Graham Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Graham Holdings Bundle

Unlock the full strategic blueprint behind Graham Holdings's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Graham Holdings, primarily through its Kaplan subsidiary, actively engages in strategic partnerships with educational institutions and universities. These collaborations are fundamental to expanding Kaplan's educational offerings, which include online courses, specialized test preparation, and pathways to earning degrees.

These alliances allow Kaplan to reach a wider student demographic and diversify its service portfolio. A notable example of such a partnership was the sale of Kaplan University to Purdue University in 2017, which was then rebranded as Purdue Global. This move underscored a commitment to serving adult learners and expanding access to higher education.

Graham Healthcare Group actively forms joint ventures with established healthcare systems and physician groups. This strategic approach allows them to extend their home health, hospice, and palliative care services into new markets. These collaborations are vital for achieving coordinated patient care and utilizing existing healthcare infrastructure efficiently.

Graham Holdings' automotive segment relies heavily on its partnerships with major automotive manufacturers. These alliances are crucial for securing a consistent supply of new vehicles, gaining access to the latest models, and maintaining brand integrity through adherence to manufacturer standards. For instance, in 2024, the automotive industry saw continued demand for SUVs and electric vehicles, making strong manufacturer relationships vital for dealerships to meet customer needs.

Technology and Digital Platform Providers

Graham Holdings leverages partnerships with technology and digital platform providers to amplify its media and digital services. These collaborations are crucial for effective content distribution across various channels and for implementing sophisticated online advertising and marketing strategies. In 2024, the digital advertising market continued its robust growth, with global spending projected to reach over $800 billion, underscoring the importance of these technology alliances for reaching wider audiences.

These strategic alliances often involve the integration of social media management tools and advanced digital advertising services. For instance, partnerships with leading social media platforms and ad tech companies allow Graham Holdings to optimize its online presence, engage with target demographics more effectively, and drive measurable results. By utilizing these platforms, they can enhance brand visibility and customer interaction, a critical component in today's competitive digital landscape.

- Content Distribution: Partnerships with Content Delivery Networks (CDNs) and streaming platforms ensure efficient and widespread access to Graham Holdings' media content.

- Advertising Solutions: Collaborations with programmatic advertising platforms and data analytics firms enable targeted ad placements and performance tracking.

- Online Marketing: Alliances with social media management tools and search engine optimization (SEO) service providers enhance digital reach and customer engagement.

- Platform Integration: Working with technology providers to integrate various digital tools streamlines operations and improves user experience across their digital properties.

Manufacturing Suppliers and Distributors

Graham Holdings' manufacturing segments, including Hoover Treated Wood Products, Dekko, and Forney, depend on robust relationships with manufacturing suppliers. These partnerships ensure a steady flow of essential raw materials, which is critical for maintaining production schedules and controlling costs. For instance, securing favorable terms with lumber suppliers directly impacts Hoover's profitability in the treated wood market.

Distribution partners are equally crucial for Graham Holdings, enabling their manufactured products to reach a wide customer base. These alliances facilitate market penetration and sales volume for companies like Dekko, which manufactures consumer products. In 2024, effective distribution networks were a key differentiator in achieving sales targets across various product lines.

- Supplier Reliability: Consistent access to raw materials from trusted suppliers underpins efficient manufacturing operations, directly influencing production output and quality for Graham Holdings' diverse manufacturing units.

- Distribution Reach: Strategic partnerships with distributors are essential for expanding market presence and driving sales for Graham Holdings' manufactured goods, ensuring products reach target consumers effectively.

- Supply Chain Efficiency: These key partnerships contribute significantly to the overall efficiency and stability of Graham Holdings' supply chains, mitigating risks and optimizing logistics for their manufacturing businesses.

- Market Access: Collaborations with distributors provide Graham Holdings with vital access to various market channels, enhancing the visibility and sales potential of products from entities like Dekko and Forney.

Graham Holdings' media and advertising segments rely on strategic alliances with technology providers and digital platforms to enhance content distribution and advertising effectiveness. These collaborations are crucial for reaching wider audiences and optimizing online marketing efforts, especially as global digital advertising spending approached $800 billion in 2024.

Key partnerships with educational institutions and healthcare systems, particularly through Kaplan and Graham Healthcare Group, are vital for expanding service offerings and market reach. These collaborations allow for the development of new educational pathways and the efficient delivery of home health and palliative care services.

The automotive segment's success is intrinsically linked to its partnerships with major car manufacturers, ensuring access to new inventory and adherence to brand standards, a critical factor in meeting consumer demand for vehicles like SUVs and EVs in 2024.

Furthermore, strong relationships with manufacturing suppliers and distribution partners are essential for Graham Holdings' industrial businesses, ensuring raw material availability and effective market penetration for products like those from Dekko and Forney.

What is included in the product

This Business Model Canvas provides a comprehensive overview of Graham Holdings' diverse portfolio, detailing its customer segments across media, education, and manufacturing, along with its value propositions and key resources.

It outlines Graham Holdings' multi-faceted revenue streams, cost structure, and strategic partnerships, offering insights into its operational efficiency and market positioning.

Graham Holdings' Business Model Canvas offers a structured approach to dissecting its diverse media and education portfolio, simplifying complex interdependencies for clearer strategic understanding.

This canvas acts as a pain point reliever by providing a single, visual representation of Graham Holdings' value proposition, customer segments, and revenue streams, streamlining analysis and decision-making.

Activities

Graham Holdings' key activity of providing educational services is primarily executed through Kaplan. This involves offering a wide array of programs, from crucial test preparation for standardized exams to comprehensive professional development courses and full higher education degrees.

The delivery of these services is a complex undertaking, encompassing the meticulous development of up-to-date curricula, the robust management of sophisticated online learning platforms, and the provision of direct instruction to a diverse, global student population.

In 2024, Kaplan reported significant engagement, with millions of students utilizing its services for test prep and professional certifications. The company continues to invest in digital learning technologies to enhance accessibility and effectiveness for its learners worldwide.

Graham Media Group's key activities in television broadcasting and media production involve operating its owned and operated local television stations. This includes the crucial task of producing and broadcasting a wide array of content, from essential local news to engaging entertainment programming.

