Gibson Energy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gibson Energy Bundle

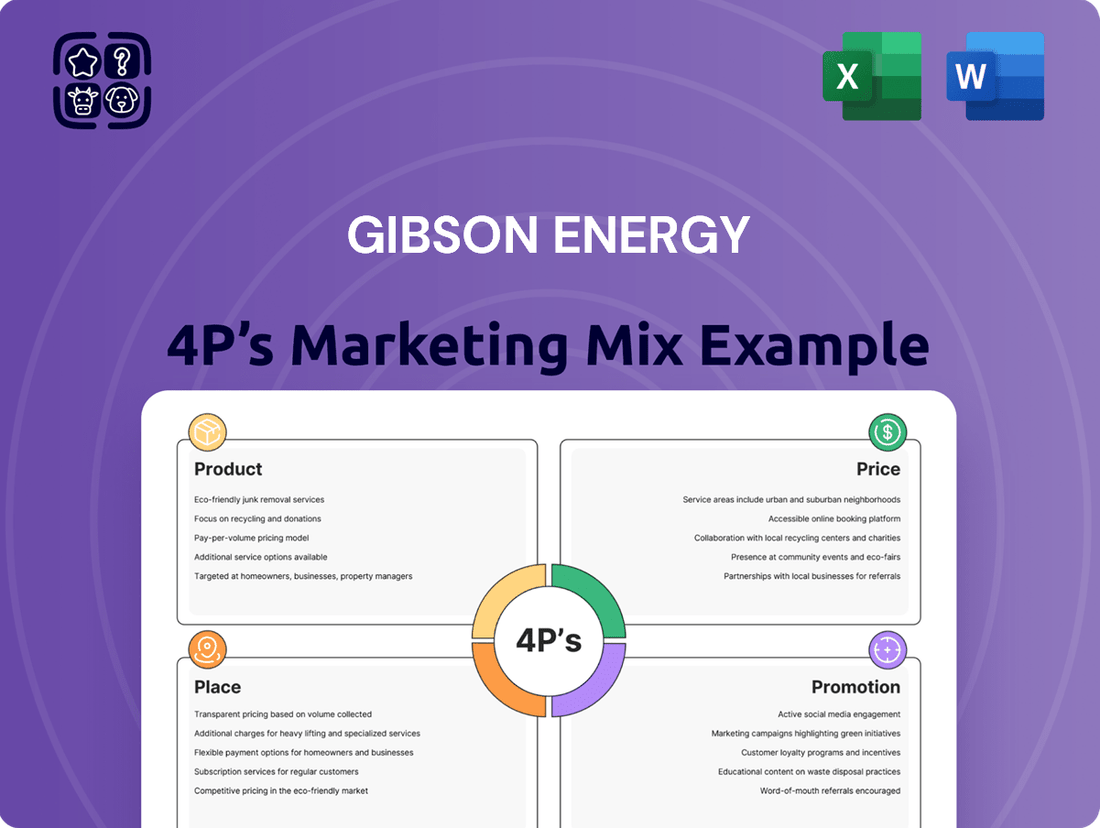

Gibson Energy's marketing mix is a carefully orchestrated symphony of product, price, place, and promotion, designed to resonate with their target audience. This analysis delves into how their product offerings meet industry needs, their pricing reflects market value, and their distribution and promotional strategies create a powerful market presence.

Unlock the full strategic blueprint of Gibson Energy’s marketing success. Our comprehensive 4Ps analysis provides actionable insights and real-world examples, perfect for anyone seeking to understand and replicate effective marketing strategies.

Go beyond the surface level and gain a deep understanding of Gibson Energy's market positioning. Our complete 4Ps Marketing Mix Analysis offers a detailed breakdown of their product, price, place, and promotion strategies, empowering you with the knowledge to inform your own business decisions.

