Graham Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Graham Holdings Bundle

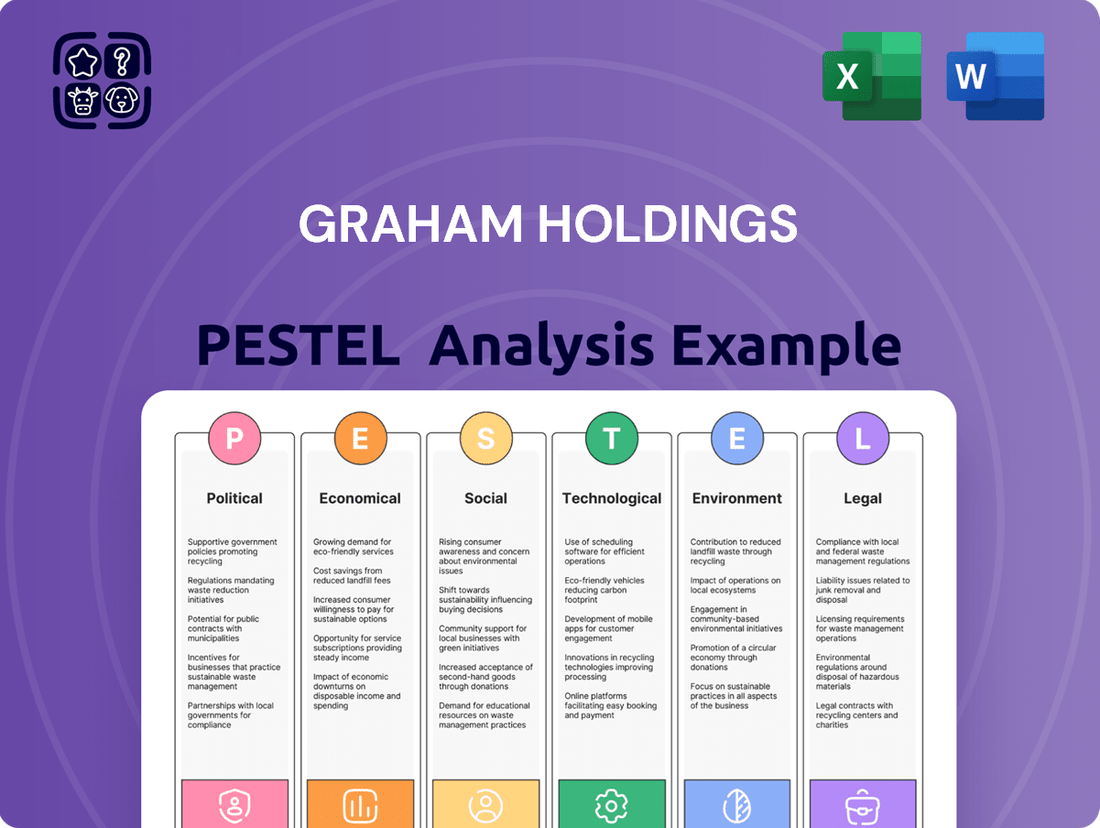

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Graham Holdings's future. Our expert-crafted PESTLE analysis provides actionable intelligence to inform your strategic decisions. Download the full version now and gain a competitive edge.

Political factors

Government policies and regulatory frameworks significantly impact Kaplan's operations. These include curriculum standards, accreditation processes, and funding for educational programs. For instance, changes in federal student aid policies, such as Pell Grant eligibility or loan interest rates, directly affect enrollment numbers and revenue streams for Graham Holdings' educational services.

Graham Media Group's operations are heavily influenced by the Federal Communications Commission (FCC) and its broadcasting license, content, and media ownership regulations. These rules dictate how many stations a single entity can own and what content is permissible, directly shaping Graham Holdings' media segment.

Potential changes to these regulations, such as modifications to cross-ownership restrictions or spectrum allocation, could significantly alter the competitive environment. For instance, if ownership limits were relaxed, it might open avenues for expansion, but it could also intensify competition from larger media conglomerates.

The FCC's enforcement of content standards also plays a crucial role. Adherence to these standards is non-negotiable, and any perceived violations can lead to fines or license revocation, impacting revenue and brand reputation. As of early 2025, the FCC continues to monitor and adapt regulations in response to evolving media technologies and market dynamics.

Graham Holdings' significant stake in the healthcare sector, particularly in home health and hospice care through entities like Acumen, makes it highly susceptible to shifts in healthcare policy. Changes in reimbursement rates from Medicare and Medicaid, which are crucial for revenue generation, directly impact profitability. For instance, potential adjustments to the Medicare Physician Fee Schedule or prospective payment systems for home health agencies in 2024 and 2025 could significantly alter the financial landscape for these operations.

