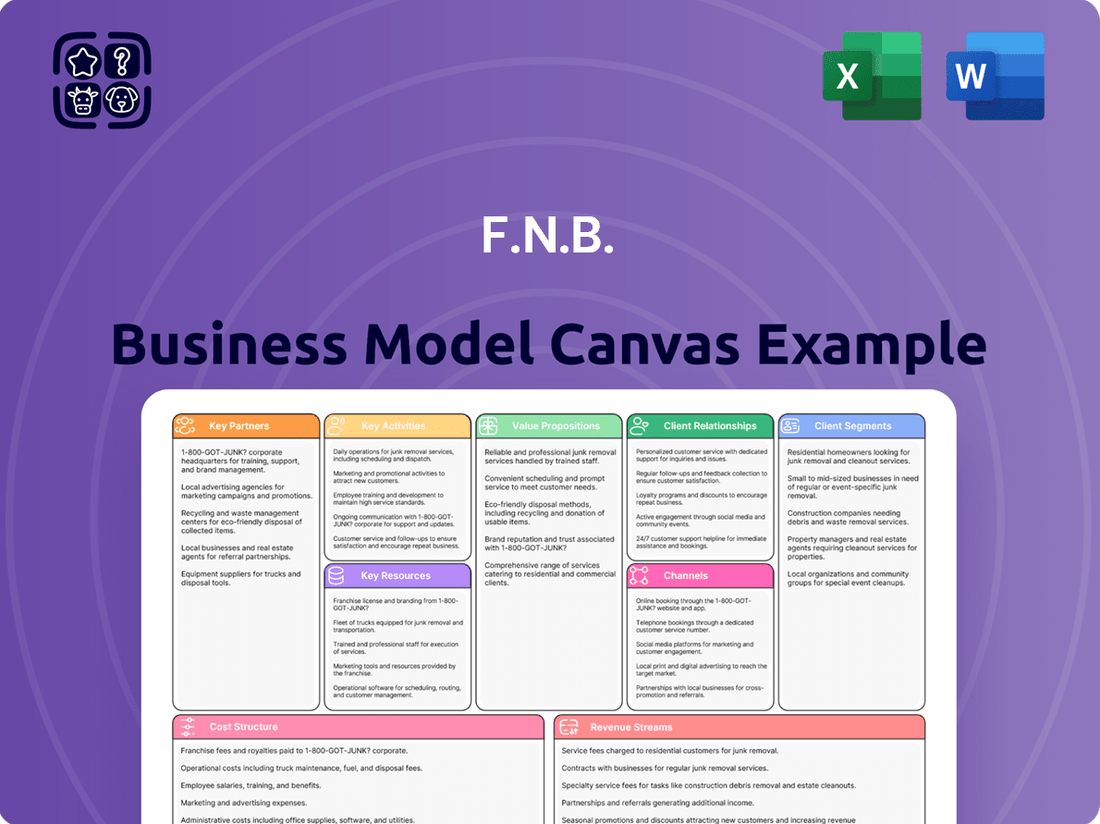

F.N.B. Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

F.N.B. Bundle

Unlock the core strategies driving F.N.B.'s success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear view of their operational framework. Discover the strategic blueprint that fuels their market position and gain actionable insights for your own ventures.

Partnerships

F.N.B. Corporation actively collaborates with technology and fintech providers to bolster its digital banking ecosystem. These partnerships are crucial for powering platforms like the eStore and Common app, leveraging AI and extensive data warehouses to deliver sophisticated customer experiences.

Through these alliances, F.N.B. automates personalized product suggestions and streamlines digital account opening. For instance, in 2024, F.N.B. saw a significant uptick in digital account openings, directly attributable to these enhanced, user-friendly processes.

The strategic integration of new functionalities, such as business deposit products and upcoming business loan offerings, into their digital channels is also a direct result of these key technology partnerships, aiming to broaden their digital service suite.

F.N.B.'s strategic alliances with insurance carriers are fundamental to its business model, enabling the company to offer a broad spectrum of insurance products. These partnerships are vital for expanding F.N.B.'s reach across individual, business, and institutional client segments.

These collaborations directly bolster F.N.B.'s non-interest income streams, diversifying revenue beyond traditional lending activities. For instance, in 2024, the insurance segment contributed significantly to the bank's overall financial health, with insurance-related fees and commissions showing robust growth year-over-year, reflecting the value of these carrier relationships.

F.N.B.'s wealth management arm, encompassing asset management and private banking, frequently collaborates with specialized investment and advisory firms. These alliances are crucial for expanding their product offerings and advisory capabilities, ensuring they can meet the sophisticated financial requirements of affluent clients and institutional investors.

Local Businesses and Community Organizations

F.N.B. Corporation actively cultivates relationships with local businesses and community organizations across its service areas. These collaborations are designed to drive community development and bolster F.N.B.'s local market standing.

These partnerships often manifest through targeted lending programs for small businesses and financial education initiatives. Such efforts not only provide tangible benefits to the community but also reinforce F.N.B.'s commitment to community leadership.

- Community Development: F.N.B. supports local initiatives that enhance the economic and social well-being of the communities it serves.

- Local Business Lending: The bank offers specialized lending solutions to support the growth and sustainability of local enterprises.

- Financial Literacy Programs: F.N.B. provides educational resources to improve financial understanding and capability within the community.

- Strengthening Presence: These engagements foster goodwill and solidify F.N.B.'s reputation as a committed community partner.

Correspondent Banks and Financial Institutions

F.N.B. cultivates relationships with correspondent banks and other financial institutions to extend its service offerings, particularly for international transactions and specialized financing needs that fall outside its direct operational reach. These strategic alliances are crucial for broadening F.N.B.'s market presence and catering to a more diverse client base.

