F.N.B. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

F.N.B. Bundle

F.N.B.'s market position is strong, but understanding its full potential requires a deeper dive. Our comprehensive SWOT analysis reveals key internal strengths and external opportunities that can drive significant growth.

Want to leverage F.N.B.'s competitive advantages and navigate potential challenges effectively? Purchase the complete SWOT analysis to gain access to actionable insights and strategic recommendations.

Unlock the full strategic picture of F.N.B. with our in-depth SWOT analysis. This report provides detailed breakdowns, expert commentary, and an editable format perfect for investors and strategists.

Strengths

F.N.B. Corporation boasts a robust and diversified financial services portfolio, spanning commercial banking, consumer banking, wealth management, and insurance. This broad spectrum of offerings allows FNB to serve a wide array of clients, from individual consumers to substantial corporate entities. For instance, as of the first quarter of 2024, FNB reported total assets of over $45 billion, demonstrating the scale of its operations across these varied segments.

F.N.B. continues to showcase impressive financial strength, marked by record capital levels that underscore its resilience. In the second quarter of 2025, the bank reported a Common Equity Tier 1 (CET1) ratio of 10.8%, comfortably surpassing regulatory minimums.

This solid capital foundation equips F.N.B. with significant capacity to fuel balance sheet expansion and strategically enhance shareholder value. It also ensures the institution is well-positioned to navigate and mitigate various financial uncertainties.

F.N.B. Corporation has demonstrated a robust financial trajectory, highlighted by consistent revenue growth and strong profitability. In the second quarter of 2025, the company reported record revenue of $438 million, reflecting a healthy 6.5% increase from the previous quarter. This performance was bolstered by significant contributions from both net interest income and non-interest income streams.

Further solidifying its financial strength, F.N.B. achieved a record $350 million in full-year operating non-interest income for 2024. This achievement underscores the effectiveness of the company's diversified business model and its ability to generate substantial income from a variety of sources, contributing to its overall profitability.

Strong Asset Quality Management

F.N.B. demonstrates a robust approach to managing its assets, consistently upholding strong credit metrics. This is a direct result of their disciplined underwriting standards and proactive risk management strategies.

The company’s commitment to asset quality is evident in its 2024 performance. For the entirety of 2024, F.N.B. reported total delinquencies at a low of 0.83% and net charge-offs at an even lower 0.19%.

While the fourth quarter of 2024 saw a minor uptick in non-performing loans to 0.48%, the overall health of the loan portfolio remains strong. This indicates F.N.B.'s effective management of its lending activities.

Key indicators of F.N.B.'s strong asset quality management include:

- Low Delinquency Rates: Total delinquencies at 0.83% for the full year 2024.

- Minimal Net Charge-offs: Net charge-offs recorded at 0.19% for the full year 2024.

- Stable Non-Performing Loans: Non-performing loans at 0.48% in Q4 2024, reflecting contained credit risk.

- Disciplined Underwriting: Consistent adherence to strict lending criteria.

Strategic Geographic Footprint

F.N.B. Corporation's strategic geographic footprint, primarily spanning the Mid-Atlantic and Southeast U.S., offers a significant advantage. This diversified presence across key markets such as Pittsburgh, Baltimore, and Charlotte, as of the first quarter of 2024, provided F.N.B. with a robust platform for both deposit and loan expansion.

The company's operations in these attractive regions, which include a mix of established and growing economies, help to mitigate risks associated with localized economic slowdowns. This broad geographic base is a cornerstone of F.N.B.'s growth strategy, allowing for cross-regional synergies and a more resilient business model.

- Diversified Market Exposure: Operating in multiple states reduces reliance on any single regional economy, as seen in F.N.B.'s presence across Pennsylvania, Ohio, Maryland, West Virginia, North Carolina, South Carolina, and Virginia.

- Access to Growth Markets: The inclusion of high-growth areas like Charlotte and expansion into the Southeast provides F.N.B. with opportunities to capture new customers and increase market share.

- Resilience to Economic Shocks: A wider geographic spread helps F.N.B. weather localized economic downturns more effectively than a bank concentrated in a single market.