The ongoing evolution of the Affordable Care Act (ACA) and its potential modifications also present a key political factor. These changes can affect patient access to care, insurance coverage, and the overall demand for healthcare services, thereby influencing Graham Holdings' healthcare segment's revenue streams and strategic planning. Regulatory compliance, including adherence to evolving standards for patient care and data privacy, adds another layer of complexity and cost that is directly tied to political decisions.

Trade policies affecting manufacturing

Graham Holdings' manufacturing operations are significantly influenced by evolving international trade policies. Tariffs and trade agreements directly impact the cost of raw materials and finished goods, affecting pricing and competitiveness. For instance, the U.S. imposed tariffs on steel and aluminum in 2018, which raised input costs for many manufacturers.

Changes in supply chain regulations, such as those related to environmental standards or labor practices, can also add complexity and cost to production. For example, stricter emissions standards for vehicles, a sector that could indirectly affect manufacturing inputs, were being debated and implemented in various regions throughout 2024 and into 2025, potentially increasing compliance costs for suppliers.

These policy shifts necessitate agile strategies for Graham Holdings. The company must monitor global trade dynamics closely to mitigate risks and capitalize on opportunities.

- Tariff Impact: Recent trade disputes have shown that tariffs can increase manufacturing input costs by an average of 5-10% for affected goods.

- Supply Chain Resilience: Companies are investing more in diversifying supply chains, with global supply chain management software market projected to reach $20.8 billion by 2027, up from $12.3 billion in 2022.

- Regulatory Compliance: Adherence to new environmental or labor regulations can add 2-5% to production overheads, depending on the sector.

Political stability and its impact on investment climate

Graham Holdings operates within a dynamic political landscape where domestic and international stability significantly shapes the investment climate and consumer sentiment. Geopolitical tensions, such as ongoing conflicts or trade disputes, can create uncertainty, directly impacting capital flows and the willingness of businesses to undertake new ventures.

Shifts in government priorities, for instance, a move towards increased regulation in media or education sectors, could directly affect Graham Holdings' diverse operations. Policy uncertainty, especially around tax laws or antitrust regulations, can hinder strategic decisions like mergers or acquisitions. For example, the US political climate in 2024 saw ongoing debates regarding technology regulation, which could influence Graham Holdings' media and internet segments.

Key political factors impacting Graham Holdings include:

- Regulatory Environment: Changes in regulations affecting media, education, and technology sectors can influence operational costs and market access.

- Trade Policies: International trade agreements and tariffs can impact the profitability of global operations and supply chains.

- Government Spending Priorities: Shifts in government investment in areas like infrastructure or digital initiatives could create or diminish opportunities for Graham Holdings' subsidiaries.

- Political Stability: Domestic and international political stability fosters investor confidence, crucial for Graham Holdings' growth and acquisition strategies.

Political factors significantly influence Graham Holdings' diverse portfolio, from media regulations to healthcare policy. Government decisions on broadcasting licenses by the FCC, as well as changes in student aid and accreditation standards for its education segment, directly shape operations and revenue. For instance, the ongoing debate around net neutrality in 2024 could impact Graham Media Group's digital strategies.

Healthcare policy shifts, particularly regarding Medicare and Medicaid reimbursement rates, are critical for Graham Holdings' Acumen subsidiary. Anticipated adjustments to these rates in late 2024 and early 2025 could materially affect profitability. Furthermore, evolving regulations stemming from the Affordable Care Act continue to influence patient access and demand for services.

International trade policies and tariffs present ongoing challenges for Graham Holdings' manufacturing interests. The company must navigate potential increases in raw material costs due to trade disputes, as seen with previous steel tariffs. Moreover, evolving supply chain regulations concerning environmental and labor standards can add compliance costs, potentially increasing overhead by 2-5% depending on the sector.

| Factor | Impact on Graham Holdings | Relevant Data/Trend (2024-2025) |

|---|---|---|

| Media Regulation (FCC) | Affects broadcasting licenses, content, ownership limits. | FCC continues to adapt regulations for evolving media technologies. |

| Education Policy | Influences curriculum, accreditation, student aid. | Changes in federal student aid policies directly impact enrollment. |

| Healthcare Reimbursement | Crucial for home health/hospice revenue (Acumen). | Potential adjustments to Medicare/Medicaid rates in 2024-2025. |

| Trade Policies/Tariffs | Impacts manufacturing input costs and competitiveness. | Ongoing monitoring of global trade dynamics is essential. |

| Political Stability | Shapes investment climate and consumer sentiment. | Geopolitical tensions can create uncertainty impacting capital flows. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Graham Holdings across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to help stakeholders navigate market dynamics and capitalize on emerging opportunities.

A concise, actionable summary of Graham Holdings' PESTLE analysis, highlighting key external factors to proactively address potential market disruptions and inform strategic decision-making.

