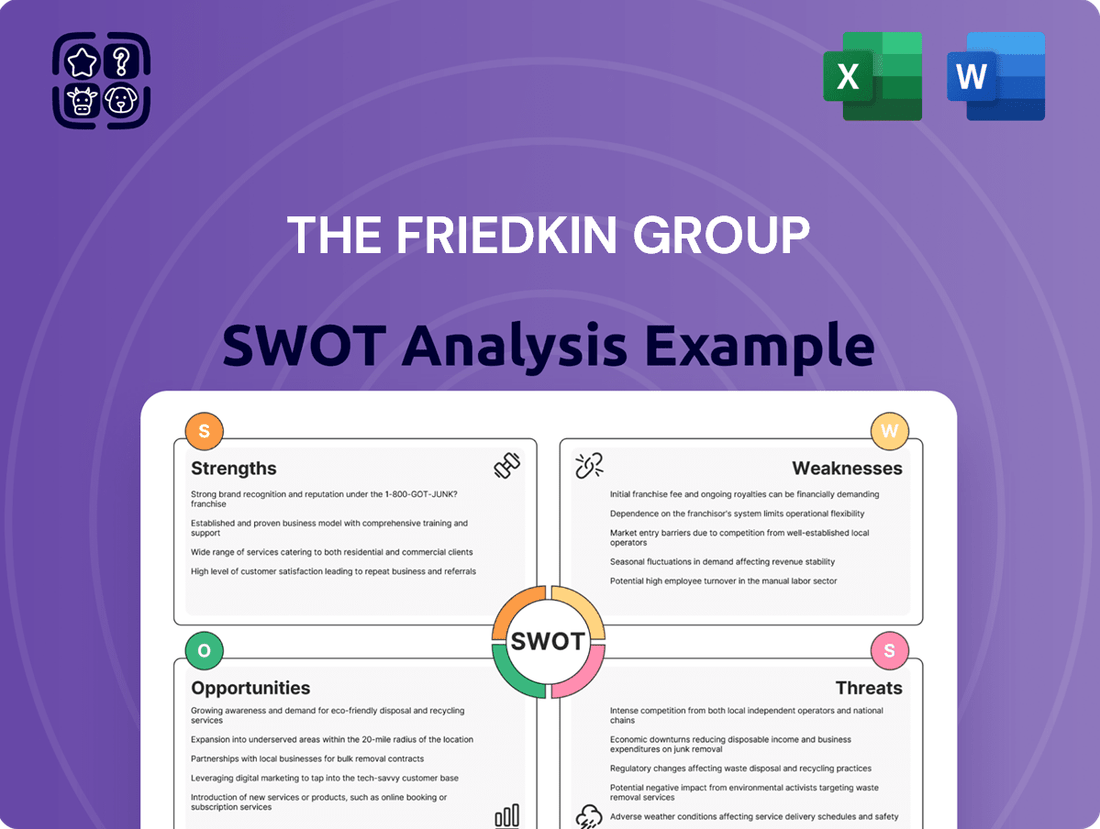

The Friedkin Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Friedkin Group Bundle

The Friedkin Group, a diversified conglomerate, navigates a landscape rich with opportunity but also fraught with potential challenges. While their diverse portfolio across sectors like automotive and entertainment presents significant strengths, understanding the nuances of their market position and competitive pressures is crucial.

Want the full story behind The Friedkin Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

The Friedkin Group's diverse portfolio, spanning automotive distribution, entertainment, luxury hospitality, golf course management, and adventure travel, offers substantial strength through diversification. This broad investment strategy effectively mitigates risks tied to any single industry's performance, creating multiple revenue streams and lessening dependence on specific market segments.

This diversification is exemplified by Gulf States Toyota, recognized as one of the largest private auto distributors worldwide. Concurrently, the Auberge Resorts Collection is actively expanding its presence in the luxury hospitality sector, demonstrating the group's ability to generate income from varied and robust business operations.

The Friedkin Group's ownership of Auberge Resorts Collection positions it strongly in the high-end travel sector. This collection is renowned for its unique, boutique luxury experiences, attracting a discerning clientele.

