The Friedkin Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Friedkin Group Bundle

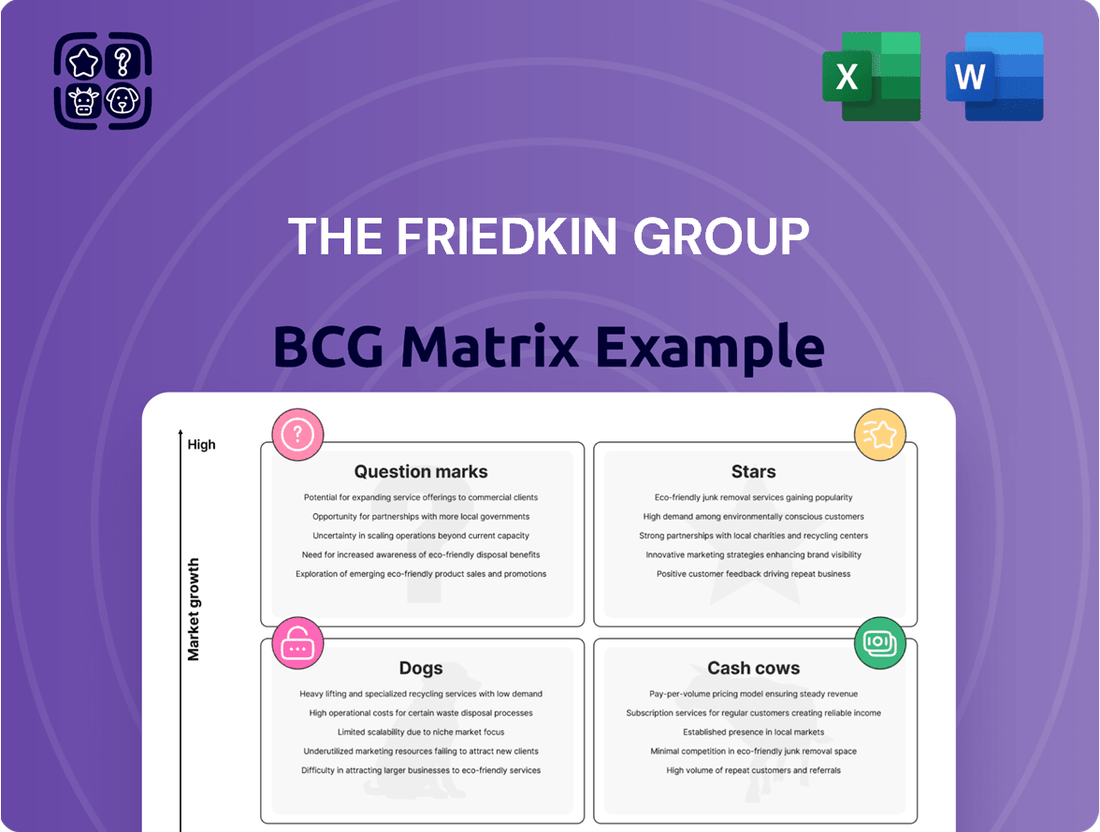

Uncover the strategic positioning of The Friedkin Group's diverse portfolio with a glimpse into their BCG Matrix. See which ventures are poised for growth and which are generating consistent returns, offering a crucial snapshot of their market performance.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for The Friedkin Group.

Stars

Auberge Resorts Collection shines as a Star for The Friedkin Group, capitalizing on the robust luxury hospitality sector. This market segment is experiencing impressive growth, valued at $154.32 billion in 2024 and expected to climb to $166.41 billion in 2025, with a projected compound annual growth rate of 10.5% through 2030.

Auberge's strategic expansion into key European and urban markets further solidifies its Star status. The brand is set to launch new properties in Florence, Italy, and London, UK, in 2025, and will also open in Houston, Texas, in 2027, demonstrating a clear commitment to high-potential growth areas.

The Friedkin Group's venture into adventure travel via Legendary Expeditions places it within a rapidly expanding sector. This market is forecast to surge from $351.57 billion in 2024 to $424.28 billion by 2025, reflecting a robust 20.7% compound annual growth rate.

Imperative Entertainment, a key player within The Friedkin Group, shines as a star in the BCG Matrix due to its consistent delivery of critically acclaimed and commercially successful film and television projects. Co-founded by Dan Friedkin, the company's involvement in high-profile productions like the Academy Award-nominated 'Killers of the Flower Moon' and 'All the Money in the World' underscores its ability to capture significant market attention and critical praise in a highly competitive landscape.

