Gibson Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gibson Energy Bundle

Unlock the strategic blueprint behind Gibson Energy's efficient operations. This comprehensive Business Model Canvas reveals how they leverage key resources and partnerships to deliver essential energy infrastructure services. Discover their customer segments and revenue streams to understand their market advantage.

Partnerships

Gibson Energy cultivates essential long-term alliances with major crude oil and refined product producers and refiners, acting as a critical conduit within their operational networks. These collaborations guarantee a steady demand for Gibson's midstream services, thereby reinforcing the resilience of its infrastructure segment. For instance, as of the first quarter of 2024, Gibson's Infrastructure segment reported an Adjusted EBITDA of $107 million, a testament to the consistent revenue generated from these strategic relationships.

Many of these vital partnerships are solidified through take-or-pay contracts. This structure provides Gibson with predictable revenue streams, even if the volume of product transported fluctuates. This contractual certainty is a cornerstone of Gibson's business model, offering a high degree of financial stability and allowing for robust capital allocation planning.

Gibson Energy actively cultivates robust relationships with Indigenous Peoples and local communities, embedding their insights and operational approaches across the company. This dedication is a cornerstone of their sustainability efforts, emphasizing social accountability and community involvement.

These collaborations are vital for ensuring Gibson's operations are conducted responsibly and for maintaining a long-term social license to operate, crucial for continued business success.

Gibson Energy relies on a network of specialized service providers and contractors for the construction, maintenance, and operation of its vast infrastructure, encompassing pipelines, terminals, and processing facilities. These collaborations are essential for maintaining operational efficiency and safety across its extensive network.

These partnerships are crucial for the successful execution of capital projects, ensuring that Gibson Energy can expand and upgrade its assets effectively. For instance, in 2024, Gibson Energy continued to engage specialized firms for critical maintenance and upgrade projects at its terminals and processing plants, ensuring compliance with stringent safety and environmental standards.

Financial Institutions and Credit Agencies

Gibson Energy’s partnerships with financial institutions, banks, and credit rating agencies are fundamental to its operational stability and expansion. These relationships are crucial for securing the necessary capital for large-scale projects and ongoing operations. For instance, Gibson Energy regularly accesses credit facilities, demonstrating the importance of these banking relationships.

Maintaining strong ties with credit rating agencies such as DBRS Morningstar and S&P is paramount for Gibson Energy. These agencies assess the company's creditworthiness, influencing its ability to borrow at favorable rates. In 2024, Gibson Energy continued to focus on its investment-grade credit profile, which is essential for attracting investors and lenders.

- Access to Capital: Partnerships with banks provide Gibson Energy with essential credit lines and debt financing options, enabling timely execution of strategic initiatives.

- Credit Rating Maintenance: Collaborations with agencies like DBRS Morningstar and S&P help Gibson Energy maintain its investment-grade status, crucial for cost-effective borrowing.

- Financial Flexibility: Strong relationships with financial partners grant Gibson Energy the flexibility to pursue growth opportunities and manage its capital structure effectively.

- Investor Confidence: A solid financial backing from reputable institutions reinforces investor confidence, supporting the company's valuation and share price.

Technology and Innovation Partners

Gibson Energy actively pursues technology and innovation partners to enhance operational efficiency and environmental performance. These collaborations are crucial for optimizing processes and reducing their environmental footprint, especially as they navigate the energy transition. For instance, in 2024, Gibson continued to explore advancements in areas like carbon capture and storage technologies to support emission reduction goals.

Key areas for these partnerships include:

- Advancements in digital solutions for process optimization and predictive maintenance.

- Collaborations on emissions reduction technologies, aligning with industry targets.

- Partnerships focused on resource conservation and sustainable operational practices.

- Joint ventures for developing and implementing new energy transition infrastructure.

Gibson Energy's key partnerships are foundational, spanning producers, refiners, Indigenous communities, service providers, and financial institutions. These alliances ensure consistent demand for its services, operational efficiency, social license, and access to capital. For example, Gibson's Infrastructure segment reported $107 million in Adjusted EBITDA in Q1 2024, reflecting the stability derived from producer and refiner relationships, often secured by take-or-pay contracts.

These strategic collaborations are vital for operational continuity and growth. In 2024, Gibson continued to leverage specialized contractors for essential maintenance and technology partners for efficiency gains, underscoring the importance of these external relationships for asset integrity and innovation.

| Partner Type | Importance | 2024 Example/Data Point |

|---|---|---|

| Producers & Refiners | Guaranteed demand for midstream services | Infrastructure Adjusted EBITDA: $107 million (Q1 2024) |

| Indigenous Peoples & Communities | Social license to operate, responsible operations | Ongoing integration of community insights into operations. |

| Service Providers & Contractors | Operational efficiency, maintenance, project execution | Engaged for critical maintenance and upgrade projects at terminals. |

| Financial Institutions & Agencies | Access to capital, creditworthiness maintenance | Continued focus on investment-grade credit profile. |

| Technology & Innovation Partners | Operational efficiency, environmental performance | Exploring carbon capture and storage technologies. |

What is included in the product

Gibson Energy's business model focuses on providing essential infrastructure and services to the North American energy industry, leveraging its extensive network of pipelines, storage facilities, and terminals to transport and store crude oil and refined products.

This model is designed to generate stable, fee-based revenue streams by offering critical logistical solutions to a diverse customer base of oil and gas producers and refiners.

Gibson Energy's Business Model Canvas offers a clear, structured way to understand how they alleviate pain points in the energy sector, providing a visual roadmap for their operations.

Activities

Gibson Energy's key activity in crude oil and liquids storage involves offering substantial storage solutions across its North American terminal network. This service is crucial for producers and refiners, providing them with the flexibility and capacity needed for effective inventory management and market participation.

