sports nutrition and healthy snacking brands, as well as major food and beverage manufacturers who utilize Glanbia's ingredients. This wide reach, serving millions of individuals and numerous large businesses, inherently reduces the bargaining power of any single customer or customer group.

For Glanbia's consumer-facing products, particularly in sports nutrition and healthy snacks, the price sensitivity of individual consumers is a significant factor. In a crowded marketplace, this can constrain the company's ability to absorb and pass on rising production costs.

The healthy snack sector, while influenced by trends like disposable income and changing consumer tastes, consistently sees price as a primary driver of purchasing decisions. For instance, in 2024, reports indicated that over 60% of consumers consider price when choosing snack products, directly impacting Glanbia's pricing strategies.

Glanbia's customers, particularly large global food and beverage manufacturers, wield considerable bargaining power. Their substantial order volumes allow them to negotiate favorable terms, and their ability to switch between ingredient suppliers further strengthens their position. For instance, major players in the dairy and nutrition sectors, who represent a significant portion of Glanbia's B2B clientele, often have the scale to demand price concessions or customized product specifications.

Availability of Substitutes for Customers

The availability of substitutes significantly impacts Glanbia's bargaining power with its customers. Consumers and businesses alike can readily find alternative nutritional ingredients and finished products. This wide array of choices means customers are not heavily reliant on Glanbia, thereby enhancing their negotiating leverage. For instance, the healthy snacks market, a key area for Glanbia, is characterized by intense competition, with numerous vendors offering comparable products. In 2024, the global healthy snacks market was valued at over $115 billion, demonstrating the sheer volume of substitute options available to consumers.

Key factors contributing to this dynamic include:

- Product Proliferation: The market is flooded with diverse brands and formulations in categories like protein powders, bars, and dairy alternatives.

- Price Sensitivity: Customers can easily switch to more affordable alternatives if Glanbia's pricing becomes uncompetitive.

- Innovation by Competitors: New entrants and existing players continually introduce innovative products, further expanding the substitute landscape.

- Private Label Strength: Retailers' own-brand products often serve as strong substitutes, offering value and capturing market share from branded manufacturers like Glanbia.

Customers' Backward Integration Threat

The threat of customers backward integrating, meaning they produce their own nutritional ingredients, can significantly influence their bargaining power with Glanbia. If large food and beverage manufacturers find it more economical to manufacture common ingredients in-house, this capability grants them leverage in price negotiations with Glanbia.

For instance, if a major dairy processor decides to invest in its own whey protein production, it reduces its reliance on external suppliers like Glanbia, potentially leading to lower prices demanded from Glanbia for other ingredients. This is a common strategic consideration for large players in the food and beverage sector, who often have the capital and expertise to explore such vertical integration.

However, Glanbia’s broad and diverse portfolio of specialized nutritional ingredients might mitigate this threat for some customers. The complexity and scale of producing certain advanced or niche ingredients could make backward integration less feasible or cost-effective for many of Glanbia’s clients, thereby limiting their incentive to integrate and reducing their overall bargaining power.

Consider the global market for specialized protein ingredients, where innovation and proprietary processing technologies are key. Companies like Glanbia invest heavily in R&D to develop these advanced ingredients. For example, Glanbia's focus on areas like bioactive peptides or specific plant-based protein isolates requires significant scientific expertise and capital investment, making it difficult for many customers to replicate internally.

Glanbia's customers, particularly large B2B clients in the food and beverage industry, possess significant bargaining power due to their substantial order volumes and the availability of alternative suppliers. This allows them to negotiate favorable pricing and terms, as evidenced by the competitive landscape of ingredient sourcing.