- Deposit and Loan Growth Potential: F.N.B.'s footprint covers areas with strong demographic trends and economic activity, supporting consistent growth in its core banking services.

F.N.B. Corporation's diversified financial services portfolio, encompassing commercial banking, consumer banking, wealth management, and insurance, allows it to serve a broad client base. As of Q1 2024, total assets exceeded $45 billion, showcasing operational scale. The bank's strong capital position, evidenced by a CET1 ratio of 10.8% in Q2 2025, provides capacity for balance sheet expansion and shareholder value enhancement.

F.N.B. has demonstrated consistent revenue growth, reporting a record $438 million in revenue for Q2 2025, a 6.5% increase from the prior quarter. Full-year operating non-interest income reached a record $350 million in 2024, highlighting the success of its diversified income streams.

The company maintains strong asset quality with disciplined underwriting, reporting low total delinquencies of 0.83% and net charge-offs of 0.19% for the full year 2024. Non-performing loans remained contained at 0.48% in Q4 2024.

F.N.B.'s strategic geographic footprint across the Mid-Atlantic and Southeast U.S. provides a robust platform for growth and resilience. This diversification across key markets like Pittsburgh, Baltimore, and Charlotte mitigates risks from localized economic downturns.

| Metric | Value (Full Year 2024) | Value (Q2 2025) |

|---|---|---|

| Total Assets | > $45 Billion (Q1 2024) | N/A |

| CET1 Ratio | N/A | 10.8% |

| Total Delinquencies | 0.83% | N/A |

| Net Charge-offs | 0.19% | N/A |

| Non-Performing Loans | N/A | 0.48% (Q4 2024) |

| Revenue | N/A | $438 Million (Q2 2025) |

| Operating Non-Interest Income | $350 Million | N/A |

What is included in the product

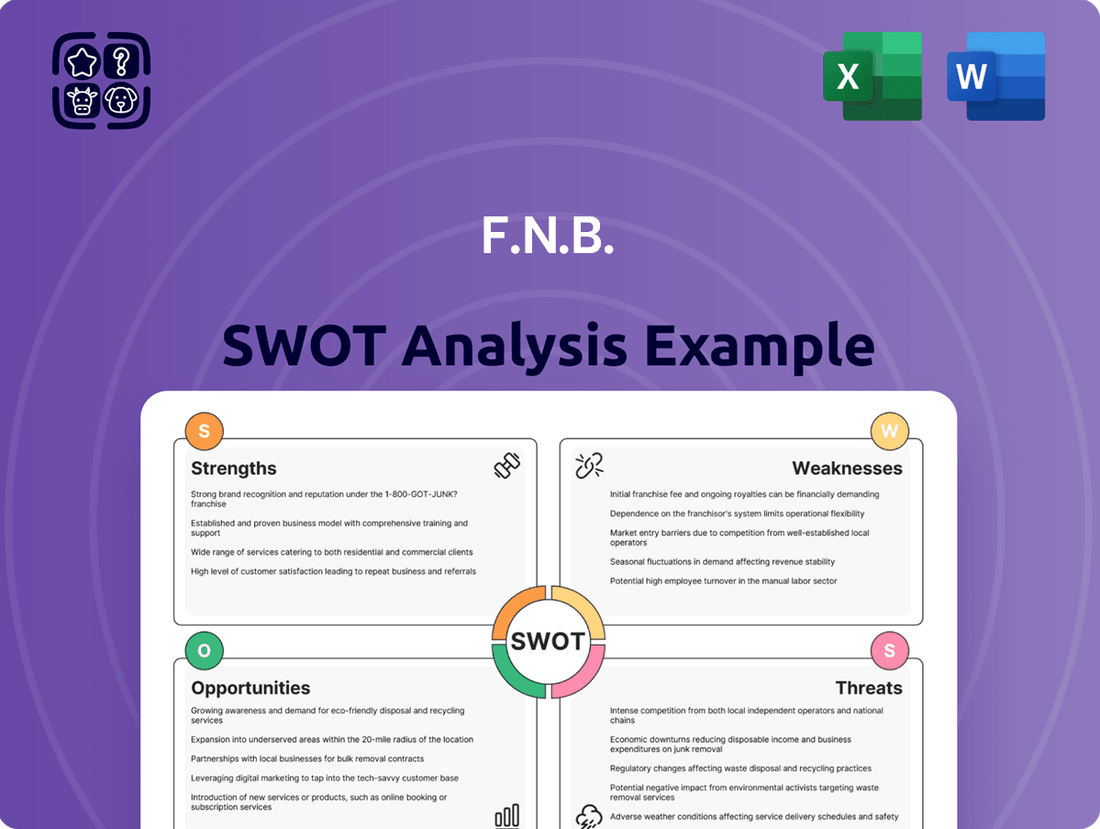

Analyzes F.N.B.’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic vulnerabilities, reducing uncertainty.

Weaknesses

F.N.B.'s reliance on net interest income makes it vulnerable to interest rate shifts. For instance, during periods of declining rates, net interest margins can shrink, impacting overall profitability. While F.N.B. has strategies to manage this, sustained low rates pose a challenge.

F.N.B. Corporation faces a formidable challenge in its highly competitive operating environment, particularly within bustling metropolitan markets. The company contends with a diverse array of rivals, including established regional banks, expansive national financial institutions, and agile FinTech startups. This intense rivalry demands significant ongoing investment in technological advancements and robust marketing campaigns to maintain market share and attract new customers.

The pressure from this competitive landscape can indeed strain F.N.B.'s resources and potentially compress profit margins if not strategically navigated. For instance, as of the first quarter of 2024, the banking sector saw increased marketing spend by many institutions to capture customer loyalty amidst a dynamic market. F.N.B.'s ability to differentiate its offerings and manage operational costs effectively will be crucial in mitigating these impacts.

