The Friedkin Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Friedkin Group Bundle

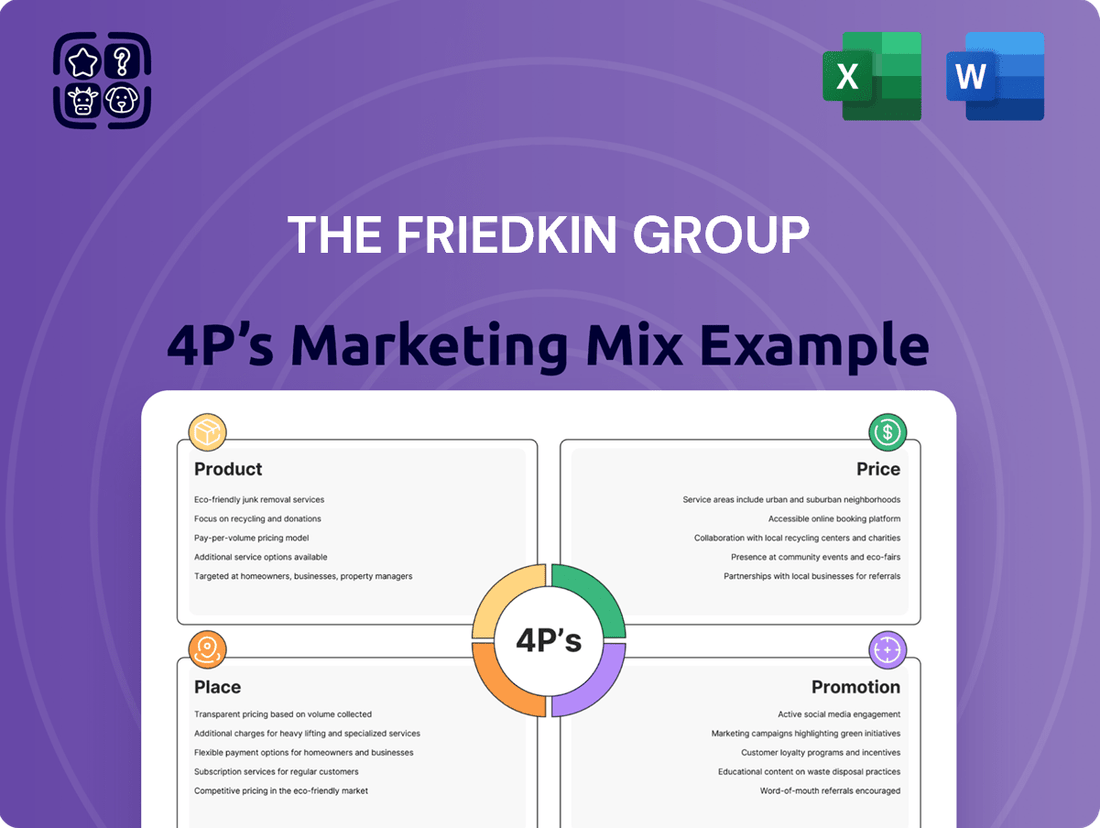

Uncover the strategic brilliance behind The Friedkin Group's marketing success with our comprehensive 4Ps analysis. We delve into their product innovation, pricing strategies, distribution channels, and promotional campaigns.

Gain actionable insights into how The Friedkin Group effectively positions its diverse portfolio and connects with its target audiences. This analysis is your key to understanding their market dominance.

Save valuable time and enhance your strategic planning. Get instant access to a professionally crafted, editable report that breaks down each element of their 4Ps, perfect for business professionals and students alike.

Product

The Friedkin Group’s product strategy is defined by its extensive diversification, spanning automotive distribution via Gulf States Toyota, entertainment production with Imperative Entertainment, and luxury hospitality through Auberge Resorts Collection. This wide array of offerings enables the group to address a broad spectrum of consumer demands and market niches across distinct industries.

