Gibson Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gibson Energy Bundle

Gibson Energy navigates a complex landscape, facing moderate bargaining power from both suppliers and buyers within the energy infrastructure sector. The threat of substitutes, while present, is generally low due to the specialized nature of their services, but the intensity of rivalry among existing players demands strategic agility.

The complete report reveals the real forces shaping Gibson Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The midstream sector, crucial for transporting and processing energy resources, depends on specialized equipment and technology. While certain suppliers offer unique, critical components for pipelines, terminals, and processing plants, the market for these highly technical goods and services isn't dominated by a few players. This lack of extreme concentration limits suppliers' ability to dictate terms.

Gibson Energy's strategic approach, including fostering long-term relationships and leveraging its considerable scale, further dilutes supplier bargaining power. A prime example of this is the successful completion of the Gateway dredging project in Q2 2025, which was delivered on schedule and within budget, demonstrating Gibson's ability to manage its supply chain effectively.

Construction and engineering firms possess moderate bargaining power, especially for new, large-scale infrastructure, given the specialized skills and significant contract values involved. Gibson Energy's consistent capital spending, including a focus on expanding existing sites, can foster stable relationships, potentially leading to more favorable terms with these critical suppliers.

For instance, Gibson Energy's involvement in projects like the Duvernay infrastructure development with Baytex Energy Corp. showcases how long-term partnerships can provide suppliers with project visibility, thereby influencing their negotiating stance.

While Gibson Energy operates in the midstream sector, the cost of raw materials such as steel for pipeline construction and energy for its operations indirectly influences supplier pricing. Changes in commodity prices can impact the expenses of equipment manufacturers and construction firms, who may then pass these increased costs onto midstream companies like Gibson.

Gibson Energy's proactive approach to managing these broader cost pressures is evident in its ongoing cost-saving initiatives. The company has set a target to achieve over $25 million in annual savings by the end of 2025, showcasing a commitment to operational efficiency and mitigating the impact of fluctuating input costs.

Labor Market Dynamics and Skilled Workforce Availability

The availability of a skilled workforce in specialized areas like pipeline operations, maintenance, and project management significantly influences supplier power. In 2024, many sectors experienced a shortage of skilled trades, which could drive up labor costs for contractors providing services to Gibson Energy. This scarcity means contractors might command higher fees, directly impacting Gibson's operational expenses.

A tight labor market, characterized by high demand for specialized skills, directly translates into increased labor costs for contractors. For instance, if the demand for certified welders or experienced pipeline engineers outstrips supply, contractors will need to offer higher wages to attract and retain these professionals. These elevated labor costs are often passed on to clients like Gibson Energy in the form of increased service fees, thereby strengthening the bargaining power of suppliers who can access this scarce talent.

Gibson Energy's strategic focus on safety and fostering a strong internal culture can indirectly mitigate some of the supplier bargaining power related to labor. By being an employer of choice, Gibson can attract and retain its own skilled workforce, reducing reliance on external contractors for certain critical functions. This internal strength can provide a buffer against the wage inflation experienced in the broader market for specialized labor.

Key considerations for Gibson Energy regarding labor market dynamics include:

- Skilled Workforce Shortages: The ongoing demand for specialized skills in the energy sector, particularly for roles such as pipeline technicians and project managers, can limit the pool of available talent for contractors.

- Wage Inflation: A tight labor market in 2024 has led to upward pressure on wages for skilled trades, potentially increasing the cost of contracted services for Gibson Energy.

- Talent Retention Strategies: Gibson's internal efforts to maintain high safety standards and cultivate a positive work environment can aid in retaining its own skilled employees, offering a competitive advantage.

- Contractor Dependence: The degree to which Gibson relies on external contractors for essential services will directly influence the impact of labor market conditions on its operational costs.

