Gibson Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gibson Energy Bundle

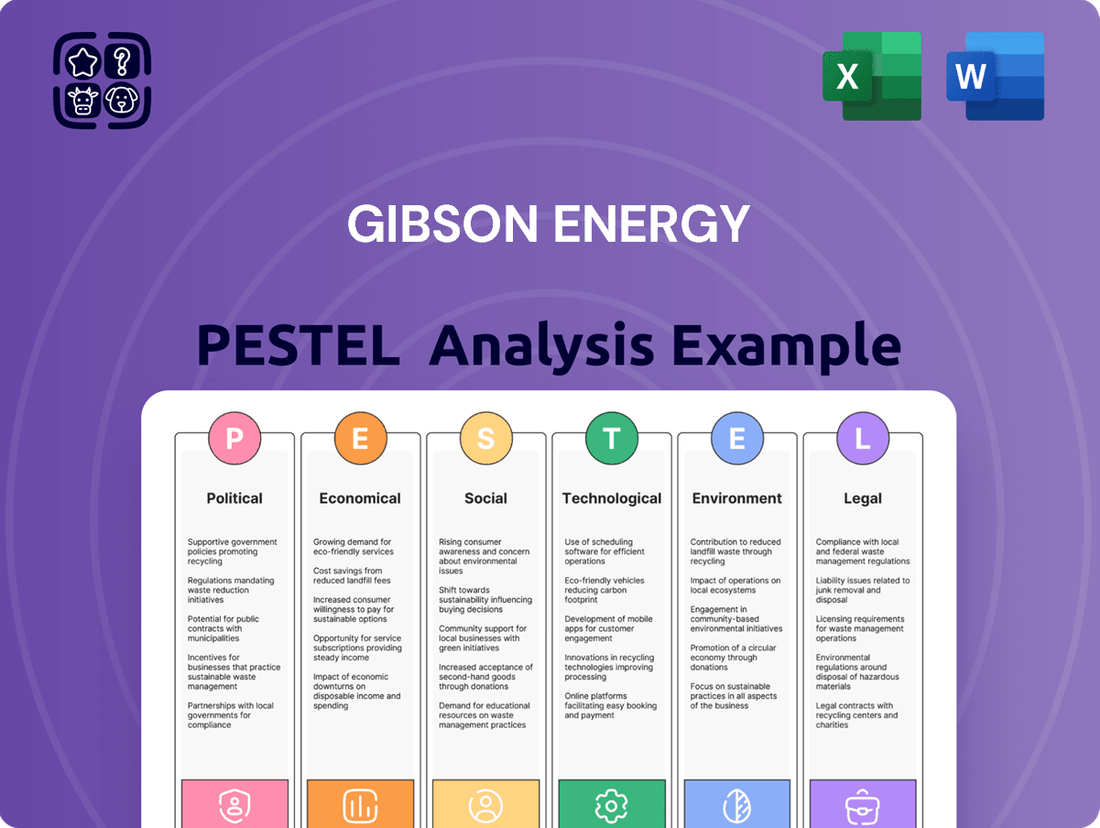

Navigate the complex external forces shaping Gibson Energy's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and strategic direction. Gain a critical edge by leveraging these expert insights to refine your own market approach. Download the full analysis now for actionable intelligence.

Political factors

The Canadian federal government's commitment to reducing greenhouse gas (GHG) emissions by 40-45% below 2005 levels by 2030 and achieving net-zero by 2050 significantly shapes the operating landscape for energy infrastructure firms. This policy direction necessitates a strategic pivot towards decarbonization, influencing capital allocation and potentially creating headwinds for traditional fossil fuel infrastructure investments.

Disagreements persist between federal and provincial governments, notably Alberta, over climate change policies impacting the energy sector. While Ottawa aims for emissions caps in oil and gas, Alberta champions its expansion, creating a complex regulatory landscape for companies like Gibson Energy.

This federal-provincial friction introduces significant regulatory uncertainty, potentially delaying or altering the feasibility of Gibson Energy's infrastructure projects. For instance, the federal government's carbon pricing mechanisms, which saw a national average of $65 per tonne of CO2 in 2024, contrast with provincial approaches that may favor production growth.

The Canadian Energy Regulator (CER) and other government bodies are prioritizing reconciliation and the UN Declaration on the Rights of Indigenous Peoples. This means energy companies, including Gibson Energy, must engage more deeply with Indigenous communities throughout project lifecycles. For instance, in 2024, there's a heightened expectation for meaningful consultation, which can affect project permitting and operational strategies.