The company boasts an impressive storage capacity, managing over 25 million barrels of tankage. This extensive infrastructure supports the efficient handling and storage of crude oil, refined products, and other specialty liquids, ensuring reliable access to markets.

Gibson Energy's midstream operations are anchored by an extensive network of pipelines and gathering systems, primarily in Western Canada. This infrastructure is crucial for efficiently collecting crude oil and other hydrocarbon products directly from production sites.

The company also leverages significant rail loading and unloading capabilities, extending its reach beyond pipeline networks. In 2023, Gibson reported that its extensive pipeline system transported approximately 700,000 barrels per day of crude oil, highlighting its vital role in the energy supply chain.

This integrated approach ensures that hydrocarbons can be moved reliably from the wellhead to processing facilities and ultimately to market terminals, supporting the flow of energy products across North America.

Gibson Energy processes crude oil at key facilities, including its Moose Jaw Facility, to upgrade its value. This processing transforms raw crude into more refined products, directly adding value.

The company also operates the Hardisty Diluent Recovery Unit, further enhancing the processing capabilities and the quality of the hydrocarbons handled. These units are crucial for maximizing the utility and marketability of the oil.

Complementing its processing operations, Gibson's marketing segment actively optimizes the purchasing, selling, and storage of hydrocarbon products. This strategic approach ensures efficient market engagement and revenue generation.

In 2023, Gibson Energy reported Adjusted EBITDA of $953 million, reflecting the successful execution of these processing and marketing activities. Their focus on optimization allows them to capture market opportunities and enhance product value.

Infrastructure Development and Expansion

Gibson Energy's core operations revolve around the continuous investment in and expansion of its liquids infrastructure. This is crucial for meeting evolving market demands and bolstering its service capabilities.

Recent strategic moves underscore this commitment. For instance, the company successfully completed the construction of new tanks at its Edmonton Terminal. Additionally, the Gateway dredging project has been finalized, enhancing logistical efficiencies.

- Infrastructure Investment: Gibson Energy consistently invests in growing its liquids storage and transportation network to serve increasing customer needs.

- Capacity Enhancement: Projects like the new tanks at Edmonton Terminal directly increase storage capacity, supporting higher throughput volumes.

- Logistical Improvements: The Gateway dredging project, completed in 2024, aims to improve access and efficiency for marine-based operations.

- Long-Term Strategy: These developments are vital for ensuring Gibson Energy’s long-term capacity and maintaining reliable service for its diverse customer base.

Safety, Environmental, and Governance (ESG) Management

Gibson Energy's key activities heavily involve robust Safety, Environmental, and Governance (ESG) management. This commitment is demonstrated through continuous efforts to achieve operational excellence in safety, such as their consistent record of low incident rates. For instance, in 2023, Gibson reported an All Injury Frequency Rate (AIFR) of 0.47, highlighting their dedication to a safe workplace.

Environmental protection is another core activity, involving the implementation of strategies to minimize their operational footprint. This includes managing emissions and waste responsibly, aligning with regulatory requirements and stakeholder expectations for sustainable practices.

Strong governance underpins all of Gibson's operations, ensuring ethical conduct, transparency, and accountability. This focus on governance is vital for building and maintaining the trust of investors, employees, and the communities in which they operate.

- Safety Milestones: Gibson Energy consistently strives for industry-leading safety performance, a critical activity for operational continuity and employee well-being.

- Environmental Mitigation: Implementing effective strategies to protect the environment is a core operational focus, ensuring compliance and responsible resource management.

- Governance Adherence: Maintaining high standards of corporate governance is fundamental to Gibson's business model, fostering trust and long-term sustainability.

Gibson Energy's key activities are centered on managing and expanding its extensive midstream infrastructure, which includes storage terminals and pipelines. They also focus on processing crude oil to enhance its value and actively market hydrocarbon products. A significant ongoing activity is investing in infrastructure growth and logistical improvements to meet market demands and ensure reliable service.

The company's operations are underpinned by a strong commitment to Safety, Environmental, and Governance (ESG) principles, aiming for operational excellence and responsible resource management. This commitment is crucial for maintaining stakeholder trust and ensuring long-term business sustainability.

| Key Activity | Description | 2023/2024 Data Point |

| Midstream Infrastructure Management | Operating and expanding storage terminals and pipelines for crude oil and refined products. | Over 25 million barrels of tankage managed. |

| Crude Oil Processing | Upgrading crude oil at facilities like Moose Jaw and Hardisty to increase value. | Operates Hardisty Diluent Recovery Unit. |

| Marketing and Optimization | Strategically purchasing, selling, and storing hydrocarbon products. | Reported Adjusted EBITDA of $953 million in 2023. |

| Infrastructure Investment & Expansion | Investing in new infrastructure and enhancing existing logistical capabilities. | Completed Gateway dredging project in 2024. |

| ESG Commitment | Prioritizing safety, environmental protection, and strong corporate governance. | Reported an All Injury Frequency Rate (AIFR) of 0.47 in 2023. |

