Gibson Energy SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gibson Energy Bundle

Gibson Energy's strategic position is shaped by its robust infrastructure and stable cash flows, but also faces challenges from evolving energy markets and regulatory shifts. Understanding these dynamics is crucial for any informed investment or strategic decision.

Want the full story behind Gibson Energy's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Gibson Energy's strength lies in its robust infrastructure-based business model, primarily driven by terminals and pipelines. These assets are characterized by stable, fee-for-service revenue streams, leading to highly contracted and predictable cash flows.

The company's infrastructure segment is the bedrock of its profitability, accounting for roughly 90% of its segment profit. This segment's resilience is further amplified by the fact that approximately 75% of its infrastructure revenue is secured through take-or-pay contracts, offering significant financial stability and insulation from commodity price fluctuations.

This strategic focus on infrastructure has translated into tangible financial success, with Gibson Energy reporting record infrastructure adjusted EBITDA in recent quarters. This performance underscores the inherent strength and reliability of its asset base and business strategy.

Gibson Energy's strategic asset locations are a significant strength, with key terminals in Western Canada, including Hardisty and Edmonton, and on the U.S. Gulf Coast at Ingleside, Texas. These locations are prime for accessing major crude oil production areas and crucial export markets.

Recent expansions bolster this advantage. The completion of new tanks at Edmonton in Q4 2024, designed to support Trans Mountain Expansion (TMX) shippers, and the Gateway terminal dredging project, have demonstrably increased Gibson's throughput capacity and market presence in vital regions.

These strategic investments and expansions position Gibson Energy to effectively leverage the ongoing growth in North American crude oil production and the increasing demand for exports, enhancing its competitive standing.

Gibson Energy has a strong commitment to shareholder returns, evidenced by a consistent history of dividend payments and annual increases for five consecutive years. This focus is central to their financial strategy, which balances funding the dividend with investments in infrastructure growth and maintaining a robust balance sheet.

The company's dividend payout ratio, standing at approximately 60% on a trailing twelve-month basis as of Q1 2024, falls comfortably within their target range. This suggests a sustainable dividend policy that aims to provide reliable income to investors while allowing for reinvestment in the business.

Robust Safety and Sustainability Performance

Gibson Energy demonstrates a strong commitment to safety and sustainability. In 2023, the company achieved an impressive milestone of over 9.5 million hours worked without a lost-time injury, underscoring its dedication to operational safety. This focus is further validated by high ratings from prominent global sustainability agencies, reflecting its robust environmental, social, and governance (ESG) performance.

The company has set ambitious ESG targets, including specific goals for 2025 and 2030, culminating in a Net Zero commitment for Scope 1 and 2 emissions by 2050. This proactive approach to sustainability not only bolsters Gibson Energy's corporate reputation but also attracts a growing pool of responsible investors and ensures alignment with increasingly stringent industry standards and regulatory expectations.

- Operational Safety: Achieved over 9.5 million hours without a lost-time injury in 2023.

- Sustainability Ratings: Receives high marks from global sustainability agencies.

- ESG Targets: Clear goals for 2025 and 2030, with a Net Zero by 2050 commitment for Scope 1 & 2 emissions.

- Investor Appeal: Enhanced reputation attracts responsible investors aligned with ESG principles.

Disciplined Capital Allocation and Cost Efficiency

Gibson Energy demonstrates a strong commitment to disciplined capital allocation, prioritizing infrastructure projects that promise high returns and favorable EBITDA build multiples. This strategic focus ensures that investments are directed towards opportunities most likely to enhance shareholder value.

The company is actively pursuing cost reduction initiatives, aiming for substantial annual savings. For instance, Gibson targeted approximately $30 million in annual cost savings through its 2023 initiatives, demonstrating a clear drive for operational efficiency. This focus on optimizing expenses directly contributes to a stronger financial profile.

- Disciplined Investment: Focus on high-return infrastructure projects.

- Cost Optimization: Targeting significant annual savings, with ~ $30 million in 2023 initiatives.

- Financial Strength: Enhanced by efficient operations and strategic capital deployment.

Gibson Energy's core strength is its stable, infrastructure-based revenue model, primarily from terminals and pipelines. These assets generate predictable, fee-for-service cash flows, with approximately 75% of infrastructure revenue secured by take-or-pay contracts, insulating it from commodity price volatility.

