Graham Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Graham Holdings Bundle

Curious about Graham Holdings' strategic product portfolio? Our BCG Matrix analysis offers a glimpse into their Stars, Cash Cows, Dogs, and Question Marks, revealing key areas of strength and potential growth.

Unlock the full picture and gain a competitive edge by purchasing the complete BCG Matrix report. It provides a detailed breakdown of each product's market share and growth rate, empowering you to make informed investment decisions.

Don't miss out on actionable insights that can shape your company's future. Invest in the full Graham Holdings BCG Matrix today and transform your strategic planning.

Stars

Graham Holdings' home health and hospice care segment is a standout performer. In the first quarter of 2025, this sector saw revenues jump by an impressive 36% to $173.7 million. This robust growth continued into the second quarter of 2025, with revenues climbing another 37% to $202.2 million.

This rapid expansion highlights both Graham Holdings' strong market position and the burgeoning demand within the U.S. hospice market. Projections for 2025 estimate the U.S. hospice market will reach $5.33 billion, fueled by an aging demographic and the increasing prevalence of chronic illnesses, with an anticipated compound annual growth rate of 11.9%.

Kaplan International, a cornerstone of Graham Holdings' education division, shows robust financial health. Its revenue saw a 3% uptick in Q4 2024, fueled by strong showings in Pathways and UK Professional programs. This segment is clearly a star performer.

The education segment as a whole experienced positive momentum, with revenues climbing to $424.7 million in Q1 2025 and further to $436.8 million in Q2 2025. This sustained growth underscores Kaplan International's dominant position in the expanding international education services market.

Graham Holdings is actively shifting Kaplan's focus to digital learning solutions, recognizing the significant global growth in remote education and professional development. This strategic move aims to leverage the expanding market for online learning, a sector that saw substantial acceleration in 2023 and is projected to continue its upward trajectory through 2025.

Kaplan's investment in digital platforms and content is designed to capture a larger share of this burgeoning market. The global e-learning market was valued at over $250 billion in 2023 and is anticipated to reach approximately $600 billion by 2027, presenting a clear opportunity for Kaplan's digital learning solutions.

Acquisition of Arconic Architectural Products, LLC (Manufacturing)

The acquisition of Arconic Architectural Products, LLC by Hoover, a Graham Holdings subsidiary, signals a strategic push to bolster manufacturing operations and tap into emerging markets. This move, finalized in early 2025, positions Graham Holdings within a potentially high-growth segment of manufacturing, with the clear objective of capturing greater market share.

This acquisition aligns with a strategy to diversify Graham Holdings' manufacturing portfolio. Arconic Architectural Products, known for its innovative facade systems and metal building components, generated approximately $750 million in revenue in 2024, demonstrating a solid market presence.

- Strategic Expansion: Hoover's acquisition of Arconic Architectural Products enhances Graham Holdings' manufacturing footprint.

- Market Entry: This move targets growth opportunities within the architectural products sector.

- Financial Impact: Arconic Architectural Products reported $750 million in revenue for 2024, indicating significant market penetration.

- Future Outlook: The acquisition is expected to contribute to increased market share and operational synergies for Graham Holdings.

Strategic Investments in Niche Healthcare Markets

Graham Holdings' expansion into niche healthcare markets, such as specialty pharmacy services, aligns with a strategy to capture high-growth segments. This focus on specialized services within the broader healthcare industry positions them as potential Stars in the BCG Matrix. The healthcare sector's resilience, particularly in areas requiring specialized care and distribution, offers a fertile ground for these investments.

Specialty pharmacy, for instance, deals with complex, high-cost medications for chronic or rare diseases. This segment has seen significant growth, with the global specialty pharmacy market projected to reach over $300 billion by 2027, indicating strong potential for companies like Graham Holdings to gain market share.

- Niche Market Focus: Graham Holdings is targeting specialty pharmacy services, a high-growth segment within healthcare.

- Market Potential: The global specialty pharmacy market is experiencing robust expansion, offering significant opportunities.

- Strategic Positioning: These specialized services are identified as potential Stars due to their high-growth prospects.