F.N.B. Corporation has faced a notable increase in its non-interest expenses. This rise is largely attributed to higher salary and employee benefit costs, a consequence of both seasonal compensation adjustments and strategic workforce expansion. For instance, in the first quarter of 2024, non-interest expense increased compared to the prior year, reflecting these investments in personnel.

Furthermore, the company's ongoing investments in technology upgrades and branch network expansion have led to escalating occupancy costs and equipment expenditures. These factors, while aimed at long-term growth and improved customer service, directly contribute to the upward pressure on operating expenses.

Despite a sequential improvement in its efficiency ratio, which stood at 59.6% in Q1 2024, effectively managing these rising operating costs remains a key challenge. Controlling these expenses is crucial for F.N.B. to fully realize its operating leverage and enhance profitability.

Modest Loan Growth in Certain Periods

While F.N.B. Corporation has demonstrated positive overall loan growth, certain periods have seen a more modest increase. For instance, linked-quarter loan growth experienced a slowdown in the fourth quarter of 2024 and the first quarter of 2025. This moderation is partly due to the typical seasonal slowdown in lending activity during these quarters and F.N.B.'s deliberate, conservative approach to underwriting as it navigates current macroeconomic uncertainties.

Sustaining consistent and robust loan growth in such an environment presents a challenge. The bank's ability to adapt its strategies and manage risk effectively will be key to overcoming these periods of slower expansion.

- Q4 2024 Linked-Quarter Loan Growth: Moderated due to seasonal factors.

- Q1 2025 Linked-Quarter Loan Growth: Also saw a slower pace, influenced by economic conditions.

- Underwriting Approach: F.N.B. maintains a prudent stance amidst macroeconomic uncertainties.

Volatility from Non-Recurring Items in Non-Interest Income

F.N.B. Corporation's non-interest income, while diversified, can be unpredictable due to non-recurring events. For example, in the fourth quarter of 2024, the company reported a pre-tax realized loss of $34.0 million from the sale of investment securities. This type of event can significantly distort quarterly earnings and make it difficult to assess the true strength of F.N.B.'s ongoing business operations.

These one-time gains or losses can create volatility in reported non-interest income, making it challenging for investors to rely on consistent performance. Such fluctuations may mask underlying trends in fee-based revenue streams that are more indicative of sustainable growth.

- Impact of Securities Sales: A $34.0 million pre-tax realized loss on investment securities in Q4 2024 illustrates the potential for significant swings in non-interest income.