The company's strategic asset locations, including key hubs in Western Canada and the U.S. Gulf Coast, coupled with recent expansions like the Edmonton terminal upgrades for TMX shippers and the Gateway terminal dredging, enhance its capacity and market access.

Gibson Energy also maintains a strong commitment to shareholder returns, consistently increasing its dividend for five years, with a payout ratio around 60% as of Q1 2024, indicating a sustainable approach to income distribution and reinvestment.

Furthermore, the company's focus on operational safety, as evidenced by over 9.5 million hours worked without a lost-time injury in 2023, and its proactive ESG strategy, including Net Zero commitments by 2050, enhance its reputation and appeal to responsible investors.

| Metric | 2023/Q1 2024 Data | Significance |

|---|---|---|

| Infrastructure Revenue Contracted | ~75% (Take-or-Pay) | Provides revenue stability and predictability. |

| Infrastructure Segment Profit Contribution | ~90% | Highlights the critical role of infrastructure in profitability. |

| Dividend Increase Streak | 5 Consecutive Years | Demonstrates commitment to shareholder returns. |

| Dividend Payout Ratio (TTM) | ~60% (as of Q1 2024) | Indicates sustainable dividend policy. |

| Hours Worked Without Lost-Time Injury | >9.5 Million (2023) | Underscores strong operational safety culture. |

What is included in the product

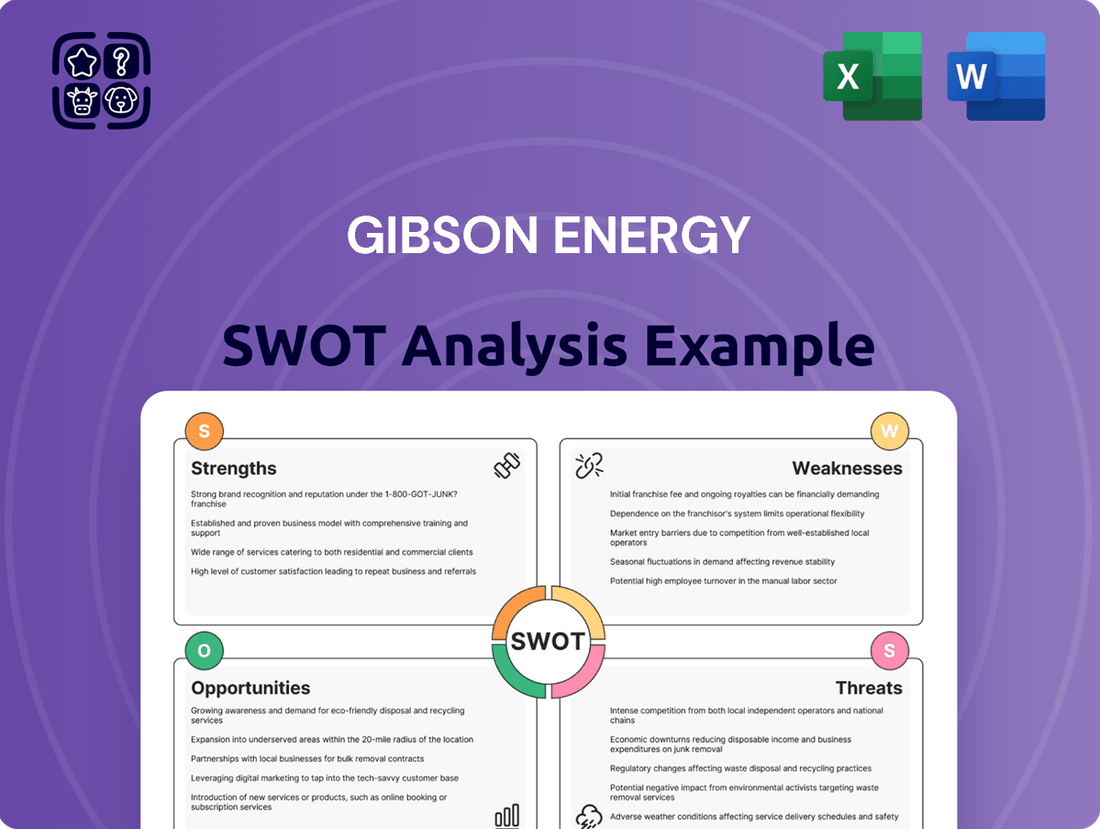

Delivers a strategic overview of Gibson Energy’s internal and external business factors, highlighting its strengths in infrastructure, weaknesses in market volatility, opportunities in energy transition, and threats from regulatory changes.