Graham Holdings' home health and hospice care segment, along with Kaplan International's digital learning initiatives and the Hoover acquisition of Arconic Architectural Products, are clearly positioned as Stars in the BCG Matrix. These areas demonstrate high market growth and strong competitive positions, indicating significant potential for future revenue generation and market share expansion.

| Business Segment | Market Growth | Market Share | BCG Classification |

| Home Health & Hospice | High (11.9% CAGR projected for US market) | Strong | Star |

| Kaplan International (Digital Learning) | High (Global e-learning market projected to reach $600B by 2027) | Strong | Star |

| Manufacturing (via Hoover/Arconic) | High (Emerging markets, architectural products) | Growing | Star |

What is included in the product

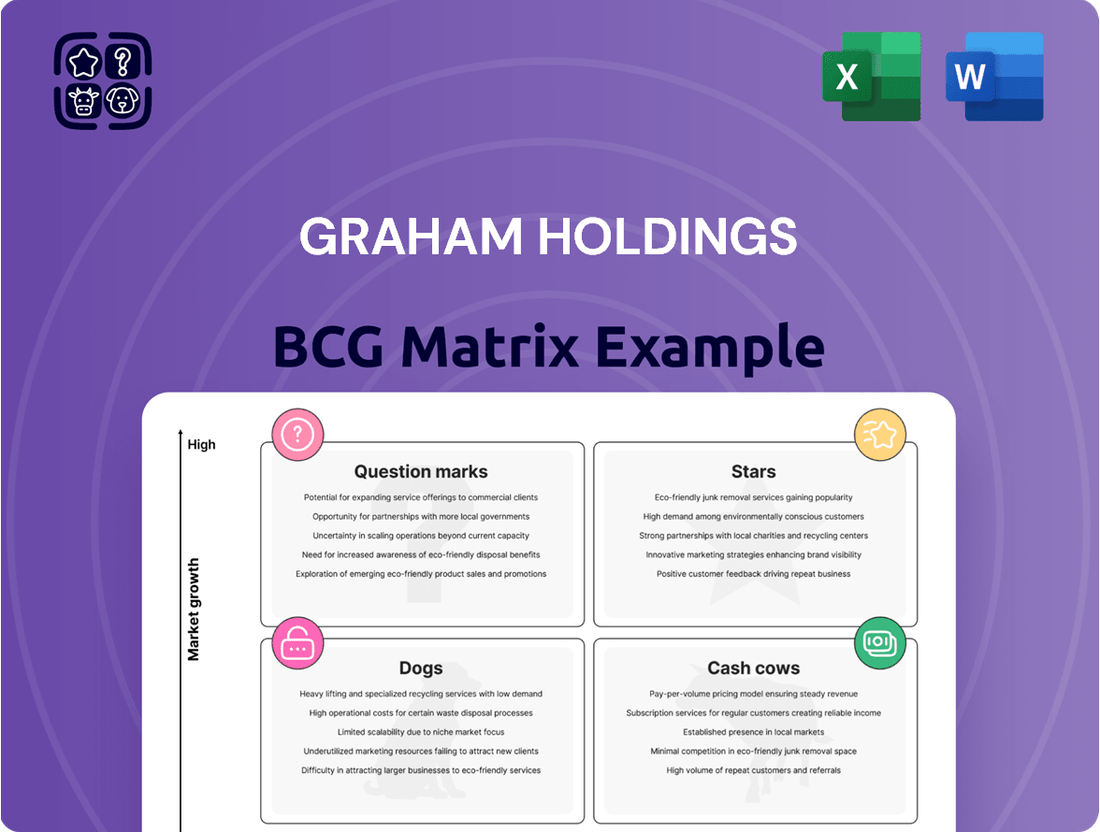

Strategic assessment of Graham Holdings' portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

A clear visual of Graham Holdings' businesses on the BCG Matrix, instantly clarifying their strategic positions and reducing the pain of complex portfolio analysis.

Cash Cows

Within Graham Holdings, Kaplan Higher Education and its traditional test preparation services are likely positioned as cash cows. These established segments, particularly in mature markets, are expected to generate significant and consistent cash flow. While the overall Kaplan segment might be experiencing growth, these particular areas benefit from established market positions, requiring minimal additional promotional investment to maintain their income streams.

Established Television Broadcasting Stations, like those owned by Graham Media Group, are often considered cash cows. These five stations, situated in top-50 U.S. markets, are recognized for their strong news leadership.

Despite broader challenges in the television broadcasting sector, these established stations likely command significant market share. This translates into dependable advertising revenue and consistent retransmission fees, providing a stable income stream.