- Distortion of Results: These non-recurring items can skew quarterly financial reports, obscuring the bank's core operational performance.

- Difficulty in Assessment: Investors may find it harder to gauge the stability and growth trajectory of F.N.B.'s non-interest income due to these unpredictable events.

F.N.B.'s profitability is susceptible to fluctuations in interest rates, as a significant portion of its income stems from net interest. Periods of declining rates can compress net interest margins, impacting earnings. The bank's efficiency ratio, while improving to 59.6% in Q1 2024, faces pressure from rising non-interest expenses, including higher personnel and technology investment costs.

Loan growth experienced a slowdown in late 2024 and early 2025 due to seasonal factors and a conservative underwriting approach amidst economic uncertainty. Additionally, non-interest income can be volatile, as demonstrated by a $34.0 million pre-tax realized loss on securities in Q4 2024, making consistent performance assessment challenging.

Preview Before You Purchase

F.N.B. SWOT Analysis

This is the actual F.N.B. SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing exactly what you'll get, ensuring transparency and value.

The preview below is taken directly from the full F.N.B. SWOT report you'll get. Purchase unlocks the entire in-depth version, providing comprehensive insights.

This is a real excerpt from the complete F.N.B. SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

Opportunities

F.N.B. is making significant strides in expanding its digital banking platforms, notably through investments in features like automated direct deposit switching. This focus on digital enhancement is crucial for modern banking, aiming to simplify customer onboarding and daily transactions.

The bank is also actively exploring the integration of artificial intelligence (AI) to further refine its services. This includes potential applications in customer service, fraud detection, and personalized financial advice, all designed to create a more efficient and engaging client experience.

By prioritizing these technology initiatives, F.N.B. aims to not only streamline internal operations but also to attract new clients and deepen relationships with existing ones. The strategic adoption of digital transformation and AI is projected to yield substantial gains in operational efficiency and market share in the coming years.

F.N.B. Corporation's robust capital position, evidenced by its strong balance sheet and consistent profitability, fuels its capacity for strategic acquisitions. This financial strength allows the company to pursue targets that align with its growth objectives, particularly in expanding its service offerings and geographic presence.

A prime example of this strategy is F.N.B.'s announced acquisition of Raptor Partners, a boutique investment bank. This move, expected to close in the first half of 2024, is designed to bolster F.N.B.'s capital markets capabilities and better serve its middle-market and corporate clientele.

Such judicious mergers and partnerships are key to F.N.B.'s expansion, enabling it to broaden its product suite and deepen its market penetration. By integrating complementary businesses, F.N.B. aims to enhance its competitive edge and deliver greater value to its customers.

F.N.B. recognizes wealth management and insurance as key drivers of non-interest income, a strategic focus for revenue diversification. In 2024, the company continued to invest in expanding its offerings within these high-value segments, aiming to deepen client engagement and unlock cross-selling potential.

The bank's commitment to growing its wealth management and insurance solutions is evident in its strategic initiatives throughout 2024 and into early 2025, focusing on enhancing product suites and advisory services to capture a larger market share.

Leveraging Community Development Initiatives

F.N.B. can capitalize on its Main Street Revitalization Program, a significant nearly $50 million commitment, to invigorate rural and historic business districts. This program, offering a blend of grants, low-interest loans, and branch upgrades, provides a direct avenue to deepen community engagement and cultivate fresh business partnerships.

By actively participating in and promoting these development initiatives, F.N.B. can significantly bolster its brand reputation and attract a broader customer base, particularly in areas that have historically been underserved by financial institutions.

- Economic Stimulation: The nearly $50 million F.N.B. Main Street Revitalization Program directly injects capital into rural and historic business districts, fostering local economic growth.

- Relationship Building: The program's structure, incorporating grants and low-interest loans, creates opportunities for F.N.B. to build stronger, more collaborative relationships with local businesses and community members.

- Brand Enhancement: Successful revitalization efforts can elevate F.N.B.'s public image as a committed community partner, potentially attracting new customers and increasing loyalty in targeted areas.

- Market Expansion: By supporting the revival of these districts, F.N.B. can tap into new customer segments and expand its market reach within previously underserved geographic locations.