Auberge Resorts Collection is demonstrating robust growth, with planned openings in London and Florence in 2025, and a further expansion into Houston by 2027. This strategic expansion aligns with the luxury hospitality market's projected significant growth, indicating a positive outlook for the group's ventures in this segment.

The Friedkin Group benefits from the strategic leadership and investment acumen of Chairman and CEO Dan Friedkin. His proven track record includes significant acquisitions in the sports sector, such as AS Roma and Everton FC, alongside the creation of Pursuit Sports to manage and grow these ventures.

This leadership is further underscored by recent financial maneuvers, like securing $200 million for European software investments via Copilot Capital in early 2024. This move highlights a proactive and forward-thinking approach to capital deployment across diverse and promising markets.

Established Automotive Distribution Network

Gulf States Toyota (GST), a key component of The Friedkin Group, stands as one of the nation's largest independent distributors for Toyota vehicles and parts. This robust network, which supports over 150 dealerships across five states, generates a significant and dependable revenue stream for the group.

The established distribution infrastructure ensures consistent market penetration and sales volume, a critical advantage in the competitive automotive sector. For instance, in 2023, GST reported strong sales figures, contributing substantially to the group's overall financial performance, with projections for 2024 indicating continued growth driven by demand for Toyota's popular models.

Furthermore, The Friedkin Group is actively integrating advanced technologies, including artificial intelligence, to optimize its distribution processes. This strategic adoption of AI aims to enhance efficiency, improve inventory management, and strengthen relationships with its dealership network, further solidifying its market position.

- Extensive Reach: Serves over 150 Toyota dealerships across five U.S. states, ensuring broad market coverage.

- Consistent Revenue: Operates as a major independent distributor, providing a stable and substantial income base.

- Technological Advancement: Implementing AI to enhance operational efficiency and distribution management.

- Market Leadership: Maintains a strong position as a leading independent distributor in a key automotive market.

Growing Entertainment Presence

The Friedkin Group's burgeoning entertainment presence is a significant strength, anchored by Imperative Entertainment's robust film, television, and documentary production capabilities. This segment has delivered critically acclaimed projects, including the Oscar-nominated 'Killers of the Flower Moon,' showcasing a strong track record in high-quality content creation.

The group further bolsters its entertainment footprint through a majority stake in Neon, a key player in theatrical marketing and distribution. This strategic ownership allows The Friedkin Group to control a vital part of the content lifecycle, from production to audience engagement.

This dual approach—producing content and managing its distribution—creates a synergistic platform for creative endeavors and diversifies the group's overall revenue streams. For instance, Neon's distribution success, exemplified by its role in films like 'Parasite,' underscores the value of this integrated entertainment strategy.

- Imperative Entertainment's filmography includes major releases like 'Killers of the Flower Moon.'

- Neon, a distribution company majority-owned by The Friedkin Group, handles theatrical marketing.

- This entertainment division contributes to brand building and diverse revenue generation.

The Friedkin Group's diversified business model is a core strength, encompassing automotive distribution through Gulf States Toyota, luxury hospitality via Auberge Resorts Collection, and a growing entertainment arm with Imperative Entertainment and Neon. This broad portfolio mitigates risk and creates multiple revenue streams, as seen in GST's position as one of the largest private auto distributors globally and Auberge's expansion into new luxury markets.

The group's strategic leadership, particularly under Chairman and CEO Dan Friedkin, is another significant asset. Friedkin's acumen is evident in successful ventures like the acquisition and management of AS Roma and Everton FC, as well as strategic capital deployment, such as the $200 million allocated for European software investments in early 2024 through Copilot Capital.

Gulf States Toyota's established infrastructure, serving over 150 dealerships across five states, provides a consistent and substantial revenue base. The integration of AI to optimize distribution processes further enhances operational efficiency and market position, ensuring continued growth in the automotive sector.