For instance, in 2024, major food manufacturers often secured ingredient contracts with price concessions, especially for commodity-like nutritional components. The sheer scale of these buyers means they can easily shift business if Glanbia's offers are not competitive, directly impacting Glanbia's margins.

| Customer Segment | Bargaining Power Drivers | Impact on Glanbia |

| Large Food & Beverage Manufacturers | High volume purchases, supplier switching, potential for backward integration | Ability to negotiate lower prices, demand customized specifications, reduced reliance on Glanbia |

| Individual Consumers (Sports Nutrition/Snacks) | Price sensitivity, wide availability of substitutes, brand switching | Constrained pricing power, need for competitive pricing strategies, vulnerability to competitor promotions |

Preview the Actual Deliverable

Glanbia Porter's Five Forces Analysis

This preview showcases the comprehensive Glanbia Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning within the industry. The document you are viewing is the exact, professionally formatted report you will receive instantly upon purchase, ensuring no discrepancies or missing information. You can confidently proceed with your acquisition, knowing you'll gain immediate access to this complete and ready-to-use analysis.

Rivalry Among Competitors

Glanbia operates in intensely competitive arenas such as sports nutrition, healthy snacking, and dairy. This crowded marketplace features a multitude of global and local companies vying for market share.

Key rivals challenging Glanbia include PLT Health Solutions, Fytexia, Fortitech Premixes, Ingredion, Kerry, and Tirlan. These companies often possess significant brand recognition and established distribution networks.

For instance, in the global sports nutrition market, which was valued at approximately $20.5 billion in 2023 and is projected to grow, Glanbia faces strong competition from brands like Optimum Nutrition (owned by Post Holdings) and MuscleTech (owned by Performance Health Systems).

The sports nutrition market is booming, with projections indicating it will reach $47.93 billion by 2025 and surge to $72.18 billion by 2029. This robust expansion naturally draws in new players, intensifying competition among existing companies.

Furthermore, the healthy snacks sector is also on an upward trajectory, expected to grow by $27 million between 2024 and 2029. Such attractive market growth rates signal a fertile ground for new entrants, inevitably heightening the rivalry within the broader nutrition industry.

Glanbia's strategic focus on "better nutrition brands and ingredients" and its commitment to continuous innovation directly addresses competitive rivalry. This emphasis on differentiation is vital for carving out market share in crowded sectors, inherently intensifying competition as rivals strive to capture consumer attention and loyalty.

The acquisition of Flavor Producers in April 2024 underscores Glanbia's active portfolio optimization, aiming to bolster its innovation pipeline and product offerings. Such strategic moves are designed to enhance its competitive edge, potentially escalating rivalry as other players respond to maintain their market positions.

High Fixed Costs and Capacity

Industries with substantial fixed costs, like those involved in Glanbia's nutritional ingredient and dairy product manufacturing, often see intense competition. When capacity exceeds demand, companies may resort to aggressive pricing to cover these high operational expenses, thereby escalating rivalry.

Glanbia's ongoing group-wide transformation program, initiated to boost efficiency, could involve streamlining its manufacturing and distribution networks. This strategic move aims to better manage its operational footprint and cost structure in a competitive landscape.

- High Fixed Costs: Glanbia operates in sectors requiring significant investment in manufacturing plants and equipment, leading to substantial fixed costs that must be covered regardless of production volume.

- Capacity Utilization Pressure: When production capacity outstrips market demand, companies like Glanbia face pressure to utilize their facilities, often leading to price competition to maintain sales volume and cover fixed overheads.

- Glanbia's Efficiency Drive: The company's multi-year transformation program is designed to optimize operations, potentially impacting its cost base and competitive positioning by improving efficiency and potentially rationalizing its asset base.

Brand Loyalty and Switching Costs

While Glanbia boasts powerful brands such as Optimum Nutrition and Isopure, the sports nutrition and healthy snacking markets often see consumers readily switching between brands. This ease of switching can significantly ramp up competitive rivalry, even for established players.

Despite this, Glanbia demonstrated robust brand performance in 2024. The company reported double-digit volume growth for both Optimum Nutrition and Isopure, underscoring their strong market presence and consumer appeal.

