Gibson Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gibson Energy Bundle

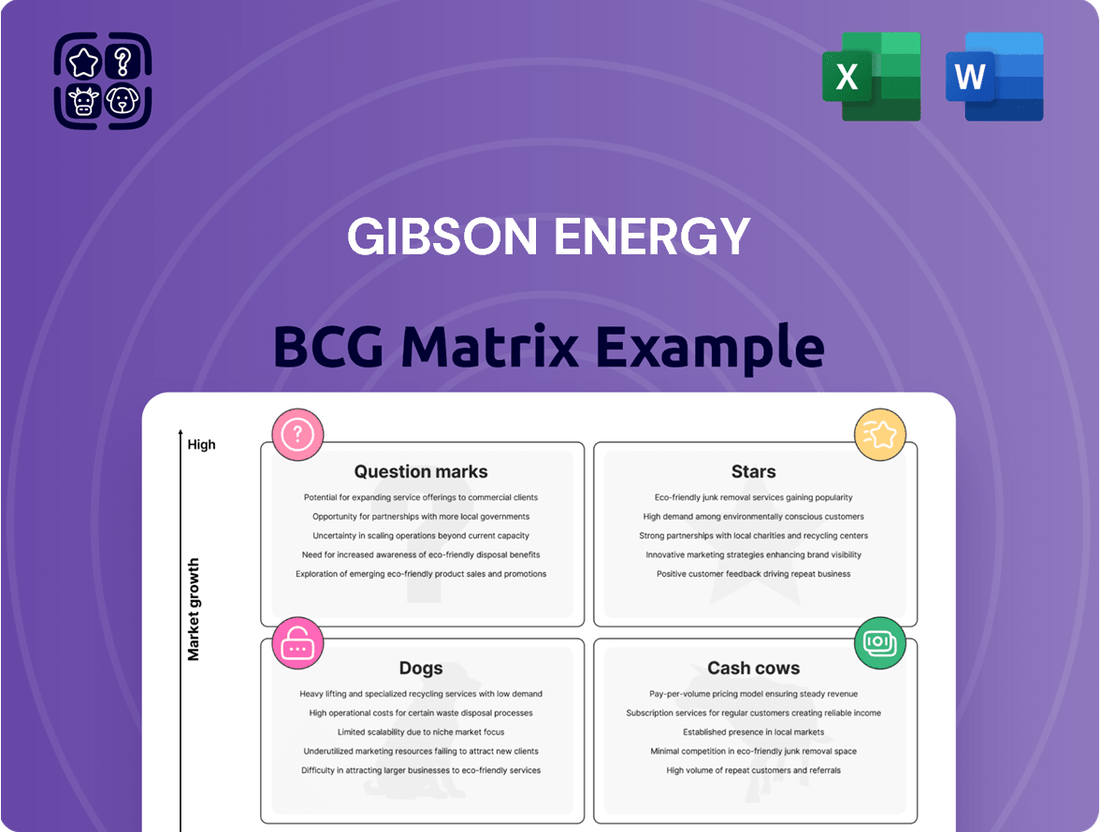

Curious about Gibson Energy's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse portfolio stacks up in terms of market share and growth potential. Understand which segments are fueling growth and which might need a strategic rethink.

Unlock the full potential of this analysis by purchasing the complete Gibson Energy BCG Matrix. Gain detailed insights into their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable strategies to optimize your own investment decisions.

Don't just guess where Gibson Energy's strengths lie; know it. Our comprehensive report provides a quadrant-by-quadrant breakdown and data-backed recommendations, empowering you to make informed, strategic moves. Purchase the full BCG Matrix today for a clear roadmap to competitive advantage.

Stars

The Gateway Terminal, significantly bolstered by its acquisition and infrastructure upgrades like dredging and the Cactus II pipeline, stands as a key growth engine for Gibson Energy. This terminal is demonstrating robust performance, evidenced by record export volumes and an expanding market share within the burgeoning Corpus Christi export market, highlighting its strong position in a high-demand sector.

Gibson Energy's Edmonton Terminal's new 435,000-barrel tanks, set for completion in Q4 2024, are a significant development. These additions are specifically designed to accommodate shippers who will be utilizing the Trans Mountain Expansion (TMX) pipeline.