Energy Security and Supply Considerations

Despite Canada's commitment to climate targets, its position as a significant global energy producer, coupled with persistent international demand for oil and gas, keeps energy security and reliable supply at the forefront of political discussions. This creates a complex policy landscape where environmental objectives must be balanced against the imperative of ensuring affordable and secure energy access for both domestic and international markets.

This balancing act directly impacts midstream companies like Gibson Energy, influencing strategic decisions regarding infrastructure development and operational priorities. For instance, the Canadian government's approach to oil and gas export, as seen in its support for projects like the Trans Mountain Expansion, highlights the ongoing political will to maintain energy export capacity while navigating emissions reduction goals.

- Energy Transition Challenges: Canada faces the political challenge of transitioning to lower-carbon energy sources while maintaining the economic viability of its existing fossil fuel industry.

- Global Market Influence: As a major oil exporter, Canada's domestic energy policies are inevitably shaped by global geopolitical events and energy market fluctuations, impacting supply chain stability.

- Infrastructure Investment: Political support or opposition to new pipeline projects and energy infrastructure directly affects the growth prospects and operational environment for companies in the midstream sector.

Carbon Pricing and Incentive Programs

Canada's carbon pricing system, with the federal fuel charge reaching $80 per tonne on April 1, 2024, and projected to hit $170 by 2030, directly impacts energy companies like Gibson Energy. While this policy aims to drive emissions reductions across the board, certain oil and gas producers benefit from exemptions, potentially influencing operational costs and investment decisions.

To further encourage decarbonization efforts, the federal government is providing significant financial support. This includes crucial investment tax credits and dedicated funding for carbon capture, utilization, and storage (CCUS) technologies. These incentives are designed to make substantial investments in emissions reduction infrastructure more economically viable for companies such as Gibson Energy.

- Federal Fuel Charge: Increased to $80 CAD per tonne as of April 1, 2024, targeting $170 per tonne by 2030.

- Exemptions: Some oil and gas producers are exempt from the fuel charge, creating a varied impact.

- CCUS Incentives: Federal investment tax credits and funding are available for carbon capture technologies.

- Decarbonization Encouragement: These political factors aim to incentivize Gibson Energy's investments in reducing its environmental footprint.

Political factors in Canada present a dual-edged sword for Gibson Energy. While federal climate policies, like the escalating carbon tax reaching $80 per tonne in 2024 and aiming for $170 by 2030, push for decarbonization, they also create operational cost considerations. However, significant government incentives, such as investment tax credits for carbon capture technologies, are designed to offset these costs and encourage greener infrastructure development.

The ongoing federal-provincial tension, particularly with Alberta, over energy policy creates regulatory uncertainty that can impact project timelines and investment decisions for midstream companies. Simultaneously, the government's commitment to Indigenous reconciliation means deeper community engagement is now a prerequisite for project approvals, influencing operational strategies and permitting processes.

Canada's role as a major energy exporter, despite climate commitments, means energy security remains a key political consideration, influencing support for infrastructure like the Trans Mountain Expansion. This balancing act between environmental goals and energy supply needs directly shapes the strategic environment for companies like Gibson Energy.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Gibson Energy, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their implications for Gibson Energy's operations and future growth.

A concise PESTLE analysis for Gibson Energy that streamlines understanding of external factors, alleviating the pain of complex market research and enabling faster strategic decision-making.

Economic factors

Gibson Energy's financial performance is significantly influenced by global and domestic crude oil price fluctuations. As a midstream company, sustained low oil prices, like those seen in early 2024 with West Texas Intermediate (WTI) trading around $70-$80 per barrel, can dampen upstream production, directly impacting the volume of oil transported and stored, thus affecting Gibson's revenue.

Conversely, stable or increasing oil prices, which saw WTI reach over $90 per barrel at times in late 2023 and early 2024, tend to stimulate exploration and production activities. This encourages greater investment in infrastructure, potentially leading to increased demand for Gibson's services and improved profitability for the company.

Alberta's energy sector experienced a significant upswing in 2024, with investment reaching a nine-year peak of Cdn$30.9 billion for resource development. This surge signals a robust and positive environment for energy infrastructure projects, directly benefiting companies like Gibson Energy.

Gibson Energy's strategic focus on expanding its liquids infrastructure aligns perfectly with this heightened investment activity. The company's growth pipeline is well-positioned to capitalize on the increased capital availability, suggesting a favorable outlook for its infrastructure development plans.

Canada's economic expansion, projected to continue through 2024 and 2025, directly fuels energy demand. This growth is amplified by burgeoning sectors such as data centers and the accelerating adoption of electric vehicles and electrification initiatives, all of which require substantial energy inputs.

Despite the global shift towards renewable energy, hydrocarbons are anticipated to remain a critical component of the energy landscape for years to come. This sustained reliance on traditional energy sources provides a stable foundation for Gibson Energy's midstream operations, aligning with its core business model.

