Graham Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Graham Holdings Bundle

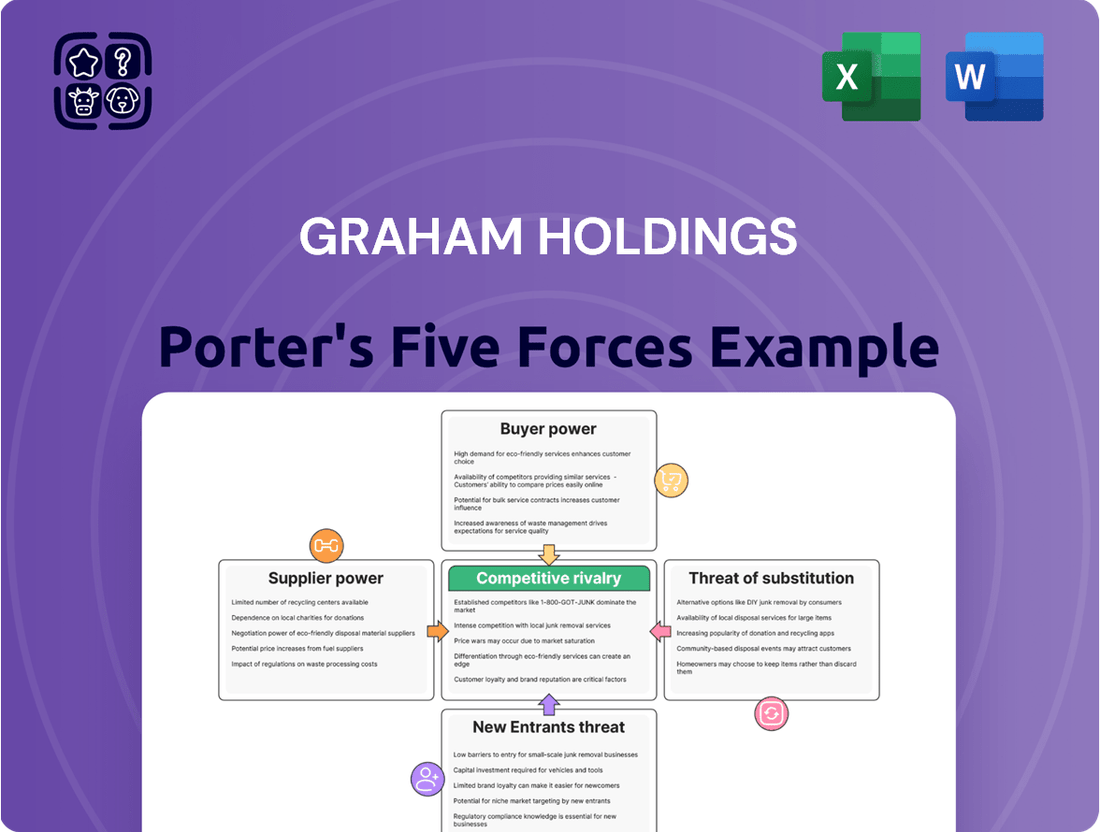

Understanding Graham Holdings's competitive landscape is crucial, and Porter's Five Forces offers a powerful lens. This framework illuminates the intensity of rivalry, the power of buyers and suppliers, and the threats of substitutes and new entrants, all shaping Graham Holdings's strategic decisions.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Graham Holdings’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of suppliers across Graham Holdings Company's varied business segments directly influences their bargaining strength. For example, Kaplan's educational services rely on content providers, technology platforms, and specialized educators, whose varying levels of concentration can impact Kaplan's negotiation leverage.

In manufacturing, the availability of niche raw materials or components from a restricted supplier base can amplify those suppliers' negotiating power. This concentration means Graham Holdings may face less flexibility in sourcing and potentially higher input costs if key suppliers are few and in high demand.

High switching costs for Graham Holdings to change suppliers would grant more power to those suppliers. In the broadcasting segment, switching broadcasting equipment or content providers could involve substantial integration costs and potential disruption, strengthening supplier positions. For instance, a significant investment in proprietary broadcast technology by a supplier could lock Graham Holdings into that ecosystem, making it costly to adopt alternatives.