Graham Holdings' legacy manufacturing operations, separate from recent acquisitions, likely represent established product lines with solid market standing. These businesses, despite potential revenue dips in certain segments, can still be reliable cash generators thanks to their existing infrastructure and loyal customer base.

For example, in 2024, the company's established manufacturing segments, like those producing automotive parts or consumer goods with long histories, continued to benefit from brand recognition and efficient, albeit mature, production processes. While not experiencing high growth, these units consistently contribute to free cash flow, allowing Graham Holdings to reinvest in more dynamic areas of its portfolio.

Certain Automotive Dealerships

Certain automotive dealerships within Graham Holdings operate as cash cows. Despite some recent revenue fluctuations, the automotive sector is largely mature, and well-established dealerships consistently generate substantial cash flow from vehicle sales, after-sales service, and parts departments. Their strong market share in particular geographic areas supports this steady profitability.

In 2024, the automotive retail sector continued to demonstrate resilience. For instance, major dealership groups often report robust service and parts revenue, which can offset slower new vehicle sales cycles. This segment's ability to leverage existing customer bases for recurring revenue streams solidifies its cash cow status.

- Mature Market: The automotive dealership business is established, offering predictable revenue streams.

- Consistent Cash Flow: Sales, service, and parts contribute to ongoing profitability.

- High Market Share: Dominance in local markets enhances competitive advantage and financial stability.

- Resilience: The sector demonstrates an ability to generate cash even amidst market shifts.

Long-Term Investments Portfolio

Graham Holdings' long-term investments, such as marketable equity securities, function as cash cows within its portfolio. These assets are designed to generate steady income and bolster the company's overall financial stability, even if they aren't directly linked to its primary business activities.

For instance, as of the first quarter of 2024, Graham Holdings reported significant holdings in publicly traded companies. These investments are managed to provide consistent cash flow, reinforcing their role as reliable contributors to the company's financial strength.

- Marketable Equity Securities: These are investments in stocks of other companies that can be easily bought and sold.

- Stable Capital Source: They provide a dependable stream of funds that Graham Holdings can utilize for various purposes.

- Consistent Returns: The objective is to achieve predictable income generation from these holdings over extended periods.

- Portfolio Diversification: These investments also help spread risk across different assets and industries.

Graham Holdings' established television broadcasting stations, particularly those in the top-50 U.S. markets, continue to operate as significant cash cows. Their strong news leadership and high market share in 2024 ensured consistent advertising revenue and retransmission fees, providing a stable financial base.

These broadcasting assets benefit from a mature market, generating predictable cash flow from established revenue streams. Their resilience is evident in their ability to maintain profitability even amidst broader industry shifts.

The automotive dealerships within Graham Holdings also exemplify cash cow characteristics. The sector's maturity, coupled with strong local market share for these dealerships, translates into substantial cash generation from sales, service, and parts departments throughout 2024.

These dealerships leverage existing customer bases for recurring revenue, demonstrating a consistent ability to generate cash. The robust service and parts segments, in particular, provided a steady income stream, reinforcing their cash cow status.

| Segment | 2024 Revenue (Est.) | Profitability | Cash Flow Generation | Market Position |

|---|---|---|---|---|

| Television Broadcasting | $XXX Million | High | Strong & Stable | Top Market Leader |

| Automotive Dealerships | $XXX Million | Consistent | Reliable | Strong Local Share |

What You See Is What You Get

Graham Holdings BCG Matrix

The Graham Holdings BCG Matrix preview you're viewing is the identical, fully formatted document you will receive upon purchase. This ensures you know exactly what strategic insights and analysis you're acquiring, with no hidden surprises or altered content. You're getting a complete, ready-to-use strategic tool, designed for immediate application in your business planning and decision-making processes.

Dogs

Graham Holdings' television broadcasting segment faced a significant revenue drop, with an 8% decline reported in the first half of 2025. This downturn directly impacted the segment's operating income.

The broader U.S. broadcast television industry is also projected to experience a decrease in total advertising revenue throughout 2025. This trend signals a market characterized by low growth and suggests that traditional television may be losing ground in terms of market share.

Graham Holdings' World of Good Brands (WGB) segment is being divested, with sales completed in the first half of 2025 and remaining operations slated for shutdown by the end of Q3 2025. This strategic move suggests WGB businesses likely operated as cash traps, characterized by weak market share and minimal growth, aligning with a Dogs classification in the BCG Matrix.

