F.N.B. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

F.N.B. Bundle

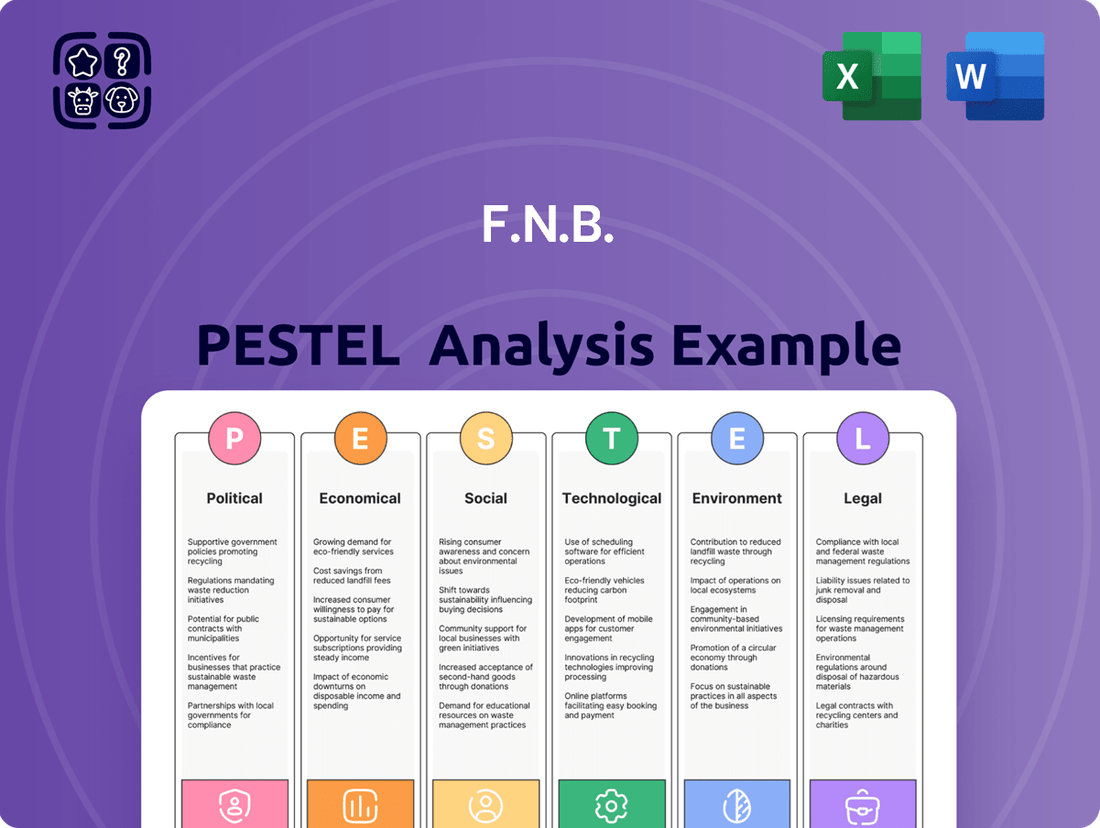

Uncover the critical Political, Economic, Social, Technological, Environmental, and Legal forces impacting F.N.B. with our comprehensive PESTLE analysis. Gain a strategic advantage by understanding these external drivers and their potential to shape the company's future. Download the full version now to access actionable intelligence and refine your market approach.

Political factors

F.N.B. Corporation, a financial holding company, navigates a complex web of federal banking regulations. Oversight from bodies like the Federal Reserve, FDIC, and OCC significantly shapes its operational capacity, capital adequacy, and risk mitigation approaches. For instance, capital requirements, such as the Common Equity Tier 1 (CET1) ratio, directly influence lending capacity and profitability.

The outcome of the 2024 US presidential election introduces a variable that could reshape the regulatory landscape. A potential shift towards deregulation might lessen compliance costs for F.N.B., but it could also bring about new uncertainties concerning future supervisory focus and enforcement priorities, impacting strategic planning.

Government fiscal policies, like spending and taxation, directly shape the banking industry. For instance, increased government spending might boost economic activity, leading to higher loan demand for banks. Conversely, tax hikes could reduce disposable income, potentially slowing lending.

Monetary policies, primarily managed by the Federal Reserve through interest rate adjustments, are crucial. The Fed's decision to maintain or lower interest rates in 2025 will significantly affect banks' net interest income, which is the profit from lending. A lower rate environment typically compresses these margins.