Suppliers who provide highly specialized or unique products and services often wield significant bargaining power. For Graham Holdings' Kaplan division, this could manifest through proprietary educational content or exclusive licensing agreements with major testing organizations, making it difficult for Kaplan to find comparable alternatives. This uniqueness allows suppliers to dictate terms, potentially increasing costs for Kaplan.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Graham Holdings' business lines significantly amplifies their bargaining power. If a key supplier, for instance, a major educational content creator for Kaplan, were to establish its own direct-to-consumer services, it would effectively bypass Kaplan. This move would grant the supplier greater leverage in negotiations with Graham Holdings, as they would control a crucial part of the value chain and could capture more of the profit margin.

This forward integration threat is particularly potent in industries where suppliers possess unique capabilities or strong brand recognition. For example, if a leading technology provider powering Graham Holdings' digital platforms decided to offer similar platforms directly to students or businesses, their negotiating position would be considerably strengthened. Such a scenario would force Graham Holdings to either concede to the supplier's terms or invest heavily in developing an alternative solution, potentially disrupting operations and increasing costs.

- Supplier Forward Integration: Suppliers may enter Graham Holdings' markets directly, increasing their leverage.

- Example: A content provider for Kaplan could offer direct-to-consumer education, bypassing Kaplan.

- Impact: This increases the supplier's bargaining power and reduces Graham Holdings' options.

Importance of the Supplier to Graham Holdings' Business

The bargaining power of suppliers for Graham Holdings is influenced by how essential their products or services are to Graham Holdings' core business operations. If a supplier provides a unique or critical component that Graham Holdings cannot easily substitute, that supplier will have more leverage.

For instance, if Graham Holdings' media segment relies heavily on a specific content licensing agreement from a single provider, that provider's bargaining power increases significantly. Conversely, suppliers offering widely available, standardized goods or services, such as office supplies or general IT support, typically have less power due to the ease of switching.

- Criticality of Inputs: Suppliers of specialized content or proprietary technology for Graham Holdings' media and education businesses likely hold higher bargaining power.

- Availability of Substitutes: For more commoditized needs, like basic printing services or standard office equipment, Graham Holdings can readily find alternative suppliers, thus limiting supplier power.

- Supplier Concentration: If a particular input is sourced from only a few dominant suppliers, their collective bargaining power is amplified.

Suppliers to Graham Holdings, particularly those providing specialized content or proprietary technology for its Kaplan education division and media operations, wield significant bargaining power. This is amplified when switching costs are high, such as with integrated broadcast technology, or when suppliers can easily integrate forward into Graham Holdings' business lines, like Kaplan offering direct-to-consumer educational services.

The criticality of unique inputs, like exclusive licensing agreements for media content, further strengthens supplier leverage. Conversely, suppliers of commoditized goods or services face diminished power due to Graham Holdings' ability to easily find alternatives.

In 2024, the educational content market saw continued consolidation, with major publishers like Pearson and McGraw Hill reporting strong revenue growth, potentially increasing their pricing power with institutions like Kaplan. Similarly, the media sector faced ongoing reliance on key content creators and distribution platforms, where exclusive rights can command premium pricing.

| Factor | Graham Holdings Impact | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | High for specialized inputs, low for commoditized ones. | Consolidation in educational publishing. |

| Switching Costs | High for technology and proprietary content. | Investment in integrated broadcast tech creates lock-in. |

| Forward Integration Threat | Significant for content providers and tech platforms. | Rise of direct-to-consumer educational platforms. |

| Input Criticality | High for unique licenses and specialized content. | Exclusive content rights are key negotiation points. |

What is included in the product

Analyzes the competitive intensity and profitability potential within Graham Holdings' diverse media and education sectors.

Instantly visualize competitive pressures with a dynamic, interactive dashboard, simplifying complex strategic analysis for Graham Holdings.

Customers Bargaining Power

Customer concentration significantly impacts bargaining power. For Graham Holdings, if its educational arm, Kaplan, serves a limited number of large institutional clients, those clients gain considerable leverage to negotiate pricing and terms. For instance, if a few major universities account for a substantial portion of Kaplan's enrollment, they could demand discounts.

Conversely, a broad and diverse customer base diminishes individual customer influence. Kaplan's individual student enrollments, spread across many learners, dilute the power of any single student to affect pricing or service conditions. This fragmentation generally leads to less customer bargaining power.