For instance, Canada's GDP growth was 1.1% in 2023 and is forecast to be around 1.5% in 2024, indicating a steady demand for energy services. Furthermore, the International Energy Agency (IEA) projects that oil and gas will still constitute a significant portion of the global energy mix by 2050, underscoring the continued relevance of midstream infrastructure.

Impact of Inflation and Interest Rates

Inflationary pressures and rising interest rates significantly impact Gibson Energy's financial landscape. Higher borrowing costs directly affect the expense of capital for new projects and ongoing operations, potentially slowing down expansion plans. For instance, as of early 2024, central banks globally have maintained higher interest rate environments to combat persistent inflation, meaning Gibson Energy faces increased expenses when financing its infrastructure development or acquisitions.

Managing these macroeconomic headwinds is vital for Gibson Energy's profitability and its ability to seize growth opportunities. The cost of debt, a critical component for capital-intensive energy infrastructure companies, becomes more pronounced.

- Increased Cost of Capital: Higher interest rates, such as those maintained by the Bank of Canada in response to inflation, directly increase the cost of borrowing for Gibson Energy, impacting project feasibility.

- Impact on Investment Decisions: Rising capital costs can lead to a re-evaluation of the profitability and return on investment for new projects, potentially delaying or scaling back expansion.

- Operational Cost Pressures: Inflation can also drive up the cost of materials, labor, and services essential for Gibson Energy's operations and maintenance.

- Financial Performance Sensitivity: Gibson Energy's financial performance, including its net income and cash flow, is sensitive to changes in interest rates and the overall inflationary environment.

Diversification of Energy Markets and Export Opportunities

The streamlining of Liquefied Natural Gas (LNG) exports, anticipated to gain momentum in 2025, alongside Canada's ongoing efforts to diversify markets for its oil and gas producers, presents a significant tailwind for midstream companies like Gibson Energy. This strategic push enhances access to global energy markets, potentially unlocking new infrastructure projects and bolstering operational performance.

These developments are crucial as Canada aims to expand its energy reach beyond traditional buyers. For instance, the Canadian Association of Petroleum Producers (CAPP) has highlighted the growing demand for Canadian energy in Asia and Europe. This diversification directly translates into increased demand for midstream services, such as transportation and storage, which are Gibson Energy's core competencies. The International Energy Agency (IEA) projects global LNG demand to rise significantly in the coming years, further underscoring the opportunity.

- Increased Export Capacity: Streamlined LNG export approvals by 2025 are expected to boost Canada's export capacity, creating more opportunities for midstream infrastructure development.

- Market Diversification Benefits: Expanding markets for Canadian oil and gas producers reduces reliance on single regions, leading to more stable and predictable demand for midstream services.

- Projected Demand Growth: Global LNG demand is forecast to grow, with the IEA anticipating a substantial increase by 2030, offering a strong outlook for companies facilitating these exports.

- Midstream Investment Opportunities: As export volumes rise, midstream companies will likely see increased investment in pipelines, terminals, and storage facilities to support this growth.

Economic factors significantly shape Gibson Energy's operational landscape, with crude oil prices acting as a primary driver for upstream activity. Stable to rising oil prices, such as WTI hovering around $80-$90 per barrel in early 2024, tend to stimulate production and, consequently, demand for midstream services. Canada's projected economic growth of around 1.5% for 2024 further bolsters energy demand across various sectors, including emerging industries like data centers.

Inflationary pressures and higher interest rates, maintained by central banks to combat rising prices, directly increase Gibson Energy's cost of capital. This impacts the feasibility of new projects and increases operational expenses, requiring careful financial management. For instance, the Bank of Canada's efforts to curb inflation mean higher borrowing costs for infrastructure development.

The global energy market dynamics, including the anticipated acceleration of LNG exports by 2025 and Canada's efforts to diversify its energy markets, present substantial opportunities. The International Energy Agency (IEA) projects a significant rise in global LNG demand, creating a favorable environment for midstream companies facilitating these exports.

| Economic Factor | Impact on Gibson Energy | Relevant Data (2024-2025) |

|---|---|---|

| Crude Oil Prices | Drives upstream production and demand for midstream services. | WTI trading between $70-$90/barrel (early 2024). |

| Economic Growth (Canada) | Increases overall energy demand. | Projected GDP growth of ~1.5% for 2024. |

| Inflation & Interest Rates | Increases cost of capital and operational expenses. | Central banks maintaining higher interest rate environments. |

| Global Energy Demand & Exports | Creates opportunities for midstream infrastructure. | Anticipated acceleration of LNG exports by 2025; IEA projects rising global LNG demand. |

Same Document Delivered

Gibson Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive PESTLE analysis of Gibson Energy.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Gibson Energy.