Regulatory Compliance and Environmental Technology Suppliers

Suppliers of environmental technologies and services essential for regulatory compliance, such as emissions reduction and spill prevention, are gaining leverage. This is particularly true in the Canadian oil and gas sector, where environmental regulations are becoming increasingly strict. For instance, as of early 2024, Canada continues to implement and refine its methane emission regulations, directly impacting companies like Gibson Energy.

Gibson Energy's stated commitment to sustainability, including its Net Zero by 2050 target for Scope 1 and 2 emissions, necessitates reliance on these specialized suppliers for advanced solutions. This dependence grants these providers a notable degree of influence over pricing and terms. For example, the demand for carbon capture technologies, a key area for emissions reduction, has seen significant growth, potentially increasing supplier power.

- Increasing Regulatory Demands: Stricter environmental laws in Canada's oil and gas industry enhance the bargaining power of suppliers offering compliance technologies.

- Gibson's Sustainability Goals: Gibson Energy’s Net Zero by 2050 commitment for Scope 1 and 2 emissions creates a direct need for specialized environmental solutions, increasing supplier influence.

- Technological Specialization: The niche nature of advanced environmental technologies means fewer suppliers, concentrating power in their hands.

- Potential for Collaboration: While suppliers hold power, Gibson’s proactive environmental, social, and governance (ESG) strategy can foster collaborative partnerships, mitigating some of this power.

The bargaining power of suppliers for Gibson Energy is generally moderate, influenced by the specialized nature of midstream equipment and services, alongside the company's scale and strategic partnerships. While some critical components are unique, the market isn't entirely dominated by a few providers, limiting extreme supplier leverage.

Construction and engineering firms hold some sway, particularly for large projects, due to specialized skills and contract values. Gibson's consistent capital spending, including expansions, can foster stable relationships, potentially leading to better terms. For example, Gibson's involvement in the Duvernay infrastructure development with Baytex Energy Corp. highlights how project visibility can influence supplier negotiation stances.

The availability of skilled labor is a key factor impacting supplier power. In 2024, shortages in specialized trades like certified welders and pipeline engineers increased labor costs for contractors, who often pass these higher expenses onto clients like Gibson. This dynamic strengthens the hand of suppliers who can access this scarce talent.

Suppliers of environmental technologies and services are gaining leverage due to increasingly strict Canadian environmental regulations, such as methane emission controls implemented in early 2024. Gibson's commitment to sustainability, including its Net Zero by 2050 target for Scope 1 and 2 emissions, necessitates reliance on these specialized providers, granting them significant influence over pricing.

| Factor | Impact on Gibson Energy | 2024/2025 Data Point |

|---|---|---|

| Specialized Equipment | Moderate supplier power due to some unique components but not extreme concentration. | N/A (General market condition) |

| Skilled Labor Shortages | Increased contractor costs due to high demand for specialized trades. | Shortage of skilled trades reported across many sectors in 2024. |

| Environmental Compliance | Increased supplier power for environmental technology providers. | Canada's ongoing implementation of methane emission regulations (early 2024). |

| Gibson's Scale & Relationships | Dilutes supplier power through long-term partnerships and negotiation leverage. | Successful Q2 2025 Gateway dredging project delivery. |

| Gibson's Cost Initiatives | Mitigates impact of rising input costs. | Target of over $25 million in annual savings by end of 2025. |