These activities encompass the entire broadcast lifecycle, from managing day-to-day broadcast operations and the intricate process of content creation to the vital function of advertising sales. A significant focus is placed on cultivating and maintaining a robust and influential local media presence in each of its markets.

In 2024, Graham Media Group continued to invest in its local news operations, recognizing their importance to community engagement and revenue. For instance, their stations consistently rank among the top local news providers in their respective markets, a testament to the quality of their production and broadcasting efforts.

Graham Holdings' manufacturing and industrial operations are central to its business model. These activities encompass the creation of diverse products, including treated wood, specialized industrial components, and aluminum cladding. The company's focus here is on efficient production and delivering high-quality goods to its customer base.

Key activities within this segment are multifaceted, involving meticulous product design to meet specific client needs. This is followed by the actual production process, where raw materials are transformed into finished goods. Rigorous quality control measures are implemented at every stage to ensure product integrity and performance. Finally, the company manages the distribution of these manufactured items to a wide array of industrial and commercial clients, ensuring timely delivery and customer satisfaction.

In 2024, the industrial sector saw varied performance. For instance, the lumber and wood products sector, relevant to Graham Holdings' treated wood operations, experienced fluctuating demand influenced by construction activity and housing starts. Similarly, the aluminum market, pertinent to their cladding products, was affected by global supply chain dynamics and energy costs, impacting production expenses and pricing strategies for manufacturers like Graham Holdings.

Healthcare Service Delivery

Graham Healthcare Group's key activity in service delivery centers on providing comprehensive home health, hospice, and palliative care. This involves intricate patient care coordination, direct clinical services, and the effective management of a skilled healthcare workforce. The focus is squarely on delivering high-quality, in-home medical and supportive care tailored to individual patient needs.

These services are crucial for patient well-being and operational success. For instance, in 2024, the demand for home healthcare services continued to surge, driven by an aging population and a preference for care outside traditional hospital settings. Graham Healthcare Group's ability to efficiently manage these diverse care pathways directly impacts patient satisfaction and clinical outcomes.

- Patient Care Coordination: Seamlessly managing patient transitions and care plans across different service lines.

- Clinical Service Provision: Delivering essential medical treatments, therapies, and supportive care in the home environment.

- Healthcare Professional Management: Recruiting, training, and deploying qualified nurses, aides, and other medical staff.

- Quality Assurance: Implementing rigorous standards to ensure the highest quality of care and patient safety.

Automotive Dealership Operations

Automotive dealership operations are central to Graham Holdings' strategy, encompassing the core functions of selling new and used vehicles. This involves meticulous inventory management, optimizing sales team performance, and ensuring a smooth customer purchasing experience. In 2024, the automotive retail sector continued to navigate supply chain challenges, with new vehicle sales in the U.S. reaching approximately 15.5 million units, demonstrating resilience and ongoing demand.

Beyond sales, these operations heavily rely on providing comprehensive after-sales services, including maintenance and repair. This segment is crucial for building customer loyalty and generating recurring revenue. The service and parts departments are often a significant profit driver for dealerships, with customer satisfaction in these areas directly impacting brand perception and repeat business.

Furthermore, facilitating customer financing and insurance is a key activity. Dealerships act as intermediaries, connecting buyers with lenders and insurance providers, which adds another layer of revenue and service. This financial arm of the operation is vital for making vehicle purchases accessible and profitable.

- Vehicle Sales: Managing inventory, pricing, and the entire sales cycle for new and pre-owned vehicles.

- After-Sales Service: Providing maintenance, repairs, and parts to existing customers, fostering long-term relationships.

- Customer Financing: Offering and arranging financing and insurance options to facilitate vehicle purchases.

- Inventory Management: Optimizing stock levels to meet demand while minimizing carrying costs.

Graham Holdings' key activities in automotive dealerships involve the core functions of selling new and used vehicles, managing inventory, and providing after-sales services like maintenance and repair. Facilitating customer financing and insurance is also a crucial revenue-generating activity.

In 2024, the automotive retail sector saw continued demand, with new vehicle sales in the U.S. approximating 15.5 million units, despite ongoing supply chain considerations.

The service and parts departments are vital profit centers, directly impacting customer loyalty and brand perception through satisfaction with maintenance and repair work.

| Key Activity | Description | 2024 Relevance/Data |

|---|---|---|

| Vehicle Sales | Selling new and used cars, trucks, and SUVs. | U.S. new vehicle sales ~15.5 million units. |

| After-Sales Service | Maintenance, repairs, parts sales, and customer support. | Significant profit driver, builds customer loyalty. |

| Customer Financing & Insurance | Arranging loans and insurance for buyers. | Facilitates purchases and adds revenue streams. |

| Inventory Management | Optimizing stock levels of vehicles for sale. | Crucial for meeting demand and managing costs. |