Low switching costs for customers significantly boost their bargaining power, allowing them to readily shift to competitors. This ease of transition directly impacts a company's ability to retain customers and maintain pricing power.

In the television broadcasting sector, for instance, viewers face minimal barriers when switching from traditional TV to a plethora of streaming services. This shift, driven by convenience and content variety, directly erodes advertising revenue for broadcasters. In 2024, the global streaming market was projected to reach over $200 billion, highlighting the massive shift in consumer preference and the diminished leverage of traditional TV providers.

Similarly, in the healthcare industry, if patients can easily select alternative providers for essential services like home health or hospice care, their collective bargaining power escalates. This increased power can lead to demands for better service, lower costs, or greater flexibility, forcing providers to compete more intensely on these factors.

Buyer information availability significantly impacts Graham Holdings' bargaining power by allowing customers to easily compare pricing and quality across various educational offerings. For instance, the proliferation of online learning platforms in 2024, with readily accessible course catalogs and student reviews, empowers prospective students to scrutinize Kaplan's value proposition against competitors.

This increased transparency directly pressures Kaplan to maintain competitive pricing and demonstrate superior educational outcomes. In 2023, the global online education market was valued at over $300 billion, a figure projected to grow substantially, indicating a market where informed consumer choice is paramount.

Price Sensitivity of Customers

Customers highly sensitive to price will naturally push Graham Holdings to reduce its prices. This is especially true in areas like education, where students often look for the most budget-friendly choices, or in manufacturing, where businesses prioritize cost-effectiveness. For instance, in 2024, the average tuition cost for a bachelor's degree in the US continued to be a significant factor for many students, highlighting the need for value-driven offerings.

Graham Holdings' success in these price-sensitive markets hinges on its capacity to make its products and services stand out. This differentiation can come from superior quality, unique features, or exceptional customer service. If customers perceive high value beyond just the price tag, their sensitivity to price decreases, lessening the pressure on Graham Holdings to compete solely on cost.

- Price Sensitivity in Education: In 2024, the rising cost of higher education made price a key consideration for students, with many seeking scholarships or more affordable alternatives.

- Manufacturing Cost Efficiency: Business clients in manufacturing sectors frequently evaluate suppliers based on cost per unit and overall operational efficiency.

- Differentiation Strategy: Graham Holdings' ability to highlight unique selling propositions, such as specialized curriculum or advanced manufacturing technology, can mitigate customer price pressure.

- Value Perception: A strong brand reputation and perceived quality can allow Graham Holdings to command premium pricing, even in competitive markets.

Threat of Backward Integration by Customers

The threat of backward integration by customers significantly amplifies their bargaining power. If customers possess the capability to produce the goods or services they currently purchase, they can exert greater pressure on suppliers to offer more favorable terms.

For example, a substantial business that is a regular client of Graham Holdings' educational division, such as Kaplan, might explore establishing its own internal training and development programs. This move would directly diminish their dependence on Kaplan, giving them leverage to negotiate lower prices or demand enhanced service levels.

Consider the scenario where a large enterprise accounts for a notable percentage of Kaplan's revenue. If this enterprise were to invest in developing its own proprietary online learning platforms and content, it could potentially bypass Kaplan altogether. This potential shift underscores the power customers wield when they can bring production in-house.

- Customer Leverage: The ability of customers to produce goods or services internally increases their bargaining power against suppliers.

- In-house Development: A large client of Kaplan, for instance, might develop its own training programs to reduce reliance on external providers.

- Reduced Dependence: Backward integration by customers directly translates to a diminished need for the supplier's offerings.

When customers have many choices and can easily switch, their bargaining power increases. This is evident in the media landscape, where consumers can readily move between numerous streaming services, impacting traditional broadcasters. In 2024, the global streaming market's continued expansion underscores this shift.

Graham Holdings must consider how easily its customers can find alternatives. For Kaplan, if alternative online education providers offer similar quality at lower prices, students will switch, forcing Kaplan to be more competitive. The vastness of the online education market in 2023, valued at over $300 billion, highlights this competitive pressure.