What is included in the product

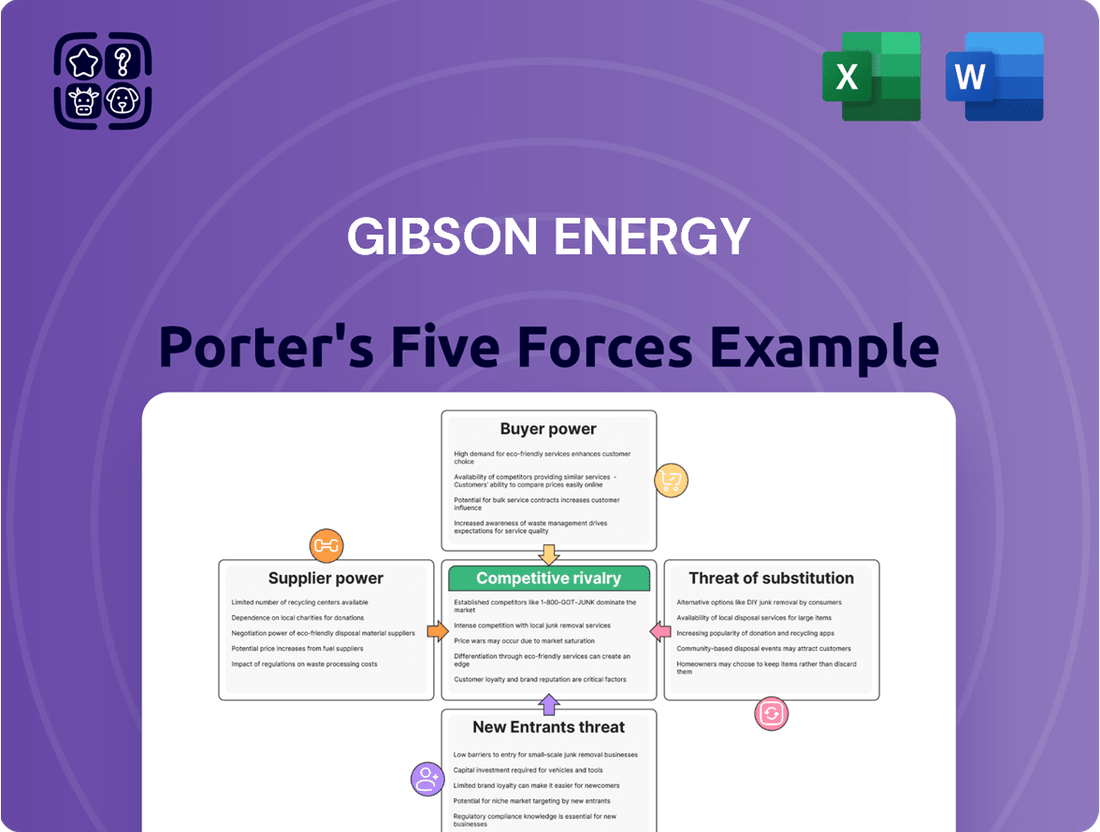

This analysis of Gibson Energy's competitive environment details the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, all within the context of the energy infrastructure sector.

Effortlessly identify and mitigate competitive pressures with a visual breakdown of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Gibson Energy's customer base is heavily concentrated, primarily consisting of major oil and gas producers and refiners. These large entities often account for a substantial portion of the throughput at Gibson's key infrastructure, such as terminals and pipelines.

This concentration grants these customers significant bargaining power. For instance, facilities like Gateway and Edmonton have seen record volumes, underscoring the importance of these large producers to Gibson's operations. Their ability to shift volumes or negotiate terms directly impacts Gibson's revenue and profitability.

The concentrated nature of Gibson's customer base allows these major players to negotiate more favorable terms, especially within the context of long-term contracts. This leverage is a direct consequence of their significant contribution to Gibson's business volumes.

Gibson Energy's infrastructure segment, a cornerstone of its operations, benefits significantly from long-term, fee-for-service contracts. These agreements, which account for roughly 95% of this segment's revenue, create a robust barrier against customer power.

The nature of these contracts, often including take-or-pay clauses, locks in revenue streams for Gibson. This contractual stability inherently limits customers' leverage to demand price concessions or easily switch to alternative service providers, thereby diminishing their bargaining power.

This contractual framework provides Gibson Energy with a predictable and stable revenue base, a critical advantage that helps insulate the company from the volatility often seen in commodity-linked markets.

For producers and refiners, switching midstream service providers can be a costly endeavor. These expenses often include necessary infrastructure modifications, establishing new pipeline connections, and navigating complex logistical arrangements. This financial and operational hurdle significantly impacts a customer's ability to easily transition to a competitor.