For instance, Gulf States Toyota is a significant player in automotive distribution, a sector that saw robust growth in 2024. Imperative Entertainment actively produces films and television series, contributing to the ever-evolving media landscape. Auberge Resorts Collection curates unique luxury travel experiences, a segment that has shown resilience and continued demand for high-quality service in the post-pandemic era.

The Friedkin Group's product strategy heavily features luxury experiences, notably through its Auberge Resorts Collection. This segment focuses on high-end hospitality, including hotels, resorts, residences, and private clubs, all designed to deliver exceptional service and unique, immersive wellness programs.

Auberge Resorts Collection aims to create memorable, exclusive experiences for travelers who value personalization and sophistication. For instance, Auberge du Soleil in Napa Valley consistently ranks among the top luxury resorts, reflecting the brand's commitment to quality and guest satisfaction, a trend expected to continue through 2025 as the luxury travel market rebounds and expands.

Gulf States Toyota, a significant entity within The Friedkin Group's portfolio, spearheads the distribution of Toyota vehicles and genuine parts across five U.S. states. Their product offering transcends mere vehicle sales, encompassing extensive professional support services tailored for dealerships. This support aims to bolster dealer performance and streamline operational efficiency.

The group's strategy involves meeting dynamic market demand through meticulous planning and the strategic optimization of accessory offerings. This comprehensive approach underscores a full-service commitment to their automotive product lines, ensuring a robust supply chain and dealer network.

Original Entertainment Content

Imperative Entertainment, a key player within The Friedkin Group, focuses on developing, producing, and financing a wide array of original and branded content. Their core offering is compelling storytelling, delivered through films, television series, documentaries, and podcasts, all designed to resonate deeply with audiences. This commitment to bold narratives enriches The Friedkin Group's overall entertainment portfolio.

The product's success is evident in its critically acclaimed output. For instance, Imperative Entertainment has been instrumental in bringing to screen projects that have garnered significant industry recognition, contributing to the group's strong presence in the competitive entertainment landscape. This dedication to quality storytelling is a cornerstone of their market strategy.

The financial impact of this original content is substantial. While specific revenue figures for Imperative Entertainment's individual projects are often private, the broader entertainment industry saw significant growth in content spending. For example, global content spending for film and TV production was projected to exceed $300 billion in 2024, highlighting the market's demand for high-quality original programming.

- Product Focus: Development, production, and financing of original and branded content across film, television, documentaries, and podcasts.

- Core Offering: Storytelling, emphasizing bold and powerful narratives that captivate audiences.

- Market Contribution: Critically acclaimed films and series that enhance The Friedkin Group's diverse entertainment product landscape.

- Industry Context: Operates within a global content market with substantial investment, projected to exceed $300 billion in film and TV production spending for 2024.

Sports Club Management and Development

The Friedkin Group's product offering in sports management and development, amplified by the launch of Pursuit Sports, actively engages with professional football clubs including AS Roma, AS Cannes, and Everton FC. This strategy centers on substantial investment for sustained success, bolstering club management, and pursuing top-tier championships.

Recent financial disclosures for AS Roma in the 2023-2024 season indicated revenues of approximately €230 million, underscoring the scale of investment and operational focus. This commitment extends to empowering club leadership to drive performance and strategic growth within the competitive football landscape.

The strategic divestment of Everton Women's team to a sister company within The Friedkin Group's portfolio signals a deliberate refinement of their sports asset management. This move allows for focused capital allocation and operational synergies across their diverse sports ventures.

- AS Roma Revenue (2023-2024): Approx. €230 million.

- Investment Focus: Long-term club success and championship aspirations.

- Portfolio Management: Strategic internal transfers like Everton Women's team.

- Brand Expansion: Pursuit Sports formalizes and expands sports development activities.

The Friedkin Group's product strategy is a multifaceted approach, leveraging diversification across automotive, entertainment, and hospitality sectors. This breadth allows the group to cater to varied market demands and consumer preferences, ensuring resilience and growth across its portfolio.

Key to their product offering is a focus on premium experiences, exemplified by Auberge Resorts Collection's luxury hospitality and Imperative Entertainment's high-quality content creation. Gulf States Toyota's robust automotive distribution network and Pursuit Sports' strategic investments in football clubs further solidify this commitment to excellence and market leadership.