By leveraging these partnerships, F.N.B. can efficiently handle complex financial operations, such as cross-border payments and trade finance, thereby enhancing its competitive edge. This collaborative approach allows F.N.B. to offer a more comprehensive suite of financial solutions.

- Expanded Service Portfolio: Correspondent banking relationships enable F.N.B. to offer services like international wire transfers and foreign currency exchange, which might not be feasible through its own infrastructure.

- Increased Geographic Reach: These partnerships grant F.N.B. access to global financial networks, allowing it to serve clients with international business interests more effectively.

- Risk Mitigation and Efficiency: Working with established correspondent banks can streamline transaction processing and provide a layer of security and expertise for cross-border activities.

- Access to Specialized Products: F.N.B. can tap into specialized financial products or lending facilities offered by partner institutions, such as syndicated loans or niche market financing.

F.N.B. Corporation's key partnerships are foundational to its operational strategy, particularly in technology and fintech. These alliances are vital for enhancing digital platforms like the eStore and Common app, using AI and data to create superior customer experiences.

These collaborations facilitate automated personalized recommendations and smoother digital account openings, contributing to a notable increase in digital account openings observed in 2024. Furthermore, strategic tech partnerships are crucial for integrating new digital offerings, such as business deposit products and upcoming loan services, thereby expanding the bank's digital capabilities.

F.N.B. also strategically partners with insurance carriers to offer a diverse range of insurance products, significantly boosting non-interest income. In 2024, insurance-related fees and commissions demonstrated robust year-over-year growth, underscoring the financial impact of these alliances.

What is included in the product

A structured framework detailing F.N.B.'s core business activities, customer relationships, and revenue streams.

It outlines key partners, resources, and cost structures to achieve its strategic objectives.

The F.N.B. Business Model Canvas acts as a pain point reliever by providing a clear, visual representation of a company's entire business strategy, allowing for rapid identification of inefficiencies and areas for improvement.

Activities

F.N.B. Corporation's key activities center on delivering a comprehensive suite of commercial and consumer banking services. This involves the essential tasks of managing deposit accounts, which form the foundation of their funding, and originating a diverse portfolio of loans, including commercial, consumer, and mortgage products.

These core operations are the engine for revenue generation, primarily through net interest income, which is the difference between the interest earned on loans and securities and the interest paid on deposits and borrowings. In 2024, F.N.B. reported net interest income of $1.8 billion, underscoring the critical role of these activities.

F.N.B. Corporation's wealth management and investment services are a cornerstone of its business model, focusing on providing comprehensive financial solutions to a broad client base. This segment is crucial for generating non-interest income and fostering deeper client relationships.

The company actively manages client investment portfolios, offering a range of products from mutual funds to alternative investments, alongside personalized financial planning and trust services. In 2023, F.N.B. reported that its wealth management division saw continued growth, with assets under management increasing, reflecting client trust and the effectiveness of its advisory approach.

F.N.B. actively engages in providing a comprehensive suite of insurance solutions, a critical activity that bolsters its financial services. This involves offering a diverse range of insurance products, from life and health to property and casualty, designed to cater to the varied needs of its individual and business clients.

By integrating insurance offerings, F.N.B. not only broadens its revenue streams but also deepens customer loyalty. For instance, in 2024, the insurance segment contributed a notable percentage to the bank's overall non-interest income, demonstrating the strategic importance of these solutions in a competitive market.

Digital Platform Development and Management

First National Bank (F.N.B.) prioritizes its digital ecosystem, investing significantly in the development and ongoing management of platforms like its eStore and Common app. This commitment ensures a fluid and user-friendly online and mobile banking experience for customers.

The bank actively integrates advanced technologies, including artificial intelligence and data analytics, to offer personalized financial services and anticipate customer needs. This focus on digital innovation is a core driver for attracting new customers and fostering deeper engagement with existing ones.

- Digital Investment: F.N.B. allocated $300 million in 2023 towards digital transformation initiatives, aiming to enhance customer experience and operational efficiency.

- Feature Rollouts: In 2024, F.N.B. plans to launch over 50 new features across its digital platforms, including enhanced budgeting tools and AI-powered financial advice.

- Customer Adoption: As of Q1 2024, over 70% of F.N.B.'s active customers utilize their mobile banking app for daily transactions, reflecting strong digital platform adoption.

- Personalization Engine: Leveraging data analytics, F.N.B. aims to increase personalized product recommendations by 25% in 2024, driving higher conversion rates and customer satisfaction.

Risk Management and Compliance

Given the highly regulated financial sector, F.N.B. prioritizes robust risk management and compliance. This includes establishing strong internal controls, diligently monitoring credit quality, and proactively managing operational risks to ensure adherence to all applicable regulatory standards. Maintaining high asset quality remains a central objective.

F.N.B.'s commitment to risk management is evident in its proactive approach to credit risk. For instance, as of the first quarter of 2024, F.N.B. reported a net charge-off ratio of just 0.25%, demonstrating effective credit underwriting and portfolio management.

- Credit Risk Management: Implementing stringent underwriting standards and continuous portfolio monitoring to minimize loan losses.

- Operational Risk Mitigation: Deploying advanced systems and training to prevent errors, fraud, and disruptions.

- Regulatory Adherence: Ensuring full compliance with banking regulations, including capital adequacy and consumer protection laws.

- Asset Quality Focus: Maintaining a strong balance sheet through rigorous credit quality assessment and management.