Product

Gibson Energy's core product offering is centered on essential midstream services, primarily for crude oil and refined products. These services encompass storage, processing, and marketing, acting as a crucial link between energy producers and consumers. This infrastructure-heavy business model generates stable, fee-based revenue, as seen in their consistent performance. For instance, in the first quarter of 2024, Gibson Energy reported Adjusted EBITDA of $259 million, demonstrating the reliability of their fee-based segment.

Gibson Energy's product strength lies in its robust infrastructure asset portfolio, a critical component of its marketing mix. This network includes strategically located crude oil terminals, pipelines, and a processing facility, essential for efficient energy logistics across North America.

Key assets are situated in Western Canada, such as Hardisty and Edmonton, and in the U.S., including Ingleside and Wink. This geographic spread ensures vital connectivity within major energy hubs. For instance, the Hardisty terminal is a significant hub for Western Canadian Select crude oil, handling substantial volumes.

In 2024, Gibson Energy continued to leverage these assets, with capital expenditures focused on enhancing their capacity and efficiency. The company reported that its infrastructure segment, which includes these assets, generated significant distributable cash flow, underpinning its financial performance and ability to return value to shareholders.

Gibson Energy's Storage and Terminaling Solutions represent a core product, offering over 25 million barrels of crude oil storage across North America. Key facilities like Hardisty (13.5 million barrels) and Gateway (8.6 million barrels) are crucial hubs for essential storage and blending services for diverse liquid products.

These vital services are typically contracted on a long-term, take-or-pay basis. This contract structure is a significant advantage, providing Gibson with highly predictable and stable revenue streams, a testament to the essential nature of their terminaling infrastructure.

Pipeline Connectivity and Gathering

Gibson Energy's Pipeline Connectivity and Gathering segment is crucial for its marketing mix, ensuring efficient movement of crude oil and liquids. This involves operating gathering systems that collect resources from production sites and connect them to larger, long-haul pipelines for broader market access.

The Hardisty terminal is a prime example of this strategic infrastructure, offering extensive connectivity. Recent developments, such as the integration with the Cactus II pipeline at Gateway, further enhance market reach for Gibson's clientele, underscoring the importance of this segment in their value proposition.

- Strategic Infrastructure: Gibson operates a network of gathering pipelines that link upstream production to downstream markets.

- Hardisty Hub: The Hardisty terminal provides significant connectivity to major oil pipelines, facilitating efficient transportation.

- Market Access Enhancement: Projects like the Cactus II pipeline connection at Gateway directly improve customer access to key markets.

- Logistical Backbone: This segment forms a critical part of Gibson's ability to offer integrated energy logistics solutions.

Value-Added Processing and Marketing

Gibson Energy extends its services beyond basic storage and transport by offering value-added processing. A prime example is its Hardisty Diluent Recovery Unit (DRU), which significantly improves the quality and marketability of heavy crude oil. This processing capability is crucial for optimizing crude streams, making them more attractive to refiners.

The Moose Jaw facility further highlights Gibson's commitment to value addition, focusing on the processing and handling of refined products. By enhancing the value of these streams, Gibson positions itself as a key player in the midstream sector, offering more than just logistical services.

Gibson also actively participates in marketing crude oil and refined products, utilizing its extensive infrastructure to facilitate efficient distribution. This marketing segment, however, is subject to market-driven volatility, impacting revenue streams. For instance, in Q1 2024, Gibson reported adjusted EBITDA of $279 million, with its Infrastructure segment, which includes processing, contributing significantly.

- Hardisty DRU: Enhances heavy crude oil by recovering diluent, improving its marketability.

- Moose Jaw Facility: Processes and handles refined products, adding value to the supply chain.

- Marketing Operations: Leverages infrastructure to distribute crude oil and refined products.

- Market Volatility: The marketing segment is susceptible to fluctuations in commodity prices and demand.

Gibson Energy's product is its integrated midstream infrastructure and services, focused on crude oil and refined products. This includes storage, processing, and transportation, all underpinned by a robust asset base. The company's strategy centers on providing essential logistical solutions that connect energy producers with markets.

