The Friedkin Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Friedkin Group Bundle

Navigate the complex external forces impacting The Friedkin Group with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping their strategic landscape. Unlock actionable intelligence to refine your own market approach.

Gain a crucial competitive edge by delving into the political, economic, social, technological, legal, and environmental factors influencing The Friedkin Group. This expertly crafted analysis offers the deep insights you need to make informed decisions and anticipate future challenges. Download the full version now for immediate strategic advantage.

Political factors

Government automotive regulations, particularly those concerning vehicle emissions and fuel efficiency, are critical for The Friedkin Group's automotive distribution. For instance, in 2024, many Gulf Cooperation Council (GCC) countries are aligning with stricter Euro 6 emission standards, requiring distributors like Gulf States Toyota to ensure their vehicle inventory meets these evolving environmental benchmarks. This directly impacts sourcing and compliance costs.

Safety regulations also play a pivotal role. As of 2025, updated vehicle safety standards are being implemented across various markets, mandating features like advanced driver-assistance systems (ADAS). Failure to comply can lead to significant penalties and market access issues, forcing adjustments in vehicle specifications and operational procedures for the Friedkin Group.

Trade policies and tariffs on imported vehicles and automotive parts present another significant political factor. For example, a potential increase in import duties on vehicles in a key market could raise the landed cost for Gulf States Toyota, influencing pricing strategies and potentially reducing sales volume. The Friedkin Group must remain agile in adapting its supply chain and pricing models to navigate these trade dynamics.

The regulatory environment for film and television, encompassing censorship, intellectual property, and broadcasting regulations, directly shapes Imperative Entertainment's approach to content production and distribution. For example, in 2024, several countries continued to review and update their media content regulations, impacting how international content can be aired and monetized.

Geopolitical shifts and varying governmental stances on media freedom significantly influence content creation and distribution channels, ultimately affecting revenue streams. For instance, increased trade tensions in 2024 between major economic blocs led some regions to impose stricter content import quotas, requiring more localized production or co-production efforts.

Adhering to both international and domestic media laws is paramount for Imperative Entertainment's global operations. Non-compliance can lead to significant fines and market access restrictions; in 2025, the European Union's updated Digital Services Act continues to place emphasis on content moderation and platform responsibility, requiring careful navigation for distributors.

Government policies significantly shape the tourism and hospitality landscape for The Friedkin Group. For instance, changes in visa requirements or the imposition of travel restrictions, as seen during global health events, can drastically affect visitor numbers to Auberge Resorts Collection properties. Conversely, investment incentives for the hospitality sector, such as tax breaks for new hotel developments, can encourage expansion. In 2024, many countries are easing travel restrictions to boost their economies, with the World Tourism Organization reporting a projected 2% growth in international tourist arrivals for the year.

International Trade Relations

The Friedkin Group's extensive global operations mean that international trade relations are a critical political factor. Changes in trade agreements, such as those affecting automotive parts or film distribution, can significantly impact revenue streams. For instance, the USMCA (United States-Mexico-Canada Agreement), which came into effect in July 2020, continues to shape automotive supply chains, and any future modifications could have ripple effects.

Geopolitical shifts and the imposition of tariffs or sanctions by major economies, like those seen in trade disputes between the US and China, can disrupt supply chains and affect market access for Friedkin's diverse business interests, from automotive manufacturing to hospitality. In 2024, ongoing geopolitical tensions in various regions continue to present potential risks to international business operations and investment strategies.

- Trade Agreements: The stability and terms of international trade agreements directly influence the cost and availability of goods and services across Friedkin's portfolio.

- Tariffs and Sanctions: Imposed tariffs or sanctions can increase operational costs and limit market access, impacting profitability in sectors like automotive and luxury travel.

- Diplomatic Relations: Positive diplomatic relations foster stable business environments, while strained relations can create uncertainty and operational challenges.

- Global Economic Policies: International economic policies and trade blocs can create both opportunities and challenges for companies with a significant global footprint.

Labor and Employment Laws

Changes in labor and employment laws, including minimum wage adjustments and evolving unionization rights, directly impact The Friedkin Group's operational costs and human resource planning. For instance, the U.S. federal minimum wage has remained at $7.25 per hour since 2009, but many states and cities have implemented significantly higher rates, such as California's $16.00 per hour for 2024. This creates a complex compliance landscape for a company with diverse operations.

The Friedkin Group's extensive presence in sectors like hospitality and entertainment, which are inherently labor-intensive, makes adherence to these varied employment policies critical. Ensuring compliance across different regions helps mitigate the risk of legal disputes and maintains smooth operational workflows. For example, in 2024, the National Labor Relations Board (NLRB) continued to focus on protecting employees' rights to organize and bargain collectively, influencing unionization efforts within the company's workforce.

Key considerations for The Friedkin Group include:

- Minimum Wage Compliance: Staying abreast of and adhering to varying federal, state, and local minimum wage laws across all operating regions.

- Union Relations: Navigating and respecting employees' rights to unionize and engage in collective bargaining, particularly in labor-heavy industries.

- Employment Policy Updates: Adapting internal employment policies to align with new or revised labor regulations concerning hiring, termination, and working conditions.