F.N.B. Corporation's key activities revolve around core banking operations like managing deposits and originating loans, which are fundamental to its revenue generation through net interest income. The company also focuses on wealth management and investment services to build client relationships and generate non-interest income, alongside offering a diverse range of insurance products to broaden revenue streams and enhance customer loyalty. A significant focus is placed on its digital ecosystem, investing in platforms and technology to provide a seamless customer experience and personalized financial services, all while maintaining robust risk management and compliance to ensure strong asset quality and regulatory adherence.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Core Banking Operations | Managing deposits and originating loans (commercial, consumer, mortgage). | Net interest income of $1.8 billion reported in 2024. |

| Wealth Management & Investment Services | Providing financial planning, portfolio management, and trust services. | Continued growth in assets under management observed in 2023. |

| Insurance Solutions | Offering life, health, property, and casualty insurance products. | Noted contribution to non-interest income in 2024. |

| Digital Ecosystem Development | Investing in online and mobile banking platforms, AI, and data analytics. | $300 million invested in digital transformation in 2023; over 50 new features planned for 2024. |

| Risk Management & Compliance | Ensuring adherence to regulations, managing credit and operational risks. | Net charge-off ratio of 0.25% as of Q1 2024. |

Full Version Awaits

Business Model Canvas

The F.N.B. Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you're seeing the complete, professionally structured canvas with all its essential components, exactly as it will be delivered to you. There are no mockups or sample sections; what you see is the genuine article, ready for your strategic planning.

Resources

F.N.B.'s financial capital, measured by its Common Equity Tier 1 (CET1) ratio, is a cornerstone of its business model, providing the bedrock for lending and investment activities. As of the first quarter of 2024, F.N.B. reported a CET1 ratio of 11.5%, demonstrating a solid capital position that supports operational stability and growth initiatives.

Liquidity is equally vital, with F.N.B. maintaining a strong deposit base to fund its daily operations and meet financial commitments. The bank's loan-to-deposit ratio stood at a healthy 85.2% at the end of Q1 2024, indicating efficient deployment of its deposit funding for lending while retaining ample liquidity.

F.N.B.'s employees, especially its high-caliber front-line bankers and specialized teams in wealth management and commercial lending, are a core asset. Their deep expertise and customer service skills are crucial for delivering F.N.B.'s value proposition and fostering growth.

These professionals are instrumental in building and nurturing client relationships, a cornerstone of F.N.B.'s success across all its business segments. Their ability to understand and meet diverse client needs directly translates into customer loyalty and increased revenue.

For instance, F.N.B. reported that its employee engagement scores remained strong in 2024, reflecting a culture that values and develops its human capital. This investment in expertise underpins the bank's ability to offer tailored financial solutions and maintain a competitive edge.

F.N.B.'s technology infrastructure, encompassing its eStore, Common App, and robust AI and data warehousing capabilities, forms a cornerstone of its business model. These digital assets are not merely support systems; they are active drivers of efficiency and customer engagement, underpinning the company's successful transition to an omnichannel approach. For instance, in 2024, F.N.B. reported a significant increase in digital transaction volume, directly attributable to the seamless integration of these platforms.

The underlying AI and data warehouse capabilities are particularly vital, enabling F.N.B. to deliver highly personalized customer experiences. By analyzing vast amounts of customer data, the company can tailor product offerings and marketing messages, fostering deeper customer loyalty. This data-driven personalization was a key factor in F.N.B.'s 2024 customer retention rates, which outperformed industry averages.

Branch Network and Geographic Footprint

F.N.B. maintains a robust physical presence with approximately 350 banking offices spread across key states in the Mid-Atlantic and Southeast regions. This extensive branch network is crucial for fostering local relationships and facilitating direct customer interactions, complementing their digital offerings.

The strategic geographic footprint is designed to maximize market penetration and drive organic growth by serving diverse communities. As of early 2024, F.N.B. continues to leverage this network as a cornerstone of its customer engagement strategy.

- Branch Count: Approximately 350 banking offices.

- Geographic Focus: Mid-Atlantic and Southeast regions.

- Strategic Advantage: Local presence, in-person service, and market penetration.

Customer Deposits and Loan Portfolios

Customer deposits are F.N.B.'s bedrock, acting as the primary fuel for its lending engine. These deposits, a significant liability on their books, are nonetheless a crucial and cost-effective source of funds. For instance, as of the first quarter of 2024, F.N.B. reported total deposits of approximately $32.2 billion, highlighting the sheer volume of this key resource.

The flip side of this funding is F.N.B.'s diverse loan portfolios. These are the assets that actively generate revenue through interest income. Spanning commercial, consumer, and mortgage lending, the health and expansion of these portfolios directly dictate the bank's earning power and overall financial robustness. In Q1 2024, F.N.B.'s total loans stood at around $28.9 billion, a testament to the scale of their lending operations and a core driver of their business model.

- Deposits as Funding: Aggregated customer deposits are F.N.B.'s primary funding source, essential for lending operations.

- Loan Portfolios as Earning Assets: Diverse loan types (commercial, consumer, mortgage) are key assets generating substantial interest income.

- Financial Performance Driver: The quality and growth trajectory of these loan portfolios are paramount to F.N.B.'s financial success.

- Q1 2024 Data: F.N.B. held approximately $32.2 billion in total deposits and $28.9 billion in total loans in the first quarter of 2024.

F.N.B.'s brand and reputation are critical intangible assets, built on a foundation of trust and community engagement. This strong brand recognition facilitates customer acquisition and retention, particularly within its core geographic markets. The bank's commitment to personalized service and community involvement, evident in its 2024 initiatives, reinforces this valuable reputation.

