The Friedkin Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Friedkin Group Bundle

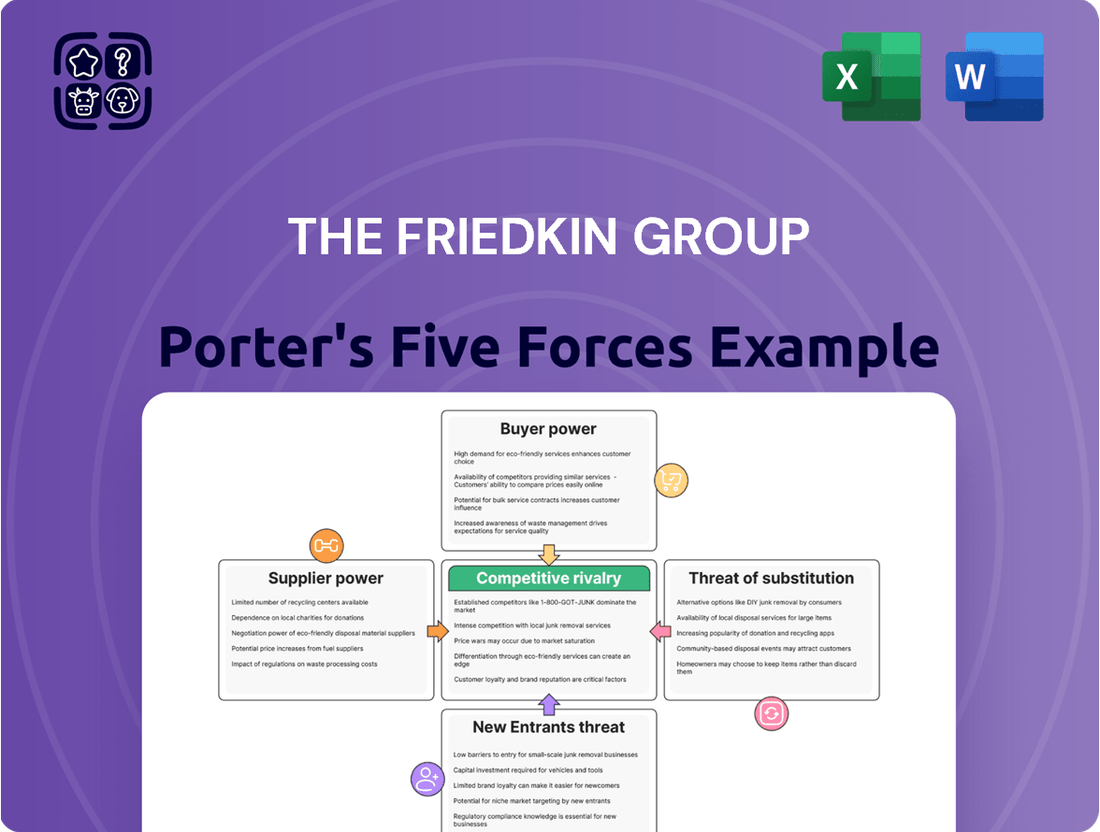

The Friedkin Group navigates a complex landscape shaped by intense rivalry and significant buyer power. Understanding these forces is crucial for any stakeholder aiming to grasp their strategic positioning.

The complete report reveals the real forces shaping The Friedkin Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

In entertainment production, especially for companies like Imperative Entertainment, directors, actors, and writers with unique skills and strong reputations wield considerable bargaining power. Their ability to command high compensation and favorable terms significantly influences production costs and schedules.

The entertainment industry's 2024 landscape, marked by an 18% rise in projects but still below pre-strike figures, amplifies the leverage of sought-after talent. As studios proceed with caution in greenlighting new productions, securing top-tier talent becomes even more critical, giving these individuals greater negotiation strength.

For Gulf States Toyota, suppliers of critical automotive components like semiconductor chips and specialized metals wield significant bargaining power. The automotive sector, facing persistent supply chain disruptions and escalating raw material costs through 2025, sees manufacturers like Toyota actively working to counter this. For instance, the global semiconductor shortage, which heavily impacted automotive production in 2022 and 2023, continued to exert pressure, with lead times for certain chips extending well into 2024.