The core product offering emphasizes reliability and efficiency, crucial for its fee-based revenue model. Gibson's extensive network of terminals, pipelines, and processing facilities, particularly in key North American energy hubs, constitutes its primary product value. This infrastructure ensures secure and effective movement and storage of hydrocarbons.

Gibson's product strength is its strategically located and interconnected asset base, designed for optimal energy logistics. These assets, including terminals like Hardisty and Gateway, handle significant volumes and offer vital services such as storage, blending, and diluent recovery, enhancing crude oil quality and marketability.

The company's product also encompasses value-added processing, such as the Hardisty Diluent Recovery Unit, which improves heavy crude oil. This processing capability, alongside its extensive storage and pipeline connectivity, solidifies Gibson's position as a comprehensive midstream solutions provider.

| Product Segment | Key Services | Capacity/Reach | 2024 Performance Indicator (Illustrative) |

|---|---|---|---|

| Storage and Terminaling | Crude oil storage, blending, throughput | 25M+ barrels storage capacity (Hardisty: 13.5M, Gateway: 8.6M) | Contributed significantly to Infrastructure segment's distributable cash flow. |

| Pipeline Connectivity and Gathering | Gathering, transportation, market access | Extensive network connecting production to major pipelines (e.g., Cactus II) | Facilitated efficient movement of hydrocarbons, enhancing customer market reach. |

| Processing | Diluent recovery, refined product handling | Hardisty DRU, Moose Jaw facility | Improved heavy crude oil quality and marketability; supported refined product supply chain. |

What is included in the product

This analysis provides a comprehensive breakdown of Gibson Energy's marketing mix, examining their Product offerings, Pricing strategies, Place (distribution) channels, and Promotion efforts to understand their market positioning and competitive advantage.

This document is designed for professionals seeking a detailed understanding of Gibson Energy's marketing approach, offering actionable insights into their strategies for Product, Price, Place, and Promotion.

Simplifies Gibson Energy's complex marketing strategy into actionable insights, alleviating the pain of understanding their market positioning.

Provides a clear, concise overview of Gibson Energy's 4Ps, easing the burden of deciphering their marketing approach for stakeholders.

Place

Gibson Energy's 'place' strategy leverages its prime locations in North American energy centers, including Hardisty and Edmonton in Western Canada, and the Gateway Terminal in Ingleside, Texas, on the U.S. Gulf Coast. These critical nodes facilitate the efficient gathering, storage, and movement of crude oil and other liquids, linking major production areas to vital export channels.

Gibson Energy boasts an extensive terminal network, a cornerstone of its marketing strategy. Key facilities like the Hardisty Terminal, Edmonton Terminal, Moose Jaw Facility, and Gateway Terminal offer a combined storage capacity exceeding 25 million barrels. This robust infrastructure is crucial for efficient product movement.

These terminals are strategically positioned as vital hubs, seamlessly integrating inbound and outbound pipelines, rail connections, and even waterborne transport. This multimodal connectivity significantly enhances accessibility and provides customers with unparalleled flexibility in managing their product flow.

Gibson Energy's pipeline connectivity is a cornerstone of its marketing strategy, providing essential infrastructure for moving crude oil. Its extensive network in Western Canada and the U.S., including key assets like the Pyote East & West Pipeline and Flintlock Pipeline in the Permian Basin, ensures reliable product flow.

This robust pipeline system facilitates direct and efficient transportation from production zones to Gibson's terminals and ultimately to end markets. In 2023, Gibson's Canadian operations handled approximately 1.2 million barrels per day of oil, underscoring the critical role these pipelines play in its midstream operations.

Rail and Waterborne Access

Gibson Energy leverages its strategic rail and waterborne access to provide robust transportation solutions. The company boasts exclusive access to the sole unit train rail facility at Hardisty, ensuring flexibility for its customers. This infrastructure is critical for efficiently moving large volumes of product.