The ability of customers to produce what they buy themselves also strengthens their hand. If a large business could create its own training programs instead of using Kaplan, it would have more leverage to negotiate terms.

| Factor | Impact on Graham Holdings' Customer Bargaining Power | 2024/2023 Data/Trend |

|---|---|---|

| Customer Concentration | High concentration (few large clients) increases power. | Kaplan's institutional clients could negotiate discounts. |

| Switching Costs | Low switching costs empower customers. | Streaming services offer low switching costs for viewers, impacting TV advertising. |

| Information Availability | Easy access to information empowers informed choices. | Online platforms with reviews pressure Kaplan on pricing and outcomes. Online education market exceeded $300 billion in 2023. |

| Price Sensitivity | High sensitivity forces price reductions. | Students prioritize affordability in higher education. |

| Backward Integration Threat | Customers producing in-house gain leverage. | Large clients could develop own training, reducing Kaplan's revenue. |

Preview Before You Purchase

Graham Holdings Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive Porter's Five Forces analysis delves into the competitive landscape of Graham Holdings, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its diverse business segments. Understand the strategic implications of these forces for Graham Holdings' current and future performance.

Rivalry Among Competitors

Graham Holdings navigates a complex competitive arena, with the number and size of rivals varying significantly across its business segments. In educational services, Kaplan contends with a vast array of competitors, from established universities to agile online learning providers and numerous specialized test preparation firms. This broad spectrum means Kaplan must constantly innovate to stand out.

The television broadcasting arm of Graham Holdings faces a dynamic competitive landscape. Local stations compete fiercely for viewership and advertising revenue, while national networks and the ever-growing presence of streaming services like Netflix and Disney+ present substantial challenges. This multi-faceted competition directly impacts market share and profitability.

The growth rate of the industries Graham Holdings operates in significantly shapes competitive rivalry. For instance, Graham Holdings' significant presence in home health and hospice care, a sector experiencing robust expansion, naturally draws new competitors and incentivizes existing ones to scale up. This dynamic intensifies the battle for market share and talent within this high-growth segment.

Conversely, in more mature segments like traditional television broadcasting, where growth is slower, competition often becomes a zero-sum game. Existing players fiercely defend their established positions, leading to aggressive pricing strategies and increased marketing spend to capture even small gains in audience or advertising revenue.

The degree to which Graham Holdings' offerings are distinct directly influences the intensity of competition. For instance, Kaplan's established brand, niche educational pathways, and advanced digital learning platforms contribute to its differentiation, potentially softening direct rivalry.

In manufacturing sectors where Graham Holdings operates, unique product attributes or proprietary production methods can limit head-to-head price wars. This allows for competition based on factors beyond just cost.

However, when products or services are perceived as similar or interchangeable, competition often escalates to a price-driven battleground. This was evident in certain segments of the media and automotive sectors historically, where differentiation was less pronounced.

Exit Barriers

High exit barriers within Graham Holdings' operating sectors, particularly in media and education, can trap less profitable competitors. This situation prolongs intense rivalry as these firms are compelled to remain operational, even at reduced margins. For instance, the substantial, sunk costs associated with broadcasting licenses and physical educational facilities create significant financial disincentives for exiting the market. This often leads to prolonged price competition and industry overcapacity, directly impacting overall profitability for all players.

These elevated exit barriers contribute to a more aggressive competitive landscape. Companies might engage in sustained price wars or maintain higher production levels than market demand warrants simply because the cost of shutting down operations is too prohibitive. In 2024, the media sector, a core area for Graham Holdings, continued to grapple with the digital transition, where legacy infrastructure investments remain substantial. This makes it difficult for companies to pivot or exit without incurring significant losses, thereby intensifying the competitive pressure on established players like Graham Holdings.

- High capital investment in broadcasting infrastructure and educational facilities acts as a significant barrier to exit for Graham Holdings' competitors.

- Prolonged price wars and overcapacity are common consequences when unprofitable firms are unable to exit due to these barriers.

- Sustained pressure on profitability results from competitors remaining in the market, even when operating at a loss, due to high exit costs.

Diversity of Competitors

The competitive landscape for Graham Holdings is characterized by a wide array of rivals, each with distinct strategic approaches, operational origins, and overarching objectives. This heterogeneity intensifies the rivalry across its diverse business segments.

Graham Holdings operates in markets populated by both legacy media giants with deep roots and established market share, and newer, digitally-focused entities that leverage agility and innovation. For instance, in the media and education sectors, it contends with companies like Paramount Global, a traditional media conglomerate, alongside emerging online learning platforms that are rapidly gaining traction.

