Graham Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Graham Holdings Bundle

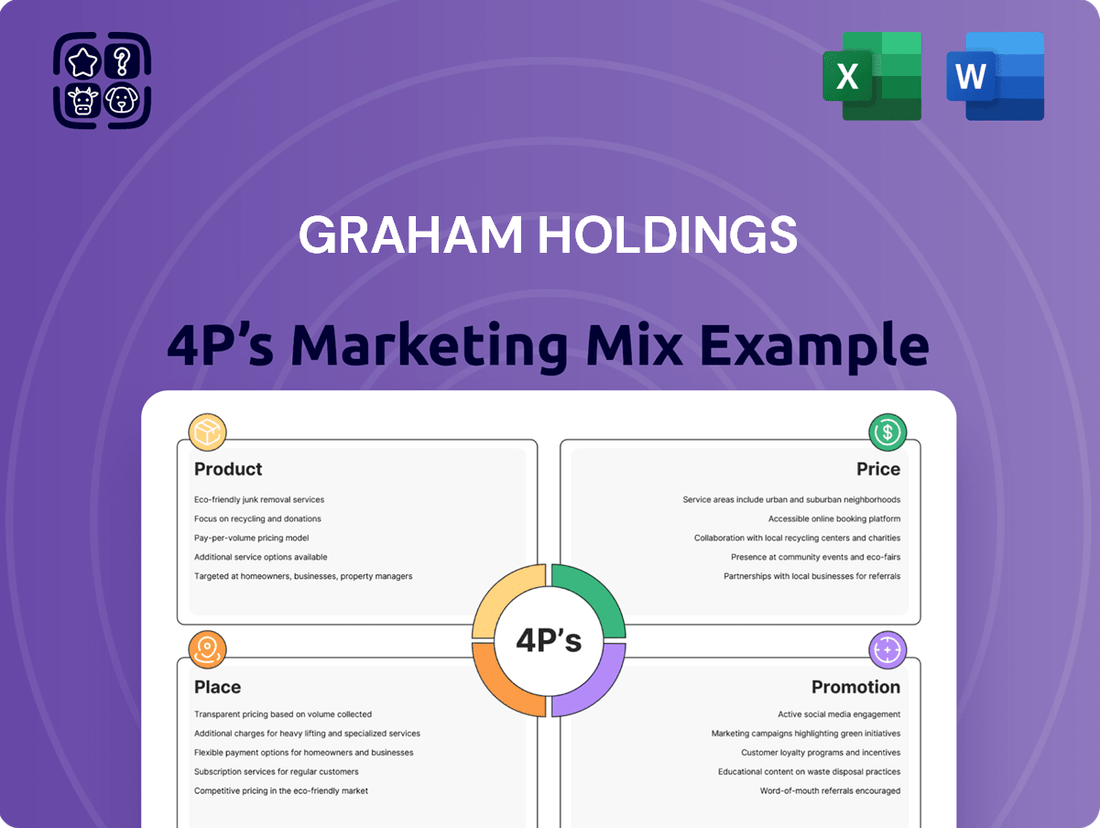

Graham Holdings masterfully orchestrates its Product, Price, Place, and Promotion to create a compelling market presence. Discover the intricate details of their product diversification, strategic pricing, effective distribution, and impactful promotional campaigns.

Want to understand the full scope of Graham Holdings' marketing genius? Unlock the complete 4Ps analysis, packed with actionable insights and ready for your strategic planning.

Product

Kaplan's educational services represent Graham Holdings' core product in the education sector, offering diverse test preparation for exams like the GRE, GMAT, and bar exam, alongside professional development and higher education. This comprehensive approach aims to equip individuals for academic and career advancement.

Kaplan's strategic product offering includes an 'All Access License' for universities, providing students with broad access to test prep materials, fostering institutional partnerships. This strategy emphasizes scalable solutions that benefit both individual learners and educational bodies.