This strategic expansion of storage capacity at the Edmonton Terminal is a direct play on the anticipated growth in Western Canadian crude oil exports. By providing this essential infrastructure, Gibson is positioning itself to benefit from increased throughput volumes on the TMX, a key driver for the region's energy sector.

The Gateway Dredging Project, completed in early 2025, positions Gibson Energy's Gateway Terminal as a strong performer. This enhancement allows for over 10% greater volume loading onto VLCCs and Suezmax vessels.

This increased capacity directly boosts the terminal's competitive edge and utilization rates. Such improvements are crucial for maintaining a high-growth trajectory, solidifying its position in the market.

Cactus II Pipeline Connection

The Cactus II Pipeline connection at Gibson Energy's Gateway Terminal is a significant near-term growth catalyst. This strategic link directly enhances Gibson's access to crude oil originating from the prolific Permian Basin. This boosts the terminal's competitive advantage in a crucial energy export market.

This enhanced connectivity strengthens the Gateway Terminal's role as a pivotal export hub. It allows Gibson to capture a larger share of the market within a high-growth energy export corridor. The pipeline integration is expected to drive increased throughput and revenue for Gibson Energy.

- Pipeline Integration: Cactus II connection provides direct access to Permian Basin crude.

- Market Position: Enhances Gateway Terminal's status as a key export hub.

- Growth Driver: Expected to increase market share in a high-demand export corridor.

Duvernay Infrastructure Partnership

Gibson Energy's Duvernay Infrastructure Partnership with Baytex Energy at its Edmonton terminal signifies a strategic move into a high-growth area. This collaboration focuses on developing new crude infrastructure, directly addressing the expanding needs of the Duvernay basin. Gibson's market presence is set to grow substantially through this venture.

This partnership is a key component of Gibson Energy's strategy, positioning it to capitalize on the increasing production from the Duvernay. The investment in new infrastructure is crucial for efficiently moving this growing volume of crude oil. The Edmonton terminal expansion is expected to enhance Gibson's fee-based revenue streams.

- Strategic Expansion: The Duvernay partnership targets new crude infrastructure in a rapidly developing basin.

- Partnership Value: Collaboration with Baytex Energy at the Edmonton terminal highlights a significant investment opportunity.

- Market Growth: This initiative allows Gibson Energy to expand its market presence in a key production area.

- Revenue Enhancement: The expansion is anticipated to bolster Gibson's fee-based revenue model.

Gibson Energy's Gateway Terminal is a clear Star in the BCG matrix, showing high market share in a high-growth export market. The recent dredging project, completed in early 2025, allows for over 10% greater volume loading on large vessels, directly increasing its competitive edge and utilization. The Cactus II pipeline connection further solidifies its position by providing direct access to Permian Basin crude, a significant growth catalyst expected to drive increased throughput and revenue.

| Asset | Market Growth | Market Share | Key Developments |

|---|---|---|---|

| Gateway Terminal | High (Corpus Christi Export Market) | High (Expanding) | Dredging Project (Early 2025), Cactus II Pipeline Connection |

What is included in the product

Gibson Energy's BCG Matrix analysis categorizes business units by market share and growth potential.

It guides strategic decisions on investment, divestment, or maintenance for each unit.

A clear BCG Matrix visual instantly clarifies Gibson Energy's portfolio, alleviating the pain of strategic ambiguity.

Cash Cows

The Hardisty Terminal is a true cash cow for Gibson Energy, holding a commanding position in Western Canada's midstream sector. It processes a significant volume of crude oil from the Western Canadian Sedimentary Basin, acting as a critical hub.

Despite moderate overall growth in the Canadian midstream market, Hardisty's established infrastructure and reliable operations translate into steady and predictable cash flows. This consistent generation of cash is a hallmark of a strong cash cow, providing financial stability.

Gibson Energy's infrastructure segment is a clear cash cow, contributing around 90% of the segment's profit. This stability is largely due to over 75% of its infrastructure revenue coming from take-or-pay contracts, ensuring highly predictable and resilient cash flows.

Gibson Energy has a well-established track record of consistent and growing dividend payments. This reliability stems from the predictable and stable cash flows generated by its mature infrastructure assets.