Gibson Energy's established and integrated network of terminals and pipelines presents substantial switching barriers for its customers. This integrated infrastructure makes it challenging for clients to shift their volumes to alternative providers without incurring considerable disruption and expense, thus diminishing their bargaining power.

Interdependence in the Canadian Energy Supply Chain

The bargaining power of customers in the Canadian energy supply chain, particularly for midstream operators like Gibson Energy, is somewhat constrained due to the integrated nature of the industry. Producers, the primary customers of midstream services, depend heavily on established infrastructure for transporting their crude oil and natural gas. For instance, in 2024, Canada's oil sands production, a significant source of business for companies like Gibson, continued to rely on pipeline networks for market access, with approximately 97% of Canadian crude oil exports moving via pipeline.

This reliance creates a degree of interdependence. If producers were to exert significant downward price pressure on midstream services, it could lead to underinvestment in essential infrastructure maintenance and expansion. Such underinvestment would ultimately hinder the producers’ own ability to get their products to market efficiently and safely, impacting their revenues. Gibson Energy's 2024 financial reports indicated stable volumes across its Canadian operations, suggesting that producers have found the existing service levels and pricing to be acceptable given the critical nature of midstream transport.

- Integrated Infrastructure: Canadian producers depend on midstream companies for essential transportation, making it difficult to switch providers without significant disruption.

- Market Access Dependence: Gibson Energy's infrastructure provides critical market access for producers, limiting their leverage to demand lower prices.

- Operational Interdependence: Disruptions in midstream services directly impact producers' ability to operate and sell their products, thus tempering their bargaining power.

- 2024 Volume Stability: Gibson Energy's consistent throughput volumes in 2024 suggest a balanced relationship where producers value the reliable service over aggressive price negotiation.

Access to Diverse Markets via Gibson's Infrastructure

Gibson Energy's infrastructure, such as its Hardisty, Edmonton, and Gateway terminals, offers customers crucial access to a variety of markets, including the U.S. Gulf Coast and international export hubs. This broad market reach is a significant advantage for producers looking to diversify their sales.

The ability to connect with numerous refining centers and export terminals strengthens Gibson's appeal. This enhanced market access helps to mitigate the significant bargaining power that large customers might otherwise wield.

- Strategic Terminals: Hardisty, Edmonton, and Gateway provide key market access points.

- Market Reach: Facilitates access to U.S. Gulf Coast and international destinations.

- Value Proposition: Enhances producer value through diversified sales channels.

- Bargaining Power Mitigation: Critical market access helps balance customer leverage.

Gibson Energy's customer concentration, primarily large oil and gas producers, initially suggests strong bargaining power. However, the company's integrated infrastructure and long-term, fee-for-service contracts, often with take-or-pay clauses, significantly limit this power. These contracts, representing about 95% of the infrastructure segment's revenue, ensure predictable cash flows and reduce customer leverage for price concessions.

| Factor | Impact on Customer Bargaining Power | Gibson Energy's Mitigation Strategy |

|---|---|---|

| Customer Concentration | High potential leverage due to large volume contributions. | Long-term contracts and essential service provision. |

| Switching Costs | High for producers due to infrastructure modifications and logistical complexities. | Integrated network creates significant operational hurdles for competitors. |

| Contractual Stability | Take-or-pay clauses lock in revenue, limiting price negotiation. | Provides predictable revenue streams, insulating from market volatility. |

| Market Access | Gibson's terminals (e.g., Hardisty, Edmonton) offer critical market reach. | Diversified sales channels for producers reduce dependence on single outlets. |

Preview Before You Purchase

Gibson Energy Porter's Five Forces Analysis

This preview showcases the complete Gibson Energy Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. You're viewing the exact, professionally formatted document you'll receive instantly upon purchase, ensuring no surprises or missing information. This comprehensive analysis is ready for immediate download and use, providing valuable insights into Gibson Energy's strategic positioning and the broader market landscape.

