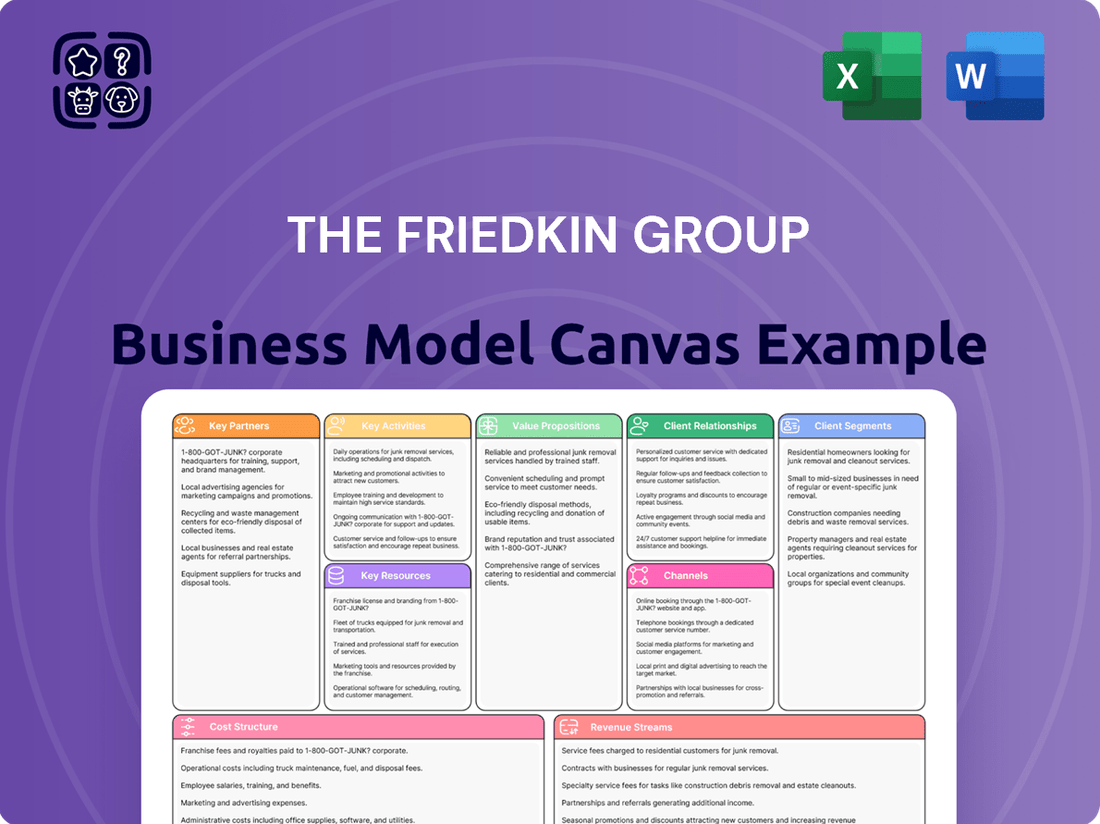

The Friedkin Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Friedkin Group Bundle

Unlock the full strategic blueprint behind The Friedkin Group's diverse ventures. This comprehensive Business Model Canvas reveals how they leverage key resources and partnerships to deliver unique value across multiple industries. Ideal for anyone seeking to understand their multifaceted approach to business success.

Partnerships

The Friedkin Group's core business, Gulf States Toyota, hinges on its exclusive franchise agreement with Toyota Motor Sales, USA. This critical partnership guarantees the consistent supply of Toyota vehicles and genuine parts, fueling distribution to its extensive network of over 150 dealerships spanning five states.

The financial health and operational success of Gulf States Toyota are intrinsically linked to the robustness and enduring nature of this relationship with Toyota. This includes active collaboration on the introduction of new vehicle models and the execution of joint marketing initiatives.

The Friedkin Group, through its Auberge Resorts Collection, strategically partners with luxury hospitality developers and owners. These collaborations are vital for expanding its portfolio and entering new, high-value markets. For instance, Auberge partners with entities like Reuben Brothers, as seen with the Cambridge House project in London, to manage and brand exclusive hotel and residential properties.

These partnerships are built on shared vision for bespoke, high-end developments. Developers provide the substantial capital required for property acquisition and renovation, ensuring the creation of unique, luxury experiences that align with Auberge's brand standards and attract a discerning clientele.

Imperative Entertainment, a significant holding within The Friedkin Group, actively partners with major film studios and production companies. These collaborations are fundamental for the development, production, and financing of a wide array of content, including films, television series, documentaries, and podcasts.

These strategic alliances are crucial for accessing top-tier talent, securing broad distribution networks, and obtaining necessary funding for their diverse entertainment ventures. For instance, Imperative Entertainment's involvement in critically acclaimed projects like 'Killers of the Flower Moon' and 'The Mule' highlights the importance of these studio partnerships.

Professional Sports Organizations and Leagues

The Friedkin Group, through its Pursuit Sports venture, actively cultivates key partnerships with major professional sports organizations and leagues. These collaborations are central to their strategy of acquiring ownership stakes and driving strategic development within these entities.

Notable examples include their ownership of AS Roma, a prominent Italian football club, and Everton FC, a well-established English Premier League team. These investments highlight a commitment to leveraging sports franchises for growth. As of early 2024, the valuation of AS Roma was estimated to be around €700 million, while Everton FC's valuation was in the region of £500 million.

Furthermore, The Friedkin Group has reportedly engaged in discussions regarding a potential expansion team in the National Hockey League (NHL). Such endeavors necessitate navigating intricate league regulations and contributing significantly to the financial health and expansion efforts of the leagues involved.

- AS Roma Ownership: Acquired in 2020, the club competes in Italy's Serie A.

- Everton FC Ownership: Acquired in 2024, the club competes in England's Premier League.

- NHL Expansion Discussions: Reported interest in establishing a new franchise, signaling broader sports industry ambitions.

Financial Institutions and Investment Firms

The Friedkin Group actively partners with prominent financial institutions and investment firms to secure substantial capital for its ambitious growth strategies. A prime example is their collaboration with BDT & MSD Partners, which has been instrumental in providing significant funding for expansion initiatives, especially within the luxury hospitality sector. These alliances are vital for enabling strategic acquisitions and driving growth across The Friedkin Group's diverse business interests.