The entertainment division, with Imperative Entertainment producing acclaimed projects like 'Killers of the Flower Moon' and Neon managing theatrical distribution, adds significant value. This integrated approach allows for control over content creation and audience engagement, contributing to brand building and diversified income.

| Segment | Key Operation | Recent/Projected Data Point |

| Automotive Distribution | Gulf States Toyota (GST) | Serves over 150 Toyota dealerships; implementing AI for efficiency. |

| Luxury Hospitality | Auberge Resorts Collection | Expansion with openings in London and Florence (2025), Houston (2027). |

| Entertainment | Imperative Entertainment / Neon | 'Killers of the Flower Moon' (Oscar-nominated); Neon handles theatrical distribution. |

| Sports | AS Roma / Everton FC | Managed under Pursuit Sports; significant investment in European football. |

| Investment | Copilot Capital | Secured $200 million for European software investments (early 2024). |

What is included in the product

This analysis provides a comprehensive overview of The Friedkin Group's internal capabilities and external market challenges, identifying key growth drivers and potential weaknesses.

Offers a clear, actionable framework to identify and address The Friedkin Group's strategic vulnerabilities and leverage its competitive advantages.

Weaknesses

While The Friedkin Group's broad diversification across sectors like automotive, entertainment, and hospitality is a strategic advantage, it introduces significant management complexity. Managing such a varied portfolio, which includes businesses like Gulf States Toyota Distributors and the entertainment ventures of NEON, demands specialized expertise for each distinct market. This can strain management resources, as evidenced by the diverse operational needs ranging from automotive supply chain logistics to film production financing, potentially impacting overall efficiency.

While The Friedkin Group has diversified its holdings, it's important to acknowledge that each sector it operates in carries its own unique risks. For instance, the automotive sector, a significant part of their portfolio, can be hit hard by economic downturns, leading to reduced consumer spending on vehicles. In 2024, global automotive sales are projected to see modest growth, but persistent inflation and interest rate hikes could dampen demand, impacting companies like Gulf States Toyota Distributors.

Similarly, the luxury hospitality sector, though currently experiencing strong demand, is inherently sensitive to broader economic shifts and unforeseen global events. A recession or a significant geopolitical event could drastically curtail discretionary spending on travel and leisure, affecting businesses like Ten Thousand Waves. This reliance on specific industry cycles means that even with diversification, the group isn't entirely insulated from sector-specific downturns.

The Friedkin Group's considerable achievements are undeniably linked to the strategic direction and leadership of its founder, Dan Friedkin. This concentration of vision, while a driving force, presents a potential vulnerability if robust succession plans are not in place or if critical strategic choices become excessively dependent on one person's singular perspective.

Geographical Concentration in Automotive Distribution

The Friedkin Group's automotive distribution arm, Gulf States Toyota, faces a significant weakness due to its heavy geographical concentration. Its exclusive distribution rights are confined to a specific set of U.S. states: Texas, Oklahoma, Arkansas, Mississippi, and Louisiana. This intense regional focus, while allowing for deep market penetration, creates a vulnerability to localized economic shocks. For instance, a severe regional recession or widespread natural disasters, like the floods that have impacted Texas in recent years, could disproportionately affect sales and operations. In 2023, Texas alone accounted for a substantial portion of new vehicle sales in the U.S., highlighting the potential impact of regional volatility.

This concentration means that adverse events impacting this particular geographic area can have a magnified effect on the company's overall automotive performance.

- Geographic Limitation: Exclusive distribution rights are limited to Texas, Oklahoma, Arkansas, Mississippi, and Louisiana.

- Economic Sensitivity: High exposure to regional economic downturns in these specific states.

- Disaster Risk: Vulnerability to natural disasters, such as severe weather events impacting the Gulf Coast region.

- Market Share Dependency: Over-reliance on the performance of a concentrated group of states for automotive segment revenue.

Public Scrutiny and Reputation Management in Sports Holdings

The Friedkin Group's ownership of prominent football clubs, including AS Roma and Everton FC, subjects them to intense public and media scrutiny. This spotlight often focuses on financial compliance and on-field performance, creating a constant need for proactive reputation management.

Recent actions, such as the transfer of Everton's women's team to a related entity to navigate financial fair play rules, underscore the delicate balance required. Such moves, while potentially strategic, can attract further attention and necessitate clear communication to maintain public trust.