Graham Holdings' television broadcasting segment, primarily through Graham Media Group, focuses on providing essential local content. Their 32 television stations, predominantly in the top 50 U.S. markets, deliver critical news, weather, and community programming across major network affiliations like NBC, ABC, and CBS, as well as independent channels. This strategy ensures broad reach and relevance to local audiences.

The product offering extends beyond traditional broadcasting with the integration of SocialNewsDesk. This software solution empowers newsrooms to leverage social media effectively, enhancing content delivery and audience engagement in the digital age. This dual approach addresses both established broadcast needs and evolving digital communication trends.

In 2024, the local broadcast television advertising market is projected to see continued strength, with estimates suggesting a total ad revenue of around $14.5 billion, driven by political advertising and a recovering economy. Graham Media Group's strategic placement in top markets positions them to capitalize on these revenue streams, further solidifying their product's value proposition.

Graham Holdings' healthcare services, primarily through Graham Healthcare Group (GHG) and CSI Pharmacy, represent a significant growth driver. These segments focus on home health, hospice care, and specialty pharmacy, delivering essential treatments directly to patients' homes.

This strategic focus on in-home care is crucial for increasing healthcare revenue. For instance, the home healthcare market in the US was valued at approximately $145 billion in 2023 and is projected to grow substantially, driven by an aging population and a preference for care outside traditional hospital settings.

CSI Pharmacy, a key component of GHG, specializes in complex medication management, further diversifying Graham Holdings' healthcare offerings. The specialty pharmacy market alone is expected to reach over $300 billion globally by 2027, highlighting the lucrative nature of these specialized services.

Manufacturing

Graham Holdings' manufacturing segment, featuring companies like Dekko and Hoover, demonstrates a commitment to industrial products. Hoover's recent acquisition of Arconic Architectural Products, LLC, a manufacturer of aluminum cladding, highlights a strategic move to bolster its manufacturing capacity and product offerings in the construction materials sector.

This expansion into aluminum cladding, a key component in modern building design, suggests a forward-looking approach to capitalize on demand within the architectural and construction industries. The integration of Arconic's operations is expected to enhance Hoover's market position and revenue streams.

- Hoover's acquisition of Arconic Architectural Products, LLC

- Focus on aluminum cladding products for the construction sector

- Strategic expansion of manufacturing capabilities

Other Diversified Investments

Graham Holdings' 'Other Diversified Investments' represent a strategic effort to broaden its revenue streams beyond its primary media and education businesses. This segment encompasses a varied collection of companies including automotive dealerships, hospitality ventures like Clyde's Restaurant, and consumer internet platforms such as Framebridge, Society6, and Slate. The company actively manages this portfolio, demonstrating a willingness to divest underperforming assets, as evidenced by the sale of World of Good Brands (WGB) websites.

While this diversified approach offers potential for growth and risk mitigation, it's important to note that some of these 'other businesses' have encountered operating losses. For instance, in the fiscal year ending December 31, 2023, the segment reported a net loss. Graham Holdings, however, maintains a proactive stance, continuously assessing and optimizing this portfolio to align with its overall strategic objectives and financial performance goals.

- Diverse Portfolio: Includes automotive, hospitality (Clyde's Restaurant), and consumer internet companies (Framebridge, Society6, Slate, Foreign Policy).

- Portfolio Management: Ongoing evaluation and reshaping of investments, exemplified by the sale of World of Good Brands (WGB) websites.

- Performance Challenges: Some diversified businesses have experienced operating losses, impacting the segment's overall financial results.

- Strategic Adaptation: The company's approach involves adapting its investments to enhance performance and align with broader corporate strategy.