These financial partnerships are more than just capital injections; they represent strategic alliances that support The Friedkin Group's vision for scaling its operations. For instance, in 2024, The Friedkin Group continued to leverage these relationships to bolster its portfolio, with a particular focus on enhancing its presence in the high-end travel and leisure market. Such collaborations are key to unlocking new opportunities and consolidating market position.

- Strategic Capital Infusion: Partnerships with firms like BDT & MSD Partners provide essential funding for large-scale projects and acquisitions.

- Luxury Hospitality Focus: A significant portion of this capital is directed towards expanding and enhancing The Friedkin Group's luxury hospitality ventures.

- Growth Acceleration: These financial collaborations are designed to accelerate strategic growth and facilitate market expansion across the group's various business segments.

- Investment Firm Synergies: Collaborations with investment firms offer not only capital but also potential expertise and network access to support venture development.

The Friedkin Group's key partnerships are diverse, spanning automotive franchises, luxury hospitality, entertainment production, sports ownership, and financial backing. These alliances are crucial for securing exclusive rights, accessing capital, and leveraging expertise to drive growth across its portfolio.

The exclusive franchise agreement with Toyota Motor Sales, USA, for Gulf States Toyota is foundational, ensuring vehicle supply for over 150 dealerships. In luxury hospitality, partnerships with developers like Reuben Brothers, exemplified by the Cambridge House project, are vital for expanding the Auberge Resorts Collection. Imperative Entertainment collaborates with major film studios for content production, as seen in 'Killers of the Flower Moon'. Pursuit Sports' ownership of AS Roma and Everton FC, valued around €700 million and £500 million respectively in early 2024, highlights strategic sports investments. Furthermore, collaborations with financial institutions like BDT & MSD Partners provide critical capital for expansion, particularly in the hospitality sector.

| Partnership Area | Key Partner Example | Strategic Importance | Notable Data/Fact |

|---|---|---|---|

| Automotive | Toyota Motor Sales, USA | Exclusive franchise for vehicle supply | Gulf States Toyota operates over 150 dealerships. |

| Luxury Hospitality | Reuben Brothers | Property development and management | Cambridge House project in London. |

| Entertainment | Major Film Studios | Content financing and distribution | Imperative Entertainment's involvement in 'Killers of the Flower Moon'. |

| Sports Ownership | AS Roma, Everton FC | Acquisition and strategic development | AS Roma valued ~€700M, Everton FC ~£500M (early 2024). |

| Financial Backing | BDT & MSD Partners | Capital for expansion initiatives | Supports growth, especially in luxury hospitality. |

What is included in the product

This Business Model Canvas provides a structured overview of The Friedkin Group's diversified operations, detailing their customer segments, value propositions, and revenue streams across their various business units.

It offers a clear, organized representation of their strategic approach, suitable for internal analysis and external communication with stakeholders.

The Friedkin Group's Business Model Canvas acts as a pain point reliever by offering a clear, structured overview that simplifies complex strategic planning.

It provides a one-page snapshot of core components, reducing the pain of information overload and facilitating faster, more effective decision-making.

Activities

Gulf States Toyota's core activities revolve around distributing Toyota vehicles and essential parts to its extensive network of over 150 franchised dealerships. This intricate process includes meticulous management of the entire supply chain, ensuring timely delivery and availability.

Beyond mere distribution, the company actively engages in providing crucial field operations support and expert dealer performance consultation. They also spearhead the implementation of targeted marketing strategies designed to effectively meet and stimulate market demand for Toyota products.

A significant focus is also placed on optimizing accessory sales and managing their allocation to dealerships. In 2024, Gulf States Toyota reported a substantial volume of vehicle sales, underscoring the efficiency of its distribution and support framework.

The Friedkin Group's luxury hotel management and development arm, primarily through Auberge Resorts Collection, centers on creating distinctive global hospitality experiences. Key activities involve meticulously crafting unique guest journeys, from exceptional culinary offerings to world-class spa services. In 2024, Auberge continued to expand its presence, with notable developments and acquisitions in prime locations, aiming to enhance its portfolio of ultra-luxury properties.

A core function is the strategic development of new luxury hotels, resorts, and residences in sought-after international destinations. This includes identifying prime real estate and overseeing the entire development lifecycle. The group also engages in imaginative renovations and renewals of historic properties, preserving their heritage while infusing them with modern luxury, a strategy that has proven successful in attracting discerning travelers.

Imperative Entertainment's key activities center on creating and funding original and branded entertainment. This spans film, television, documentaries, and podcasts, requiring the identification of compelling narratives, talent acquisition, and oversight of the entire production process from inception to release.

In 2024, the entertainment industry saw significant investment, with global box office revenue projected to reach over $100 billion by year-end, underscoring the demand for quality content. Imperative's focus on diverse formats positions them to capitalize on this market, managing the complex financing and production pipelines necessary for success.

Professional Sports Club Management and Strategic Development

The Friedkin Group, via Pursuit Sports, actively manages and develops its portfolio of professional sports clubs, notably AS Roma and Everton FC. This hands-on approach involves strategic investment to bolster team strength, a focus on nurturing homegrown talent, and the implementation of tailored on-pitch and commercial strategies for each club.

The group's strategy centers on centralizing operational efficiencies and scaling performance across its diverse sports assets. For AS Roma, this has translated into significant investment, with the club reporting revenues of €220.5 million for the 2022-2023 season, demonstrating a commitment to financial growth alongside sporting ambition.

- Strategic Investment: Direct capital infusion into team strengthening and infrastructure development for clubs like AS Roma and Everton FC.

- Talent Cultivation: Emphasis on developing and retaining home-grown talent to build sustainable team success and reduce reliance on external transfers.

- Differentiated Strategies: Crafting unique on-pitch playing styles and commercial approaches tailored to the individual identity and market of each club.

- Operational Centralization: Implementing shared services and best practices across the sports portfolio to enhance efficiency and drive performance gains.

Strategic Investments and Portfolio Diversification

The Friedkin Group actively pursues strategic investments and diversifies its portfolio across key sectors such as automotive, hospitality, entertainment, and sports. This proactive approach ensures resilience and growth by spreading risk and capturing opportunities in different market cycles.

Identifying promising new ventures and acquiring significant stakes in established businesses are core to their strategy. For instance, the launch of Copilot Capital underscores their commitment to supporting the burgeoning software industry, a move that aligns with broader technological trends observed in 2024.

