F.N.B. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

F.N.B. Bundle

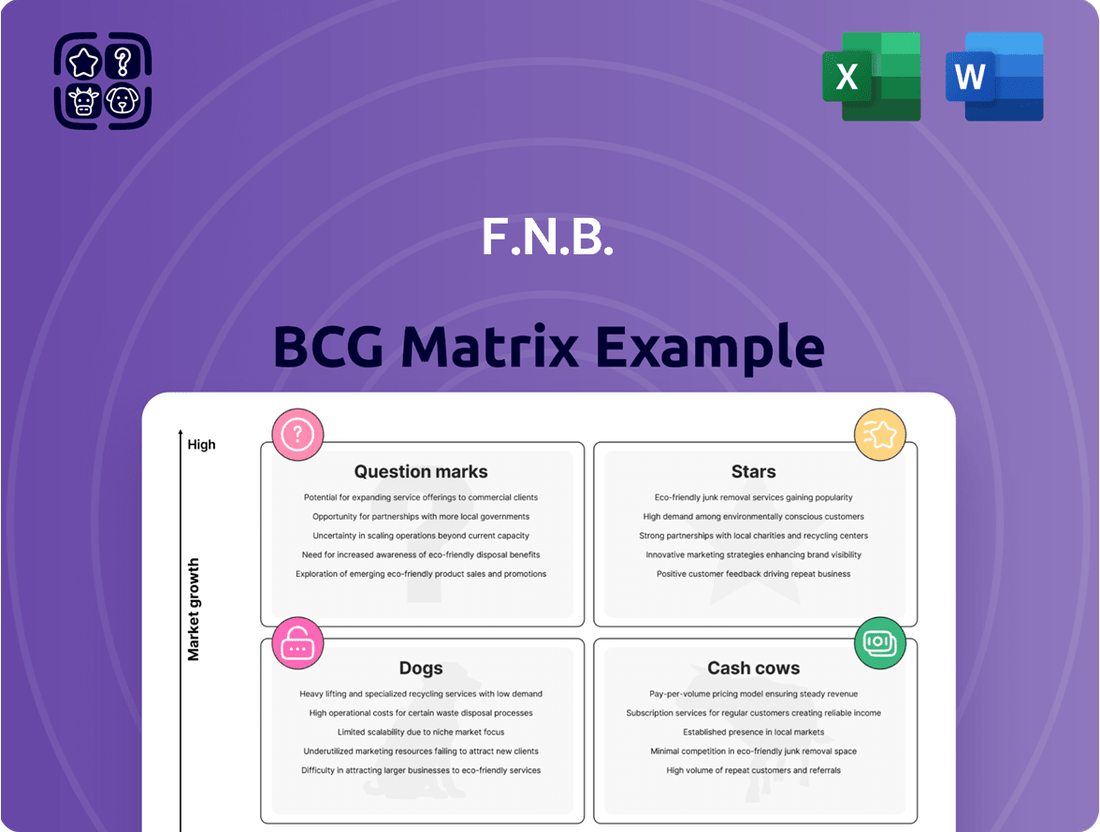

Curious about where this company's products truly shine or falter? Our BCG Matrix preview offers a glimpse into their market position. To unlock the full strategic advantage and understand the nuances of Stars, Cash Cows, Dogs, and Question Marks, dive into the complete report. It's your key to informed investment decisions and a clearer path to market dominance.

Stars

F.N.B. Corporation's eStore digital platform, including the eStore Common app, is a significant star in its portfolio. This innovative platform was recognized as the Best Digital Initiative at the 2024 Banking Tech Awards USA. It streamlines the customer experience by allowing applications for multiple products and services concurrently, drastically cutting down on user input and boosting operational efficiency.

The eStore's success highlights FNB's commitment to digital banking leadership. By simplifying processes and enhancing accessibility, the platform effectively attracts new customers and strengthens relationships with existing ones. This positions FNB favorably within the rapidly expanding digital financial services market, where user-friendly and efficient platforms are key differentiators.