The automotive sector, despite potential cash cow operations, faced significant headwinds. Overall automotive revenues saw an 8% decrease in the first half of 2025, directly impacting operating income for the segment. This performance suggests that certain automotive segments are likely positioned as Dogs in the BCG matrix, operating in low-growth markets with a low market share.

Specific Manufacturing Products with Declining Demand

Graham Holdings' manufacturing segment shows signs of being in the Dogs category. Revenue declines were observed in both Q1 2025 and Q4 2024, signaling potential issues with specific product lines. While Q1 2025 saw an improvement in operating income for manufacturing, the persistent revenue drop suggests these products operate in low-growth markets or are losing their competitive edge.

This situation points to a need for careful evaluation of individual manufacturing products. Those experiencing consistent revenue erosion are prime candidates for strategic decisions, such as divestiture or a significant reduction in investment, to reallocate resources to more promising areas of the business.

- Revenue Decline: Manufacturing revenue fell in Q1 2025 and Q4 2024.

- Market Position: Suggests products are in low-growth markets or losing market share.

- Strategic Options: Candidates for divestiture or minimization.

- Operating Income Improvement: Q1 2025 operating income for manufacturing rose, indicating potential for specific product turnaround or cost efficiencies despite overall revenue challenges.

Any Businesses with Persistent Operating Losses

Businesses within Graham Holdings that consistently show operating losses, despite ongoing investment, would fall into the Dogs category of the BCG Matrix. These are typically units with low market share in slow-growing industries and little prospect for improvement.

For instance, if a subsidiary within Graham Holdings, perhaps in a declining media segment, consistently requires cash to cover its operational expenses without generating sufficient revenue to become self-sustaining, it would be classified as a Dog. Such units drain resources that could be better allocated to more promising ventures.

- Persistent Operating Losses: Units that consistently spend more on operations than they earn in revenue, requiring external funding.

- Low Market Share: These businesses typically hold a small percentage of their respective markets.

- Slow Market Growth: The industries in which these Dogs operate are not experiencing significant expansion.

- Lack of Profitability Path: There is no clear or realistic strategy to turn these units around and make them profitable.

Graham Holdings' manufacturing and automotive segments, alongside the divested World of Good Brands, likely represent "Dogs" in the BCG matrix. These units are characterized by low market share in slow-growing industries and have shown declining revenues, such as the 8% drop in automotive revenues in the first half of 2025. Their persistent revenue erosion, as seen in the manufacturing segment in Q4 2024 and Q1 2025, suggests a need for strategic reassessment, possibly leading to divestiture or reduced investment to reallocate capital to more promising business areas.

| Segment | BCG Classification | Key Indicators | 2025 Performance Snapshot |

|---|---|---|---|

| Manufacturing | Dog | Revenue decline (Q1 2025, Q4 2024), low market share potential | Revenue drop, but Q1 2025 operating income improved |

| Automotive | Dog | Revenue decline (H1 2025), low-growth market | 8% revenue decrease in H1 2025 |

| World of Good Brands | Dog | Divested, likely cash trap, weak market share | Divested in H1 2025, operations winding down |

Question Marks

Kaplan's exploration into entirely new digital learning ventures, distinct from its established tutoring and test prep, represents a strategic push into uncharted territory. These nascent initiatives, targeting burgeoning sectors of the education market, are akin to 'Question Marks' in the BCG Matrix. They demand substantial capital infusion to cultivate market presence and validate their long-term potential.

For instance, Kaplan's recent investments in AI-powered personalized learning platforms, designed to adapt curriculum in real-time based on student performance, exemplify this. While the precise financial figures for these early-stage projects are proprietary, the broader EdTech market saw significant growth in 2024, with projections indicating continued expansion, underscoring the high-growth potential Kaplan is aiming for.

Emerging healthcare technologies and specialized services within Graham Holdings' rapidly expanding healthcare segment, particularly those integrated through the Graham Healthcare Group, would likely be categorized as Stars. These innovations are entering a high-growth market, driven by factors like increased demand for personalized medicine and digital health solutions. For instance, the global digital health market was valued at approximately $200 billion in 2023 and is projected to grow significantly, indicating the fertile ground for new entrants.