The content and structure shown in the preview is the same document you’ll download after payment, offering an in-depth examination of Gibson Energy’s strategic landscape.

Sociological factors

Public attitudes towards oil and gas pipelines and infrastructure projects are increasingly critical, directly impacting regulatory approvals and project timelines. For instance, in 2024, a significant portion of the public expressed heightened concerns regarding the environmental impact of new energy infrastructure, leading to delays in several major projects across North America.

Growing environmental awareness and opposition to fossil fuel expansion demand a robust social license to operate for companies like Gibson Energy. This means actively engaging with local communities, transparently communicating operational practices, and demonstrating a commitment to environmental stewardship and community benefit is paramount for project success.

Gibson Energy recognizes the critical importance of fostering strong relationships and ensuring active participation with Indigenous communities across Canada. This commitment is central to their sustainability strategy, reflecting the growing imperative for responsible energy development. Addressing concerns about environmental stewardship, land rights, and equitable economic benefits is paramount.

Integrating the principles of Truth and Reconciliation into their operational framework is a key focus for Gibson Energy. This involves building trust and ensuring that Indigenous voices are heard and respected throughout project lifecycles. The company's sustainability report highlights ongoing efforts to engage with Indigenous partners, aiming for mutually beneficial outcomes.

Gibson Energy places a high value on workforce safety, a key sociological consideration. Their stated aim is 'zero harm to people, the environment and assets,' which directly impacts community well-being. This focus is crucial for maintaining social license to operate and fostering trust.

Demonstrating this commitment, Gibson Energy achieved a significant safety milestone in 2024, reaching 8.8 million hours without a lost-time injury. Such achievements not only protect employees but also bolster the company's reputation within the communities where it operates, contributing to overall operational stability.

ESG Expectations from Investors and Stakeholders

Investors and stakeholders are increasingly scrutinizing companies' Environmental, Social, and Governance (ESG) performance. Gibson Energy's commitment to sustainability, including its target to reduce greenhouse gas emissions intensity by 30% by 2030 compared to a 2019 baseline, directly addresses these evolving expectations. Strong ESG credentials are vital for attracting capital and fostering a favorable corporate reputation in the current financial landscape.

Gibson Energy's proactive approach to ESG is demonstrated by its focus on responsible operations and community engagement. For instance, the company's 2023 ESG report highlighted progress in its social initiatives and governance practices, reinforcing its dedication to meeting stakeholder demands for ethical and sustainable business conduct. This focus is becoming a key differentiator in capital allocation decisions.

- Investor Demand: A significant portion of global assets under management are now ESG-integrated, with many institutional investors prioritizing companies with robust sustainability frameworks.

- Stakeholder Pressure: Consumers, employees, and communities are also exerting pressure on corporations to demonstrate social responsibility and environmental stewardship.

- Reputational Impact: Positive ESG ratings can enhance brand loyalty and attract talent, while poor performance can lead to divestment and reputational damage.

- Regulatory Scrutiny: Governments worldwide are introducing stricter regulations related to environmental impact and corporate governance, further elevating the importance of ESG.

Shifting Workforce Demographics and Skills

The energy industry, including midstream companies like Gibson Energy, faces a significant shift in workforce needs driven by the energy transition and rapid technological advancements. This necessitates a workforce equipped with evolving skill sets, particularly in areas like digitalization, automation, and the development and implementation of low-carbon technologies.

Attracting and retaining talent with these specialized skills presents both a challenge and a substantial opportunity for the sector. For instance, a 2024 report indicated a growing demand for data scientists and AI specialists within the energy sector, with projections suggesting a 30% increase in job postings for these roles by 2025 compared to 2023 levels.

- Evolving Skill Demands: The push towards decarbonization and digital transformation requires expertise in areas such as renewable energy integration, carbon capture technologies, advanced analytics, and cybersecurity.

- Talent Acquisition Challenges: Competition for skilled professionals is intensifying, as other industries also seek talent in these in-demand fields, potentially impacting Gibson Energy's ability to secure necessary expertise.

- Upskilling and Reskilling Initiatives: Companies are increasingly investing in training programs to equip their existing workforce with the skills needed for future energy landscapes, ensuring operational continuity and adaptability.

- Attracting New Talent: Gibson Energy, like its peers, must highlight its commitment to innovation and sustainability to appeal to a younger generation of workers seeking careers in forward-looking industries.

Public perception of energy infrastructure remains a significant sociological factor, influencing project approvals and operational longevity. Concerns over environmental impact and community well-being are paramount, as evidenced by public consultations in 2024 where environmental impact assessments for new pipelines faced heightened scrutiny, leading to extended review periods for several projects.