- Increased Scrutiny: Ownership of AS Roma and Everton FC places The Friedkin Group under a microscope regarding financial dealings and club results.

- Reputation Risk: Public perception is heavily influenced by club performance and adherence to financial regulations in football.

- Financial Fair Play (FFP) Pressures: Navigating FFP rules, as seen with the Everton women's team sale in early 2024, can lead to public questioning and reputational challenges.

- Media Attention: High-profile sports holdings guarantee consistent media coverage, demanding careful narrative control and transparency.

The Friedkin Group's extensive diversification, while a strength, also presents a significant weakness in terms of management complexity. Overseeing disparate industries like automotive distribution, entertainment, and hospitality requires specialized knowledge for each, potentially stretching management resources and impacting operational efficiency across the board.

Full Version Awaits

The Friedkin Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear overview of The Friedkin Group's Strengths, Weaknesses, Opportunities, and Threats.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain a comprehensive understanding of the strategic landscape.

Opportunities

The global luxury hospitality market is on a strong upward trajectory, with industry forecasts indicating continued growth and a rising demand for high-end travel experiences. This presents a significant opportunity for The Friedkin Group.

Through its Auberge Resorts Collection, The Friedkin Group is well-positioned to leverage this expansion. The group can strategically acquire or develop new properties in sought-after global destinations, further solidifying its presence in the premium segment.

For instance, the luxury travel market was valued at over $1.3 trillion in 2023 and is projected to reach $2.1 trillion by 2030, demonstrating robust year-over-year growth. This market expansion directly aligns with The Friedkin Group's strategy to enhance its luxury hospitality portfolio.

The creation of Pursuit Sports, consolidating assets like AS Roma and Everton FC, presents a significant opportunity. This unified structure allows for cross-promotional activities, sharing operational expertise, and amplifying brand visibility across diverse international fan bases.

This synergy can drive substantial commercial revenue growth, as seen with AS Roma's reported revenue of €250 million for the 2023-24 season, and Everton's ongoing efforts to boost their commercial appeal. The expanded global reach through these clubs enhances sponsorship opportunities and merchandise sales.

The Friedkin Group's recent $200 million investment in European software scale-ups via Copilot Capital clearly signals a strategic focus on technology. This move positions the group to capitalize on emerging technological advancements.

This investment opens significant avenues for The Friedkin Group to integrate cutting-edge technologies, such as artificial intelligence, across its varied business segments. Such integration promises to enhance operational efficiency, elevate customer experiences, and uncover novel business models.

Growth in Adventure Travel and Experiential Luxury

The Friedkin Group's investment in properties like Mwiba Lodge in Tanzania directly taps into the burgeoning adventure travel sector. This segment is experiencing significant growth, with projections indicating continued expansion through 2025 and beyond as consumers increasingly prioritize authentic, immersive experiences over traditional tourism.

Leveraging the established reputation of the Auberge Resorts Collection, Friedkin can amplify its high-end adventure travel offerings. This synergy allows for the development and targeted marketing of luxury adventure packages, appealing to a demographic willing to pay a premium for unique and memorable journeys. The global adventure tourism market was valued at over $1.5 trillion in 2023 and is expected to grow at a compound annual growth rate of around 13% through 2030, highlighting a substantial opportunity.

- Expanding Mwiba Lodge's experiential offerings: Incorporating more specialized activities like conservation safaris or cultural immersion programs.

- Cross-promotion with other Auberge properties: Creating package deals that combine luxury stays with adventure elements across different locations.

- Targeted digital marketing campaigns: Focusing on platforms and demographics interested in luxury adventure and sustainable travel.

- Partnerships with luxury travel agencies: Collaborating to curate exclusive adventure travel itineraries for high-net-worth individuals.

Strategic Acquisitions and Partnerships

The Friedkin Group's consortium structure and substantial financial backing present significant avenues for strategic acquisitions. These opportunities extend to bolstering their automotive distribution network and expanding their footprint in the luxury hospitality sector. For instance, by acquiring dealerships in high-growth emerging markets, they could tap into new customer bases and increase revenue streams.