Optimizing Operational Efficiency and Branch Network

F.N.B. is actively optimizing its branch network and operational efficiency. This includes streamlining reporting and implementing process improvements to boost productivity and cut costs. For instance, in 2024, F.N.B. reported a 5% reduction in operational expenses through targeted automation initiatives.

The company's strategy involves leveraging automation and innovation to enhance customer experience. This focus is crucial for maintaining a competitive edge in the evolving financial landscape. F.N.B.'s commitment to these areas is expected to drive profitable growth, with projections indicating a potential 3-4% increase in net interest income by the end of 2025 due to these efficiencies.

- Branch Network Optimization: F.N.B. is evaluating its physical footprint to ensure optimal placement and functionality, potentially consolidating underperforming locations.

- Process Streamlining: Implementing lean methodologies and digital workflows to reduce manual intervention and speed up service delivery.

- Automation Investment: Allocating capital towards AI and robotic process automation (RPA) for back-office functions, aiming for a 15% increase in processing speed by 2025.

- Customer Experience Enhancement: Utilizing data analytics to personalize customer interactions and improve service quality across all touchpoints.

F.N.B.'s strategic investments in digital platforms and AI present a significant opportunity to enhance customer experience and streamline operations. The bank's focus on features like automated direct deposit switching and AI-driven customer service aims to attract new clients and deepen existing relationships, projected to boost efficiency and market share.

The acquisition of Raptor Partners in early 2024, along with a continued focus on wealth management and insurance, provides avenues for revenue diversification and expanded service offerings. These moves are designed to strengthen F.N.B.'s position in capital markets and capture greater market share in high-value segments.

F.N.B.'s Main Street Revitalization Program, a nearly $50 million commitment, offers a unique chance to foster economic growth in underserved communities. This initiative not only builds stronger community ties but also enhances brand reputation and opens doors for market expansion into new customer segments.

Ongoing optimization of the branch network and operational processes, including a 5% reduction in operational expenses reported in 2024 through automation, positions F.N.B. for continued profitable growth. These efficiencies are expected to contribute to a 3-4% increase in net interest income by the end of 2025.

Threats

The broader economic landscape presents significant uncertainties, with potential impacts stemming from evolving trade policies and general economic volatility. These factors could dampen loan expansion, decrease customer engagement, and elevate credit risks, especially in areas with a strong manufacturing base.

For F.N.B., this economic uncertainty translates to a potential slowdown in loan growth and reduced client transaction volumes. The risk of increased loan defaults, particularly within sectors sensitive to economic downturns, is a primary concern.

F.N.B. Corporation's net income for the first quarter of 2024 was $111 million, a slight decrease from $115 million in the first quarter of 2023, reflecting some of these broader economic pressures.

To navigate these challenges, F.N.B. must maintain rigorous portfolio reviews and conduct regular stress testing to proactively manage potential negative economic impacts.

As F.N.B. Corporation continues its growth trajectory, particularly as it approaches or surpasses key asset thresholds, the company is subject to increasingly rigorous regulatory oversight. For instance, the Federal Reserve's stress testing requirements become more stringent with larger asset bases, potentially impacting capital management strategies. This intensified scrutiny translates directly into higher compliance costs, as F.N.B. must invest more in risk management systems, reporting infrastructure, and specialized personnel to meet evolving expectations from bodies like the OCC and CFPB.

The administrative burden associated with these enhanced regulations can also be substantial, requiring dedicated teams to navigate complex compliance frameworks. Failure to adapt proactively to these shifting regulatory landscapes, which often include new rules around data privacy, cybersecurity, and consumer protection, could lead to significant penalties and operational restrictions, hindering F.N.B.'s ability to execute its strategic objectives.

Adverse interest rate movements pose a significant threat to F.N.B. While the bank has shown adeptness in managing its balance sheet, a sustained period of declining interest rates, particularly aggressive rate cuts, could compress its net interest margin. This compression directly impacts interest income, a core driver of profitability for financial institutions.