Preview Before You Purchase

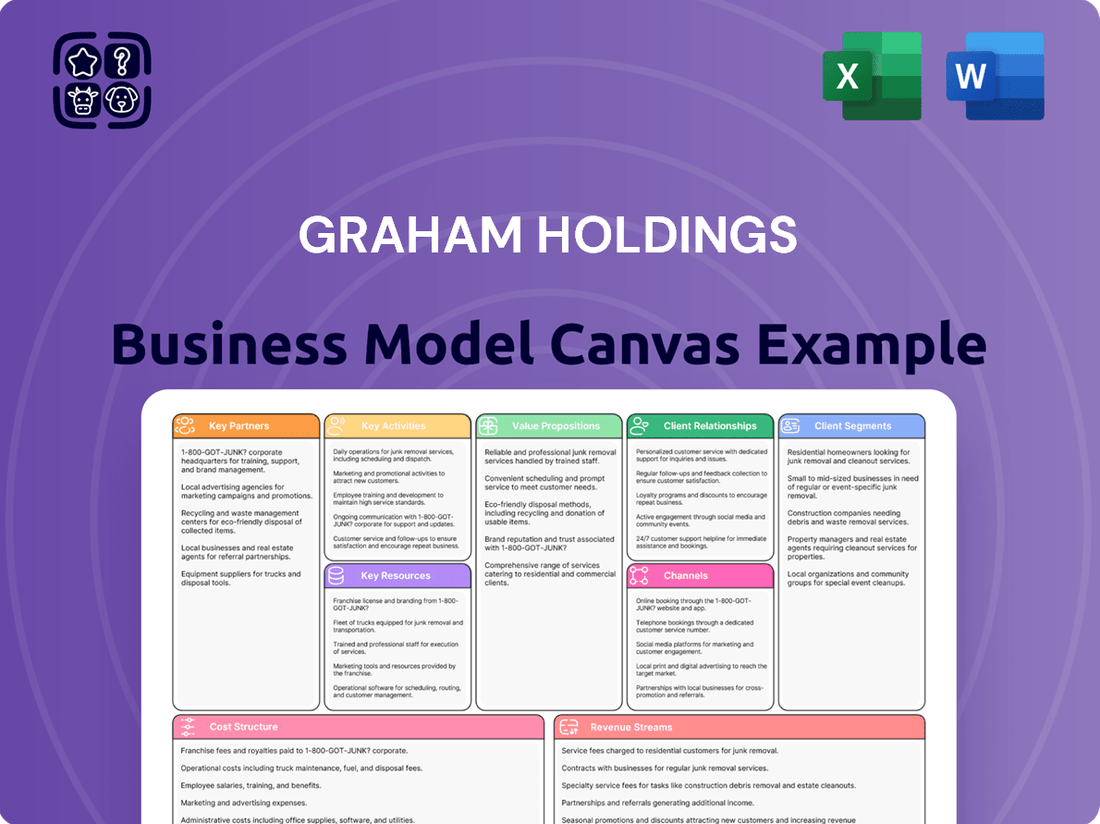

Business Model Canvas

This preview offers an authentic glimpse into the Graham Holdings Business Model Canvas, showcasing the exact structure and content you will receive upon purchase. You are not viewing a sample or a mockup; this is a direct representation of the final, comprehensive document. Once your order is complete, you will gain full access to this identical, ready-to-use Business Model Canvas, ensuring no surprises and immediate usability.

Resources

Graham Holdings leverages substantial intellectual property, notably through its Kaplan subsidiary, a leader in test preparation and higher education. This IP includes a vast library of proprietary educational content and digital learning platforms, forming a core asset. In 2024, Kaplan continued to adapt its offerings to evolving educational technologies, reinforcing its market position.

Beyond education, Graham Holdings' media segment, including its ownership stakes in media companies like Washington Post, contributes significant brand equity. These established media brands command strong recognition and trust, which are invaluable for attracting audiences and advertisers. This brand strength is a key intangible asset, translating into sustained revenue streams and market influence.

Graham Holdings' diverse operations rely heavily on a skilled workforce. For instance, Kaplan, their education arm, employs thousands of educators and support staff, crucial for delivering quality learning experiences. In 2024, Kaplan continued to adapt its online and in-person programs, emphasizing the need for up-to-date pedagogical expertise.

Management expertise is equally vital across Graham Holdings' portfolio. The leadership teams at Washington Post, Automotive, and Healthcare segments bring industry-specific knowledge to navigate complex markets. This seasoned management guides strategic decisions, ensuring operational excellence and adaptability in rapidly changing environments.

Graham Holdings leverages its physical assets, including broadcasting stations, campuses, manufacturing facilities, and dealerships, as core components of its business model. These tangible assets are crucial for delivering services and producing goods across its diverse portfolio.

For instance, Kaplan's network of physical campuses, alongside its robust online platforms, represents a significant investment in accessible education. This dual approach allows Kaplan to cater to a wide range of student needs and preferences, directly supporting its revenue generation through tuition and program fees.

The company's broadcasting division relies on its physical station infrastructure to produce and distribute content, a fundamental aspect of its media operations. Similarly, manufacturing facilities and automotive dealerships are essential for the tangible output and sales processes of relevant subsidiaries, underpinning their market presence and profitability.

Financial Capital and Diversified Investment Portfolio

Graham Holdings leverages its substantial financial capital, including significant cash reserves and a broadly diversified investment portfolio, as a cornerstone of its business model. This financial strength acts as a powerful enabler for both strategic acquisitions and the funding of organic growth across its diverse business segments. As of the first quarter of 2024, the company reported cash and cash equivalents of approximately $1.2 billion, underscoring its robust liquidity position.

This formidable balance sheet directly supports the operational needs and expansion plans of Graham Holdings' various ventures, from media and education to healthcare. The company's ability to generate consistent cash flow from its established businesses further bolsters its financial capacity, allowing for continued investment and prudent capital allocation. In 2023, Graham Holdings generated over $1.7 billion in revenue, demonstrating the underlying strength of its operating entities.

- Financial Capital: Approximately $1.2 billion in cash and cash equivalents as of Q1 2024.

- Revenue Generation: Over $1.7 billion in revenue reported for the fiscal year 2023.

- Strategic Flexibility: Enables both opportunistic acquisitions and sustained organic growth initiatives.

- Shareholder Returns: Supports consistent dividend payouts and potential share buybacks, enhancing shareholder value.

Customer Data and Digital Infrastructure

Graham Holdings leverages extensive customer data and a sophisticated digital infrastructure as critical resources, particularly for its education and digital marketing arms. This foundation enables highly effective targeted marketing campaigns and the delivery of personalized services, crucial for customer engagement and retention.

The company’s digital infrastructure supports efficient online operations across its diverse portfolio. For instance, in 2024, Kaplan, a key education segment, continued to invest in its digital learning platforms, aiming to enhance user experience and data analytics capabilities. This focus on digital assets is paramount for scaling operations and adapting to evolving market demands.

- Customer Data: Graham Holdings utilizes aggregated customer information to refine product offerings and marketing strategies, driving personalized engagement.

- Digital Infrastructure: Robust online platforms and data management systems are essential for operational efficiency and service delivery, especially within Kaplan's online education services.

- Targeted Marketing: The integration of customer data allows for precise audience segmentation, leading to more effective and cost-efficient marketing initiatives.

- Personalized Services: Digital capabilities enable the customization of educational content and marketing messages, fostering stronger customer relationships.