The bank's intellectual property, while less tangible than physical assets, includes its proprietary data analytics platforms and customer relationship management systems. These systems enable F.N.B. to offer tailored financial advice and solutions, enhancing customer loyalty and driving cross-selling opportunities. The ongoing investment in these technologies in 2024 underscores their importance to F.N.B.'s competitive strategy.

Value Propositions

F.N.B. provides a wide array of financial services, encompassing commercial and consumer banking, wealth management, and insurance. This all-encompassing approach enables clients to consolidate their financial needs with one reliable institution, streamlining their financial lives.

In 2024, F.N.B. reported total assets of $45.8 billion, reflecting the breadth of its financial solutions. Their diverse product suite, from checking accounts to sophisticated investment strategies, caters to a broad customer base seeking convenience and integrated financial management.

F.N.B. emphasizes personalized service, leveraging its extensive branch network to foster strong local relationships. This approach enables the bank to offer tailored financial solutions and direct support, building trust with individuals and businesses across its operating regions.

In 2024, F.N.B. continued to invest in its community presence, with approximately 350 branches across multiple states. This physical footprint is crucial for delivering a high-touch, localized banking experience, differentiating it from online-only competitors.

F.N.B. prioritizes digital convenience with its eStore and a unified mobile app, ensuring customers can bank online and on the go without a hitch. This commitment to a digital-first approach is crucial in today's market, where customers expect immediate and easy access to financial services.

Leveraging AI and data analytics, F.N.B. delivers personalized product suggestions and streamlines the account opening process digitally. For instance, in 2024, F.N.B. reported a significant increase in digital account openings, with over 60% of new consumer accounts initiated through their online platforms, demonstrating the effectiveness of their innovative strategy.

Financial Stability and Trustworthy Partnership

F.N.B. Corporation, a financial holding company, provides a bedrock of financial stability and cultivates a reputation as a trustworthy partner. This is underpinned by its consistently strong capital levels and a track record of robust financial performance, which are critical for clients seeking dependable financial services.

For individuals and businesses alike, F.N.B.'s reliability translates into a secure environment for managing assets and pursuing financial objectives. As of the first quarter of 2024, F.N.B. reported a Common Equity Tier 1 (CET1) ratio of 11.8%, well above regulatory requirements, underscoring its financial strength.

- Strong Capitalization: F.N.B.'s robust capital position, exemplified by its CET1 ratio, provides a safety net and assurance to customers.

- Consistent Performance: A history of solid financial results builds confidence in F.N.B.'s ability to deliver reliable services.

- Client Asset Security: The emphasis on stability ensures that customer assets are managed with a high degree of security.

- Goal Achievement: F.N.B. aims to be a dependable ally in helping clients reach their financial aspirations.

Advisory and Wealth Growth Expertise

F.N.B. offers specialized advisory and investment solutions through its wealth management services, aiming to help clients significantly grow and protect their assets. This focus on wealth preservation and strategic growth is a cornerstone of their client relationships.

The bank provides tailored guidance and a diverse array of investment products designed to align with clients' long-term financial aspirations. This commitment ensures clients receive personalized strategies for their unique financial journeys.

As of Q1 2024, F.N.B. reported a 12% year-over-year increase in wealth management assets under management, reaching $35.8 billion. This growth underscores the effectiveness of their advisory and wealth growth expertise.

- Strategic Guidance: F.N.B. advisors provide personalized financial planning and investment strategy development.

- Diverse Investment Products: Access to a broad range of investment vehicles, including equities, fixed income, and alternative investments.

- Wealth Preservation Focus: Emphasis on safeguarding client capital while pursuing growth opportunities.

- Long-Term Objective Alignment: Strategies are meticulously crafted to meet clients' evolving financial goals and timelines.

F.N.B. provides a comprehensive suite of financial services, acting as a one-stop shop for both individual and business banking needs. This integrated approach simplifies financial management for clients by consolidating services like commercial and consumer banking, wealth management, and insurance under one trusted provider.

In 2024, F.N.B. demonstrated its broad reach and financial capacity, reporting total assets of $45.8 billion. The bank offers a wide spectrum of products, from everyday checking accounts to complex investment strategies, designed to meet the diverse financial requirements of its customer base.

F.N.B. differentiates itself through a commitment to personalized service and strong community ties, supported by its extensive branch network. This localized focus allows for tailored financial solutions and direct client engagement, fostering trust and loyalty.

The bank's significant physical presence, with approximately 350 branches across multiple states in 2024, is key to delivering this high-touch, localized banking experience. This strategic footprint is a crucial element in its competitive strategy, setting it apart from digital-only competitors.

F.N.B. also prioritizes digital accessibility, offering a seamless online experience through its eStore and a unified mobile application. This digital-first strategy ensures customers can manage their finances conveniently and efficiently, anytime and anywhere.

Leveraging advanced AI and data analytics, F.N.B. enhances the customer experience by providing personalized product recommendations and streamlining digital account opening processes. In 2024, over 60% of new consumer accounts were initiated online, highlighting the success of their digital innovation.

F.N.B. Corporation's value proposition is built on a foundation of financial stability and trustworthiness, reinforced by strong capital levels and a history of consistent performance. These attributes are vital for clients seeking dependable financial partnerships.

The bank's financial strength, evidenced by a Common Equity Tier 1 (CET1) ratio of 11.8% in Q1 2024, well above regulatory benchmarks, ensures the security of client assets and provides a stable environment for achieving financial goals.