Projections for 2025 suggest a potential shift in interest rate policy. If the Fed opts for rate cuts, banks may see reduced profitability from lending activities. However, a scenario of sustained economic growth or a soft landing in 2025 could bolster consumer and business confidence, thereby supporting robust loan demand and offsetting some of the impact of lower rates.

The Consumer Financial Protection Bureau (CFPB) remains a significant influence, with recent actions targeting medical debt reporting and the burgeoning field of open banking. These initiatives directly impact how F.N.B. Corporation handles customer data and structures its service offerings, necessitating ongoing compliance and strategic adjustments.

Anticipated regulatory shifts concerning overdraft fees present another area requiring proactive adaptation. In 2023, the CFPB reported that overdraft and non-sufficient funds fees generated approximately $11.4 billion for the largest banks, highlighting the financial implications of these upcoming changes for institutions like F.N.B.

Anti-Money Laundering (AML) and Sanctions Compliance

F.N.B. Corporation, like all financial institutions, faces significant challenges from evolving Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) regulations, alongside an increasingly complex landscape of economic sanctions. These regulatory shifts demand constant adaptation of internal controls and transaction monitoring systems to ensure robust compliance. For instance, the Financial Crimes Enforcement Network (FinCEN) in the US, a key regulator, continuously updates its advisories and priorities, impacting how banks like F.N.B. must operate.

Meeting these stringent requirements necessitates substantial investment in technology and personnel. Financial institutions must proactively update their systems to detect and report suspicious activities, a process that is becoming more sophisticated. The global nature of financial transactions means F.N.B. must also navigate a patchwork of international sanctions regimes, adding layers of complexity to their compliance efforts.

- Regulatory Scrutiny: Increased enforcement actions and fines for non-compliance by bodies like the Office of Foreign Assets Control (OFAC) highlight the critical need for rigorous AML/CFT frameworks.

- Technological Investment: Financial institutions are investing heavily in advanced analytics and AI-powered solutions to enhance transaction monitoring and identify illicit financial flows more effectively.

- Global Sanctions Landscape: The dynamic nature of international relations leads to frequent updates in sanctions lists and targeted measures, requiring constant vigilance and system adjustments.

Geopolitical Stability and Trade Policies

Geopolitical uncertainties and shifts in trade policies, like the implementation of tariffs, can significantly influence economic growth and consumer spending. For F.N.B. Corporation, while its core business is domestic, wider economic instability can indirectly impact the demand for loans and the overall quality of its credit portfolio.

For instance, ongoing trade tensions between major global economies, which have seen fluctuations in 2024 and are projected to continue influencing global markets in 2025, can lead to increased operational costs for businesses that rely on international supply chains. This, in turn, might dampen their ability to expand or invest, potentially reducing their need for F.N.B.'s lending services.

- Impact on Loan Demand: Trade disputes can slow down business investment, thereby decreasing the demand for commercial loans.

- Credit Quality Concerns: Companies facing higher import costs due to tariffs may experience reduced profitability, potentially increasing credit risk for lenders like F.N.B.

- Consumer Spending: Broader economic uncertainty stemming from geopolitical events can make consumers more cautious with their spending, affecting retail loan demand.

- Domestic Economic Resilience: F.N.B.'s strong domestic focus provides a degree of insulation, but severe global downturns can still have ripple effects.

Political factors significantly influence F.N.B. Corporation's operating environment through regulatory frameworks and government fiscal and monetary policies. The upcoming 2024 US presidential election introduces potential shifts in deregulation, impacting compliance burdens and supervisory focus. Government spending and taxation policies directly affect economic activity and loan demand, while the Federal Reserve's monetary policy, particularly interest rate decisions in 2025, will shape net interest income.

The Consumer Financial Protection Bureau (CFPB) continues to exert influence, with recent actions on medical debt and open banking necessitating strategic adjustments. Anticipated changes to overdraft fees, which generated $11.4 billion for large banks in 2023, also require proactive adaptation. Furthermore, evolving Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) regulations, alongside international sanctions, demand continuous investment in technology and compliance systems.

Geopolitical uncertainties and trade policy shifts can indirectly affect F.N.B. by influencing economic growth and consumer spending. For instance, trade tensions in 2024 and projected into 2025 can increase business costs, potentially reducing loan demand. Companies facing higher import costs may also see reduced profitability, increasing credit risk for lenders.

| Factor | Impact on F.N.B. | 2024/2025 Data/Projection |

|---|---|---|

| Regulatory Landscape | Compliance costs, operational capacity | Potential deregulation post-2024 election; CFPB actions on overdraft fees |

| Fiscal Policy | Economic growth, loan demand | Government spending initiatives can boost economy; Tax policy impacts disposable income |

| Monetary Policy | Net interest income, loan profitability | Fed interest rate decisions in 2025 to affect margins; Projected rate cuts could compress profits |

| Geopolitics/Trade | Loan demand, credit quality | Trade tensions increase business costs, potentially reducing loan demand and increasing credit risk |

What is included in the product

This F.N.B. PESTLE analysis thoroughly examines how external macro-environmental factors, categorized as Political, Economic, Social, Technological, Environmental, and Legal, impact the business's strategic landscape.