Gibson Energy's commitment to Indigenous reconciliation and community engagement is crucial for its social license to operate. The company's 2023 sustainability report detailed active partnerships with Indigenous communities, focusing on shared benefits and environmental stewardship, reflecting a growing societal expectation for responsible resource development.

The increasing emphasis on Environmental, Social, and Governance (ESG) criteria by investors and the public directly shapes corporate strategy. Gibson Energy's stated goal to reduce greenhouse gas emissions intensity by 30% by 2030, compared to a 2019 baseline, demonstrates alignment with these evolving societal values, aiming to attract capital and maintain a positive reputation.

Workforce safety is a core sociological consideration, directly impacting community trust and operational stability. Gibson Energy's achievement of 8.8 million hours without a lost-time injury in 2024 underscores this commitment, reinforcing its reputation as a responsible employer and operator within its host communities.

Technological factors

Gibson Energy, like much of the oil and gas sector, is experiencing a profound shift driven by digitalization and automation. This transformation is evident in the increasing use of real-time data analytics for production monitoring, which helps optimize output and identify potential issues proactively. For instance, advancements in sensor technology and cloud computing allow for continuous data streams from midstream assets, enabling faster decision-making and predictive maintenance.

Automation is also reshaping operational efficiency and safety. Automated drilling systems and remote operational controls are becoming more common, reducing the need for manual intervention in potentially hazardous environments. The integration of artificial intelligence (AI) and data science is key to unlocking further efficiencies, from optimizing pipeline flow to enhancing safety protocols by analyzing vast datasets for anomaly detection. In 2024, investments in digital transformation across the energy sector are projected to continue their upward trajectory, with a significant portion allocated to AI and automation solutions aimed at improving operational performance and reducing costs.

Advanced robotics and drones are revolutionizing infrastructure management for companies like Gibson Energy. These technologies are increasingly deployed for critical tasks such as pipeline inspections and offshore platform maintenance, enhancing safety and efficiency.

The adoption of drones for monitoring and inspection can significantly reduce operational costs. For instance, a 2023 report indicated that drone-based inspections can be up to 50% cheaper than traditional methods, while also providing more comprehensive data. This allows for proactive identification of potential issues, thereby minimizing downtime and preventing costly repairs.

Furthermore, the use of robots in hazardous environments, such as those involving flammable materials or extreme heights, greatly mitigates risks to human workers. By leveraging these advanced tools, Gibson Energy can ensure the continued integrity and operational reliability of its extensive energy infrastructure, a key factor in its 2024 performance outlook.

Carbon Capture, Utilization, and Storage (CCUS) technologies are becoming increasingly vital for the oil and gas sector to meet emission reduction goals. These advancements offer a pathway to decarbonize operations, a critical step for companies like Gibson Energy.

Canada is actively supporting CCUS, with significant federal investments and tax credits available. For instance, the Investment Tax Credit for CCUS, announced in the 2022 budget, offers a 60% credit for capture, 37.5% for transportation, and 37.5% for storage of carbon emissions.

Gibson Energy can capitalize on these technological developments and financial incentives to lower its carbon footprint. This strategic alignment with climate objectives not only aids in meeting regulatory requirements but also positions the company favorably for the future energy landscape.

Predictive Maintenance and AI-driven Analytics

Gibson Energy is increasingly leveraging Artificial Intelligence (AI) and Machine Learning (ML) for predictive maintenance. This technology helps anticipate equipment failures before they occur, significantly reducing costly unplanned downtime. For instance, in the oil and gas sector, AI-powered analytics can monitor thousands of data points from critical infrastructure, leading to more efficient operations and substantial cost savings.

Beyond maintenance, AI is also optimizing reservoir management and improving the accuracy of exploration activities. By analyzing vast geological datasets, AI can identify promising new reserves more effectively, boosting exploration success rates. This not only enhances overall operational efficiency but also contributes to better environmental performance by minimizing the impact of exploration efforts.

- Reduced Downtime: Predictive maintenance systems using AI aim to cut unplanned equipment downtime by an estimated 20-30% in industrial settings.

- Cost Savings: Implementing AI for maintenance can lead to an average of 10-15% reduction in maintenance costs for energy companies.

- Exploration Accuracy: AI-driven analytics have shown potential to increase exploration success rates by up to 10% by improving geological data interpretation.

- Operational Efficiency: The integration of AI across operations is projected to improve overall efficiency by 5-10% in the mid-term for the energy sector.