Offers a clear breakdown of Gibson Energy's strategic advantages, weaknesses, opportunities, and threats to pinpoint and address key operational challenges.

Weaknesses

Gibson Energy's marketing segment has experienced a volatile performance, with adjusted EBITDA showing breakeven or declines in recent quarters. For instance, in Q1 2024, adjusted EBITDA for the marketing segment was $1 million, a significant drop from $19 million in Q1 2023, highlighting this weakness.

This instability stems from market conditions such as narrow commodity price differences, low inventory levels, and scarce storage options, all of which directly depress the segment's profitability. These external factors create an unpredictable operating environment for this business unit.

Looking ahead, the company projects a subdued marketing landscape in the immediate future. This outlook suggests that the challenges impacting the segment's performance are expected to persist, continuing to weigh on its financial contributions.

Gibson Energy's debt-to-Adjusted EBITDA ratio has been a concern, standing at 4.0x in the second quarter of 2025. This figure is notably above their desired long-term target range of 3.0-3.5x. The elevated leverage is a direct consequence of a significant capital expenditure program coupled with weaker performance in marketing operations.

Gibson Energy's marketing segment, while largely infrastructure-based, remains sensitive to fluctuations in crude oil price differentials and crack spreads. For instance, in early 2024, we observed widening Western Canadian Select (WCS) to West Texas Intermediate (WTI) differentials, which generally benefits Gibson's marketing operations by creating arbitrage opportunities. However, a tightening of these spreads, as can occur with increased demand for Canadian heavy oil or improved pipeline capacity, can reduce the profitability of storage and time-based trading strategies within this segment.

Potential Delays in Infrastructure Projects

Gibson Energy's growth pipeline, while promising, faces inherent risks associated with large infrastructure projects. These ventures are susceptible to delays and budget overruns, even with the company's history of successful execution. External factors like unexpected regulatory changes or disruptions in the supply chain could potentially impact project schedules and the anticipated financial gains. For instance, in early 2024, several major energy infrastructure projects across North America experienced extended timelines due to permitting challenges and increased material costs, highlighting the real-world impact of such vulnerabilities.

These potential setbacks can affect Gibson's ability to capitalize on market opportunities promptly. The company's financial performance could be impacted if project timelines extend significantly beyond initial projections, leading to higher capital expenditures and delayed revenue generation. For example, a delay in the second phase of a key expansion project, initially slated for late 2024 completion, might push expected EBITDA contributions into 2025, altering the near-term financial outlook.

- Risk of Project Delays: Large infrastructure developments are prone to unforeseen delays.

- Cost Overrun Potential: Budgets can be exceeded due to external pressures.

- External Factor Impact: Regulatory hurdles and supply chain issues pose significant threats to timely completion.

- Financial Repercussions: Delayed projects can negatively affect revenue generation and capital expenditure forecasts.

Impact of Seasonal Demand Changes

Gibson Energy's refined products business, particularly asphalt, faces a significant weakness due to seasonal demand shifts. This cyclicality can lead to considerable variability in the marketing segment's financial performance throughout the year.

For instance, during the first quarter of 2025, while stronger crack spreads offered some support, the impact of reduced demand for asphalt products, a direct consequence of seasonality, contributed to a more challenging operational environment. This offset positive pricing dynamics.

- Seasonal Demand Impact: Reduced demand for asphalt products during off-peak seasons directly affects revenue generation within the marketing segment.

- Performance Variability: Seasonal fluctuations create inherent unpredictability in the marketing segment's quarterly results, making consistent performance more difficult to achieve.

- Offsetting Factors: While improved crack spreads can mitigate some of this weakness, they may not fully compensate for the volume decline caused by seasonal demand reductions, as observed in Q1 2025.

Gibson Energy's marketing segment is vulnerable to volatile commodity price differentials and crack spreads, which directly impact profitability. For example, a tightening of WCS to WTI differentials in early 2024 reduced arbitrage opportunities for the company.