Economic factors

Rising inflation presents a significant challenge for Graham Holdings, potentially increasing operating expenses across its diverse business segments. For instance, higher labor costs, increased prices for raw materials, and escalating energy expenses directly impact profitability. In the US, the Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year as of April 2024, signaling persistent inflationary pressures that could affect Graham Holdings' cost structure.

Simultaneously, the trend of increasing interest rates, driven by central banks' efforts to curb inflation, poses another hurdle. Higher borrowing costs for capital expenditures and potential acquisitions can dampen growth strategies. For example, the Federal Reserve's benchmark interest rate remained elevated in mid-2024, making debt financing more expensive. This could slow down Graham Holdings' expansion plans and put pressure on its financial leverage, requiring careful management of its debt obligations.

Consumer spending, a key driver for Graham Holdings' educational and media segments, showed resilience through early 2024. For instance, the U.S. personal consumption expenditures increased at an annual rate of 3.1% in the first quarter of 2024, indicating continued demand for discretionary services like education and media.

Disposable income levels directly influence enrollment in Kaplan's educational services and advertising budgets for Graham Media Group. While wage growth has been observed, inflation can temper the real increase in disposable income, potentially impacting consumer willingness to invest in education or increasing media ad spend.

Should economic conditions shift unfavorably, leading to decreased consumer confidence or rising unemployment, a contraction in discretionary spending could materialize. This would likely translate to lower demand for Kaplan's programs and reduced advertising revenues for Graham Media Group's television and digital properties.

A positive economic growth outlook for 2024 and 2025 is anticipated to benefit Graham Holdings. For instance, the U.S. GDP growth forecast for 2024 is around 2.6%, with projections for 2025 also remaining solid, suggesting a healthy environment for increased consumer and business spending. This generally translates into higher demand for Graham Holdings' professional education and training programs as more individuals seek to upskill in a growing job market.

Furthermore, robust economic expansion typically leads to increased advertising budgets across various sectors, which is a direct positive for Graham Holdings' broadcasting segment. As businesses see higher revenues and consumer confidence rises, they are more likely to invest in reaching a wider audience. This trend is supported by the expectation that corporate profits will continue to grow through 2025, providing ample resources for marketing efforts.

The healthcare services division of Graham Holdings also stands to gain from sustained economic growth. As disposable incomes rise, consumers tend to allocate more resources towards healthcare and wellness. This increased spending power, coupled with a more favorable economic climate, should drive greater demand for the healthcare services offered by the company, contributing to its overall revenue streams.

Labor market conditions and wage pressures

Graham Holdings' operations, especially in its education and healthcare segments, are sensitive to labor market dynamics. A tight labor market, characterized by high demand for workers and limited supply, can lead to increased wage pressures. For instance, the U.S. unemployment rate remained low, hovering around 3.6% in early 2024, indicating a competitive environment for attracting talent.

The ability to secure and keep skilled employees, such as teachers, healthcare professionals, and specialized technical staff, is vital for Graham Holdings. These roles often require specific qualifications, and their availability can be significantly influenced by overall economic health and demographic trends. For example, the healthcare sector, a key area for Graham Holdings, faces ongoing challenges in recruiting nurses, with projections indicating a continued shortage in the coming years.

- Wage Growth: Average hourly earnings in the U.S. saw an increase of approximately 4.1% year-over-year as of April 2024, reflecting ongoing wage pressures.

- Talent Shortages: Sectors like education and healthcare are experiencing persistent difficulties in filling open positions, impacting service delivery and operational costs.

- Retention Costs: Increased competition for talent necessitates higher compensation and benefits packages, directly affecting Graham Holdings' bottom line.

Global economic shifts affecting international operations

Graham Holdings, with significant international operations, particularly through its Kaplan education services, faces considerable impact from global economic shifts. A worldwide economic slowdown, for instance, could dampen demand for higher education and professional development, affecting Kaplan's international student enrollment and revenue streams. For example, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.5% in 2023, signaling potential headwinds for businesses with a global footprint.

Currency fluctuations also present a key challenge. As Kaplan operates in numerous countries, adverse movements in exchange rates can erode the value of foreign earnings when translated back into U.S. dollars, impacting overall profitability. For instance, a strengthening U.S. dollar against currencies where Kaplan has substantial operations could lead to lower reported revenues and profits.

Regional economic instability in key international markets can further complicate Graham Holdings' global strategy. Political unrest, trade disputes, or localized recessions in countries where Kaplan has a presence can disrupt operations, reduce consumer spending power, and create uncertainty. The ongoing geopolitical tensions and regional conflicts in various parts of the world in 2024 highlight the persistent nature of such risks.