Preview Before You Purchase

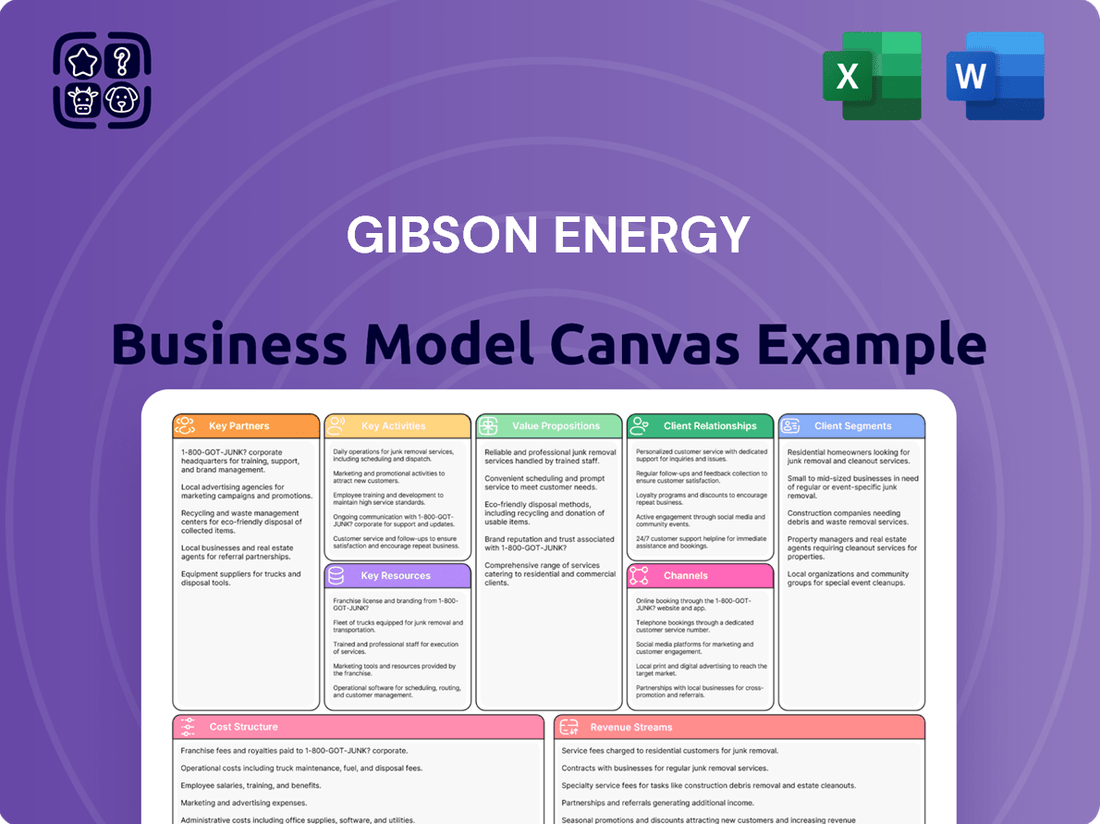

Business Model Canvas

This preview showcases a genuine section of the Gibson Energy Business Model Canvas. Upon purchase, you will receive the complete, identical document, ensuring no discrepancies between what you see and what you get. This means you'll have the full, professionally structured canvas ready for immediate use.

Resources

Gibson Energy's extensive liquids infrastructure network is its backbone, featuring a vast array of oil terminals, rail loading and unloading facilities, and gathering pipelines. This network spans key energy regions, including Western Canada and the U.S. Gulf Coast, with strategically positioned hubs like Hardisty and the South Texas Gateway Terminal.

These physical assets are crucial for Gibson's midstream operations, facilitating the efficient movement of crude oil and other liquid hydrocarbons. For instance, in 2023, Gibson handled approximately 1.1 million barrels per day of crude oil and condensate across its system, highlighting the scale and importance of this infrastructure.

Gibson Energy boasts significant tankage capacity, holding over 25 million barrels of crude oil and liquids storage across North America. This substantial infrastructure, including recent expansions like new tanks at their Edmonton Terminal, is a cornerstone of their business, offering vital storage solutions. These assets are crucial for producers and refiners needing reliable and flexible storage options.

Gibson Energy's success hinges on its highly experienced and skilled workforce, complemented by robust management expertise. This human capital is critical for the safe and efficient operation of their extensive infrastructure, including pipelines and storage terminals.

The team's proficiency is essential for executing complex projects and driving the company's strategic initiatives. For instance, in 2024, Gibson Energy continued to emphasize its commitment to operational excellence and safety, a core tenet supported by its dedicated personnel.

Financial Capital and Strong Balance Sheet

Gibson Energy's access to substantial financial capital, underpinned by a disciplined financial strategy and investment-grade credit ratings, is a cornerstone of its operations. This financial strength allows for robust funding of ongoing activities, strategic investments in growth initiatives, and efficient debt management.

Maintaining a strong balance sheet is a fundamental financial principle for Gibson Energy. As of the first quarter of 2024, the company reported total assets of approximately CAD 7.7 billion and total liabilities of around CAD 4.3 billion, showcasing a solid financial foundation.

- Financial Capital Access: Gibson Energy leverages its investment-grade credit ratings to secure the necessary funds for operations and expansion.

- Disciplined Financial Strategy: A focus on prudent financial management ensures efficient use of capital and effective debt servicing.

- Strong Balance Sheet: The company prioritizes maintaining a healthy balance sheet, reflected in its asset-to-liability ratio.

- Operational Funding and Growth: Financial resources are allocated to sustain current operations and invest in future growth projects, such as pipeline expansions and terminal upgrades.

Proprietary Technology and Operational Know-how

Gibson Energy leverages over 70 years of industry experience, translating into significant operational know-how and optimization capabilities within its liquids infrastructure. This deep-seated expertise is crucial for efficient asset management and the effective execution of projects, ensuring continuous improvement in service delivery.

This operational acumen extends to sophisticated processes for product processing, blending, and optimization, which are vital for maximizing value from their infrastructure. For example, in 2023, Gibson Energy reported a distributable cash flow of CAD $724 million, underscoring their ability to generate substantial cash flow through efficient operations.

- Operational Know-how: Over 70 years of experience in liquids infrastructure management.

- Efficiency Gains: Expertise in asset management, project execution, and service delivery optimization.

- Process Optimization: Skilled in processing, blending, and optimizing various products.

- Financial Impact: Contributes to strong financial performance, evidenced by CAD $724 million in distributable cash flow in 2023.

Gibson Energy's intellectual property includes proprietary technologies and operational best practices developed over decades. These intangible assets enhance efficiency and safety in their midstream operations, providing a competitive edge.