Graham Holdings' key resources include its intellectual property, particularly through Kaplan's educational content and platforms, alongside strong brand equity from media holdings like The Washington Post. These intangible assets are complemented by a skilled workforce and experienced management teams across its diverse segments. The company also possesses significant physical assets, including broadcasting stations and educational facilities, and maintains a robust financial position with substantial cash reserves, as evidenced by approximately $1.2 billion in cash and cash equivalents as of Q1 2024. Furthermore, extensive customer data and a sophisticated digital infrastructure are leveraged for personalized services and targeted marketing, with Kaplan continuing to enhance its digital learning platforms in 2024.

| Resource Category | Specific Examples | 2023/2024 Data/Context |

|---|---|---|

| Intellectual Property | Kaplan's educational content, digital learning platforms | Kaplan adapted offerings to evolving educational technologies in 2024. |

| Brand Equity | The Washington Post, other media brands | Strong recognition and trust attract audiences and advertisers. |

| Human Capital | Educators, support staff, management teams | Kaplan employed thousands of educators in 2024; experienced management guides strategy. |

| Physical Assets | Broadcasting stations, Kaplan campuses, manufacturing facilities | Essential for service delivery and production across segments. |

| Financial Capital | Cash and cash equivalents, investment portfolio | $1.2 billion in cash and equivalents (Q1 2024); over $1.7 billion revenue (2023). |

| Customer Data & Digital Infrastructure | Customer databases, online platforms | Kaplan invested in digital platforms in 2024 to enhance user experience and analytics. |

Value Propositions

Kaplan provides students and professionals with a broad spectrum of educational services. These include test preparation for exams like the SAT and GRE, professional certifications for fields such as finance and healthcare, and even higher education degrees.

The core value proposition is delivering accessible, high-quality learning experiences. These programs are designed to directly contribute to career advancement and academic success for individuals navigating competitive educational and professional landscapes.

In 2024, Kaplan continued to adapt its offerings, with digital learning solutions playing a significant role. For instance, its online test prep platforms saw continued high engagement, reflecting the demand for flexible, self-paced learning that aids in achieving measurable outcomes like improved test scores.

Graham Media Group's television stations are a vital source of reliable local news, offering timely and relevant content that keeps communities informed. This commitment to quality journalism and engaging programming serves the public interest, fostering a deeper connection between citizens and their local media.

In 2024, Graham Media Group continued to focus on delivering trusted information and entertainment. Their stations across the country provided essential local news coverage, including election updates and community-focused stories, reinforcing their role as a cornerstone of local discourse.

Graham Holdings' manufacturing segment delivers specialized products such as treated wood, industrial components, and aluminum cladding to industrial and commercial clients. This offers significant value by providing high-quality, dependable, and frequently custom-engineered solutions tailored to precise industry requirements.

Compassionate and Coordinated Healthcare Services

Graham Healthcare Group delivers essential home health, hospice, and palliative care, prioritizing a compassionate, patient-focused approach. This coordinated care model aims to enhance the quality of life for individuals in their own homes, offering comfort and dignity during challenging times. The core value lies in providing vital medical and supportive services that significantly reduce the strain on families by managing complex care needs effectively.

The group's commitment to integrated care ensures patients receive seamless transitions between different levels of support, from recovery after illness to end-of-life comfort. This holistic strategy addresses not just the physical ailments but also the emotional and practical needs of patients and their loved ones. For instance, in 2024, the demand for home healthcare services continued to surge, with projections indicating a market growth of over 7% annually, underscoring the increasing reliance on such compassionate, in-home solutions.

- Patient-Centered Care: Focus on individual needs and preferences in a familiar home environment.

- Coordinated Services: Seamless integration of home health, hospice, and palliative care for comprehensive support.

- Quality of Life Improvement: Providing medical and emotional support to enhance comfort and well-being.

- Family Burden Reduction: Alleviating stress on families through expert in-home care management.

Convenient and Trusted Automotive Sales and Service

Graham Holdings' automotive dealerships are designed to be a one-stop shop for car buyers and owners. They provide a wide selection of new and used vehicles, coupled with dependable service and maintenance options. This convenience is a core part of their offering.

The primary value proposition here is building trust and simplifying the entire process of owning a car. From the initial purchase to ongoing care, customers can rely on a consistent and reliable experience.

For instance, in 2024, the automotive retail sector saw continued demand for both new and used vehicles, with many consumers prioritizing dealerships that offer comprehensive service packages. Graham Holdings aims to meet this demand by ensuring their service centers are well-equipped and staffed by certified technicians.

- Convenience: A single point of contact for vehicle purchase, financing, and after-sales support.

- Trust: Emphasis on reliable service and transparent dealings to build customer loyalty.

- Selection: Offering a diverse range of automotive brands and models to cater to various customer needs.

- After-Sales Support: Providing essential maintenance and repair services to ensure vehicle longevity and customer satisfaction.

Graham Holdings' diverse portfolio offers distinct value propositions across its various business segments. Kaplan provides accessible, high-quality education and test preparation, directly aiding individuals in achieving academic and career advancement, as evidenced by continued high engagement in its online platforms in 2024. Graham Media Group delivers essential local news and programming, fostering community connection and informed citizenry, with its stations remaining a trusted source in 2024. The manufacturing segment offers specialized, dependable industrial products, while Graham Healthcare Group provides compassionate, patient-centered home health and hospice care, improving quality of life and reducing family burden, a sector experiencing significant growth in 2024. Finally, automotive dealerships offer convenience and trust through comprehensive vehicle sales and support services, meeting ongoing consumer demand for reliable automotive solutions in 2024.

| Business Segment | Key Value Proposition | 2024 Focus/Trend |

|---|---|---|

| Kaplan | Accessible, high-quality education and test preparation for career/academic advancement. | High engagement in digital learning solutions, flexible and self-paced options. |

| Graham Media Group | Reliable local news and engaging programming, fostering community connection. | Continued focus on trusted information, essential local news coverage, and community stories. |

| Manufacturing | Specialized, high-quality, and dependable industrial products, often custom-engineered. | Supplying critical components to industrial and commercial clients. |

| Graham Healthcare Group | Compassionate, patient-centered home health, hospice, and palliative care; improves quality of life and reduces family burden. | Surging demand for home healthcare services, with market growth projected over 7% annually. |

| Automotive Dealerships | Convenience, trust, and comprehensive support for vehicle purchase and ownership. | Meeting demand for new and used vehicles, emphasizing dealerships with strong service packages. |

Customer Relationships

Graham Holdings' education segment prioritizes personalized academic advising and tutoring to build strong customer relationships. This approach ensures students receive tailored support, fostering loyalty and aiding in their journey from enrollment through graduation and beyond. For instance, in 2024, Kaplan, a key part of Graham Holdings, reported a significant increase in student engagement metrics following the implementation of enhanced personalized support initiatives.