This track record of producing impactful content positions Imperative Entertainment as a high-growth entity within its specialized segment of the entertainment industry. While the broader entertainment sector experiences fluctuating growth, Imperative Entertainment's demonstrated capacity for quality and its engagement with prestigious projects suggest strong forward momentum and a leading market position.

Luxury Real Estate and Branded Residences

Luxury real estate, particularly branded residences, represents a dynamic growth area within the hospitality sector, and The Friedkin Group's Auberge Resorts Collection is strategically positioned to capitalize on this trend.

This segment caters to a discerning clientele seeking not just luxury, but also the prestige and services associated with established luxury brands. The demand for private, personalized, and exclusive accommodations continues to rise, making branded residences a compelling offering.

BDT & MSD Partners' significant investment in Auberge Resorts Collection, announced in 2024, underscores the market's confidence in this niche. This capital infusion is earmarked for acquiring and developing high-end hotel and residential assets, signaling a robust growth trajectory for the brand.

- Growing Market Segment: The global luxury real estate market is experiencing robust growth, with branded residences emerging as a key driver.

- Increased Demand for Exclusivity: Consumers are increasingly prioritizing privacy, personalized experiences, and unique amenities in their accommodation choices.

- Strategic Investment: The 2024 investment by BDT & MSD Partners in Auberge Resorts Collection highlights significant confidence in the expansion potential of luxury hospitality and residential offerings.

- Brand Value Enhancement: Integrating residential components with established luxury hotel brands offers a synergistic approach, enhancing both property values and guest loyalty.

Pursuit Sports

Pursuit Sports, launched by The Friedkin Group in July 2025, is positioned as a star within their portfolio due to its high growth potential in the evolving sports industry. This new entity is designed to consolidate and enhance the performance of their sports assets, such as AS Roma and Everton FC. By focusing on data-driven strategies, Pursuit Sports aims to replicate the commercial achievements of established multi-club ownership models.

The strategic intent behind Pursuit Sports is to create a synergistic ecosystem for its football clubs. This approach is supported by the growing trend of multi-club ownership, which has seen significant financial growth. For instance, the global sports market was valued at an estimated $488.5 billion in 2023 and is projected to reach $614.1 billion by 2027, indicating a robust expansion phase.

- Centralized Operations: Pursuit Sports will streamline management and operational efficiencies across its clubs.

- Data-Driven Performance: Leveraging advanced analytics to inform player recruitment, training, and tactical strategies.

- Commercial Scalability: Aiming to maximize revenue streams through shared resources and cross-promotional activities.

- Market Expansion: Exploring opportunities to acquire and develop new sports properties in high-growth markets.

Imperative Entertainment represents a Star for The Friedkin Group, consistently delivering high-quality content in the competitive film and television landscape. Its success is evidenced by critically acclaimed projects like Killers of the Flower Moon, showcasing its ability to generate significant market attention and critical praise.

Auberge Resorts Collection is another Star, thriving in the expanding luxury hospitality sector. Its strategic global expansion, including new openings in Florence and London in 2025, highlights its strong growth trajectory and market penetration.

Pursuit Sports, launched in July 2025, is positioned as a Star, aiming to optimize The Friedkin Group's sports assets through data-driven strategies and multi-club ownership synergies. This venture taps into the robust growth of the global sports market, projected to reach $614.1 billion by 2027.

Legendary Expeditions, focusing on adventure travel, is a Star due to the sector's rapid expansion. The adventure travel market is expected to grow from $351.57 billion in 2024 to $424.28 billion by 2025, a strong indicator of its high-potential growth.

| Business Unit | BCG Category | Key Growth Drivers | Market Data Point (2024/2025) |

|---|---|---|---|

| Auberge Resorts Collection | Star | Luxury hospitality growth, branded residences demand, strategic investments | Luxury hospitality sector valued at $154.32 billion (2024) |

| Imperative Entertainment | Star | Critically acclaimed content, strong market attention, high-profile productions | N/A (qualitative success metrics) |

| Pursuit Sports | Star | Multi-club ownership trend, data-driven strategies, sports market expansion | Global sports market projected to reach $614.1 billion by 2027 |

| Legendary Expeditions | Star | Adventure travel surge, increasing demand for unique experiences | Adventure travel market forecast to reach $424.28 billion by 2025 |

What is included in the product

This BCG Matrix analysis provides a strategic overview of The Friedkin Group's portfolio, categorizing business units.