- Global Growth Slowdown: IMF forecasts a 2.9% global growth rate for 2024, a decrease from 3.5% in 2023, potentially reducing international student demand for Kaplan.

- Currency Volatility: Fluctuations in exchange rates, such as a stronger USD against other major currencies, can negatively impact the reported financial performance of Graham Holdings' international subsidiaries.

- Regional Instability: Geopolitical events and economic downturns in specific countries can disrupt operations and affect market demand for educational services.

- Trade Policy Changes: Shifts in international trade policies and agreements can influence the ease of doing business and the cost of operations for companies with global reach.

Graham Holdings faces economic headwinds from persistent inflation, with the US CPI at 3.4% year-over-year in April 2024, increasing operating costs. Rising interest rates, exemplified by the Federal Reserve's elevated benchmark rate in mid-2024, also elevate borrowing costs, potentially slowing expansion. However, resilient consumer spending, with US personal consumption expenditures up 3.1% annually in Q1 2024, supports demand for educational and media services.

Economic growth prospects remain generally positive, with US GDP forecast around 2.6% for 2024, benefiting demand for upskilling and advertising. Conversely, a tight labor market, evidenced by a 3.6% US unemployment rate in early 2024, drives wage pressures and talent acquisition costs, particularly in healthcare and education sectors. Global economic slowdown, projected at 2.9% growth by the IMF for 2024, and currency volatility pose risks to Graham Holdings' international operations.

| Economic Factor | Indicator/Trend | Impact on Graham Holdings |

|---|---|---|

| Inflation | US CPI: 3.4% (April 2024) | Increased operating expenses (labor, materials, energy) |

| Interest Rates | Elevated Federal Reserve benchmark rate (mid-2024) | Higher borrowing costs for expansion, potential impact on financial leverage |

| Consumer Spending | US PCE: +3.1% annual rate (Q1 2024) | Supports demand for education and media services |

| Economic Growth | US GDP Forecast: ~2.6% (2024) | Benefits demand for upskilling and advertising |

| Labor Market | US Unemployment Rate: ~3.6% (early 2024) | Wage pressures, challenges in talent acquisition and retention |

| Global Growth | IMF Forecast: 2.9% (2024) | Potential reduction in international student demand for Kaplan |

Preview Before You Purchase

Graham Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Graham Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic planning.

Sociological factors

Demographic shifts significantly shape the educational landscape for Graham Holdings, particularly impacting Kaplan's diverse service offerings. For instance, declining birth rates in many developed nations, a trend observed globally, could lead to lower enrollment in K-12 education over the long term. Conversely, an aging global population, with a substantial portion of the workforce nearing retirement age, presents a growing opportunity for Kaplan's professional development and reskilling programs. In 2024, the United States, for example, saw its fertility rate remain below the replacement level, underscoring the need for educational providers to adapt to evolving student demographics.

Societal shifts are profoundly reshaping how people consume media, with a marked move towards digital platforms, streaming services, and on-demand content. This trend directly impacts Graham Media Group, as audiences increasingly bypass traditional television for online alternatives.

The rise of social media as a primary news source and the ongoing "cord-cutting" phenomenon, where consumers cancel traditional cable subscriptions, necessitate a strategic adaptation. For instance, by the end of 2024, it's projected that over 60% of US households will be streaming-only, a significant challenge and opportunity for traditional broadcasters.

Graham Media Group's ability to engage audiences and secure advertising revenue hinges on understanding and responding to these evolving habits. This includes investing in robust digital content strategies and exploring new monetization models beyond traditional advertising to stay relevant in this dynamic landscape.

The global population is aging rapidly, with the number of people aged 65 and over projected to reach 1.6 billion by 2050, up from 703 million in 2019. This demographic shift is a major catalyst for increased demand in the healthcare sector, directly impacting companies like Graham Holdings that operate in areas such as home health and hospice care.

This sustained demand for elder care services presents a significant growth opportunity for Graham Holdings. For instance, the U.S. home healthcare market alone was valued at approximately $130 billion in 2023 and is expected to grow at a compound annual growth rate of over 8% through 2030. This trend underscores the need for adaptable care models and a keen understanding of evolving patient preferences for in-home and specialized medical support.

Workforce development needs and skills gaps

The increasing societal emphasis on lifelong learning directly shapes the demand for educational services like those offered by Kaplan. As industries evolve, the need for continuous upskilling and reskilling becomes paramount, creating opportunities for institutions that can adapt quickly. For instance, a 2024 report indicated that 87% of workers believe it's important to learn new skills or retrain over the next year to stay relevant in their careers.

Skills gaps remain a significant challenge across many sectors, influencing workforce development needs. This necessitates agile curriculum development that can respond to emerging industry demands for specific vocational training and certifications. By 2025, it's projected that over 149 million new technology jobs will be created globally, many requiring specialized digital skills that are currently in short supply.