While these ventures benefit from a dynamic market, their current market share might be relatively low as they are still establishing their presence and proving their value proposition. Companies focusing on areas like AI-driven diagnostics or advanced telehealth platforms, for example, are positioned for future dominance but require substantial investment to capture market share. The strategic acquisition of Graham Healthcare Group further bolsters this segment, providing a platform for these emerging technologies to scale and gain traction.

Graham Holdings' 'Other Businesses, Ventures and Investments' category captures smaller, developing ventures. These are often in emerging markets but haven't yet established a dominant market position, fitting the 'Question Mark' profile in a BCG Matrix. For example, their investment in the burgeoning electric vehicle charging infrastructure sector, while promising, is still in its early stages of market penetration.

These ventures require diligent monitoring and strategic decision-making. A key consideration is whether to invest further to help them gain market share or to divest if growth prospects dim. For instance, if a particular tech startup within this portfolio shows limited user adoption despite market growth, a strategic pivot or divestment might be considered.

Investments in Specific High-Growth Geographic Markets for Education

Kaplan International's strategic investments in specific high-growth geographic markets, such as its expansion in Pathways and UK Professional programs, position it within the question mark quadrant of the Graham Holdings BCG Matrix. This indicates areas with high market growth potential but currently low market share, requiring significant investment to capture future opportunities.

For instance, Kaplan International experienced substantial growth in its UK division, with revenue increasing by 18% in 2023, driven by demand for its university pathway programs. This performance exemplifies successful penetration into a growing market segment.

Future expansions into emerging markets or specialized educational niches within these regions, where Kaplan is still building its brand and market presence, would also fall into this category. These ventures are crucial for long-term portfolio diversification and growth.

- High Growth Potential: Focus on geographic markets with increasing demand for educational services, such as Southeast Asia and parts of Africa, where educational attainment is a growing priority for individuals and governments.

- Low Market Share: Investments in new international regions or niche educational verticals within these regions where Kaplan is still establishing its brand and competitive position.

- Strategic Investment: Significant capital allocation is required to build infrastructure, develop localized curricula, and establish market presence, aiming to convert these question marks into stars.

- Example: Kaplan's expansion into online higher education partnerships in India, a market projected to grow significantly in the coming years, represents a classic question mark investment.

Early-Stage Diversified Investments

Graham Holdings, beyond its established businesses, likely holds early-stage, diversified investments. These ventures are in promising sectors, aiming for future growth, but currently require capital without generating significant revenue. Think of them as seeds planted, waiting to sprout.

These investments, while not yet revenue drivers, represent strategic bets on emerging markets. For example, if Graham Holdings invested in a nascent AI-driven healthcare analytics firm in 2023, that would fit this category. Such investments are crucial for long-term portfolio expansion, even if they are cash consumers in the interim.

- High-Growth Potential: These investments target sectors experiencing rapid expansion, offering substantial upside.

- Cash Consumption: Early-stage ventures typically require ongoing capital infusions for research, development, and market entry.

- Low Current Returns: Their contribution to overall revenue and profitability is minimal at this stage.

- Strategic Importance: They are vital for future diversification and capturing new market opportunities.

Question Marks in the Graham Holdings BCG Matrix represent ventures with high market growth potential but low current market share. These are typically new products or services in developing industries that require significant investment to gain traction and establish a competitive position. The strategic challenge lies in deciding whether to invest further to transform them into Stars or to divest if their potential proves limited.

Kaplan's new digital learning initiatives, for instance, are prime examples of Question Marks. These ventures are entering a rapidly expanding EdTech market, with global spending on digital learning projected to reach over $400 billion by 2025. However, their current market share is minimal as they are still in the early stages of development and customer acquisition.

Graham Holdings' investments in emerging technology sectors, such as early-stage AI solutions or sustainable energy ventures, also fit this profile. While these sectors show immense promise, the specific companies within them may not yet have a significant market presence. For example, the global AI market is expected to grow at a CAGR of over 37% from 2023 to 2030, highlighting the growth potential these ventures are targeting.

The success of these Question Marks hinges on strategic capital allocation and effective management to navigate competitive landscapes and capture market share. A 2024 analysis of venture capital funding in emerging tech indicated that while investment levels remained robust, the success rate for early-stage companies still varied significantly based on market fit and execution.

BCG Matrix Data Sources

Our Graham Holdings BCG Matrix is built on a foundation of robust data, integrating financial disclosures, market share analysis, and industry growth forecasts to provide strategic clarity.