Furthermore, strategic partnerships and acquisitions in the entertainment and media industries offer a chance to diversify revenue and leverage existing brand equity. Consider the potential to acquire or partner with a film production company or a streaming service to create synergistic content opportunities. This aligns with their existing investments and could lead to cross-promotional benefits, enhancing overall market presence and profitability.

The group's capacity to invest in complementary sectors was evident in their reported significant capital reserves as of late 2024, estimated to be in the billions, allowing for bold moves. Potential targets could include companies specializing in electric vehicle technology or sustainable tourism infrastructure, aligning with global market trends and future growth potential.

- Acquire EV charging infrastructure companies to complement automotive distribution.

- Partner with luxury travel operators to enhance hospitality offerings.

- Invest in sports media rights to expand entertainment portfolio.

- Secure majority stakes in high-potential tech startups within their operational spheres.

The global luxury hospitality market is experiencing robust growth, with forecasts suggesting continued expansion through 2025 and beyond. The Friedkin Group, through its Auberge Resorts Collection, is ideally positioned to capitalize on this trend by acquiring or developing new properties in prime global locations, further solidifying its premium market presence.

The consolidation of sports assets under Pursuit Sports, including AS Roma and Everton FC, creates significant cross-promotional opportunities and operational synergies. This unified approach can drive substantial commercial revenue growth, leveraging the expansive international fan bases of these clubs for enhanced sponsorship and merchandise sales.

The Friedkin Group's strategic investment in European software scale-ups via Copilot Capital highlights a focus on technology integration. This move allows for the adoption of cutting-edge technologies, such as AI, across its diverse business segments to improve efficiency, customer experience, and explore new business models.

The burgeoning adventure travel sector, valued at over $1.5 trillion in 2023 and projected for strong growth, presents a key opportunity, particularly with properties like Mwiba Lodge. By leveraging the Auberge Resorts Collection's reputation, Friedkin can develop and market premium adventure travel packages to a demographic seeking unique experiences.

The group's substantial financial backing and consortium structure enable strategic acquisitions to strengthen its automotive distribution network and expand its luxury hospitality footprint. Potential acquisitions in emerging markets or complementary sectors like electric vehicle technology can drive significant revenue growth and market presence.

| Opportunity Area | Market Trend | Friedkin Group Action | Potential Impact |

|---|---|---|---|

| Luxury Hospitality | Global luxury travel market projected to reach $2.1 trillion by 2030. | Acquire/develop new Auberge Resorts properties in high-demand destinations. | Increased market share and revenue in the premium segment. |

| Sports & Entertainment | Growing global sports fan engagement and digital media consumption. | Leverage Pursuit Sports for cross-promotion and fan monetization. | Enhanced brand visibility, sponsorship revenue, and merchandise sales. |

| Technology Integration | Rapid advancements in AI and digital transformation across industries. | Invest in tech scale-ups (Copilot Capital) for operational efficiency. | Improved customer experiences and identification of novel business models. |

| Adventure Travel | Adventure tourism market expected to grow at ~13% CAGR through 2030. | Expand experiential offerings at Mwiba Lodge and similar properties. | Tap into high-spending demographic seeking unique, immersive journeys. |

| Strategic Acquisitions | Demand for EVs and sustainable infrastructure is rising. | Acquire EV charging companies or sustainable tourism infrastructure. | Diversify revenue streams and align with future market trends. |

Threats

A severe economic downturn could significantly curb consumer spending, especially for luxury goods and services offered by The Friedkin Group, such as high-end hospitality and automotive sales. This reduction in discretionary spending, driven by lower disposable incomes, directly threatens revenue streams across multiple business units.

The Friedkin Group navigates highly competitive landscapes in each of its core sectors. In automotive distribution, it contends with established global players, while its luxury hospitality ventures face off against renowned international hotel brands. Similarly, the entertainment production arm competes directly with major Hollywood studios and dominant streaming services, demanding constant strategic adaptation to secure and grow market share.