The company's commitment to funding its dividend underscores the strong cash-generating capabilities of its core business segments. For instance, in 2023, Gibson Energy reported distributable cash flow of approximately $700 million, a significant portion of which was allocated to shareholder returns.

Long-term Contracted Asset Base

Gibson Energy's infrastructure assets, largely secured by long-term, take-or-pay contracts, function as reliable cash cows. These agreements, typically with investment-grade counterparties, insulate a significant portion of revenue from the unpredictable swings of commodity prices.

This contractual framework provides a predictable and stable cash flow, a hallmark of cash cow businesses. For instance, in 2024, Gibson continued to emphasize the strength of its contracted revenue base, which underpins its ability to generate consistent earnings.

- Contracted Revenue Stability: The majority of Gibson's infrastructure revenue is derived from long-term, take-or-pay contracts.

- Investment-Grade Counterparties: These contracts are generally with customers possessing strong credit ratings.

- Reduced Commodity Price Volatility: The contractual nature minimizes direct exposure to fluctuations in oil and gas prices.

- Reliable Cash Generation: This stability translates into a dependable stream of cash flow, supporting its cash cow status.

Moose Jaw Facility Operations

The Moose Jaw facility, a key component of Gibson Energy's infrastructure, is positioned as a Cash Cow within the BCG framework. This designation stems from its mature status and consistent contribution to stable cash flow generation.

Operations at Moose Jaw are characterized by regular turnarounds and ongoing processing of refined products. This sustained activity underscores its vital role in Gibson's business, ensuring a predictable revenue stream.

In 2024, Gibson Energy reported that its Infrastructure segment, which includes facilities like Moose Jaw, generated significant and stable cash flows. For instance, the company's distributable cash flow in Q1 2024 was approximately $111 million, with the Infrastructure segment being a primary driver of this stability.

- Moose Jaw Facility's Role: Contributes stable cash flow as a mature asset within Gibson Energy's infrastructure segment.

- Operational Stability: Engages in regular turnarounds and continuous operations, processing refined products.

- Financial Contribution: Provides consistent and predictable financial results to the company.

- 2024 Performance Context: Gibson Energy's Infrastructure segment, including Moose Jaw, was a key contributor to its Q1 2024 distributable cash flow of approximately $111 million, highlighting its ongoing importance.

Gibson Energy's infrastructure assets, particularly those secured by long-term, take-or-pay contracts with investment-grade counterparties, are its primary cash cows. These contracts shield a substantial portion of revenue from commodity price volatility, ensuring consistent and predictable cash flow generation. This stability is crucial for funding operations and shareholder returns, as demonstrated by the company's consistent dividend payments, which are underpinned by these reliable earnings streams.

The Hardisty Terminal exemplifies this cash cow status, processing significant volumes of crude oil and benefiting from established infrastructure. Similarly, the Moose Jaw facility, while mature, contributes consistently to stable cash flow through its regular operations and processing of refined products. In 2024, Gibson Energy's Infrastructure segment, driven by these assets, continued to be a major contributor to its distributable cash flow, underscoring their importance.

| Asset/Segment | BCG Category | Key Characteristics | Financial Data (Illustrative 2024 Context) |

|---|---|---|---|

| Infrastructure Segment (Overall) | Cash Cow | High revenue from take-or-pay contracts, stable operations, minimal commodity price exposure. | Contributed significantly to distributable cash flow (e.g., Q1 2024: ~$111 million). |

| Hardisty Terminal | Cash Cow | Dominant position in Western Canada, critical processing hub, reliable cash generation. | Steady cash flows from established infrastructure. |

| Moose Jaw Facility | Cash Cow | Mature asset, consistent operations, predictable revenue from refined product processing. | Ensures a predictable revenue stream within the stable Infrastructure segment. |

Full Transparency, Always

Gibson Energy BCG Matrix

The Gibson Energy BCG Matrix you are currently previewing is the complete, unwatermarked document you will receive immediately after your purchase. This means the strategic insights and analysis presented here are exactly what you'll utilize for your business planning. You'll gain access to the fully formatted report, ready for immediate application in your decision-making processes, without any additional steps or modifications required.