It highlights which units to invest in, hold, or divest for optimal resource allocation.

The Friedkin Group BCG Matrix clarifies portfolio performance, relieving the pain of unclear strategic direction.

Cash Cows

Gulf States Toyota stands as a significant cash cow for The Friedkin Group, operating as one of the largest independent distributors of Toyota vehicles and parts globally. This robust operation supports over 150 dealerships spread across five states and has consistently been recognized on Forbes' America's Largest Private Companies list.

In 2024, the automotive sector, while facing some economic headwinds, continues to demonstrate resilience, particularly for established players with strong distribution networks like Gulf States Toyota. The company's consistent high market share and operational efficiency generate substantial and reliable cash flow, requiring minimal reinvestment for growth.

Established Auberge Resorts properties are indeed the cash cows for The Friedkin Group. These luxury hotels operate in a mature market but consistently deliver strong profits. Their high occupancy rates and premium pricing are testament to their excellent reputation and service. For instance, in 2023, several Auberge Resorts properties reported occupancy rates exceeding 80%, a significant achievement in the luxury segment.

The Friedkin Group's ownership of established, high-performing golf clubs such as Congaree and Diamond Creek Golf Club positions them firmly within the cash cow quadrant of the BCG matrix. These properties are likely mature, generating substantial and consistent profits with minimal reinvestment needs.

The golf industry has demonstrated resilience and growth, with reports indicating a significant uptick in participation and revenue. For instance, rounds played have seen an increase, and facility revenue has also risen, underscoring the stable demand for quality golf experiences.

While the broader golf course management market is projected to grow at a compound annual growth rate of 4.7% between 2024 and 2031, existing, well-established clubs like those owned by Friedkin typically require less capital for marketing and expansion. This allows them to serve as reliable sources of cash flow to fund other business ventures.

Toyota and Lexus Vehicle Distribution

The distribution of Toyota and Lexus vehicles and parts through Gulf States Toyota represents a significant cash cow for The Friedkin Group. This core business enjoys a dominant market share within its service regions, a testament to the enduring appeal and consistent demand for Toyota and Lexus vehicles. The company’s robust distribution network and deep-rooted partnerships with dealerships ensure a reliable and predictable stream of revenue.

In 2024, the automotive sector, particularly the luxury and reliable segments represented by Lexus and Toyota respectively, continued to show resilience. Gulf States Toyota’s performance is intrinsically linked to these brand strengths. For instance, Toyota was consistently ranked among the top automotive brands globally for sales volume and customer satisfaction throughout the early 2020s, a trend expected to persist. Lexus, meanwhile, has solidified its position in the premium market, often leading in customer loyalty metrics.

- Market Dominance: Gulf States Toyota commands a high market share in its distribution territories, benefiting from the strong brand equity of Toyota and Lexus.

- Consistent Demand: The unwavering popularity and reliability of Toyota and Lexus vehicles create a stable demand for both new vehicles and replacement parts.

- Established Infrastructure: A well-developed distribution network and long-standing dealer relationships contribute to operational efficiency and predictable cash flows.

- Brand Strength: Toyota and Lexus consistently rank high in global sales and customer satisfaction, underpinning the segment's cash-generating ability.

GSFSGroup and Related Automotive Services

GSFSGroup and its related automotive services, including US AutoLogistics, Ascent Automotive Group, Westside Lexus, Northside Lexus, and Accelerated Solutions Group, represent significant cash cows within The Friedkin Group's portfolio. These businesses are integral to the success of Gulf States Toyota, providing crucial support functions that generate consistent and substantial revenue. Their established market positions and mature operations indicate a stable, high-margin contribution to the group's overall financial health.

These entities function as vital support mechanisms for the core automotive distribution business. GSFSGroup, for instance, likely offers financial services, while US AutoLogistics handles the complex movement of vehicles. Ascent Automotive Group, along with dealerships like Westside Lexus and Northside Lexus, directly contribute to sales volume and customer retention. Accelerated Solutions Group probably focuses on specialized services that enhance the customer experience and operational efficiency.

- GSFSGroup: Provides essential financial services, likely generating steady interest income and fees.

- US AutoLogistics: Manages the critical and often high-volume transportation of vehicles, ensuring efficient supply chain operations.

- Ascent Automotive Group, Westside Lexus, Northside Lexus: These dealerships capitalize on established brand loyalty and demand for luxury vehicles, offering predictable sales and service revenue.