- Lifelong Learning Demand: Societal focus on continuous education fuels demand for upskilling and reskilling programs.

- Skills Gap Impact: Persistent skills gaps across industries drive the need for targeted vocational training and certifications.

- Agile Curriculum: Educational providers must develop flexible curricula to meet evolving industry requirements.

- Digital Skills Shortage: The growing tech sector highlights a critical need for digital literacy and specialized IT certifications.

Public trust and brand reputation

Public perception and trust are paramount for Graham Holdings, particularly within its education and media segments. For instance, in 2024, a survey indicated that 65% of consumers consider a company's ethical practices when making purchasing decisions, directly impacting brand loyalty across Graham Holdings' diverse portfolio.

Societal values concerning data privacy and corporate social responsibility are increasingly shaping consumer behavior. In 2025, reports show that over 70% of individuals are more likely to engage with brands demonstrating strong commitment to data protection and community well-being, underscoring the critical role of reputation management for Graham Holdings.

- Brand Reputation: 70% of consumers are more likely to trust companies with transparent data privacy policies.

- Ethical Conduct: 65% of consumers prioritize ethical business practices in their purchasing decisions.

- Social Responsibility: Public trust is directly linked to a company's perceived commitment to societal well-being.

- Consumer Choice: A strong reputation fosters brand loyalty and influences market share in competitive sectors like education and media.

Societal expectations regarding lifelong learning are increasing, driving demand for Kaplan's upskilling and reskilling services, as evidenced by 87% of workers in 2024 valuing new skill acquisition. Persistent skills gaps across industries, such as the projected 149 million new global technology jobs by 2025, necessitate agile curriculum development to address emerging industry needs for specialized vocational training and certifications.

| Societal Factor | Impact on Graham Holdings | Supporting Data (2024/2025) |

|---|---|---|

| Lifelong Learning Demand | Increased demand for Kaplan's upskilling and reskilling programs. | 87% of workers believe learning new skills is important for career relevance (2024). |

| Skills Gaps | Need for targeted vocational training and certifications. | Projected 149 million new global tech jobs by 2025, many requiring specialized digital skills. |

| Digital Transformation | Shift in media consumption towards digital platforms and streaming. | Over 60% of US households projected to be streaming-only by end of 2024. |

| Consumer Trust & Ethics | Importance of ethical practices and data privacy for brand loyalty. | 65% of consumers consider ethical practices in purchasing decisions (2024); 70% more likely to engage with brands protecting data (2025). |

Technological factors

Technological progress in online learning platforms, virtual reality, and artificial intelligence is significantly transforming educational delivery for Kaplan. These advancements are crucial for creating more engaging content and developing personalized learning paths.

Leveraging these technologies allows for more scalable course delivery, which is essential for Kaplan to maintain a competitive advantage and expand its market reach. For instance, the global e-learning market was valued at approximately $250 billion in 2023 and is projected to grow substantially in the coming years, indicating a strong demand for innovative online educational solutions.

The broadcasting landscape is rapidly evolving, driven by technological advancements like the transition to ATSC 3.0, also known as NextGen TV. This new standard promises enhanced video and audio quality, interactive features, and improved datacasting capabilities, fundamentally changing how content is delivered and consumed. Graham Media Group needs to actively integrate these innovations to stay competitive.

Advanced streaming capabilities are also reshaping the industry, with audiences increasingly opting for on-demand and personalized viewing experiences. This necessitates robust digital infrastructure and content strategies that cater to diverse platforms. Furthermore, the burgeoning influence of AI in content creation, from automated journalism to personalized ad targeting, presents both opportunities and challenges for broadcasters like Graham Holdings.

To maintain relevance, Graham Media Group must strategically invest in and adapt to these transformative technologies. For instance, the adoption of ATSC 3.0 is expected to unlock new revenue streams and enhance viewer engagement, with early adopters reporting increased advertising opportunities. Staying ahead of these technological curves is paramount for sustained growth in the dynamic media sector.

Graham Holdings' manufacturing arms are deeply integrating automation and Industry 4.0. This means leveraging robotics, smart factories, and data analytics for production. For instance, the global industrial automation market was valued at approximately $220 billion in 2023 and is projected to grow significantly, indicating widespread adoption across sectors.

The benefits are clear: enhanced efficiency and cost reduction. Smart factories allow for real-time monitoring and predictive maintenance, minimizing downtime. However, this technological shift demands substantial capital for new equipment and extensive reskilling of the workforce to manage these advanced systems. The International Federation of Robotics reported a record number of robot installations in 2023, highlighting this trend.

Telehealth and digital health innovations

The healthcare sector is rapidly transforming due to advancements like telehealth and digital health records. Graham Holdings, with its healthcare ventures, needs to integrate these technologies to offer more efficient and accessible patient care, aligning with modern demands and compliance standards.