Graham Holdings cultivates deep community ties through its media properties by prioritizing local news and interactive engagement. This approach builds significant trust and loyalty, positioning its stations and publications as essential sources for local information and events.

For instance, in 2024, local news outlets like those owned by Graham Holdings often see higher engagement rates when covering community-specific issues, such as local government decisions or school board meetings. This direct relevance fosters a stronger connection with their audience.

Graham Holdings likely manages B2B relationships through dedicated account managers, especially in sectors like manufacturing and certain healthcare services where long-term contracts are common. These managers focus on deeply understanding client needs, offering customized solutions, and fostering ongoing satisfaction to secure repeat business and build loyalty.

Direct Patient and Family Care

In healthcare, customer relationships are deeply personal, forged through trust, empathy, and ongoing communication with patients and their families. This direct care model prioritizes delivering exceptional quality, tailoring services to individual needs, and offering crucial emotional support during vulnerable periods.

Graham Holdings, through its various healthcare ventures, emphasizes this intimate connection. For instance, in 2024, many healthcare providers reported that patient satisfaction scores directly correlate with the perceived quality of communication and emotional support received. A study found that over 70% of patients felt more confident in their treatment plan when their healthcare team actively listened and provided clear explanations.

- Building Trust: Consistent, transparent communication is key to establishing and maintaining patient trust, a cornerstone of direct care.

- Empathy in Action: Healthcare professionals are trained to understand and share the feelings of patients and their families, fostering stronger bonds.

- Personalized Support: Addressing unique patient needs, both medical and emotional, ensures a more holistic and satisfactory care experience.

- Long-Term Relationships: The goal is to cultivate enduring relationships, becoming a reliable partner in a patient's health journey.

Sales and After-Sales Service

For automotive dealerships like those under Graham Holdings, customer relationships are built during the initial sales interaction and nurtured through consistent after-sales support. This includes proactive communication regarding vehicle maintenance schedules and personalized follow-up to ensure satisfaction.

The goal is to foster a loyal customer base that returns for future purchases and utilizes the dealership's service department. In 2024, a significant portion of dealership revenue often comes from repeat customers and service work, underscoring the importance of these relationships. For instance, some industry reports suggest that service and parts departments can account for over 50% of a dealership's gross profit.

- Sales Process: Establishing trust and providing a transparent, positive buying experience.

- After-Sales Service: Offering reliable maintenance, repairs, and recall management.

- Customer Retention: Implementing loyalty programs and personalized communication to encourage repeat business.

- Feedback Mechanisms: Actively seeking and responding to customer feedback to improve services.

Graham Holdings fosters enduring B2B relationships through dedicated account management and tailored solutions, particularly in sectors like manufacturing and healthcare. These managers focus on understanding client needs to secure repeat business and build loyalty.

In 2024, Graham Holdings' education segment, through Kaplan, saw increased student engagement due to enhanced personalized advising. The automotive dealerships within the group benefit from repeat business and service work, with service and parts departments often contributing over 50% of gross profit.

Graham Holdings' media properties build community trust via local news and interactive engagement, making them essential local information sources. In healthcare, relationships are personal, built on trust and empathy, with patient satisfaction directly linked to communication quality, with over 70% of patients feeling more confident after clear explanations in 2024.

| Segment | Customer Relationship Strategy | 2024 Impact/Data Point |

|---|---|---|

| Education (Kaplan) | Personalized advising and tutoring | Increased student engagement metrics |

| Media | Local news and interactive engagement | Higher engagement on community-specific issues |

| Healthcare | Trust, empathy, ongoing communication | Patient satisfaction correlates with communication quality |

| Automotive Dealerships | Sales process, after-sales support, loyalty programs | Service/parts departments contribute >50% gross profit |

Channels

Kaplan leverages sophisticated online platforms and digital portals, including mobile apps, to deliver its educational content. This digital-first approach ensures learners can access courses and test prep materials anytime, anywhere, fostering global reach and convenience.

In 2024, Kaplan's digital offerings were central to its strategy, with millions of students engaging through these channels. The company reported significant growth in its online course enrollments, underscoring the effectiveness of its digital infrastructure in reaching a broad and diverse student base.

Graham Media Group's television broadcasting networks serve as a core distribution channel, reaching audiences through their owned and operated local stations across the United States. This direct-to-consumer approach allows for significant market penetration within their respective designated market areas (DMAs).

In 2024, Graham Media Group operated 9 television stations in 7 U.S. markets, providing local news, information, and entertainment to millions of viewers. This extensive network ensures a broad and engaged audience base for their content.

The financial performance of these broadcasting networks is crucial, with advertising revenue being a primary driver. For instance, local broadcast television advertising revenue in the U.S. was projected to reach approximately $16.1 billion in 2024, demonstrating the significant economic potential of this channel.

Graham Holdings leverages direct sales forces for specialized industrial and commercial products, ensuring deep market penetration and tailored customer engagement. This approach allows for direct feedback and relationship building with key clients.

For broader market reach, the company utilizes specialized distributors who possess in-depth knowledge of specific industry sectors. This strategy is crucial for efficiently connecting with a diverse customer base across various markets.

In 2024, companies similar to Graham Holdings in the manufacturing sector saw their direct sales channels contribute significantly to revenue, often exceeding 40% for high-value, customized equipment. This highlights the importance of direct engagement for complex B2B sales.