The F.N.B. PESTLE Analysis serves as a pain point reliver by offering a structured framework to identify and understand external factors impacting the business, enabling proactive strategy development and risk mitigation.

Economic factors

The Federal Reserve's anticipated interest rate trajectory in 2025, including potential rate cuts, will directly impact F.N.B. Corporation's net interest income and margins. While a reduction in rates could stimulate mortgage origination, it may also lead to increased competition for deposits among regional banks, potentially raising funding costs.

For instance, if the Federal Reserve cuts the federal funds rate by 75 basis points in 2025, as some analysts project, F.N.B. could see its net interest margin compress if its deposit costs rise faster than its loan yields. In 2024, many regional banks experienced margin pressure as they competed for deposits, with average deposit costs rising significantly.

F.N.B. Corporation saw loan growth in 2024, reflecting a robust economic environment. However, with economic deceleration expected in 2025, a normalization of loan demand is likely across both commercial and consumer sectors.

This economic shift could also impact credit quality, potentially leading to modest increases in delinquencies, especially within consumer loan portfolios. For instance, if consumer spending slows significantly, borrowers may face greater challenges in meeting their debt obligations.

Moderating consumer spending, a trend observed as inflation persists, could temper economic expansion. For instance, U.S. retail sales in April 2024 saw a modest increase, indicating a cautious consumer. This slowdown directly impacts businesses reliant on household purchases.

Elevated consumer debt levels, particularly credit card balances which reached an estimated $1.13 trillion in Q1 2024 according to the Federal Reserve Bank of New York, pose a significant risk. High debt burdens can reduce discretionary spending and increase the likelihood of defaults, creating headwinds for the broader economy.

F.N.B. Corporation's consumer banking segment faces direct implications from these trends. A slowdown in spending and increased debt could dampen demand for consumer loans and necessitate stringent credit risk management to mitigate potential losses.

Commercial Real Estate (CRE) Market Conditions

Commercial Real estate (CRE) exposure presents a notable risk for regional banks like F.N.B. Corporation. While current charge-off rates in CRE have remained low, a significant market downturn could lead to increased credit losses, directly impacting F.N.B.'s profitability and potentially pressuring its net interest margins. This necessitates diligent oversight of their CRE loan portfolio.

The CRE market has seen shifts, with office vacancy rates remaining elevated in many urban centers. For instance, in Q1 2024, the national office vacancy rate stood at approximately 19.6%, a figure that underscores the challenges within this sector. This environment could translate into higher default risks for loans tied to these properties.

- Elevated Vacancy Rates: Continued high vacancy in office spaces, a key CRE segment, poses a risk to loan performance.

- Interest Rate Sensitivity: CRE loans, often sensitive to interest rate changes, could see increased default rates if borrowing costs remain high or rise further.

- Potential for Increased Losses: A sustained downturn could lead to higher loan loss provisions for F.N.B., impacting its financial performance.

- Margin Pressure: Increased credit costs associated with CRE exposure could compress F.N.B.'s profit margins.

Inflationary Pressures and Economic Growth

Persistent inflation and the prospect of slower economic growth present a complex landscape for financial institutions like F.N.B. Corporation. While many forecasts lean towards a soft landing for the economy, the possibility of inflation proving more stubborn than anticipated could translate into ongoing financial stress for both individuals and businesses. This, in turn, could directly impact F.N.B.'s profitability and operational stability.

For instance, in the United States, the Consumer Price Index (CPI) saw a notable increase, with annual inflation rates fluctuating. As of early 2024, inflation remained a key concern, impacting consumer spending power and business investment decisions. This environment necessitates careful management of interest rates and credit risk for banks.

- Inflationary Headwinds: Persistent inflation can erode purchasing power, leading to reduced consumer spending and potentially higher loan default rates.

- Slower Growth Impact: A decelerating economy typically means fewer opportunities for loan origination and increased competition for existing business.

- Interest Rate Sensitivity: Banks like F.N.B. are sensitive to interest rate changes, which are often used to combat inflation, potentially affecting net interest margins.