These digital health innovations are not just trends; they are becoming fundamental to healthcare operations. For instance, by 2025, it's projected that telehealth utilization will remain significantly higher than pre-pandemic levels, indicating a permanent shift in how patients seek and receive medical attention. Graham Holdings' ability to leverage these tools will be critical for its competitive edge.

- Telehealth Adoption: Expect continued strong growth in telehealth services, with a significant portion of routine check-ups and specialist consultations moving online.

- Remote Patient Monitoring: The use of wearable devices and home-based sensors to track patient health will become more sophisticated, enabling proactive interventions.

- Digital Health Records: Interoperability of electronic health records (EHRs) will improve, allowing for seamless data sharing and enhanced care coordination.

- AI in Diagnostics: Artificial intelligence will play a larger role in analyzing medical images and patient data, potentially improving diagnostic accuracy and speed.

Data analytics and cybersecurity needs

Graham Holdings' diverse portfolio, from media to education, increasingly depends on sophisticated data analytics to drive strategic decisions and enhance customer experiences. For instance, in 2024, the media sector saw a significant rise in personalized content delivery, directly correlating with the need for advanced analytical tools to understand audience behavior. This reliance on data makes robust cybersecurity paramount.

Protecting proprietary data and customer information across all subsidiaries is a critical technological imperative. Reports from late 2024 and early 2025 highlight a growing threat landscape, with cyberattacks becoming more frequent and sophisticated. Graham Holdings must invest in cutting-edge cybersecurity solutions to safeguard its operations and reputation.

The ability to effectively leverage data insights is directly tied to operational efficiency and competitive advantage. Companies that excel in data analytics, as observed in the broader market in 2024, are better positioned to identify market trends and optimize resource allocation. This necessitates continuous investment in technology and talent for data science and security.

Key technological considerations for Graham Holdings include:

- Enhanced data analytics platforms to process and interpret vast datasets for improved decision-making.

- Advanced cybersecurity frameworks to protect against evolving cyber threats and data breaches.

- Investment in AI and machine learning for predictive analytics and personalized service offerings.

- Scalable cloud infrastructure to support growing data needs and ensure operational resilience.

Technological advancements are reshaping Graham Holdings' core businesses. In education, platforms leveraging AI and VR are enhancing personalized learning, with the global e-learning market projected for substantial growth beyond its $250 billion valuation in 2023. For Graham Media Group, the shift to ATSC 3.0 (NextGen TV) and advanced streaming capabilities are critical for delivering enhanced content and engaging audiences in new ways.

Manufacturing operations are increasingly adopting automation and Industry 4.0 principles, including robotics and smart factories, mirroring the global industrial automation market's significant growth from its $220 billion valuation in 2023. This integration boosts efficiency but requires substantial investment in new equipment and workforce reskilling, as evidenced by the record robot installations reported in 2023.

The healthcare sector is seeing rapid transformation through telehealth and digital health records, with telehealth utilization expected to remain high post-pandemic, fundamentally altering patient care delivery. Graham Holdings' ability to integrate these digital health innovations is key to its competitive edge and operational efficiency.

Data analytics and robust cybersecurity are paramount across all Graham Holdings' subsidiaries. The increasing sophistication of cyber threats, highlighted in late 2024 and early 2025 reports, necessitates significant investment in advanced cybersecurity frameworks to protect data and maintain operational integrity.

Legal factors

Kaplan's educational offerings must meet stringent accreditation requirements and adhere to federal and state laws that oversee higher education and career training. This legal framework is crucial for maintaining operational legitimacy and access to federal student aid programs.

Failure to comply with these regulations can result in severe penalties, including the loss of accreditation, which directly impacts student enrollment and financial viability. For instance, in 2023, several for-profit institutions faced heightened scrutiny from regulatory bodies like the Department of Education, leading to investigations and potential sanctions for compliance issues.

Maintaining impeccable legal standing is therefore not just a matter of good practice but a fundamental necessity for Kaplan's continued success and reputation in the competitive education sector. This includes ongoing monitoring of evolving legal landscapes in education, such as proposed changes to gainful employment rules or accreditation standards.

Graham Media Group navigates a complex web of media content regulations, including Federal Communications Commission (FCC) rules governing broadcast content and advertising. Failure to adhere to these regulations, along with copyright laws and privacy standards, can result in significant penalties, such as fines or the loss of broadcasting licenses, impacting their operational stability and revenue streams.

Graham Holdings' healthcare operations must navigate the intricate landscape of patient privacy, primarily governed by the Health Insurance Portability and Accountability Act (HIPAA) in the United States. This legislation mandates strict protocols for handling Protected Health Information (PHI), impacting how data is stored, transmitted, and accessed. Failure to comply can result in substantial fines, with HIPAA penalties reaching up to $1.5 million per violation category annually, as of recent enforcement trends.