The company's debt-to-Adjusted EBITDA ratio stood at 4.0x in Q2 2025, exceeding its target range of 3.0-3.5x due to capital expenditures and weaker marketing performance.

Large infrastructure projects carry inherent risks of delays and cost overruns, as seen with other North American energy projects experiencing permitting challenges and rising material costs in early 2024, potentially impacting Gibson's revenue generation timelines.

Seasonal demand for refined products, particularly asphalt, creates performance variability in the marketing segment, as demonstrated by reduced demand in Q1 2025, which offset improved crack spreads.

| Metric | Q1 2024 | Q1 2025 | Target Range |

|---|---|---|---|

| Marketing Adjusted EBITDA | $1 million | $X million (est.) | N/A |

| Debt-to-Adjusted EBITDA | X.X | 4.0x | 3.0x - 3.5x |

Preview the Actual Deliverable

Gibson Energy SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file, providing a clear snapshot of Gibson Energy's strategic landscape. The complete version, offering in-depth insights into their Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after purchase.

Opportunities

Gibson Energy is actively pursuing a substantial growth pipeline, projecting over $1 billion in capital expenditure to bolster its liquids infrastructure. This expansion is strategically focused on enhancing its existing footprint, particularly through upgrades to the Gateway terminal and Edmonton facilities. These enhancements, including dredging to boost vessel loading capacity, are designed to maximize the utility of their current assets.

A key near-term objective involves the Duvernay expansion, a project Gibson is undertaking through strategic partnerships. This collaborative approach aims to leverage shared infrastructure and expertise, thereby increasing throughput and solidifying Gibson's market position in this key region. The company's commitment to these infrastructure expansions underscores its strategy to drive long-term value and operational efficiency.

Western Canadian crude production is poised for significant growth, with forecasts suggesting an increase from 5.7 million barrels per day in 2023 to 6.4 million barrels per day by 2030. This expansion directly benefits Gibson Energy by increasing the volume of crude requiring transportation and storage.

The rising global oil demand, particularly in North America, coupled with increasing export volumes, creates a robust market for Gibson's midstream infrastructure. Its strategically positioned terminals and pipelines are well-equipped to capitalize on this growing demand, offering essential services for producers.

Gibson Energy can significantly expand its asset base and secure future volumes by forging strategic, long-term partnerships. A prime example is the collaboration with Baytex Energy Corp. for Pembina Duvernay infrastructure development, which highlights the potential for growth through shared investment and operational synergies.

These types of joint ventures offer a pathway to new projects and can boost the utilization rates of Gibson's existing infrastructure. For instance, in 2024, such partnerships are crucial for capitalizing on the increasing demand for midstream services in key resource plays, potentially leading to enhanced revenue streams and improved operational efficiency.

Energy Transition and Decarbonization Initiatives

Gibson Energy's dedication to Environmental, Social, and Governance (ESG) principles, including its Net Zero by 2050 objective, positions it favorably to capitalize on the global shift towards decarbonization. This strategic alignment allows for investments in emerging cleaner technologies, such as carbon capture utilization and storage (CCUS) or hydrogen production, which are projected to see significant growth. For instance, the International Energy Agency (IEA) forecasts that global investment in clean energy technologies could reach $2 trillion annually by 2030, highlighting the vast market potential.

This proactive stance on sustainability not only attracts environmentally conscious investors and lenders but also strengthens Gibson Energy's social license to operate. By demonstrating a commitment to reducing its environmental footprint, the company can foster stronger relationships with communities and regulators. Furthermore, adapting its infrastructure and business models to support the energy transition could unlock new revenue streams and business ventures in areas like renewable energy logistics and low-carbon fuel distribution.

- Investment in cleaner technologies: Gibson Energy can pursue opportunities in areas like CCUS and hydrogen infrastructure, aligning with a growing global market.

- Enhanced social license to operate: Demonstrating ESG commitment can improve stakeholder relations and regulatory standing.

- New business ventures: Adapting operations can lead to expansion into logistics for renewable energy and low-carbon fuels.