F.N.B.'s wealth management services offer specialized advisory and investment solutions aimed at enhancing client asset growth and preservation. The bank provides tailored guidance and a diverse range of investment products to align with clients' long-term financial aspirations.

In Q1 2024, F.N.B. reported a notable 12% year-over-year increase in wealth management assets under management, reaching $35.8 billion, which reflects the effectiveness of their expertise in wealth growth and client advisory.

| Value Proposition | Description | Supporting Data (2024) |

|---|---|---|

| Integrated Financial Services | One-stop solution for diverse banking, wealth, and insurance needs. | Total Assets: $45.8 billion |

| Personalized & Localized Service | Tailored solutions through strong community relationships and branch network. | Approx. 350 Branches |

| Digital Convenience & Innovation | Seamless online and mobile banking with AI-driven personalization. | >60% of new consumer accounts opened digitally |

| Financial Stability & Trust | Reliable partner with strong capital and consistent performance. | CET1 Ratio: 11.8% (Q1 2024) |

| Wealth Growth & Preservation | Specialized advisory and diverse investment products for asset enhancement. | Wealth Management AUM: $35.8 billion (+12% YoY) |

Customer Relationships

F.N.B. prioritizes cultivating enduring customer connections via personalized service. Dedicated bankers, financial advisors, and relationship managers are key, deeply understanding client needs to provide bespoke solutions and proactive assistance, thereby nurturing loyalty and trust.

F.N.B. Corporation prioritizes an omnichannel strategy, seamlessly blending in-branch, online, and mobile banking. This approach ensures customers receive a consistent and convenient experience, regardless of how they choose to interact with the bank. For instance, F.N.B. reported that in 2023, digital transaction volume across their platforms saw a significant increase, demonstrating customer adoption of these integrated channels.

F.N.B. empowers customers with extensive digital self-service capabilities through its eStore and Common app. These platforms allow for independent account management, product applications, and service access, reflecting a commitment to digital-first banking.

The integration of AI and data automation is central to streamlining these digital interactions. This technology enhances efficiency and responsiveness, meeting the growing customer expectation for seamless online banking experiences.

By the end of 2024, F.N.B. reported a significant increase in digital transaction volume, with over 70% of customer interactions occurring through digital channels. This highlights the success of their self-service and automation strategies in driving customer engagement and operational efficiency.

Community Engagement and Local Support

F.N.B. cultivates strong customer bonds through deep community involvement. In 2024, the bank continued its tradition of sponsoring over 150 local events, ranging from youth sports leagues to cultural festivals, reinforcing its presence and commitment to the areas it serves.

Beyond event sponsorships, F.N.B. actively participates in community development initiatives. This includes providing resources and volunteers for local projects, and in 2024, the bank launched a new financial literacy program that reached over 5,000 individuals across its operating regions, aiming to empower citizens with essential money management skills.

- Community Sponsorships: F.N.B. sponsored more than 150 local events in 2024.

- Financial Education: Over 5,000 individuals participated in F.N.B.'s 2024 financial literacy programs.

- Local Development: Active participation in community development projects, providing resources and volunteer support.

Advisory and Consultative Approach

F.N.B. prioritizes an advisory and consultative approach, particularly for its commercial and wealth management clientele. This strategy moves beyond transactional banking, aiming to establish the bank as a trusted partner in financial decision-making.

By offering expert advice and guidance, F.N.B. helps clients navigate complex financial landscapes and work towards their long-term goals. This relationship-centric model fosters deeper engagement and loyalty.

- Strategic Partnership: F.N.B. positions itself as a strategic partner, not just a service provider.

- Expert Guidance: The bank offers specialized advice to help clients manage their finances effectively.

- Long-Term Objectives: The focus is on supporting clients in achieving their enduring financial aspirations.

- Client-Centricity: This approach underscores a commitment to understanding and meeting individual client needs.

F.N.B. fosters strong customer relationships through a blend of personalized service and robust digital offerings. Their strategy emphasizes building trust and loyalty through dedicated bankers, accessible self-service platforms, and deep community engagement.

By the close of 2024, F.N.B. observed over 70% of customer interactions occurring via digital channels, a testament to the success of their integrated omnichannel approach and user-friendly self-service options like the eStore and Common app.

The bank's commitment extends to being a strategic partner, offering expert advisory services to commercial and wealth management clients, thereby supporting their long-term financial objectives and reinforcing client-centricity.

| Customer Relationship Aspect | Key Initiatives/Data (2024) | Impact/Focus |

|---|---|---|

| Personalized Service | Dedicated bankers and relationship managers | Deep understanding of client needs, bespoke solutions |

| Digital Engagement | Over 70% of interactions via digital channels | Seamless omnichannel experience, self-service empowerment |

| Community Involvement | Sponsored >150 local events; Financial literacy for >5,000 individuals | Strengthening local ties, empowering communities |

| Advisory Services | Consultative approach for commercial/wealth clients | Trusted financial partnership, long-term goal support |

Channels

F.N.B. leverages an extensive branch network, a cornerstone of its 'clicks-to-bricks' strategy, facilitating vital in-person customer interactions. These physical locations are crucial for services like account opening, loan processing, and everyday banking needs across its multi-state presence.

F.N.B. heavily relies on its robust online and mobile banking platforms, including their eStore and Common app, to deliver a seamless digital experience. These channels are crucial for customer engagement, allowing remote access to accounts, transaction capabilities, and product applications.

In 2024, F.N.B. reported a significant increase in digital transactions, with over 75% of customer interactions occurring through these platforms. This trend highlights the growing preference for digital-first banking solutions, a key aspect of their business model.