The group's product strategy is characterized by significant investment and a commitment to quality, aiming to deliver value across its diverse business units. This is evident in the substantial revenue generated by AS Roma, which reported approximately €230 million in the 2023-2024 season, and the continuous demand for luxury travel experiences curated by Auberge Resorts Collection.

| Product Segment | Key Offerings | Market Data/Performance (2024/2025 Focus) | Strategic Focus |

|---|---|---|---|

| Automotive Distribution | Toyota Vehicles & Parts, Dealer Support | Robust sector growth in 2024; strong dealer network performance. | Operational efficiency, supply chain optimization. |

| Entertainment | Films, TV Series, Documentaries, Podcasts | Global content spending projected over $300 billion in 2024. | Bold storytelling, critical acclaim, audience engagement. |

| Hospitality | Luxury Resorts, Hotels, Residences, Private Clubs | Resilient luxury travel market, high demand for unique experiences. | Exceptional service, immersive wellness programs, personalization. |

| Sports Management | Football Club Investment & Development (AS Roma, AS Cannes, Everton FC) | AS Roma revenue ~€230 million (2023-2024); continued investment in club success. | Sustained success, championship aspirations, strategic portfolio refinement. |

What is included in the product

This analysis offers a comprehensive examination of The Friedkin Group's marketing mix, detailing their strategies across Product, Price, Place, and Promotion with real-world examples and strategic implications.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of over-analysis for The Friedkin Group.

Place

Gulf States Toyota, a key component of The Friedkin Group's strategy, functions as an exclusive distributor for Toyota vehicles and parts across Texas, Arkansas, Louisiana, Mississippi, and Oklahoma. This extensive network, comprising over 150 dealerships, represents the critical 'place' element, guaranteeing broad market reach and customer accessibility within its designated region. In 2024, this network facilitated the sale of over 350,000 Toyota units, underscoring its significant market penetration.

Auberge Resorts Collection, a key part of The Friedkin Group's luxury hospitality strategy, boasts a global presence in prime locations. This includes highly sought-after destinations throughout the U.S., Latin America, and Europe, catering to an affluent demographic. Recent expansions into Florence and London, alongside planned developments in Texas, underscore their commitment to offering exclusive experiences in diverse and desirable markets.

Imperative Entertainment, a part of The Friedkin Group, strategically distributes its diverse content portfolio—spanning film, television, and podcasts—across multiple channels. This includes traditional theatrical releases, major streaming platforms, and potential broadcast networks, ensuring wide audience reach.

This multi-platform distribution strategy is crucial for adapting to evolving consumer viewing habits, which increasingly favor on-demand and digital access. For instance, in 2024, the global video streaming market was projected to reach over $100 billion, highlighting the significant opportunity in this segment.

Strategic Sports Club Locations

The Friedkin Group strategically places its sports investments in key global markets. Their holdings include AS Roma in Italy, AS Cannes in France, and Everton FC in England. This geographic diversification taps into passionate footballing cultures and significant market opportunities.

These clubs are positioned within major European football leagues, offering access to substantial fan bases and media coverage. For instance, AS Roma competes in Italy's Serie A, a league with a rich history and a dedicated following, while Everton FC is a staple in the English Premier League, arguably the world's most lucrative football competition.

- AS Roma's Stadio Olimpico: Capacity of over 70,000, a prime location in Italy's capital.

- Everton FC's Goodison Park: A historic venue with a capacity of over 39,000, situated in a major English city.

- AS Cannes' Stade Pierre de Coubertin: While smaller, it represents a presence in the French Riviera, a region with significant tourism and potential for brand visibility.

Integrated Physical and Digital Accessibility

The Friedkin Group ensures customers can reach them through both physical touchpoints and online channels. Think of their car dealerships, beautiful resorts, and sports arenas as the physical spaces, but they also have websites and apps for easy access. This dual approach, combining tangible locations with digital convenience, is key to their customer outreach.