In the luxury hospitality sector, Auberge Resorts Collection often depends on specialized suppliers for unique amenities, premium food and beverage, and custom design features. The stringent quality and exclusivity expectations of this market segment mean there are frequently limited options for these specific, high-value inputs.

This reliance on a select few providers can significantly enhance their bargaining power. With the luxury hospitality market's value anticipated to reach $166.41 billion by 2025, these niche suppliers are well-positioned to leverage their unique offerings.

Technology and Software Vendors in Golf Management

Golf course management operations are increasingly dependent on sophisticated technology, particularly specialized software. This reliance grants significant bargaining power to the vendors providing these essential solutions.

As golf clubs adopt AI, automation, and data analytics to enhance operations and customer engagement, these technology providers can dictate terms and pricing. This trend is projected to intensify, making advanced, integrated golf course software a necessity for maintaining a competitive edge.

- Increased reliance on specialized software: Golf courses are integrating AI, automation, and data analytics for operational efficiency and personalized member experiences.

- Vendor pricing power: Essential software providers can command higher prices due to the critical nature of their technology.

- Strategic importance by 2025: Feature-rich and integrated golf course management software is expected to become indispensable for competitive operations.

Unique Adventure Travel Operators and Local Guides

In the adventure travel sector, suppliers are typically local operators and specialized guides who offer unique, authentic experiences. The distinctive nature of these services, often rooted in specific geographic locations and deep expertise, can significantly enhance their bargaining power.

The adventure tourism market is experiencing robust growth, with projections indicating a market value of $424.28 billion by 2025. This expansion, coupled with a growing consumer preference for personalized and customized travel, further amplifies the influence of these specialized suppliers.

- Supplier Distinctiveness: Local guides and operators often possess exclusive knowledge and access to unique adventure locations, making their services difficult to replicate.

- Market Growth: The adventure tourism sector's projected growth to $424.28 billion by 2025 highlights the increasing demand for the very experiences these suppliers provide.

- Personalization Trend: The shift towards bespoke travel experiences means that operators who can deliver highly tailored adventures have a stronger negotiating position.

The Friedkin Group's diverse operations face varying supplier bargaining power. For Imperative Entertainment, the scarcity of highly sought-after talent in 2024, despite an 18% rise in projects, gives directors, actors, and writers significant leverage, impacting production costs.

Gulf States Toyota contends with suppliers of critical automotive components like semiconductors, where persistent global shortages through 2024 and beyond mean these providers hold considerable sway. This is particularly true for specialized chips, where lead times remained extended into 2024, impacting automotive production volumes.

In luxury hospitality, Auberge Resorts Collection deals with niche suppliers of unique amenities and premium F&B. With the luxury hospitality market projected to reach $166.41 billion by 2025, these specialized providers, offering hard-to-replicate inputs, possess strong bargaining power.

Golf course management, increasingly reliant on integrated software solutions incorporating AI and data analytics, sees technology vendors gaining leverage. The strategic importance of such advanced software by 2025 positions these providers to influence pricing and terms.

Adventure travel, a market expected to reach $424.28 billion by 2025, sees local operators and specialized guides with unique expertise and access to locations holding significant bargaining power, especially with the growing demand for personalized experiences.

What is included in the product

This analysis dissects The Friedkin Group's competitive environment by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its diverse industries.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

The bargaining power of end consumers for Gulf States Toyota dealerships is a key factor. While individual buyers have limited sway, the overall demand for Toyota vehicles and the franchise structure can consolidate their power. For instance, in 2024, the average transaction price for a new vehicle remained elevated, with some reports indicating prices were still 20-30% higher than pre-pandemic levels. This sustained high pricing in 2024 and projected into 2025 could heighten consumer price sensitivity, potentially increasing their collective bargaining leverage.

For Imperative Entertainment, the primary customers are major studios and streaming platforms. These entities wield considerable bargaining power due to their market dominance and control over distribution channels. In early 2025, the film and television industry experienced a slowdown in production, prompting more cautious spending from these major distributors, which in turn amplified their leverage over content creators.

Luxury hospitality guests, particularly high-net-worth individuals and corporate clients of Auberge Resorts Collection, wield substantial bargaining power. Their demand for highly personalized services and unique, exclusive experiences allows them to dictate terms and expect exceptional value.