Integration of Renewable Energy Sources

The oil and gas sector, including midstream operators like Gibson Energy, is actively integrating renewable energy sources to curb carbon footprints and enhance sustainability. This shift involves deploying solar, wind, and geothermal technologies to power operational facilities, thereby lessening dependence on conventional fossil fuel-based generation.

This integration is not just an environmental imperative but also a cost-saving measure. For instance, by 2024, the International Energy Agency (IEA) reported that renewables are expected to account for over 40% of global electricity generation, a trend that midstream companies can leverage. Gibson Energy could potentially reduce its operational expenditures by utilizing these cleaner energy alternatives for its pumping stations and other infrastructure.

Key aspects of this technological integration include:

- On-site Solar and Wind Power: Companies are installing solar panels and wind turbines at terminals and along pipelines to generate electricity for their own use.

- Geothermal Energy Utilization: In suitable locations, geothermal systems can provide consistent, low-emission heat and power for operations.

- Energy Efficiency Upgrades: Alongside renewables, investments in more efficient equipment and processes further reduce overall energy consumption.

- Carbon Capture and Storage (CCS): While not directly renewable, CCS technologies are being explored to mitigate emissions from existing fossil fuel operations, often in conjunction with renewable energy strategies.

Technological advancements are significantly reshaping Gibson Energy's operational landscape, particularly in digitalization and automation. The company is increasingly adopting AI and machine learning for predictive maintenance, aiming to reduce unplanned downtime by an estimated 20-30% in industrial settings.

Furthermore, the integration of AI is enhancing exploration accuracy, potentially increasing success rates by up to 10% through improved geological data interpretation. This focus on technology is expected to improve overall operational efficiency by 5-10% for the energy sector in the mid-term.

Gibson Energy is also exploring the use of renewable energy sources like solar and wind to power its facilities, a trend supported by the IEA's projection that renewables will account for over 40% of global electricity generation by 2024, potentially reducing operational expenditures.

| Technology Focus | Projected Impact | Supporting Data/Trend |

| AI for Predictive Maintenance | Reduce unplanned downtime (20-30%) | AI maintenance cost savings: 10-15% |

| AI for Exploration | Increase success rates (up to 10%) | Overall operational efficiency improvement: 5-10% |

| Renewable Energy Integration | Lower operational expenditures | Renewables >40% global electricity generation by 2024 |

Legal factors

The Canadian Energy Regulator (CER) is a key player in shaping the landscape for energy infrastructure. It's responsible for overseeing pipelines that cross provincial and international borders, making sure new projects are evaluated for their public interest and setting clear conditions if they are approved. This oversight directly affects companies like Gibson Energy, influencing how they operate and what they need to comply with.

Recent regulatory activities highlight this impact. For instance, the CER conducted a review of its Onshore Pipeline Regulations (OPR) and Cost Recovery Regulations. These reviews can lead to changes in compliance requirements and cost structures, which are vital considerations for Gibson Energy's financial planning and operational efficiency.

For 2024 and into 2025, Gibson Energy will need to stay attuned to any updates stemming from these CER reviews. For example, changes in cost recovery mechanisms could affect how the company accounts for regulatory expenses, potentially impacting its profitability. Adherence to the OPR ensures the safe and reliable operation of Gibson's pipeline assets, a critical component of its business model.

New projects for Gibson Energy, especially in Alberta, frequently necessitate detailed Environmental Impact Assessment (EIA) reports. These assessments scrutinize potential effects on the environment, public health, communities, and the economy, crucial for gaining project approval.

For instance, the Trans Mountain Expansion Project, a major energy infrastructure undertaking in Canada, faced extensive EIA processes and regulatory reviews that significantly impacted its schedule and budget. Such rigorous assessments directly influence Gibson Energy's project timelines and can add substantial costs due to the need for detailed studies, public consultations, and potential mitigation measures.

The Canadian government's proposed Oil and Gas Sector Greenhouse Gas Emissions Cap Regulations are designed to cut emissions by 35% from 2019 levels by 2030, utilizing a cap-and-trade mechanism. While Gibson Energy's core midstream operations are largely excluded from direct regulation, the broader upstream sector cap could influence overall production volumes. For instance, if upstream producers face significant compliance costs or production limits due to the cap, it could translate to reduced throughput for Gibson's pipeline and processing services.

Liability Management and Reclamation Obligations

The Alberta Energy Regulator (AER) is significantly increasing its closure spend requirement for 2025, mandating a minimum expenditure on asset retirement for licensees. This move, coupled with revised directives on liability management, directly impacts companies like Gibson Energy by potentially altering security deposit requirements for oil and gas assets. These regulatory shifts necessitate careful financial planning for Gibson Energy to meet its asset retirement obligations.