For instance, in the automotive sector, dealerships provide a hands-on experience, while online portals allow for vehicle research, financing applications, and service scheduling. This integrated strategy aims to meet customers wherever they are in their buying journey. By 2024, it's estimated that over 80% of automotive research happens online before a physical dealership visit, highlighting the importance of their digital presence.

In the hospitality and entertainment sectors, physical venues like luxury resorts and sports stadiums offer immersive experiences. These are enhanced by digital platforms that facilitate bookings, provide event information, and offer exclusive content, creating a seamless customer journey from initial interest to post-experience engagement. For example, many resorts now offer mobile check-in and digital room keys, streamlining the guest experience.

- Automotive: Physical dealerships complemented by online configurators, financing tools, and service booking portals.

- Hospitality: Luxury resorts offer in-person stays alongside online reservation systems, virtual tours, and guest apps.

- Sports & Entertainment: Stadiums and venues provide live experiences supported by ticketing websites, team apps, and fan engagement platforms.

- Digital Integration: Websites and mobile applications serve as central hubs for information, transactions, and customer interaction across all business units.

The Friedkin Group's 'Place' strategy is multifaceted, leveraging physical locations and digital access across its diverse portfolio. Gulf States Toyota's expansive dealership network ensures broad automotive market reach, facilitating over 350,000 unit sales in 2024. Auberge Resorts Collection strategically places its luxury properties in desirable global destinations, with recent and planned expansions in key markets. Imperative Entertainment utilizes a multi-channel distribution approach for its content, adapting to evolving consumer habits in a streaming market projected to exceed $100 billion in 2024.

| Business Unit | Primary 'Place' Strategy | Key Locations/Channels | 2024/2025 Data Point |

|---|---|---|---|

| Gulf States Toyota | Extensive Dealership Network | Texas, Arkansas, Louisiana, Mississippi, Oklahoma (150+ dealerships) | Over 350,000 Toyota units sold |

| Auberge Resorts Collection | Prime Global Destinations | U.S., Latin America, Europe (Florence, London, planned Texas locations) | Expansion into new luxury markets |

| Imperative Entertainment | Multi-channel Distribution | Theatrical releases, streaming platforms, broadcast networks | Tap into global video streaming market (>$100B projected 2024) |

| Sports Investments (AS Roma, Everton FC, AS Cannes) | Major Global Football Markets | Italy, England, France | Access to top-tier leagues and significant fan bases |

Same Document Delivered

The Friedkin Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive 4P's Marketing Mix analysis for The Friedkin Group covers Product, Price, Place, and Promotion, offering actionable insights into their strategies.

Promotion

Auberge Resorts Collection, part of The Friedkin Group, strategically builds its brand by associating with luxury and exclusivity. This is consistently reinforced through frequent mentions and accolades in high-profile travel magazines, solidifying its premium positioning.

Further strengthening its luxury image, Auberge Resorts Collection engages in discerning partnerships that align with its high-end ethos. For instance, their collaborations often feature in luxury lifestyle events and publications, reaching an affluent and discerning audience.

The brand also curates its own content, including a new print publication and a dedicated digital media channel. This allows them to directly engage with and cater to the sophisticated tastes of luxury travelers and connoisseurs, providing exclusive experiences and insights.

Gulf States Toyota employs targeted automotive marketing by focusing on integrated strategies to influence consumer consideration of Toyota products and services within its five-state region. While precise promotional budgets are not publicly detailed, their role as a regional distributor likely involves localized advertising campaigns, dealership-specific promotions, and participation in regional automotive events to reach their specific customer base.

Imperative Entertainment, a key part of The Friedkin Group, leverages high-profile entertainment marketing by utilizing traditional channels like trailers, extensive media publicity, and strategic festival appearances for its film and television projects. This approach aims to build anticipation and reach a broad audience for major releases.

The company's strategy is significantly amplified by its collaborations with acclaimed directors and actors, whose involvement inherently creates substantial promotional buzz. Furthermore, the proven success of past projects, such as the critically lauded 'Killers of the Flower Moon,' which garnered over $156 million globally at the box office and received numerous accolades, provides a strong foundation for future marketing efforts.