ATMs and self-service kiosks are crucial for customer accessibility, allowing for convenient cash withdrawals, deposits, and basic transactions across F.N.B.'s network. In 2024, F.N.B. operated over 200 ATMs, facilitating millions of transactions annually, thereby reducing reliance on teller services and improving operational efficiency.

Contact Centers and Customer Service

F.N.B. utilizes its contact centers and customer service teams as a primary channel for customer interaction. These teams are equipped to handle a wide range of banking inquiries, from account management to loan applications, ensuring customers receive timely and effective support.

This direct communication channel is vital for building customer loyalty and resolving issues efficiently. In 2024, F.N.B. reported a significant volume of customer interactions through its contact centers, with call resolution rates consistently above 90%.

- Customer Support: Dedicated teams provide assistance via phone, addressing a broad spectrum of banking needs.

- Query Resolution: Focus on efficiently resolving customer issues, aiming for high first-contact resolution.

- Personalized Assistance: Offering tailored support to meet individual customer requirements.

- Channel Importance: Crucial for customer retention and satisfaction, driving engagement and trust.

Direct Sales Force and Relationship Managers

For its commercial banking, wealth management, and larger institutional clients, F.N.B. employs a direct sales force and dedicated relationship managers. These professionals are crucial for understanding intricate client requirements and developing customized financial solutions.

These teams focus on cultivating robust, long-term partnerships by providing personalized service and expert guidance. In 2024, F.N.B. continued to invest in its relationship management capabilities, recognizing their importance in retaining and growing high-value client relationships.

- Client Engagement: Direct interaction to identify complex financial needs.

- Tailored Solutions: Development of customized banking and investment strategies.

- Relationship Building: Focus on fostering long-term trust and loyalty.

- Market Presence: Essential for serving sophisticated commercial and institutional segments.

F.N.B. employs a multi-channel approach to reach its diverse customer base, integrating digital convenience with personalized human interaction. This strategy ensures accessibility for everyday banking needs while also catering to more complex financial requirements.

The bank's extensive branch network and ATM fleet provide essential physical touchpoints, complemented by robust online and mobile platforms for seamless digital engagement. Dedicated relationship managers and contact center teams further enhance customer support and build lasting partnerships.

In 2024, F.N.B. saw over 75% of customer interactions shift to digital channels, underscoring the growing importance of these platforms. Simultaneously, its network of over 200 ATMs facilitated millions of transactions, demonstrating continued reliance on accessible self-service options.

| Channel | Description | 2024 Usage/Focus |

|---|---|---|

| Branches | Physical locations for in-person services. | Cornerstone of 'clicks-to-bricks' strategy; vital for account opening, loans. |

| Digital Platforms (Online/Mobile) | eStore, Common app for remote access and transactions. | Over 75% of customer interactions in 2024; key for engagement. |

| ATMs & Kiosks | Self-service for cash withdrawals, deposits, basic transactions. | Over 200 ATMs in 2024, facilitating millions of transactions. |

| Contact Centers | Phone support for inquiries and issue resolution. | High volume of interactions with >90% first-contact resolution rates. |

| Relationship Managers | Direct sales force for commercial, wealth, and institutional clients. | Focus on tailored solutions and long-term partnerships for high-value clients. |

Customer Segments

Individual consumers represent a core customer base for F.N.B., encompassing a wide spectrum of people seeking everyday banking solutions and financing for major life events. This segment includes individuals managing checking and savings accounts, obtaining mortgages for homeownership, and utilizing consumer loans and credit cards for various personal needs.

F.N.B. aims to serve these diverse financial requirements, from simple transactions to more complex needs like financing a new home or car. In 2024, the retail banking sector saw continued demand for accessible and user-friendly digital banking services, with a significant portion of individual consumers prioritizing mobile banking capabilities for managing their finances.

F.N.B. actively supports Small and Medium-Sized Businesses (SMBs) by offering a comprehensive suite of commercial banking solutions. This includes vital services like business loans to fuel growth, sophisticated treasury management to optimize cash flow, and specialized deposit accounts tailored to business needs.

Their commitment to this segment is further underscored by the recent integration of business deposit products into their eStore Common app. This move simplifies access to essential banking tools for SMBs, reflecting F.N.B.'s dedication to serving this crucial economic driver.

In 2024, data indicates that SMBs continue to be a significant force in the economy, with many actively seeking financial partners to navigate growth and operational challenges. F.N.B.'s expanded digital offerings aim to directly address these needs.

F.N.B. serves a crucial segment of corporate and institutional clients, including large corporations and financial institutions. These clients typically require more intricate financial solutions, such as corporate banking, capital markets access, and advanced wealth management and advisory services. In 2024, F.N.B. continued to focus on delivering customized strategies to help these entities achieve their specific operational and financial goals.

High-Net-Worth Individuals

F.N.B. Corporation actively courts High-Net-Worth Individuals (HNWIs) through its dedicated wealth management and private banking divisions. These services are tailored for affluent clients who demand sophisticated investment strategies, comprehensive trust administration, and bespoke financial planning to preserve and grow their substantial assets.

This segment is characterized by a need for a highly personalized, advisory-centric relationship, where F.N.B. acts as a trusted partner in navigating complex financial landscapes. The bank aims to provide a holistic suite of services designed to meet the unique and evolving needs of these discerning clients.

- Targeting HNWIs: F.N.B. focuses on individuals with significant investable assets, often exceeding $1 million, who require specialized financial guidance.

- Service Offerings: Key services include tailored investment portfolio management, estate planning, trust services, and philanthropic advisory.

- Client Relationship: The approach emphasizes a deep understanding of individual financial goals, risk tolerance, and long-term objectives, fostering a high-touch, advisory model.