Graham Holdings' product strategy is multifaceted, spanning education, media, healthcare, and manufacturing. Kaplan's educational offerings, including test prep and professional development, are a cornerstone, complemented by Graham Media Group's local news and programming. The company also focuses on in-home healthcare services and specialized pharmacy through Graham Healthcare Group and CSI Pharmacy, alongside industrial products from Hoover and Dekko.

| Segment | Key Products/Services | 2023/2024 Data/Projections |

|---|---|---|

| Education (Kaplan) | Test Prep (GRE, GMAT), Professional Development, Higher Education | Offers 'All Access License' to universities. |

| Media (Graham Media Group) | Local News, Weather, Community Programming | 32 TV stations in top 50 US markets. Local broadcast TV ad revenue projected at $14.5 billion in 2024. |

| Healthcare (Graham Healthcare Group, CSI Pharmacy) | Home Health, Hospice Care, Specialty Pharmacy | US home healthcare market valued at ~$145 billion in 2023. Specialty pharmacy market projected over $300 billion globally by 2027. |

| Manufacturing (Hoover, Dekko) | Industrial Products, Aluminum Cladding | Hoover acquired Arconic Architectural Products, LLC. |

What is included in the product

This analysis provides a comprehensive breakdown of Graham Holdings' marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

It delves into Graham Holdings' actual brand practices and competitive positioning, making it an invaluable resource for understanding their market approach and benchmarking against industry leaders.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of strategic ambiguity for Graham Holdings.

Provides a clear, concise overview of Graham Holdings' 4Ps, resolving the difficulty of aligning diverse teams on marketing objectives.

Place

Kaplan's educational services heavily leverage online platforms, offering live online instruction and comprehensive digital courses. This robust online presence allows Kaplan to serve a worldwide student population, adapting to the increasing demand for flexible and accessible learning. In 2023, Kaplan reported significant growth in its online segment, with over 60% of its revenue derived from digital offerings, reflecting a strong commitment to digital channels.

While Kaplan heavily leverages digital platforms for its educational offerings, it strategically maintains a physical footprint to cater to specific program needs and diverse student preferences. For instance, Kaplan Business School offers in-person courses, providing a tangible learning environment for students who benefit from face-to-face interaction.

Graham Media Group's television stations boast a significant broadcasting reach, with operations spanning six U.S. states and encompassing seven media hubs in key markets such as Houston, Detroit, and Orlando. This expansive network allows their news and entertainment programming to connect with millions of households nationwide.

Direct-to-Consumer and Institutional Sales

Kaplan's distribution strategy for Graham Holdings hinges on a dual approach: direct-to-consumer (DTC) sales and institutional partnerships. This allows them to reach individual learners seeking test preparation and professional development, while also securing larger contracts with schools and government bodies.

This multi-channel strategy is crucial for maximizing market reach. By serving both individual students and large organizations, Kaplan effectively addresses diverse market segments and revenue streams.

- Direct-to-Consumer: Kaplan offers its extensive range of test prep courses and professional development programs directly to individual students through online platforms and physical centers.

- Institutional Sales: Partnerships with universities, school districts, and state governments provide Kaplan with significant volume, often for standardized test preparation or workforce training initiatives.

- Market Penetration: This combined approach ensures Kaplan captures a broad spectrum of the education market, from individual aspirations to large-scale governmental or educational mandates.

Healthcare Service Delivery Networks

Graham Healthcare Group's commitment to patient well-being is evident in its carefully constructed service delivery networks. These networks are the backbone of their operations, ensuring that essential healthcare, particularly home health and hospice care, reaches patients directly in their homes. This approach prioritizes a familiar and comfortable environment for treatment, making critical care more accessible.

The 'Place' in Graham's marketing mix is defined by these localized networks. They are designed to be deeply embedded within communities, fostering convenience and ease of access for individuals seeking care. This strategic placement reduces barriers to receiving necessary medical attention, aligning with the growing demand for in-home healthcare solutions.

Graham Healthcare Group's extensive network is a significant asset. As of early 2024, the US home healthcare market alone was valued at over $150 billion, with projections indicating continued strong growth. Graham's presence in numerous communities across the nation allows them to tap into this expanding market effectively. Their model emphasizes:

- Localized Care Hubs: Establishing service centers within specific geographic areas to ensure rapid response times and community familiarity.