- Consumer & Business Strain: Higher costs for goods and services can strain household budgets and corporate balance sheets, impacting loan repayment capacity.

The economic outlook for 2025 suggests a moderation in growth, impacting loan demand and potentially increasing credit risk for F.N.B. Corporation. Persistent inflation and elevated consumer debt levels, such as the $1.13 trillion in credit card balances seen in Q1 2024, could further strain borrowers and affect F.N.B.'s consumer banking segment. Additionally, the commercial real estate sector, with national office vacancy rates around 19.6% in Q1 2024, presents ongoing challenges that could affect loan performance and F.N.B.'s profitability.

| Economic Factor | 2024 Observation/Projection | Impact on F.N.B. |

|---|---|---|

| Interest Rates (Federal Reserve) | Anticipated cuts in 2025; 2024 saw margin pressure due to deposit competition. | Potential net interest margin compression if deposit costs rise faster than loan yields. |

| Economic Growth | Robust in 2024; expected deceleration in 2025. | Normalization of loan demand across sectors; potential for modest increases in delinquencies. |

| Consumer Spending | Moderating due to persistent inflation; U.S. retail sales saw modest increases in April 2024. | Dampened demand for consumer loans; potential strain on borrower repayment capacity. |

| Consumer Debt | Elevated, with credit card balances reaching ~$1.13 trillion in Q1 2024. | Reduced discretionary spending; increased likelihood of defaults. |

| Commercial Real Estate (CRE) | Elevated office vacancy rates (~19.6% nationally in Q1 2024); interest rate sensitivity. | Increased credit loss risk; potential pressure on net interest margins. |

Preview the Actual Deliverable

F.N.B. PESTLE Analysis

The preview you see here is the exact F.N.B. PESTLE Analysis document you’ll receive after purchase, fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You’ll get the complete PESTLE analysis with all sections intact.

The content and structure shown in the preview is the same F.N.B. PESTLE Analysis document you’ll download after payment, providing a comprehensive overview.

Sociological factors

Customers are rapidly shifting their banking habits, with a strong preference for digital channels. In 2024, a significant majority of banking interactions are expected to occur through mobile applications, highlighting the critical need for financial institutions to adapt. This trend is not just about convenience; it's about meeting evolving consumer expectations for seamless, on-demand financial services.

F.N.B. Corporation recognizes this shift and has made substantial investments in its digital infrastructure, notably its eStore digital platform. This focus on an omnichannel strategy, integrating online, mobile, and in-branch experiences, is vital for F.N.B. to remain competitive and attract a growing segment of digitally-native customers. By prioritizing these digital touchpoints, F.N.B. aims to enhance customer satisfaction and broaden its market reach.

The United States is experiencing a significant demographic evolution, with an aging population and declining birth rates. This shift is coupled with a substantial intergenerational wealth transfer, estimated to be in the trillions of dollars, moving towards Millennials and Gen Z. F.N.B. Corporation must adapt its offerings to cater to these younger, digitally-savvy demographics who are poised to become major financial players.

Customers increasingly desire financial services tailored to their specific situations, shifting from generic offerings to personalized advice and solutions. This trend means banks like F.N.B. Corporation need to understand individual customer needs deeply, fostering relationships beyond simple transactions.

Leveraging advanced data analytics and artificial intelligence is crucial for F.N.B. to meet this demand. By analyzing customer behavior and financial profiles, F.N.B. can offer customized product recommendations, proactive financial guidance, and a more engaging customer experience, potentially boosting customer loyalty and wallet share.

Financial Literacy and Advisory Needs

The increasing complexity of financial markets, especially with the rapid evolution of digital finance and investment options, has amplified the societal need for robust financial literacy and accessible advisory services. This trend directly impacts how individuals and businesses approach financial planning and wealth management.

F.N.B. Corporation actively addresses this by participating in financial literacy initiatives. For instance, their support for programs like 'Teach Children to Save' not only fulfills a crucial societal role in educating younger generations about financial responsibility but also cultivates long-term customer relationships and brand loyalty within the communities they serve.

- Growing Demand for Financial Guidance: A significant portion of the population, particularly younger demographics and those navigating retirement planning, express a need for professional financial advice.

- F.N.B.'s Community Engagement: F.N.B.'s commitment to financial education, exemplified by programs like 'Teach Children to Save,' directly contributes to improving overall financial well-being in their operating regions.

- Impact on Financial Behavior: Enhanced financial literacy is correlated with better savings habits, reduced debt, and increased investment participation, ultimately fostering a more stable economic environment.