The intensely competitive nature of the luxury travel sector empowers these guests. With numerous high-end options available, travelers can easily switch providers if their expectations for bespoke comfort and customized service are not met, forcing brands to continually innovate and cater to individual desires.

To meet these demands, luxury hotels are investing heavily in creating bespoke guest journeys. This includes offering services like private chefs and in-villa dining, demonstrating a direct response to the discerning preferences of their clientele and a strategy to retain their business.

Golf Club Members and Event Organizers

The bargaining power of golf club members and event organizers is a key consideration for The Friedkin Group's golf course management. This power is directly tied to how many other golf clubs are available and the overall appeal of the club's offerings. For instance, in 2024, the golf industry saw a continued trend of clubs needing to diversify beyond just the game itself to attract and retain members. This means clubs that offer robust social calendars, dining options, and family activities often find members have less power to demand concessions, as the value proposition extends beyond just tee times.

Younger demographics, like Millennials and Gen Z, are particularly influential. They often prioritize experiences and community over traditional golf-centric memberships. This shift means their expectations for amenities and non-golf related events are higher, increasing their collective bargaining power. Clubs are responding by creating flexible membership structures and more inclusive, family-oriented programming to meet these evolving demands.

- Member Retention Challenges: In 2024, many golf clubs reported increased churn rates, particularly among younger members, highlighting their willingness to switch if their expectations for diverse experiences aren't met.

- Event Organizer Demands: Event organizers, whether for corporate outings or private functions, leverage competition among venues. They can negotiate for better package deals and customized services, especially if a club relies heavily on event revenue.

- Value-Added Services: The ability of a golf club to offer unique or premium services, such as high-end F&B, spa facilities, or exclusive social events, can mitigate the bargaining power of members and organizers by creating a stickier, more valuable proposition.

Adventure Travelers

Adventure travelers, a key customer segment for The Friedkin Group, are prioritizing unique and authentic experiences. This discerning clientele is willing to pay a premium for transformative journeys. Despite a 37% decrease in the number of travelers served in 2024 compared to 2023, the segment's revenue growth indicates a strong demand for high-quality, differentiated offerings.

- Customer Demand: Adventure travelers seek unique, authentic, and transformative experiences.

- Pricing Power: Customers are willing to pay more for high-quality, differentiated adventure travel.

- Market Trend: While traveler numbers decreased by 37% in 2024 from 2023, revenue growth suggests customers are investing in premium offerings.

The bargaining power of customers within The Friedkin Group's diverse portfolio is a significant force. For Gulf States Toyota, elevated vehicle prices in 2024, potentially remaining high into 2025, increase buyer price sensitivity and collective leverage. Imperative Entertainment faces powerful studio and streaming platform clients whose cautious spending in early 2025 amplifies their negotiating strength.

Luxury hospitality guests at Auberge Resorts Collection, especially high-net-worth individuals, command considerable power due to their demand for personalized, exclusive experiences. Similarly, golf club members and event organizers can negotiate terms, particularly if clubs don't offer sufficient value beyond the game itself, as seen with the trend in 2024 for clubs to diversify offerings to retain members.

Adventure travelers, while fewer in number in 2024 (a 37% decrease from 2023), demonstrate strong purchasing power by paying premiums for unique, high-quality experiences, driving revenue growth in the segment.

| Business Segment | Customer Type | Bargaining Power Factors | 2024/2025 Data Point |

|---|---|---|---|

| Gulf States Toyota | New Vehicle Buyers | Price sensitivity, collective demand | New vehicle transaction prices 20-30% above pre-pandemic levels |

| Imperative Entertainment | Studios, Streaming Platforms | Market dominance, distribution control | Cautious spending in early 2025 production slowdown |

| Auberge Resorts Collection | High-Net-Worth Individuals, Corporate Clients | Demand for personalization, exclusivity | Investment in bespoke guest journeys (private chefs, in-villa dining) |

| Golf Course Management | Club Members, Event Organizers | Availability of alternatives, club's value proposition | Increased churn among younger members seeking diverse experiences (2024) |

| Adventure Travel | Adventure Travelers | Preference for unique, authentic experiences | 37% decrease in travelers served (2024 vs 2023), but revenue growth |

Preview Before You Purchase

The Friedkin Group Porter's Five Forces Analysis

This preview shows the exact Friedkin Group Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It delves into the competitive landscape, assessing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industries The Friedkin Group operates in. This comprehensive document is ready for your immediate strategic planning needs.