The company also holds key permits and regulatory approvals essential for operating its extensive network of pipelines and terminals. These governmental licenses are critical for maintaining business continuity and expansion. For instance, in 2024, Gibson continued to navigate and secure necessary regulatory frameworks for its ongoing projects.

Gibson Energy's strong brand reputation and established customer relationships are vital intellectual resources. These relationships, built on reliability and service, foster long-term contracts and recurring revenue streams.

Intellectual Resources Summary:

| Resource Type | Description | Impact |

|---|---|---|

| Proprietary Technologies | Developed operational efficiencies and safety protocols. | Competitive advantage, cost reduction. |

| Permits & Approvals | Essential licenses for infrastructure operation. | Business continuity, expansion enablement. |

| Brand Reputation & Relationships | Trust and loyalty from customers. | Long-term contracts, recurring revenue. |

Value Propositions

Gibson Energy's midstream services are built on a foundation of unwavering reliability and security, essential for producers and refiners who depend on uninterrupted operations. Their robust infrastructure, designed for the safe storage, processing, and transportation of crude oil and refined products, minimizes the risk of service disruptions.

This commitment to consistent delivery is a core value proposition. In 2024, Gibson Energy continued to invest in maintaining and upgrading its extensive network, ensuring that clients experience minimal downtime. For instance, their terminals and pipelines are engineered to handle significant volumes while adhering to stringent safety protocols, a critical factor in the volatile energy market.

Gibson Energy offers producers unparalleled strategic market access, acting as a vital conduit connecting Western Canadian crude oil to crucial North American and international destinations, notably the U.S. Gulf Coast. This essential link ensures that producers can reach a wider customer base, thereby maximizing the potential value of their output.

The company's extensive network of strategically positioned terminals and pipelines is the backbone of this market access, enabling the efficient and reliable movement of petroleum products. This robust infrastructure not only facilitates broader reach but also underpins the competitive advantage of its customers by reducing transportation friction and costs.

In 2024, Gibson Energy's infrastructure played a critical role in transporting millions of barrels of crude oil, demonstrating its significant contribution to market connectivity. For instance, their Hardisty Terminal, a key asset, handled substantial volumes, directly impacting the flow of Canadian oil to refining centers, thereby reinforcing the value proposition of market access.

Gibson Energy provides over 25 million barrels of tankage capacity, offering highly flexible and scalable storage solutions that adapt to diverse customer requirements and fluctuating market conditions. This extensive capacity ensures clients can manage varying volumes and product types with ease, fostering significant operational agility.

The company's commitment to scalability is evident in ongoing strategic expansions, such as the recent addition of new tanks at their Edmonton terminal. These developments underscore Gibson Energy's dedication to meeting evolving client needs and market dynamics through continuous infrastructure enhancement.

Stable and Contracted Infrastructure Model

Gibson Energy's infrastructure segment is built on a robust foundation of stable, fee-for-service and take-or-pay contracts. This structure ensures reliable revenue streams, offering a predictable financial outlook for the company and its stakeholders.

This contractual framework significantly de-risks the service offering, making it an attractive proposition for customers and investors seeking stability. For example, in 2024, a substantial portion of Gibson's infrastructure revenue was secured through these long-term agreements, demonstrating the model's effectiveness.

- Contractual Stability: A high percentage of revenue is derived from long-term, fee-based contracts.

- Predictable Cash Flows: This model generates consistent and reliable cash flow generation.

- De-risked Operations: Reduces exposure to commodity price volatility and market fluctuations.

- Customer Commitment: Signifies long-term partnerships and a secure service base.

Commitment to Sustainability and Responsible Operations

Gibson Energy's value proposition is deeply intertwined with its unwavering commitment to sustainability and responsible operations. This resonates strongly with a growing segment of customers and investors who actively seek out businesses that demonstrate robust Environmental, Social, and Governance (ESG) performance. Gibson's dedication to safety, environmental stewardship, and strong governance practices forms the bedrock of this appeal.

The company's focus on these critical areas isn't just a statement; it's backed by tangible achievements. Gibson has consistently met and exceeded expectations in safety and sustainability ratings, underscoring their commitment. For instance, in 2024, Gibson reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.23, a testament to their safety culture. Furthermore, their ongoing efforts in reducing greenhouse gas emissions, aiming for a 30% reduction by 2030 compared to a 2019 baseline, highlight their environmental responsibility.

- Commitment to Safety: Gibson maintained a low TRIFR of 0.23 in 2024, demonstrating a strong safety culture.

- Environmental Stewardship: The company is actively working towards a 30% reduction in greenhouse gas emissions by 2030 from a 2019 baseline.

- Robust Governance: Strong governance practices are integral to Gibson's operations, fostering trust with stakeholders.

- Stakeholder Appeal: These ESG commitments attract customers and investors who prioritize responsible and sustainable business practices.

Gibson Energy's value proposition centers on providing essential, reliable midstream infrastructure services for the energy sector. They offer secure storage, processing, and transportation of crude oil and refined products, minimizing operational risks for their clients.

The company ensures strategic market access for producers by connecting Western Canadian crude oil to key North American markets, notably the U.S. Gulf Coast, thereby maximizing product value. This is facilitated by an extensive network of terminals and pipelines, which in 2024, efficiently moved millions of barrels of oil.

Gibson Energy offers flexible and scalable storage solutions, boasting over 25 million barrels of tankage capacity. This adaptability allows clients to effectively manage varying volumes and product types, supported by ongoing infrastructure enhancements like recent expansions at their Edmonton terminal.