This blend of established and disruptive competitors means Graham Holdings must constantly monitor a broad spectrum of strategic maneuvers. The unpredictable nature of these diverse competitive actions necessitates continuous adaptation of its own strategies to preserve and advance its market standing. For example, while The Washington Post, a Graham Holdings asset, competes with other major newspapers like The New York Times and The Wall Street Journal, it also faces competition from digital-native news aggregators and social media platforms that capture audience attention and advertising revenue.

- Diverse Competitor Strategies: Competitors range from traditional media outlets focused on print and broadcast to digital-first platforms emphasizing content aggregation and social engagement.

- Varied Origins: Rivals include long-standing corporations with decades of operational history and newer entrants that have rapidly scaled through digital channels.

- Conflicting Goals: Some competitors prioritize legacy revenue streams and brand preservation, while others focus on rapid user acquisition and disruption of existing markets.

- Impact on Rivalry: This diversity creates a dynamic and often unpredictable competitive environment, forcing Graham Holdings to remain agile and responsive to a wide range of threats and opportunities.

The competitive rivalry for Graham Holdings is intense, driven by a mix of established players and agile disruptors across its varied business segments. In educational services, Kaplan faces competition from traditional universities and online learning platforms, while its media and broadcasting arms contend with legacy media giants and digital-native content providers. This dynamic landscape necessitates continuous innovation and strategic adaptation to maintain market share and profitability.

The intensity of competition is further amplified by high exit barriers in sectors like media, where substantial sunk costs in infrastructure make it difficult for firms to leave the market. This can lead to prolonged price wars and overcapacity, as seen in 2024 within the media sector's ongoing digital transition. For instance, in 2023, the U.S. advertising market saw significant shifts, with digital advertising spending projected to reach over $300 billion, a trend that puts pressure on traditional media revenue streams and intensifies competition for audience attention and ad dollars.

| Graham Holdings Segment | Key Competitors | Competitive Intensity Factors |

|---|---|---|

| Educational Services (Kaplan) | Universities, Online Learning Platforms (Coursera, edX), Test Prep Firms (Princeton Review) | Broad spectrum of rivals, need for digital innovation, brand differentiation |

| Television Broadcasting | National Networks (NBCUniversal, Disney), Streaming Services (Netflix, Max), Local Stations | Declining linear TV viewership, rise of streaming, competition for ad revenue |

| Home Health & Hospice Care | Large healthcare systems, smaller regional providers, private equity-backed firms | Industry growth attracting new entrants, competition for skilled labor, regulatory environment |

SSubstitutes Threaten

The availability of close substitutes for Graham Holdings' offerings, particularly in education and media, represents a significant threat. For Kaplan, a key subsidiary, this means free online courses, open educational resources, and even informal skill-building platforms can draw potential students away from more structured, paid programs. For instance, the massive growth in free content on platforms like Coursera and edX, often supported by universities, directly competes with Kaplan's certification and degree preparation courses.

In the television broadcasting segment, Graham Holdings faces intense competition from substitutes that cater to changing consumer viewing habits. Streaming services such as Netflix, Disney+, and Amazon Prime Video, which offer on-demand content and flexible viewing schedules, have significantly eroded the market share of traditional linear television. By mid-2024, it's estimated that over 80% of U.S. households subscribe to at least one streaming service, highlighting the pervasive nature of these substitutes.

The threat of substitutes for Graham Holdings is amplified when these alternatives present a more attractive price-performance ratio. For instance, if online learning platforms offer comparable or better educational outcomes at a significantly lower cost than Kaplan’s traditional programs, Kaplan’s market position weakens. In 2024, the online education market continued its robust growth, with many platforms offering specialized certifications that can be completed in months rather than years, directly challenging the value proposition of longer, more expensive degree programs.

Similarly, within Graham Holdings’ media segment, the increasing availability of free or low-cost digital content directly competes with traditional media offerings. Ad-supported streaming services, for example, provide vast libraries of entertainment for a fraction of the cost of cable subscriptions. By mid-2024, major streaming services reported significant subscriber growth, indicating a clear consumer preference for flexible, cost-effective content delivery, thereby increasing the threat of substitution for legacy media businesses.