Rivalry Among Competitors

The automotive distribution market is a battlefield with many established players. Gulf States Toyota, as part of The Friedkin Group, faces fierce competition from numerous global automotive brands, each with their own extensive dealer networks. This rivalry is fueled by aggressive pricing strategies, innovative vehicle features, strong brand loyalty cultivated over years, and the quality of after-sales service offered.

This sector is quite mature, meaning growth often comes at the expense of competitors. While US auto sales are anticipated to see a modest uptick in 2025, the underlying competitive intensity remains high. Furthermore, persistent supply chain disruptions continue to add another layer of complexity, impacting inventory levels and delivery times, which can be leveraged by rivals.

Competitive rivalry in the global film and TV production industry, where Imperative Entertainment operates, is intense. A multitude of production companies, major studios, and streaming giants battle for compelling content, sought-after talent, and viewer engagement.

The industry experienced a notable slowdown in production early in 2025. Global production volumes saw a 10% decrease by January 2025 when compared to January 2024. This contraction has further amplified the competition for project approvals and overall market presence.

The luxury hospitality sector is intensely competitive, with established brands, independent boutiques, and new players vying for market share. This market, projected to reach $166.41 billion by 2025, sees companies differentiating through unique experiences, personalized service, and sustainability initiatives.

Auberge Resorts Collection's strategic expansion, including its planned London opening in 2025, exemplifies the proactive measures taken by key players to stay ahead in this dynamic and growing industry.

Golf Course Management Industry

Competitive rivalry within the golf course management industry is a significant force, driven by a diverse array of private clubs, public courses, and even alternative recreational pursuits. This competition, while often localized, is remarkably intense as businesses vie for member loyalty and new patrons.

Golf course operators are actively differentiating themselves by offering highly personalized experiences, improving on-course amenities, and integrating modern technologies. For instance, many clubs are adopting advanced booking systems and digital communication platforms to enhance member engagement.

The industry is also responding to evolving consumer preferences, with a growing emphasis on health, wellness, and social aspects of the golfing experience. This strategic shift is crucial for maintaining relevance and attracting a broader demographic, reflecting a broader trend observed across the leisure sector.

- Intense Localized Competition: Numerous private and public golf courses, alongside other recreational options, create a highly competitive environment in most geographic areas.

- Differentiation Strategies: Clubs focus on personalized service, upgraded facilities, and technological adoption to attract and retain members.

- Demographic and Expectation Shifts: The industry is adapting to demand for wellness and social experiences, moving beyond traditional golf play.

- Member Retention Focus: Strategies are geared towards keeping existing members happy and engaged in a competitive market.

Adventure Travel Market

The adventure travel market is booming, with projections indicating it will hit $424.28 billion by 2025. This rapid expansion intensifies rivalry among numerous specialized tour operators, all vying for a piece of this lucrative sector.

Competition hinges on several key factors, including the uniqueness of travel itineraries, a strong emphasis on safety protocols, and demonstrable commitment to sustainable practices. Operators also differentiate themselves by offering authentic and deeply immersive experiences that resonate with today's travelers.

- Market Growth: Adventure travel market size projected to reach $424.28 billion in 2025.

- Competitive Drivers: Rivalry centers on unique itineraries, safety, sustainability, and authentic experiences.

- Growth Factors: Increasing disposable incomes and a strong preference for experiential travel fuel market expansion.

- Differentiation Tactics: Operators are innovating, offering solutions like discount passes to attract customers.