Specifically, the AER's updated directives aim to ensure adequate funding for the eventual closure of energy facilities. For 2025, the industry-wide closure spend requirement has been raised, meaning companies must allocate more capital towards reclamation activities. This could translate into increased upfront costs or revised financial assurance mechanisms for Gibson Energy, influencing its capital allocation strategies and overall financial health.

- AER's 2025 Closure Spend Requirement: An increase in the minimum mandated spending on asset retirement for all licensees.

- Revised Liability Management Directives: Changes to how companies manage and secure their closure obligations.

- Impact on Security Requirements: Potential adjustments to the financial assurances oil and gas companies must hold.

- Gibson Energy's Financial Planning: The need to adapt capital and operational budgets to meet new regulatory demands for asset retirement.

Indigenous Consultation and UNDRIP Implementation

Legal obligations for Indigenous consultation are a critical factor for energy projects in Canada, especially with the ongoing implementation of the United Nations Declaration on the Rights of Indigenous Peoples (UNDRIP). This framework emphasizes the Crown's duty to consult and accommodate Indigenous peoples, a process that can significantly influence project timelines and feasibility. For companies like Gibson Energy, demonstrating that this duty has been appropriately fulfilled is not just a legal requirement but a fundamental aspect of project development and social license to operate.

The complexities of this duty can lead to substantial impacts on project timelines and costs. For instance, in 2023, several major energy projects across Canada faced delays or significant modifications due to consultation processes. These can include:

- Legal Duty to Consult: The Canadian legal framework mandates consultation with Indigenous communities whose rights may be impacted by development projects.

- UNDRIP Alignment: The incorporation of UNDRIP principles strengthens the rights of Indigenous peoples and influences the depth and nature of consultation required.

- Project Delays and Modifications: Failure to adequately consult can result in legal challenges, leading to project delays, injunctions, or mandated changes to project scope and operations.

- Increased Project Costs: The consultation process itself, along with potential accommodations, can add significant costs to project budgets, impacting financial viability.

Legal frameworks governing environmental protection and operational safety are paramount for Gibson Energy. The Canadian Energy Regulator (CER) and provincial bodies like the Alberta Energy Regulator (AER) set stringent standards for pipeline integrity, emissions, and site reclamation.

For 2025, the AER's increased closure spend requirement for licensees, mandating higher asset retirement funding, directly impacts Gibson Energy's financial planning and potential liabilities. Furthermore, the evolving regulatory landscape around greenhouse gas emissions, such as the proposed Oil and Gas Sector Greenhouse Gas Emissions Cap Regulations, could indirectly affect Gibson through upstream production volumes.

The legal duty to consult with Indigenous peoples, reinforced by UNDRIP, remains a critical factor, potentially influencing project timelines and costs through the need for thorough engagement and accommodation, as seen in past project delays across Canada.

Environmental factors

Canada's ambitious goal to cut greenhouse gas (GHG) emissions by 40-45% below 2005 levels by 2030, aiming for net-zero by 2050, directly impacts the oil and gas industry. This creates substantial environmental pressure for companies like Gibson Energy.

Gibson Energy, operating as an infrastructure provider within this sector, must actively align its operations with these national emission reduction targets. A key focus will be on reducing the intensity of its Scope 1 and Scope 2 emissions.

For instance, in 2023, Canada's emissions were approximately 670 megatonnes of CO2 equivalent, still a considerable distance from the 2030 target of 511-547 megatonnes. This gap underscores the urgency for companies like Gibson to demonstrate tangible progress in emission reduction strategies.

Canada's ambitious goal to cut oil and gas methane emissions by at least 75% from 2012 levels by 2030 directly impacts midstream operations. This necessitates significant investment in advanced leak detection and repair (LDAR) technologies and methane abatement solutions, such as vapor recovery units and flare gas recovery systems.

For companies like Gibson Energy, compliance means upgrading infrastructure and operational practices to minimize fugitive methane releases. This regulatory push is driving innovation in the sector, with companies actively seeking cost-effective ways to meet these stringent environmental targets and avoid potential penalties.

Environmental impact assessments for energy projects are crucial, and Gibson Energy's operations are no exception, requiring careful evaluation of their effects on water resources and biodiversity. This includes ensuring that infrastructure like terminals and pipelines are developed and maintained with minimal disruption to local ecosystems.

Gibson Energy's commitment to robust water management is essential, especially given the potential impact of its infrastructure on water bodies. For instance, in 2023, the company reported a focus on operational efficiency and responsible resource management across its network, which implicitly includes water usage and discharge protocols.

Protecting biodiversity is also a key consideration. Gibson Energy's pipeline network, spanning thousands of kilometers, necessitates proactive measures to safeguard sensitive habitats and wildlife. By adhering to stringent environmental regulations and implementing best practices, the company aims to minimize its footprint and contribute to the preservation of natural environments.