- Global Labor Standards: Understanding and implementing labor practices that meet or exceed international employment standards where applicable.

Government policies significantly impact The Friedkin Group's automotive distribution through regulations on emissions and safety. For instance, the push for stricter Euro 6 emission standards in GCC countries by 2024 necessitates compliance, affecting inventory and costs for Gulf States Toyota. Similarly, evolving safety standards in 2025, mandating features like ADAS, require adjustments to vehicle specifications to avoid penalties.

Trade policies, including tariffs on imported vehicles and parts, are crucial. Increased import duties in a key market could raise costs for Gulf States Toyota, influencing pricing and sales volume, demanding agile supply chain and pricing model adaptations.

Geopolitical shifts and trade relations also play a vital role. Changes in trade agreements, like the USMCA, continue to shape automotive supply chains, and geopolitical tensions in 2024 present ongoing risks to international operations and investment strategies across Friedkin's diverse interests.

What is included in the product

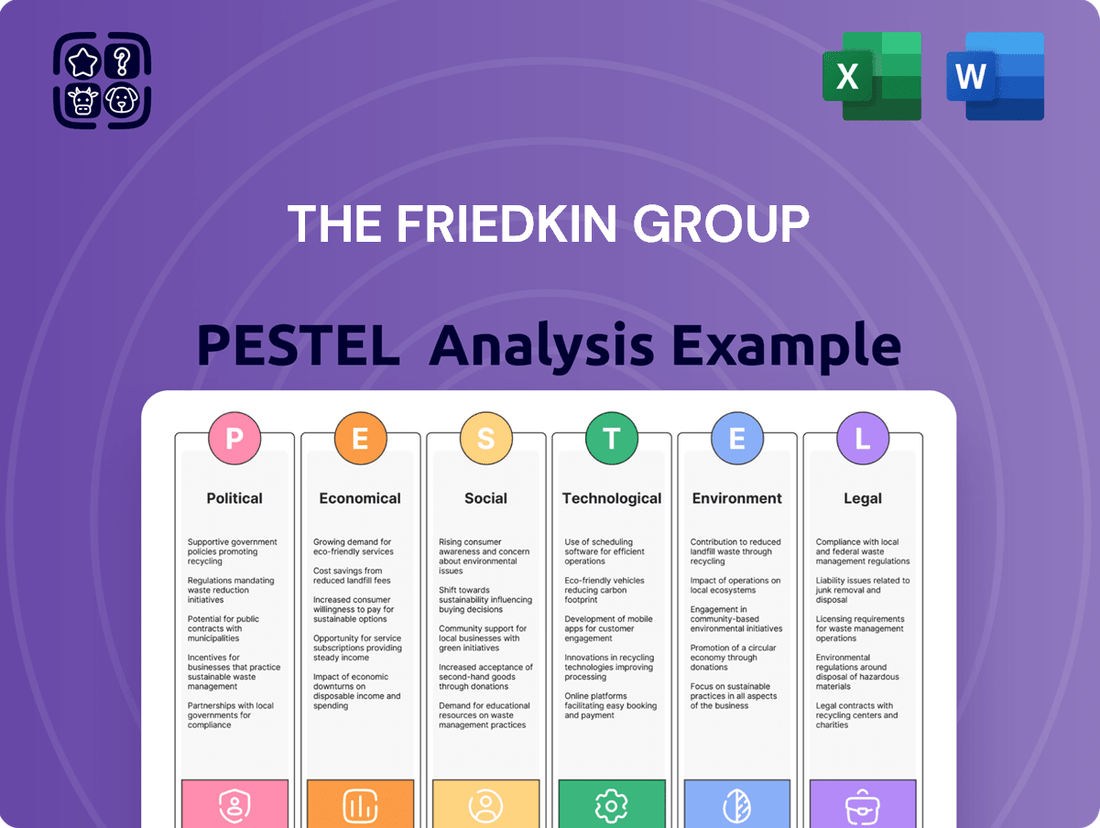

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting The Friedkin Group across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats within the Group's operating landscape.

A PESTLE analysis for The Friedkin Group offers a clear, summarized version of external factors, simplifying complex market dynamics for easier referencing during strategic planning and decision-making.

Economic factors

Global economic growth and consumer spending are pivotal for The Friedkin Group's diverse operations. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a steady pace that supports discretionary spending. This health directly impacts demand for luxury hospitality like Auberge Resorts Collection and high-end automotive products from Gulf States Toyota.

Periods of economic expansion, such as the anticipated continued growth through 2025, typically translate to increased consumer confidence and a greater willingness to spend on non-essential goods and services. This positive environment benefits all segments of The Friedkin Group's portfolio, from travel experiences to automotive sales.

Conversely, economic downturns or recessions can significantly dampen consumer spending. For instance, if global growth falters in late 2024 or 2025, consumers may cut back on luxury purchases, directly affecting revenues for Auberge Resorts Collection and Gulf States Toyota.

Interest rate fluctuations directly impact The Friedkin Group's cost of capital. For instance, if the Federal Reserve maintains its benchmark interest rate in the 5.25%-5.50% range, as it did through early 2024, borrowing becomes more expensive for the group's ventures, potentially slowing investment in areas like hospitality real estate development.