A core aspect of Gibson's offering is its stable, fee-for-service and take-or-pay contract structure, which generates predictable revenue streams and de-risks operations from commodity price volatility. In 2024, a significant portion of their infrastructure revenue was secured through these long-term agreements.

| Value Proposition Element | Description | Key Metric/Fact (2024 Data) |

|---|---|---|

| Reliability & Security | Uninterrupted storage, processing, and transportation of oil and refined products. | Continued investment in network maintenance and upgrades. |

| Strategic Market Access | Connecting producers to crucial North American and international markets. | Millions of barrels transported, facilitating flow to refining centers. |

| Flexible Storage Solutions | Scalable tankage capacity to meet diverse client needs. | Over 25 million barrels of tankage capacity. |

| Contractual Stability | Revenue secured through long-term, fee-based contracts. | Substantial portion of infrastructure revenue secured via long-term agreements. |

Customer Relationships

Gibson Energy secures long-term customer relationships through its infrastructure services, which are predominantly governed by contractual agreements. These often include take-or-pay provisions, ensuring revenue stability. For instance, in 2023, Gibson's infrastructure segment generated a significant portion of its adjusted EBITDA from these contracted assets, highlighting the dependable nature of these relationships.

Gibson Energy likely offers dedicated account management and robust technical support to its core clientele, such as oil producers and refineries. This personalized approach is crucial for addressing their unique operational demands, intricate logistics, and specific technical needs. For instance, in 2024, the energy sector saw significant investment in supply chain optimization, highlighting the importance of such tailored support services.

Gibson Energy cultivates strong customer relationships through unwavering operational excellence and reliability in its midstream services. By consistently delivering safe and timely product handling, the company solidifies its reputation as a trusted, dependable partner.

This commitment is evidenced by impressive safety metrics, such as achieving 8.8 million hours without a lost time injury in 2023, directly translating to customer confidence and reduced operational risk for clients.

Strategic Partnerships and Collaborations

Gibson Energy cultivates strategic partnerships to enhance customer relationships and unlock growth. A prime example is their collaboration with Baytex Energy Corp., focusing on shared infrastructure and operational efficiencies. This goes beyond typical service provision, creating a more integrated approach to meeting evolving energy market demands.

These deeper alliances are crucial for Gibson Energy’s business model. They allow for tailored solutions that address specific customer needs and capitalize on emerging opportunities within the energy sector. Such collaborations are designed to foster mutual growth and shared success, moving beyond simple transactional interactions.

- Strategic Partnership with Baytex Energy Corp.: Focused on optimizing infrastructure and operational synergies.

- Beyond Transactional Relationships: Deeper alignment of business objectives with key partners.

- Fostering Mutual Growth: Collaborations designed for shared success and expanded market reach.

- Addressing Specific Customer Needs: Tailored solutions developed through strategic alliances.

Transparency and Stakeholder Engagement

Gibson Energy prioritizes transparency with its stakeholders, evident in its consistent delivery of regular financial reporting and detailed investor presentations. This commitment ensures customers and investors are well-informed about the company's operational performance and strategic initiatives, fostering trust and confidence.

The company actively engages with Indigenous Peoples and local communities, integrating their perspectives into its operations and development plans. This approach is crucial for building strong, lasting relationships and ensuring responsible resource development.

- Financial Reporting: Gibson Energy's commitment to transparency is demonstrated through its timely release of quarterly and annual financial reports, providing stakeholders with clear insights into financial health and operational results. For instance, their 2023 annual report detailed significant capital expenditures and operational efficiencies.

- Investor Relations: Regular investor calls and presentations, often accompanied by detailed slide decks, offer in-depth analysis of Gibson Energy's business segments, market outlook, and growth strategies, facilitating informed investment decisions.

- Sustainability Reports: The company publishes comprehensive sustainability reports, outlining its environmental, social, and governance (ESG) performance, including progress on emissions reduction targets and community investment initiatives.

- Community Engagement: Gibson Energy actively consults with Indigenous communities regarding project development and operational impacts, often establishing benefit agreements that contribute to local economic development and socio-cultural well-being.

Gibson Energy's customer relationships are built on a foundation of long-term, contracted infrastructure services, ensuring revenue stability through provisions like take-or-pay. This contractual security is paramount, as seen in 2023 where contracted assets formed the bedrock of their infrastructure segment's adjusted EBITDA. This dependable revenue stream underscores the trust and reliance clients place in Gibson's services, fostering enduring partnerships.

Channels

Gibson Energy's extensive terminal network forms its primary channel for service delivery, featuring key locations like Hardisty and Edmonton in Canada, and the South Texas Gateway Terminal in Ingleside. These facilities are crucial for storing, processing, and transferring crude oil and liquids, underpinning the company's infrastructure segment.

In 2024, Gibson Energy continued to leverage this robust network, which is central to its ability to connect producers with markets efficiently. The strategic placement of these terminals allows for optimized logistics and cost-effective operations for its customers.

Gibson Energy's pipeline systems are a crucial element, acting as the arteries for moving crude oil and refined products. This extensive network includes gathering pipelines, which collect resources from production sites, and inter-terminal pipelines, ensuring products reach their final destinations efficiently.

These pipelines are the backbone of their logistics, facilitating the continuous, large-volume movement of hydrocarbons. In 2024, Gibson Energy continued to leverage these assets, which are known for their cost-effectiveness and reliability in transporting significant quantities of product compared to other methods.

Gibson Energy's rail loading and unloading facilities are a crucial channel, providing essential flexibility for transporting petroleum products and accessing markets beyond direct pipeline connections. These operations are key to their midstream services, allowing for the efficient movement of crude oil and other liquids via railcars, thereby broadening their distribution capabilities.

In 2024, Gibson Energy continued to leverage these facilities to serve a diverse customer base. For instance, their rail infrastructure plays a significant role in connecting production areas to refining centers and export terminals, demonstrating the vital link between their storage and transportation segments.

Direct Sales and Marketing Teams

Gibson Energy leverages direct sales and marketing teams as a core channel for its operations. These teams are instrumental in the purchasing, selling, and overall optimization of hydrocarbon products. Their primary function is to actively engage with both buyers and sellers within the dynamic commodity markets, ensuring efficient transactions and maximizing value.