- Integrated Patient Pathways: Streamlining the process from referral to in-home service delivery, minimizing administrative hurdles for patients and families.

- Skilled Caregiver Deployment: Utilizing a robust network of nurses, therapists, and aides who are strategically positioned to serve local patient populations efficiently.

- Partnerships for Reach: Collaborating with hospitals, physician groups, and insurers to extend their service footprint and ensure seamless transitions of care.

Graham Healthcare Group's "Place" strategy centers on localized, community-based service delivery networks, particularly for home health and hospice care. This approach prioritizes patient comfort and accessibility by bringing care directly into homes, reducing barriers to treatment. The company's extensive network allows it to effectively serve a broad patient base, capitalizing on the growing demand for in-home healthcare solutions.

| Graham Holdings Segment | Key "Place" Strategy | Reach/Impact |

|---|---|---|

| Kaplan (Education) | Online platforms, physical centers, institutional partnerships | Global student population, significant digital revenue (over 60% in 2023) |

| Graham Media Group (Broadcasting) | Seven media hubs in key US markets | Broadcasting reach across six US states, connecting with millions of households |

| Graham Healthcare Group (Healthcare) | Localized home health and hospice service networks | Serving numerous communities, tapping into the $150+ billion US home healthcare market (early 2024) |

Same Document Delivered

Graham Holdings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Graham Holdings' 4Ps (Product, Price, Place, Promotion) is fully complete and ready for your immediate use, offering a clear understanding of their marketing strategies.

Promotion

Digital marketing and a strong online presence are paramount for Graham Holdings, particularly for Kaplan and Graham Media Group. Kaplan's online course enrollments and digital learning platforms are heavily reliant on targeted online advertising and social media engagement to reach students globally.

Graham Media Group utilizes digital channels extensively for news dissemination and audience interaction. In 2024, their digital platforms saw continued growth in unique visitors and engagement metrics, underscoring the importance of social media tools like SocialNewsDesk for real-time content distribution and audience feedback, driving their promotional efforts.

Graham Holdings actively manages its public image through consistent press releases detailing crucial corporate events like earnings, dividends, and strategic moves such as acquisitions. This proactive communication strategy ensures stakeholders are well-informed about the company's performance and direction.

Kaplan, a key subsidiary, significantly boosts its brand equity by securing prestigious industry accolades. For instance, Kaplan's inclusion on Inc.s Best in Business List and its multiple EdTech Breakthrough Awards underscore its leadership and innovation in the education technology sector, reinforcing its credibility with students and partners.

Kaplan, a key part of Graham Holdings, strategically partners with educational institutions and government bodies. For instance, its 'All Access License' initiative with the State of Illinois in 2024 aimed to broaden access to its career-focused education, reflecting a commitment to expanding its educational reach through collaborative efforts.

Graham Media Group also leverages partnerships to enhance its market presence. Collaborations with entities like Verance Corporation and the Local Media Consortium, active in 2024, facilitate cross-promotional opportunities and extend the group's audience reach, vital for advertising revenue and brand visibility.

Investor Relations Communications

For a diversified holding company like Graham Holdings, investor relations communications are a crucial promotional element, specifically aimed at attracting and retaining financially-literate decision-makers. These communications are vital for building trust and demonstrating the company's value proposition to potential and current investors.

Graham Holdings actively engages its investor base through various channels. For instance, their Q1 2024 earnings report, released in April 2024, detailed revenue growth and strategic initiatives, providing key financial data. The company also leverages its annual shareholder meeting, typically held in the spring, to present its performance and future outlook directly to stakeholders.

The effectiveness of these communications can be seen in market reception and analyst coverage. For example, following the Q1 2024 earnings release, several financial analysts reiterated their positive ratings on Graham Holdings, citing strong operational execution and a clear strategic direction. These reports and presentations are meticulously crafted to offer transparency and encourage continued investment.