- Market Presence: As of early 2024, F.N.B. continues to expand its wealth management capabilities, aiming to capture a larger share of the affluent market through strategic hires and service enhancements.

Real Estate Investors and Developers

F.N.B. serves real estate investors and developers by offering specialized financing solutions for property acquisition, development, and management. This segment is crucial, with the U.S. commercial real estate market projected to reach $12.4 trillion by the end of 2024, highlighting significant opportunities for growth and investment.

Our tailored lending products are designed to meet the unique needs of this sector. For instance, in 2024, construction spending on new residential buildings saw a notable increase, reflecting the demand for development financing that F.N.B. can support.

- Targeting Investors: Providing capital for acquiring income-generating properties.

- Supporting Developers: Offering construction and renovation loans for new projects.

- Industry Expertise: Understanding the nuances of real estate markets and development cycles.

- Financing Growth: Facilitating expansion and portfolio diversification for clients.

F.N.B. caters to a broad customer base, including individual consumers seeking everyday banking and financing, and Small to Medium-sized Businesses (SMBs) requiring commercial banking solutions. The bank also serves large corporate and institutional clients with complex financial needs, alongside High-Net-Worth Individuals (HNWIs) who benefit from specialized wealth management. Furthermore, F.N.B. targets real estate investors and developers with tailored lending products.

| Customer Segment | Key Needs/Services | 2024 Market Context/Focus |

|---|---|---|

| Individual Consumers | Checking/savings accounts, mortgages, consumer loans, credit cards, digital banking | High demand for accessible and user-friendly mobile banking services. |

| SMBs | Business loans, treasury management, deposit accounts, digital access | Significant economic force seeking financial partners; expanded digital offerings to meet needs. |

| Corporate & Institutional | Corporate banking, capital markets, wealth management, advisory services | Focus on customized strategies for operational and financial goals. |

| High-Net-Worth Individuals (HNWIs) | Investment strategies, trust administration, financial planning, private banking | Emphasis on personalized, advisory-centric relationships for asset growth. |

| Real Estate Investors & Developers | Property acquisition/development financing, construction loans | U.S. commercial real estate market projected at $12.4 trillion; increased residential construction spending. |

Cost Structure

F.N.B.'s cost structure is heavily influenced by interest expenses, a direct result of paying interest on customer deposits and other borrowed funds. This is a core component of their operational expenses, directly impacting their profitability.

In 2024, managing the cost of these funds is paramount for F.N.B. to sustain a healthy net interest margin. For instance, if F.N.B. holds $10 billion in interest-bearing deposits and pays an average rate of 3%, this alone represents $300 million in annual interest expense.

Salaries, wages, and employee benefits represent a significant portion of F.N.B. Corporation's cost structure, reflecting its investment in its workforce of approximately 4,200 employees. These expenses cover a wide range of personnel, from frontline branch staff to corporate executives and specialized financial experts. For instance, in 2023, F.N.B. reported total salaries, wages, and benefits expense of $711.3 million, a notable increase from $640.5 million in 2022.

This substantial outlay is directly tied to F.N.B.'s operational needs, including customer service, financial product development, risk management, and overall corporate governance. The bank's commitment to strategic hiring and continuous employee development, crucial for maintaining a competitive edge in the financial services sector, further contributes to these personnel-related costs.

F.N.B.'s investment in technology and digital infrastructure is a significant expense. This includes the ongoing costs of developing and maintaining their software, acquiring necessary hardware, operating data centers, and bolstering cybersecurity measures. For instance, in 2023, many financial institutions saw their IT spending increase, with some projecting further growth in 2024 due to the need for advanced digital capabilities.

Furthermore, F.N.B. incurs costs related to the integration and utilization of artificial intelligence (AI) and data analytics. These technologies are crucial for enhancing their digital services, personalizing customer experiences, and improving operational efficiency. The global spending on AI in financial services is projected to reach tens of billions of dollars annually by 2025, highlighting the substantial investment required in this area.

Occupancy and Equipment Expenses

F.N.B. Corporation's cost structure is heavily influenced by its extensive physical presence. Operating its numerous branches and corporate offices incurs substantial expenses, including rent, utilities, and ongoing maintenance. These costs are fundamental to providing customer service and maintaining operational capacity.

Depreciation of equipment, from ATMs to office technology, also represents a significant outlay. The recent development of their new headquarters in Pittsburgh adds to this component, reflecting investments in modern infrastructure and employee facilities. These capital expenditures are amortized over time, impacting the company's reported expenses.

- Occupancy Costs: F.N.B. manages a wide network of physical locations, leading to consistent expenses for rent and property upkeep.

- Utilities and Maintenance: Keeping branches and offices operational requires ongoing spending on electricity, water, and repairs.

- Depreciation: The value of F.N.B.'s physical assets, including buildings and equipment, decreases over time, resulting in depreciation charges.

- New Headquarters: The recent investment in a new corporate headquarters in Pittsburgh contributes to both capital expenditure and ongoing operational costs.

Regulatory Compliance and Risk Management Costs

F.N.B. faces significant expenses due to the heavily regulated nature of the financial sector. These costs encompass ongoing efforts in regulatory compliance, internal and external audits, and the development and maintenance of a strong risk management framework.

Key expenditures in this area include salaries for dedicated legal, compliance, and risk management professionals, as well as investments in specialized technology and robust operational processes designed to meet stringent industry standards.

- Personnel Costs: Dedicated teams for legal, compliance, and risk management are essential, representing a significant operational outlay.

