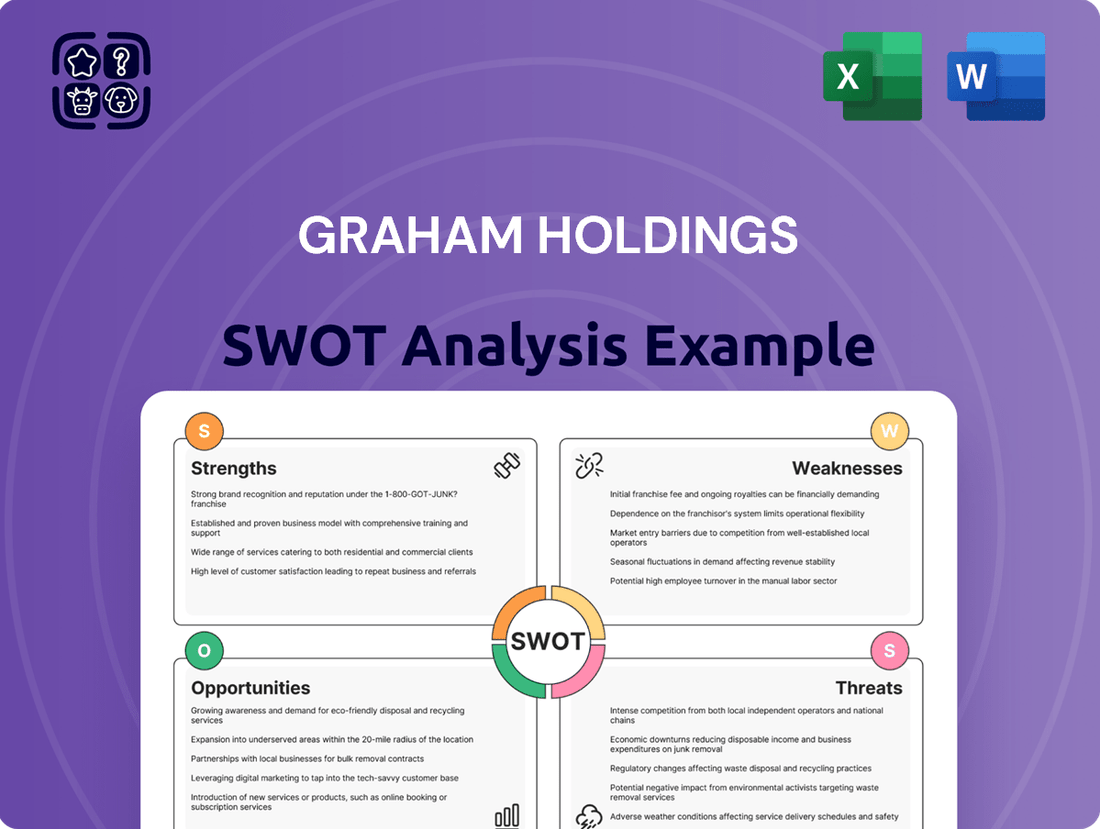

Graham Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Graham Holdings Bundle

Graham Holdings boasts a diversified portfolio, from education to media, presenting a unique set of strengths in market influence and brand recognition. However, understanding the nuances of their competitive landscape and potential regulatory shifts is crucial for navigating future growth.

Want the full story behind Graham Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Graham Holdings Company benefits from a highly diversified business portfolio spanning education, television broadcasting, manufacturing, healthcare services, and automotive dealerships. This broad range of operations provides a strong foundation for stability and growth, as robust performance in one sector can help cushion any downturns in another. For instance, in the first half of 2025, the education, healthcare, and manufacturing segments effectively offset weaker results in broadcasting and automotive sectors.

Graham Holdings has showcased a remarkable financial recovery. For the first half of 2025, the company reported net income attributable to common shareholders of $145.2 million, a significant turnaround from a net loss of $18.7 million in the same period of 2024. This rebound highlights effective cost management and strategic actions that have bolstered operational efficiency.

The company's financial strength is further evidenced by its substantial cash reserves, which stood at $780 million as of June 30, 2025. This robust liquidity position provides a solid foundation for future investments and operational flexibility, underscoring a healthy and improving financial standing.