Higher borrowing costs can make new projects less appealing and increase the financial burden of existing debt. This is particularly relevant for capital-intensive sectors where significant upfront investment is required, impacting the profitability of expansions and new ventures.

Access to capital markets is critical for funding growth initiatives, such as new film productions or acquisitions in the automotive sector. Favorable market conditions, characterized by lower interest rates and investor confidence, enable The Friedkin Group to secure the necessary funding for strategic expansion and operational enhancements.

Inflationary pressures significantly impact The Friedkin Group's diverse portfolio. For instance, rising raw material costs directly affect automotive manufacturing, while increased energy and labor expenses elevate production costs for films and operational overheads for luxury resorts. This creates a balancing act, demanding careful management of input costs to maintain competitive pricing across all ventures.

The challenge lies in absorbing these escalating costs without deterring customers. For example, if the Consumer Price Index (CPI) in key markets continues its upward trend, as seen with a 3.1% annual increase in the US as of January 2024, The Friedkin Group must strategically decide how much of these higher expenses can be passed on. Successfully navigating this requires a keen understanding of consumer price sensitivity to ensure continued demand and protect profit margins.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for The Friedkin Group, given its diverse international operations in entertainment, hospitality, and automotive sourcing. Volatility in exchange rates directly affects the group's consolidated financial results.

A strengthening U.S. dollar, for instance, can make overseas investments and operations more costly, while simultaneously devaluing earnings generated abroad when they are converted back into dollars. For example, if The Friedkin Group has substantial revenue streams in Euros, a stronger dollar means those Euros translate to fewer dollars upon repatriation. This impacts profitability and the group's ability to reinvest in foreign markets.

Conversely, a weaker dollar can boost the value of foreign earnings but might increase the cost of imported goods or services, which could be relevant for automotive sourcing. Effective currency risk management is therefore crucial. This often involves hedging strategies, such as forward contracts or options, to lock in exchange rates for future transactions and protect against adverse movements.

For instance, in 2024, the U.S. dollar experienced notable strength against several major currencies, impacting multinational corporations. Companies with significant European operations saw their reported earnings reduced due to this currency translation effect. The Bank for International Settlements (BIS) reported that the average daily turnover in the foreign exchange market exceeded $7.5 trillion in 2023, highlighting the scale of currency movements that businesses must navigate.

- Impact on Revenue Repatriation: A strong dollar reduces the dollar value of foreign earnings for The Friedkin Group.

- Increased Operational Costs: For international ventures, a stronger dollar can make local currency expenses more expensive.

- Hedging Necessity: Implementing currency hedging strategies is vital to mitigate financial risks from exchange rate volatility.

- Market Volatility: The global foreign exchange market's daily turnover, exceeding $7.5 trillion as of 2023, underscores the constant potential for significant currency shifts.

Discretionary Income and Wealth Distribution

The Friedkin Group's luxury-oriented businesses are significantly impacted by how wealth is distributed and the amount of discretionary income available to their target consumers. For instance, in 2024, the top 1% of households globally are expected to continue holding a substantial portion of global wealth, directly influencing the market for high-end goods and services.

Economic policies and trends that affect high-net-worth individuals, such as changes in capital gains tax or estate taxes, can directly alter demand for luxury vehicles like those potentially offered by Friedkin's automotive interests or exclusive travel experiences. A widening wealth gap, while potentially increasing the absolute number of affluent individuals, can also lead to shifts in consumer sentiment and spending priorities.

- Global Wealth Concentration: As of late 2023, the top 1% of adults globally held approximately 45.8% of total wealth, a figure that remains a key indicator for luxury market demand.

- Discretionary Spending Power: In developed economies like the United States, discretionary income for the top quintile of earners is projected to see modest growth in 2024, supporting continued spending on premium experiences.

- Impact of Economic Policies: Proposed tax reforms in various regions could either increase or decrease the disposable income of affluent segments, directly affecting purchasing decisions for luxury assets.

Global economic conditions significantly shape consumer spending, directly impacting The Friedkin Group's diverse portfolio. In 2024, the IMF projected global growth at 3.2%, a rate that generally supports discretionary spending on luxury hospitality and automotive products. Continued economic expansion through 2025 is anticipated to bolster consumer confidence and spending, benefiting sectors like Auberge Resorts Collection and Gulf States Toyota.

Interest rate policies influence The Friedkin Group's cost of capital and investment decisions. For example, the Federal Reserve's benchmark rate remaining in the 5.25%-5.50% range through early 2024 makes borrowing more expensive, potentially slowing capital-intensive projects. Access to capital markets, facilitated by favorable interest rates and investor confidence, is crucial for funding growth initiatives.

Inflationary pressures directly affect The Friedkin Group's operational costs across its ventures. Rising raw material costs impact automotive manufacturing, while increased energy and labor expenses affect film production and resort operations. The group must strategically manage these costs to maintain competitive pricing, as seen with the US CPI's 3.1% annual increase in January 2024.