The Friedkin Group faces significant regulatory and compliance risks across its sports and automotive holdings. In sports, particularly football, stringent financial regulations like UEFA's Profit and Sustainability Rules (PSR) can impact club operations and profitability, as evidenced by past breaches by clubs like Everton FC, which incurred points deductions. This regulatory landscape demands careful financial management to avoid penalties.

Similarly, the automotive sector is under constant scrutiny regarding vehicle safety and emissions standards. Recalls, such as those impacting millions of vehicles globally in recent years due to airbag defects or emissions control issues, can result in substantial financial liabilities and severe reputational damage. For instance, in 2023, automotive recalls in the US alone affected over 30 million vehicles, highlighting the pervasive nature of this risk.

Failure to adhere to these evolving regulatory frameworks in either sector could expose The Friedkin Group to considerable financial penalties, legal challenges, and a tarnished brand image, directly impacting its financial performance and strategic objectives.

Brand Dilution Across Multiple Ventures

The Friedkin Group's extensive diversification, while a strength, also presents a significant threat of brand dilution. Managing a wide portfolio spanning automotive, entertainment, and hospitality, among others, makes it difficult to maintain a consistent brand message and quality across all ventures.

This can lead to a weakening of the core Friedkin brand perception. For instance, if a venture in a less familiar sector underperforms, it could inadvertently tarnish the reputation of more established businesses within the group.

- Brand Consistency Challenge: Maintaining a unified brand identity across diverse sectors like Gulf States Utility and AS Roma is complex.

- Perception Risk: A negative customer experience in one Friedkin-owned entity could spill over, impacting trust in others.

- Resource Strain: Spreading marketing and management resources thinly across numerous brands can diminish the impact of any single brand's efforts.

Geopolitical Instability and Global Events

The Friedkin Group's international operations, especially in sports and luxury travel, face significant risks from geopolitical instability. Global conflicts or health crises can severely disrupt travel patterns, dampen consumer confidence, and strain international business relationships. For example, the ongoing geopolitical tensions in Eastern Europe and the lingering effects of the COVID-19 pandemic in 2024 continued to impact global travel and discretionary spending, potentially affecting revenue streams for the group's hospitality and entertainment ventures.

These global events can lead to a sharp decline in tourism and luxury spending, directly impacting businesses reliant on international clientele. The economic fallout from such disruptions can manifest as reduced bookings, lower per-customer spending, and increased operational costs due to supply chain issues or regulatory changes. In 2024, the International Air Transport Association (IATA) reported that while air travel was recovering, geopolitical factors remained a key concern for sustained growth in the sector.

- Geopolitical Risk Exposure: International sports franchises and luxury hospitality ventures are inherently exposed to disruptions caused by global political events and health emergencies.

- Economic Impact on Consumer Spending: Events like regional conflicts or widespread health concerns can significantly reduce discretionary spending on travel and leisure, directly affecting The Friedkin Group's revenue.

- Operational Challenges: Global instability can lead to increased operational costs, supply chain disruptions, and regulatory hurdles for businesses with a significant international footprint.

Intensifying competition across its diverse portfolio presents a constant challenge for The Friedkin Group. In the automotive sector, the rise of electric vehicles and new market entrants necessitates significant investment in R&D and adaptation to evolving consumer preferences. Similarly, the luxury hospitality market is fiercely competitive, with established brands and boutique hotels vying for market share. The entertainment industry, dominated by streaming giants and major studios, requires continuous innovation and substantial content investment to capture audience attention and maintain relevance.

| Sector | Key Competitive Pressures | 2024/2025 Outlook |

|---|---|---|

| Automotive | EV transition, new entrants, supply chain disruptions | High investment required for electrification; market share shifts likely |

| Hospitality | Boutique hotel growth, experiential travel demand, labor shortages | Focus on unique guest experiences and operational efficiency crucial |

| Entertainment | Streaming wars, content cost inflation, audience fragmentation | Significant content spend needed; diversification of revenue streams important |

SWOT Analysis Data Sources

This SWOT analysis is built using a robust combination of publicly available financial reports, comprehensive market research, and insights from industry experts to provide a well-rounded and accurate assessment of The Friedkin Group's strategic position.