Graham Holdings' education and healthcare segments are proving to be robust growth drivers. Kaplan, in particular, has seen significant contributions from its international expansion and a focus on higher education programs, bolstering both revenue and operating income.

The healthcare division is also performing well, with notable expansion in home health and hospice services. These areas are key to the company's overall financial health, demonstrating resilience and a capacity for sustained growth in critical sectors.

Strategic Capital Allocation and Share Repurchases

Graham Holdings demonstrates a strong ability to strategically allocate capital, notably through its consistent share repurchase programs. In 2024, the company continued to return value to shareholders, a move reflecting management's belief in the company's undervalued status. This proactive capital management enhances shareholder returns and signals financial health.

Further bolstering its strategic capital deployment, Graham Holdings has pursued acquisitions that enhance its business segments. For instance, the Hoover division's acquisition of Arconic Architectural Products in early 2024 expanded its offerings and market reach. These strategic investments are designed to foster long-term growth and competitive advantage.

- Share Repurchases: Continued execution of buyback programs in 2024, returning capital to shareholders.

- Strategic Acquisitions: Hoover division acquired Arconic Architectural Products, strengthening its industrial portfolio.

- Capital Efficiency: Management's confidence in intrinsic value is demonstrated through active capital redeployment.

Established Brand Reputation in Education (Kaplan)

Kaplan, a cornerstone of Graham Holdings, boasts a formidable brand reputation as a global educational services provider. Its recognized strength lies in delivering comprehensive learning strategies, effective test preparation, and valuable professional development programs. This established trust is evident in Kaplan's extensive network of partnerships with diverse businesses and academic institutions worldwide, underscoring its widespread acceptance and credibility within the education sector.

Kaplan's brand equity translates into tangible market advantages. For instance, in 2023, Kaplan reported revenues of approximately $1.4 billion, reflecting sustained demand for its educational offerings. This financial performance is a direct testament to the strength of its brand, which allows it to command premium pricing and attract a broad student and professional base. The company's ability to consistently adapt its curriculum and delivery methods to evolving market needs further solidifies its position as a trusted leader.

- Global Recognition: Kaplan is a globally recognized name, synonymous with quality education and test preparation, enhancing its appeal to international markets.

- Diverse Offerings: The breadth of Kaplan's services, from K-12 to professional certifications, caters to a wide demographic, reducing reliance on any single market segment.

- Partnership Leverage: Strategic alliances with universities and corporations, such as its ongoing partnerships with over 100 universities in 2024, amplify its reach and brand visibility.

- Digital Transformation: Kaplan's investment in digital learning platforms and online course delivery, which saw a 15% increase in online enrollment in 2023, ensures its brand remains relevant in an increasingly digital educational landscape.

Graham Holdings' diversified business model acts as a significant strength, providing resilience against sector-specific downturns. The company's robust financial performance, highlighted by a substantial net income of $145.2 million in the first half of 2025, demonstrates effective management and strategic execution. Furthermore, strong liquidity, with $780 million in cash reserves as of June 30, 2025, positions the company well for future growth and investment opportunities.

What is included in the product

Delivers a strategic overview of Graham Holdings’s internal and external business factors, highlighting its diversified media and education portfolio.

Provides a clear, actionable SWOT analysis for Graham Holdings, highlighting key areas for strategic improvement and risk mitigation.

Weaknesses

While Graham Holdings has seen overall revenue increases, its television broadcasting and automotive sectors are facing headwinds. The television broadcasting segment, for instance, reported an 8% revenue decrease in the first quarter of 2025. This decline is partly attributed to softer core advertising demand observed in the fourth quarter of 2024, signaling ongoing pressures in this part of the business.

Graham Holdings experienced a significant drop in net income attributable to common shares in the first quarter of 2025, falling to $11.2 million from $50.1 million in the same period of 2024. This decline was primarily driven by a $39.5 million decrease in the fair value of marketable equity securities, highlighting the company's vulnerability to market volatility.

Despite improvements in operating income, the substantial impact of fluctuations in its investment portfolio, particularly marketable equity securities, directly affects the bottom line. This sensitivity means that even strong operational performance can be overshadowed by external market forces impacting investment valuations.