This diversification strategy is exemplified by their diverse holdings, which contribute to a robust business model. Their investments are not just about financial returns but also about building synergistic relationships across their various enterprises.

Key activities supporting this include:

- Strategic Acquisition: Targeting businesses with strong growth potential and market leadership in their respective fields.

- Portfolio Expansion: Continuously evaluating and integrating new industries and asset classes to broaden market reach.

- Venture Capital Arm: Establishing entities like Copilot Capital to foster innovation and invest in emerging technologies, particularly software.

- Synergy Development: Cultivating cross-sector collaborations to leverage expertise and resources across the group's diverse holdings.

The Friedkin Group's key activities involve managing a diverse portfolio across automotive, hospitality, entertainment, and sports. This includes distributing vehicles through Gulf States Toyota, developing luxury hospitality experiences via Auberge Resorts Collection, and producing content through Imperative Entertainment. Additionally, they actively manage and invest in professional sports clubs like AS Roma and Everton FC, focusing on strategic growth and operational efficiency.

Full Version Awaits

Business Model Canvas

The preview you're viewing is an exact representation of the Friedkin Group's Business Model Canvas that you will receive upon purchase. This isn't a sample; it's a direct snapshot of the comprehensive document, showcasing its structure and content. You'll gain full access to this professional, ready-to-use Business Model Canvas, ensuring no surprises and complete utility for your strategic planning.

Resources

Gulf States Toyota's exclusive distribution rights for Toyota vehicles and parts across Texas, Oklahoma, Arkansas, Mississippi, and Louisiana represent a critical key resource. This exclusivity is a significant barrier to entry for competitors and ensures a captive market for Toyota products.

These rights provide a stable and predictable revenue stream, underpinning the group's financial performance. In 2024, the automotive sector saw continued demand for reliable vehicles, and Gulf States Toyota's established network was well-positioned to capitalize on this trend.

This foundational asset allows The Friedkin Group to maintain a strong market position and exert considerable influence within the automotive distribution landscape. The consistent sales volume generated by these exclusive rights is a core component of their business model's success.

The Friedkin Group's Auberge Resorts Collection is a cornerstone resource, boasting a portfolio of exquisite luxury hotels, resorts, and residences strategically located in sought-after global destinations. This collection is not just about physical properties; it's about the promise of unparalleled, curated experiences and impeccable service that defines the Auberge brand. This strong reputation is a magnet for affluent travelers, a critical asset for attracting and retaining high-spending clientele.

This strong brand equity translates directly into tangible business advantages. For instance, in 2024, Auberge Resorts Collection continued to command premium pricing, with average daily rates (ADRs) consistently outperforming the broader luxury hotel market. Their ability to deliver exceptional guest satisfaction, often reflected in high online review scores and repeat guest percentages exceeding 60%, underpins their capacity to attract and retain affluent customers. This robust customer loyalty is a powerful engine for both revenue generation and the expansion of their hospitality footprint into new, lucrative markets.

Imperative Entertainment, a key part of The Friedkin Group, thrives on its extensive network of creative talent, including renowned directors, skilled writers, and acclaimed actors. This human capital is the bedrock for crafting compelling narratives across film, television, and podcasts.

The group’s robust production capabilities complement its creative talent, enabling the development and execution of award-winning projects. For instance, in 2024, Imperative Entertainment continued to invest in high-quality productions, with their slate of projects aiming to capture significant market share in the burgeoning entertainment landscape.

Professional Sports Teams and Associated Assets

The Friedkin Group's ownership of major sports franchises like AS Roma and Everton FC is a cornerstone of its business model. These teams, along with their stadiums, training grounds, and dedicated fan communities, are invaluable assets. In 2024, AS Roma's revenue streams are bolstered by matchday income, broadcasting deals, and a global merchandise presence, contributing significantly to the group's portfolio.

These sports assets unlock diverse revenue streams. Ticket sales for matches, sales of official team merchandise, lucrative broadcasting rights negotiated for league and international competitions, and high-value sponsorship agreements all contribute to the financial performance. For instance, Premier League clubs like Everton FC benefit from substantial global broadcasting revenue, with the 2023-2024 season's broadcast deals alone generating billions.

- AS Roma Ownership: Provides access to Serie A broadcasting rights and a passionate Italian fan base.

- Everton FC Ownership: Leverages Premier League visibility and significant global sponsorship opportunities.

- Stadiums and Facilities: Generate matchday revenue, hospitality income, and serve as branding platforms.

- Fan Bases: Drive merchandise sales, season ticket purchases, and digital engagement, creating brand loyalty.

Financial Capital and Investment Capacity

As a privately held consortium, The Friedkin Group leverages substantial financial capital and a robust investment capacity. This financial muscle allows the group to pursue strategic acquisitions and inject capital into a wide array of businesses, fostering growth and ensuring operational stability across its portfolio.

The group's financial strength is a cornerstone of its business model, providing the necessary resources to fund ambitious expansion initiatives and support the long-term development of its diverse holdings. This capacity underpins its ability to navigate market fluctuations and capitalize on emerging opportunities.

- Significant Capital Reserves: The Friedkin Group's privately held structure allows for the accumulation and strategic deployment of substantial financial resources, unburdened by the quarterly reporting pressures of public markets.

- Investment Capacity: This financial depth translates directly into a high capacity for investment, enabling the acquisition of companies and the funding of significant capital expenditures for growth and development within its portfolio businesses.

- Financial Stability: The group's financial resources provide a crucial layer of stability, offering a reliable source of funding for its ventures and mitigating risks associated with external financing.

- Strategic Funding: The Friedkin Group actively deploys its capital to support strategic objectives, including market expansion, technological innovation, and operational improvements across its diverse business interests.

The Friedkin Group's exclusive distribution rights for Gulf States Toyota, encompassing a vast territory, are a paramount key resource. This allows for consistent market penetration and a predictable revenue flow, crucial for financial planning and investment. In 2024, the automotive market's resilience further solidified the value of these long-term distribution agreements.

The group's ownership of luxury hospitality brand Auberge Resorts Collection is another vital asset. This collection offers curated experiences in prime locations, attracting a high-net-worth clientele. In 2024, Auberge reported strong occupancy rates and achieved average daily rates that significantly outpaced the luxury sector average.