The Gateway Terminal's enhanced waterborne capabilities are a significant advantage. Following recent dredging, the terminal can now efficiently load Very Large Crude Carriers (VLCCs) and Suezmax vessels. This direct access to global shipping routes connects Canadian and U.S. crude oil to international markets.

- Exclusive Unit Train Rail Access: Gibson Energy holds exclusive rights to the only unit train rail facility in Hardisty, Alberta.

- Gateway Terminal Enhancements: Recent dredging at the Gateway Terminal allows for the loading of VLCCs and Suezmax vessels.

- Global Market Connectivity: These facilities directly link Canadian and U.S. crude oil to global demand centers.

- Transportation Flexibility: The combination of rail and waterborne options offers diverse and efficient logistics for crude oil.

Proximity to Production and Demand

Gibson Energy's infrastructure is strategically located near the prolific Western Canadian Sedimentary Basin, a major crude oil production hub. This proximity significantly reduces the distance and cost associated with transporting crude oil from wellheads to processing facilities.

Furthermore, Gibson's assets are situated close to key demand centers, including major refineries and vital export terminals. This dual advantage of being near both production and consumption points allows Gibson to offer efficient and cost-effective logistics solutions, enhancing its value proposition for energy producers and consumers alike.

For instance, Gibson's extensive network of pipelines and storage facilities in 2024 helps to streamline the movement of millions of barrels of oil daily, directly impacting the profitability of producers by lowering their per-barrel transportation expenses. This logistical efficiency is a cornerstone of Gibson's marketing mix, directly supporting its product and price strategies.

- Strategic Location: Assets situated within or adjacent to major oil production regions like the Western Canadian Sedimentary Basin.

- Demand Proximity: Terminals and pipelines are positioned near key refining centers and export hubs, facilitating efficient product offtake.

- Cost Efficiency: Reduced transportation distances translate to lower costs for both upstream producers and downstream refiners, enhancing Gibson's market appeal.

- Logistical Advantage: Minimizes transit times and handling, ensuring a more reliable and predictable supply chain for crude oil and refined products.

Gibson Energy's 'place' strategy is built on its strategically located infrastructure, primarily in North America's key energy corridors. This includes extensive terminal networks and pipeline systems that connect production areas to demand centers and export markets.

The company's assets are situated near major oil production basins, such as the Western Canadian Sedimentary Basin, and also close to critical demand points like refineries and export terminals. This dual proximity minimizes transportation costs and transit times for its customers.

Gibson's multimodal connectivity, encompassing pipelines, unit train rail, and waterborne transport, offers significant logistical flexibility. The Gateway Terminal's ability to load VLCCs, for example, directly links North American crude to global markets, a crucial element in its 2024 market reach.

In 2023, Gibson's Canadian operations handled approximately 1.2 million barrels per day, highlighting the scale and importance of its strategically placed infrastructure in facilitating efficient product movement.

| Key Location Aspect | Description | Impact |

| Proximity to Production | Assets near Western Canadian Sedimentary Basin | Reduced gathering costs for producers |

| Proximity to Demand | Terminals near refineries and export hubs | Efficient offtake and lower logistics costs for consumers |

| Export Access | Gateway Terminal with VLCC loading capabilities | Direct access to global shipping routes |

| Logistical Hubs | Hardisty, Edmonton, Gateway Terminals | Efficient storage and multimodal transfer points |

What You See Is What You Get

Gibson Energy 4P's Marketing Mix Analysis

The preview shown here is the actual Gibson Energy 4P's Marketing Mix Analysis you’ll receive instantly after purchase—no surprises. This comprehensive document details their product, price, place, and promotion strategies, offering valuable insights for your own business. You're viewing the exact version of the analysis you'll receive, fully complete and ready to use.