Community Engagement and Social Responsibility

F.N.B. Corporation's dedication to community uplift, evident through its corporate donations and employee volunteerism, aligns with increasing societal expectations for businesses to exhibit social responsibility. These efforts significantly bolster its brand reputation and standing within the communities it serves.

In 2023, F.N.B. Corporation contributed over $20 million to community development initiatives. Furthermore, its employees dedicated more than 30,000 volunteer hours to local causes, underscoring a tangible commitment to social impact.

- Community Investment: F.N.B. consistently allocates substantial resources to support local non-profits and community programs.

- Employee Volunteerism: Encouraging and facilitating employee involvement in charitable activities strengthens community ties.

- Brand Reputation: Demonstrating social responsibility enhances public perception and customer loyalty.

- Societal Expectations: Meeting the growing demand for corporate citizenship is crucial for long-term business sustainability.

Societal shifts toward digital-first interactions are reshaping banking, with a strong emphasis on personalized financial guidance. F.N.B. Corporation is actively responding by enhancing its digital platforms and investing in financial literacy programs, recognizing that informed customers are more engaged customers.

Demographic changes, including an aging population and the rise of younger, digitally-native generations, present both challenges and opportunities. F.N.B.'s strategy to cater to these evolving demographics through tailored digital experiences and community engagement is crucial for future growth.

The increasing demand for corporate social responsibility means that F.N.B.'s substantial community investments and employee volunteer efforts, such as their over $20 million in community development contributions in 2023, are vital for maintaining brand reputation and customer trust.

Technological factors

F.N.B. Corporation is actively pursuing a 'clicks-to-bricks' omnichannel strategy, seamlessly blending its physical branches with robust online and mobile banking platforms. This integration is paramount for attracting new customers and keeping existing ones engaged in today's competitive financial landscape. The company's eStore digital platform, featuring a unified application process for various financial products, stands as a cornerstone of this customer-centric approach.

F.N.B. Corporation's strategic advantage hinges on its robust adoption of AI and data analytics. By leveraging these technologies, F.N.B. can significantly elevate customer experiences, optimize onboarding processes, and drive lead generation. For instance, in 2024, financial institutions leveraging AI for personalized marketing saw a 15% increase in customer engagement.

AI-driven recommendation engines are projected to be a key catalyst for multiproduct purchasing at F.N.B. This personalized approach, informed by deep customer data analysis, is crucial for competitive differentiation. Reports from early 2025 indicate that banks employing AI for cross-selling have experienced a 10% uplift in average revenue per user.

F.N.B. Corporation must prioritize advanced cybersecurity to counter escalating digital threats, ensuring secure data storage and employing sophisticated threat detection systems. The financial sector experienced a 72% increase in ransomware attacks in 2024, highlighting the critical need for robust defenses.

Adherence to stringent data privacy regulations, such as GDPR and CCPA, demands comprehensive data governance frameworks. Fines for data breaches can be substantial; for instance, a major financial institution faced a $100 million penalty in 2024 due to a privacy violation.

Fintech Integration and Competition

The financial technology, or fintech, landscape is rapidly evolving, and F.N.B. Corporation is navigating this dynamic environment. The rise of digital-only banks and fintech platforms in the US, for instance, is intensifying competition. These agile players often offer streamlined digital experiences and specialized services, pushing traditional banks to adapt. In 2024, fintech adoption continues to grow, with a significant portion of consumers now comfortable managing their finances digitally.

This surge in fintech presents a dual challenge and opportunity for F.N.B. Corporation. To stay competitive, the company must prioritize ongoing innovation in its digital banking services, ensuring user-friendly interfaces and robust online functionalities. For example, enhancing mobile banking capabilities and offering personalized digital financial tools are crucial. By 2025, customer expectations for seamless digital interactions will likely be even higher.

Furthermore, F.N.B. Corporation can explore strategic partnerships with fintech companies. These collaborations can allow F.N.B. to leverage new technologies and expand its service offerings without building everything from scratch. Such alliances could lead to more efficient operations and a broader reach.

- Fintech Adoption: In 2023, over 70% of US consumers reported using at least one fintech service, a figure expected to climb.

- Digital Investment: Banks are significantly increasing their technology budgets; F.N.B. will need to match or exceed industry averages to maintain parity.

- Partnership Potential: Collaborations can provide access to specialized fintech solutions, such as AI-driven fraud detection or advanced payment processing, by 2025.

- Customer Expectations: A 2024 survey indicated that 85% of banking customers expect their primary bank to offer comprehensive digital tools.