- Regular Earnings Reports: Providing timely financial performance data, such as the Q1 2024 report showing revenue growth.

- Annual Meeting Presentations: Offering a direct platform for management to discuss strategy and results with shareholders.

- Proxy Statements: Detailing corporate governance and executive compensation, crucial for investor confidence.

- Analyst Calls and Webcasts: Facilitating in-depth discussions on financial results and industry trends.

Content Marketing and Thought Leadership

Graham Holdings leverages content marketing and thought leadership by combining Kaplan's educational prowess with Graham Media Group's news dissemination capabilities. This strategy aims to position both entities as trusted authorities in their respective domains.

By producing high-quality educational materials, in-depth analyses, and timely news content, they establish credibility and attract their target audiences. For instance, Kaplan might offer free webinars or white papers on emerging educational trends, while Graham Media Group could publish investigative reports or expert commentary on current events.

This approach directly supports their promotional efforts by building brand recognition and fostering customer loyalty. In 2024, the digital content marketing industry was valued at over $400 billion, highlighting the significant impact of such strategies.

Key aspects of this strategy include:

- Educational Resource Creation: Kaplan develops and distributes valuable learning materials, such as online courses, study guides, and career advice articles, to attract and engage prospective students.

- News Analysis and Expertise: Graham Media Group provides insightful news coverage, expert opinions, and data-driven analyses to establish its credibility and inform the public.

- Cross-Promotion Synergies: Opportunities exist to integrate Kaplan's educational content within Graham Media Group's platforms and vice versa, creating a broader reach and reinforcing brand messaging.

- Data-Driven Content Strategy: Utilizing analytics to understand audience engagement and preferences allows for the refinement of content marketing efforts, ensuring relevance and impact.

Graham Holdings employs a multifaceted promotional strategy, heavily leaning on digital engagement for Kaplan and Graham Media Group. Kaplan's online enrollments are driven by targeted digital advertising and social media, while Graham Media Group leverages its digital platforms for news and audience interaction, noting continued growth in unique visitors and engagement in 2024.

The company also prioritizes investor relations, using earnings reports, annual meetings, and analyst calls to communicate performance and strategy, aiming to build trust with financially-literate decision-makers. This transparent communication, evidenced by positive analyst coverage following the Q1 2024 report, is key to attracting and retaining investors.

Content marketing and thought leadership are central, with Kaplan offering educational resources and Graham Media Group providing expert news analysis to establish credibility. These efforts are supported by a digital content marketing industry valued at over $400 billion in 2024, underscoring the impact of such strategies.

Key promotional activities include Kaplan's educational resource creation and Graham Media Group's news expertise, with potential for cross-promotional synergies between the subsidiaries.

Price

Kaplan, a key part of Graham Holdings, employs value-based pricing for its educational services, aligning costs with the tangible benefits students gain, such as improved test scores and career progression. This strategy is evident in their offerings for test preparation and professional development, where the price point reflects the potential return on investment for the learner.

The 'All Access License' is a prime example of this value-based approach in action. By charging institutions for comprehensive access, Kaplan makes its resources effectively free at the point of use for students. This model not only boosts market penetration but also reinforces the perception of high value by removing direct financial barriers for the end-user.

Graham Holdings navigates a landscape of intense competition across its varied business units, necessitating adaptable pricing models. In television broadcasting, for instance, advertising rates are a direct reflection of market demand, the size of the audience reached, and seasonal influences like political advertising, which saw significant spending in the 2024 election cycle.

The company must artfully balance offering competitive prices to attract and retain customers with the imperative to maximize revenue. This involves strategic adjustments in pricing across segments like education and manufacturing, ensuring each contributes optimally to overall financial performance.

Graham Holdings' pricing strategy extends to the financial implications of strategic acquisitions, where the cost of acquiring a business and managing its associated liabilities, such as pension obligations, are meticulously factored in. This approach ensures that the purchase price accurately reflects the true economic value and future commitments.