Currency exchange rate volatility presents a notable risk for The Friedkin Group's international operations. A strengthening U.S. dollar, for instance, can reduce the dollar value of foreign earnings and increase the cost of imported goods. The global foreign exchange market's substantial daily turnover, exceeding $7.5 trillion in 2023, underscores the need for effective currency risk management strategies.

| Economic Factor | 2024/2025 Outlook | Impact on The Friedkin Group |

| Global Economic Growth | Projected 3.2% in 2024 (IMF) | Supports discretionary spending for luxury hospitality and automotive. |

| Interest Rates | Federal Reserve rate ~5.25%-5.50% (early 2024) | Increases cost of capital, potentially slowing investment. |

| Inflation | US CPI +3.1% (Jan 2024) | Raises operational costs for manufacturing, film production, and resorts. |

| Currency Exchange Rates | Notable USD strength vs. major currencies (2024) | Reduces value of foreign earnings, increases import costs. |

Preview Before You Purchase

The Friedkin Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of The Friedkin Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions. Gain a complete understanding of the external forces shaping this diverse conglomerate.

Sociological factors

Consumer preferences are rapidly shifting towards electric vehicles (EVs) and sustainable transportation options. For instance, global EV sales are projected to reach 13.1 million units in 2024, a significant increase from previous years, indicating a strong demand for greener alternatives. This trend directly influences Gulf States Toyota's product lineup and marketing strategies, necessitating an adaptation to cater to environmentally conscious buyers.

The integration of digital technology within vehicles is also becoming a key driver of consumer choice. Features like advanced infotainment systems, connectivity services, and driver-assistance technologies are increasingly expected, even in entry-level models. The Friedkin Group needs to ensure its offerings align with these evolving expectations, potentially through partnerships or internal development of digital solutions.

Furthermore, generational differences in vehicle ownership attitudes play a vital role. Younger generations, in particular, may prioritize shared mobility services or flexible leasing options over traditional ownership. Understanding and responding to these diverse generational demands is crucial for The Friedkin Group to maintain market relevance and capture future sales.

Societal shifts are fueling a significant rise in demand for experiential travel and wellness tourism, a trend directly benefiting The Friedkin Group's Auberge Resorts Collection. Consumers are actively seeking more than just a place to stay; they desire unique, authentic journeys that often incorporate cultural immersion and a focus on personal well-being. This preference is evident in the projected growth of the wellness tourism market, which was valued at over $700 billion in 2023 and is expected to continue its upward trajectory through 2025, with many travelers prioritizing health-focused activities and sustainable practices.

This evolving consumer mindset presents a clear opportunity for The Friedkin Group's hospitality division. By curating bespoke travel packages that highlight local culture, offer robust wellness programs, and emphasize eco-friendly operations, Auberge Resorts can attract and retain this increasingly discerning clientele. For instance, offering farm-to-table dining experiences, guided nature excursions, and mindfulness retreats aligns perfectly with these growing consumer values, differentiating the brand in a competitive market.

The media landscape is transforming, with audiences increasingly favoring streaming services and on-demand content. In 2024, global streaming revenue is projected to reach over $300 billion, highlighting this shift. Imperative Entertainment needs to align its production and distribution with these evolving consumer preferences.

This includes experimenting with new content formats and digital platforms to capture attention. Furthermore, there's a growing audience appetite for culturally resonant and socially conscious storytelling, influencing content creation decisions for a more engaged viewership.

Workforce Demographics and Talent Acquisition

Societal shifts are significantly reshaping the workforce, impacting how The Friedkin Group attracts and retains talent. Generational differences are a key factor, with younger workers often prioritizing flexibility and purpose alongside compensation. For instance, a 2024 survey indicated that 70% of Gen Z employees value work-life balance, a stark contrast to previous generations' focus on traditional career progression. The burgeoning gig economy also presents both opportunities and challenges, offering specialized skills on demand but requiring adaptable HR strategies for integration.

The Friedkin Group's diverse portfolio, spanning film production, luxury hospitality, and automotive sales, necessitates a nuanced approach to talent acquisition. Specialized fields demand a deep understanding of evolving worker expectations. For example, attracting top-tier film talent in 2024 often involves offering robust benefits packages that include mental health support and professional development opportunities, as reported by industry analysts. Similarly, the luxury hospitality sector faces intense competition for skilled staff, making employee well-being and career advancement crucial retention tools.

- Generational Expectations: Younger generations, particularly Gen Z, increasingly prioritize work-life balance and company values, influencing recruitment strategies.

- Gig Economy Growth: The rise of contract and freelance work demands flexible engagement models for specialized skills.

- Diversity and Inclusion: Strong D&I initiatives are becoming a competitive advantage in talent acquisition, with companies demonstrating commitment often seeing higher application rates.

- Employee Well-being: Investment in mental health resources and career development is critical for retaining skilled labor across Friedkin's varied business units.

Sustainability and Ethical Consumption Awareness

Growing consumer awareness regarding sustainability and ethical consumption is a significant sociological factor impacting The Friedkin Group. In 2024, reports indicate that over 70% of consumers consider sustainability when making purchasing decisions, a trend expected to continue its upward trajectory through 2025. This heightened demand necessitates that The Friedkin Group showcases genuine commitment to environmental stewardship within its resort operations, ensures ethical sourcing across its diverse supply chains, and champions responsible production methods in its entertainment ventures.