Customer willingness to switch to alternatives significantly impacts the threat of substitutes. This propensity is often shaped by shifting consumer tastes, technological leaps, or economic fluctuations. For instance, in the healthcare sector, patients are increasingly choosing telehealth and at-home monitoring over traditional hospital stays, thereby raising the substitution threat for certain Graham Holdings healthcare ventures.

Switching Costs for Customers to Substitutes

The threat of substitutes for Graham Holdings is significantly influenced by how easily and cheaply customers can switch to alternatives. When switching costs are low, customers are more likely to explore and adopt substitute offerings, thereby increasing the competitive pressure on Graham Holdings.

For instance, in the education sector, if a student finds it simple and affordable to transition from a traditional Kaplan test preparation course to an online platform, this raises the threat of substitution. Similarly, the broadcasting industry faces a potent threat from substitutes as consumers can readily cancel cable subscriptions and opt for streaming services, demonstrating low switching costs.

In 2024, the media and education industries are seeing a continued trend of declining traditional media consumption and a surge in digital learning platforms. For example, the global online education market was projected to reach over $400 billion by 2026, indicating a substantial and growing availability of substitutes for traditional educational offerings.

- Low switching costs empower customers to explore alternatives, increasing the threat of substitutes.

- The ease of moving from traditional cable to streaming services exemplifies this threat in broadcasting.

- In education, simple and inexpensive transitions to online platforms amplify the threat for traditional providers like Kaplan.

- Industry data suggests a growing digital shift, making substitutes more attractive and accessible to consumers.

Impact of Technological Advancements on Substitutes

Rapid technological advancements frequently introduce novel and compelling substitutes, directly impacting Graham Holdings' market position. For instance, the escalating capabilities of AI-driven educational platforms present a significant and growing threat to conventional learning institutions, potentially diverting students and resources.

Furthermore, ongoing innovations in digital media and increasingly sophisticated personalized content delivery mechanisms are enhancing the appeal of substitutes for Graham Holdings' core broadcasting and media operations. This trend is evident as streaming services continue to capture market share from traditional television. In 2024, the global streaming market was valued at over $80 billion, with projections indicating continued robust growth, underscoring the competitive pressure from these substitutes.

- Technological Disruption: New technologies consistently create more attractive alternatives to existing products and services.

- AI in Education: AI-powered learning platforms are rapidly evolving, posing a direct challenge to traditional educational models.

- Digital Media Evolution: Innovations in digital media and personalized content delivery are making substitutes more appealing to consumers.

- Market Shift: The growing popularity of streaming services over traditional broadcasting highlights the impact of substitutes on Graham Holdings' media segments.

The threat of substitutes for Graham Holdings is substantial, particularly in education and media, as readily available and often lower-cost alternatives emerge. For instance, the proliferation of free online courses and open educational resources directly challenges Kaplan's paid programs. By mid-2024, the global online education market was projected to exceed $400 billion, underscoring the vast landscape of substitutes.

In broadcasting, streaming services like Netflix and Disney+ have become powerful substitutes for traditional television, offering on-demand viewing and flexible subscriptions. This shift is significant, with over 80% of U.S. households subscribing to at least one streaming service by mid-2024. These substitutes often present a superior price-performance ratio, as seen with ad-supported streaming options offering extensive content at a fraction of cable costs.

| Segment | Key Substitutes | Impact on Graham Holdings | 2024 Market Trend/Data |

|---|---|---|---|

| Education (Kaplan) | Free online courses (Coursera, edX), informal skill platforms | Diverts potential students from paid programs | Online education market projected >$400B by 2026 |

| Media (Broadcasting) | Streaming services (Netflix, Disney+), digital content | Erodes linear TV market share, reduces ad revenue | >80% of U.S. households subscribe to streaming (mid-2024) |

Entrants Threaten

High capital requirements significantly deter new entrants in many of Graham Holdings' core sectors. For instance, launching a national television broadcasting network demands hundreds of millions, if not billions, of dollars for infrastructure, content creation, and marketing. Similarly, establishing and scaling an educational institution like Kaplan involves substantial upfront investment in curriculum development, technology, and physical or online learning platforms.

In 2024, the average cost to launch a new broadcast television station in a major US market could easily exceed $50 million, factoring in FCC licensing, equipment, and initial operating expenses. This immense financial hurdle makes it exceptionally challenging for smaller, less capitalized entities to compete with established players like Graham Holdings' WDCW, thereby reinforcing existing market structures.