The Friedkin Group operates in sectors characterized by intense competition. In automotive distribution, Gulf States Toyota faces numerous global brands with established dealer networks, leading to aggressive pricing and feature innovation. The film and TV production segment, where Imperative Entertainment competes, sees a crowded field of production companies and streaming giants vying for content and talent, with a notable 10% decrease in global production volumes by January 2025 amplifying this rivalry.

| Segment | Key Competitors | Competitive Intensity | Key Differentiators |

|---|---|---|---|

| Automotive Distribution | Global Automotive Brands | High | Pricing, Features, Brand Loyalty, After-Sales Service |

| Film & TV Production | Major Studios, Streaming Giants, Other Production Companies | High | Content, Talent, Viewer Engagement |

| Luxury Hospitality | Established Brands, Independent Boutiques, New Entrants | High | Unique Experiences, Personalized Service, Sustainability |

| Golf Course Management | Private Clubs, Public Courses, Other Recreational Pursuits | High (Localized) | Personalized Experiences, Amenities, Technology, Wellness Focus |

| Adventure Travel | Specialized Tour Operators | High | Itinerary Uniqueness, Safety, Sustainability, Immersive Experiences |

SSubstitutes Threaten

For Gulf States Toyota, substitutes in automotive distribution include public transportation, ride-sharing services like Uber and Lyft, and car-sharing platforms. While car ownership is still strong, the growing ease and appeal of these alternatives, especially in cities, present a persistent challenge.

In 2024, ride-sharing services continued to gain traction, with global users projected to reach over 1.5 billion. This trend directly impacts the demand for traditional vehicle purchases, particularly for second-car households or urban dwellers seeking flexible mobility.

Furthermore, the evolving landscape of mobility, including the rise of electric vehicles and innovative transportation solutions, represents an emerging category of substitutes. Companies investing in these areas could further erode market share for traditional automotive distributors.

Imperative Entertainment, The Friedkin Group's production division, contends with a significant threat from substitutes. Consumers now have an expansive universe of entertainment choices, ranging from interactive video games and engaging social media platforms to readily available user-generated content, live performances, and a vast spectrum of digital media. This proliferation means that traditional film and television content must constantly vie for audience attention against these diverse alternatives.

The intense competition for consumer engagement was underscored in 2024, a year where the broader entertainment industry's recovery did not meet initial projections. This slowdown was partly attributed to a noticeable reduction in content expenditure by major media conglomerates, signaling a more cautious approach to production and a heightened awareness of shifting consumer preferences and the impact of substitute entertainment forms.

The luxury hospitality sector, including Auberge Resorts Collection, faces significant threats from alternative accommodations. High-end private villa rentals, luxury cruise lines, and fractional ownership of vacation properties offer comparable exclusivity and personalized service. For instance, the luxury villa rental market saw substantial growth, with platforms like Airbnb Luxe reporting a 500% increase in bookings in some regions during 2024, directly competing for the same discerning clientele.

Other Recreational Activities and Virtual Experiences

For golf course management, the threat of substitutes is significant, encompassing a broad spectrum of recreational activities and evolving virtual experiences. These alternatives compete directly for consumers' leisure time and discretionary spending.

The golf industry is actively responding to this competitive pressure. A key strategy involves adapting offerings to align with changing consumer preferences, such as introducing shorter game formats and more casual, non-traditional golf experiences. This pivot aims to attract a wider audience and retain engagement in an increasingly diverse entertainment landscape.

- Alternative Leisure Activities: Consumers can choose from numerous sports like tennis, pickleball, hiking, or cycling, as well as cultural attractions and dining out, all vying for leisure time.

- Home Entertainment and Digital Engagement: Streaming services, video games, and social media provide readily accessible and often lower-cost entertainment options that compete for attention.

- Virtual Golf Simulators: Advancements in technology have made virtual golf simulators increasingly realistic and accessible, offering a convenient and weather-independent alternative to traditional golf courses. In 2024, the global golf simulator market was valued at approximately $1.5 billion and is projected to grow, indicating a strong substitute offering.

- Industry Adaptations: Golf courses are introducing shorter course layouts, Topgolf-style entertainment venues, and social leagues to appeal to a broader demographic and counter the appeal of substitutes.

DIY Travel and Virtual Adventures

The threat of substitutes in adventure travel is significant, with travelers increasingly exploring self-organized 'DIY' trips. These can range from independent hiking expeditions to self-drive tours, offering a more personalized and often less expensive alternative to curated adventure packages. General leisure tourism, which might incorporate mild adventurous elements like scenic hikes or kayaking, also presents a substitute for more specialized adventure offerings.