- Technology Investments: Implementing and updating systems for fraud detection, anti-money laundering (AML), and regulatory reporting are crucial.

- Audit and Advisory Fees: External audits and specialized consulting services are necessary to ensure adherence to evolving regulations.

- Training and Development: Continuous training for staff on new compliance requirements and risk mitigation strategies is an ongoing cost.

F.N.B.'s cost structure is multifaceted, encompassing interest expenses on deposits and borrowings, significant personnel costs for its workforce, and substantial investments in technology and digital infrastructure. Additionally, occupancy costs related to its physical branch network and compliance-related expenditures are key drivers of its overall cost base.

| Cost Category | 2023 Expense (Millions) | Notes |

|---|---|---|

| Interest Expense | $945.8 | Primarily on deposits and borrowings. |

| Salaries, Wages, and Benefits | $711.3 | Reflects investment in ~4,200 employees. |

| Occupancy Expense | $265.1 | Includes rent, utilities, and maintenance for branches and offices. |

| Technology & Digital Investments | Not separately itemized, but significant growth noted industry-wide. | Crucial for digital services, AI, and data analytics. |

| Compliance & Risk Management | Not separately itemized, but includes personnel, technology, and audit fees. | Essential due to heavy financial sector regulation. |

Revenue Streams

F.N.B.'s core revenue generator is net interest income. This comes from the spread between the interest F.N.B. earns on its various loans, like commercial, consumer, and mortgage loans, as well as its investment securities, and the interest it pays out on customer deposits and other borrowings.

For instance, in the first quarter of 2024, F.N.B. reported total interest income of $448 million, with interest expense at $174 million, resulting in a net interest income of $274 million. This demonstrates the significant contribution of their lending and investment activities to their overall financial performance.

F.N.B. generates significant revenue through service charges and fees, a crucial element of its Business Model Canvas. These fees stem from a variety of customer interactions, including those associated with maintaining deposit accounts and utilizing treasury management services tailored for businesses.

These non-interest income streams are vital for diversifying F.N.B.'s overall revenue base, offering a buffer against fluctuations in interest rate environments. For instance, in the first quarter of 2024, F.N.B. reported non-interest income of $174.4 million, a notable portion of which is attributable to these service charges and fees.

F.N.B. Corporation's wealth management segment generates substantial non-interest income through various fees and commissions. This includes asset management fees, private banking service charges, and commissions earned from securities transactions.

The company actively pursues growth in its wealth management revenues, recognizing its importance as a key driver of overall financial performance. For instance, as of the first quarter of 2024, F.N.B. reported a notable increase in non-interest income, with wealth management services playing a significant role in this expansion.

Insurance Premiums and Commissions

F.N.B. generates revenue from its insurance offerings through two primary avenues: premiums collected directly on policies it underwrites or manages, and commissions earned from acting as an intermediary, placing insurance products with other insurance companies. This dual approach diversifies its income, making it less reliant on a single revenue source within this segment. For instance, in 2024, the insurance division contributed significantly to the company's overall financial health, reflecting a growing market demand for integrated financial services.

The company's insurance solutions tap into a broad customer base, from individual policyholders to businesses seeking comprehensive coverage. This segment is crucial for F.N.B. as it not only provides a steady stream of income but also strengthens customer relationships by offering a more complete financial ecosystem. The growth in this area is often tied to the overall economic climate and the specific needs of the populations it serves.

- Premiums: Direct income from insurance policies sold and managed by F.N.B.

- Commissions: Fees earned from brokering insurance products from other providers.

- Diversification: This segment offers a stable, additional income stream alongside traditional banking services.

- Market Penetration: In 2024, F.N.B. reported a 7% year-over-year increase in revenue from its insurance products, indicating successful market penetration and customer adoption.

Mortgage Banking Income

F.N.B. Corporation generates revenue through its mortgage banking operations. This income stream is multifaceted, encompassing origination fees charged to borrowers, profits realized from selling mortgages in the secondary market, and the value of mortgage servicing rights (MSRs).

These activities contribute to F.N.B.'s diversified revenue base, although they are sensitive to shifts in interest rates and overall housing market conditions. For instance, in the first quarter of 2024, F.N.B. reported a notable increase in mortgage originations compared to the previous year, reflecting a more favorable lending environment.

- Origination Fees: Charges applied when a new mortgage loan is created.

- Gains on Sale: Profits earned from selling originated mortgages to investors.

- Mortgage Servicing Rights (MSRs): The value of the right to collect principal and interest payments on mortgages.

F.N.B.'s revenue streams are diverse, extending beyond traditional net interest income. Service charges and fees from deposit accounts and treasury management, along with wealth management services, provide significant non-interest income. The insurance segment contributes through premiums and commissions, while mortgage banking operations add revenue via origination fees, gains on sale, and mortgage servicing rights.

| Revenue Stream | Description | Q1 2024 Contribution (Millions USD) |

|---|---|---|

| Net Interest Income | Interest earned on loans and securities minus interest paid on deposits and borrowings. | $274.0 |

| Service Charges & Fees | Fees from deposit accounts and treasury management services. | Included in Non-Interest Income |

| Wealth Management | Asset management fees, private banking, and securities transaction commissions. | Included in Non-Interest Income |

| Insurance | Premiums and commissions from insurance products. | Included in Non-Interest Income |

| Mortgage Banking | Origination fees, gains on sale, and mortgage servicing rights. | Contributes to Non-Interest Income |

Business Model Canvas Data Sources

The F.N.B. Business Model Canvas is meticulously constructed using a blend of financial statements, customer feedback, and internal operational data. These diverse sources ensure a comprehensive and accurate representation of our business strategy.