Potential for Share Buybacks and Increased Shareholder Value

Gibson Energy is exploring the possibility of initiating share buybacks in the latter half of 2025. This strategic move is contingent upon the company's ability to manage its leverage effectively and achieve stronger performance within its marketing segment. Successfully lowering the debt-to-EBITDA ratio and boosting marketing results could pave the way for a return to share repurchase programs in 2026.

Resuming share buybacks would serve as a strong signal of management's confidence in the company's financial health and future prospects. Such actions can directly enhance shareholder value by increasing earnings per share and potentially boosting the stock price, rewarding investors for their continued support.

- Potential for Share Buybacks: Gibson Energy is evaluating share buybacks for the second half of 2025.

- Conditions for Buybacks: Success depends on managing leverage and improving marketing segment performance.

- 2026 Outlook: A debt-to-EBITDA ratio reduction and better marketing results could enable buybacks in 2026.

- Shareholder Value Enhancement: Buybacks aim to increase EPS and signal financial strength to investors.

Gibson Energy is well-positioned to capitalize on the projected growth in Western Canadian crude production, which is expected to rise from 5.7 million barrels per day in 2023 to 6.4 million barrels per day by 2030. This expansion in output directly translates into increased demand for Gibson's midstream services. The company's strategic investments in infrastructure, such as the Gateway terminal upgrades and the Duvernay expansion, are designed to meet this rising demand efficiently.

Furthermore, the increasing global demand for oil, particularly in North America, coupled with growing export volumes, creates a favorable market environment for Gibson's assets. The company's ability to form strategic, long-term partnerships, like the one with Baytex Energy Corp. for Pembina Duvernay infrastructure, offers a clear path to expanding its asset base and securing future volumes. These collaborations not only facilitate new projects but also enhance the utilization of existing infrastructure, driving revenue growth and operational efficiencies.

Gibson's commitment to ESG principles, including its Net Zero by 2050 target, opens doors to new business ventures in cleaner technologies such as carbon capture and hydrogen infrastructure. The International Energy Agency (IEA) projects global investment in clean energy to reach $2 trillion annually by 2030, indicating substantial market potential. This strategic alignment with decarbonization trends strengthens Gibson's social license to operate and can unlock new revenue streams in areas like renewable energy logistics.

| Opportunity Area | Description | Key Data/Forecast |

| Production Growth | Increased crude oil output in Western Canada | Production forecast to rise from 5.7 MMbbls/d (2023) to 6.4 MMbbls/d (2030) |

| Market Demand | Rising global and North American oil demand | Growing export volumes enhance demand for midstream services |

| Strategic Partnerships | Collaborations for infrastructure development | Example: Baytex Energy Corp. partnership for Duvernay infrastructure |

| Clean Energy Transition | Investment in decarbonization technologies | IEA forecasts $2 trillion annual clean energy investment by 2030 |

Threats

Gibson Energy operates within Canada's oil and gas midstream sector, a landscape increasingly shaped by regulatory complexities and mounting environmental concerns. A significant challenge stems from the growing pressure to reduce carbon emissions across the industry.

Evolving government policies and more stringent environmental regulations are anticipated to require substantial capital outlays for cleaner technologies or carbon capture initiatives. These investments could directly impact operational costs and the timeline for securing project approvals, affecting Gibson Energy's strategic planning and financial performance.

While Gibson Energy's infrastructure segment offers a stable, contracted revenue base, its marketing operations are susceptible to the unpredictable swings of market volatility. This includes significant fluctuations in commodity prices, crack spreads, and differentials, which directly impact profitability. For instance, in 2024, the energy markets have seen considerable price volatility for crude oil and refined products, directly affecting the margins in Gibson's marketing segment.

Unforeseen shifts in storage demand and periods of unusually tight commodity differentials can further erode the marketing segment's financial performance. These market dynamics, often driven by geopolitical events or supply/demand imbalances, create a challenging operating environment. In early 2025, analysts noted a tightening of Western Canadian Select (WCS) differentials to West Texas Intermediate (WTI), which would pressure marketing margins if sustained.

The Canadian oil and gas midstream sector is a crowded space, with established companies and new entrants vying for opportunities. This heightened competition can directly impact Gibson Energy by increasing the cost of securing new projects and customer agreements. For instance, in 2024, the race for pipeline capacity and storage solutions intensified as producers looked to optimize their logistics.