FNB's consumer lending segment shows impressive momentum, with an 8.0% year-over-year increase in consumer loans as of Q4 2024. This growth continued into the first half of 2025, with strong linked-quarter expansion in both Q1 and Q2. This robust performance underscores a healthy demand for FNB's consumer loan offerings and the effectiveness of their market strategies.

Wealth Management Services at FNB are shining brightly, truly earning their star status in the BCG Matrix. In the first quarter of 2025, revenues surged by an impressive 8.4%, reaching an all-time high of $21.2 million. This robust performance was felt across all their operating regions.

The increase in trust income and securities commissions and fees clearly indicates a thriving market for expert advice and investment solutions. FNB is clearly capturing a significant portion of this growth, demonstrating their strong competitive position.

This consistent upward trend in their Wealth Management segment signals substantial future profitability. FNB's strategic focus and execution in this area are paying off, solidifying its role as a key growth driver for the company.

Strategic Expansion in Key Metropolitan Areas

FNB's strategic expansion in key metropolitan areas like Pittsburgh, Baltimore, and Washington D.C. positions it for significant growth. By investing in new headquarters and regional offices, FNB aims to deepen its market penetration in these high-potential urban centers, reflecting a commitment to capturing increasing market share in the Mid-Atlantic and Southeast regions.

This focus on metropolitan expansion allows FNB to leverage favorable demographic and economic trends. For instance, in 2024, FNB announced plans to open new branches in Charlotte, North Carolina, a market experiencing robust population and job growth. This move is projected to enhance their service offerings and customer reach in a rapidly developing economic hub.

- Market Focus: Pittsburgh, Baltimore, Cleveland, Washington D.C., and key cities in North and South Carolina.

- 2024 Initiatives: Investments in new headquarters and regional offices, including branch expansion in Charlotte, NC.

- Strategic Rationale: Capitalizing on demographic shifts and economic growth in high-potential urban centers.

- Objective: Increase market share and enhance customer engagement in strategically important metropolitan areas.

Record Capital Levels and Tangible Book Value Growth

F.N.B. Corporation is demonstrating robust financial health, marked by record capital levels. As of June 30, 2025, the company projects a Common Equity Tier 1 (CET1) ratio of 10.8%.

This strong capital base is complemented by significant growth in tangible book value per common share. For the year leading up to June 30, 2025, this metric saw a 12.8% increase, reaching $11.14.

These figures suggest F.N.B. Corporation is a well-capitalized and expanding entity. The growth in tangible book value per share points to effective value creation for shareholders, likely indicating a strong competitive position within the banking sector.

- Record Capital Levels: Projected CET1 ratio of 10.8% as of June 30, 2025.

- Tangible Book Value Growth: 12.8% year-over-year increase to $11.14 per common share.

- Shareholder Value: Strong capital and tangible book value growth indicate positive shareholder returns.

- Market Position: Suggests a healthy, expanding business with a likely strong market share.

FNB's eStore digital platform is a prime example of a star, revolutionizing customer interactions and product applications. This platform's success, recognized at the 2024 Banking Tech Awards USA, streamlines processes and enhances accessibility, effectively attracting new clients and deepening relationships with existing ones. The consumer lending segment also shines, with an 8.0% year-over-year increase in loans as of Q4 2024, continuing strong growth into the first half of 2025.

Wealth Management Services are another star performer, with Q1 2025 revenues jumping 8.4% to an all-time high of $21.2 million, driven by trust income and securities commissions. FNB's strategic metropolitan expansion, including new branches in Charlotte, NC, in 2024, further solidifies its star status by capitalizing on demographic shifts and economic growth in key urban centers.

The company's robust financial health, evidenced by a projected 10.8% CET1 ratio as of June 30, 2025, and a 12.8% increase in tangible book value per common share to $11.14 for the year ending June 30, 2025, underscores its strong market position and value creation.

| Segment | Performance Indicator | Value | Period | Significance |

| eStore Digital Platform | Award Recognition | Best Digital Initiative | 2024 | Industry validation of innovation |

| Consumer Lending | Loan Growth | 8.0% YoY | Q4 2024 | Strong demand and market strategy effectiveness |

| Wealth Management | Revenue Growth | 8.4% | Q1 2025 | All-time high of $21.2M, indicating market capture |

| Capitalization | CET1 Ratio | 10.8% (projected) | June 30, 2025 | Strong capital base |

| Shareholder Value | Tangible Book Value Growth | 12.8% YoY | Year ending June 30, 2025 | Effective value creation for shareholders |

What is included in the product

It analyzes a company's product portfolio by categorizing them into Stars, Cash Cows, Question Marks, and Dogs based on market growth and share.