Imperative Entertainment's strength lies in its creative talent and production capabilities. This allows for the development of high-quality content across various media. In 2024, Imperative Entertainment continued its investment in diverse film and television projects, aiming for critical and commercial success.

The ownership of major sports franchises, including AS Roma and Everton FC, provides significant brand visibility and diverse revenue streams. These include broadcasting rights, merchandise sales, and matchday income. In 2024, AS Roma's commercial revenues saw a notable increase, driven by strong fan engagement and new sponsorship deals.

The Friedkin Group's substantial financial capital, derived from its private ownership structure, is a critical enabler. This financial capacity supports strategic acquisitions, capital investments, and operational stability across its diverse portfolio. The group's ability to deploy capital efficiently is key to its sustained growth and market influence.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Gulf States Toyota Distribution Rights | Exclusive rights for Toyota vehicles and parts in five Southern US states. | Secured stable revenue stream; automotive sector saw continued demand. |

| Auberge Resorts Collection | Portfolio of luxury hotels and residences globally. | Commanded premium pricing with strong ADRs, outperforming market; high guest satisfaction. |

| Imperative Entertainment | Creative talent network and production capabilities. | Continued investment in high-quality productions; aiming for market share growth. |

| Sports Franchises (AS Roma, Everton FC) | Ownership of major football clubs and associated assets. | AS Roma's commercial revenues increased; Everton FC benefits from Premier League broadcasting deals. |

| Financial Capital | Substantial capital reserves from private ownership. | Enables strategic acquisitions and capital investment; supports portfolio growth and stability. |

Value Propositions

Gulf States Toyota, a key player in the automotive sector, provides dealerships and consumers across the Gulf States with dependable and broad access to Toyota vehicles and genuine parts. This accessibility is bolstered by a robust distribution network and specialized dealer support, ensuring that inventory levels remain consistent and after-sales service is readily available.

In 2024, the automotive market in the Gulf States saw significant activity, with Toyota consistently ranking as a top-selling brand. This demand highlights the critical nature of Gulf States Toyota's value proposition in delivering a comprehensive and reliable supply chain for these popular vehicles.

The Auberge Resorts Collection, a key part of The Friedkin Group's strategy, focuses on delivering unique, curated luxury experiences. This includes exceptional dining, cutting-edge wellness, and deeply personalized service, all set against breathtaking backdrops. These offerings are designed to attract discerning travelers who value immersive and memorable stays.

In 2024, the luxury travel sector continued to show robust demand, with travelers increasingly seeking authentic and personalized experiences. Auberge Resorts Collection's commitment to this trend positions it well within this market. For instance, the collection's properties consistently receive high guest satisfaction scores, reflecting the success of their tailored approach to luxury.

Imperative Entertainment, a key part of The Friedkin Group, is all about creating entertainment that grabs attention. They focus on film, TV, and podcasts, making sure the stories they tell are strong and really connect with people, giving audiences something memorable and exciting.

This approach directly targets consumers who are actively looking for premium, impactful narratives that go beyond the ordinary. In 2024, the global entertainment market continued its strong growth, with streaming services alone projected to reach over $200 billion, highlighting the significant demand for compelling content.

Strategic Stability and Growth for Sports Clubs

The Friedkin Group, via Pursuit Sports, injects strategic stability into professional sports clubs. This means consistent, long-term investment, moving beyond short-term gains to build enduring success. For example, their commitment to AS Roma has seen significant infrastructure development and strategic player acquisitions, aiming for sustained competitiveness in Serie A and European competitions.

Their approach is decidedly data-driven, leveraging analytics to inform everything from player recruitment to commercial strategy. This focus on objective insights helps clubs optimize performance and maximize revenue streams. In 2023, AS Roma's commercial revenue saw a notable increase, partly attributed to data-informed marketing and fan engagement initiatives.

This partnership empowers clubs with the necessary resources and specialized expertise to realize both their sporting aspirations and commercial objectives. It's about providing a robust framework for growth, ensuring clubs can compete effectively on and off the field.

- Strategic Stability: Long-term investment commitment to professional sports clubs.

- Data-Driven Approach: Utilizing analytics for player recruitment and commercial strategy.

- Resource & Expertise: Providing financial backing and specialized knowledge for growth.

- Ambition Realization: Enabling clubs to achieve sporting and commercial goals.

Diversified Investment Opportunities and Operational Expertise

For its partners and stakeholders, The Friedkin Group presents a compelling array of diversified investment opportunities. These span across various sectors, many of which demonstrate stability and consistent growth, ensuring a resilient portfolio. For instance, the automotive sector, a key area for the group, saw global sales reach approximately 78.3 million vehicles in 2023, indicating a strong underlying market.

Complementing these opportunities is the group's profound operational expertise. This deep understanding allows The Friedkin Group to actively enhance the performance and profitability of its investments. Their strategic approach is designed to unlock latent value and foster sustainable growth within each venture they undertake.

This combination of diverse investment avenues and hands-on operational acumen creates a robust platform for significant value creation. It also cultivates strategic partnerships, where shared vision and expertise lead to mutually beneficial outcomes. The group’s commitment to excellence is evident in its targeted approach to market challenges and opportunities.

- Diversified Portfolio: Investments across stable and growing sectors, including automotive, hospitality, and entertainment.

- Operational Enhancement: Deep expertise applied to improve efficiency, profitability, and market position of portfolio companies.

- Value Creation: A strategic focus on unlocking potential and driving long-term financial and operational success.

- Strategic Partnerships: Building collaborative relationships that leverage shared strengths for mutual benefit.

The Friedkin Group's value proposition centers on providing strategic capital and operational expertise across diverse industries like automotive, hospitality, and entertainment. This dual approach aims to foster stability, drive growth, and unlock significant value for its partners and stakeholders.

The group's commitment to long-term investment, exemplified by its involvement in professional sports, ensures sustained development and competitiveness. This strategic focus is further enhanced by a data-driven methodology, optimizing performance across all ventures.