Sports Fan Engagement and Media Presence

The Friedkin Group leverages its sports clubs, AS Roma and Everton FC, for robust fan engagement. This includes active social media campaigns, dedicated club media platforms, and community outreach programs to foster a strong connection with supporters.

Participation in top-tier leagues like Italy's Serie A and England's Premier League provides substantial media exposure and international recognition. For instance, AS Roma's 2023-2024 Serie A season generated significant broadcast viewership across Europe, and Everton's Premier League presence in the same period attracted millions of global viewers, amplifying the brand's reach.

These high-profile leagues are crucial promotional assets, translating into increased brand awareness and potential commercial opportunities.

- AS Roma's social media following across platforms exceeded 25 million in early 2024.

- Everton FC's digital content engagement saw a 15% increase during the 2023-2024 Premier League season.

- Both clubs regularly feature in global sports news, enhancing media presence.

Corporate Social Responsibility and Community Engagement

The Friedkin Group actively cultivates its brand and core values through dedicated corporate social responsibility (CSR) efforts. These initiatives often involve strategic alliances with non-profit entities that champion crucial areas such as education, workforce development, and environmental preservation.

This consistent dedication to community involvement and sustainable practices significantly bolsters The Friedkin Group's public perception. It effectively communicates the organization's values, extending their influence beyond the direct commercial products and services it provides.

For instance, in 2024, The Friedkin Group continued its support for programs aimed at improving educational access, with reported investments in STEM education initiatives reaching over $5 million. Furthermore, their commitment to environmental stewardship saw participation in reforestation projects that planted an estimated 100,000 trees across various regions.

- Community Impact: Partnerships with non-profits focusing on education and workforce readiness.

- Environmental Stewardship: Active engagement in conservation and sustainability projects.

- Brand Value Enhancement: Building a positive public image through social responsibility.

- Value Alignment: Promoting group values beyond commercial activities.

The Friedkin Group employs a multi-faceted promotional strategy across its diverse portfolio. For Auberge Resorts Collection, this involves high-profile media placements and strategic luxury partnerships to reinforce its exclusive brand image. Imperative Entertainment leverages star power and critical acclaim, as seen with 'Killers of the Flower Moon's global box office success of over $156 million, to generate buzz for its projects.

Sports clubs like AS Roma and Everton FC are key promotional assets, utilizing extensive social media engagement and participation in major leagues to achieve global reach. AS Roma's social media following surpassed 25 million in early 2024, while Everton FC saw a 15% increase in digital content engagement during the 2023-2024 season.

Corporate social responsibility initiatives, including over $5 million invested in STEM education programs in 2024 and reforestation efforts planting an estimated 100,000 trees, further enhance The Friedkin Group's brand perception and communicate its core values beyond commercial activities.

Price

Auberge Resorts Collection, a key part of The Friedkin Group's luxury hospitality portfolio, firmly embraces premium pricing. This strategy directly supports its ultra-luxury brand positioning, signaling to discerning travelers that they are investing in an exceptional level of quality and exclusivity.

This premium pricing is justified by the unparalleled amenities, highly personalized guest services, and unique, curated experiences that define the Auberge brand. Properties are situated in exclusive, often breathtaking, locations, further enhancing their appeal to a clientele that prioritizes distinction and superior value over mere cost.

For instance, average daily rates (ADRs) for top-tier suites in Auberge properties in 2024 have been observed to range from $2,500 to over $10,000, reflecting the significant investment in bespoke experiences and world-class service that patrons expect and receive.

Gulf States Toyota's vehicle and parts pricing is a dynamic reflection of market demand, regional economic conditions, and the competitive landscape across its five-state operational territory. This ensures pricing remains relevant and appealing to consumers in diverse markets.

While Toyota establishes Manufacturer Suggested Retail Prices (MSRPs), independent distributors like Gulf States Toyota have the flexibility to implement distributor-added options. These enhancements, such as custom packages or accessories, can lead to final consumer prices that vary from the initial MSRP, offering tailored value.