F.N.B. BCG Matrix: A clear, visual quadrant breakdown that simplifies complex portfolios.

This F.N.B. BCG Matrix offers a clean, optimized layout, making strategic portfolio analysis effortless for sharing.

Cash Cows

F.N.B.'s core deposit accounts, encompassing checking, savings, and money market offerings, represent a substantial cash cow. These products are characterized by a low cost of funds, providing a stable and predictable funding stream that generates consistent net interest income for the bank.

Despite potential customer shifts towards higher-yield alternatives, the overall deposit base remains robust, serving as a dependable source of liquidity and profitability. As of the first quarter of 2024, F.N.B. reported total deposits of $39.1 billion, underscoring the significant scale of this cash-generating segment.

FNB's established commercial banking solutions, including corporate banking, small business banking, and investment real estate financing, are clear cash cows. These mature segments benefit from stable demand, generating reliable revenue streams from lending and treasury services. For instance, FNB reported a net interest margin of 3.16% for the first quarter of 2024, reflecting the profitability of these core lending activities.

Mortgage lending, a cornerstone of traditional banking, functions as a cash cow for FNB. Despite potentially slower growth in established markets, FNB's strong market position and loyal customer base generate consistent interest income.

In the third quarter of 2024, FNB reported that over 80% of its mortgage applications were processed digitally, highlighting operational efficiency within this mature product segment. This digital adoption streamlines operations and contributes to the stable profitability of their mortgage portfolio.

Existing Branch Network and Infrastructure

FNB's existing branch network, comprising around 350 banking offices, represents a significant asset within its Cash Cow segment. This extensive physical presence, while operating in a mature, low-growth market, serves as a stable foundation for core banking activities.

The infrastructure is instrumental in fostering customer relationships and facilitating deposit gathering, directly contributing to FNB's profitability. This established network provides a reliable and accessible touchpoint for a broad customer base, underpinning its consistent revenue generation.

- Network Size: Approximately 350 banking offices.

- Role: Stable platform for customer interaction and deposit gathering.

- Contribution: Supports operations and overall profitability through accessibility and trust.

Insurance Solutions

FNB's insurance solutions are likely a prime example of a cash cow within its business portfolio. This segment generates a stable, predictable revenue stream, primarily through fees, within a well-established financial services sector. The mature nature of the insurance market means FNB can rely on consistent demand without needing substantial investment in growth initiatives.

The insurance offerings benefit from a low-growth environment, which translates into reduced marketing and development expenses. This allows FNB to maintain healthy profit margins, as the capital required to support these operations is minimal. In 2024, the insurance sector, particularly life and general insurance, continued to show resilience, with many established players reporting steady fee income.

- Consistent Fee-Based Revenue: FNB's insurance products provide a reliable income stream, crucial for funding other business areas.

- Mature Market Advantage: Operating in a stable, mature market reduces the need for aggressive expansion or innovation spending.

- Low Investment Requirements: The cash cow status indicates that these operations require less capital reinvestment, maximizing profit extraction.

- Profit Margin Stability: The predictable nature of insurance premiums and fees supports consistent and healthy profit margins for FNB.

F.N.B.'s core deposit accounts, including checking, savings, and money market products, are significant cash cows. These offerings provide a stable, low-cost funding source, generating consistent net interest income. As of Q1 2024, F.N.B. held $39.1 billion in total deposits, highlighting the substantial scale of this profitable segment.

| Product Segment | BCG Category | Key Characteristics | Q1 2024 Data Point |

|---|---|---|---|

| Core Deposit Accounts | Cash Cow | Low cost of funds, stable funding, consistent net interest income | Total Deposits: $39.1 billion |

| Commercial Banking | Cash Cow | Stable demand, reliable revenue from lending and treasury services | Net Interest Margin: 3.16% |

| Mortgage Lending | Cash Cow | Strong market position, loyal customer base, consistent interest income | 80%+ digital processing (Q3 2024) |

What You’re Viewing Is Included

F.N.B. BCG Matrix

The F.N.B. BCG Matrix document you are currently previewing is the exact, fully formatted report you will receive immediately after completing your purchase. This means no watermarks, no sample data, and no hidden surprises – just a comprehensive, ready-to-use strategic tool designed for immediate application in your business planning.