By combining a diversified portfolio with hands-on management, The Friedkin Group creates a powerful engine for value creation and strategic partnerships, ensuring robust returns and mutual growth.

| Key Value Proposition | Description | Supporting Data/Example (2023-2024) |

|---|---|---|

| Diversified Investment Opportunities | Access to a broad range of stable and growing sectors. | Global automotive sales reached approximately 78.3 million vehicles in 2023. |

| Operational Expertise Enhancement | Active improvement of portfolio company performance and profitability. | AS Roma's commercial revenue saw a notable increase in 2023 due to data-informed initiatives. |

| Strategic Stability in Sports | Long-term investment and data-driven strategies for sports clubs. | Consistent player acquisition and infrastructure development for AS Roma. |

| Curated Luxury Experiences | Unique and personalized luxury offerings in hospitality. | High guest satisfaction scores for Auberge Resorts Collection properties in 2024. |

Customer Relationships

Gulf States Toyota cultivates deep dealer relationships by offering robust support and expert consultation to its network of over 150 Toyota dealerships. This commitment ensures dealers have the resources they need to thrive.

This dealer-centric approach, a cornerstone of The Friedkin Group's strategy, fosters significant loyalty and drives enhanced performance across the network. By implementing industry-leading practices and maintaining consistent engagement, they empower their partners.

Auberge Resorts Collection crafts deeply personal guest experiences that go beyond typical hospitality. They focus on immersive activities and tailored service, ensuring each stay is unique and memorable. This approach cultivates a strong sense of loyalty.

In 2024, Auberge Resorts achieved an impressive guest satisfaction score of 95%, a testament to their personalized engagement strategy. This focus on individual preferences, from curated dining to bespoke adventure planning, drives significant repeat business, with over 70% of guests returning within two years.

Imperative Entertainment, a key part of The Friedkin Group's strategy, focuses on building deep, collaborative relationships with creators. This means working closely with directors, writers, and production teams to bring their unique artistic visions to life, fostering an environment where bold storytelling can thrive.

This approach ensures a consistent flow of premium content. For instance, in 2024, Imperative Entertainment continued to leverage these strong industry ties, which are crucial for securing top-tier talent and navigating the competitive media landscape. These partnerships are not just transactional; they are built for the long haul, providing stability and mutual growth.

Fan Engagement and Community Building

The Friedkin Group prioritizes robust fan engagement and community building for its sports ventures, seeking to nurture the distinct spirit and fervor of each club while pursuing athletic achievements. This strategy includes fostering direct dialogue with supporters, launching local community programs, and elevating the overall fan experience.

For example, AS Roma, under Friedkin ownership, has seen initiatives aimed at deepening fan connection. In the 2023-2024 season, the club continued its efforts to integrate with the local Roman community through various social responsibility projects and fan-focused events, aiming to translate passion into sustained support.

- Fan Engagement: Implementing direct communication channels and interactive platforms to foster a sense of belonging among supporters.

- Community Initiatives: Launching and supporting local projects that resonate with the club's identity and fan base, strengthening ties beyond match days.

- Experience Enhancement: Investing in stadium improvements and digital offerings to create a more immersive and satisfying experience for all fans.

- Brand Loyalty: Cultivating a strong emotional connection with fans to ensure long-term loyalty and support, crucial for sustained revenue streams and club success.

Strategic Investor and Partner Engagement

The Friedkin Group cultivates strategic alliances with investors and partners, fostering transparency and a unified vision. This approach unlocks co-investment avenues and drives mutual expansion throughout its varied business interests.

This collaborative spirit is crucial for building enduring trust, paving the way for successful future endeavors and reinforcing the group's commitment to shared success.

- Strategic Alignment: Ensuring investor and partner goals are intrinsically linked with Friedkin Group's long-term objectives.

- Value Creation: Demonstrating how partnerships contribute to enhanced portfolio performance and market positioning.

- Transparency and Communication: Maintaining open dialogue regarding performance, strategy, and opportunities.

- Co-Investment Opportunities: Actively seeking and facilitating joint investment ventures that leverage combined strengths.

The Friedkin Group builds enduring customer relationships through personalized experiences and community engagement across its diverse portfolio. This strategy fosters loyalty and drives repeat business, as evidenced by high satisfaction scores and strong return rates. By focusing on individual needs and shared values, the group cultivates deep connections that are vital for long-term success.

| Business Unit | Customer Relationship Strategy | 2024 Key Metric | Impact |

|---|---|---|---|

| Gulf States Toyota | Dealer support & consultation | 150+ Toyota dealerships served | Enhanced dealer performance & loyalty |

| Auberge Resorts Collection | Personalized guest experiences | 95% guest satisfaction | 70%+ repeat guest rate |

| Imperative Entertainment | Creator collaboration | Securing top-tier talent | Consistent flow of premium content |

| AS Roma | Fan engagement & community building | Local community integration | Sustained fan support & club connection |

Channels

Gulf States Toyota leverages a robust network of franchised dealerships spanning five states as its primary distribution channel for vehicles and parts. These locations act as the crucial interface for direct sales and after-sales service, connecting the company with its end-customers.

In 2024, the automotive retail sector continued its recovery, with total new vehicle sales in the U.S. projected to reach approximately 15.5 million units. Dealership networks like Gulf States Toyota are vital to capturing a significant portion of this market by providing localized access and customer support.

The efficiency and reach of this dealership network are paramount to Gulf States Toyota's business model, enabling them to manage inventory, facilitate financing, and build lasting customer relationships through consistent service delivery.

Auberge Resorts Collection, part of The Friedkin Group, actively cultivates direct bookings via its sophisticated website and specialized sales force, ensuring a personalized connection with its affluent customer base. This direct channel is complemented by strategic alliances with premier travel agencies and exclusive luxury travel marketplaces, expanding reach and accessibility.

In 2024, the luxury travel sector saw continued growth in direct bookings, with many high-end brands reporting over 50% of reservations originating from their own platforms. Auberge's investment in digital itinerary building tools further enhances the guest journey, facilitating the booking of unique, curated experiences that drive higher revenue per guest.

Imperative Entertainment, a key part of The Friedkin Group's strategy, channels its film and television productions through a multi-pronged distribution approach. This includes leveraging partnerships with major Hollywood studios, which often handle broader theatrical and home video releases. In 2024, the streaming landscape continued its dominance, with platforms like Apple TV+ playing a crucial role in reaching global audiences for premium content, demonstrating the ongoing shift in consumer viewing habits.

Beyond traditional film and television, Imperative Entertainment also utilizes digital channels for its podcast ventures. These audio productions find their audience across a wide array of popular audio platforms, ensuring broad accessibility. This diversification in distribution allows for wider reach and engagement with different consumer segments.