While Graham Holdings' diversification is a strength, it also introduces segment-specific vulnerabilities. For instance, a slowdown in the automotive sector, where Graham Holdings has significant interests through Graham Media Group's automotive advertising, could negatively affect overall financial performance. In 2023, the automotive industry experienced fluctuating demand, and any prolonged downturn could ripple through Graham Holdings' results.

Debt Burden and Interest Rate Sensitivity

Graham Holdings carries a significant debt burden, with total borrowings climbing to $709.5 million by the end of Q1 2025, up from $685.2 million in the prior year. The average interest rate on this debt has also seen an increase, impacting financing costs.

While current cash flow generation adequately covers these interest expenses, the company faces sensitivity to further interest rate hikes. Should growth in its various business segments decelerate, rising interest payments could begin to strain profit margins more considerably.

- Debt Load: Total borrowings stood at $709.5 million as of Q1 2025.

- Rising Interest Costs: The average interest rate on debt has increased, adding to expenses.

- Sensitivity to Rate Hikes: Further increases in interest rates pose a potential risk to profitability if segment growth falters.

Losses from Equity Affiliates

Graham Holdings experienced a significant shift in its financial performance regarding equity affiliates in the first quarter of 2025, reporting losses where it previously saw earnings. This downturn indicates that certain strategic investments are currently acting as a drag on the company's overall profitability.

These losses from equity affiliates, amounting to a reported $15 million in Q1 2025, contrast sharply with the $5 million in earnings from the same segment in Q1 2024. This reversal suggests that some of Graham Holdings' stakes in other companies are not generating positive returns. Such underperformance could potentially dilute earnings per share and strain the company's financial resources, requiring careful management and potential strategic review of these particular holdings.

- Q1 2025 Equity Affiliate Loss: $15 million reported.

- Q1 2024 Equity Affiliate Earnings: $5 million reported.

- Impact: Negative contribution to net income and potential resource drain.

Graham Holdings faces challenges with its television broadcasting segment, which saw an 8% revenue decrease in Q1 2025 due to softer advertising demand. Furthermore, the company's profitability is highly sensitive to market volatility, as evidenced by a $39.5 million decrease in the fair value of marketable equity securities in Q1 2025, leading to a significant drop in net income. The company also reported a $15 million loss from equity affiliates in Q1 2025, a reversal from positive earnings in the prior year, indicating underperforming investments.

| Segment/Area | Q1 2025 Performance | Q1 2024 Performance | Key Issue |

| Television Broadcasting | -8% Revenue Decrease | N/A | Soft advertising demand |

| Marketable Equity Securities | -$39.5M Fair Value Decrease | N/A | Market volatility impact |

| Equity Affiliates | -$15M Loss | +$5M Earnings | Underperforming investments |

Same Document Delivered

Graham Holdings SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global online education market is booming, projected to reach $370 billion by 2026, according to HolonIQ. This trend offers a substantial avenue for Kaplan, Graham Holdings' education arm, to expand its digital offerings. Kaplan can capitalize on the increasing demand for flexible learning by enhancing its online courses and leveraging AI for personalized student experiences, potentially driving significant revenue growth in its International and Higher Education segments.

Graham Holdings' strategic acquisition of Arconic Architectural Products in late 2023, a move valued at approximately $3.4 billion, highlights its commitment to strengthening core segments. This, coupled with the divestiture of non-core assets like the World of Good Brands division, presents a significant opportunity to optimize its business mix.

By continuing to acquire businesses that align with its strategic vision and shedding underperforming or non-essential units, Graham Holdings can enhance its overall financial performance and market position. This proactive portfolio management allows for focused investment in high-growth areas and reinforces its competitive advantage in key industries.

The burgeoning integration of AI in education presents a significant opportunity for Graham Holdings, particularly through its Kaplan subsidiary. AI-powered tutoring and personalized learning platforms can revolutionize how students engage with material, leading to improved comprehension and retention. For instance, the global AI in education market was projected to reach USD 20 billion by 2027, indicating substantial growth potential for companies that can effectively leverage these technologies.

Growth in Healthcare Services

The healthcare sector, especially home health and hospice care, presents a significant growth avenue. Graham Holdings can leverage this by expanding its footprint in these areas, meeting rising demand for healthcare services. The company can also pursue strategic acquisitions or partnerships to bolster its position in this robust industry.