Public perception of a company's social and environmental responsibility directly correlates with its brand reputation and consumer loyalty. For instance, a 2023 study revealed that brands with strong ESG (Environmental, Social, and Governance) profiles saw a 15% higher customer retention rate compared to those with weaker profiles. The Friedkin Group's proactive engagement in sustainability initiatives, such as reducing its carbon footprint or supporting fair labor practices, will be crucial in building and maintaining trust with its stakeholders.

- Consumer Demand for Sustainability: Over 70% of consumers factored sustainability into their 2024 purchasing decisions, a figure projected to rise.

- Brand Reputation Impact: Companies with robust ESG commitments experienced 15% higher customer retention in 2023.

- Ethical Sourcing Importance: Consumers increasingly scrutinize supply chains for ethical labor and environmental impact.

- Responsible Production: The entertainment sector, like others, faces pressure to adopt greener and more ethical production practices.

Societal attitudes towards health and wellness continue to evolve, influencing consumer choices across The Friedkin Group's portfolio. There's a growing emphasis on mental well-being and preventative health measures, which Auberge Resorts Collection can leverage through curated experiences. For example, the global wellness tourism market was valued at over $700 billion in 2023 and is projected for continued growth through 2025, indicating a strong market for health-focused travel.

Furthermore, the demand for authentic and localized experiences is on the rise. Travelers increasingly seek genuine cultural immersion and connection to the places they visit. This trend aligns with Auberge Resorts' commitment to providing unique, destination-specific offerings that resonate with discerning travelers looking for more than just a standard hotel stay.

The Friedkin Group must also consider the increasing societal focus on corporate social responsibility and ethical business practices. Consumers and employees alike are scrutinizing companies' impacts on communities and the environment. Demonstrating a commitment to sustainability and ethical operations is becoming paramount for brand loyalty and talent acquisition.

Technological factors

The automotive sector is experiencing a technological revolution, particularly with the rapid advancements in electric vehicle (EV) technology. By the end of 2024, global EV sales are projected to exceed 17 million units, a significant jump from previous years, indicating a strong consumer shift. This trend directly impacts The Friedkin Group's Gulf States Toyota operations, necessitating strategic investments in EV charging infrastructure and specialized servicing capabilities.

Autonomous driving systems and connected car features are also reshaping the automotive landscape. By 2025, it's estimated that over 75% of new vehicles sold globally will have some level of advanced driver-assistance systems (ADAS) integration. For Gulf States Toyota, this means adapting distribution models and ensuring dealership staff are proficient in the maintenance and explanation of these increasingly complex technologies to maintain a competitive edge.

Technology is a cornerstone for Auberge Resorts Collection, directly impacting guest satisfaction and operational effectiveness. Innovations like smart room controls, AI for personalized guest services, and user-friendly online booking systems are key. For instance, a 2024 report indicated that 75% of luxury travelers expect seamless digital integration in their hotel experience.

The adoption of digital transformation allows for significant operational optimization. By leveraging data analytics for customer relationship management, Auberge can better understand guest preferences, leading to tailored experiences. This digital push is not just about efficiency; it's about unlocking new revenue avenues in the competitive luxury hospitality market.

Technological leaps in entertainment production are fundamentally reshaping how content is made and consumed. Imperative Entertainment, a part of The Friedkin Group, must navigate advancements like sophisticated visual effects (VFX), immersive virtual reality (VR), and augmented reality (AR). For instance, AI is increasingly being used for tasks ranging from script analysis to automating aspects of post-production, potentially streamlining workflows.

The shift towards digital distribution and direct-to-consumer (DTC) models is equally critical. Platforms like Netflix and Disney+ have set new standards, forcing traditional players to adapt their content delivery strategies. In 2024, the global streaming market is projected to reach over $200 billion, highlighting the immense scale and ongoing evolution of these digital channels.

Embracing these technological shifts offers significant advantages. By integrating new tools, Imperative Entertainment can not only enhance the creative quality of its productions but also expand its reach to a global audience more efficiently. This strategic adoption is key to maintaining competitiveness in the rapidly evolving media landscape.

Cybersecurity and Data Privacy Technologies

The Friedkin Group's diverse operations, from automotive sales to hospitality and entertainment, necessitate advanced cybersecurity and data privacy technologies. With the increasing volume of customer data collected, protecting this information is critical. For instance, the automotive sector alone saw a 15% increase in cyber threats targeting connected vehicles in 2024, according to industry reports.

Investing in cutting-edge solutions like AI-powered threat detection and robust data encryption is therefore crucial for maintaining customer trust and operational integrity. This also involves staying ahead of evolving data privacy regulations, such as the potential expansion of GDPR-like frameworks globally. Companies that fail to comply can face significant penalties; for example, fines under GDPR can reach up to 4% of annual global revenue.

- Enhanced Data Encryption: Implementing end-to-end encryption for all customer touchpoints, from online bookings to in-car infotainment systems.

- Advanced Threat Detection: Deploying AI and machine learning tools to proactively identify and neutralize cyber threats across all digital platforms.