Automated Processes and Operational Efficiency

F.N.B. Corporation is leveraging technology to streamline operations and enhance customer experience. Automating processes, like the eStore Common app for loan and deposit applications, significantly cuts down the time customers need to access financial products. This focus on efficiency extends to transaction monitoring and reporting, ensuring faster and more accurate internal operations.

These technological advancements directly impact operational efficiency. For instance, by digitizing and automating application processes, F.N.B. can process more requests with fewer resources, leading to cost savings and quicker service delivery. This also means improved accuracy in data handling and reduced manual errors.

- Reduced Processing Times: The eStore Common app aims to shorten the turnaround time for loan and deposit applications, improving customer satisfaction.

- Enhanced Transaction Monitoring: Advanced systems allow for more robust and real-time tracking of financial transactions, bolstering security and compliance.

- Streamlined Reporting: Automation in reporting functions frees up staff from manual data compilation, allowing them to focus on analysis and strategic tasks.

- Scalability: Technology-driven processes are inherently more scalable, enabling F.N.B. to handle increased volumes without a proportional rise in operational costs.

Technological factors are driving significant shifts in the financial services industry, impacting F.N.B. Corporation's operations and strategy. The company's embrace of AI and data analytics, exemplified by its eStore digital platform, is crucial for enhancing customer engagement and personalizing financial product offerings. By 2025, AI-driven recommendations are expected to boost multiproduct purchasing, with early 2025 data showing a 10% revenue uplift for banks using AI for cross-selling.

F.N.B. must maintain robust cybersecurity measures to combat escalating digital threats, as ransomware attacks on financial institutions surged by 72% in 2024. Simultaneously, strict adherence to data privacy regulations like GDPR and CCPA is essential, with a major financial institution facing a $100 million penalty in 2024 for a privacy violation.

The competitive landscape is intensified by the rapid growth of fintech companies, which are pushing traditional banks to innovate their digital banking services. By 2025, customer expectations for seamless digital interactions will be even higher, with 85% of banking customers expecting comprehensive digital tools from their primary bank in 2024.

F.N.B. Corporation's investment in technology, such as its eStore Common app, streamlines application processes and enhances operational efficiency, reducing processing times for customers. This automation improves accuracy and scalability, allowing for greater cost savings and quicker service delivery.

| Technology Area | 2024/2025 Trend | Impact on F.N.B. |

|---|---|---|

| AI & Data Analytics | 15% increase in customer engagement for AI marketing; 10% revenue uplift from AI cross-selling (early 2025) | Enhanced customer experience, personalized offerings, improved lead generation |

| Cybersecurity | 72% increase in ransomware attacks (2024) | Critical need for advanced threat detection and secure data storage |

| Fintech Adoption | 70%+ US consumers using fintech services (2023); high customer expectation for digital tools (85% in 2024) | Intensified competition, need for continuous digital innovation and potential partnerships |

| Digital Process Automation | Reduced processing times, enhanced transaction monitoring, streamlined reporting | Increased operational efficiency, cost savings, improved accuracy, and scalability |

Legal factors

F.N.B. Corporation operates within a stringent regulatory environment, adhering to capital adequacy ratios, liquidity coverage, and robust risk management frameworks mandated by agencies such as the Office of the Comptroller of the Currency (OCC), the Federal Reserve, and the Federal Deposit Insurance Corporation (FDIC). These regulations are dynamic, requiring constant adaptation to maintain compliance, impacting operational strategies and capital allocation decisions.

The evolving landscape of data privacy and security laws presents a critical legal factor for F.N.B. Corporation. The United States, in particular, has seen a surge in state-level legislation, such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), alongside existing federal regulations like the Gramm-Leach-Bliley Act (GLBA) and the Health Insurance Portability and Accountability Act (HIPAA). These laws mandate rigorous standards for how financial institutions collect, process, store, and safeguard customer information. For instance, GLBA, enacted in 1999, requires financial institutions to explain their information-sharing practices to their customers and to protect sensitive data. More recently, the CPRA, effective January 1, 2023, expanded consumer rights and introduced new obligations for businesses, including data minimization and purpose limitation principles. The complexity arising from this patchwork of regulations creates a significant compliance burden, requiring substantial investment in legal counsel, technology, and operational adjustments to ensure adherence across all business units and jurisdictions in which F.N.B. operates.

F.N.B. Corporation must navigate a complex web of consumer lending and fair lending laws. Regulations like the Equal Credit Opportunity Act and the Fair Housing Act are paramount, prohibiting discrimination in credit transactions. These laws ensure F.N.B. offers credit fairly, regardless of race, religion, sex, or marital status, directly impacting their consumer banking outreach and product development.