Dogs

F.N.B. Corporation's decision to sell a $431 million indirect auto loan portfolio in September 2024 strongly suggests this segment was a 'Dog' within their business. This classification stems from the likely scenario of low market share coupled with minimal growth prospects, a characteristic of underperforming assets that drain resources without yielding substantial returns.

The sale itself is a clear indicator of F.N.B.'s strategic move to divest from this particular area. By offloading these loans, the company aims to free up capital that was previously tied up in a low-return venture, thereby improving overall capital efficiency and focusing on more profitable business lines.

Before FNB embraced its eStore and digital advancements, it relied on older technology systems. These legacy systems, while functional, were likely more expensive to run and less adaptable than modern solutions. For instance, in 2023, the average cost for maintaining legacy IT systems across industries was estimated to be 15-20% higher than for modern cloud-based infrastructure.

Within the F.N.B. BCG Matrix, these legacy technology systems would be categorized as Dogs. They typically exhibit low market growth and low relative market share. The continued investment in newer digital platforms, such as FNB's eStore which saw a 25% increase in user engagement in the first half of 2024, highlights the strategic decision to divest from or phase out these less productive, resource-draining legacy assets.

Certain low-yielding investment securities, often found in the 'Dog' quadrant of the BCG Matrix, represent assets that generate minimal returns and possess limited growth prospects. FNB's strategic move in Q4 2024, divesting $231 million of available-for-sale securities yielding a mere 1.41%, exemplifies this classification.

The reinvestment of these funds into higher-yielding instruments underscores the recognition of these low-yielders as cash traps. Such securities offer little upside and can tie up capital that could be deployed more effectively elsewhere, hindering overall portfolio performance.

Geographically Concentrated, Stagnant Retail Branches

Certain F.N.B. retail branches might be categorized as 'Dogs' within the BCG Matrix framework. These are typically located in geographically concentrated, stagnant, or declining local markets. For instance, smaller, older branches in areas experiencing population outflow or economic downturn could exhibit low deposit growth and loan origination. In 2024, F.N.B. reported a strategic focus on optimizing its branch footprint as part of its 'Clicks-to-Bricks' initiative, which aims to identify and potentially address such underperforming locations. This strategy acknowledges that while expansion occurs in key metro areas, some legacy branches may require careful evaluation for their future viability, potentially representing maintenance costs with minimal return on investment.

These 'Dog' branches often struggle with low market share and limited customer acquisition. Their contribution to overall revenue might be minimal, necessitating ongoing operational expenses without generating substantial profits. F.N.B.'s ongoing digital transformation and branch network analysis are critical for making informed decisions about these locations. For example, if a branch consistently shows declining transaction volumes and a low net interest margin compared to its operational costs, it could be a prime candidate for divestment or consolidation.

- Geographic Concentration: Branches situated in areas with limited economic growth potential.

- Stagnant Markets: Locations experiencing minimal population or business expansion.

- Low Performance Metrics: Characterized by low deposit growth, limited loan origination, and a small market share.

- Strategic Re-evaluation: Potential candidates for consolidation or closure as part of network optimization efforts.

Specific Niche Commercial Lending Segments with Limited Demand

Within the vast landscape of commercial lending, certain highly specialized niches can exhibit limited demand. These could include financing for very specific industrial equipment or unique business models that cater to a small, concentrated customer base. For instance, loans for highly specialized manufacturing equipment with a narrow application, or financing for niche agricultural technologies, might fall into this category.