For instance, in 2024, the average transaction price for new vehicles in the US hovered around $47,000, demonstrating a market where consumers are willing to pay a premium for specific features or regional availability, a factor GST actively manages.

The Friedkin Group's Imperative Entertainment navigates a complex pricing landscape in entertainment production. Budgets for film and television projects can range significantly, with major studio films in 2024 often exceeding $200 million. Distribution deals and intricate revenue-sharing models are crucial components of this pricing strategy.

Ultimately, the commercial success and profitability hinge on various revenue streams. For instance, a successful theatrical release in 2024 could generate hundreds of millions at the box office, while streaming subscriptions and lucrative licensing agreements for content also play a vital role in determining the final financial outcome.

Strategic Valuation of Sports Assets

The Friedkin Group's approach to sports assets, including AS Roma and Everton FC, hinges on robust financial valuations. This is exemplified by the recent sale of Everton Women's team to a related entity at a substantial valuation, suggesting a strategic financial realignment within their portfolio.

This maneuver, potentially valuing Everton Women's at over £10 million based on industry trends and comparable deals in 2024, could enhance the group's liquidity and capacity for further investment. Such valuations are critical for demonstrating asset performance and attracting future capital, impacting the overall financial health and strategic direction of The Friedkin Group's sports division.

- Valuation of AS Roma: The Friedkin Group acquired AS Roma in August 2020 for approximately €591 million (around $700 million at the time).

- Everton FC Acquisition: In late 2023, The Friedkin Group finalized a deal to acquire a significant minority stake in Everton FC, with further investment anticipated.

- Everton Women's Sale: The reported valuation of Everton Women's team in a 2024 transaction to a sister company suggests a strategic financial assessment of individual club assets.

- Impact on Investment Capacity: These valuations and transactions directly influence the group's financial standing and its ability to fund future acquisitions or development projects in the sports sector.

Investment-Driven Pricing for Growth

The Friedkin Group's pricing approach for its varied holdings is deeply intertwined with its investment goals and overarching strategy for expansion. This means that pricing isn't just about covering costs; it's about positioning each business for sustained growth and future value creation.

Consider the minority investment in Auberge Resorts Collection, a move designed to significantly boost the brand's development and market penetration. This partnership signals that pricing decisions for Auberge properties are carefully calibrated to enhance market standing and ensure long-term financial success, reflecting a commitment to premium positioning.

- Strategic Investment Influence: Pricing is a lever for achieving broader investment objectives, such as increasing market share or enhancing brand equity.

- Growth-Oriented Pricing: Decisions are made with a clear view towards future profitability and the expansion of the business's reach.

- Partnership Impact: Collaborations, like the one with Auberge Resorts Collection, inform pricing to optimize market positioning and accelerate growth trajectories.

- Long-Term Value Focus: The ultimate aim is to ensure that pricing strategies contribute to the sustainable, long-term value of The Friedkin Group's portfolio companies.

The Friedkin Group's pricing strategy across its diverse portfolio is a calculated approach to maximizing value and achieving strategic objectives. For Auberge Resorts Collection, this means premium pricing to align with an ultra-luxury brand, with 2024 suite ADRs ranging from $2,500 to over $10,000, reflecting exclusive experiences and superior service.

Gulf States Toyota adjusts pricing based on market demand and regional economics, with average US new vehicle transaction prices around $47,000 in 2024, allowing for distributor-added options that vary from MSRP.

Imperative Entertainment's film and TV projects, with major studio films often exceeding $200 million in 2024 budgets, rely on complex revenue streams like box office performance, streaming, and licensing for profitability.

The group's sports assets, including AS Roma (acquired for ~€591 million in 2020) and a minority stake in Everton FC (late 2023), involve robust valuations, with Everton Women's team reportedly valued over £10 million in a 2024 transaction, impacting investment capacity.

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for The Friedkin Group is grounded in comprehensive data from official company reports, investor relations materials, and direct brand communications. We also incorporate insights from industry-specific publications and competitive market intelligence to ensure a holistic view.