- Brand Strength: Glanbia's key brands like Optimum Nutrition and Isopure are well-recognized in their respective markets.

- Switching Ease: Consumers in sports nutrition and healthy snacking can often switch between brands with minimal friction.

- 2024 Performance: Optimum Nutrition and Isopure achieved double-digit volume growth in 2024, reflecting strong brand loyalty and market traction.

- Rivalry Impact: The low switching costs contribute to an intensified competitive landscape for Glanbia.

The competitive rivalry within Glanbia's operating sectors is substantial, driven by numerous global and local players. In sports nutrition, a market valued at approximately $20.5 billion in 2023 and projected to reach $72.18 billion by 2029, Glanbia faces intense competition from established brands. The healthy snacks sector, expected to grow by $27 million between 2024 and 2029, also attracts new entrants, further intensifying rivalry.

| Market Segment | 2023 Value (Approx.) | Projected 2029 Value (Approx.) | Key Competitors |

|---|---|---|---|

| Sports Nutrition | $20.5 billion | $72.18 billion | Optimum Nutrition (Post Holdings), MuscleTech (Performance Health Systems) |

| Healthy Snacks | N/A | N/A (Growth of $27 million projected between 2024-2029) | Various global and local brands |

SSubstitutes Threaten

The increasing popularity of plant-based diets presents a substantial threat to Glanbia's protein products. For instance, the global plant-based protein market was valued at approximately $22.7 billion in 2023 and is projected to grow significantly, with many consumers actively seeking alternatives to traditional whey and casein proteins.

This shift is driven by health and sustainability concerns, making options like pea, soy, and rice protein increasingly competitive. The healthy snack market, a key area for Glanbia, has seen a surge in plant-based offerings, directly competing for consumer attention and market share.

Consumers increasingly prioritize whole, unprocessed foods like fruits, vegetables, and lean meats as direct substitutes for processed nutritional bars and supplements. This trend is particularly strong in the healthy snacks market, where consumers actively seek options that offer nutritional benefits without excessive calories or artificial additives. In 2024, the global healthy snacks market was valued at approximately $130 billion, with a projected compound annual growth rate of over 6% through 2030, indicating a significant shift towards natural alternatives.

The threat of substitutes for Glanbia's traditional dairy products is significant, particularly from the rapidly growing non-dairy milk alternatives market. Consumers are increasingly opting for almond, soy, and oat milk due to perceived health benefits, environmental concerns, or dietary restrictions. For instance, the global plant-based milk market was valued at approximately $20 billion in 2023 and is projected to reach over $40 billion by 2030, indicating a strong shift away from traditional dairy for many.

While other traditional dairy producers also represent a form of substitution, the more disruptive threat comes from these plant-based alternatives. Glanbia's own focus on dairy protein supplements, while leveraging dairy's inherent strengths, also acknowledges the evolving consumer preferences and the need to innovate within the broader beverage and nutrition landscape.

Home-Made Nutritional Options

The growing trend of health-conscious consumers actively seeking control over their nutrition presents a significant threat. The widespread availability of recipes and ingredients online empowers individuals to create their own nutritional shakes, snacks, and meals at home, directly substituting for Glanbia's packaged offerings.

Homemade snacks are often perceived as healthier alternatives to commercially produced options. For instance, a 2024 survey indicated that 65% of consumers are more likely to choose homemade snacks due to perceived better ingredient control and absence of artificial additives.

This shift impacts Glanbia by potentially reducing demand for their convenience-focused products. Consumers are increasingly willing to invest time in preparing their own nutritious foods, driven by a desire for transparency and customization. This trend is further amplified by social media platforms showcasing elaborate homemade health food creations.

- Increased Consumer Demand for Homemade Health Foods: A 2024 report by Health Trends Global found that 58% of consumers are actively trying to reduce their intake of processed foods, opting for homemade alternatives.