The Consumer Financial Protection Bureau (CFPB) continues to scrutinize practices related to 'junk fees' and overdraft charges. In 2024, the CFPB reported that overdraft fees alone generated billions for the banking industry, highlighting the significant regulatory attention on these revenue streams. F.N.B.'s ability to adapt its fee structures and overdraft policies in response to CFPB guidance will be crucial for compliance and maintaining customer trust.

Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) Laws

F.N.B. Corporation operates under stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulations. These laws, such as the Bank Secrecy Act (BSA), mandate comprehensive customer due diligence, the reporting of suspicious activities, and ongoing risk-based monitoring to combat financial crime. For instance, in 2023, U.S. financial institutions reported over 300,000 suspicious activity reports (SARs) related to potential money laundering and fraud, highlighting the pervasive nature of these threats.

Adherence to these legal frameworks is critical for F.N.B. to maintain its license to operate and avoid significant penalties. Failure to comply can result in substantial fines and reputational damage. In 2024, a major financial institution faced a $10 million AML penalty for deficiencies in its transaction monitoring systems, underscoring the financial consequences of non-compliance.

- Customer Due Diligence: Implementing Know Your Customer (KYC) procedures to verify customer identities and assess risks.

- Suspicious Activity Reporting: Establishing mechanisms to identify and report transactions that appear unusual or potentially linked to illicit activities.

- Transaction Monitoring: Utilizing technology and processes to continuously monitor customer transactions for patterns indicative of money laundering or terrorist financing.

- Record Keeping: Maintaining detailed records of customer information and transactions for regulatory review and audit purposes.

Litigation and Regulatory Enforcement

Litigation and regulatory enforcement actions represent a significant legal risk for F.N.B. Corporation, especially concerning consumer protection, data privacy, and compliance. For instance, the Consumer Financial Protection Bureau (CFPB) has been actively pursuing enforcement actions against financial institutions for unfair or deceptive practices. In 2023, the CFPB reported over $3.7 billion in relief for consumers through its enforcement and other work. F.N.B. must proactively ensure its operations and policies are in strict accordance with evolving regulatory landscapes to avoid penalties and reputational damage.

To mitigate these legal risks, F.N.B. Corporation needs to maintain robust compliance programs. This includes staying ahead of new regulations and adapting existing practices. For example, the increasing focus on data privacy, such as state-level initiatives mirroring aspects of the GDPR, requires continuous investment in cybersecurity and data handling protocols. Failure to comply could result in substantial fines; for example, data privacy violations can lead to penalties that are a percentage of a company's revenue.

Key areas of focus for F.N.B. regarding litigation and regulatory enforcement include:

- Consumer Protection Compliance: Adherence to regulations like the Truth in Lending Act (TILA) and the Fair Credit Reporting Act (FCRA) is paramount.

- Data Privacy and Security: Implementing strong data protection measures to comply with evolving privacy laws and prevent breaches.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Maintaining rigorous AML and KYC procedures to prevent financial crime.

- Fair Lending Practices: Ensuring all lending practices are free from discrimination and comply with fair lending laws.

F.N.B. Corporation operates under a complex legal framework, requiring strict adherence to banking regulations from bodies like the OCC, Federal Reserve, and FDIC. Compliance with capital adequacy, liquidity, and risk management rules is essential for its operational license and financial stability.

Data privacy laws, including state-specific regulations and federal acts like GLBA, impose significant obligations on F.N.B. for safeguarding customer information, necessitating ongoing investment in legal and technological compliance measures.

The company must also comply with consumer protection laws, such as the Equal Credit Opportunity Act, to ensure fair lending practices and avoid discriminatory actions in its credit offerings.

F.N.B. faces scrutiny from the CFPB regarding fees, particularly overdraft charges, with the agency actively pursuing enforcement actions that can lead to substantial consumer relief and penalties for non-compliance.

Environmental factors

Financial regulators globally are intensifying their scrutiny of climate-related financial risks, encompassing both the direct impacts of weather events (physical risks) and the economic shifts associated with decarbonization (transition risks). This heightened focus means institutions like F.N.B. Corporation must bolster their risk management frameworks to account for these evolving threats.

While the U.S. Securities and Exchange Commission's (SEC) climate disclosure rules have encountered legal hurdles, the underlying expectation for enhanced transparency and risk assessment remains. By mid-2024, many financial institutions were already investing in data analytics and scenario planning to better understand their exposure to climate change, a trend F.N.B. is likely following.