- Privacy-Preserving Technologies: Utilizing anonymization and differential privacy techniques to protect customer data while still enabling valuable analytics.

- Compliance Automation: Investing in software solutions that help automate compliance with global data privacy regulations like GDPR and CCPA.

Supply Chain Digitization and Automation

The Friedkin Group's supply chain operations are undergoing a significant digital transformation. By implementing advanced digital solutions for inventory tracking and logistics automation, the group aims to boost efficiency and build greater resilience, particularly within its automotive distribution segments. This strategic focus on digitization is crucial for navigating the complexities of modern global commerce.

Technologies such as blockchain for enhanced transparency, the Internet of Things (IoT) for real-time asset tracking, and robotic process automation (RPA) are being integrated to streamline operations. These advancements are expected to reduce operational costs and significantly improve the group's ability to respond swiftly to fluctuating market demands across its diverse business units. For instance, in 2024, companies heavily investing in supply chain automation reported an average of 15% reduction in logistics costs and a 20% improvement in on-time delivery rates.

- Blockchain Adoption: Enhancing traceability and security in parts and vehicle movements.

- IoT Integration: Enabling real-time monitoring of inventory levels and transportation conditions.

- Robotic Process Automation (RPA): Automating administrative tasks within the supply chain, such as order processing and invoicing.

- Data Analytics: Leveraging predictive analytics for demand forecasting and inventory optimization.

Technological advancements are a primary driver of change across The Friedkin Group's diverse portfolio. The automotive sector, for example, is rapidly shifting towards electric and autonomous vehicles, with global EV sales projected to surpass 17 million units by the end of 2024. In hospitality, guest expectations are increasingly shaped by digital integration, with 75% of luxury travelers in 2024 anticipating seamless online experiences. Furthermore, the entertainment industry is leveraging AI for production efficiencies and embracing digital distribution models that are projected to see the global streaming market exceed $200 billion in 2024.

| Sector | Key Technological Trend | Projected Impact/Data (2024/2025) |

|---|---|---|

| Automotive | Electric & Autonomous Vehicles | Global EV sales > 17M units (2024); 75%+ new vehicles with ADAS (2025) |

| Hospitality | Digital Guest Experience | 75% luxury travelers expect digital integration (2024) |

| Entertainment | AI in Production & Digital Distribution | Global streaming market > $200B (2024) |

Legal factors

The Friedkin Group's automotive distribution, particularly through Gulf States Toyota, navigates a dense regulatory landscape. This includes federal mandates on vehicle safety, such as those from the National Highway Traffic Safety Administration (NHTSA), and emissions standards set by the Environmental Protection Agency (EPA). For instance, the EPA's Tier 3 emission standards, fully phased in by 2025, require significant advancements in vehicle technology to reduce pollutants.

Compliance with state-specific dealer franchise laws and consumer protection regulations is also paramount. These laws govern everything from advertising practices to warranty obligations, ensuring fair dealings with customers. Failure to adhere to these can result in substantial fines and legal challenges, impacting operational continuity and brand reputation.

The ongoing evolution of automotive legislation presents a continuous challenge. Staying ahead of new requirements, such as those related to data privacy for connected vehicles or updated recall notification procedures, demands constant vigilance and adaptation. For example, the increasing focus on cybersecurity for automotive systems, driven by potential vulnerabilities, necessitates proactive compliance measures.

Imperative Entertainment, a subsidiary of The Friedkin Group, operates under stringent intellectual property and copyright laws. This legal framework is critical for protecting original film and television content, managing distribution rights, and ensuring compliance with international copyright regulations. In 2024, the global film and TV industry continued to grapple with the complexities of digital rights management and the evolving landscape of content piracy, underscoring the importance of robust IP protection strategies.

Auberge Resorts Collection navigates a complex legal landscape, with property laws, zoning regulations, and stringent health and safety standards dictating operational parameters for its luxury hotels and resorts. For instance, in 2024, states like California continued to refine building codes and environmental impact assessments, directly affecting new resort development and renovation projects.

Labor laws are critical, encompassing wage and hour regulations, employee benefits, and guest privacy rights, all of which are subject to ongoing legislative review. In 2024, the hospitality sector saw increased scrutiny on overtime pay and fair scheduling practices, impacting labor costs and management strategies across the industry.

Licensing requirements, from liquor permits to operational licenses, are essential for day-to-day business and expansion. The Friedkin Group's Auberge Resorts must ensure strict adherence to these varied local, state, and national mandates to maintain compliance and facilitate growth.

Anti-Trust and Competition Law

The Friedkin Group, operating across diverse sectors like automotive and entertainment, must meticulously adhere to anti-trust and competition laws. These regulations, enforced by bodies such as the Federal Trade Commission (FTC) and the Department of Justice (DOJ) in the US, aim to prevent monopolistic practices and ensure a level playing field for businesses. For instance, in 2023, the FTC continued its aggressive stance on mergers, scrutinizing deals across various industries to maintain competitive markets. Failure to comply can result in significant penalties, including hefty fines and forced divestitures, impacting growth and strategic initiatives.