Graham Holdings benefits from significant economies of scale across its diverse portfolio, acting as a formidable barrier to new entrants. For instance, Kaplan, a key subsidiary, leverages its extensive infrastructure for course development, marketing, and student support, creating a cost advantage that smaller, emerging education providers find difficult to match. This established operational efficiency means new players would face substantially higher per-student costs.

For Graham Holdings, difficulty in accessing established distribution channels presents a significant threat. In the media sector, securing favorable carriage agreements with major cable and satellite providers is crucial for television broadcasting, and new entrants often face uphill battles to gain widespread reach. This was evident in 2024, where established networks continued to dominate subscriber numbers, making it harder for emerging platforms to secure prime placement.

Government Policy and Regulation

Government policy and regulation significantly impact the threat of new entrants for Graham Holdings. Stringent regulations, such as those in the healthcare sector, require extensive licensing, certifications, and adherence to numerous standards. For instance, the home health and hospice care industry, a segment Graham Holdings operates within, faces considerable regulatory oversight, which can deter new players by increasing upfront costs and operational complexity.

Broadcasting also presents a notable regulatory barrier. Obtaining and maintaining broadcasting licenses involves navigating complex legal frameworks and often requires significant capital investment and lobbying efforts. In 2024, the Federal Communications Commission (FCC) continued to refine rules around media ownership and spectrum allocation, directly influencing the ease with which new entities can enter the broadcasting market.

- Regulatory Hurdles: High compliance costs and licensing requirements in sectors like healthcare and broadcasting act as substantial barriers to entry.

- Policy Impact: Evolving government policies, such as FCC regulations on media ownership, can either facilitate or restrict new competition.

- Capital Intensity: The need for significant upfront investment to meet regulatory standards makes entry more challenging for smaller, less capitalized firms.

Brand Loyalty and Differentiation

Graham Holdings benefits from substantial brand loyalty and product differentiation, making it challenging for new competitors to enter its markets. Kaplan, for instance, has cultivated a strong reputation in the education sector over many years, fostering trust among students.

Graham Media Group's television stations also command established viewership, a significant asset that new media companies would struggle to replicate quickly.

To effectively challenge Graham Holdings, new entrants would need to invest heavily in marketing and develop truly unique value propositions that resonate with consumers and distinguish them from the existing, well-regarded offerings.

- Brand Loyalty: Kaplan's established presence in test preparation and lifelong learning has built a loyal customer base.

- Media Reach: Graham Media Group's local television stations in key markets like Detroit and Washington D.C. have consistent audience engagement.

- Differentiation: The integrated approach of Kaplan, offering a range of educational services from test prep to professional development, differentiates it from standalone competitors.

- Barriers to Entry: Significant capital investment in media infrastructure and brand building is required for new entrants to compete effectively.

The threat of new entrants for Graham Holdings is generally moderate, primarily due to high capital requirements and established brand loyalty across its key sectors. For instance, the media and education industries demand substantial upfront investment in infrastructure, content, and marketing, creating significant barriers. In 2024, the average cost to launch a new broadcast television station in a major US market could easily exceed $50 million, a figure that deters many smaller players.

Graham Holdings benefits from strong brand recognition and established distribution channels, particularly through its media properties like Graham Media Group's local television stations. Kaplan, its education arm, also enjoys considerable brand loyalty, making it difficult for new competitors to gain traction. New entrants would need to invest heavily in marketing and product differentiation to effectively challenge Graham Holdings' market position.

| Barrier Type | Graham Holdings Sector | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | Broadcasting, Education | High | Broadcast station launch: $50M+ |

| Brand Loyalty/Differentiation | Education, Media | High | Kaplan's established reputation, Graham Media Group's viewership |

| Economies of Scale | Education | High | Lower per-student costs for Kaplan |

| Distribution Channels | Media | Moderate | Difficulty for new media to secure favorable carriage agreements |

| Government Policy/Regulation | Healthcare, Broadcasting | Moderate | FCC rules, healthcare licensing requirements |

Porter's Five Forces Analysis Data Sources

Our Graham Holdings Porter's Five Forces analysis is built upon a robust foundation of data, incorporating insights from their annual reports, SEC filings, and investor relations materials. We also leverage industry-specific market research reports and reputable financial news outlets to capture current competitive dynamics.