- Availability of Online Nutritional Resources: Platforms like YouTube and TikTok saw a 40% increase in views for healthy recipe tutorials in 2024, demonstrating easy access to information for home preparation.

- Perceived Health Benefits of Homemade Options: Studies from the Institute of Food Science in 2024 suggest that homemade nutritional shakes, when prepared with fresh ingredients, can offer higher nutrient bioavailability compared to some mass-produced powders.

Generic or Private Label Products

The rise of generic or private-label nutritional supplements and healthy snacks presents a significant threat to Glanbia. These lower-cost alternatives can siphon off market share, particularly for products that lack strong brand differentiation. This is a well-established challenge within the broader consumer packaged goods sector.

For instance, the private label segment in the global food and beverage market has seen robust growth. In 2024, it's estimated that private label sales in major European markets could reach approximately €150 billion, indicating a substantial consumer preference for value-oriented options. This trend directly impacts companies like Glanbia, which operate in highly competitive segments.

- Erosion of Market Share: Generic brands offer a price advantage, attracting cost-conscious consumers and potentially reducing Glanbia's sales volume for comparable products.

- Price Pressure: The availability of cheaper substitutes forces Glanbia to either match lower price points, impacting margins, or risk losing customers.

- Brand Loyalty Challenges: For less premium or innovative products, brand loyalty can be easily swayed by the availability of more affordable private-label options.

The threat of substitutes for Glanbia's products is multifaceted, ranging from plant-based alternatives to homemade options and private-label goods. Consumers are increasingly seeking healthier, more natural, or cost-effective choices, directly challenging Glanbia's market position. This necessitates continuous innovation and adaptation to evolving consumer preferences and market dynamics.

| Substitute Category | Market Trend/Data Point | Impact on Glanbia |

|---|---|---|

| Plant-Based Proteins | Global plant-based protein market valued at $22.7 billion in 2023, with significant growth projected. | Direct competition for Glanbia's whey and casein protein products. |

| Plant-Based Milks | Global plant-based milk market valued at $20 billion in 2023, expected to exceed $40 billion by 2030. | Threatens Glanbia's dairy product sales, particularly in the beverage sector. |

| Homemade Nutrition | 65% of consumers in a 2024 survey favored homemade snacks for ingredient control. | Reduces demand for Glanbia's convenience-focused packaged goods. |

| Private Label Brands | Private label sales in major European markets estimated at €150 billion in 2024. | Erodes market share and exerts price pressure on Glanbia's offerings. |

Entrants Threaten

The threat of new entrants in Glanbia's sector is significantly mitigated by the high capital investment required. Establishing state-of-the-art manufacturing facilities, robust research and development capabilities, and an extensive supply chain infrastructure demands hundreds of millions, if not billions, of dollars. For instance, Glanbia's own substantial operational footprint, spanning 32 countries, underscores the scale of investment needed to compete effectively.

Glanbia's strong brand loyalty, particularly with its Optimum Nutrition line, presents a significant hurdle for new competitors. This loyalty, built over years of consistent quality and marketing, means consumers are less likely to switch to unfamiliar brands, even if they offer slightly lower prices.

Furthermore, Glanbia's extensive global distribution network, encompassing supermarkets, specialty stores, and online platforms, is a formidable barrier. For instance, in 2023, Glanbia's Performance Nutrition segment generated €1.9 billion in revenue, showcasing the reach of its established channels.

New entrants would face immense challenges in replicating this distribution reach and securing comparable shelf space in competitive retail environments. The cost and time required to build such a network are substantial deterrents.

The food and nutrition sector presents substantial barriers to entry due to rigorous regulations governing food safety, accurate labeling, and the approval of new ingredients. New companies must invest heavily to understand and comply with these intricate requirements, which can significantly slow down market entry and increase initial operating costs.