- Accelerated Solutions Group: Focuses on value-added services, enhancing customer satisfaction and creating additional revenue streams.

The Friedkin Group's portfolio includes several established entities that function as cash cows, generating substantial and consistent profits with minimal need for further investment. These businesses typically operate in mature markets where they hold a strong competitive position.

Gulf States Toyota, a prime example, continues to be a significant cash cow. Its extensive distribution network across five states, supporting over 150 dealerships, ensures a steady flow of revenue from Toyota and Lexus sales and parts. The company’s operational efficiency and market dominance, bolstered by the enduring appeal of Toyota and Lexus brands, contribute to its reliable cash generation.

Similarly, established Auberge Resorts properties represent mature, high-profit assets. Their consistent high occupancy rates, often exceeding 80% in 2023 for luxury segments, and premium pricing strategies underscore their strong market standing and profitability. The golf clubs, such as Congaree and Diamond Creek, also fall into this category, benefiting from the golf industry's resilience and consistent demand for quality experiences.

| Business Segment | Role in BCG Matrix | Key Characteristics | 2024 Outlook/Data Point |

| Gulf States Toyota | Cash Cow | High market share, strong brand loyalty (Toyota/Lexus), established distribution network | Toyota consistently ranks high in global sales and customer satisfaction. |

| Auberge Resorts (Established Properties) | Cash Cow | Luxury market, high occupancy rates, premium pricing, strong reputation | Occupancy rates often exceeded 80% in 2023 for select properties. |

| Congaree & Diamond Creek Golf Clubs | Cash Cow | Mature market, stable demand, minimal reinvestment needs | Golf industry projected to grow at 4.7% CAGR (2024-2031). |

Full Transparency, Always

The Friedkin Group BCG Matrix

The Friedkin Group BCG Matrix preview you are viewing is the exact, fully completed document you will receive upon purchase. This comprehensive analysis is ready for immediate use, offering strategic insights without any watermarks or demo content. You can confidently download this professionally formatted report, knowing it's the final version designed for actionable business planning and competitive analysis.

Dogs

AS Roma, a prominent football club, currently falls into the 'dog' category within The Friedkin Group's BCG Matrix due to its recent financial struggles. The club posted a net loss of €81.4 million for the fiscal year ending June 30, 2024. This figure, while an improvement from the prior year, still represents a substantial financial deficit.

The team's financial health relies heavily on owner investment, with €90 million injected in the 2023/24 season alone. Furthermore, AS Roma faces persistent hurdles in meeting UEFA's Financial Fair Play regulations. Despite ongoing initiatives aimed at bolstering financial sustainability, the club's current low profitability and high cash burn, coupled with a lack of significant revenue growth compared to leading Italian clubs, solidify its position as a dog.

Everton FC, acquired by The Friedkin Group in December 2024, presents as a dog within the BCG Matrix. The club has grappled with substantial financial difficulties, including violations of the Premier League's Profit and Sustainability Rules (PSR), resulting in point deductions. For the 2023-2024 season, Everton incurred a loss of £120.1 million, contributing to their ongoing financial strain and a six-point deduction.

Despite The Friedkin Group's commitment to immediate financial stabilization and strategic investment, Everton's current standing, characterized by a low league position and the necessity for considerable capital to achieve stability and growth, aligns with the dog quadrant. The club lacks a high market share or immediate profitability, underscoring its dog status.

Within The Friedkin Group's entertainment sector, specific ventures under Imperative Entertainment, 30WEST, or NEON might qualify as dogs if they're not yielding substantial returns. These could be niche film projects or experimental content that, while artistically valuable, haven't captured significant market share. For instance, a film with a production budget of $20 million that only grossed $5 million worldwide would be a clear example of a dog, consuming resources without generating positive cash flow.

Less Utilized Golf Course Properties

While the overall golf industry is showing resilience, certain golf course properties within The Friedkin Group's portfolio could be classified as dogs if they exhibit low utilization rates or declining profitability. This might be particularly true for courses located in areas experiencing a downturn in golf participation. For instance, if a specific course saw a year-over-year decrease in rounds played, say a 5% drop in 2024 compared to 2023, it would signal underperformance.

These underperforming assets may necessitate substantial capital injections for revitalization efforts. However, the projected returns on such investments might not justify the expenditure, especially if market conditions remain unfavorable. A property requiring extensive upgrades, such as a $2 million renovation, but only expected to generate an additional $100,000 in annual revenue, would represent a classic dog scenario.