Navigating these complex legal frameworks is paramount for The Friedkin Group's expansion plans, especially concerning potential acquisitions or joint ventures. These laws directly influence how the group can grow its market share and enter new territories. For example, the European Commission's Directorate-General for Competition actively reviews mergers to ensure they do not harm competition, with several large transactions facing in-depth investigations in 2024. Strategic planning must therefore incorporate thorough legal due diligence to anticipate and mitigate any anti-trust concerns, safeguarding against potential legal challenges.

- Regulatory Scrutiny: Increased focus by global competition authorities on market concentration and potential anti-competitive practices.

- Merger Control: Stringent review processes for acquisitions, requiring detailed analysis of market impact and potential for dominance.

- Compliance Costs: Investment in legal expertise and due diligence to ensure adherence to evolving anti-trust legislation across operating regions.

- Market Access: Potential limitations on market entry or expansion if deemed to create unfair competitive advantages.

Data Privacy and Consumer Protection Laws

The Friedkin Group's diverse operations, from automotive sales and luxury hospitality to entertainment platforms, place it under the scrutiny of robust data privacy and consumer protection laws. Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States mandate strict handling of customer information. Failure to comply can result in significant financial penalties; for instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. The group must prioritize data security, obtain explicit consent for data usage, and maintain transparent privacy policies to avoid such repercussions and safeguard its reputation.

Key legal considerations for The Friedkin Group include:

- Compliance with GDPR and CCPA: Ensuring all data collection, processing, and storage practices align with these comprehensive privacy frameworks.

- Data Security Measures: Implementing advanced security protocols to protect sensitive customer data from breaches, a critical concern given the increasing sophistication of cyber threats.

- Consumer Consent and Transparency: Obtaining clear consent for data usage and providing easily accessible, understandable privacy policies to build trust and avoid legal challenges.

- Reputational Risk Management: Proactively addressing data privacy concerns to prevent negative publicity and maintain customer confidence, which is vital in the service-oriented industries the group operates in.

The Friedkin Group operates under a complex web of legal and regulatory frameworks across its diverse business units. Automotive distribution, exemplified by Gulf States Toyota, faces stringent federal safety standards from NHTSA and EPA emission mandates, with the latter's Tier 3 standards fully phased in by 2025. Imperative Entertainment must adhere to robust intellectual property laws to protect its content, a critical area given the ongoing challenges of digital rights management and piracy in 2024. Auberge Resorts Collection navigates property, zoning, and health and safety regulations, with California's evolving building codes impacting development in 2024. Furthermore, labor laws, including wage and hour regulations and privacy rights, are under continuous review, with the hospitality sector facing increased scrutiny on scheduling in 2024.

Anti-trust and competition laws are crucial for The Friedkin Group, with bodies like the FTC and DOJ enforcing regulations against monopolistic practices. The European Commission also actively reviews mergers, with several large transactions undergoing in-depth investigations in 2024. Data privacy is another significant legal consideration, with GDPR and CCPA imposing strict rules on customer data handling, carrying potential fines up to 4% of global annual turnover for non-compliance.

| Legal Factor | Description | Relevant 2024/2025 Data/Trend |

| Automotive Regulations | NHTSA safety standards, EPA emissions standards (Tier 3 by 2025) | Continued focus on vehicle emissions reduction and safety compliance. |

| Intellectual Property | Copyright and IP protection for entertainment content | Increased digital rights management complexity and piracy concerns in 2024. |

| Data Privacy | GDPR, CCPA compliance for customer data | Significant fines for non-compliance; ongoing evolution of data protection laws. |

| Competition Law | Anti-trust regulations, merger reviews | Heightened scrutiny of market concentration and potential anti-competitive practices by authorities. |

Environmental factors

The Friedkin Group's Auberge Resorts Collection and its adventure travel ventures face significant environmental challenges. Extreme weather, including more frequent and intense hurricanes and wildfires, directly threatens coastal properties and outdoor recreational areas. For instance, the 2023 hurricane season saw increased activity, impacting Caribbean destinations where luxury resorts are prevalent.

Rising sea levels pose a long-term threat to beachfront resorts, potentially leading to property damage and increased insurance costs. Furthermore, shifts in natural ecosystems, such as coral bleaching due to warming oceans or changes in wildlife migration patterns, can diminish the appeal of destinations reliant on natural beauty and biodiversity, affecting visitor numbers.

To mitigate these risks, implementing robust climate resilience strategies is crucial. This includes investing in infrastructure upgrades to withstand extreme weather and adopting sustainable tourism practices, such as reducing carbon footprints and supporting conservation efforts. The global tourism sector, valued at trillions of dollars, is increasingly prioritizing sustainability, with a growing segment of travelers seeking eco-friendly options.

The automotive distribution sector, including Gulf States Toyota, is navigating stricter environmental regulations focused on vehicle emissions and fuel efficiency. For instance, by 2025, many regions are targeting average fleet emissions reductions of 30% compared to 2021 levels, a significant driver for change.

Government mandates and growing environmental awareness are accelerating the adoption of electric and hybrid vehicles. In 2024, global sales of electric vehicles were projected to reach over 17 million units, representing a substantial portion of new car registrations.