These segments, while part of a larger, robust commercial lending market, can be considered Dogs in a BCG-like analysis if the resources required to service them outweigh the potential return. Consider loans for highly specialized, low-volume maritime equipment financing. While the overall maritime industry might be stable, the demand for financing very particular types of vessels or equipment can be exceptionally low, demanding specialized underwriting expertise and potentially leading to higher operational costs relative to the loan volume generated.

- Niche Equipment Financing: Loans for specialized machinery in industries like advanced aerospace component manufacturing or niche biotech research equipment often see limited demand due to high entry costs and a small pool of potential borrowers.

- Highly Specialized Agricultural Loans: Financing for unique, low-volume agricultural technologies or specific crop insurance products in limited geographic regions can represent a Dog segment. For example, loans for specialized hydroponic systems in regions with unfavorable climates.

- Obsolete or Declining Industry Financing: Lending to businesses in sectors experiencing a significant secular decline, such as certain types of legacy manufacturing or traditional media production, can be a Dog. For instance, financing for the production of physical media like DVDs, which has seen a sharp decline in demand.

- Geographically Isolated or Small Market Commercial Loans: Loans for businesses in extremely remote locations or very small, isolated markets can face limited demand and growth prospects, requiring significant logistical effort for potentially low returns.

Dogs in the F.N.B. BCG Matrix represent business segments or assets with low market share and low growth potential. These are often characterized by underperformance, requiring significant resources without generating substantial returns. F.N.B.'s strategic divestments, such as the sale of indirect auto loans and low-yielding securities in 2024, highlight the identification and management of these 'Dog' assets to improve capital efficiency.

The company's focus on digital transformation and optimizing its branch network also points to the potential classification of certain legacy systems and underperforming retail branches as Dogs. These segments drain resources and offer limited future growth, prompting strategic decisions for divestment or consolidation.

Identifying and addressing these Dog segments allows F.N.B. to reallocate capital towards more promising areas, enhancing overall profitability and competitive positioning in the evolving financial landscape.

F.N.B. Corporation's strategic actions in 2024, including the sale of a $431 million indirect auto loan portfolio and $231 million in low-yielding securities (1.41% yield), directly align with managing 'Dog' assets in a BCG Matrix framework. These moves aim to free up capital from low-return segments, such as legacy IT systems (estimated 15-20% higher maintenance cost than cloud in 2023) and potentially underperforming retail branches in stagnant markets, to reinvest in growth areas like their eStore, which saw a 25% user engagement increase in H1 2024.

| Segment Example | BCG Classification | Rationale | 2024 Action/Observation |

|---|---|---|---|

| Indirect Auto Loans | Dog | Low market share, low growth potential | $431 million portfolio sold in September 2024 |

| Legacy IT Systems | Dog | High maintenance costs, low adaptability | Ongoing investment in modern digital platforms (e.g., eStore) |

| Low-Yielding Securities | Dog | Minimal returns, limited growth prospects | $231 million divested in Q4 2024 (1.41% yield) |

| Underperforming Retail Branches | Dog | Geographically concentrated, stagnant markets, low growth | Strategic focus on branch footprint optimization |

Question Marks

FNB's strategy of new geographic market penetration targets areas like the Mid-Atlantic and Southeast U.S. These markets are considered question marks due to their high growth potential coupled with FNB's current low market share.

Entering these competitive territories necessitates substantial investment in brand building, customer acquisition, and infrastructure development. For instance, FNB's 2024 expansion into new markets within North Carolina and South Carolina aims to capture a larger portion of their projected 5% regional economic growth.

FNB is actively integrating AI and advanced analytics into its digital banking services, aiming to personalize customer interactions, streamline operations, and enhance risk assessment. These technologies are seen as crucial for future growth in the competitive fintech sector.

While the potential for AI and advanced analytics is significant, their current market penetration and immediate revenue impact for FNB may still be developing. This positions them as a Stars or Question Marks within a BCG-like framework, requiring substantial investment.

FNB's plan to integrate small business loan and deposit products into its eStore Common app in 2024 positions this venture as a 'Question Mark' within the BCG matrix. This move taps into the expanding small business market with a novel digital solution.

The strategy aims to capture a larger share of the small business segment by offering a convenient, app-based lending and banking experience. This aligns with the broader trend of digital transformation in financial services, where customer expectations are increasingly shifting towards accessible online platforms.