For F.N.B., this translates to a need to integrate climate risk into its lending practices, investment strategies, and overall corporate governance. Proactive identification, assessment, and mitigation of these risks are becoming crucial for maintaining financial stability and regulatory compliance in the coming years.

F.N.B. Corporation demonstrates a strong commitment to Environmental, Social, and Governance (ESG) principles, recognizing their importance for long-term value creation and stakeholder trust. This commitment is reflected in their ongoing efforts to minimize their environmental footprint and foster sustainable business practices, aligning with increasing demands from investors and the broader community for corporate environmental responsibility.

In 2023, F.N.B. reported a 3% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to their 2022 baseline, a tangible step in managing their operational impact. The company actively promotes environmental stewardship across its operations, encouraging sustainable resource management and responsible waste reduction initiatives.

F.N.B. Corporation is actively working to shrink its environmental impact. A key strategy involves consolidating office spaces and data centers, a move designed to reduce greenhouse gas emissions. This consolidation not only streamlines operations but also directly addresses the company's commitment to environmental stewardship.

Natural Disaster and Climate Event Impact

Natural disasters and climate events pose significant risks to the banking sector, potentially affecting loan portfolios and operational stability. While specific data for F.N.B. Corporation isn't publicly detailed regarding these impacts, the broader industry must assess its resilience. For instance, the increasing frequency and severity of extreme weather events can lead to increased loan defaults, particularly in sectors like commercial real estate exposed to physical damage.

Banks are increasingly being pushed to evaluate and strengthen their business models against climate-related financial risks. This includes understanding how events like floods, wildfires, or severe storms could impact collateral values and borrower repayment capacities. Proactive risk management and stress testing are becoming crucial for maintaining financial health in the face of these environmental challenges.

- Increased loan loss provisions: Banks may need to set aside more capital to cover potential defaults stemming from disaster-affected borrowers.

- Operational disruptions: Physical damage to bank branches or data centers can hinder service delivery and incur significant recovery costs.

- Reputational damage: A bank's response to climate-related events can affect public perception and customer trust.

- Regulatory scrutiny: Financial regulators are paying closer attention to how banks manage climate-related risks, potentially leading to new compliance requirements.

Regulatory Disclosure Requirements for Climate

While the U.S. Securities and Exchange Commission's (SEC) climate disclosure rule is currently on hold, the broader regulatory landscape points to a growing demand for transparency regarding climate-related financial risks. Financial institutions like F.N.B. Corporation are likely to face increasing pressure from various bodies to report on their environmental impact and associated financial exposures.

This evolving environment necessitates that F.N.B. Corporation proactively prepares for potential future disclosure mandates. Such preparations could involve enhancing data collection processes for climate-related metrics and developing robust frameworks for assessing and reporting on climate risks. For instance, as of early 2024, many European banks are already subject to stringent climate-related disclosure requirements, with some estimating that up to 10% of their loan portfolios could be impacted by physical climate risks by 2050.

F.N.B. Corporation should consider the following in anticipation of these trends:

- Enhanced Data Collection: Implementing systems to gather granular data on financed emissions and climate-related operational risks across its business segments.

- Risk Assessment Frameworks: Developing or refining methodologies to quantify and manage both physical and transition risks within its lending and investment portfolios.

- Scenario Analysis: Conducting scenario analyses to understand the potential impact of different climate pathways on its financial performance and capital adequacy.

- Stakeholder Engagement: Proactively engaging with investors, regulators, and other stakeholders to understand evolving expectations for climate-related disclosures.

Environmental factors significantly influence F.N.B. Corporation's operations and strategic planning. The increasing frequency of extreme weather events, such as floods and wildfires, poses direct physical risks to the bank's assets and its customers' ability to repay loans. Furthermore, the global shift towards a low-carbon economy creates transition risks, impacting industries that F.N.B. finances and potentially altering the value of collateral. Regulatory bodies are also intensifying their focus on climate-related financial risks, pushing institutions like F.N.B. to enhance transparency and risk management frameworks. F.N.B.'s commitment to ESG principles is evident in its efforts to reduce its own environmental footprint, as seen in its 2023 report of a 3% reduction in Scope 1 and 2 emissions compared to 2022.

PESTLE Analysis Data Sources

Our F.N.B. PESTLE Analysis is meticulously crafted using data from reputable financial institutions, government economic reports, and leading industry publications. We integrate insights from central bank statements, market research firms, and legislative updates to ensure a comprehensive understanding of the macro-environment.