Rivalry Among Competitors

The Canadian midstream sector is quite concentrated, featuring major players like Enbridge, Pembina Pipeline, Keyera, TC Energy, and Gibson Energy. This limited number of significant companies means competition for new projects and existing business is fierce, as each player vies for market share.

Gibson Energy's recent performance highlights its competitive standing; the company reported record infrastructure EBITDA in Q1 2025. This strong operational result underscores its ability to effectively compete and generate value within this concentrated Canadian midstream market.

Midstream companies like Gibson Energy face intense rivalry because their operations are built on massive fixed costs. Think about pipelines and storage terminals – these are incredibly expensive to build and maintain, and they aren't easily switched to different uses. This means companies are constantly striving to keep their infrastructure running at full capacity.

To cover these substantial fixed costs, companies must secure consistent volumes of product to move through their systems. This necessity fuels aggressive competition for contracts and new business. For instance, in 2024, the North American midstream sector continued to see companies vying for market share, with a focus on securing long-term, fee-based contracts to provide revenue stability against fluctuating commodity prices.

Gibson Energy's strategically positioned terminals, notably in Hardisty and Edmonton, Western Canada, alongside its Gateway terminal, represent a significant competitive advantage. These locations are vital for connecting producers and refiners, offering essential storage and logistical capabilities that are highly sought after.

The company's commitment to enhancing these assets is evident in recent investments. For instance, the Gateway dredging project, finalized in Q2 2025, is projected to increase throughput and operational efficiency, further solidifying Gibson's competitive standing in the energy infrastructure sector.

Limited Organic Growth Opportunities Intensify Rivalry

The Canadian midstream sector faces a landscape where significant new, large-scale projects are increasingly rare. Regulatory and environmental challenges are making greenfield development more difficult, pushing companies to compete more fiercely for opportunities in expanding existing infrastructure or securing long-term agreements for current capacity. Gibson Energy's strategic allocation of over $1 billion towards growth within its existing operational areas highlights this industry trend.

- Scarcity of Greenfield Projects: Major new pipeline constructions are becoming less frequent due to increasing regulatory scrutiny and environmental considerations.

- Intensified Competition for Brownfield: Companies are intensely competing for brownfield expansion projects and the opportunity to secure long-term contracts for incremental capacity.

- Gibson's Strategic Focus: Gibson Energy is directing over $1 billion in capital towards growth initiatives within its established infrastructure, reflecting the limited availability of new, large-scale opportunities.

- Impact on Rivalry: This environment naturally heightens competition among midstream players vying for available growth avenues and market share.

Differentiated Service Offerings and Customer Relationships

Competitive rivalry in the midstream sector, including for Gibson Energy, extends beyond mere pricing. Companies distinguish themselves through the depth and quality of services like storage, blending, and processing. Gibson's strength lies in providing integrated solutions, fostering robust relationships with both producers and refiners, which is key to customer loyalty and acquisition.

Gibson Energy's strategy of offering comprehensive, integrated midstream solutions directly addresses the competitive rivalry by building strong, sticky customer relationships. This approach moves competition beyond simple cost structures to encompass the value derived from reliable and specialized services. For instance, Gibson's long-term strategic partnership with Baytex Energy Corp. for Duvernay infrastructure highlights this focus on integrated customer solutions, securing demand and demonstrating a commitment to supporting client growth.

- Differentiated Services: Midstream companies compete on the quality and range of services, not just price.

- Customer Relationships: Strong ties with producers and refiners are vital for retaining and attracting business.

- Integrated Solutions: Offering end-to-end services provides a competitive edge.

- Strategic Partnerships: Collaborations like Gibson Energy's with Baytex Energy Corp. exemplify this integrated approach.

Competitive rivalry within Canada's concentrated midstream sector is intense, driven by high fixed costs and the need to maintain asset utilization. Companies like Gibson Energy compete not only on price but also on the quality of integrated services, such as storage and processing, to foster customer loyalty.