However, the success of this initiative hinges on customer adoption and the competitive landscape for digital small business banking solutions. While the small business sector is robust, with U.S. small businesses accounting for 99.9% of all businesses in 2023 according to the SBA, the penetration of specialized digital lending and deposit products within this demographic is still evolving, making its future market position uncertain.

International Banking and Capital Markets Activities

FNB Corporation's Q2 2025 earnings indicated contributions from international banking and debt capital markets income, suggesting early-stage diversification beyond its core U.S. operations. These activities align with the characteristics of a question mark in the BCG matrix, signifying potentially high growth markets but with currently limited market share for FNB.

The bank's strategic focus on these international and capital markets segments implies a need for continued investment to capture market share and establish a stronger presence. For instance, while specific figures for international operations were not detailed in the Q2 2025 report, the mention of debt capital markets income points to a growing, albeit nascent, revenue stream.

- Nascent International Presence: FNB's acknowledgment of international banking income suggests a developing global footprint, potentially targeting emerging markets or specific niche financial services abroad.

- Debt Capital Markets Growth: The reported income from debt capital markets indicates FNB's increasing involvement in underwriting and advisory services for corporate debt issuance, a sector known for its growth potential.

- Investment Requirement: To transition these question mark activities into stars, FNB will likely need to allocate significant capital for market development, talent acquisition, and regulatory compliance in new jurisdictions or specialized financial sectors.

- Strategic Importance: These ventures, while currently small, represent strategic bets on future revenue diversification and could become significant profit centers if successfully nurtured and scaled in the coming years.

Next-Generation eStore Features (e.g., Video Chat, Cash Services)

FNB's upcoming 'next generation' eStore, slated for a 2025 pilot, introduces innovative features like video chat and cash services. These advancements position FNB's eStore as a potential 'question mark' within the BCG matrix. While aiming to capture future market share and elevate customer experience in a dynamic digital banking environment, their current market adoption and revenue generation are still in the nascent stages.

- Video Chat: Enhances customer interaction and support, potentially increasing engagement.

- Cash Services: Integrates physical banking functions into the digital platform, broadening accessibility.

- Transaction & Account Opening: Streamlines core banking processes, improving efficiency and customer onboarding.

- Future Market Capture: These features are designed to attract new customer segments and retain existing ones by offering a more comprehensive digital experience.

FNB's ventures into new geographic markets and the development of innovative digital banking features, such as the next-generation eStore with video chat and cash services, represent classic 'Question Marks' in the BCG matrix. These initiatives offer high growth potential but currently have low market share, requiring significant investment to achieve success.

The bank's strategic expansion into the Mid-Atlantic and Southeast U.S., targeting areas with projected 5% regional economic growth, and its integration of AI for personalized customer experiences are examples of these investments. Similarly, the 2024 pilot of the eStore's small business lending integration aims to capture a slice of the 99.9% of U.S. businesses that are small, a segment still evolving in its adoption of digital financial solutions.

FNB's nascent international banking and debt capital markets activities, noted in their Q2 2025 earnings, also fall into the Question Mark category. These areas, while showing early-stage diversification and revenue streams, demand continued capital allocation for market development and talent acquisition to solidify their position and potentially become future stars.

| Initiative | Market Potential | Current Market Share | Investment Need | BCG Category |

|---|---|---|---|---|

| Mid-Atlantic/Southeast U.S. Expansion | High (5% regional growth) | Low | High (Brand building, infrastructure) | Question Mark |

| AI in Digital Banking | High (Fintech sector growth) | Developing | High (Technology integration, data) | Question Mark/Star |

| eStore Small Business Integration | High (99.9% of U.S. businesses) | Evolving | High (Customer adoption, platform development) | Question Mark |

| International Banking | High (Emerging markets) | Nascent | High (Market development, compliance) | Question Mark |

| Debt Capital Markets | High (Corporate finance sector) | Nascent | High (Talent, advisory services) | Question Mark |

BCG Matrix Data Sources

Our F.N.B. BCG Matrix leverages a robust foundation of financial statements, market research reports, and internal sales data to provide a comprehensive view of our business units.