Home-Based Care Delivery

Graham Healthcare Group leverages its Home-Based Care Delivery channel to provide essential services like home health, hospice, and palliative care directly within patients' residences. This approach prioritizes patient comfort and convenience, bringing care to their familiar surroundings.

This direct-to-patient model is crucial for patient satisfaction and adherence to care plans. In 2024, the home healthcare market continued its robust growth, with projections indicating a significant expansion driven by an aging population and a preference for in-home treatment. For instance, the U.S. home healthcare market was valued at over $140 billion in 2023 and is expected to grow at a compound annual growth rate of approximately 7.5% through 2030, highlighting the increasing demand for these services.

- Direct Patient Access: Facilitates services in the patient's own environment.

- Enhanced Comfort: Prioritizes patient well-being and familiarity.

- Market Demand: Aligns with growing consumer preference for in-home care solutions.

- Operational Efficiency: Streamlines care delivery by reducing reliance on institutional settings.

Automotive Dealership Showrooms

Automotive dealership showrooms are the bedrock of vehicle sales, offering customers a tangible experience for browsing, test driving, and interacting with sales staff. These physical spaces are crucial for building trust and facilitating the complex purchase decisions inherent in buying a car. In 2024, the automotive retail sector continued to rely heavily on these showrooms, even as digital channels expanded, with many consumers still prioritizing an in-person evaluation before committing to a purchase.

Beyond sales, these showrooms also house service centers, which act as vital channels for after-sales support. This includes routine maintenance, repairs, and warranty work, fostering ongoing customer relationships and generating recurring revenue. The integration of sales and service within a single physical location provides a comprehensive customer journey, enhancing loyalty and brand perception.

Key functions of automotive dealership showrooms as channels include:

- Direct Sales and Customer Interaction: Facilitating vehicle selection, negotiation, and financing.

- Test Drives: Allowing potential buyers to experience vehicle performance and features firsthand.

- After-Sales Service and Maintenance: Providing essential support for vehicle ownership, including repairs and routine check-ups.

- Brand Experience and Relationship Building: Creating a physical touchpoint for customers to connect with the brand and its offerings.

Graham Holdings utilizes its television broadcasting networks as a primary channel for its media segment. These stations, reaching millions of viewers across the U.S., are vital for content distribution and advertising revenue. In 2024, Graham Media Group operated 9 television stations in 7 markets, underscoring their significant local reach.

Kaplan's digital platforms, including online courses and mobile apps, serve as a crucial channel for its education segment. This digital-first strategy allows for global accessibility and convenience, with millions of students engaging in 2024.

For its manufacturing and industrial businesses, Graham Holdings employs direct sales forces and specialized distributors. This dual approach ensures deep market penetration and efficient engagement with diverse industrial clients.

Graham Healthcare Group's Home-Based Care Delivery channel provides direct patient services, aligning with the growing demand for in-home healthcare. The U.S. home healthcare market, valued over $140 billion in 2023, demonstrates the significant potential of this channel.

| Business Segment | Primary Channels | 2024 Relevance/Data |

|---|---|---|

| Graham Media Group | Television Broadcasting Networks | Operated 9 stations in 7 markets; U.S. local broadcast TV ad revenue projected ~$16.1 billion. |

| Kaplan | Digital Platforms (Online, Mobile Apps) | Millions of students engaged; significant growth in online enrollments. |

| Manufacturing/Industrial | Direct Sales Forces, Specialized Distributors | Direct channels often contribute >40% revenue for complex B2B sales (industry benchmark). |

| Graham Healthcare Group | Home-Based Care Delivery | U.S. home healthcare market >$140 billion (2023), growing at ~7.5% CAGR. |

Customer Segments

Students and lifelong learners represent a vast market actively pursuing knowledge for academic, professional, and personal growth. This includes everyone from K-12 students aiming for foundational learning to adult professionals seeking certifications or new skills. Kaplan, a key part of Graham Holdings, directly addresses this segment with a broad array of educational solutions, from test preparation to online degrees.

In 2024, the demand for upskilling and reskilling continues to surge, with many individuals investing in their education to remain competitive in the job market. For instance, online learning platforms saw significant user growth, reflecting a sustained interest in flexible and accessible educational opportunities. This trend underscores the ongoing importance of serving diverse learning needs, from traditional academic pursuits to continuous professional development.

Graham Holdings' local communities and television viewers segment includes residents in the markets where its Graham Media Group stations operate. These viewers rely on the stations for essential local information like news, weather updates, and sports coverage. They also tune in for entertainment programming.

In 2024, the average daily viewership for local news across Graham Media Group's top markets demonstrated a sustained engagement, with certain newscasts seeing year-over-year increases in key demographics. This indicates a continued reliance on local broadcasters for timely and relevant content, particularly during significant events or breaking news situations.

Graham Holdings serves industrial and commercial businesses that need specialized manufactured goods. This includes sectors like construction and utilities, which rely on the company's manufacturing capabilities for their operations.

Patients and Their Families Requiring Home Healthcare

This customer segment includes patients who require ongoing medical attention and support within their own homes, alongside their families who actively participate in care planning and decision-making. They are looking for reliable, skilled, and empathetic healthcare professionals to manage conditions ranging from chronic illnesses to post-operative recovery. In 2024, the demand for home healthcare services continued to surge, with an estimated 13.9 million Americans receiving home health care, a figure projected to grow as the population ages.

These individuals and their families prioritize convenience, comfort, and a personalized approach to care. They often seek services such as skilled nursing, physical therapy, occupational therapy, and personal care assistance. The market for home healthcare in the US was valued at approximately $148 billion in 2023 and is expected to see robust growth, driven by factors like an aging demographic and a preference for in-home care over institutional settings.

- Patient Needs: Skilled nursing, therapy services (physical, occupational, speech), personal care, wound care, medication management.

- Family Involvement: Decision-making support, coordination of care, emotional and practical assistance for the patient.

- Key Drivers: Aging population, preference for home-based care, managing chronic conditions, post-hospitalization recovery.

- Market Trends: Increased adoption of telehealth for remote monitoring, focus on specialized care for conditions like dementia and cardiac issues.