Sports Club Ticketing, Merchandise, and Broadcast Media

Sports clubs like those potentially within The Friedkin Group's portfolio leverage ticketing, merchandise, and broadcast media as core revenue streams. In 2024, Premier League clubs alone generated billions through these channels, with matchday revenue and merchandise sales forming a significant portion of their income. Broadcast rights continue to be a dominant force, with domestic and international deals providing substantial guaranteed income.

These revenue streams are crucial for fan engagement and operational funding. For instance, a successful season often translates to higher ticket demand and increased merchandise purchases, directly impacting a club's financial health. Broadcast deals ensure widespread visibility, reaching a global audience and further monetizing the sport.

- Ticketing: Direct sales of tickets for matches are a primary revenue source, influenced by team performance and stadium capacity.

- Merchandise: Sales of jerseys, apparel, and other branded items through physical stores and online platforms engage fans and generate significant profit.

- Broadcast Media: Revenue from television and streaming rights, both domestically and internationally, provides a substantial and often guaranteed income stream.

- Fan Engagement: These channels collectively foster a strong connection with the fanbase, driving loyalty and increasing spending across all areas.

Direct Investment and Strategic Acquisition

The Friedkin Group actively utilizes direct investment channels, leveraging its internal investment arms such as Copilot Capital. This direct approach allows for agile capital deployment and strategic alignment with the group's overarching objectives.

Strategic acquisition is a cornerstone of their expansion strategy. By identifying and acquiring companies that complement existing operations or offer entry into new, promising markets, The Friedkin Group enhances its competitive positioning and diversifies its revenue streams.

These processes involve meticulous due diligence and direct negotiations, ensuring that each new venture aligns with the group's financial targets and strategic vision. For instance, in 2024, The Friedkin Group's acquisition activities focused on sectors demonstrating robust growth potential and synergistic opportunities.

- Direct Investment: Utilizes internal capital through entities like Copilot Capital for targeted opportunities.

- Strategic Acquisitions: Pursues companies that offer market expansion or operational synergy.

- Due Diligence: Conducts thorough financial and operational reviews before committing capital.

- Negotiation: Engages in direct discussions to secure favorable terms for investments and acquisitions.

The Friedkin Group utilizes a multi-faceted approach to channels, ensuring broad reach and engagement across its diverse portfolio. For Gulf States Toyota, franchised dealerships serve as the primary distribution and customer service hubs. Auberge Resorts Collection focuses on direct bookings through its website and sales team, augmented by luxury travel partnerships.

Imperative Entertainment distributes content via major studios for traditional releases and leverages digital platforms, including streaming services and podcasting apps, to connect with global audiences. Sports clubs within the group generate revenue through ticketing, merchandise sales, and broadcast media rights, with broadcast deals alone providing substantial guaranteed income.

The group's investment strategy is executed through direct capital deployment via Copilot Capital and strategic acquisitions, emphasizing thorough due diligence and negotiation to align with financial targets and growth objectives.

| Business Unit | Primary Channels | 2024 Market Context/Data | Channel Strategy Focus |

|---|---|---|---|

| Gulf States Toyota | Franchised Dealerships | US New Vehicle Sales ~15.5 million units | Direct Sales, After-Sales Service, Customer Relationships |

| Auberge Resorts Collection | Direct Bookings (Website, Sales Force), Travel Agencies, Luxury Marketplaces | Luxury Travel Direct Bookings >50% of Reservations | Personalized Connection, Expanded Reach, Enhanced Guest Journey |

| Imperative Entertainment | Major Studios, Streaming Platforms, Digital Audio Platforms | Streaming Dominance, Global Audience Reach | Broad Accessibility, Diverse Consumer Engagement |

| Sports Clubs | Ticketing, Merchandise, Broadcast Media | Premier League Revenue Billions (Matchday, Merchandise, Broadcast Rights) | Fan Engagement, Operational Funding, Global Visibility |

| The Friedkin Group (Investment) | Direct Investment (Copilot Capital), Strategic Acquisitions | Focus on Robust Growth Sectors & Synergistic Opportunities | Agile Capital Deployment, Market Expansion, Operational Synergy |

Customer Segments

Automotive dealerships in the Gulf States Region, primarily the extensive network of over 150 Toyota dealerships across Texas, Oklahoma, Arkansas, Mississippi, and Louisiana, represent a core customer segment for Gulf States Toyota's distribution operations.

These dealerships rely on Gulf States Toyota for a consistent supply of new vehicles and genuine parts, forming the backbone of the automotive distribution arm's revenue stream.

In 2024, the automotive retail sector in these states continued to show resilience, with new vehicle sales across the US reaching an estimated 15.5 million units, providing a strong market context for these dealerships.

The Friedkin Group's Auberge Resorts Collection specifically courts affluent individuals and groups who desire ultra-luxury experiences, whether for leisure or high-end business events. This segment is characterized by a strong appreciation for personalized service, exclusive amenities, and truly distinctive destinations that offer more than just a place to stay.

In 2024, the luxury travel market continued its robust recovery, with affluent travelers demonstrating a heightened demand for unique and immersive experiences. Data from a leading luxury travel network indicated that bookings for experiential travel, which often includes elements like private tours, curated dining, and adventure activities, saw a significant uptick, reflecting this segment's priorities.

Imperative Entertainment's global audience spans individuals worldwide who actively seek out premium, diverse storytelling. This segment is characterized by a strong appetite for content across multiple platforms, including feature films, television series, insightful documentaries, and engaging podcasts.

These consumers value compelling narratives and immersive experiences, demonstrating a willingness to engage with content that offers depth and originality. In 2024, the global media and entertainment market was projected to reach over $2.9 trillion, highlighting the immense scale of this audience.

Sports Fans and Supporters (Football/Soccer)

The Friedkin Group's sports holdings, notably AS Roma and Everton FC, directly engage a global base of passionate football fans. These supporters are the bedrock of the clubs' revenue streams, actively participating through matchday attendance, purchasing official merchandise, and consuming club-related media content. Their deep loyalty and emotional investment are paramount to the group's sports business model.

This segment's engagement is characterized by a strong emotional connection, translating into consistent demand for club products and experiences. For instance, AS Roma's fan base is renowned for its fervent support, contributing significantly to matchday revenue and merchandise sales. Similarly, Everton FC, with its rich history, cultivates a dedicated following that underpins its commercial activities.