Dogs

Gibson Energy's Marketing segment, characterized by its volatile performance, likely falls into the 'Dog' category of the BCG Matrix. In 2024, this segment saw a substantial drop in Adjusted EBITDA, and early 2025 results for Q1 and Q2 remained subdued. This underperformance is attributed to narrow commodity price differences and scarce storage options, directly impacting profitability.

The persistent challenges in the Marketing segment, including tight commodity differentials and limited storage, indicate a low-growth, low-market-share position for Gibson. This environment often means the segment consumes more cash than it reliably generates, a hallmark of 'Dog' businesses that struggle to gain traction or offer consistent returns.

Gibson Energy's divestiture of non-core assets aligns with the 'Dog' quadrant of the BCG matrix. These divested assets likely possessed low market share and limited growth potential, making them candidates for sale to streamline operations and focus on more promising ventures.

The Hardisty Unit Train Facility's contribution to Gibson Energy's Infrastructure Adjusted EBITDA saw a decrease in 2024. This decline signals a potential shift in its strategic importance or a softening in its market performance relative to other Gibson Energy assets.

Legacy Assets with Subdued Growth

Within Gibson Energy's diverse asset base, certain legacy components might exhibit subdued growth. These assets, while contributing to current operations, may not align with the company's future strategic growth initiatives. Their market share within their respective segments could be limited, and they may require consistent capital for upkeep rather than expansion.

These "dogs" in the BCG matrix context represent areas where Gibson Energy might need to carefully evaluate its investment strategy. The focus here is on managing these assets efficiently, potentially through cost optimization or a phased divestment if they no longer serve a strong strategic purpose. For instance, if a particular pipeline segment is aging and facing declining throughput, it would fit this category.

- Low Growth Potential: Assets characterized by minimal expansion opportunities or declining demand in their end markets.

- Mature Infrastructure: Older facilities or transportation systems that require ongoing maintenance but offer limited scope for significant return on investment.

- Strategic Re-evaluation: Segments that may warrant a review for potential divestiture or restructuring to free up capital for higher-growth areas.

Projects with Negative Final Investment Decisions

Gibson Energy's strategic review in December 2024 led to a negative final investment decision on its proposed Waste-to-Energy project, which was intended to include carbon capture technology.

Despite the overall growth potential in the energy transition sector, this particular project was assessed as not being commercially viable for Gibson Energy at this time. This decision effectively classifies the project as an abandoned venture, representing a sunk cost that will not generate future returns for the company.

- Project Name: Waste-to-Energy with Carbon Capture

- Decision Date: December 2024

- Outcome: Negative Final Investment Decision

- Reason: Deemed not viable for Gibson Energy

Gibson Energy's Marketing segment, facing narrow commodity price differences and limited storage, experienced a substantial drop in Adjusted EBITDA in 2024, with early 2025 results remaining subdued. This underperformance, coupled with low market share and growth prospects, firmly places it in the 'Dog' category of the BCG Matrix. The segment likely consumes more cash than it generates, necessitating careful management, potential cost optimization, or eventual divestment to reallocate capital to more promising ventures.

| Segment | BCG Category | 2024 Performance Indicator | Key Challenges |

|---|---|---|---|

| Marketing | Dog | Substantial drop in Adjusted EBITDA | Narrow commodity price differences, scarce storage options |

| Waste-to-Energy Project | Dog (Abandoned) | Negative Final Investment Decision (Dec 2024) | Not commercially viable |

Question Marks

Gibson Energy's Biofuels Blending expansion, particularly the project completed at its Edmonton Terminal in 2022, represents a strategic move into a burgeoning market. This infrastructure upgrade allows for the storage, blending, and transportation of renewable diesel, a key component of the evolving energy landscape.

While the renewable fuels sector is experiencing significant growth, its current contribution to Gibson's overall financial performance is likely in its early stages. This positions the biofuels blending segment as a potential high-growth opportunity, albeit one with a currently small market share within Gibson's broader portfolio.

Gibson Energy, like many in the midstream sector, is actively exploring opportunities within the burgeoning hydrogen economy. This aligns with their stated commitment to decarbonization and adapting to evolving energy demands. As a company with established infrastructure, the potential to leverage existing assets or build new ones for hydrogen transport and storage represents a significant, albeit currently nascent, growth avenue.