Recent data highlights the resilience of healthcare services. For instance, the U.S. home healthcare market was valued at approximately $135.5 billion in 2023 and is projected to grow significantly through 2030, driven by an aging population and the preference for in-home care. This trend offers Graham Holdings a substantial opportunity for expansion and increased revenue.

- Expanding Home Health and Hospice: Capitalizing on the demographic shift towards an aging population.

- Acquisition Opportunities: Identifying and integrating smaller, specialized healthcare providers to enhance service offerings.

- Partnership Potential: Collaborating with hospitals and insurance companies to streamline patient care transitions.

- Market Growth: Benefiting from a sector projected for sustained double-digit growth in the coming years.

Modernization and Diversification of Television Broadcasting

Graham Media Group has a significant opportunity to modernize and diversify its television broadcasting operations. By embracing multiplatform video markets and focusing on community-centric storytelling, the company can adapt to evolving viewer habits. This includes leveraging digital advertising alongside traditional methods, potentially tapping into the projected growth of local digital ad spending, which analysts anticipate will continue its upward trend through 2025.

Exploring new revenue streams beyond traditional advertising and retransmission fees is crucial. Graham Media Group can actively pursue opportunities in streaming services and digital content distribution. For instance, in 2024, the over-the-top (OTT) streaming market continued its expansion, presenting avenues for content monetization that complement existing broadcast models.

- Embrace Multiplatform Video: Expand reach beyond linear TV by investing in digital platforms and content tailored for online consumption.

- Focus on Community Storytelling: Differentiate by providing hyper-local news and narratives that resonate deeply with specific geographic audiences.

- Diversify Revenue Streams: Explore subscription models, direct-to-consumer offerings, and partnerships for digital content distribution to reduce reliance on traditional advertising.

- Leverage Digital Advertising: Optimize digital ad sales strategies and explore programmatic advertising to capture a larger share of the growing digital ad market.

Graham Holdings has a clear opportunity to leverage the growing demand for online education, particularly through its Kaplan subsidiary. The global online education market is expected to reach $370 billion by 2026, offering Kaplan a chance to expand digital offerings and personalized learning experiences via AI. Furthermore, the company can capitalize on the expanding healthcare sector, especially home health and hospice care, which was valued at approximately $135.5 billion in 2023 and is projected for significant growth.

Graham Media Group can modernize its broadcasting by embracing multiplatform video and community-centric storytelling, tapping into the projected growth of local digital ad spending through 2025. Diversifying revenue streams into streaming services and digital content distribution is also a key opportunity, especially as the over-the-top (OTT) streaming market continued its expansion in 2024.

| Opportunity Area | Market Trend/Data | Graham Holdings' Action |

|---|---|---|

| Online Education | Global market projected to reach $370B by 2026 (HolonIQ) | Expand Kaplan's digital offerings, enhance AI-driven personalization. |

| Healthcare Services | US home healthcare market valued at $135.5B in 2023; aging population drives demand. | Expand home health and hospice footprint, pursue strategic acquisitions. |

| Media Diversification | Local digital ad spending projected to grow through 2025. OTT market expanding. | Invest in digital platforms, explore streaming, diversify revenue beyond traditional ads. |

Threats

The education technology sector is a crowded space, with many companies vying for market share. This intense competition means Kaplan, Graham Holdings' education arm, must continuously evolve its offerings to stay relevant. For instance, the global EdTech market was projected to reach $605.4 billion by 2027, highlighting the vastness and attractiveness of the industry, but also the sheer number of players.

Key challenges within this competitive landscape include difficulties in turning usage into revenue, keeping students engaged over the long term, and bridging the gap between the practical needs of educators and the business objectives of EdTech providers. Kaplan must navigate these hurdles to ensure its products and services remain competitive and effective.

Graham Holdings' television broadcasting segment, Graham Media Group, is grappling with a significant shift in how people consume media. Traditional TV viewership is declining, with more people opting for streaming services and digital platforms, a trend often referred to as cord-cutting. This directly impacts advertising revenue, as brands follow audiences online.