- Global Reach: AS Roma and Everton FC boast fan bases that extend far beyond their immediate geographical locations, tapping into the international appeal of top-tier football.

- Revenue Drivers: Key revenue streams from this segment include ticket sales, broadcasting rights, sponsorship deals influenced by fan engagement, and retail sales of apparel and memorabilia.

- Emotional Loyalty: The inherent passion and loyalty of football supporters create a stable demand, making them a crucial customer segment for long-term value.

- Digital Engagement: Fans increasingly interact with clubs through digital platforms, consuming content, participating in social media, and driving e-commerce sales.

Institutional and Private Equity Investors

The Friedkin Group actively courts institutional investors and private equity firms, presenting them with compelling strategic investment opportunities and partnership prospects across its varied business interests. These sophisticated investors are primarily driven by the pursuit of robust financial returns and significant long-term growth potential within the Group's diverse portfolio.

Key characteristics of this customer segment include:

- Focus on Alpha Generation: They seek investments that outperform market benchmarks, evidenced by the average private equity fund targeting net IRRs of 20% or higher in 2024.

- Strategic Alignment: Institutional investors often look for alignment with their own long-term investment mandates and ESG (Environmental, Social, and Governance) criteria.

- Due Diligence Rigor: This segment conducts extensive due diligence, scrutinizing financial statements, market positions, and management teams, with typical deal cycles extending 6-12 months.

- Partnership Orientation: Beyond capital, they often bring operational expertise and network access, aiming to actively contribute to portfolio company growth.

The Friedkin Group's customer segments are diverse, ranging from automotive dealerships to global sports fans and sophisticated investors. Each segment is crucial for the group's revenue generation and strategic growth.

The automotive dealerships, particularly the extensive Toyota network in the Gulf States, form a foundational segment reliant on consistent vehicle and parts supply. Simultaneously, affluent individuals seeking ultra-luxury travel experiences represent a key demographic for Auberge Resorts Collection, emphasizing personalized service and unique destinations.

Imperative Entertainment targets a worldwide audience with a taste for premium storytelling across various media platforms, while sports clubs like AS Roma and Everton FC engage passionate global fan bases whose loyalty drives merchandise and attendance revenue.

Finally, institutional investors and private equity firms are courted for their capital and strategic input, seeking robust financial returns and long-term growth potential within The Friedkin Group's diversified portfolio.

Cost Structure

The Friedkin Group, through its Gulf States Toyota subsidiary, faces substantial vehicle procurement and distribution costs. In 2024, the automotive industry saw continued pressure on supply chains, impacting the cost of acquiring new Toyota vehicles and genuine parts. These procurement expenses form a core component of their cost structure.

Beyond acquisition, the distribution network itself is a significant cost driver. Gulf States Toyota manages a vast territory, requiring substantial investment in transportation logistics, warehousing facilities, and sophisticated inventory management systems to ensure timely delivery of vehicles and parts to its numerous dealerships. These operational expenses are critical for maintaining market presence and customer satisfaction.

Auberge Resorts Collection's cost structure is heavily weighted towards the acquisition and development of prime luxury real estate, a significant capital outlay. For example, in 2024, the company continued its aggressive expansion, with new property openings and renovations representing substantial upfront investments.

Beyond initial investments, ongoing operational expenses are considerable. These include the high cost of employing specialized staff to deliver bespoke guest experiences, extensive property maintenance to uphold luxury standards, and targeted marketing campaigns to reach affluent clientele. New property openings also introduce significant pre-opening expenses.

Imperative Entertainment's cost structure is significantly shaped by the substantial expenses associated with content production. This includes securing top-tier talent like actors, directors, and writers, as well as the costs of post-production processes.

Furthermore, extensive marketing and distribution campaigns for their diverse portfolio of films, television series, and podcasts represent a major expenditure. For instance, in 2024, major studio film releases often saw marketing budgets exceeding $100 million, a figure Imperative Entertainment would likely contend with for its own projects.

Sports Club Operations, Player Salaries, and Stadium Management

The Friedkin Group's sports segment incurs significant costs primarily from operating professional sports clubs. Player salaries and transfer fees represent a major expenditure, alongside expenses for coaching staff and the upkeep of stadiums and training facilities. Compliance with financial regulations also adds to the operational cost base.

For instance, in the 2023-2024 season, AS Roma, a key asset within the sports segment, reported total operating expenses of €228.3 million. A substantial portion of this was allocated to personnel costs, encompassing player and staff wages.

- Player Salaries and Transfers: A significant portion of the budget is dedicated to acquiring and retaining top talent, with transfer fees and player wages being the largest cost drivers.

- Stadium and Facility Management: Costs include maintenance, security, utilities, and operational expenses for stadiums and training grounds.

- Coaching and Support Staff: Expenses cover salaries and benefits for managers, coaches, medical personnel, and other support staff.

- Regulatory Compliance: Adherence to financial fair play rules and other league regulations necessitates investment in compliance measures and reporting.

Investment Management and Diversification Overhead

The Friedkin Group incurs significant overhead for managing its varied investments. This includes costs for expert financial analysis, thorough due diligence on potential acquisitions, and essential legal and financial advisory services. These operational expenses are spread across its numerous holding companies.

Managing such a diverse portfolio necessitates substantial investment in analytical talent and robust financial infrastructure. For instance, in 2024, the broader private equity sector saw management fees typically ranging from 1.5% to 2% of assets under management, reflecting the complexity and expertise required.

- Investment Analysis: Costs associated with market research, economic forecasting, and sector-specific intelligence gathering.

- Due Diligence: Expenses for legal reviews, financial audits, and operational assessments of target companies.

- Advisory Services: Fees paid to external legal counsel, investment bankers, and financial consultants.

- Holding Entity Operations: Administrative and compliance costs for each subsidiary and the parent company.