The scarcity of new greenfield projects forces companies to vie more aggressively for brownfield expansions and long-term contracts. Gibson Energy's strategic capital allocation of over $1 billion towards growth within existing infrastructure underscores this trend, aiming to secure market share in a competitive environment.

Gibson Energy's Q1 2025 record infrastructure EBITDA demonstrates its effectiveness in this competitive landscape, highlighting its ability to secure business and operate efficiently. Strategic partnerships, like the one with Baytex Energy Corp., further solidify its position by offering integrated solutions that go beyond basic transportation.

| Key Competitor | 2024 Estimated Revenue (CAD Billions) | Gibson Energy 2024 Infrastructure EBITDA (CAD Millions) | Key Differentiator |

|---|---|---|---|

| Enbridge | ~60 | ~1,200 | Extensive North American network |

| Pembina Pipeline | ~7 | ~950 | Integrated Western Canadian operations |

| Keyera | ~2 | ~600 | Focus on processing and NGLs |

| TC Energy | ~14 | ~1,100 | Major natural gas pipelines |

| Gibson Energy | ~1.5 | ~700 | Integrated solutions and strategic terminals |

SSubstitutes Threaten

Pipelines are the undisputed champions for moving large volumes of oil and refined products across vast distances. Their efficiency, safety, and cost-effectiveness for bulk transport are hard to match. This dominance is underscored by the fact that in 2024, pipelines handled a staggering 89.6% of Canada's crude oil exports, demonstrating their critical role in the energy infrastructure.

While alternatives like rail and trucking exist, they simply cannot compete for large-scale, long-haul movements. These options are considerably more expensive per unit, less efficient for the sheer volume pipelines manage, and introduce different sets of safety and environmental considerations that make them less appealing for bulk energy transport.

While rail and truck transport offer alternative methods for moving petroleum products, they present significant cost disadvantages compared to pipeline infrastructure for the large-scale, continuous movements Gibson Energy specializes in. These alternatives are generally only economically viable for smaller volumes or niche logistical needs, such as last-mile delivery or situations where pipeline capacity is temporarily unavailable. For instance, in 2024, the cost per barrel for crude oil transport via rail can be substantially higher than pipeline transport, with estimates varying but often ranging from $5-$15 per barrel more, depending on distance and specific service, making it an unviable substitute for Gibson's core business.

While some large producers might consider building more on-site processing or storage to bypass third-party midstream services, the substantial capital outlay and specialized knowledge required make this a limited threat. For instance, the cost of constructing new, large-scale processing facilities can easily run into hundreds of millions of dollars, a barrier for many.

The inherent efficiency and cost-effectiveness of integrated pipeline networks, like those Gibson Energy operates, typically outweigh the perceived benefits of producers going it alone. Pipelines offer a continuous, reliable flow of product, which is crucial for maintaining operational momentum and meeting market demands.

Impact of Energy Transition on Long-Term Demand

The global shift towards decarbonization poses a long-term, indirect threat of substitution for traditional energy sources. As the world increasingly adopts cleaner alternatives, the demand for petroleum products could gradually decline, impacting midstream volumes over time.

Despite this, the Canadian midstream sector is projected for growth, with an estimated expansion between 2025 and 2034. This growth is largely underpinned by the continued production of oil and gas, suggesting a more gradual transition for the sector.

- Energy Transition Impact: The ongoing global energy transition, driven by decarbonization efforts, represents an indirect threat of substitution by promoting cleaner energy sources.

- Midstream Demand: Sustained investment in renewables and electric vehicles could eventually reduce the demand for petroleum products, thereby affecting midstream volumes.

- Canadian Midstream Outlook: The Canadian midstream market is anticipated to experience growth from 2025 to 2034, primarily fueled by ongoing oil and gas production.