This direct engagement allows Gibson Energy to effectively manage the commercial aspects of product movement. They identify and capitalize on optimization opportunities throughout the supply chain. For instance, in 2024, Gibson Energy continued to focus on strategic marketing initiatives to enhance its market position. Their marketing segment performance is closely tied to the effectiveness of these direct sales efforts, driving revenue and operational efficiency.

- Direct Market Engagement: Teams directly interact with buyers and sellers in commodity markets.

- Product Optimization: Focus on purchasing, selling, and optimizing hydrocarbon product flows.

- Commercial Management: Oversee the commercial aspects of product movement and identify optimization opportunities.

- Revenue Generation: These teams are crucial for driving sales and contributing to overall financial performance.

Digital and Investor Relations Platforms

Gibson Energy leverages its corporate website and dedicated investor relations portal as primary channels to disseminate crucial information. These digital platforms offer a centralized hub for financial results, investor presentations, and sustainability reports, ensuring accessibility for investors, analysts, and the wider financial community.

These channels are vital for maintaining transparency and fostering robust stakeholder engagement. For instance, in 2024, Gibson Energy's investor relations website provided real-time updates on financial performance and strategic initiatives, facilitating informed decision-making.

Key information shared through these digital avenues includes:

- Quarterly and Annual Financial Reports: Detailed breakdowns of financial performance, including revenue, expenses, and net income.

- Investor Presentations: Management commentary on strategy, market outlook, and operational highlights.

- Sustainability Reports: Information on environmental, social, and governance (ESG) performance and initiatives.

- Press Releases: Timely announcements of material news and corporate developments.

Gibson Energy's channels are multifaceted, encompassing physical infrastructure like terminals and pipelines, alongside digital platforms and direct sales teams. These elements work in concert to move and market hydrocarbon products effectively.

The company's extensive terminal network and pipeline systems are critical for the physical movement and storage of crude oil and liquids, ensuring efficient delivery to various markets.

Direct sales and marketing teams actively engage with market participants, optimizing product flows and driving revenue, while digital channels like the corporate website provide essential information to stakeholders.

In 2024, Gibson Energy continued to optimize these channels, with its infrastructure segment reporting strong performance, supported by consistent utilization of its terminals and pipelines, and its marketing segment benefiting from effective commercial management.

| Channel | Description | 2024 Relevance/Data Point |

|---|---|---|

| Terminals | Key storage and transfer facilities (e.g., Hardisty, South Texas Gateway) | Crucial for infrastructure segment performance, facilitating efficient product movement. |

| Pipelines | Gathering and inter-terminal systems for crude oil and liquids transport | Backbone of logistics, offering cost-effective, high-volume transportation. |

| Rail Loading/Unloading | Flexible transport for markets beyond pipeline access | Broadens distribution capabilities, connecting production to refining and export. |

| Direct Sales & Marketing | Teams managing product purchase, sale, and optimization | Drives revenue and operational efficiency through market engagement. |

| Digital Platforms (Website, Investor Relations) | Dissemination of financial results, strategy, and ESG information | Ensures transparency and stakeholder engagement; vital for investor communication in 2024. |

Customer Segments

Gibson Energy's primary customer segment consists of crude oil producers, with a significant focus on those operating within Western Canada. These producers rely on Gibson's essential midstream services to get their product from the wellhead to various markets.

Gibson's services, including gathering, storage, and transportation, are critical for the efficient operation of these producers. For instance, in 2024, Gibson continued to invest in its infrastructure to support the growing production needs of its Western Canadian customers, ensuring reliable access to pipelines and storage facilities.

Petroleum refiners are a crucial customer segment for Gibson Energy, relying on its services to process and store crude oil and other specialty liquids. Gibson's infrastructure plays a vital role in ensuring refiners have a consistent supply of feedstock, which is essential for their continuous operations. In 2024, the refining sector faced fluctuating crude oil prices, making efficient supply chain management, supported by companies like Gibson, even more critical for profitability.

Integrated energy companies, encompassing both upstream production and downstream refining, represent a cornerstone customer segment for Gibson Energy. These large entities often leverage Gibson's comprehensive midstream solutions, including gathering, storage, processing, and marketing capabilities, to optimize their operations.

These strategic partnerships are typically characterized by their long-term nature, reflecting the significant investment and operational integration involved. For instance, Gibson's 2024 performance, with reported Adjusted EBITDA of approximately CAD 400 million, underscores its capacity to serve the complex needs of these major industry players.

Commodity Traders and Marketers

Commodity traders and marketers are key customers for Gibson Energy's marketing segment. These clients rely on Gibson's robust infrastructure to facilitate the buying, selling, and efficient movement of hydrocarbon products.

Gibson's storage and logistics services enable these traders to exploit price differences across various markets and capture arbitrage opportunities, thereby enhancing their profitability. This commercial flexibility is a significant draw for this customer group.

- Market Access: Traders gain access to Gibson's extensive network of terminals and pipelines, crucial for moving large volumes of commodities.

- Arbitrage Opportunities: Gibson's infrastructure supports traders in capitalizing on price differentials between different locations or time periods.

- Risk Management: Storage facilities provide a buffer, allowing traders to manage inventory and mitigate price volatility risks.

- Commercial Flexibility: Gibson's services offer the agility needed for traders to adapt to dynamic market conditions and optimize their trading strategies.

Financial Stakeholders and Investors

Gibson Energy views financial stakeholders and investors as a vital customer segment, even though they don't directly use the company's services. Their primary interest lies in the financial returns Gibson Energy can generate and the clarity of its reporting. The company's strategy revolves around delivering shareholder value, which it aims to achieve through consistent dividends and carefully planned growth initiatives.