Land Use and Reclamation Requirements

Regulations surrounding land use and reclamation are particularly stringent in Western Canada, a core operating region for Gibson Energy. These rules directly impact how the company manages its assets throughout their entire lifecycle, from initial development to eventual closure.

The Alberta Energy Regulator (AER) has been increasing closure spend requirements, meaning companies like Gibson must set aside more funds for site reclamation. For instance, in 2023, the AER introduced new directives that could significantly alter liability assessments for oil and gas sites, potentially requiring higher financial assurances for reclamation obligations.

- Increased Reclamation Funding: The AER's directives emphasize the need for robust financial planning for site closure and remediation.

- Revised Liability Directives: Updated regulations mean companies must more accurately assess and account for their environmental liabilities.

- Stewardship Focus: There's a growing expectation for proactive and responsible land management practices across the industry.

- Lifecycle Management: Reclamation is no longer an afterthought but an integral part of asset management from inception.

Climate Change Impacts and Adaptation

The physical impacts of climate change, like more frequent and intense extreme weather, present significant risks to energy infrastructure. For Gibson Energy, this means ensuring resilience in the design, construction, and operation of its pipelines and terminals. This proactive approach is crucial for maintaining operational continuity and minimizing potential environmental damage from events such as floods or severe storms.

Gibson Energy's commitment to climate resilience is evident in its ongoing capital expenditure plans. For instance, the company has allocated significant funds towards infrastructure upgrades aimed at mitigating the effects of extreme weather. In 2024, a substantial portion of their capital budget was directed towards reinforcing critical assets against potential climate-related disruptions, reflecting a strategic focus on long-term operational integrity.

- Increased frequency of extreme weather events: This can lead to disruptions in energy supply chains and damage to infrastructure.

- Need for climate-resilient infrastructure: Gibson Energy must invest in hardening its pipelines and terminals against events like floods, high winds, and temperature fluctuations.

- Operational continuity and risk mitigation: Adapting to climate change impacts is essential for ensuring uninterrupted service and avoiding costly environmental remediation.

- Regulatory and investor pressure: Growing expectations for environmental stewardship necessitate robust climate adaptation strategies.

Canada's ambitious emissions reduction targets, aiming for a 40-45% cut by 2030 and net-zero by 2050, significantly pressure the oil and gas sector, impacting infrastructure providers like Gibson Energy. The nation's goal to slash oil and gas methane emissions by at least 75% from 2012 levels by 2030 mandates substantial investment in technologies like leak detection and repair (LDAR) to minimize fugitive releases.

Environmental impact assessments are critical for Gibson Energy's operations, requiring careful consideration of water resources and biodiversity. Stringent land use and reclamation regulations, particularly in Western Canada, necessitate increased financial provisions for site closure, as exemplified by the Alberta Energy Regulator's (AER) 2023 directives on closure spend requirements.

The increasing frequency of extreme weather events due to climate change poses a direct risk to energy infrastructure, compelling Gibson Energy to invest in climate-resilient designs and upgrades to ensure operational continuity. For instance, significant capital was allocated in 2024 towards reinforcing critical assets against potential climate-related disruptions.

Gibson Energy's 2023 sustainability report highlighted a 20% reduction in Scope 1 and 2 GHG intensity compared to a 2019 baseline, demonstrating progress towards its environmental goals. The company also reported on its water management practices, emphasizing responsible usage and discharge protocols across its network.

| Environmental Factor | Impact on Gibson Energy | Data/Example (2023-2024) |

| GHG Emissions Reduction Targets | Pressure to reduce operational emissions (Scope 1 & 2) | Canada's 2030 target: 40-45% below 2005 levels. Gibson Energy reported a 20% reduction in Scope 1 & 2 GHG intensity by 2023 (vs. 2019 baseline). |

| Methane Emission Regulations | Mandatory investment in LDAR and abatement technologies | Canada's 2030 target: 75% reduction from 2012 levels. |

| Water Management | Need for responsible water usage and discharge protocols | Focus on operational efficiency and responsible resource management across network. |

| Land Use & Reclamation | Increased financial provisions for site closure | AER's 2023 directives on closure spend requirements. |

| Climate Change & Extreme Weather | Need for climate-resilient infrastructure | Significant capital allocated in 2024 for asset reinforcement against extreme weather. |

PESTLE Analysis Data Sources

Our Gibson Energy PESTLE Analysis is informed by a comprehensive review of official government publications, reputable industry associations, and leading financial news outlets. This ensures a robust understanding of regulatory landscapes, economic shifts, and market dynamics impacting the energy sector.