Furthermore, the rise of virtual reality (VR) technology offers immersive experiences that can simulate extreme or exotic adventures without the physical travel or inherent risks. While the adventure tourism market is seeing growth, with reports from 2024 indicating a focus on higher-value, unique experiences, this trend also highlights that travelers are seeking out offerings that are more difficult to replicate through substitutes. For instance, a 2023 industry analysis noted that while overall traveler numbers might be impacted by economic factors, the revenue per traveler in adventure tourism has shown resilience, suggesting a premium placed on authenticity and specialized experiences.

- DIY Travel: Self-organized trips offer cost savings and customization, directly competing with packaged adventure tours.

- General Leisure Tourism: Broader travel categories incorporating some adventurous activities can appeal to a wider audience.

- Virtual Reality (VR) Adventures: Immersive VR simulations provide an accessible, risk-free alternative to physical adventure.

- Market Trends: A 2024 report indicated that while traveler numbers might fluctuate, revenue per traveler in adventure tourism is increasing, suggesting a demand for unique, less substitutable experiences.

The threat of substitutes for golf course management is substantial, as consumers have a wide array of leisure activities and entertainment options. These alternatives compete directly for discretionary spending and leisure time.

Virtual golf simulators, offering convenience and weather independence, represent a growing substitute. The global golf simulator market was valued at approximately $1.5 billion in 2024 and continues to expand, demonstrating a strong competitive alternative.

Moreover, other sports like pickleball, tennis, and outdoor activities, alongside home entertainment such as streaming services and video games, also draw consumer attention away from traditional golf. The industry's response includes introducing shorter game formats and social events to broaden appeal.

| Substitute Category | Examples | 2024 Market Data/Trend |

|---|---|---|

| Virtual Golf Simulators | Home simulators, entertainment venues | Market valued at ~$1.5 billion, growing |

| Alternative Sports & Recreation | Pickleball, tennis, hiking, cycling | Growing participation rates in many activities |

| Home Entertainment | Streaming services, video games, social media | Continued high engagement and spending |

| Other Leisure Activities | Dining out, cultural events | Direct competition for discretionary spending |

Entrants Threaten

The automotive distribution sector, exemplified by The Friedkin Group's Gulf States Toyota, poses a formidable threat of new entrants. The sheer scale of capital needed for dealerships, vast inventory, and sophisticated logistics infrastructure is a significant deterrent. For instance, establishing a single new dealership can easily run into millions of dollars, a sum many aspiring competitors cannot readily access.

Beyond financial requirements, stringent regulatory landscapes, including complex franchise laws and emissions standards, create substantial hurdles. These regulations demand significant expertise and investment to navigate, effectively limiting the pool of potential new entrants. Moreover, achieving the brand recognition and trust that established players like Gulf States Toyota enjoy takes years and substantial marketing investment.

The intricate nature of automotive supply chains and the specialized knowledge required for efficient vehicle logistics further solidify this barrier. Newcomers must overcome the complexities of sourcing, transportation, and warehousing, often dealing with global manufacturers and demanding delivery timelines. This operational complexity, coupled with the need for a proven track record, makes market entry exceptionally challenging.

The threat of new entrants for Imperative Entertainment is assessed as moderate to high. While digital advancements have reduced some initial production expenses, substantial capital remains essential for ambitious projects. For instance, major studio films in 2024 often carried budgets well into the hundreds of millions of dollars, a significant barrier for newcomers.

Attracting and retaining elite talent—directors, actors, and writers—is another considerable challenge. These individuals command high salaries and are often tied to established production houses, making it difficult for new entities to secure their services. Building a strong industry reputation, crucial in a sector driven by successful projects, also takes considerable time and investment.

Furthermore, gaining access to reliable distribution channels, typically dominated by major studios and streaming giants, presents a significant hurdle. In 2024, securing prime release windows on platforms like Netflix or Disney+ required established relationships and proven track records, which new entrants lack.

The luxury hospitality sector, where The Friedkin Group's Auberge Resorts Collection operates, presents a moderate threat from new entrants. Launching a luxury brand demands significant capital for acquiring prime real estate, creating distinctive design, and delivering unparalleled service. For instance, the average cost to develop a new luxury hotel can range from $300,000 to over $1 million per key, a substantial barrier.