To cater to this segment, Gibson Energy places a strong emphasis on transparent financial reporting and regular investor communications. These efforts are designed to build trust and provide the necessary information for informed investment decisions. For instance, in 2024, Gibson Energy continued its commitment to returning capital to shareholders, reflecting its focus on this crucial customer group.

- Shareholder Value Focus: Gibson Energy prioritizes delivering returns to its investors.

- Dividend Payouts: The company aims to provide consistent dividends as a key return mechanism.

- Disciplined Growth: Strategic investments are made with a focus on sustainable, long-term growth.

- Transparent Reporting: Financial reports and investor presentations are key communication tools for this segment.

Gibson Energy's customer base is diverse, primarily serving crude oil producers in Western Canada who depend on its midstream infrastructure for efficient product movement. Additionally, petroleum refiners are critical, relying on Gibson for a consistent supply of feedstock, a need amplified by fluctuating 2024 crude oil prices.

Integrated energy companies, which span both production and refining, are also key clients, leveraging Gibson's end-to-end midstream solutions. Commodity traders and marketers utilize Gibson's extensive network for market access and to capitalize on arbitrage opportunities.

Finally, financial stakeholders and investors are a crucial segment, valued for their capital and focus on shareholder returns, which Gibson aims to deliver through dividends and strategic growth, as evidenced by its 2024 performance.

| Customer Segment | Key Needs | Gibson's Role/Value Proposition |

|---|---|---|

| Crude Oil Producers | Reliable gathering, storage, transportation | Essential midstream services, infrastructure investment |

| Petroleum Refiners | Consistent feedstock supply | Storage and processing, supply chain efficiency |

| Integrated Energy Companies | Comprehensive midstream solutions | Gathering, storage, processing, marketing |

| Commodity Traders & Marketers | Market access, arbitrage opportunities | Storage, logistics, commercial flexibility |

| Financial Stakeholders/Investors | Shareholder value, clear financial reporting | Consistent dividends, disciplined growth, transparency |

Cost Structure

Operating and maintenance expenses represent a substantial portion of Gibson Energy's cost structure, directly tied to the upkeep of its vast infrastructure. These costs encompass essential elements like energy consumption for facility operations, skilled labor for ongoing maintenance and repairs, and the necessary expenditures to ensure adherence to stringent regulatory standards. For instance, in 2023, Gibson Energy reported operating expenses of approximately $1.6 billion, reflecting the significant investment required to keep its extensive network of terminals, pipelines, and processing facilities running smoothly and safely.

Gibson Energy's cost structure is significantly influenced by capital expenditures for infrastructure development and maintenance. These investments are crucial for expanding capacity, ensuring asset integrity, and adapting to market needs. For instance, in 2023, Gibson Energy reported capital expenditures of approximately $380 million, with a substantial portion allocated to growth projects like new storage tanks and pipeline expansions.

Gibson Energy's asset-intensive business model necessitates substantial finance costs, primarily interest expenses on its considerable debt. This debt is crucial for funding both ongoing operations and strategic growth projects, reflecting the capital demands of its infrastructure.

As of the first quarter of 2024, Gibson Energy reported total debt of approximately $2.5 billion, underscoring the scale of its financial leverage.

The company's commitment to maintaining investment-grade credit ratings, such as its BBB- rating from S&P, is a key strategy to mitigate these borrowing costs. This financial discipline allows Gibson to access capital at more favorable rates, directly impacting its overall profitability and ability to invest in future opportunities.

Personnel and Administrative Costs

Personnel and administrative costs are a core component of Gibson Energy's expenses. These include salaries, benefits, and the overhead associated with managing its workforce, which is crucial for operational efficiency and safety. For instance, in 2023, Gibson Energy reported total employee compensation and benefits expenses of approximately CAD 215 million, highlighting the significant investment in its human capital.

Beyond direct compensation, these costs also cover essential functions like safety training, human resources management, and general corporate administration. Investing in a skilled and safe workforce is not just an expense but a strategic imperative for Gibson Energy, ensuring regulatory compliance and operational integrity across its diverse business segments.

- Salaries and Benefits: Direct compensation for employees across all operational and corporate functions.

- Safety Training: Costs associated with ensuring a highly trained and safe workforce, critical in the energy sector.

- Human Resources: Expenses related to recruitment, employee relations, and HR administration.

- General Administration: Overhead for corporate functions, legal, finance, and IT support.

Environmental, Social, and Governance (ESG) Investments

Gibson Energy incurs costs related to environmental compliance, sustainability, and social responsibility. These expenditures are crucial for maintaining operational integrity and fostering long-term stakeholder value. For instance, in 2024, the company continued its investments in technologies aimed at reducing greenhouse gas emissions, aligning with its sustainability targets.

These costs encompass investments in emission reduction technologies, enhanced safety programs for employees and surrounding communities, and various community engagement initiatives. These outlays underscore Gibson Energy's dedication to operating responsibly and creating enduring value.

- Environmental Compliance: Costs associated with meeting regulatory standards for emissions, waste management, and water usage.

- Sustainability Initiatives: Investments in renewable energy adoption, energy efficiency improvements, and carbon capture technologies.

- Social Responsibility Programs: Funding for community development projects, employee well-being programs, and ethical supply chain management.

Gibson Energy's cost structure is heavily weighted towards operating and maintenance expenses, essential for its extensive energy infrastructure. These costs, which reached approximately $1.6 billion in 2023, cover everything from energy usage to specialized labor for upkeep and regulatory adherence. Significant capital expenditures, totaling around $380 million in 2023, are also a major component, funding crucial growth projects and asset integrity.