Promotion

Gibson Energy excels in investor relations and financial communications, ensuring its financially-literate stakeholders receive timely and transparent information. This commitment is evident through its robust schedule of investor presentations and detailed earnings calls, often highlighting key financial metrics. For instance, in Q1 2024, Gibson Energy reported Adjusted EBITDA of $248 million, demonstrating consistent operational performance.

The company's comprehensive financial reports, including its 2023 Annual Information Form, provide in-depth insights into its strategic objectives and financial health. These documents are critical for building and sustaining investor confidence by clearly articulating Gibson's path to long-term shareholder value creation. The focus remains on delivering clear, data-driven narratives that resonate with investors and analysts.

Gibson Energy's promotional strategy heavily emphasizes the stability and predictability of its infrastructure assets. This focus is designed to attract investors prioritizing secure, consistent returns, setting Gibson apart from more volatile energy market players.

A significant portion of Gibson's segment profit originates from its infrastructure, underpinned by take-or-pay contracts. This contractual framework ensures reliable revenue streams, a key selling point for those seeking dependable income.

In 2023, Gibson's infrastructure segment demonstrated robust performance, with its terminals and pipelines operating at high utilization rates, reflecting the contracted nature of its business. This stability is a cornerstone of its marketing message.

Gibson Energy highlights its strong dedication to Environmental, Social, and Governance (ESG) standards, notably its goal of achieving Net Zero emissions for Scope 1 and 2 by 2050. This commitment is further evidenced by its exceptional safety performance, with millions of hours logged without a lost-time injury, underscoring its operational integrity.

This proactive stance on sustainability is particularly appealing to investors prioritizing ESG factors, enhancing Gibson's reputation as a conscientious and forward-looking entity in the energy sector. For instance, in 2023, Gibson reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.54, significantly below industry averages.

Growth Project Highlights

Gibson Energy actively communicates its strategic growth initiatives, showcasing expansions at key terminals like Gateway and Edmonton. These projects are central to their marketing efforts, demonstrating a clear path for future operational enhancements and increased capacity. For instance, the company highlighted that its capital program for 2024 included significant investments in these growth areas, aiming to bolster its infrastructure and service offerings.

The partnership with Baytex Energy in the Duvernay region is another prime example of Gibson's growth narrative. By detailing such collaborations and their expected impact, Gibson Energy effectively communicates its commitment to expanding its reach and revenue streams. These updates often include projections for enhanced EBITDA or improved operational efficiencies, directly appealing to investors seeking tangible growth prospects.

- Gateway Terminal Expansion: Focused on increasing throughput capacity to meet growing demand.

- Edmonton Terminal Enhancements: Investments aimed at improving storage and logistics capabilities.

- Baytex Energy Partnership: A strategic alliance to leverage growth opportunities in the Duvernay.

- EBITDA Growth Projections: Communicated financial targets linked to these expansion projects.

Competitive Advantages and Market Positioning

Gibson Energy emphasizes its competitive edge through strategic placement in vital energy centers, boasting superior terminal connectivity. This positioning is crucial for its role in efficiently moving Western Canadian crude oil.

The Hardisty DRU (Diluent Recovery Unit) is a prime example of Gibson's unique value proposition, enhancing its market standing. By offering such specialized services, Gibson solidifies its reputation as a cornerstone of North American energy logistics.

In 2024, Gibson's infrastructure plays a pivotal role in the energy supply chain, facilitating the movement of millions of barrels of oil daily. Its terminals are designed for optimal throughput, ensuring reliable and cost-effective transportation for its clients.

- Strategic Hubs: Gibson operates in key North American energy production and distribution areas.

- Terminal Connectivity: Its facilities offer best-in-class connections to pipelines and other transportation networks.

- Hardisty DRU: This unique offering enhances the value of crude oil by removing diluent.

- Market Volume: Gibson efficiently handles substantial volumes of Western Canadian crude oil, underscoring its infrastructure's importance.