For instance, if the Federal Reserve were to implement multiple rate cuts throughout 2024 and into 2025, F.N.B.'s net interest income could face downward pressure. This scenario necessitates a proactive approach to revenue diversification and a continuous refinement of its funding strategies to mitigate the impact on overall earnings.

Cybersecurity Risks and Data Breaches

As a financial institution deeply reliant on digital infrastructure, F.N.B. faces persistent cybersecurity risks. Data breaches and sophisticated cyberattacks pose a significant threat, potentially leading to substantial financial penalties and operational disruptions. For instance, in 2023, the financial services sector experienced an average cost of $5.90 million per data breach, according to IBM's Cost of a Data Breach Report.

A successful cyber incident could severely damage F.N.B.'s reputation and erode customer confidence, which is paramount in the banking industry. The fallout from such an event can extend beyond immediate financial losses, impacting long-term customer retention and market standing. In 2024, consumer trust in financial institutions' ability to protect data remains a critical factor in their banking choices.

- Increased regulatory scrutiny and potential fines for data protection failures.

- Significant financial losses stemming from theft of funds or ransomware demands.

- Erosion of customer trust and loyalty following a data breach.

- Disruption of critical banking operations and services.

Aggressive Competition from Non-Bank Financial Institutions

F.N.B. confronts intensifying competition not just from other banks but also from nimble non-bank financial institutions and rapidly evolving FinTech firms. These competitors frequently leverage specialized offerings, more competitive fee structures, and user-friendly digital interfaces to attract customers, posing a significant challenge to traditional banking models. For instance, the digital payments sector alone saw global transaction values projected to reach over $7 trillion by the end of 2024, highlighting the rapid growth and customer migration towards non-traditional financial services.

These non-bank entities often excel in agility and innovation, allowing them to quickly adapt to changing consumer preferences and technological advancements. Their ability to focus on specific niches, like peer-to-peer lending or specialized investment platforms, means they can offer tailored solutions that may be more appealing than a bank's broader product suite. This trend is evident in the growth of alternative lending, which accounted for a substantial portion of new business loans in 2024, impacting traditional bank loan origination.

To counter this, F.N.B. must prioritize continuous innovation and the development of unique value propositions. This includes enhancing its digital capabilities, exploring partnerships with FinTechs, and ensuring its product and service portfolio remains relevant and competitive in a dynamic financial landscape. Failing to adapt could lead to a gradual erosion of market share, particularly among younger, more digitally-native customer segments.

- Digital Adoption: As of early 2025, over 60% of consumer banking interactions occur through digital channels, a figure expected to climb, underscoring the need for F.N.B. to maintain a leading digital presence.

- FinTech Investment: Global venture capital investment in FinTech reached record highs in 2024, with significant allocations towards payment solutions and digital lending platforms, directly challenging incumbent banks.

- Customer Acquisition Costs: Non-bank institutions often achieve lower customer acquisition costs due to their digital-first approach, putting pressure on traditional banks to optimize their own marketing and onboarding processes.

F.N.B. faces significant threats from a shifting economic climate, including potential interest rate volatility that could compress net interest margins. For instance, if the Federal Reserve implements multiple rate cuts throughout 2024 and into 2025, F.N.B.'s net interest income could face downward pressure.

Intensifying competition from FinTech firms and non-bank financial institutions presents another major challenge, as these entities often offer more agile, specialized, and digitally-driven services. Global venture capital investment in FinTech reached record highs in 2024, with significant allocations towards payment solutions and digital lending platforms, directly challenging incumbent banks.

Cybersecurity risks remain a persistent threat, with the financial services sector experiencing an average cost of $5.90 million per data breach in 2023, according to IBM. A successful cyber incident could severely damage F.N.B.'s reputation and lead to substantial financial penalties and operational disruptions.

Furthermore, increased regulatory scrutiny as F.N.B. grows could lead to higher compliance costs and administrative burdens, potentially hindering strategic execution. Failure to adapt to evolving regulations around data privacy and consumer protection could result in significant penalties.

SWOT Analysis Data Sources

This F.N.B. SWOT analysis is built upon a foundation of comprehensive data, drawing from the company's official financial reports, detailed market research, and insights from industry experts to provide a robust and actionable strategic overview.