Finance costs, primarily interest on substantial debt, are another key element, reflecting the capital-intensive nature of the business. As of Q1 2024, Gibson Energy's total debt stood at roughly $2.5 billion. Personnel and administrative costs, including salaries and benefits, are also significant, with employee compensation and benefits amounting to approximately CAD 215 million in 2023, underscoring the investment in its workforce.

| Cost Category | 2023 (Approx.) | Notes |

|---|---|---|

| Operating & Maintenance Expenses | $1.6 billion | Includes energy, labor, regulatory compliance. |

| Capital Expenditures | $380 million | For infrastructure development and maintenance. |

| Total Debt (as of Q1 2024) | $2.5 billion | Primarily for funding operations and growth. |

| Employee Compensation & Benefits | CAD 215 million | Salaries, benefits, training, HR, admin. |

Revenue Streams

Gibson Energy's core revenue generation relies heavily on its infrastructure fee-for-service model. This means they earn money by charging for the use of their extensive network of storage tanks, pipelines, and processing facilities. Think of it like renting out space and services for oil and gas companies.

These fee-for-service agreements are typically long-term, often with take-or-pay provisions. This is a crucial detail because it ensures Gibson Energy receives payment for a minimum level of service, even if the actual volume of product moving through their infrastructure is lower. This structure provides a very stable and predictable cash flow, which is highly attractive in the energy sector.

For instance, in 2023, Gibson Energy reported that its Infrastructure segment generated approximately $624 million in revenue. This segment is the backbone of their business, demonstrating the significant contribution of these fee-based services to their overall financial performance.

Gibson Energy's infrastructure segment heavily relies on take-or-pay contracts, a key revenue stream. These agreements ensure customers pay for committed capacity, even if not fully utilized, creating a predictable income. In 2023, over 75% of Gibson's infrastructure revenue came from these stable, de-risked contracts.

Gibson Energy generates revenue from its marketing segment, which focuses on the trading and optimization of crude oil, refined products, and specialty liquids. This involves buying, selling, and strategically managing these commodities to capture market opportunities and drive volume through their extensive infrastructure network.

While this segment can experience volatility due to commodity price swings and differential changes, it plays a crucial role in Gibson's overall revenue generation. For instance, in the first quarter of 2024, Gibson reported that its marketing segment contributed significantly to adjusted EBITDA, highlighting its importance despite inherent market sensitivities.

Processing Facility Revenue

Gibson Energy earns revenue from its crude oil processing operations, notably at its Moose Jaw Facility. This facility refines crude oil into a range of higher-value products, effectively transforming raw materials.

The company's ability to successfully execute planned turnarounds at these facilities is crucial for maintaining uninterrupted revenue generation from its processing segment. For instance, in 2023, Gibson Energy reported that its Terminals segment, which includes processing activities, generated significant revenue, contributing to the overall financial health of the business.

- Revenue Source: Crude oil processing and refining into various products.

- Value Addition: Transformation of raw crude oil into higher-value refined goods.

- Operational Impact: Successful facility turnarounds are essential for sustained revenue.

- 2023 Performance Indicator: The Terminals segment, encompassing processing, was a key revenue contributor.

Ancillary Services and Other Income

Gibson Energy's ancillary services and other income streams bolster its financial stability beyond core transportation and storage. These can include specialized liquid handling, such as blending services tailored to customer needs, and terminaling fees charged to third parties utilizing Gibson's extensive infrastructure for their own connections and operations.

These additional revenue sources are crucial for diversifying income and enhancing overall profitability. For instance, in 2024, Gibson Energy continued to leverage its terminals for third-party services, contributing to its robust financial performance.

- Terminaling Fees: Revenue generated from allowing other companies to connect to and utilize Gibson's storage and transportation assets.

- Blending Services: Income derived from mixing different product streams to meet specific customer specifications.

- Specialized Liquid Handling: Fees for unique or value-added services related to the management and movement of various liquids.

Gibson Energy's revenue streams are primarily built on its extensive infrastructure, where it charges fees for the use of its storage, pipelines, and processing facilities. These are often secured through long-term, take-or-pay contracts, ensuring predictable income even with fluctuating volumes. In 2023, the Infrastructure segment alone brought in approximately $624 million, with over 75% of that revenue stemming from these stable, de-risked contracts.

Beyond infrastructure, Gibson's marketing segment generates revenue through the trading and optimization of crude oil and refined products. While susceptible to market volatility, this segment is vital for capturing opportunities and driving throughput. For instance, in Q1 2024, marketing contributed significantly to adjusted EBITDA.

The company also earns from its crude oil processing, particularly at the Moose Jaw Facility. Successful operational turnarounds are key to maintaining this revenue. The Terminals segment, which includes processing, was a substantial revenue contributor in 2023.

Ancillary services, like blending and third-party terminaling fees, further diversify Gibson's income. These services leverage their existing infrastructure for specialized liquid handling and allow other companies to utilize their assets, as seen with continued third-party service utilization in 2024.

| Revenue Stream | Primary Mechanism | Key Data Point (2023/2024) | Stability Factor |

|---|---|---|---|

| Infrastructure (Storage, Pipelines, Processing) | Fee-for-service | $624 million (Infrastructure segment revenue 2023) | Long-term, take-or-pay contracts (over 75% of infra revenue) |

| Marketing (Commodity Trading) | Buying, selling, and optimizing energy products | Significant contribution to adjusted EBITDA (Q1 2024) | Market-driven, subject to price and differential changes |

| Crude Oil Processing | Refining crude into higher-value products | Terminals segment (incl. processing) was a key revenue contributor (2023) | Operational efficiency, successful turnarounds |

| Ancillary Services (Blending, Terminaling Fees) | Specialized liquid handling, third-party asset utilization | Continued third-party service utilization (2024) | Diversification, leveraging existing assets |

Business Model Canvas Data Sources

The Gibson Energy Business Model Canvas is built upon a foundation of extensive financial disclosures, regulatory filings, and market intelligence reports. These sources provide the granular data necessary to accurately define revenue streams, cost structures, and key partnerships.