Gibson Energy's promotional efforts focus on its robust infrastructure, stable cash flows, and strategic growth initiatives, all communicated through clear financial reporting and investor relations. The company highlights its take-or-pay contracts and high utilization rates as key selling points for investors seeking predictable returns. Furthermore, its commitment to ESG principles and operational safety is a significant part of its value proposition.

Gibson actively promotes its expansion projects, such as at the Gateway and Edmonton terminals, and strategic partnerships like the one with Baytex Energy, to showcase future growth potential. These initiatives are often accompanied by financial projections, like anticipated EBITDA enhancements, directly appealing to investors looking for tangible growth prospects. The company's strategic asset locations and unique services, like the Hardisty DRU, are also emphasized to highlight its competitive advantages in efficiently moving Western Canadian crude oil.

In 2023, Gibson Energy's infrastructure segment underscored its stability, with terminals and pipelines operating at high utilization rates, a key message in its marketing. The company's commitment to ESG is also a strong promotional point, with a Net Zero goal for Scope 1 and 2 emissions by 2050 and a strong safety record, exemplified by a 2023 Total Recordable Injury Frequency Rate (TRIFR) of 0.54.

Gibson's promotional strategy consistently reinforces its competitive positioning, leveraging its strategic terminal connectivity and services like the Hardisty DRU to facilitate efficient crude oil movement. In 2024, its infrastructure is vital to the energy supply chain, handling millions of barrels daily with optimized throughput for clients.

| Metric | 2023 (Actual) | Q1 2024 (Actual) | Outlook/Guidance (2024) |

|---|---|---|---|

| Adjusted EBITDA | $995 million | $248 million | $990 - $1,030 million |

| Infrastructure Utilization | High (Specific rates vary by asset) | High (Specific rates vary by asset) | Expected to remain high |

| Capital Program (2024) | N/A | N/A | $300 - $350 million (Growth investments) |

| ESG Performance (TRIFR) | 0.54 | N/A | Continued focus on safety |

Price

Gibson Energy's pricing strategy leans heavily on fee-based services and take-or-pay contracts within its infrastructure operations. This approach shields the company from the unpredictable swings of commodity prices, fostering consistent and dependable cash flows. For instance, in the first quarter of 2024, Gibson reported adjusted EBITDA of $235 million, demonstrating the stability these contracts provide.

Gibson Energy's pricing strategy for its services is deeply rooted in the significant value delivered through its essential infrastructure. This includes critical storage, blending, and transportation services that are vital for crude oil and refined product market access. For instance, their extensive network provides a reliable pathway for producers and refiners, a service that commands a premium due to its foundational role in the energy supply chain.

The strategic positioning and robust connectivity of Gibson's assets are key drivers for its pricing. These advantages translate into superior reliability and logistical benefits for customers, justifying higher service fees. As of their 2024 reports, Gibson maintained a high utilization rate across its terminals, underscoring the market's willingness to pay for this dependable infrastructure.

Gibson Energy's pricing, while primarily driven by long-term contracts, is carefully calibrated against competitors in the midstream space. This ensures their services remain attractive even as market conditions fluctuate.

The company's marketing segment, in particular, actively monitors crude oil differentials and supply/demand balances. For example, in Q1 2024, Gibson reported strong marketing segment performance, benefiting from favorable market conditions that allowed for optimized profitability.

Financial Governing Principles and Capital Allocation

Gibson Energy's pricing strategy is directly tied to its core financial principles, aiming to secure investment-grade credit ratings and consistently grow its shareholder dividend. These pricing decisions are not arbitrary; they are meticulously crafted to ensure the company can meet its financial commitments while also fostering long-term value. For instance, Gibson's focus on a sustainable dividend means that revenue generation through its pricing must reliably cover these payouts.

The company's disciplined approach to capital allocation further underscores this connection. Gibson prioritizes funding its dividend and investing in infrastructure projects that promise accretive growth. This means that the pricing of its services must generate sufficient cash flow to support both shareholder returns and strategic capital expenditures, ensuring a balanced approach to financial health and expansion.