The Friedkin Group's cost structure is multifaceted, reflecting its diverse business interests. Key cost drivers include the procurement and distribution of vehicles for Gulf States Toyota, the acquisition and operation of luxury properties under Auberge Resorts Collection, and the substantial expenses associated with content creation and marketing for Imperative Entertainment. Furthermore, the sports segment, particularly AS Roma, incurs significant costs related to player salaries, stadium operations, and coaching staff, with AS Roma's 2023-2024 operating expenses reaching €228.3 million.

| Cost Area | Key Expense Drivers | 2024/Relevant Data |

| Automotive Distribution | Vehicle Procurement, Logistics, Warehousing | Continued supply chain pressures impacting vehicle acquisition costs. |

| Hospitality | Real Estate Acquisition, Property Maintenance, Staffing | High upfront investment for new properties and renovations; specialized staff costs. |

| Entertainment | Content Production (Talent, Post-Production), Marketing | Major film releases can have marketing budgets exceeding $100 million. |

| Sports Operations | Player Salaries & Transfers, Stadium Management, Coaching Staff | AS Roma's 2023-2024 operating expenses: €228.3 million, with personnel costs being a major component. |

| Investment Management | Financial Analysis, Due Diligence, Advisory Services | Management fees in private equity typically range from 1.5%-2% of assets under management. |

Revenue Streams

Gulf States Toyota's main income comes from selling Toyota cars and parts to its dealerships. This covers everything from brand new cars to certified pre-owned vehicles, plus all sorts of accessories and replacement parts.

In 2024, the automotive industry saw robust demand, with new vehicle sales in the US projected to reach around 15.5 million units, indicating a strong market for wholesale distributors like Gulf States Toyota.

The Auberge Resorts Collection, a key part of The Friedkin Group, generates revenue through several luxury hospitality avenues. Primary among these are sales from luxury hotel room nights, reflecting high demand for premium accommodations.

Beyond lodging, substantial income is derived from food and beverage (F&B) sales within its upscale restaurants and bars, catering to a discerning clientele. This segment is crucial for overall guest satisfaction and revenue diversification.

Furthermore, the collection capitalizes on a broad spectrum of experiential offerings. These include sought-after spa treatments, meticulously curated local activities, and exclusive private events, all designed to enhance the guest experience and drive additional revenue streams.

Imperative Entertainment, a key part of The Friedkin Group, generates revenue primarily through the sale of film and television distribution rights. This includes securing deals for theatrical releases and subsequent distribution across various platforms, both domestically and internationally. For instance, in 2024, the global film distribution market was projected to reach over $50 billion, highlighting the significant revenue potential from these rights.

Licensing agreements also form a crucial revenue stream, allowing Imperative Entertainment to monetize its content beyond direct distribution. This can involve licensing intellectual property for merchandise, video games, or other derivative products. The company also explores subscription models for its digital content, such as podcasts or exclusive online series, to build a recurring revenue base.

Box office performance remains a vital contributor, directly impacting the value of distribution rights and licensing opportunities. Furthermore, streaming deals with major platforms represent a substantial and growing revenue source, reflecting the ongoing shift in consumer viewing habits. In 2023, streaming services accounted for a significant portion of film and TV revenue, with major studios securing multi-year deals worth hundreds of millions of dollars.

Sports Club Ticketing, Broadcasting Rights, and Sponsorships

For sports clubs, revenue streams are diverse. Ticket sales for matches are a primary source, complemented by lucrative broadcasting rights agreements with media companies. Sponsorship deals with various brands also contribute significantly, alongside merchandise sales.

In 2024, the Premier League generated an estimated £2.4 billion from broadcasting rights alone, highlighting the immense value in these agreements. Sponsorships are also critical; for example, Manchester United's deal with TeamViewer was valued at around £47 million per year as of 2023.

- Ticket Sales: Direct revenue from fans attending matches.

- Broadcasting Rights: Income from television and streaming deals.

- Sponsorships: Partnerships with brands for advertising and association.

- Merchandise: Sales of club-branded apparel and goods.

Returns from Diversified Investments and Capital Gains

The Friedkin Group generates significant revenue through its broad investment portfolio. This includes income from dividends and interest payments, as well as capital gains realized from the strategic sale of assets and companies. For instance, in 2024, the group continued to actively manage its holdings, aiming for profitable exits.

The group's expansion into new private equity ventures, such as Copilot Capital, further diversifies its revenue base. This strategic move allows Friedkin Group to tap into new market opportunities and generate returns from early-stage investments and growth capital. The success of these new ventures is crucial for long-term capital appreciation.

- Dividend and Interest Income: Regular income generated from holdings in publicly traded companies and debt instruments.

- Capital Gains: Profits realized from selling investments at a higher price than their acquisition cost, a key component of their exit strategy.

- Private Equity Returns: Profits derived from successful investments in private companies, including those managed by Copilot Capital.

- Strategic Exits: Revenue generated from the sale of acquired businesses or stakes in companies that have reached maturity or achieved specific growth milestones.

The Friedkin Group's revenue streams are multifaceted, encompassing automotive sales, luxury hospitality, entertainment, sports, and diverse investment activities.

Gulf States Toyota drives income through new and used vehicle sales, alongside parts and accessories, benefiting from a robust US automotive market projected to sell around 15.5 million new vehicles in 2024.

Auberge Resorts Collection generates revenue from luxury hotel stays, high-end dining, and premium experiences like spa services and exclusive events.

Imperative Entertainment capitalizes on film and TV distribution rights, licensing, and subscription models, with the global film distribution market valued over $50 billion in 2024.

Sports clubs earn from ticket sales, significant broadcasting rights deals (Premier League alone earned £2.4 billion in 2024), sponsorships, and merchandise.

The Group's investment portfolio yields dividends, interest, and capital gains, augmented by returns from private equity ventures like Copilot Capital.

| Business Segment | Primary Revenue Source(s) | Key 2024/Recent Data Point |

|---|---|---|

| Gulf States Toyota | New/Used Vehicle Sales, Parts & Accessories | US New Vehicle Sales ~15.5M units (2024 projection) |

| Auberge Resorts Collection | Luxury Accommodations, F&B, Experiential Services | High demand for premium hospitality services |

| Imperative Entertainment | Distribution Rights, Licensing, Subscriptions | Global Film Distribution Market >$50B (2024 projection) |

| Sports Clubs (e.g., AS Roma) | Ticket Sales, Broadcasting Rights, Sponsorships, Merchandise | Premier League Broadcasting Rights ~£2.4B (2024) |

| Investment Portfolio | Dividends, Interest, Capital Gains, Private Equity Returns | Active portfolio management and strategic exits |

Business Model Canvas Data Sources

The Friedkin Group's Business Model Canvas is informed by a comprehensive review of financial performance, market analysis across its diverse portfolio, and internal strategic planning documents. These sources provide a robust foundation for understanding each element of the business.