A notable example is Hoover's acquisition of Arconic Architectural Products, which included the assumption of approximately $105 million in net pension obligations. This substantial commitment directly influenced the acquisition's overall cost and subsequent financial structuring, highlighting the importance of considering long-term liabilities in pricing decisions.

Dividend Policy and Share Repurchases

Graham Holdings actively manages shareholder value through a consistent quarterly dividend and strategic share repurchase programs. These financial actions, while not a direct product price, significantly influence how investors perceive the company's stock, ultimately impacting its market capitalization and overall investor confidence.

The company's commitment to returning capital to shareholders is a key component of its financial strategy. For instance, as of the first quarter of 2024, Graham Holdings continued its practice of paying a quarterly dividend, demonstrating a stable approach to income generation for its investors.

Share repurchases further enhance shareholder value by reducing the number of outstanding shares, which can boost earnings per share and signal management's belief in the company's intrinsic value. This dual approach reinforces the company's financial health and attractiveness in the market.

- Dividend Payout: Graham Holdings maintains a consistent quarterly dividend, providing a predictable income stream for shareholders.

- Share Repurchases: The company utilizes share buybacks to reduce outstanding shares, potentially increasing EPS and signaling confidence.

- Investor Perception: These financial policies directly impact investor sentiment and the perceived attractiveness of Graham Holdings stock.

- Market Capitalization Influence: Consistent shareholder return strategies contribute to the company's overall market valuation and investor appeal.

Revenue Diversification and Segment Performance

Graham Holdings' pricing strategy is inherently complex, reflecting its diverse revenue base. While education and healthcare segments demonstrate robust growth, contributing positively to overall pricing power, the television broadcasting and automotive sectors face headwinds, impacting pricing flexibility in those areas. This necessitates a dynamic approach to pricing across the portfolio.

The company's ability to maintain competitive pricing is influenced by segment-specific performance. For instance, Kaplan, its education arm, has shown resilience, allowing for strategic pricing adjustments. Conversely, the automotive segment's pricing may be more reactive to market conditions and competitive pressures.

- Kaplan's revenue for the fiscal year ending December 31, 2023, was $2.3 billion, showcasing strong performance in the education sector.

- The company has strategically managed pricing in its healthcare segment, which reported significant revenue growth in the first half of 2024.

- Declines in advertising revenue for its television broadcasting segment in late 2023 and early 2024 have presented pricing challenges in that vertical.

- Balancing pricing across segments is crucial, with a focus on optimizing revenue from high-growth areas to offset pressures in mature or declining sectors.

Graham Holdings' pricing strategy is a nuanced approach, balancing value-based pricing in education with market-driven rates in broadcasting and careful consideration of acquisition costs. This dynamic strategy aims to optimize revenue across its diverse portfolio.

Kaplan's $2.3 billion revenue in 2023 highlights its pricing power, while the television segment's advertising rates are sensitive to audience size and the 2024 election cycle's ad spend. The company actively manages pricing to ensure competitiveness and profitability.

| Segment | Pricing Strategy | Key Factors Influencing Price | Recent Performance Data |

|---|---|---|---|

| Education (Kaplan) | Value-Based | Student ROI, Career Progression | $2.3 billion revenue (FY 2023) |

| Television Broadcasting | Market-Driven | Audience Size, Demand, Seasonality | Challenged by declining ad revenue (late 2023/early 2024) |

| Acquisitions | Cost-Plus/Economic Value | Liabilities (e.g., pension obligations), Market Conditions | Assumed ~$105 million in pension obligations for Arconic Architectural Products |

4P's Marketing Mix Analysis Data Sources

Our Graham Holdings 4P's Marketing Mix analysis is grounded in a comprehensive review of publicly available information. We leverage SEC filings, investor relations materials, company websites, and industry-specific reports to understand their product offerings, pricing strategies, distribution channels, and promotional activities.