Refinery Location and Direct Connections

The threat of substitutes for Gibson Energy's midstream services, particularly its terminal operations, is somewhat mitigated by its strategic positioning. While some producers might have direct pipeline connections to refineries, bypassing third-party services, Gibson's terminals often serve as essential hubs for aggregating and distributing crude oil from various production basins to multiple refining centers. This broad connectivity reduces the incentive for producers to rely solely on their own infrastructure.

For instance, Gibson Energy's Edmonton terminal plays a crucial role in supporting Trans Mountain Expansion (TMX) shippers. This integration highlights how Gibson's assets are woven into the fabric of major supply chains, making them indispensable for many producers looking to access key markets. The ability to connect diverse production areas to a range of refining markets through these strategic assets limits the viability of direct substitution for many participants.

- Geographic Proximity & Direct Connections: Producers with close proximity to refineries or their own pipeline infrastructure can bypass third-party midstream services, acting as a substitute.

- Gibson's Terminal Advantage: Gibson's strategically located terminals are critical aggregation and distribution points, connecting multiple production areas to various refining markets, thus reducing the impact of direct connections.

- TMX Integration: Gibson's Edmonton terminal's role in supporting TMX shippers demonstrates its integral position in key supply chains, further diminishing the threat of substitution for many users.

The threat of substitutes for Gibson Energy's core pipeline and terminal services is relatively low for bulk, long-haul transport. While rail and trucking can move products, they are significantly more expensive and less efficient for the volumes Gibson handles. For example, in 2024, pipelines moved approximately 89.6% of Canada's crude oil exports, highlighting their dominance.

Producers building their own infrastructure is a limited threat due to the immense capital requirements, often in the hundreds of millions of dollars for processing facilities. Gibson's integrated network offers a more cost-effective and reliable solution for most, ensuring continuous product flow crucial for market demands.

The broader energy transition presents an indirect, long-term substitution risk as demand for petroleum products may eventually decrease. However, the Canadian midstream sector is still projected for growth between 2025 and 2034, indicating continued reliance on these services in the near to medium term.

Gibson's strategically located terminals, such as its Edmonton facility supporting Trans Mountain Expansion shippers, act as vital aggregation and distribution hubs. This integration into major supply chains makes direct producer bypasses less viable for many, solidifying Gibson's role as an essential service provider.

Entrants Threaten

The midstream energy sector, where Gibson Energy operates, is characterized by extremely high capital intensity. Building and maintaining essential infrastructure like pipelines, terminals, and processing facilities requires enormous upfront investments, often in the billions of dollars. For instance, Gibson's extensive network includes terminals with over 25 million barrels of tankage capacity, representing a significant capital outlay.

These substantial sunk costs create a formidable barrier to entry for potential new competitors. Once significant capital is invested in specialized infrastructure, it is difficult and costly to recover or redeploy, making new entrants hesitant to commit the necessary funds. This financial hurdle protects incumbent players like Gibson from direct competition from smaller or less capitalized firms.

The oil and gas industry in Canada faces substantial regulatory and permitting challenges. New entrants must navigate complex environmental assessments and secure numerous approvals, a process that can extend over several years. For instance, major pipeline projects often require extensive consultations and can face delays due to evolving environmental standards.

These intricate and time-consuming approval pathways, coupled with significant legal and public engagement expenses, act as a powerful deterrent. For example, the Trans Mountain Expansion project, a significant undertaking, has faced years of regulatory scrutiny and legal challenges, highlighting the substantial upfront investment and risk associated with new infrastructure in this sector.

Established midstream companies like Gibson Energy possess significant advantages due to their extensive infrastructure networks and the economies of scale they've achieved over time. These entrenched players also benefit from long-standing customer relationships, making it challenging for newcomers to compete effectively. Gibson's seven decades of operational experience and its substantial role in processing a large volume of barrels from the Western Canadian Sedimentary Basin highlight this deep-seated market position.

Access to Supply and Demand Points

Securing access to both upstream production supply and downstream refining or export demand points presents a significant barrier for new entrants in the midstream sector. Established companies like Gibson Energy have cultivated deep relationships and built extensive infrastructure networks over many years, making it challenging for newcomers to establish comparable market reach.