The Friedkin Group must proactively adjust its inventory and operational setup to accommodate and promote sustainable transport. This includes investing in charging infrastructure and diversifying its vehicle offerings to align with both regulatory mandates and evolving consumer preferences for greener mobility solutions.

The Friedkin Group's hospitality and golf operations are under increasing environmental scrutiny. For instance, the hospitality sector globally generated an estimated 1.5 billion tons of waste in 2024, with water consumption in golf course irrigation being a significant concern, especially in drought-prone regions.

Adopting robust waste management and resource conservation strategies, such as advanced recycling initiatives and water-efficient landscaping, is paramount. These efforts not only ensure regulatory compliance but also bolster brand reputation, potentially reducing operational costs by an estimated 5-15% through energy and water savings, as seen in comparable luxury resort chains.

Conservation and Biodiversity Protection

The Friedkin Group's Auberge Resorts Collection and adventure travel segments face increasing scrutiny regarding conservation and biodiversity protection, particularly for properties in ecologically sensitive areas. By 2024, many luxury travel brands are investing heavily in eco-tourism initiatives, with some reporting that over 60% of their guests express a preference for environmentally conscious travel options. This trend is projected to grow, making sustainable land management and minimizing ecological disruption not just ethical imperatives but crucial for long-term business viability and brand reputation.

Adherence to rigorous environmental impact assessments and the protection of local flora and fauna are paramount legal and ethical responsibilities for The Friedkin Group. For instance, the tourism industry globally is seeing a rise in regulations, with countries like Costa Rica, a popular adventure travel destination, implementing stricter guidelines for ecotourism operations. Failure to comply can result in significant fines and reputational damage, impacting guest bookings and investor confidence.

Sustainable land management practices are therefore central to The Friedkin Group's operational strategy in these segments. This includes initiatives such as:

- Implementing water conservation technologies: Reducing water usage by an average of 15% in resort operations by 2025.

- Waste reduction and recycling programs: Aiming for a 70% waste diversion rate from landfills across all properties by 2026.

- Supporting local conservation projects: Partnering with NGOs to protect endangered species and their habitats, contributing a percentage of adventure tour revenue.

- Utilizing renewable energy sources: Increasing the proportion of energy sourced from solar and other renewables to 50% by 2027.

Stakeholder Pressure for Sustainability Initiatives

The Friedkin Group is experiencing heightened demand from investors, customers, and regulators to implement and clearly communicate its environmental sustainability efforts. This translates to expectations around setting ambitious goals for reducing its carbon footprint, prioritizing the use of sustainable materials, and integrating environmentally sound practices throughout its varied business units.

Stakeholder pressure is a significant driver for The Friedkin Group to enhance its environmental performance. For instance, in 2024, a significant portion of institutional investors, estimated to be over 70% by some market analyses, are incorporating ESG (Environmental, Social, and Governance) factors into their investment decisions, directly impacting companies like The Friedkin Group.

This focus on sustainability is not just about compliance; it's a strategic imperative. Companies that demonstrate strong environmental stewardship, such as by setting science-based targets for emissions reduction, often see improved brand loyalty and attract capital from a growing segment of socially responsible investors. By 2025, it's projected that sustainable investments could reach trillions globally, making this a critical area for The Friedkin Group.

Key areas of focus for The Friedkin Group in response to this pressure include:

- Carbon Footprint Reduction: Setting measurable targets for greenhouse gas emissions across all operations.

- Sustainable Sourcing: Prioritizing suppliers and materials that meet environmental standards.

- Eco-Friendly Operations: Implementing energy efficiency measures and waste reduction programs.

- Transparent Reporting: Clearly communicating progress and challenges in sustainability initiatives to stakeholders.

Environmental factors significantly impact The Friedkin Group's diverse operations. Climate change poses direct threats to its Auberge Resorts Collection through extreme weather events and rising sea levels, necessitating resilience investments. The automotive sector faces evolving regulations driving the adoption of electric vehicles, requiring strategic inventory shifts.

The group's hospitality and golf divisions must manage water consumption and waste, with sustainability becoming a key differentiator. Furthermore, growing stakeholder demand for ESG performance, particularly from investors, is pushing for transparent reporting and ambitious carbon reduction goals.

| Environmental Factor | Impact on Friedkin Group | Data Point/Trend (2024/2025) |

|---|---|---|

| Climate Change & Extreme Weather | Threatens resort infrastructure, increases insurance costs | Increased frequency of hurricanes impacting Caribbean destinations in 2023. |

| Environmental Regulations (Automotive) | Drives shift to EVs/hybrids, impacts inventory | Projected 17+ million EV sales globally in 2024; 30% fleet emission reduction targets by 2025. |

| Sustainability Expectations (Hospitality/Golf) | Requires waste management, water conservation | Hospitality sector generated 1.5 billion tons of waste in 2024; potential 5-15% cost savings via efficiency. |

| Stakeholder Pressure (ESG) | Demands carbon reduction, sustainable sourcing, transparent reporting | Over 70% of institutional investors incorporate ESG in 2024; sustainable investments projected in trillions by 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for The Friedkin Group is built upon a comprehensive review of official government publications, reputable financial news outlets, and authoritative industry-specific reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting their diverse business interests.