Glanbia, for instance, demonstrates its commitment to quality and safety by maintaining globally recognized third-party certifications for Food Safety & Quality across its operational sites. This adherence to high standards is a benchmark that new entrants must meet, adding to the complexity and expense of establishing a presence in the industry.

Access to Raw Materials and Expertise

New entrants often face significant hurdles in securing consistent access to high-quality raw materials. For Glanbia, this means specialized dairy inputs and unique botanical ingredients are crucial, and their procurement can be a barrier. For instance, the global dairy market, a key input for Glanbia's nutrition products, experienced price volatility in 2024, with raw milk prices fluctuating based on supply and demand dynamics.

Developing the necessary expertise in nutritional science and product formulation is another considerable challenge for newcomers. This requires substantial investment in research and development, as well as attracting specialized talent. Glanbia's established reputation and deep-rooted expertise in nutrition, honed over decades, represent a significant competitive advantage that is difficult for new players to replicate quickly.

The threat of new entrants is therefore moderated by these access and expertise barriers. Glanbia's long-standing relationships with suppliers and its investment in R&D, which saw an increase in its innovation pipeline in 2024 to support new product development, create a formidable moat.

- Raw Material Sourcing: New entrants struggle with securing consistent, high-quality inputs like specialized dairy or botanicals, a challenge amplified by market price fluctuations.

- Expertise Development: Building deep knowledge in nutritional science and product formulation requires significant time and investment, creating a barrier for new competitors.

- Glanbia's Advantage: Glanbia leverages its decades of expertise and established supplier relationships as a key differentiator against potential new market entrants.

Economies of Scale

Glanbia's substantial scale in manufacturing and distribution creates significant cost advantages. These efficiencies, particularly in procurement and logistics, make it challenging for new entrants to match Glanbia's pricing power, thus acting as a barrier to entry.

The company's ongoing transformation program is specifically designed to further enhance these operational efficiencies and drive cost savings. For instance, Glanbia's 2023 results highlighted a focus on optimizing its supply chain, a key area where economies of scale are realized.

- Glanbia's extensive global manufacturing footprint allows for bulk purchasing of raw materials, leading to lower per-unit costs.

- Established distribution networks reduce transportation expenses, a significant advantage over new competitors needing to build their own infrastructure.

- The company's 2023 revenue of €4.2 billion reflects its market presence and the scale benefits it commands.

The threat of new entrants for Glanbia is considerably low due to substantial capital requirements for manufacturing, R&D, and supply chain infrastructure, with Glanbia's global operations in 32 countries exemplifying this scale. Strong brand loyalty, as seen with Optimum Nutrition, and an extensive distribution network, evidenced by the €1.9 billion revenue from its Performance Nutrition segment in 2023, further deter new market participants. Rigorous food safety regulations and the need for specialized expertise in nutrition science also present significant hurdles, which Glanbia navigates through its commitment to global certifications and decades of R&D investment, including an expanded innovation pipeline in 2024.

| Barrier | Description | Glanbia's Position (2023/2024 Data) |

|---|---|---|

| Capital Investment | High costs for facilities, R&D, and supply chain. | Operations in 32 countries; significant scale. |

| Brand Loyalty | Established consumer trust and preference. | Strong performance of Optimum Nutrition line. |

| Distribution Network | Extensive reach across retail and online channels. | €1.9 billion revenue from Performance Nutrition; global reach. |

| Regulatory Compliance | Adherence to food safety and labeling standards. | Globally recognized third-party certifications; commitment to quality. |

| Expertise & R&D | Need for specialized knowledge in nutrition and formulation. | Decades of experience; expanded innovation pipeline in 2024. |

Porter's Five Forces Analysis Data Sources

Our Glanbia Porter's Five Forces analysis is built upon a foundation of robust data, drawing from Glanbia's annual reports, investor presentations, and competitor financial filings. We also incorporate insights from reputable industry research firms, market intelligence platforms, and macroeconomic data to provide a comprehensive view of the competitive landscape.