- Underutilization: Properties with significantly lower rounds played per year compared to industry benchmarks, potentially indicating a 20% or more gap in capacity utilization.

- Declining Revenue Trends: Courses experiencing a consistent drop in green fees and ancillary revenue streams, perhaps a 3% annual decline over the past three years.

- High Operating Costs Relative to Income: Properties where operational expenses, like maintenance and staffing, consume a disproportionately large percentage of revenue, exceeding 70%.

- Geographic Challenges: Courses situated in regions with a shrinking golf demographic, potentially reflected in a 10% decrease in local golf association memberships since 2020.

Legacy or Outdated Automotive Service Models

Legacy or outdated automotive service models within The Friedkin Group's portfolio represent potential 'dogs' in a BCG matrix analysis. These are services struggling to keep pace with evolving consumer expectations and technological shifts in the automotive industry.

These models might include specialized repair shops for older vehicle types with diminishing demand, or service centers that haven't invested in modern diagnostic equipment or electric vehicle servicing capabilities. Their inability to adapt drains resources while offering little prospect for future growth or profitability.

- Declining Demand: Services catering to internal combustion engine (ICE) vehicles may see reduced demand as the market shifts towards electric vehicles (EVs). For instance, while the global EV market share was around 14% in 2023, it's projected to grow significantly, potentially making ICE-specific services less relevant.

- Technological Obsolescence: Workshops lacking advanced diagnostic tools or the expertise to service modern vehicle electronics and powertrains are at a disadvantage. The complexity of new vehicle systems requires continuous investment in training and equipment.

- Inefficient Operations: Outdated workflow processes or a lack of integration with digital customer management systems can lead to higher operating costs and lower customer satisfaction compared to more agile competitors.

- Niche Market Saturation: Some legacy services might operate in niche markets that have become saturated or are experiencing a long-term decline in customer base, making profitable expansion unlikely.

Within The Friedkin Group's portfolio, 'dogs' represent ventures with low market share and low growth prospects, often requiring significant investment without commensurate returns. These assets consume resources and may need divestment or substantial restructuring to improve their standing.

AS Roma's financial performance, marked by a €81.4 million net loss in fiscal year 2024, exemplifies a dog due to its low profitability and reliance on owner funding, despite efforts towards sustainability.

Everton FC, acquired in late 2024, also fits the dog category, burdened by financial rule breaches and a £120.1 million loss in the 2023-2024 season, necessitating considerable capital for stabilization.

Other potential dogs include underperforming entertainment projects with low box office returns, niche automotive services catering to declining markets, and golf courses with low utilization rates, all characterized by weak market share and limited growth potential.

Question Marks

Auberge Resorts Collection's ventures into new urban and international locales like Florence, London, and Houston likely position them as question marks within The Friedkin Group's BCG Matrix. These markets demand substantial capital to build brand awareness and capture market share in established luxury segments.

The success of these new Auberge properties hinges on their ability to quickly gain traction with travelers and achieve target occupancy and revenue per available room (RevPAR) metrics. For instance, the luxury hotel market in London saw RevPAR reach approximately $200 in early 2024, a benchmark these new Auberge locations will need to meet or exceed.

The Friedkin Group's potential ventures into new sports, such as reported interest in an NHL expansion team in Houston or a bid for an NBA team, represent classic question marks in a BCG matrix. These markets, particularly Houston, show significant growth potential; the NBA's global revenue reached an estimated $10 billion in the 2022-2023 season, and the NHL is also experiencing a surge in popularity and revenue.

While these sports offer substantial growth opportunities, The Friedkin Group would be entering them with a negligible market share. For instance, establishing a competitive NHL team from scratch requires immense capital, potentially exceeding hundreds of millions of dollars for expansion fees and initial player acquisitions. Similarly, acquiring an existing NBA franchise would involve a significant upfront investment, likely in the billions, reflecting the team's valuation and market position.

The core challenge for these new ventures is their low current market share combined with high growth potential. The group would need to invest heavily to build brand recognition, cultivate a loyal fan base, and assemble a winning team to compete effectively. This necessitates a strategic approach to market penetration and long-term commitment to achieve a dominant position.

Copilot Capital, a new entrant focused on European software, fits the question mark category within The Friedkin Group's BCG Matrix. This sector is characterized by high growth potential, but Copilot's investments are in early-stage or developing businesses. These ventures demand substantial capital and specialized knowledge to achieve scalability, making their future success uncertain.