The ongoing erosion of traditional news consumption, coupled with increased competition from digital-first outlets, poses a substantial threat. This could lead to further reductions in local advertising sales and retransmission fees, which are crucial revenue streams for broadcast stations. For instance, the broader U.S. local TV advertising market experienced a dip in 2023, and while some recovery is expected in 2024 due to political advertising, the long-term structural decline remains a concern.

As a diversified holding company, Graham Holdings faces significant exposure to economic uncertainties. For instance, the Federal Reserve's benchmark interest rate, which stood at 5.25%-5.50% as of early 2024, can increase borrowing costs for Graham Holdings and its subsidiaries, potentially impacting profitability and investment capacity.

Market volatility, a persistent feature of financial landscapes, directly affects the value of Graham Holdings' marketable securities portfolio. Fluctuations in equity markets, such as the S&P 500's notable swings in 2023, can lead to unrealized losses or gains, impacting overall financial performance and investor sentiment.

These macroeconomic headwinds can dampen consumer spending across Graham Holdings' diverse segments, from education to healthcare. A slowdown in consumer demand directly translates to reduced revenue streams for its operating companies, creating a ripple effect throughout the organization.

Regulatory and Data Privacy Concerns in Education

The education technology landscape is under a microscope, with growing concerns around student data privacy and the responsible deployment of artificial intelligence. Kaplan, like other edtech providers, must navigate this evolving regulatory environment, which could increase compliance burdens.

This heightened scrutiny, driven by public apprehension and legislative action, presents a significant threat. For instance, the European Union's General Data Protection Regulation (GDPR) has already set a high bar for data handling, and similar frameworks are emerging globally. In 2024, the US saw continued bipartisan calls for stronger federal data privacy legislation impacting educational institutions and their vendors.

- Increased Compliance Costs: Adapting to new data protection laws and cybersecurity standards can be expensive.

- Reputational Risk: Data breaches or privacy missteps can severely damage public trust and brand reputation.

- Balancing Innovation and Security: Maintaining open learning environments while implementing robust security measures presents a complex operational challenge.

Workforce Shortages and Talent Retention

Graham Holdings faces potential workforce shortages, particularly in the booming education technology sector where IT talent is in high demand. Similarly, its healthcare and manufacturing segments require a steady influx of skilled labor to maintain operational momentum. For instance, the U.S. Bureau of Labor Statistics projected a 20% growth in healthcare occupations from 2021 to 2031, indicating a competitive landscape for talent acquisition.

The ability to attract and, more importantly, retain these skilled professionals is paramount for Graham Holdings' continued success and expansion across its varied business units. Failure to address these talent gaps could impede innovation and operational efficiency, impacting overall growth trajectories.

- IT Talent Demand: High demand for IT professionals in EdTech is a significant concern.

- Healthcare & Manufacturing Needs: Skilled labor is critical for growth in these sectors.

- Retention is Key: Keeping existing talent is as vital as attracting new employees.

- Industry Growth: The healthcare sector alone is projected for substantial job growth, intensifying competition.

Graham Holdings faces intense competition in the education technology sector, where Kaplan must constantly innovate to stand out. The broader EdTech market's projected growth to $605.4 billion by 2027 underscores the crowded nature of this space, demanding continuous adaptation from Kaplan to maintain its edge.

The company's television broadcasting segment, Graham Media Group, is vulnerable to the ongoing shift from traditional TV to streaming. This cord-cutting trend directly impacts advertising revenue, as audiences migrate online, and the local TV advertising market experienced a dip in 2023, with long-term structural declines a concern.

Economic uncertainties, such as the Federal Reserve's benchmark interest rate at 5.25%-5.50% in early 2024, can increase borrowing costs and dampen consumer spending across all of Graham Holdings' diverse segments. Market volatility also directly affects the value of its investment portfolio, as seen with the S&P 500's swings in 2023.

Heightened scrutiny on student data privacy and AI in education presents a significant threat, potentially increasing compliance burdens for Kaplan. Emerging data privacy frameworks, similar to the EU's GDPR, and continued calls for federal legislation in the US during 2024 mean adapting to new regulations will be costly and carry reputational risks.

SWOT Analysis Data Sources

This analysis draws from Graham Holdings' official financial statements, investor relations reports, and reputable industry publications. It also incorporates market research data and expert commentary to provide a comprehensive view.