This competitive pressure can squeeze Gibson's profit margins as they may need to offer more attractive terms to win business. Furthermore, aggressive expansion by existing rivals or the emergence of new players could dilute Gibson's market share. This dynamic makes it crucial for Gibson to maintain operational efficiency and secure long-term, stable contracts to mitigate the impact of this increasing competition on its growth prospects.

Economic Downturn and Reduced Energy Demand

A significant economic downturn, whether in Canada or globally, poses a substantial threat by potentially curbing demand for crude oil and refined products. This reduced demand would directly translate to lower throughput volumes across Gibson Energy's extensive terminal and pipeline network. Furthermore, the marketing segment's performance could be significantly hampered, impacting overall revenue and profitability.

For instance, a prolonged recession could see industrial activity slow, impacting fuel consumption for transportation and manufacturing. This scenario directly affects Gibson's core business. While specific forecasts for a downturn are fluid, economic indicators in late 2024 and early 2025 will be crucial to monitor for signs of weakening demand in the energy sector.

- Reduced Throughput: Lower demand directly decreases the volume of product moving through Gibson's infrastructure.

- Marketing Segment Pressure: The profitability of selling refined products could decline due to lower prices and volumes.

- Impact on Revenue: Both throughput and marketing segments contribute to overall revenue, making them vulnerable to economic contraction.

- Profitability Concerns: Reduced revenue, coupled with fixed operating costs, could squeeze profit margins.

Geopolitical Risks and Energy Transition Pace

Geopolitical tensions, such as the ongoing conflicts in Eastern Europe, continue to create volatility in global energy markets. These events can disrupt supply chains and alter established trade routes, directly impacting the demand for and flow of crude oil and refined products, which are central to Gibson Energy's business. For instance, in 2023, global oil prices experienced significant fluctuations driven by these geopolitical uncertainties, impacting transportation volumes and pricing power for midstream companies.

The pace of the global energy transition presents a significant long-term threat. If the shift towards renewable energy sources accelerates faster than current projections, it could reduce the demand for traditional fossil fuel midstream infrastructure. For example, a more aggressive push for electric vehicle adoption and renewable energy generation could decrease the need for oil transportation and storage services over time. Gibson Energy's strategic planning must account for this evolving energy landscape to ensure continued relevance and profitability.

- Geopolitical Instability: Events like the Russia-Ukraine conflict (ongoing as of mid-2025) have demonstrated the potential for rapid shifts in energy supply and demand, impacting global trade flows and potentially affecting Gibson's access to key markets.

- Energy Transition Acceleration: A faster-than-expected global move away from fossil fuels, driven by policy changes or technological advancements, could diminish the long-term demand for Gibson's core oil and gas midstream services.

- Supply Chain Disruptions: Geopolitical events can directly interrupt the physical movement of energy commodities, affecting the volumes handled by Gibson's infrastructure and potentially increasing operational costs.

Gibson Energy faces significant threats from increasing regulatory scrutiny and the ongoing global energy transition. Evolving environmental policies and the push for decarbonization could necessitate substantial investments in cleaner technologies, impacting operational costs and project timelines. For instance, as of early 2025, discussions around stricter methane emission regulations in Canada are ongoing, potentially requiring capital for compliance measures.

Market volatility remains a key concern, particularly for the marketing segment, which is exposed to fluctuating commodity prices and differentials. In 2024, the energy markets experienced notable price swings, which directly affected marketing margins. Analysts in early 2025 observed a narrowing of the WCS-WTI differential, a trend that could compress profitability if it persists.

Intensifying competition within the midstream sector also poses a threat, potentially increasing the cost of securing new projects and customer agreements. The race for efficient logistics solutions in 2024 highlighted this competitive pressure. Furthermore, a broad economic downturn could reduce overall energy demand, leading to lower throughput volumes across Gibson's infrastructure and impacting revenue streams.

Geopolitical instability, as seen with ongoing conflicts, can disrupt global energy markets and supply chains, indirectly affecting Gibson's operations and market access. The long-term threat of an accelerated energy transition, with a faster shift to renewables, could also diminish the demand for traditional fossil fuel midstream services over time, requiring strategic adaptation.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from Gibson Energy's official financial statements, comprehensive market research reports, and expert industry commentary to provide a well-rounded perspective.