Emerging Adventure Travel Niche Markets

Emerging adventure travel niche markets represent potential question marks for The Friedkin Group within the broader adventure travel sector. These are areas with high growth prospects but currently low market penetration, demanding significant investment to develop and promote.

Consider the rise of astro-tourism, which saw a surge in interest, with the global market valued at approximately $3.2 billion in 2023 and projected to grow substantially. Another area is regenerative adventure travel, focusing on positive environmental and social impact, which aligns with growing consumer demand for sustainable experiences. The global adventure tourism market itself was valued at over $1.4 trillion in 2023, indicating the vast potential within its sub-segments.

- Astro-tourism: Experiencing remote locations for stargazing and celestial events, tapping into a growing curiosity about space.

- Regenerative Adventure Travel: Journeys designed to leave a place better than they were found, emphasizing conservation and community benefit.

- Wellness Adventure Retreats: Combining physical challenges with mental and spiritual rejuvenation in natural settings.

- Digital Nomad Adventure Hubs: Developing destinations that cater to remote workers seeking adventure and unique cultural immersion.

Digital Transformation in Golf Course Management

Investments in digital transformation for golf course management, such as AI-driven operational tools and virtual simulators, fall into the question mark category for The Friedkin Group. These technologies offer substantial growth prospects, aligning with shifting player preferences and technological progress. For instance, the global golf market was valued at approximately $8.7 billion in 2023 and is projected to reach $11.5 billion by 2028, indicating a strong growth trajectory for innovative solutions.

The adoption of these advanced systems presents a significant opportunity but also carries inherent risks. While the potential for enhanced efficiency and new revenue streams, like indoor golf facilities, is high, the return on investment is not yet guaranteed. The Friedkin Group's golf holdings would need to navigate substantial upfront capital expenditures and ensure seamless integration and user acceptance for these technologies to achieve widespread profitability.

- AI and Automation: Implementing AI for course maintenance, weather forecasting, and customer service can optimize resource allocation, potentially reducing operational costs by 10-15% in well-executed strategies.

- Virtual Golf Simulators: The growth of the indoor golf market, projected to expand significantly in the coming years, offers a new avenue for revenue generation and player engagement, especially in regions with less favorable weather conditions.

- Evolving Player Expectations: Modern golfers increasingly expect seamless digital experiences, from booking tee times online to personalized in-app offers, making technology adoption crucial for competitive advantage.

- Early Stage Adoption: Widespread, proven success of these specific digital transformation initiatives within The Friedkin Group's portfolio is still emerging, necessitating careful piloting and data analysis before full-scale rollout.

Question marks in The Friedkin Group's BCG Matrix represent ventures with low market share but high growth potential. These require significant investment to capture market share and achieve profitability. Their success hinges on strategic execution and market acceptance.

The Friedkin Group's potential expansion into new sports, like the NHL or NBA, exemplifies question marks. These sectors offer substantial growth, as evidenced by the NBA's $10 billion revenue in 2022-2023, but demand immense upfront capital and strategic market penetration to establish a competitive presence.

Auberge Resorts Collection's new urban and international locations, such as Florence and London, also fall into the question mark category. These markets are competitive luxury segments requiring considerable investment to build brand awareness and achieve benchmarks like London's early 2024 RevPAR of approximately $200.

Copilot Capital's focus on early-stage European software ventures and emerging adventure travel niches, like astro-tourism (valued at $3.2 billion in 2023), represent further question marks. These areas have high growth prospects but require substantial capital and specialized knowledge to scale, making their future market position uncertain.

| Venture Area | BCG Category | Market Potential | Key Challenge | Example Data Point |

|---|---|---|---|---|

| New Sports Franchises (NHL/NBA) | Question Mark | High Growth | Low Market Share, High Capital Investment | NBA Revenue: $10 billion (2022-23) |

| Auberge Resorts (New Markets) | Question Mark | High Growth | Brand Building, Market Penetration | London Luxury Hotel RevPAR: ~$200 (Early 2024) |

| Copilot Capital (Early-Stage Software) | Question Mark | High Growth | Scalability, Capital Needs | N/A (Early Stage) |

| Emerging Adventure Travel Niches | Question Mark | High Growth | Market Development, Investment | Astro-tourism Market: $3.2 billion (2023) |

BCG Matrix Data Sources

Our Friedkin Group BCG Matrix is informed by comprehensive financial statements, detailed market share data, and expert industry analysis to provide a clear strategic overview.