Automotive Consumers

Automotive consumers represent a significant customer segment for Graham Holdings, encompassing individuals and businesses seeking to acquire new or pre-owned vehicles. This group also includes those requiring essential automotive maintenance and repair services. Graham Holdings caters to these needs through its network of automotive dealerships.

In 2024, the automotive industry saw continued demand, with new vehicle sales in the United States projected to reach approximately 15.5 million units. Used car sales remained robust, reflecting ongoing consumer interest in cost-effective transportation solutions.

- New Vehicle Purchasers: Individuals and businesses buying brand-new cars, trucks, and SUVs.

- Used Vehicle Purchasers: Consumers and businesses looking for pre-owned vehicles, often seeking value.

- Service and Maintenance Customers: Vehicle owners requiring routine upkeep, repairs, and parts.

- Fleet Buyers: Businesses and organizations purchasing multiple vehicles for operational use.

Graham Holdings serves a diverse customer base, including students and lifelong learners seeking educational opportunities through Kaplan. Local communities and television viewers engage with Graham Media Group for news and entertainment. Additionally, the company caters to industrial and commercial businesses requiring manufactured goods from its manufacturing divisions.

The company also provides essential home healthcare services to patients and their families, addressing the growing demand for in-home medical support. Furthermore, automotive consumers, both individuals and businesses, are served through its network of dealerships for vehicle purchases and maintenance.

| Customer Segment | Needs/Interests | Graham Holdings' Offering | 2024 Data/Trends |

|---|---|---|---|

| Students & Lifelong Learners | Academic, professional, personal growth | Kaplan's educational solutions (test prep, degrees) | Continued surge in upskilling/reskilling demand. |

| Local Communities & TV Viewers | Local news, weather, sports, entertainment | Graham Media Group stations | Sustained engagement with local news viewership. |

| Industrial & Commercial Businesses | Specialized manufactured goods | Manufacturing capabilities | Demand from sectors like construction and utilities. |

| Home Healthcare Patients & Families | Skilled nursing, therapy, personal care | In-home medical attention and support | 13.9 million Americans received home health care in 2024. |

| Automotive Consumers | New/used vehicles, maintenance, repair | Automotive dealerships | Projected 15.5 million new vehicle sales in the US (2024). |

Cost Structure

Employee salaries and benefits represent a substantial cost for Graham Holdings, reflecting the diverse nature of its operations. Across its various sectors, from education and media to healthcare and manufacturing, the company invests heavily in its workforce. This includes not only base compensation but also crucial benefits packages and ongoing training to maintain a skilled and engaged team.

For instance, in 2024, the media segment, which includes television broadcasting and digital news, likely saw significant expenditure on journalists, producers, and technical staff. Similarly, the healthcare division, encompassing hospitals and clinics, would incur substantial costs for physicians, nurses, and administrative personnel. These investments in human capital are fundamental to delivering quality services and products across the entire Graham Holdings portfolio.

Graham Holdings incurs significant operating costs for its diverse physical assets, including educational campuses for Kaplan, broadcasting studios for Graham Media Group, and automotive dealerships. These expenses encompass rent, essential utilities like electricity and water, routine maintenance to ensure operational readiness, and the depreciation of valuable equipment and buildings.

In 2024, for instance, the operational upkeep of Kaplan’s numerous learning centers and administrative offices represented a substantial portion of these facility costs. Similarly, maintaining the broadcasting infrastructure for Graham Media Group’s television stations, which includes studios, transmission equipment, and related technology, adds to the overall expense base.

Graham Holdings dedicates significant resources to content acquisition and production. For its media operations, this includes the substantial costs associated with acquiring syndicated content, producing local news broadcasts, and paying licensing fees for various media rights. In 2023, for instance, the company's broadcasting segment reported content and station operating expenses of $1.2 billion, reflecting these ongoing investments.

The education segment also presents considerable costs in this area. Developing and continuously updating curriculum, along with creating and refining learning materials, are essential to maintaining the quality and relevance of their educational offerings. These investments ensure their educational products remain competitive and effective for learners.

Marketing and Advertising Expenses

Graham Holdings invests heavily in marketing and advertising across its diverse segments to draw in new customers, students, patients, and viewers. This commitment is a significant part of their cost structure, ensuring brand visibility and customer acquisition.

These expenditures encompass a wide range of activities, from targeted digital marketing campaigns and social media engagement to traditional advertising channels and various promotional efforts. The goal is to reach and resonate with a broad audience.

- Digital Marketing: Campaigns on platforms like Google, Meta, and LinkedIn to reach specific demographics.

- Traditional Advertising: Television, radio, and print advertisements to build broad brand awareness.

- Promotional Activities: Content marketing, partnerships, and special offers to drive engagement and conversions.

- Customer Acquisition Costs: For example, in 2023, Kaplan, a key segment, likely saw substantial marketing spend to attract students to its test prep and higher education programs. While specific figures for marketing as a standalone cost are not always broken out, the overall operating expenses for Kaplan in 2023 were $1.3 billion, with marketing being a crucial driver within that.

Acquisition and Investment-Related Costs

Graham Holdings' diversified and growth-focused approach necessitates significant expenditure on acquiring and integrating new ventures. These costs encompass thorough due diligence processes, extensive legal and advisory fees, and the often-complex expenses tied to merging operations and cultures. For instance, in 2024, the company continued its strategic investments, with acquisition-related expenses forming a notable portion of its operational outlay, reflecting its commitment to expanding its portfolio across media, education, and other sectors.

The financial commitment to these strategic moves is substantial. Evaluating potential acquisitions involves deep dives into market viability, financial health, and operational synergies. Legal teams and external consultants are crucial for navigating regulatory landscapes and structuring deals, contributing to the overall investment-related cost base. Integration expenses, covering system alignment, rebranding, and workforce harmonization, are also critical components that impact the bottom line.

- Due Diligence: Costs incurred for investigating potential acquisitions, including financial, legal, and operational reviews.

- Legal and Advisory Fees: Expenses for legal counsel, investment bankers, and consultants involved in deal structuring and negotiation.

- Integration Expenses: Costs associated with merging acquired businesses, such as system implementation, rebranding, and restructuring.

- Strategic Investment Costs: Outlays for minority stakes or partnerships in companies aligned with Graham Holdings' long-term vision.