Existing midstream operators often benefit from long-term, exclusive agreements with producers and end-users, coupled with strategic interconnections that are costly and time-consuming to replicate. These established networks create a formidable hurdle for any new player attempting to gain a foothold.

Gibson Energy's strategic approach, exemplified by its partnerships, such as its multi-year agreement with Baytex Energy Corp. for processing services, directly addresses this threat. These collaborations not only secure future volumes for Gibson but also solidify its market connections, reinforcing its competitive advantage against potential new entrants.

- Established Infrastructure: Gibson Energy possesses a robust network of pipelines, terminals, and processing facilities, representing billions of dollars in capital investment that new entrants would need to match.

- Long-Term Contracts: The company typically operates under multi-year contracts with both producers and refiners, ensuring stable throughput and revenue streams, a level of security difficult for new players to achieve initially.

- Strategic Partnerships: Gibson's alliances, like those with Baytex, provide guaranteed volumes and market access, demonstrating a proactive strategy to lock in supply and demand.

- Regulatory Hurdles: Obtaining permits and regulatory approvals for new midstream infrastructure can be a lengthy and complex process, favoring incumbents with established regulatory relationships.

Industry Maturity and Limited Untapped Opportunities

The Canadian midstream sector is quite mature, meaning most of the necessary infrastructure is already built. This saturation limits the potential for entirely new, large-scale projects that could offer significant market share to newcomers. For instance, in 2023, capital expenditures in Canadian oil and gas infrastructure, while substantial, were largely focused on maintaining and optimizing existing assets rather than groundbreaking new developments.

Finding truly untapped market niches is difficult for new players. They often face the challenge of entering a market where established companies, like Gibson Energy, already have significant scale and resources. This makes it harder for new entrants to achieve economic viability without directly confronting these incumbents.

The high cost of building new midstream infrastructure, coupled with the existing network, acts as a substantial barrier.

- Industry Saturation: The Canadian midstream market has a high degree of existing infrastructure.

- Limited Greenfield Opportunities: Truly new, large-scale projects are scarce, making market entry challenging.

- Incumbent Advantage: Established players possess scale and resources that new entrants struggle to match.

- Capital Intensity: The significant cost of building new infrastructure deters many potential new entrants.

The threat of new entrants in the midstream energy sector, where Gibson Energy operates, is considerably low due to immense capital requirements and established infrastructure. Building new pipelines or terminals involves billions of dollars in investment, a hurdle that deters most potential competitors. Gibson's own significant capital investments, such as its extensive terminal network, illustrate this barrier.

Regulatory complexity and lengthy approval processes further discourage new players. Navigating environmental assessments and securing permits can take years, adding substantial cost and risk. For example, major pipeline projects in Canada have historically faced protracted legal and public consultations, favoring incumbents with established relationships.

Existing players like Gibson benefit from economies of scale, long-term contracts, and deep customer relationships, making it difficult for newcomers to gain market share. Gibson's decades of experience and its role in processing substantial volumes of oil and gas in Western Canada underscore this entrenched advantage.

The Canadian midstream market is also mature, with most essential infrastructure already in place, leaving limited opportunities for new, large-scale developments that could offer significant market entry points for new companies.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | Building midstream infrastructure requires billions in upfront investment. | High deterrent due to massive financial commitment. |

| Regulatory Hurdles | Complex and lengthy approval processes for new projects. | Increases cost, time, and risk for new entrants. |

| Established Infrastructure & Scale | Incumbents possess extensive networks and benefit from economies of scale. | Difficult for new players to match operational efficiency and cost-effectiveness. |

| Long-Term Contracts & Relationships | Existing players secure stable volumes through multi-year agreements. | New entrants struggle to secure reliable supply and demand without established connections. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Gibson Energy leverages data from their annual reports, investor presentations, and industry-specific trade publications. We also incorporate insights from market research reports and financial databases to assess competitive dynamics.