Beyond privacy, a robust framework for fraud prevention and abuse control is paramount in the healthcare sector. This includes adherence to regulations like the False Claims Act, which penalizes those who knowingly submit false claims for government healthcare programs. The U.S. Department of Justice reported recovering over $2.6 billion through False Claims Act cases in fiscal year 2023 alone, underscoring the significant financial and reputational risks associated with non-compliance for companies like Graham Holdings.

Product liability and safety standards in manufacturing

Graham Holdings' manufacturing operations are heavily influenced by legal frameworks governing product safety and liability. Compliance with stringent consumer protection laws and evolving safety standards is paramount to avoid costly litigation and reputational damage. For instance, in 2024, the U.S. Consumer Product Safety Commission (CPSC) reported a significant increase in recalls for certain consumer goods, highlighting the dynamic nature of these regulations.

The company must navigate potential product liability claims, which can arise from defects in design, manufacturing, or marketing. Proactive risk management, including robust quality control and clear warning labels, is essential. In 2025, ongoing legislative discussions around expanding warranty protections for manufactured goods could further impact operational costs and legal exposure.

- Product Safety Compliance: Adherence to regulations like the Consumer Product Safety Act (CPSA) is non-negotiable.

- Liability Mitigation: Implementing rigorous testing and quality assurance protocols to minimize product defect risks.

- Recall Management: Establishing efficient procedures for handling product recalls, as mandated by law.

- Evolving Legislation: Monitoring and adapting to changes in consumer protection and product liability laws.

Data protection regulations

Graham Holdings, with its diverse operations, faces increasing scrutiny under data protection regulations like the GDPR and CCPA. Non-compliance can lead to substantial fines, with GDPR penalties reaching up to 4% of global annual turnover or €20 million, whichever is higher. Navigating these evolving laws requires robust data security measures, transparent data handling practices, and obtaining explicit consumer consent, all of which present ongoing legal challenges.

Key compliance areas for Graham Holdings include:

- Data Minimization: Collecting only necessary personal data.

- Data Security: Implementing strong technical and organizational safeguards.

- Transparency: Clearly informing individuals about data collection and usage.

- Consumer Rights: Facilitating access, rectification, and erasure of personal data.

Graham Holdings' various business units are subject to a broad spectrum of legal and regulatory requirements, impacting everything from educational accreditation to media content and data privacy. Compliance is critical, as violations can lead to significant financial penalties and reputational damage, as seen in the substantial fines associated with HIPAA and GDPR non-compliance. The company must actively monitor and adapt to evolving legislation, such as potential changes in consumer protection laws or gainful employment rules, to maintain operational integrity and mitigate legal risks across its diverse portfolio.

Environmental factors

Graham Holdings faces increasing pressure from stakeholders to demonstrate strong corporate social responsibility and environmental stewardship. This translates into a need to integrate sustainability into core operations.

The company's commitment to reducing its environmental footprint and transparently reporting on Environmental, Social, and Governance (ESG) metrics is crucial for attracting and retaining investors. For instance, in 2024, the S&P 500 companies with robust ESG practices saw an average outperformance of 3-5% compared to those with weaker profiles, highlighting the financial benefit of sustainability.

As of early 2025, investors are increasingly scrutinizing companies based on their ESG performance, making robust reporting and tangible initiatives vital for Graham Holdings' brand reputation and long-term investor relations.

Graham Holdings' diverse operations, spanning manufacturing facilities and large educational and broadcasting sites, inherently contribute to its carbon footprint. The company's energy consumption across these varied sectors is a key factor in its environmental impact.

Assessing and actively reducing energy use and greenhouse gas emissions is a significant and growing environmental concern for businesses. This focus on corporate responsibility is increasingly important for stakeholders and regulatory bodies.

While specific 2024/2025 carbon footprint data for Graham Holdings is not publicly detailed, the broader trend in the media and education sectors shows a push towards sustainability. For instance, many media companies are investing in energy-efficient broadcasting technologies and sustainable office practices to lower their environmental impact.

Manufacturing firms like Graham Holdings are increasingly pressured to minimize waste and use resources more effectively. For instance, the U.S. EPA reported that in 2022, industrial sectors generated 150 million tons of solid waste, highlighting a significant area for improvement.

Adopting robust waste management strategies, such as enhanced recycling programs and material reuse, not only aids environmental compliance but also directly impacts operational costs. In 2024, companies focusing on circular economy principles saw an average reduction in material costs by 10-15%.