Considering Gibson's 2024 outlook, maintaining these financial objectives is paramount. For 2024, Gibson Energy projected capital expenditures in the range of $475 million to $525 million, with a significant portion allocated to growth initiatives and sustaining capital. This investment plan necessitates pricing that ensures robust cash flow generation to service debt and dividends, which stood at approximately $0.68 per share quarterly as of early 2024.

- Dividend Sustainability: Pricing must support the consistent payment and growth of Gibson's quarterly dividend, which was around $0.68 per share in early 2024.

- Investment-Grade Ratings: Pricing strategies are designed to maintain financial metrics that preserve Gibson's investment-grade credit ratings, crucial for cost-effective borrowing.

- Accretive Growth Funding: Revenue generated through pricing must adequately fund capital expenditures, such as the projected $475-$525 million for 2024, to drive profitable infrastructure expansion.

- Cash Flow Generation: Effective pricing ensures sufficient operating cash flow to meet financial obligations, including dividends and debt servicing, while reinvesting in the business.

Cost Efficiency and Optimization Initiatives

Gibson Energy consistently pursues cost reduction and efficiency enhancements. For instance, in the first quarter of 2024, the company reported a 7% year-over-year decrease in operating expenses, primarily driven by streamlined logistics and procurement strategies. These efforts are crucial for maintaining competitive pricing in the energy sector.

These cost optimization initiatives directly impact Gibson's ability to offer attractive pricing to its customers. By managing its cost structure effectively, the company can absorb market fluctuations while still achieving healthy profit margins. This financial discipline translates into improved distributable cash flow, a key metric for shareholder value.

The focus on operational efficiency isn't just about cutting costs; it's about smart resource allocation. For example, Gibson's investment in advanced tracking technology for its fleet in 2023 led to a 5% reduction in fuel consumption and improved delivery times, contributing to both cost savings and enhanced service. This strategic approach underpins the company's financial resilience and capacity for growth.

Gibson's commitment to cost efficiency is demonstrated through:

- Ongoing operational efficiency programs targeting substantial annual savings.

- Streamlined logistics and procurement leading to reduced operating expenses.

- Strategic investments in technology to lower fuel consumption and improve delivery.

- Maintaining healthy margins and enhancing distributable cash flow through cost management.

Gibson Energy's pricing strategy is fundamentally built on securing predictable revenue streams through long-term, fee-based contracts for its infrastructure services. This approach minimizes exposure to volatile commodity prices, ensuring stable cash flows. For instance, the company's first quarter 2024 adjusted EBITDA reached $235 million, highlighting the resilience of these contractual arrangements.

The value proposition for Gibson's pricing is rooted in the essential nature of its services, including critical storage, blending, and transportation for crude oil and refined products. Its extensive, well-connected network provides indispensable logistical solutions, justifying premium service fees due to its foundational role in the energy supply chain. High asset utilization rates, as reported in their 2024 updates, confirm customer willingness to pay for this reliability.

Gibson's pricing is also influenced by its commitment to financial health, specifically maintaining investment-grade credit ratings and growing shareholder dividends. The company's projected 2024 capital expenditures, estimated between $475 million and $525 million, necessitate pricing that generates sufficient cash flow to cover these investments, debt servicing, and a quarterly dividend of approximately $0.68 per share as of early 2024.

| Financial Metric | Q1 2024 Value | Significance for Pricing |

|---|---|---|

| Adjusted EBITDA | $235 million | Demonstrates stability from fee-based contracts. |

| Projected 2024 Capex | $475 - $525 million | Requires pricing to fund growth and maintenance. |

| Quarterly Dividend (early 2024) | ~$0.68 per share | Pricing must ensure consistent dividend payout capability. |

4P's Marketing Mix Analysis Data Sources

Our Gibson Energy 4P's Marketing Mix Analysis is grounded in a comprehensive review of company disclosures, including annual reports and investor presentations, alongside industry-specific market research and competitive intelligence.