The company's strategic positioning suggests they are likely in the early investigation or development phases for hydrogen infrastructure. While the market share for hydrogen in the overall energy mix remains low, its projected growth trajectory makes it a compelling area for forward-thinking energy companies. For instance, global hydrogen production is expected to see substantial increases, with various governmental initiatives and private investments pouring into the sector, aiming to scale up production and distribution networks in the coming years.

Gibson Energy, despite a setback with a particular waste-to-energy carbon capture and storage (CCS) project, is actively exploring other avenues for growth and emission reduction. The company’s commitment to sustainability remains strong as they look for new strategic opportunities within the evolving energy landscape.

The global CCS market is experiencing significant expansion, presenting a promising area for Gibson to leverage its extensive pipeline infrastructure expertise. While large-scale CCS projects are still in the initial development stages, Gibson is positioned to capitalize on future opportunities as the technology matures and regulatory frameworks solidify.

In 2024, the industrial CCS sector saw continued investment, with projects like ExxonMobil's proposed carbon capture hub in Houston aiming to sequester millions of tons of CO2 annually. Gibson's involvement in such ventures, or similar ones, could represent a strategic move into a high-growth segment, aligning with their long-term environmental goals.

Digitalization & Automation Investments

Gibson Energy's strategic focus on cost reduction and efficiency improvements, aligning with broader industry shifts, positions digitalization and automation as key investment areas. These technologies, while not generating direct product revenue, are crucial for building operational competitive advantages and are expected to drive significant future growth.

These investments are characteristic of a "Question Mark" in the BCG Matrix, indicating high market growth potential but currently low relative market share in terms of direct revenue contribution. For instance, in 2024, Gibson Energy continued to explore automation in its terminals and pipelines to streamline operations and reduce manual processes.

- Focus on Efficiency: Gibson's 2024 initiatives included piloting AI-driven predictive maintenance for its infrastructure, aiming to minimize downtime and operational costs.

- High Growth Potential: The market for industrial automation and digitalization solutions is experiencing robust growth, projected to reach hundreds of billions globally by the late 2020s.

- Low Current Market Share: While these technologies enhance Gibson's operational standing, their direct contribution to overall market share is nascent, reflecting their role as enablers rather than primary revenue generators.

- Strategic Importance: Investments in these areas are vital for Gibson to maintain and enhance its competitive edge in an increasingly digitalized energy sector.

New Strategic Growth Pipeline Initiatives

Gibson Energy's strategic growth pipeline, valued at over $1 billion, primarily targets expansion within its liquids infrastructure. These initiatives are designed to increase capacity across its three core terminals, reflecting a commitment to long-term development and market responsiveness.

These projects, currently in early stages or unsanctioned, are positioned to capitalize on emerging market demands and potential expansions. While they represent significant future growth potential, their current market share is low due to their developmental status.

- Pipeline Value: Exceeds $1 billion in identified growth opportunities.

- Focus Area: Expansion of strategic liquids infrastructure.

- Terminal Capacity: Aiming for increased capacity across all three core terminals.

- Project Stage: Primarily unsanctioned or early-stage, indicating high future potential but low current market share.

Gibson Energy's investments in digitalization and automation, such as piloting AI-driven predictive maintenance in 2024, fit the "Question Mark" profile. These initiatives have high growth potential in the expanding industrial automation market, which is projected to reach hundreds of billions globally by the late 2020s.

While these technologies enhance operational efficiency and competitive advantage, their direct contribution to Gibson's overall market share is currently nascent. They are crucial enablers rather than primary revenue generators at this stage.

Similarly, Gibson's strategic growth pipeline, valued at over $1 billion and focused on expanding liquids infrastructure, represents significant future potential. However, as these projects are primarily unsanctioned or in early stages, their current market share contribution is low, aligning them with the "Question Mark" category.

These ventures are characterized by high market growth prospects but a currently low relative market share, requiring careful monitoring and strategic investment to determine their future success.

BCG Matrix Data Sources

Gibson Energy's BCG Matrix is constructed using a blend of financial disclosures, competitor analysis, and industry growth forecasts to provide a comprehensive strategic overview.