Building a strong brand reputation and cultivating a loyal clientele in this segment is also challenging. Travelers in the luxury space prioritize unique experiences and supreme comfort, making it difficult for newcomers to gain traction without substantial marketing and a proven track record. Despite the sector's growth, attracting significant investment is contingent on possessing considerable financial resources.

Land, Capital, and Membership Base in Golf Management

The threat of new entrants in golf course management is considerably low. Significant capital investment is a primary deterrent, encompassing land acquisition, the complex construction and upkeep of golf courses, and the associated infrastructure. For instance, developing a new 18-hole golf course can easily cost tens of millions of dollars, a substantial hurdle for any newcomer.

Building a loyal membership or customer base, particularly for private clubs, demands considerable time and extensive marketing expenditure. This established loyalty provides a competitive moat for existing players. In 2024, the industry is increasingly emphasizing personalized experiences and technological integration, such as advanced booking systems and member engagement apps. New entrants would need to rapidly invest in and adopt these technologies to compete effectively.

- High Capital Requirements: Land acquisition and course development costs are a major barrier.

- Brand Loyalty and Membership Base: Established clubs benefit from long-term customer relationships.

- Technological Adoption: New entrants must quickly embrace experience-driven tech to be competitive.

- Regulatory Hurdles: Zoning, environmental permits, and land use regulations add complexity and cost.

Specialized Expertise and Safety Standards in Adventure Travel

The adventure travel sector presents a mixed landscape for new entrants. While smaller, niche operators might find relatively lower barriers to entry, the prospect of large, established companies entering the market is a more significant concern, especially for a company like The Friedkin Group. Success in this field isn't just about offering a trip; it demands deep, specialized knowledge of activities and destinations. For instance, in 2024, the adventure travel market was valued at approximately $132.7 billion globally, underscoring its significant economic appeal.

Moreover, new entrants must navigate and adhere to rigorous safety standards and secure comprehensive insurance coverage. These are not optional extras but fundamental requirements to operate responsibly and build customer confidence. The industry is increasingly focused on sustainability and eco-friendly practices, adding another layer of complexity for those looking to break in. A 2023 report indicated that 72% of travelers are willing to pay more for sustainable travel options, highlighting this as a key differentiator.

- Specialized Expertise: New entrants need extensive knowledge of adventure activities, local cultures, and environmental best practices.

- Safety and Insurance: Adherence to strict safety protocols and obtaining adequate insurance are critical for credibility and legal compliance.

- Reputation Building: Establishing trust and a strong brand reputation, particularly concerning unique and sustainable experiences, takes time and consistent delivery.

- Market Demand: The growing consumer preference for authentic, immersive, and eco-conscious travel experiences means new entrants must offer compelling value propositions.

The threat of new entrants for The Friedkin Group's various businesses is generally low to moderate, primarily due to significant capital requirements and established brand loyalty. For instance, in the automotive distribution sector, the cost of establishing a single new dealership can easily exceed millions of dollars, a substantial barrier for most potential competitors. Similarly, the luxury hospitality sector demands considerable investment in prime real estate and unique design, with new luxury hotel development costs often ranging from $300,000 to over $1 million per key in 2024.

Regulatory hurdles also play a crucial role in deterring new entrants across several of The Friedkin Group's operating segments. Complex franchise laws in automotive distribution and stringent environmental and zoning regulations in golf course management require significant expertise and investment to navigate. Furthermore, building the necessary brand recognition and trust, as seen in both automotive and luxury hospitality, takes years and substantial marketing efforts, making it difficult for newcomers to compete with established players.

| Industry Segment | Barrier to Entry Factor | Example Data/Impact |

|---|---|---|

| Automotive Distribution | High Capital Requirements | Millions of dollars for a single dealership setup. |

| Luxury Hospitality | High Capital Requirements | $300,000 - $1M+ per key for luxury hotel development (2024). |

| Golf Course Management | High Capital Requirements | Tens of millions of dollars for new 18-hole course development. |

| Adventure Travel | Specialized Expertise & Safety Standards | Need for deep knowledge of activities, destinations, and rigorous safety protocols. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for The Friedkin Group leverages a comprehensive dataset including the group's annual reports, financial statements, and investor relations disclosures. We supplement this with industry-specific market research reports and competitor analysis from reputable business intelligence platforms.