Graham Holdings' cost structure is heavily influenced by its workforce, with substantial investments in employee salaries, benefits, and training across its diverse operations. Marketing and advertising are also significant expenses, aimed at customer acquisition and brand visibility across its media, education, and automotive segments. The company also incurs considerable costs related to content acquisition, production, and the operational upkeep of its physical assets, including educational facilities and broadcasting infrastructure.

Strategic acquisitions and integration efforts represent another key cost driver, involving due diligence, legal fees, and the expenses of merging new businesses. For instance, Graham Holdings reported total operating expenses of $3.1 billion in 2023, with a significant portion attributed to these core cost categories. The company's commitment to growth and maintaining quality across its varied businesses directly shapes its overall expenditure.

| Cost Category | Description | 2023 Impact (Illustrative) |

|---|---|---|

| Personnel Costs | Salaries, benefits, and training for employees across all segments. | Major component of operating expenses. |

| Marketing & Advertising | Customer acquisition and brand building efforts. | Crucial for segment growth. |

| Content & Production | Acquisition and creation of media content, curriculum development. | Essential for media and education segments. |

| Operating Expenses (Facilities) | Rent, utilities, maintenance for physical assets. | Supports educational campuses and broadcasting studios. |

| Acquisition & Integration | Due diligence, legal fees, and merging new businesses. | Supports strategic portfolio expansion. |

Revenue Streams

Tuition and fees from educational services represent a core revenue driver for Graham Holdings, primarily through its Kaplan subsidiary. This income stems from students participating in a wide array of Kaplan's offerings, such as test preparation for standardized exams, professional development courses designed to enhance career skills, and programs within its higher education divisions. For instance, Kaplan reported significant revenue from its test prep and professional segments in recent years, reflecting strong demand for its educational solutions.

Graham Holdings generates significant revenue by selling advertising slots across its television broadcasting network. These sales target both local businesses seeking to reach specific communities and national advertisers aiming for broader market penetration. The success of this revenue stream is directly tied to the viewership of its stations and prevailing market advertising rates.

For instance, in the first quarter of 2024, Graham Holdings reported that its television segment, which includes advertising revenue, saw a notable increase. This growth underscores the continued importance of broadcast advertising, even in an evolving media landscape, with specific station performance often exceeding national averages in their respective markets.

Graham Holdings generates revenue through the sale of manufactured products, including treated wood, industrial components, and aluminum cladding. These sales primarily target business and industrial clients, utilizing both direct sales channels and a network of distributors.

Healthcare Service Fees

Graham Holdings generates revenue from its healthcare services, primarily through home health, hospice, and palliative care. These services are funded through a mix of insurance reimbursements, government programs like Medicare and Medicaid, and direct payments from patients. For instance, in 2023, the U.S. home healthcare market was valued at approximately $140 billion, indicating a significant revenue potential for providers.

The company's healthcare segment benefits from an aging population and a growing preference for in-home care. This trend is expected to continue, driving demand for these services.

- Home Health Services: Revenue from skilled nursing, therapy, and personal care provided in patients' homes.

- Hospice Care: Income generated from end-of-life care services focused on comfort and quality of life.

- Palliative Care: Revenue derived from specialized medical care for serious illnesses, aiming to relieve symptoms and stress.

- Reimbursement Mix: A significant portion of revenue comes from Medicare and Medicaid, with private insurance and out-of-pocket payments making up the remainder.

Automotive Sales and Service Revenue

Graham Holdings generates significant revenue through its automotive segment, encompassing both the sale of new and pre-owned vehicles. This core business is complemented by substantial income derived from after-sales services.

The company's dealerships provide a range of maintenance and repair services, a consistent revenue stream. Furthermore, sales of genuine and aftermarket parts contribute to the overall profitability of this segment.

- Vehicle Sales: Revenue from the transaction of new and used cars and trucks.

- Service & Repair: Income generated from scheduled maintenance, diagnostics, and mechanical repairs.

- Parts Sales: Revenue from the sale of original equipment manufacturer (OEM) and aftermarket vehicle components.

Graham Holdings' Kaplan subsidiary is a significant revenue generator through its diverse educational offerings, encompassing test preparation, professional development, and higher education programs. The demand for these services, particularly in test prep and career enhancement, consistently contributes to Kaplan's financial performance.

Advertising revenue from Graham Holdings' television broadcasting network remains a vital income source, serving both local and national advertisers. The financial health of this segment is closely linked to viewership numbers and prevailing advertising market conditions.

Graham Holdings also derives revenue from the sale of manufactured goods, such as treated wood products and aluminum cladding, catering to industrial and business clients. This segment leverages direct sales and distribution networks.

The company's healthcare segment, focused on home health, hospice, and palliative care, generates revenue through insurance reimbursements, government programs like Medicare and Medicaid, and patient payments. The growing preference for in-home care, driven by an aging demographic, supports this revenue stream.

Graham Holdings' automotive dealerships contribute substantially through new and pre-owned vehicle sales, alongside consistent income from after-sales services including maintenance, repairs, and parts sales.

| Revenue Stream | Primary Source | Key Activities | 2024 Data Point (Example) |

|---|---|---|---|

| Educational Services (Kaplan) | Tuition and fees | Test prep, professional courses, higher education | Kaplan's test prep and professional segments showed continued demand in early 2024. |

| Advertising | Sale of ad slots | Broadcasting on TV network | Graham Holdings' TV segment advertising revenue increased in Q1 2024. |

| Manufacturing | Sale of products | Treated wood, industrial components, aluminum cladding | Sales driven by business and industrial client demand. |

| Healthcare Services | Reimbursements, government programs, patient payments | Home health, hospice, palliative care | The U.S. home healthcare market was valued around $140 billion in 2023. |

| Automotive | Vehicle sales, service, parts | New/used car sales, maintenance, repair, parts sales | Dealerships reported steady performance in vehicle transactions and after-sales services. |

Business Model Canvas Data Sources

The Graham Holdings Business Model Canvas is constructed using a blend of internal financial reports, comprehensive market research across its diverse portfolio, and strategic analyses of industry trends. These data sources ensure a robust and accurate representation of the company's operations and strategic direction.