Climate change impact on supply chains

Climate change presents tangible risks to Graham Holdings' supply chains, especially impacting its manufacturing operations. Extreme weather events, such as hurricanes or prolonged droughts, can directly disrupt production facilities and damage inventory. For instance, the increasing frequency of severe weather in regions where manufacturing components are sourced could lead to significant delays and increased costs.

Resource scarcity, another facet of climate change, can affect the availability and price of raw materials essential for Graham Holdings' products. Water scarcity in agricultural regions, for example, could impact the supply of certain natural fibers or agricultural byproducts used in manufacturing. This necessitates a proactive approach to sourcing and potentially exploring alternative materials.

Transportation networks, vital for moving goods, are also vulnerable. Rising sea levels and more intense storms can threaten port operations and inland waterways, creating bottlenecks. In 2024, the global supply chain experienced disruptions from climate-related events, with the World Meteorological Organization reporting a significant increase in weather and climate disasters compared to previous decades, underscoring the need for robust risk assessment and mitigation strategies to ensure operational resilience for Graham Holdings.

- Supply Chain Vulnerability: Extreme weather events can halt production and damage goods, impacting companies like Graham Holdings.

- Resource Scarcity: Climate change can limit access to essential raw materials, driving up costs and necessitating material diversification.

- Transportation Disruptions: Threats to ports and logistics infrastructure due to climate impacts can cause significant delays and increase operational expenses.

- Mitigation Imperative: Proactive risk assessment and adaptation strategies are crucial for maintaining supply chain stability and operational resilience in the face of climate change.

Environmental regulations and compliance costs

Graham Holdings, like many diversified media and education companies, navigates a complex web of environmental regulations. These laws, covering everything from air emissions at broadcast facilities to waste management at educational campuses, necessitate significant investment in compliance infrastructure and ongoing operational adjustments. For instance, in 2024, companies in the media sector faced increasing scrutiny over energy consumption and carbon footprint reporting, potentially impacting broadcast operations and data center management.

The financial implications of environmental compliance are substantial. Costs for permits, pollution control equipment, and potential site remediation can directly affect profitability and capital allocation. For 2025, analysts project that investments in sustainable practices and reporting frameworks, driven by both regulatory pressures and investor demand, will continue to rise across the industry. This trend may influence strategic decisions regarding facility upgrades and the adoption of greener technologies.

- Regulatory Landscape: Graham Holdings must adhere to diverse environmental laws governing emissions, waste, and land use, impacting all its operational segments.

- Compliance Costs: Expenses related to permits, pollution control, and potential remediation efforts represent a significant factor in operational budgeting and investment planning for 2024-2025.

- Energy and Emissions: The media industry, including Graham Holdings' broadcast operations, faces growing pressure to manage energy consumption and reduce carbon emissions, with compliance costs potentially rising in 2025.

- Sustainable Investments: Anticipated increases in investments towards sustainable practices and transparent environmental reporting are expected to influence strategic decisions and financial outlays for the company.

Graham Holdings must navigate evolving environmental regulations, impacting operations from manufacturing to broadcasting. Compliance costs, including permits and pollution control, are significant, with projections indicating continued investment in sustainable practices for 2025.

The company's diverse operations, including manufacturing and large educational sites, contribute to its environmental footprint, particularly through energy consumption. Addressing this requires a focus on reducing energy use and greenhouse gas emissions, a trend mirrored across the media and education sectors.

Climate change poses risks to Graham Holdings' supply chains through extreme weather and resource scarcity, affecting raw material availability and transportation networks. Proactive risk assessment and adaptation are crucial for maintaining operational resilience.

The drive for sustainability and transparent ESG reporting is paramount for investor relations, as companies with strong ESG profiles have shown outperformance. This necessitates tangible initiatives and robust reporting to maintain brand reputation and attract investment.

| Environmental Factor | Impact on Graham Holdings | 2024/2025 Data/Trend |

|---|---|---|

| Regulatory Compliance | Costs for permits, pollution control, and potential remediation | Increased scrutiny on energy consumption and carbon footprint reporting in media sector; projected rise in sustainable investments. |

| Energy Consumption & Emissions | Carbon footprint from manufacturing, broadcasting, and educational facilities | Broader industry trend towards energy-efficient technologies and sustainable office practices. |

| Climate Change Risks | Supply chain disruptions (weather, resource scarcity), transportation vulnerabilities | Increased frequency of severe weather events impacting global supply chains; need for robust risk mitigation. |

| Waste Management | Operational costs and environmental impact from manufacturing processes | Companies focusing on circular economy principles saw average material cost reductions of 10-15% in 2024. |

PESTLE Analysis Data Sources

Our Graham Holdings PESTLE Analysis is meticulously constructed using a blend of public and proprietary data. We draw insights from leading industry publications, financial reports, and government regulatory filings to ensure a comprehensive understanding of the operating environment.